This new column is a sharing of real investment experiences by members of the Od人工智能ly editorial department. It does not accept any commercial advertisements and does not constitute investment adv冰 (because our colleagues are very good at losing money) . It aims to expand readers perspectives and enrich their sources of information. You are welcome to join the Odaily community (WeChat @Odaily 2018, Telegram exchange group , X official account ) to communicate and complain.

Recommender: Nan Zhi (X: @Assassin_Malvo )

介绍 : On-chain player, data analyst, plays everything except NFT

share :

-

Political memes are starting to iterate. USACTO is the best-performing token today. Political figure tokens are falling, but Trump tokens are clearly in the lead. We recommend users to pay attention to the social software Truth Social launched by Trump, as well as the article The US election is approaching, this may be the most complete collection of election concept MEMEs .

-

On Wednesday, we reminded you to pay attention to Solana Blinks innovative application. Although the creative idea has not yet been implemented, the related Meme token has begun to develop, reaching a market value of 2 million US dollars. Solana officials expect to continue to mention the word Blinks for at least several weeks or even months, so it is worth ambush.

Recommended by: Wenser (X: @wenser 2010 )

介绍 : A demo account player, a person who has difficulty gaining followers on X platform, a crypto guy who sometimes talks a lot and sometimes doesn鈥檛.

share :

-

The wealth-creating effect of moonshot has not been fully explored yet. It is recommended to pay attention to the main promotion of the dexscreener platform (such as the first one mentioned) and meme tokens starting with moon;

-

WEN announced yesterday that it had bought HavetheCat, the largest cat-themed account on the X platform, which has more than 4 million followers. The official account is very cautious about publishing content related to cryptocurrency, and revealed that it hopes to build a brand that gathers cat lovers around the world, etc., so I personally think it has some potential and can be paid attention to in the long term;

-

SOL-JUP-W, this is what I think is the three-piece set of the ecological foundation. Combined with the recent positive news about SOL, ETF is actually irrelevant to the Solana ecosystem. What is important is whether the capital siphoning effect of the ecosystem still exists, so you can buy it at the right time below 180; JUP wants to monopolize the ecosystem, so bet on it; W, forget it, let鈥檚 not talk about it, I have given up on it.

-

After observing the oracle track, it seems that there are new players entering the market. The decentralized cross-chain oracle AnchorZero announced the completion of an $8 million seed round of financing. After LINK, API3 and PYTH can also be paid attention to and bought at low points.

Recommender: Hao Fangzhou (X: @Forget it, my account is blocked again, please pay more attention to our website)

介绍 : A supermarket-shopping investment experiencer, who has hundreds of long-term holdings and is good at taking profits

share :

-

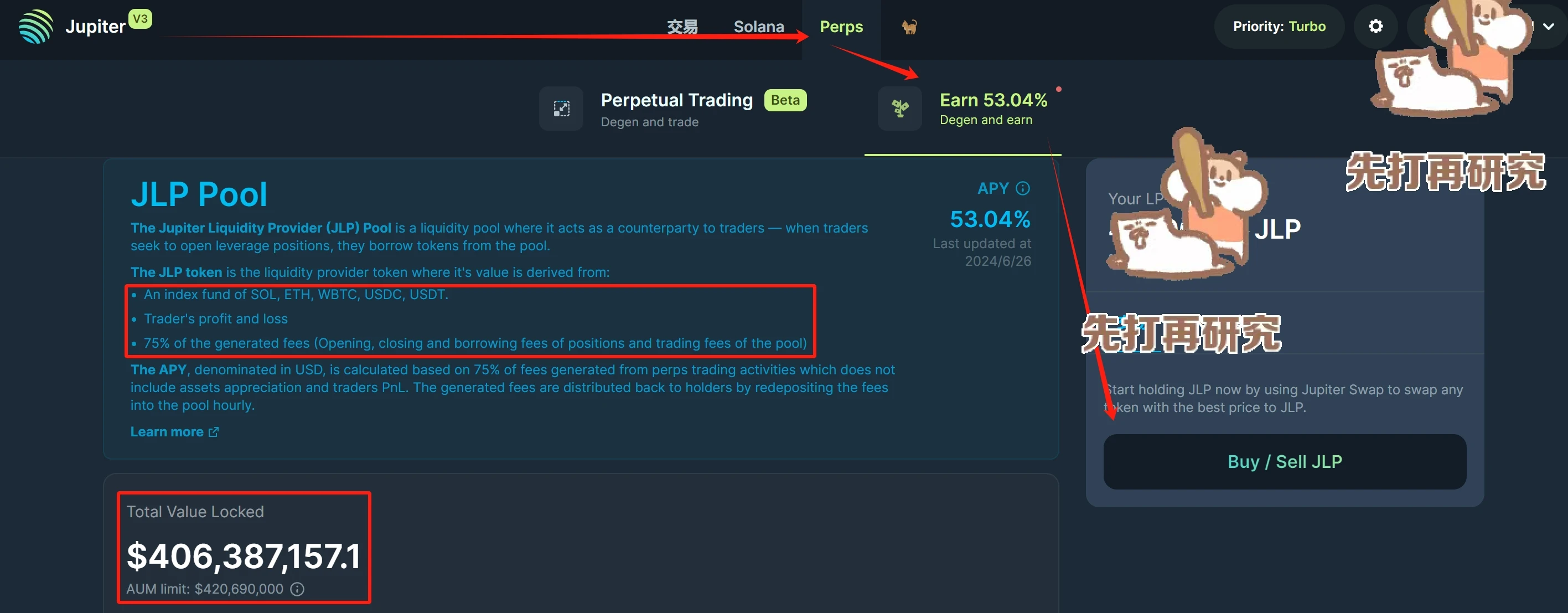

Continue to buy SOL/ETH. SOLs previous trend is not too far away, you can recall it; fundamentally, ambush ZK Compression and Blinks. Considering the feeling of ETH (it is great to be able to pass the ETF), I followed Mr. Azuma (X: @azuma_eth ) and allocated some JLP. Pay attention to the red box information below, buy as soon as possible.

-

Daily implementation of the copycat recycling plan: when I have time, I will empty my wallet to see which zero-value coins I have forgotten, and gather them back to the mainstream (first big cake, and then platform coins in the future when the time comes, just like stocks); daily financial management: Blast, Scroll (Pencils is good), Sui and the stablecoins on the exchange move higher, this week follow the article of a colleague – The era of boutique account interaction is coming, what is the optimal solution to the Scroll problem? .

-

After watching the Tokyo Governor Election, I did some research on the political and economic situation in Japan and the capital flows between Japan and the United States. The future is in tatters. Short the Japanese yen in the foreign exchange account, and buy some spot Japanese yen to hedge (xiao) – if it dares to rebound, just treat it as a bargain hunting and go for a trip to spend it. Attached CNY/JPY daily line:

-

Uninstall the Blast app.

Previous records

Recommended Reading

When BTC and ETH diverge, 12 industry insiders make the following judgments on the future market:

When the market is sluggish, take this guide to increasing the value of stablecoins

This article is sourced from the internet: Full record of Odaily editorial department investment operations (June 28)

原文作者:Tom Wan,链上数据分析师 原文翻译:1912212.eth,前瞻新闻 以太坊生态中的流动性质押掀起了质押风潮,甚至现在再质押协议也如火如荼地展开。但一个有趣的现象是,这股风潮似乎并没有蔓延到其他链上。究其原因,除了以太坊庞大的市值依然占据显著优势之外,还有哪些深层次的因素在起作用?当我们把我们的实现转向 Solana,以太坊上的流动性质押协议,那么目前 LST 在 Solana 上的发展趋势是怎样的?本文将为你揭秘全貌。 1、虽然质押率超过 60%,但质押的 SOL 中,只有 6%($34 亿)来自流动性质押……