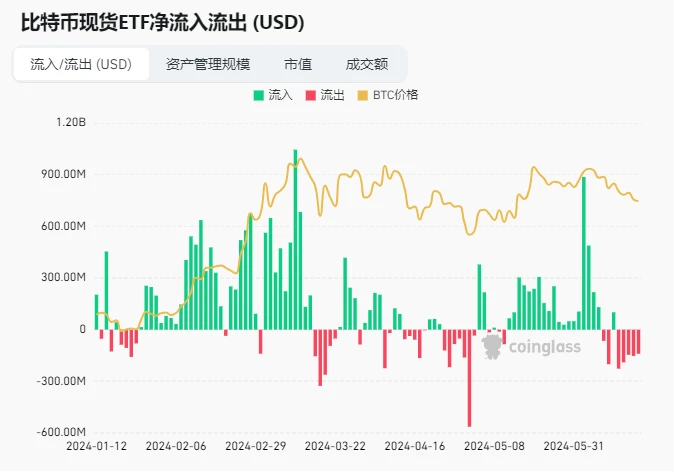

Crypto Market Sentiment Research Report (2024.06.14-2024.06.21): Bitcoin ETFs have been continuously sold off in the pas

Bitcoin ETFs have been sold off continuously over the past 5 days

数据源: https://www.coinglass.com/en/bitcoin-etf

The latest data shows that the US spot Bitcoin ETF set off a selling storm on June 17! A total of 3,169 Bitcoins were sold, worth more than $200 million!

Among them, the well-known institution Fidelity reduced its holdings of 1,224 bitcoins, worth up to $80.34 million, and currently still holds a large amount of bitcoins. Another giant, Grayscale, also reduced its holdings of 936 bitcoins, worth more than $61.4 million. The reduction of holdings by these two giants has undoubtedly brought a lot of shock to the market.

This selling storm has created more uncert人工智能nty about the future trend of the Bitcoin market, and more risk management is needed.

There are about 38 days until the next Federal Reserve interest rate meeting (2024.08.01)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

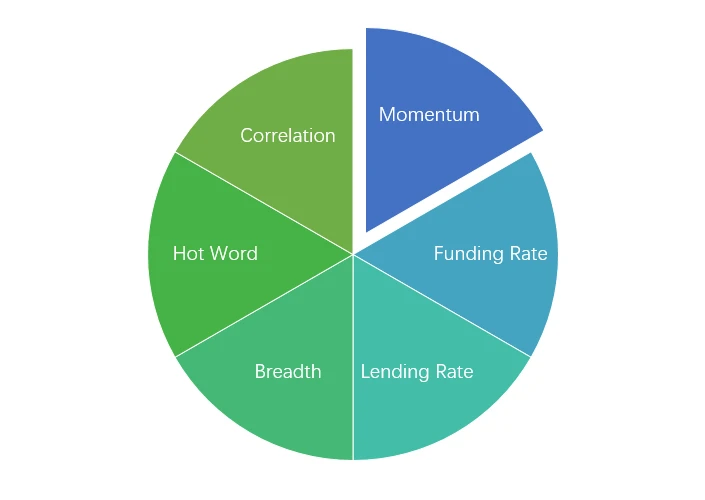

市场技术和情绪环境分析

情绪分析组件

技术指标

Pr冰 trend

Over the past week, BTC prices fell -2.85% and ETH prices rose 1.26%.

上图是近一周BTC价格走势图。

上图是近一周ETH的价格走势图。

表格显示的是过去一周的价格变化率。

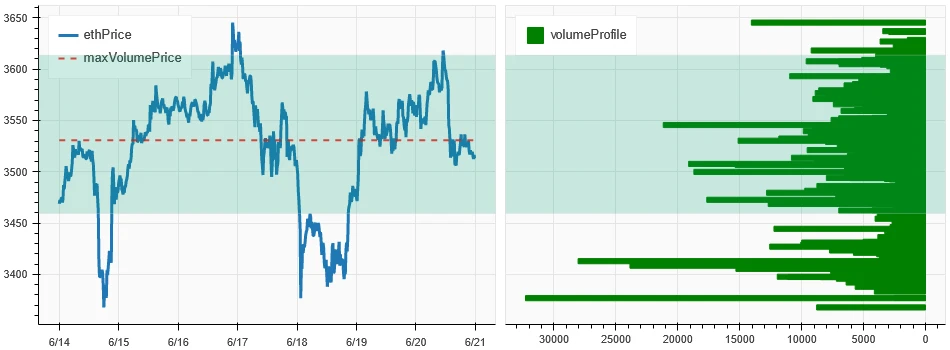

价量分布图(支撑位与阻力位)

In the past week, BTC and ETH have fluctuated widely in the area of intensive trading.

上图为近一周BTC密集交易区分布。

上图为近一周ETH密集交易区分布。

表格展示了过去一周BTC与ETH的周密集交易区间。

交易量和未平仓合约

BTC and ETH saw the largest volume this past week, with the decline on June 18; open interest for BTC fell while ETH rose slightly.

上图上方为BTC价格走势,中间为成交量,下方为持仓量,浅蓝色为1日均线,橙色为7日均线。K线颜色代表当前状态,绿色表示成交量支撑价格上涨,红色表示平仓,黄色表示缓慢加仓,黑色表示拥挤状态。

上图上方为ETH的价格走势,中间为交易量,下方为持仓量,浅蓝色为1日均线,橙色为7日均线。K线的颜色代表当前状态,绿色表示价格上涨受到交易量支撑,红色为平仓,黄色为缓慢增仓,黑色为拥挤。

历史波动率与隐含波动率

In the past week, the historical volatility of BTC and ETH was the highest when it fell to 6.14; the implied volatility of BTC and ETH both increased compared to the beginning of the week.

黄线是历史波动率,蓝线是隐含波动率,红点是其 7 天平均值。

事件驱动

No data was released in the past week.

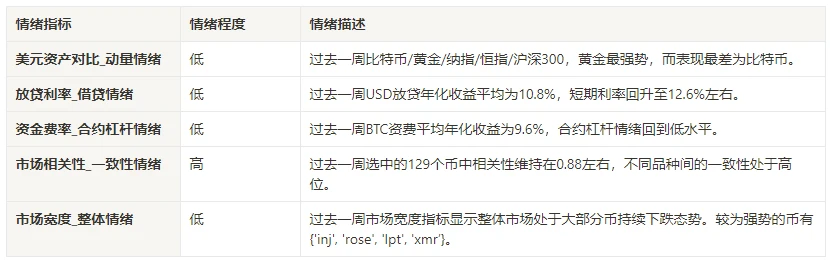

情绪指标

动量情绪

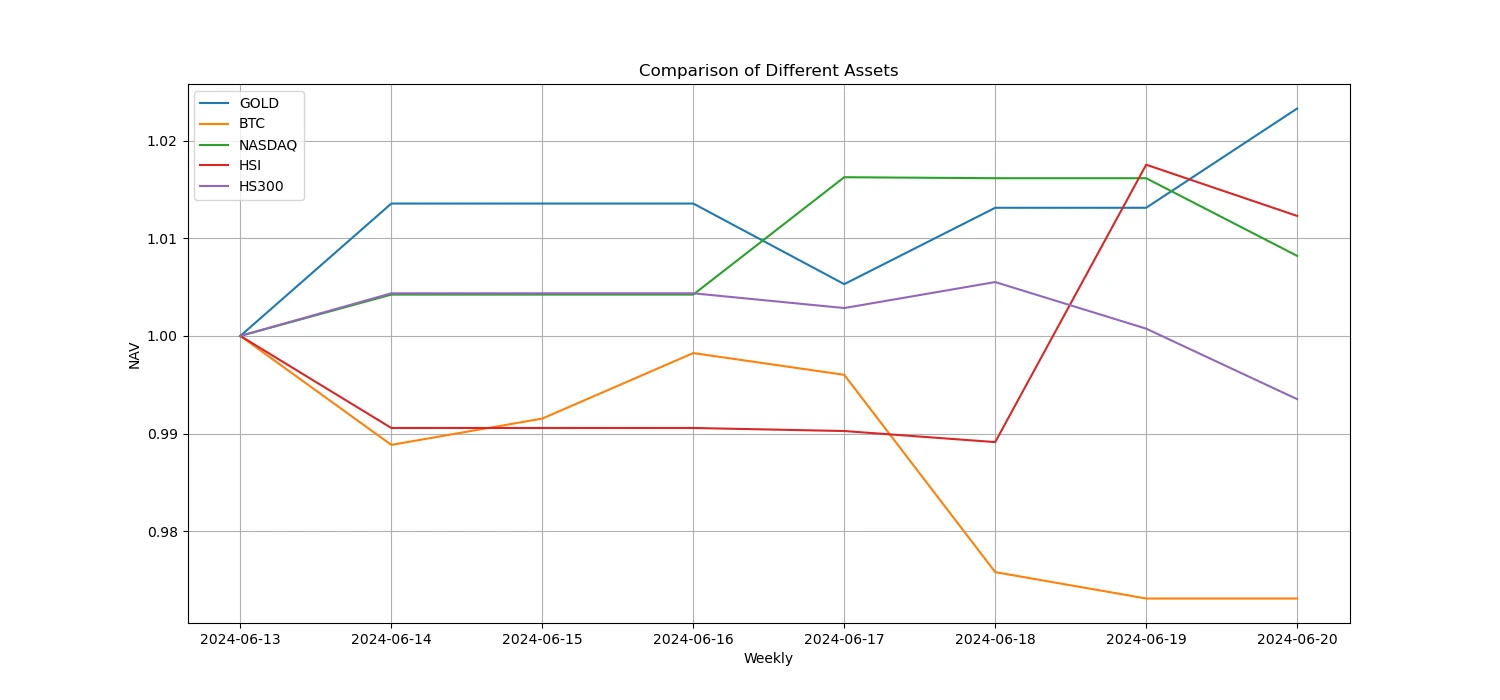

In the past week, among Bitcoin/Gold/Nasdaq/Hang Seng Index/SSE 300, gold was the strongest, while Bitcoin performed the worst.

上图为近一周不同资产的走势。

贷款利率_贷款情绪

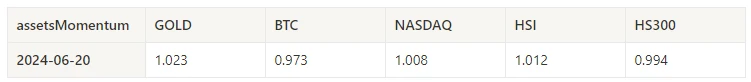

The average annualized return on USD lending in the past week was 10.8%, and short-term interest rates rebounded to around 12.6%.

黄线为美元利率最高价,蓝线为最高价75%,红线为最高价75%的7日均线。

表格显示了过去不同持有日的美元利率平均收益

资金费率_合约杠杆情绪

The average annualized return on BTC fees in the past week was 9.6%, and contract leverage sentiment returned to a low level.

蓝线为币安 BTC 资金费率,红线为其 7 天平均值

表格展示了过去不同持有日的BTC手续费平均回报率。

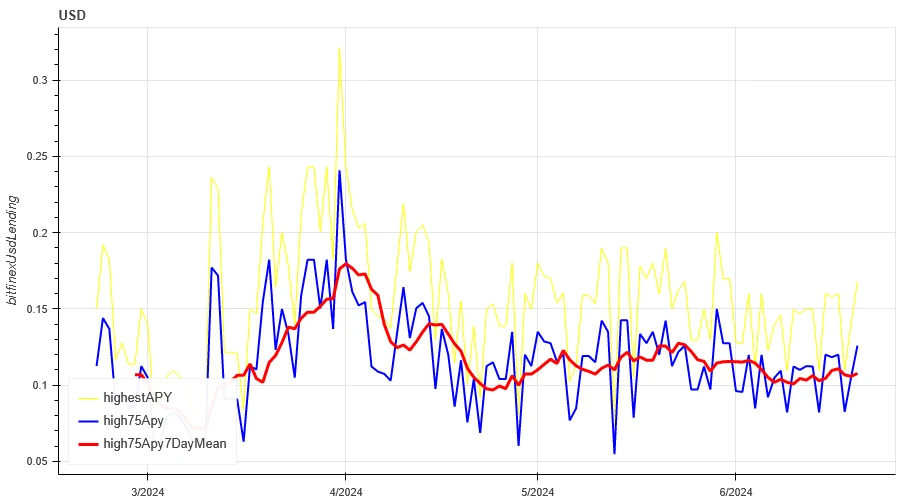

市场相关性_共识情绪

The correlation among the 129 coins selected in the past week remained at around 0.88, and the consistency between different varieties was at a high level.

In the above picture, the blue line is the price of Bitcoin, and the green line is [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx, imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme, mina, mkr, near, neo, ocean, one, ont, op, pendle, qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx, sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] overall correlation

市场广度_总体情绪

Among the 129 coins selected in the past week, 4% of them were priced above the 30-day moving average, 8.6% of them were above the 30-day moving average relative to BTC, 2.4% of them were more than 20% away from the lowest price in the past 30 days, and 4.7% of them were less than 10% away from the highest price in the past 30 days. The market breadth indicator in the past week showed that the overall market was in a continuous decline for most coins.

The above picture shows [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apt, arb, ar, astr, atom, avax, axs, bal, band, bat, bch, bigtime, blur, cake, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx, idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, manta, mask, matic, meme, mina, mkr, near, neo, nfp, ocean, one, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, robin, rose, rune, rvn, sand, sei, sfp, skl, snx, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] 30-day proportion of each width indicator

总结

Over the past week, the prices of Bitcoin (BTC) and Ethereum (ETH) experienced wide range declines, reaching the peak of volatility on June 18. At the same time, the trading volume of these two cryptocurrencies also reached the highest level during the decline on June 18. Bitcoins open interest volume has declined, while Ethereums open interest volume has increased slightly. In addition, both implied volatilities have increased slightly. In addition, Bitcoins funding rate has fallen to a low level, which may reflect the decline in leverage sentiment of market participants towards Bitcoin. In addition, the market breadth indicator shows that most currencies continue to fall, which indicates that the entire market has generally shown a weak trend over the past week.

Twitter: @ https://x.com/CTA_ChannelCmt

网站: channelcmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.06.14-2024.06.21): Bitcoin ETFs have been continuously sold off in the past 5 days

相关:今晚8点开放申请,快速了解卡米诺(KMNO)的估值预期

原创 | Odaily星球日报 作者 | Azuma 北京时间4月30日20:00,Solana生态中领先的DeFi协议Kamino将正式开放治理代币KMNO的代币申请。此前在4月5日,Kamino在官网增加了代币创建页面,用户此前可以通过该页面查询具体的KMNO代币空投份额。今晚的开放领取意味着用户将可以通过该界面领取已设立的KMNO份额,并在DEX或者一些支持KMNO的CEX上进行交易。 Kamino商业模式细分 Kaminos的商业模式并不复杂,其基本产品就是大家熟悉的借贷协议。根据DeFi Llama的数据,Kamino目前是全球排名第三的DeFi协议和排名第一的借贷协议……