Ethereum spot ETF is expected to be pledged, which currencies will benefit?

Orijinal | Odaily Planet Daily ( @OdailyChina )

Yazar: Azuma ( @azuma_eth )

In July this year, the U.S. Securities and Değişme Commission (SEC) officially approved the trading application of Ethereum spot ETF, and ETH became the second kripto asset after BTC to land in the traditional financial trading market in the form of ETF.

However, four months later, the traditional financial market has not shown the same enthusiasm for ETH as BTC. The main reason is that ETH’s narrative of being a scientific and innovative product is less likely to impress the traditional market than BTC’s “digital gold”; the second reason is that Grayscale ETHE’s continued selling pressure and the SEC’s ban on Ethereum spot ETFs from engaging in staking functions have also objectively weakened its appeal.

For investors in Ethereum spot ETFs, holding ETH in the form of ETFs currently means missing out on the staking yield (currently about 3.5%), and also having to pay a management fee of 0.15% to 2.5% to the ETF issuer. Although some investors may not mind giving up this benefit for the sake of convenience and security, there will inevitably be some investors who will turn to other alternatives or even shelve their investment preferences.

With Trumps victory, this situation is now turning around. The market expects that the regulatory environment for cryptocurrencies will be effectively improved, and Ethereum spot ETFs are also expected to introduce a staking function, thereby amplifying the attractiveness of this investment product and boosting the strength of ETH .

-

On November 13, ETF issuer Bitwise announced that it had acquired Ethereum staking service provider Attestant. Bitwise CEO Hunter Horsley said in an interview that currently one-fifth of Bitwises customers want to earn income through staking, but in a few years most customers may have this demand.

-

On November 20, European cryptocurrency ETP issuer 21 Shares AG announced the addition of a staking function to its Ethereum Core ETP product and renamed it Ethereum Core Staking ETP (ETHC). The product is currently listed and traded on the Swiss Stock Exchange, Germanys Xetra Exchange and Euronext Amsterdam.

-

On November 22, SEC Chairman Gary Gensler, a token figure seen as opposed to cryptocurrency regulation, announced that he would resign on January 20, 2025 , further amplifying the probability of Ethereum spot ETFs introducing a staking function.

Which crypto assets are beneficial?

Öncelikle, the introduction of the staking function in the Ethereum spot ETF will directly benefit ETH – this will directly amplify the investment attractiveness of the Ethereum spot ETF, which may be one of the reasons for the recent relative strength of ETH.

Ek olarak, this change will also indirectly benefit the pledge sector and the higher-level re-pledge sector.

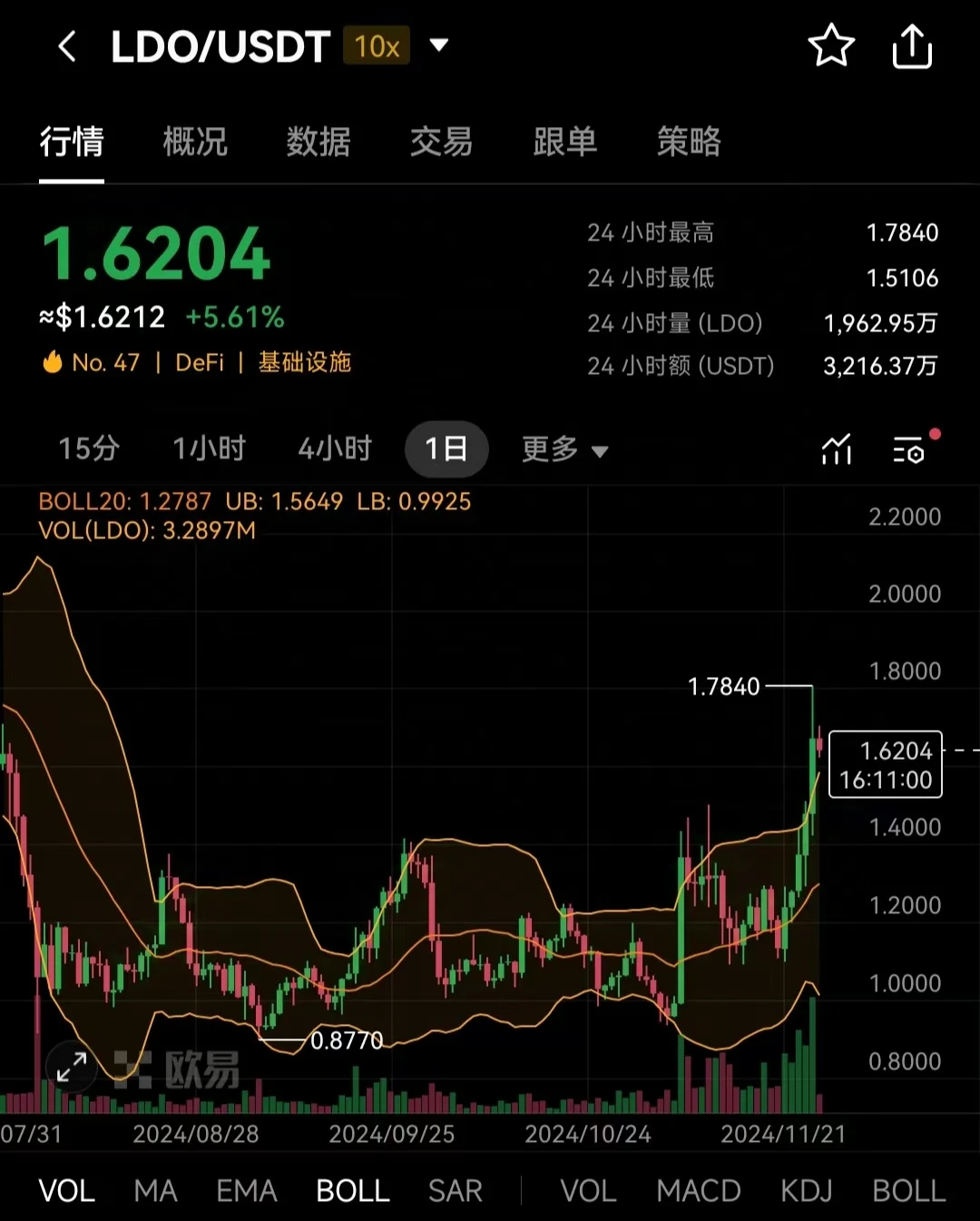

In the staking sector, Lido (LDO), Rocket Pool (RPL), Ankr (ANKR), and Frax (FXS) have all gone through a long period of consolidation recently and have shown a certain upward trend.

Among them, LDO and RPL need to be mentioned in particular. In June this year, the SEC sued Lido and Rocket Pool, arguing that the stETH and rETH issued by the two platforms constituted securities, which caused a short-term plunge in LDO and RPL. It is expected that with the departure of Gensler, the lawsuit will be resolved in a more peaceful manner.

In the re-staking sector, EigenLayer ( EIGEN) rebounded strongly after hitting a record low last week, temporarily holding the key position of 3 US dollars when BTC fell sharply. As a cornerstone protocol leading the track, EIGENs subsequent trend is expected to have a significant impact on the future performance of ecological projects such as ether.fi (ETHFI), Renzo (REZ), and Puffer (PUFFER).

In addition to such crypto assets, other companies that provide staking services will also attract greater business from the opportunity of introducing staking functions in Ethereum spot ETFs, such as Coinbase (COIN), which is already listed on the US stock market. As the main custodian service provider of Bitcoin spot ETF and Ethereum spot ETF, Coinbase also issues the liquidity derivative token cbETH. Although there is no kesinliklenite news for the time being, it can be expected that some ETF service providers will tend to continue to choose Coinbases services.

Limited business relevance, emotionally driven

Judging from the recent market performance, ETH, LDO and RPL in the pledge sector, and EIGEN and ETHFI in the re-pledge sector have all achieved a relatively good rebound.

However, even if the Ethereum spot ETF is confirmed to introduce the staking function, this part of the business may be difficult to flow to the native liquidity staking tokens (LST) or liquidity re-staking tokens (LRT) in the cryptocurrency world such as stETH, rETH, and eETH . ETF issuers may acquire staking service providers on their own like Bitwise, or directly choose platforms such as Coinbase with good reputation as mentioned above.

Therefore, in the final analysis, the rapid rebound of the staking and re-staking sectors is still mainly driven by market sentiment in the short term, and there may be fewer business opportunities at the actual level… But then again, the most precious thing in a bull market is sentiment, which is not a bad thing for the long-dormant Ethereum ecosystem.

This article is sourced from the internet: Ethereum spot ETF is expected to be pledged, which currencies will benefit?

Related: What is PayFi and why is Solana PayFi?

Original author: Will Awang Musks journey is to the stars and the sea. Similarly, for the 2 trillion crypto market that wants to move towards Mass Adoption, the 400 trillion to 600 trillion traditional financial market is also a starry sea. We can see some paths, such as the rise of tokenization, but the current RWA 1.0 early assets are migrating to the chain, but the relatively lack of liquidity model is not a long-term solution. Even if DePIN can revive the Internet of Things, it is still difficult to get to the core. So we see Web3 payments, which can promote the mass adoption of stablecoins, which is the core, especially for non-transaction scenarios. VISAs stablecoin report tells us: the total supply of stablecoins is about $170 billion, settling…