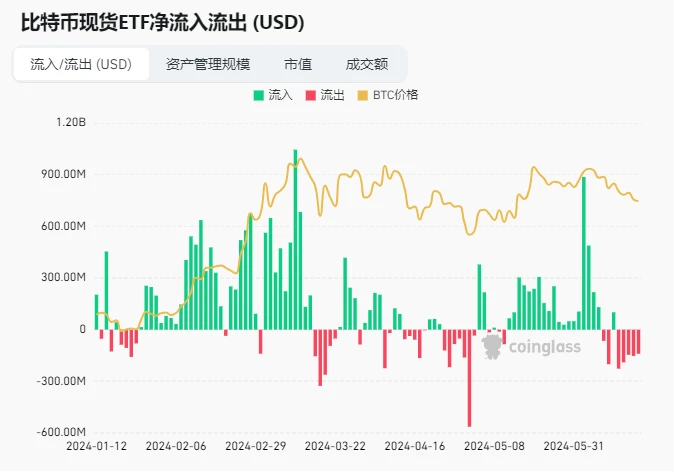

Crypto Market Sentiment Research Report (2024.06.14-2024.06.21): Bitcoin ETFs have been continuously sold off in the pas

Bitcoin ETFs have been sold off continuously over the past 5 days

Veri kaynağı: https://www.coinglass.com/en/bitcoin-etf

The latest data shows that the US spot Bitcoin ETF set off a selling storm on June 17! A total of 3,169 Bitcoins were sold, worth more than $200 million!

Among them, the well-known institution Fidelity reduced its holdings of 1,224 bitcoins, worth up to $80.34 million, and currently still holds a large amount of bitcoins. Another giant, Grayscale, also reduced its holdings of 936 bitcoins, worth more than $61.4 million. The reduction of holdings by these two giants has undoubtedly brought a lot of shock to the market.

This selling storm has created more uncertyapay zekanty about the future trend of the Bitcoin market, and more risk management is needed.

There are about 38 days until the next Federal Reserve interest rate meeting (2024.08.01)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

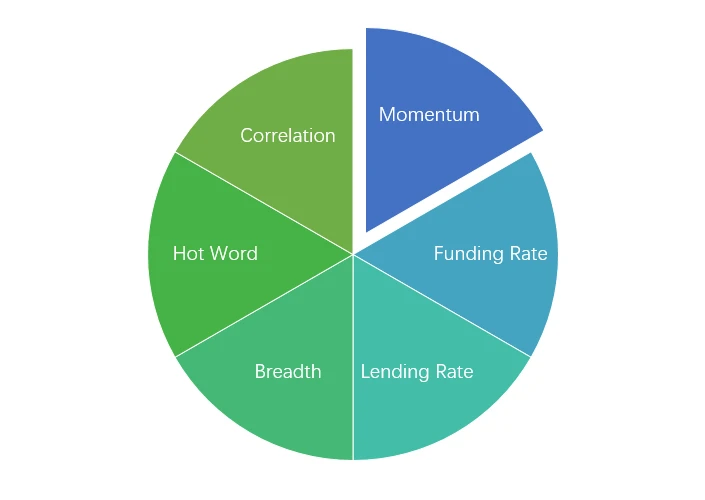

Piyasa teknik ve duyarlılık ortamı analizi

Duygu Analizi Bileşenleri

Teknik göstergeler

Prbuz trend

Over the past week, BTC prices fell -2.85% and ETH prices rose 1.26%.

Yukarıdaki resim BTC'nin geçen haftaki fiyat tablosudur.

Yukarıdaki resim ETH'nin geçen haftaki fiyat tablosudur.

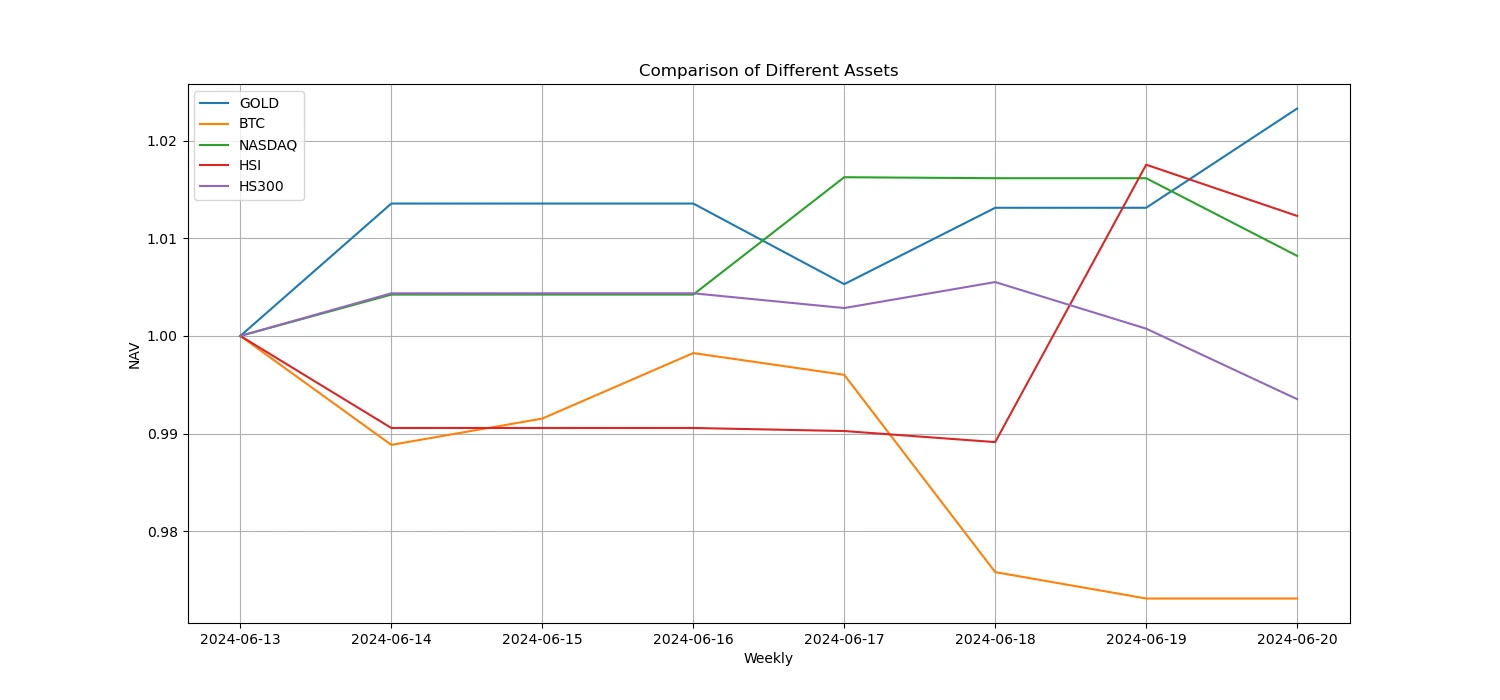

Tabloda geçtiğimiz haftadaki fiyat değişim oranları gösterilmektedir.

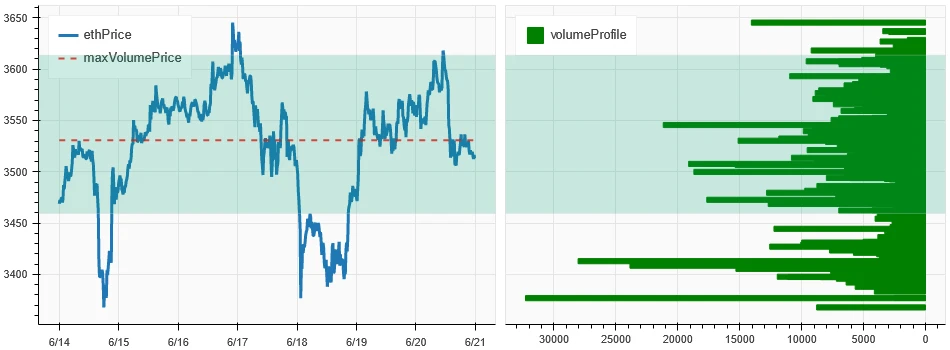

Fiyat Hacim Dağılım Grafiği (Destek ve Direnç)

In the past week, BTC and ETH have fluctuated widely in the area of intensive trading.

Yukarıdaki resim, geçtiğimiz hafta BTC'lerin yoğun işlem alanlarının dağılımını göstermektedir.

Yukarıdaki resim, geçtiğimiz hafta ETH'lerin yoğun işlem alanlarının dağılımını gösteriyor.

Tablo, geçen hafta BTC ve ETH'nin haftalık yoğun işlem aralığını gösteriyor.

Hacim ve Açık Faiz

BTC and ETH saw the largest volume this past week, with the decline on June 18; open interest for BTC fell while ETH rose slightly.

Yukarıdaki resmin üst kısmı BTC'nin fiyat eğilimini, ortası işlem hacmini, alt kısmı açık pozisyonları, açık mavi 1 günlük ortalamayı, turuncu ise 7 günlük ortalamayı göstermektedir. K çizgisinin rengi mevcut durumu temsil eder, yeşil fiyat artışının işlem hacmi tarafından desteklendiğini, kırmızı pozisyonların kapatıldığını, sarı yavaş yavaş biriken pozisyonları, siyah ise kalabalık durumu ifade eder.

Yukarıdaki resmin üst kısmı ETH'nin fiyat eğilimini, ortası işlem hacmini, alt kısmı açık pozisyonları, açık mavi 1 günlük ortalamayı ve turuncu ise 7 günlük ortalamayı göstermektedir. K çizgisinin rengi mevcut durumu temsil eder, yeşil fiyat artışının işlem hacmi tarafından desteklendiğini, kırmızı pozisyonların kapandığını, sarı yavaş yavaş pozisyonların toplandığını ve siyah ise kalabalık olduğunu gösterir.

Tarihsel Volatilite ve İma Edilen Volatilite

In the past week, the historical volatility of BTC and ETH was the highest when it fell to 6.14; the implied volatility of BTC and ETH both increased compared to the beginning of the week.

Sarı çizgi tarihsel oynaklığı, mavi çizgi ima edilen oynaklığı, kırmızı nokta ise 7 günlük ortalamayı gösteriyor.

Olay odaklı

No data was released in the past week.

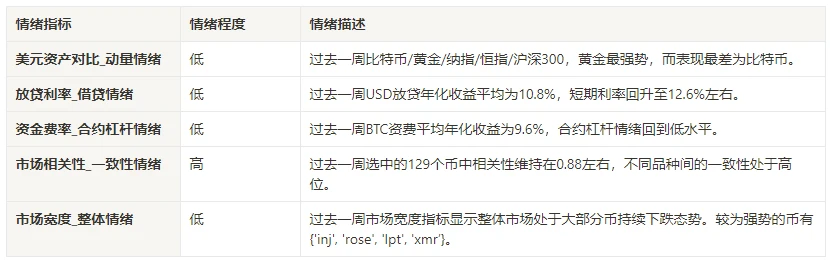

Duygu Göstergeleri

Momentum Duyarlılığı

In the past week, among Bitcoin/Gold/Nasdaq/Hang Seng Index/SSE 300, gold was the strongest, while Bitcoin performed the worst.

Yukarıdaki resim farklı varlıkların geçen haftaki eğilimini göstermektedir.

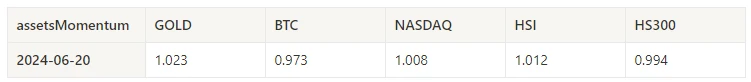

Borç Verme Oranı_Kredi Verme Duyarlılığı

The average annualized return on USD lending in the past week was 10.8%, and short-term interest rates rebounded to around 12.6%.

Sarı çizgi USD faiz oranının en yüksek fiyatı, mavi çizgi en yüksek fiyat olan 75%, kırmızı çizgi ise en yüksek fiyat olan 75%'nin 7 günlük ortalamasıdır.

Tablo, geçmişteki farklı elde tutma günleri için USD faiz oranlarının ortalama getirisini göstermektedir

Fonlama Oranı_Sözleşme Kaldıraç Duyarlılığı

The average annualized return on BTC fees in the past week was 9.6%, and contract leverage sentiment returned to a low level.

Mavi çizgi BTC'nin Binance'teki fonlama oranı, kırmızı çizgi ise 7 günlük ortalamasıdır

Tablo, geçmişteki farklı tutma günleri için BTC ücretlerinin ortalama getirisini göstermektedir.

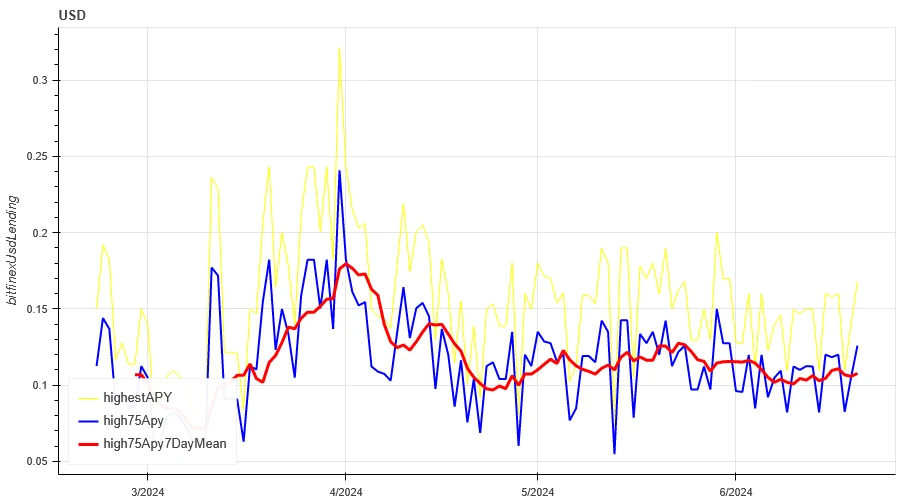

Piyasa Korelasyonu_Konsensüs Duyarlılığı

The correlation among the 129 coins selected in the past week remained at around 0.88, and the consistency between different varieties was at a high level.

In the above picture, the blue line is the price of Bitcoin, and the green line is [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx, imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme, mina, mkr, near, neo, ocean, one, ont, op, pendle, qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx, sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] overall correlation

Pazar Genişliği_Genel Duygu

Among the 129 coins selected in the past week, 4% of them were priced above the 30-day moving average, 8.6% of them were above the 30-day moving average relative to BTC, 2.4% of them were more than 20% away from the lowest price in the past 30 days, and 4.7% of them were less than 10% away from the highest price in the past 30 days. The market breadth indicator in the past week showed that the overall market was in a continuous decline for most coins.

The above picture shows [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apt, arb, ar, astr, atom, avax, axs, bal, band, bat, bch, bigtime, blur, cake, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx, idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, manta, mask, matic, meme, mina, mkr, near, neo, nfp, ocean, one, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, robin, rose, rune, rvn, sand, sei, sfp, skl, snx, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] 30-day proportion of each width indicator

Özetle

Over the past week, the prices of Bitcoin (BTC) and Ethereum (ETH) experienced wide range declines, reaching the peak of volatility on June 18. At the same time, the trading volume of these two cryptocurrencies also reached the highest level during the decline on June 18. Bitcoins open interest volume has declined, while Ethereums open interest volume has increased slightly. In addition, both implied volatilities have increased slightly. In addition, Bitcoins funding rate has fallen to a low level, which may reflect the decline in leverage sentiment of market participants towards Bitcoin. In addition, the market breadth indicator shows that most currencies continue to fall, which indicates that the entire market has generally shown a weak trend over the past week.

Twitter: @ https://x.com/CTA_ChannelCmt

İnternet sitesi: channelcmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.06.14-2024.06.21): Bitcoin ETFs have been continuously sold off in the past 5 days

Orijinal | Odaily Planet Günlük Yazar | Azuma 30 Nisan Pekin saatiyle 20:00'de Solana ekosisteminin önde gelen DeFi protokolü Kamino, yönetişim tokeni KMNO için token başvurularını resmi olarak açacak. Daha önce 5 Nisan'da Kamino, resmi web sitesine bir token oluşturma sayfası eklemişti. Kullanıcılar daha önce bu sayfa aracılığıyla belirli KMNO token airdrop paylaşımlarını sorgulayabiliyordu. Bu gecenin açık talebi, kullanıcıların bu arayüz aracılığıyla yerleşik KMNO hisselerini talep edebilecekleri ve bunları DEX'te veya KMNO'yu destekleyen bazı CEX'lerde alıp satabilecekleri anlamına geliyor. Kamino iş modelinin dökümü Kamino'nun iş modeli karmaşık değildir ve temel ürünü herkesin aşina olduğu bir borç verme protokolüdür. DeFi Llama verilerine göre Kamino şu anda üçüncü sıradaki DeFi protokolü ve birinci sıradaki borç verme protokolü…