ソファ is a non-profit DAO organization dedicated to developing a decentralized clearing protocol. On August 29, SOFA.org had an in-depth discussion with Mr. John Cahill, COO of Galaxy Digital Asia, to explore the long-term value of the project as an industry-grade settlement system and its secure and reliable on-chain structured product suite. The discussion was hosted by the Real Moonlight Show on Binance Live.

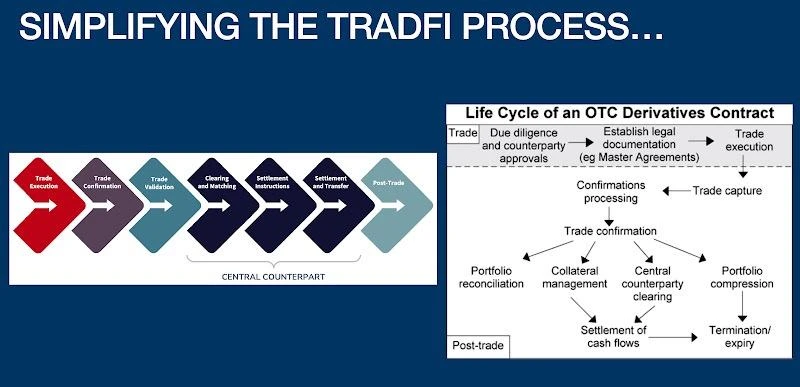

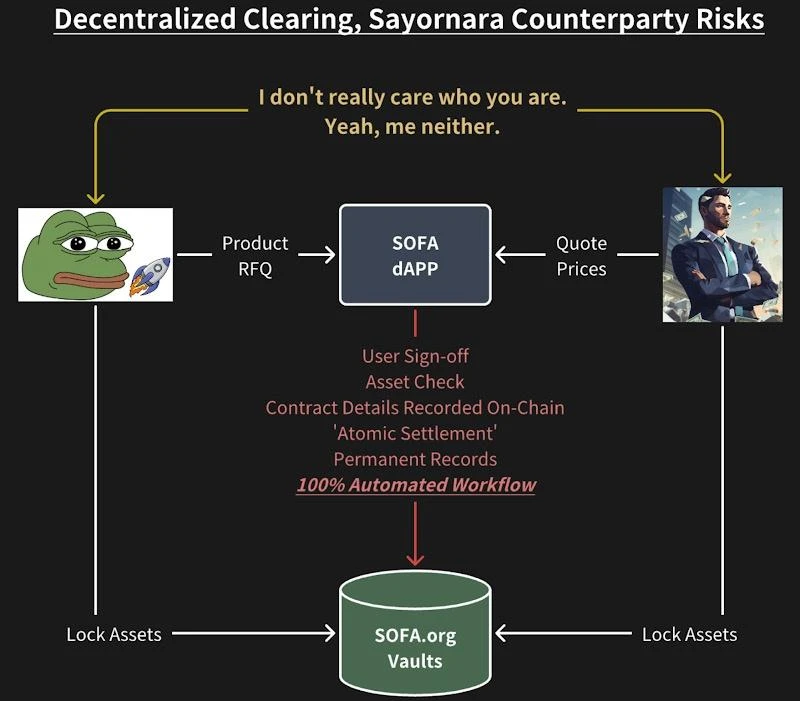

SOFA.org was established to lay the foundation for a digital clearing and settlement ecosystem for handling any financial asset on-chain, including RWAs and tokenized assets. SOFA.org was developed by professionals with rich institutional backgrounds to provide ordinary users with on-chain access to innovative products while leveraging the inherent security advantages of blockchain to ensure end-to-end transparent workflows and asset security. SOFA.org can completely eliminate trade execution and counterparty risk by leveraging the security advantages of smart contract vaults, allowing users to focus on the transaction itself without having to worry about counterparty issues.

Augustine Fan, founding partner of SOFA.org, said: We firmly believe that blockchain technology provides an ideal solution for the clearing and settlement of financial assets. As the best choice for on-chain asset custody, the smart contract vault not only achieves fully decentralized on-chain access, but also ensures data is tamper-proof and traceable, which are the core requirements of institutional-grade settlement systems. SOFA has taken the initial step to become the first fully on-chain crypto structured product protocol. We look forward to extending this innovation to the entire ecosystem, including traditional finance (TradFi), to promote DeFi to a new stage of development.

With the support of founding DAO members such as HashKey Capital, OKX Ventures, and Galaxy Asia Trading Ltd, SOFA.org positions itself as the Android of DeFi, encouraging interoperability between different DeFi protocols to establish a clear and robust industry-level digital asset liquidation benchmark. The project is currently available on the Ethereum mainnet and Arbitrum, and plans to expand to other EVM chains in the future.

Since its successful launch in June this year, SOFA.org has achieved steady growth and has strong community support. The team is still working hard to establish partnerships with various leading CeFi and DeFi institutions to achieve its long-term goals. In addition, the project has taken a 100% fair token issuance route (RCH), with no pre-sales, pre-allocations, and no internal interests. All protocol revenues will be used to burn RCH tokens, ensuring that users become the ultimate beneficiaries of the long-term value growth of the protocol. This ensures that the interests between the project team and users are aligned, and jointly promote the long-term sustainable development of the project.

About SOFA.org

SOFA.org is a decentralized, non-profit and open-source DAO dedicated to developing a trustless DeFi ecosystem that can atomically settle financial assets on the blockchain. The organizations first protocol will focus on crypto structured products, providing users and market makers with a smooth trading experience through pre-made dAPPs and standardized vaults. SOFA.org is supported by many leading DeFi builders and crypto platforms. If you want to learn more about SOFA.org, please visit the official website www.sofa.org.

This article is sourced from the internet: SOFA.org discusses the future of on-chain financial settlement: building new standards for the DeFi ecosystem

関連: 85 年の急落データの分析: 急速に回復しているのは誰か? 弱いセクターは誰か?

原文|Odaily Planet Daily( @OdailyChina )執筆者|Nan Zhi( @Assassin_Malvo )昨日、暗号資産市場は世界市場とともにパニックスパイラルに陥りました。BTCは$6億以上から$4.9億に下落し、ETHは$3,000以上から$2,100前後に下落しました。市場は一般的に米国株式市場がサーキットブレーカーで開くと予想していたところ、下からの大きな反撃が迎えられ、暗号資産市場も急速に反発しました。市場を8月4日夜から昨日午後までの急落期間と、米国株式市場のオープンから今朝までの反発期間に分けて、どのトークンが最も下落し、どのトークンが最も速く反発したのでしょうか?この記事では、Odailyがデータを整理して分析しました…