Bankless starts cashing out crazily, has the market entered the exploitative PvP stage?

Original title: Local Tops: what makes the market go up and down

Original author: mikeykremer, Technical Director of MessariCrypto

الترجمة الأصلية: zhouzhou, BlockBeats

فيما يلي المحتوى الأصلي (لتسهيل القراءة والفهم، تمت إعادة تنظيم المحتوى الأصلي):

Alpha first release: BanklessVCs disgusting behavior clearly shows that we have entered the extractive PvP phase of the market, protect yourself and your returns. I suspect that this cycle has peaked, and this is just a natural adjustment, reflecting that the تشفير market is looking for pain points to extract, but this pain point may last for some time.

رمز مميزs like Virtuals, ai16z, and heyanon may set new highs during the recovery period, but they also face narrative risks, so keep reevaluating your market views.

Why is the market going up?

سوقs go up because new money comes into the market, and this is obvious, so from now on I will use the term “wealth effect” to describe the process of new money coming into the market. We all want cryptocurrencies to create real value in the world and allow us to share in this growth through monetary expansion. Here are a few ways to achieve this goal:

1. Creating Wealth through Innovation (إنزال جوي)

إنزال جويs have become a powerful value redistribution mechanism in crypto markets, capable of delivering significant wealth effects that benefit a broad range of participants. For example, the September 2020 Uniswap airdrop set the industry standard by distributing 400 UNI tokens (valued at approximately $1,400 at the time of issuance) to over 250,000 addresses, with a total value that ultimately exceeded $900 million.

The Jito airdrop in December 2023 was an early catalyst for the Solana memecoin bull run.

The Jito airdrop distributed 90 million JTO tokens, worth $165 million at launch, with some users receiving up to $10,000 in rewards just for transferring $40 worth of JitoSOL. The Jito airdrop drove Solana’s TLV growth and increased on-chain activity. This wealth effect boosted adoption and growth of the broader Solana ecosystem, just as Uniswap’s UNI token catalyzed the growth of DeFi.

Jupiters token distribution method further demonstrates the inclusive potential of airdrops. They plan to distribute 700 million JUP tokens, covering more than 2.3 million eligible wallets, which is one of the most widely distributed airdrops in crypto history. Jupiters airdrop strategy aims to expand its ecosystem by incentivizing long-term participation and governance participation. These airdrops have shown extraordinary efficiency in expanding market participation.

The wealth effect is not limited to direct economic gains, these airdrops transform users into stakeholders, enabling them to participate in governance and protocol development. This transformation creates a virtuous cycle where the benefited participants reinvest their wealth into the ecosystem, further driving market expansion and innovation.

These strategic allocations have proven to be powerful market catalysts, sparking broader bull cycles in their respective sectors. For example, Uniswap’s airdrop ignited the DeFi summer of 2020, with its distribution driving a wave of innovation in the decentralized finance sector. Similarly, the Jito airdrop in December 2023 became a turning point for the Solana ecosystem, driving TVL growth and triggering unprecedented on-chain activity.

This surge in liquidity and market confidence set the stage for the subsequent memecoin explosion, which saw significant market growth. These airdrops effectively served as stimulus packages across the entire ecosystem, creating a self-reinforcing cycle of investment and innovation that تحديned the era of their respective markets.

Wealth accumulation (marginal buyer)

When positive catalysts such as strategic airdrops appear in the market, it will attract previously sidelined participants to enter with new capital and enthusiasm. The influx of these marginal buyers forms a virtuous circle of market expansion and innovation.

Airdrops inspire major positive FOMO, driving new and existing users to participate more deeply in the market.

Investors who were originally on the sidelines began to invest capital after witnessing the successful airdrop and the subsequent market momentum, and transformed from spectators to active participants. This shift from cash to crypto assets represents real new funds entering the ecosystem, rather than a simple transfer between existing participants.

Large financial institutions are increasingly facilitating this transition. Firms like BlackRock, Fidelity, and Franklin Templeton have launched products that connect traditional finance with digital assets. The involvement of these institutions helps legitimize the market and provides a more convenient entry point for sideline funds. This expansion creates a positive-sum environment where new participants contribute to overall market growth.

Unlike a zero-sum trading environment, a market with active new participants creates a real wealth effect through expanded liquidity, increased development activity, and broader adoption. This positive feedback loop attracts more sideline funds, further driving the growth of the ecosystem.

3. Wealth is created through leverage (multiple expansion)

In the terminal stage of a bull market, leverage becomes the main driver of price increases, marking the market’s shift from value creation to value multiplication. When the market enters the price discovery phase, traders increasingly use leverage to amplify their positions, forming a self-reinforcing upward momentum cycle.

When Bitcoin enters a price discovery phase above its all-time high, leverage ratios expand significantly as traders try to maximize their exposure. This triggers a chain reaction where borrowed stablecoins drive further buying, pushing up prices and encouraging more leveraged positions. This multiplier effect accelerates price volatility.

The growing popularity of leverage also introduces systemic fragility into the market, with the likelihood of cascading liquidations increasing as more traders take leveraged positions, especially as borrowing stablecoins becomes more expensive and difficult to access.

Rising stablecoin borrowing costs are a key indicator that the market is entering its final phase, marking a shift from organic growth to leverage-driven expansion, where the market is no longer creating new value but simply multiplying existing value through debt.

During this phase, the high reliance on leverage puts the market in a dangerous position where sudden price fluctuations can trigger large-scale liquidations, leading to rapid price corrections. This fragility indicates that the bull market is nearing its end as the market becomes increasingly dependent on borrowed funds rather than fundamental value creation.

Whats driving the market down?

When money leaves the market, the market goes down, and its obvious. This is essentially a reversal of the wealth effect, with speculators taking advantage of market sentiment, smart money pulling out to lock in profits, and dumb money getting hurt by liquidations.

Wealth is being extracted from the market, and you are going through this phase

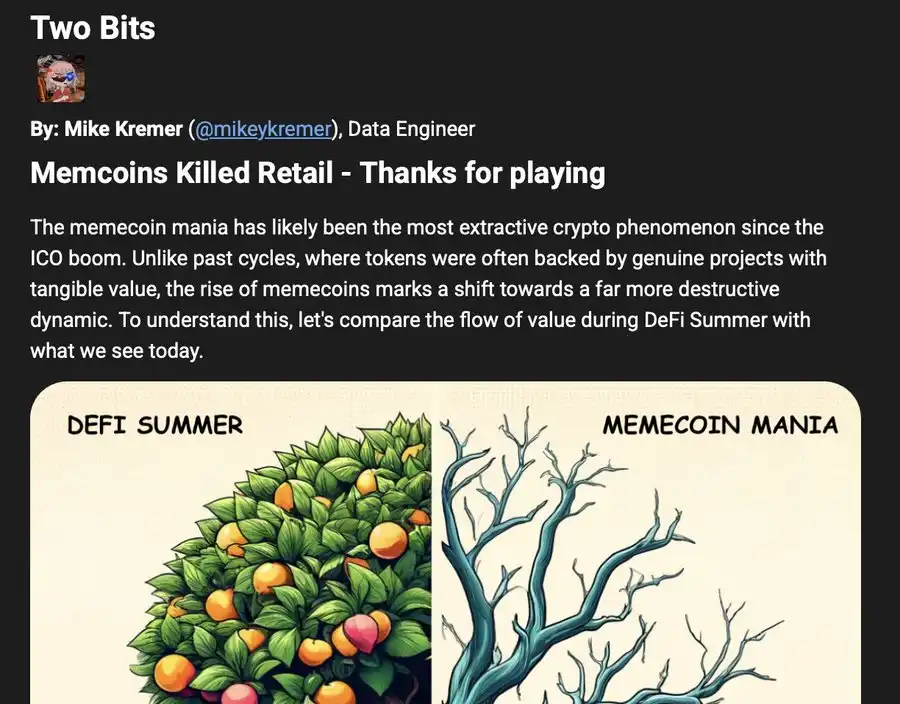

The crypto ecosystem often goes through cycles of value extraction, where savvy operators devise various strategies to extract funds from enthusiastic market participants. Rather than innovations that distribute value, these strategies systematically drain liquidity from the market through various predatory mechanisms.

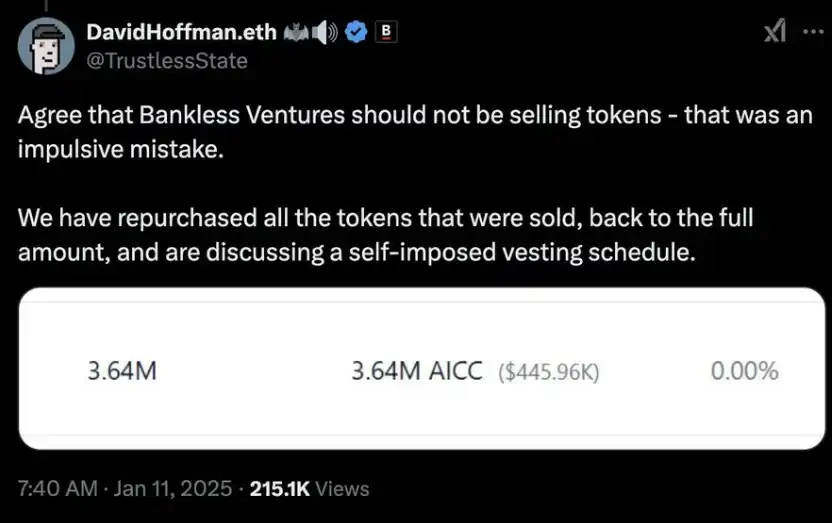

The most disgusting thing about the Bankless story is that they squeezed thousands of SOLs from the ecosystem with just 2 SOLs.

The recent launch of Aiccelerate DAO further demonstrates the evolution of this phenomenon. Despite the support of well-known advisors such as the founder of Bankless and industry veterans, the project was criticized as soon as it was launched because insiders who received tokens began to sell without a lock-up period. Even well-known projects can become a tool for rapid value extraction.

Star tokens are also a typical example of this predatory behavior. These projects transferred wealth from retail buyers to insiders through malicious smart contracts and organized sell-offs, ending the bull cycle of meme coins. Such value extraction events have severely damaged market confidence and hindered the entry of compliant participants.

Not only have these actions failed to build a sustainable ecosystem, but they have also created a cycle of distrust that has hampered the maturity of the entire cryptocurrency ecosystem.

Rather than reinvesting profits into the development of the ecosystem, these schemes systematically drain liquidity from the market. The funds that are extracted often flow out of the crypto ecosystem entirely, reducing the total amount of capital available for legitimate projects and innovation.

The trend from obvious scams to sophisticated operations backed by well-known institutions is worrisome. When well-known institutions are involved in rapid value extraction, it becomes increasingly difficult for market participants to distinguish between legitimate projects and sophisticated scams.

2. Sellers only

Did it surprise you that BAYC peaked after 3 months?

When the market started to fall, a clear asymmetry emerged between veteran players and retail participants. The former were able to quickly detect the market turn, while the latter were still immersed in the optimistic narrative. This stage is not characterized by the inflow of new capital, but the orderly withdrawal of liquidity by experienced traders.

Professional traders and investment firms are reducing their exposure while maintaining an outwardly optimistic tone. Venture capital firms are quietly cashing out through over-the-counter trades and strategic exits, thereby preserving capital without affecting the market. This operation creates the illusion of market stability even as large amounts of money are quietly withdrawn from the system.

“Smart money” has also begun to withdraw liquidity from DeFi protocols and trading platforms. This subtle but ongoing withdrawal of funds has made market conditions increasingly fragile, although the impact is not immediately apparent to the average observer.

It looks like some smart money is exiting the market. The psychology of denial: While veteran players are securing profits, retail investors often remain convinced that the dip is just a temporary buying opportunity.

This cognitive dissonance is reinforced by:

Social media echo chambers sustain an optimistic narrative

Reliance on unrealized gains in a bull market

Misinterpreting the Diamond Hand mentality

Most retail investors miss the best time to exit, often holding on to the initial decline, trying to justify their decisions. When the downtrend becomes apparent, much value has been lost, and as panic spreads, selling pressure intensifies.

The continued withdrawal of professional capital has caused market conditions to deteriorate, with each subsequent sell order having an increasingly significant impact on price. This deterioration in market depth is often not noticed until large price swings expose systemic vulnerabilities.

Unlike the positive-sum environment of new money entering during a bull market, this phase represents pure value destruction, with capital systematically exiting the crypto ecosystem and remaining participants being forced to bear increasing losses.

Leverage explosion (liquidation chain reaction)

The final stages of market capitulation reveal the devastating effects of excessive leverage, and as Warren Buffett famously said, “Only when the tide goes out do you discover who’s been swimming naked.” The most dramatic crash in the crypto markets clearly illustrates this principle.

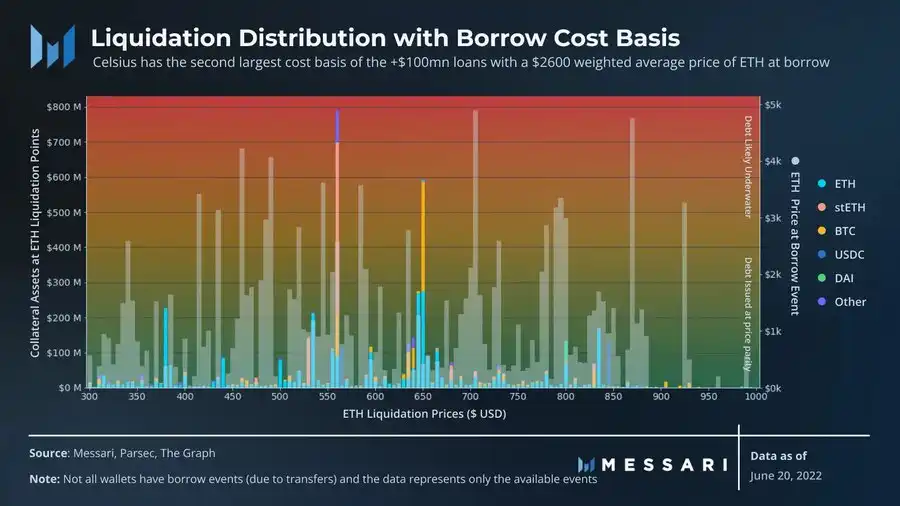

The collapse began in June 2022 with the bankruptcy of 3AC’s $10 billion hedge fund. Their leveraged positions, including $200 million in LUNA and significant exposure to Grayscale Bitcoin Trust, triggered a chain reaction of forced liquidations. The fund’s failure exposed an intricate web of interconnected loans, with more than 20 institutions affected by its default.

The collapse of FTX further illustrates the dangers of hidden leverage. Alameda Research borrowed $10 billion of FTX clients’ funds, creating an unsustainable leverage structure that ultimately led to the collapse of both institutions. The revelation that 40% of Alameda’s $14.6 billion in assets were locked in illiquid FTT tokens further exposed the vulnerability of its leveraged positions.

The collapse triggered a widespread market contagion effect. 3AC’s collapse led to the bankruptcy of multiple crypto lending platforms, including BlockFi, Voyager, and Celsius. Similarly, FTX’s collapse triggered a domino effect within the industry, with many platforms freezing withdrawals and eventually filing for bankruptcy.

Chain liquidations reveal the true depth of the market. As leveraged positions are forced to close, asset prices plummet, triggering further liquidations, forming a vicious cycle. This exposes that behind the seemingly stable market, it relies more on leverage than real liquidity.

The receding tide revealed that many supposedly savvy institutions were actually swimming naked, lacking proper risk management and over-leveraged. The interconnectedness of these positions meant that a failure could trigger a system-wide crisis, exposing the fragility of the entire crypto ecosystem.

Looking Ahead – Narrative Risk

The title of this post is somewhat provocative. My gut tells me that this market correction is healthy, and while a little painful, the market will rebound. My price targets, especially for Bitcoin, remain high – but I have taken my chips off the table and locked in the Bitcoin gains I am willing to take into the next cycle. If this is truly the end of the cycle, remember: no one ever went bankrupt taking profits.

I have written many times (Article 1, Article 2, and Article 3) about the importance of following the market narrative and avoiding being stuck with old coins. The longer the market is down, the more the narrative will change. If the market fully recovers tomorrow morning, I expect cryptocurrencies, ai16z, and cryptocurrencies to continue to lead. But if the market takes longer to recover, then you should focus on emerging coins that are trying to attract the attention of new funds.

What I am trying to tell you is, dont be biased against the coins you own and dont hold on to them through these downturns (unless you really have a strong conviction). Even if they hit new highs, I bet youll lose a lot of potential gains by not converting to new coins in time.

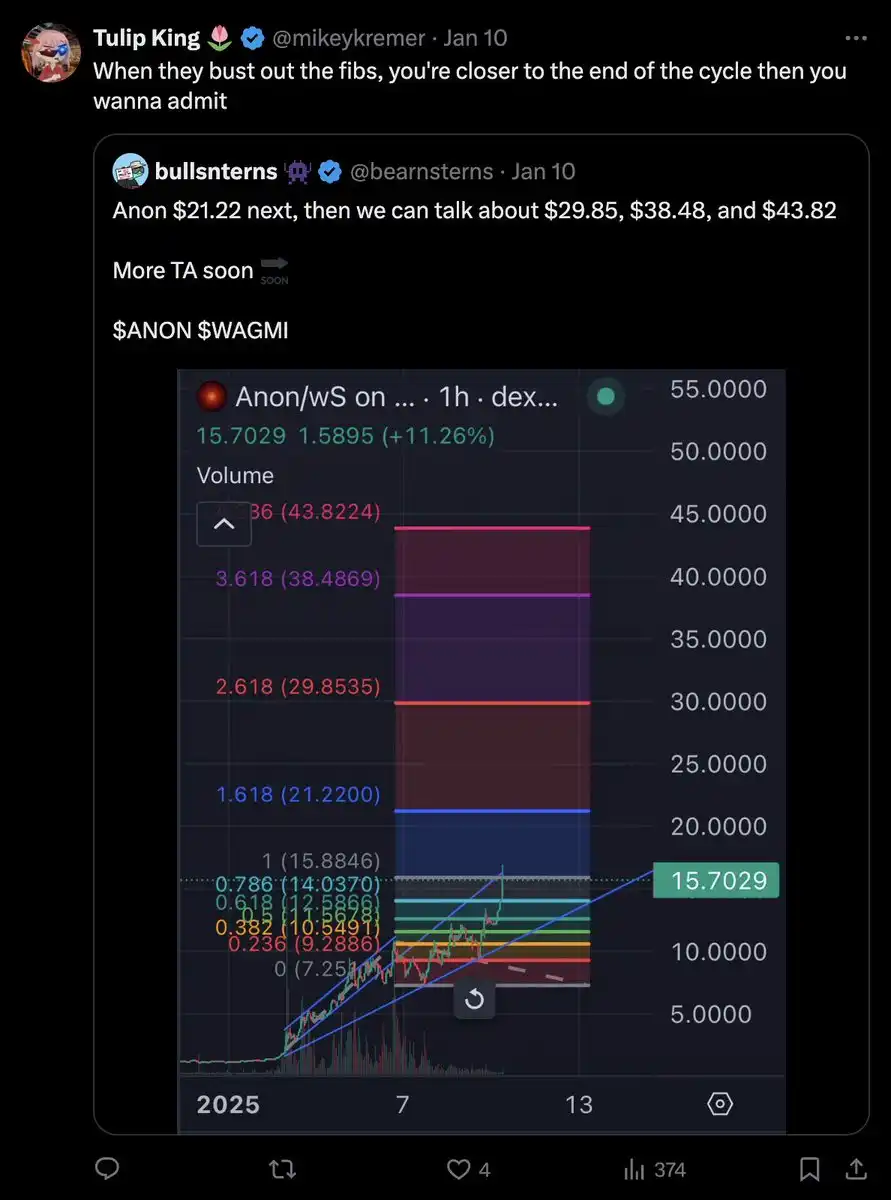

The only reason anyone posts a Fibonacci chart is to convince themselves (and others) that they can sell at a higher price.

This article is sourced from the internet: Bankless starts cashing out crazily, has the market entered the exploitative PvP stage?

Related: Follow Trump and start the easy mode of this bull market

Many old players and investors in this cycle feel that the bull market in 2024 will be very different from that in 2021. The difficulty lies in the lack of original narrative creation, the lack of new investors, the huge amount of high FDV projects entering the market, and the lack of Mass adaptation that has been longed for for many years… However, as Dickens said, “It is the best of times, it is the worst of times.” The answer to the wealth code is often written on the puzzle. Copy Trumps bull market The moment Bitcoin passed the ETF, crypto assets became a Western-dominated market. Almost all the major positives and narrative innovations in this round came from Western capital, whether it was SocialFi, DePIN or Restaking. In this…