The next generation of public chain competition: MegaETH vs Hyperliquid vs Monad

Original title: MegaETH vs Monad vs Hyperliquid: Who Leads in Instant Blockchain Transactions?

المؤلف الأصلي: Three Sigma

الترجمة الأصلية: Odaily Planet Daily Husband How

In the evolving blockchain space, instant transactions are no longer a luxury, but a necessity. As DeFi, payments, gaming, and high-frequency trading continue to push the boundaries of traditional blockchain capabilities, the need for real-time performance is more pressing than ever. Among the solutions that are reتحديning transaction speed and scalability, MegaETH, Monad, and Hyperliquid are strong contenders.

As we mentioned in our previous article, MegaETH is an emerging Layer 2 solution designed to prioritize real-time performance, and its promise of almost instant block times and high transaction TPS has attracted widespread attention.

However, Hyperliquid and Monad are strong rivals with their own unique approaches to optimizing blockchain performance. This article will take a deep dive into the benefits, architecture, and comparison of these solutions to see who is ahead in the race for instant blockchain transactions.

MegaETH Overview

MegaETH is a Layer 2 scaling solution designed for Ethereum. The biggest highlight of MegaETH is that it focuses on real-time blockchain performance, enabling ultra-low latency and scalability for applications that require instant response.

Key Takeaways:

-

Latency and Speed: MegaETH has a block time between 1 and 10 milliseconds and is capable of handling up to 100,000 transactions per second (TPS).

-

Specialized nodes: It adopts a sequencer-centric model, where nodes are divided into sequencers, provers, and full nodes, which simplifies the execution process and reduces redundancy.

-

Integration with EigenDA: MegaETH leverages EigenDA for data availability guarantees, enabling it to scale without compromising reliability or performance.

MegaETH鈥檚 architecture is designed for speed and efficiency, making it stand out in the competitive Layer 2 space:

-

Low latency: Its near-instant transaction processing is ideal for high-frequency trading, gaming, and payment systems.

-

Scalability: By processing blocks in milliseconds, MegaETH avoids the congestion issues common to other L2 solutions during peak demand.

-

EVM compatibility: Fully compatible with the Ethereum ecosystem, able to seamlessly integrate with existing DApps while maintaining security.

Hyperliquid and Monad

While MegaETH is focused on real-time performance, it faces stiff competition from Hyperliquid and Monad, two platforms that take different approaches to optimizing blockchain transactions.

Hyperliquid Overview

Hyperliquid is a fully on-chain perpetual trading protocol built on its own Layer 1 blockchain, optimized for low latency and high TPS. By integrating spot, derivatives, and pre-launch markets into the platform, Hyperliquid has introduced HyperBFT, a high-performance consensus mechanism, and plans to launch HyperEVM, aiming to expand its ecosystem through efficient liquidity aggregation.

-

Vision: Hyperliquid aims to redefine the trading experience by providing a high-speed, decentralized market infrastructure. This makes it particularly popular with financial institutions and high-volume traders.

-

سوق expertise: Hyperliquid鈥檚 unique combination of spot and perpetual markets enables seamless liquidity aggregation and fast settlement.

Hyperliquids technology stack includes a wider range of financial primitives such as lending, governance, and native stablecoins. Based on its HyperBFT consensus mechanism, Hyperliquid achieves a block time of 0.2 seconds while maintaining a unified state across all components, ensuring performance, liquidity, and programmability. With over 262,000 users and processing 200,000 transactions per second, Hyperliquid is clearly positioning itself as a leader in decentralized market infrastructure.

To further expand its reach, Hyperliquid offers Builder Codes, a feature that allows other DApps and CEXs to seamlessly integrate its liquidity by paying a fee on each trade. Builder Codes not only expands Hyperliquid鈥檚 reach, but also enhances liquidity and expands network effects by incentivizing external platforms to utilize its high-performance trading infrastructure.

Monad Overview

Monad redesigns the EVM architecture through parallel execution to achieve high TPS. By addressing the limitations of Ethereums sequential transaction processing, Monad breaks the bottleneck of efficiency and scalability and opens up a new level of performance.

-

Vision: Monad aims to provide cutting-edge blockchain performance while maintaining decentralization, setting a new standard for Layer 1 scalability.

-

Parallel Execution: Monad鈥檚 architecture supports multiple EVM instances processing transactions concurrently, ensuring seamless integration with existing user and developer workflows.

-

Full compatibility: Monad remains fully compatible with Ethereum鈥檚 bytecode while improving performance through internal optimizations without changing the development experience.

Monad introduces pipeline technology to optimize transaction execution, consensus process and state synchronization, maximize hardware efficiency and minimize latency. Based on HotStuffs MonadBFT consensus mechanism, the protocol supports a strong and decentralized validator set while achieving fast block finality.

Key innovations include MonadDB, a database designed specifically for Ethereum state access, and Optimistic parallel execution, which ensures high TPS with minimal overhead. Monad further improves scalability by separating the consensus and execution layers, enabling developers to build applications that require exceptional performance and low latency.

Monad鈥檚 breakthroughs make it a powerful platform for enterprise-level applications, providing developers with the tools they need to create high TPS DApps while maintaining compatibility with Ethereum and embracing the future of blockchain innovation.

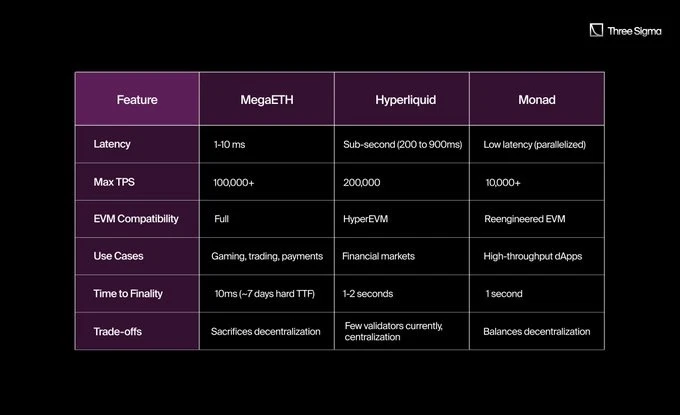

Comparison of the advantages and disadvantages of the three

By evaluating MegaETH, Hyperliquid, and Monad on key metrics, we can gain a comprehensive understanding of their unique advantages and trade-offs. In this comparison, we focus on features such as latency, TPS, EVM compatibility, application scenarios, final confirmation time (TTF), and decentralization trade-offs. These features highlight the fundamental requirements for ensuring real-world utility and performance when scaling blockchain infrastructure.

Delay:

-

MegaETH exhibits extremely low latency (1-10 milliseconds) in Layer 2 transactions, making it ideal for applications that require near-instant responses, such as high-frequency trading or competitive gaming.

-

With a latency of less than one second, Hyperliquid is optimized for financial markets, enabling fast order execution and a seamless trading experience.

-

Monads parallel low-latency execution ensures consistent performance even under heavy network load, supporting various DApps. The team has not yet released a specific time statement.

TPS:

-

MegaETH鈥檚 TPS exceeds 100,000 TPS, highlighting its scalability for large-scale applications.

-

Hyperliquid achieves 200,000 TPS through its proprietary HyperBFT consensus mechanism and Layer 1 optimization.

-

Monad supports up to 10,000 TPS and strives to strike a balance between high performance and decentralization.

EVM Compatibility:

-

MegaETH is fully compatible with EVM, ensuring seamless access for developers and existing DApps.

-

Hyperliquid integrates HyperEVM, a version customized for financial market use cases.

-

Monads redesigned EVM provides high-performance execution while maintaining compatibility with Ethereum tools and standards.

Application scenarios:

-

MegaETH is mainly aimed at games, transactions and payment systems, emphasizing real-time interaction and high scalability.

-

Hyperliquid focuses on financial markets, providing a strong infrastructure to support derivatives, spot trading and market making.

-

Monad鈥檚 versatility supports a wide variety of DApps, especially those that require high TPS and low latency.

Final confirmation time (TTF):

-

MegaETH Layer 2 transactions are able to achieve near-instant confirmation (10 milliseconds), but full settlement on Ethereum L1 will take approximately 7 days.

-

Hyperliquid has a confirmation time of 1-2 seconds, balancing low latency and a strong consensus mechanism.

-

Monad completes transaction confirmation within 1 second, providing a practical balance of speed and security.

Decentralization Tradeoffs:

-

MegaETH鈥檚 centralized sequencer design sacrifices decentralization to a certain extent in order to achieve real-time performance at the Layer 2 level.

-

Hyperliquid鈥檚 market-focused architecture prioritizes low latency and high TPS over decentralization.

-

Monad design strives to maintain a balance, leveraging parallel execution and lazy state updates to optimize performance and decentralization.

ختاماً

MegaETH, Hyperliquid, and Monad each bring unique innovations to the blockchain ecosystem, meeting different needs:

-

MegaETH: Excellent in latency and TPS, well suited for real-time applications, but questionable in terms of decentralization due to its centralized sequencer design.

-

Hyperliquid: Stands out in financial markets with its HyperEVM and liquidity integrations, but is not as versatile as MegaETH in other DApp categories.

-

Monad: Provides a balance between decentralization and performance through parallel execution, improves TPS and supports a variety of applications.

The answer depends on the specific application scenario:

-

For trading and liquidity, Hyperliquid is a strong contender, focusing on financial markets.

-

For general dApp scalability, MegaETH leads in terms of real-time performance and wide application scope.

-

For decentralized high TPS applications, Monads parallelized EVM provides a powerful option for developers who prioritize decentralization.

Key observations:

-

MegaETHs tradeoffs: By sacrificing decentralization, MegaETH achieves unparalleled speed, making it very attractive in real-time systems such as transactions and games. However, despite MegaETHs reliance on Ethereum Layer 1 for settlement (ensuring trust and security), it still inherits Ethereums finality delay. In contrast, Monad and Hyperliquid achieve faster local finality through independent consensus mechanisms, prioritizing instant performance but sacrificing Ethereums shared security guarantees.

-

Hyperliquids Specialization: Hyperliquid has performed well in financial markets, with its unparalleled speed, liquidity aggregation, and seamless trading infrastructure. However, its focus on trading makes it lack versatility in the broader dApp ecosystem, making it less attractive for general-purpose applications. In addition, its centralized HyperBFT consensus mechanism raises concerns about decentralization and trust, and its performance and continued growth of the ecosystem are heavily dependent on external liquidity.

-

Monads balance: Monad strikes a balance between scalability and decentralization through a parallel execution model, providing developers with high TPS without sacrificing EVM compatibility. However, reliance on powerful hardware (e.g., 32 GB of memory and high bandwidth) limits the accessibility of small operators and may lead to centralization of the network. Its independent Layer 1 consensus provides autonomy but sacrifices Ethereums security guarantees, which may discourage developers who prioritize trust and shared security.

لخص

The competition between MegaETH, Hyperliquid, and Monad highlights a key aspect of blockchain development: there is currently no single solution that can dominate all application scenarios. Each platform excels in its field, provides a unique value proposition, and meets different needs. For developers and enterprises, the final decision often depends on the specific application requirements, whether it is speed, market liquidity, or decentralized scalability.

These projects also highlight the importance of continued innovation in blockchain infrastructure. As adoption grows, the industry must find a balance between the scalability trilemma, low fees, high performance, and strong security. Collaborative innovation integrated across ecosystems may drive the next wave of blockchain breakthroughs. As blockchain technology evolves, these platforms are pushing the boundaries of technology, paving the way for faster, more scalable, and efficient decentralized systems.

Ultimately, the choice comes down to the priorities of developers and users: speed, decentralization, or specialization.

This article is sourced from the internet: The next generation of public chain competition: MegaETH vs Hyperliquid vs Monad

Next weeks highlights December 23 Aligned will airdrop 26% of ALIGN to 891,322 addresses. إنزال جوي users must register before December 23 . December 24 Pump Science Roadmap: New partners announced Dec. 24 ; December 25 Binance delists AKRO, BLZ, and WRX ; December 27 LayerZero’s vote on activating the “fee switch” will end on December 27 at 8:00 am ; December 28 Sophon released the mining migration timeline, and mainnet mining will be open on December 28 . From December 23 to December 29, more noteworthy events in the industry are previewed below. December 23 South Korean crypto exchange Aprobit announces suspension of operations, last withdrawal date is December 23 Odaily Planet Daily reported that South Korean crypto exchange Aprobit announced its closure and will stop trading on September 23.…