Analysis of the Prospects of Ethereum Protocol Technology Upgrade (2): The Surge

Since October this year, Ethereum co-founder Vitalik Buterin has published a series of articles on the future possibilities of the Ethereum protocol, covering the six parts of the Ethereum development roadmap: The Merge, The Surge, The Scourge, The Verge, The Purge and The Splurge.

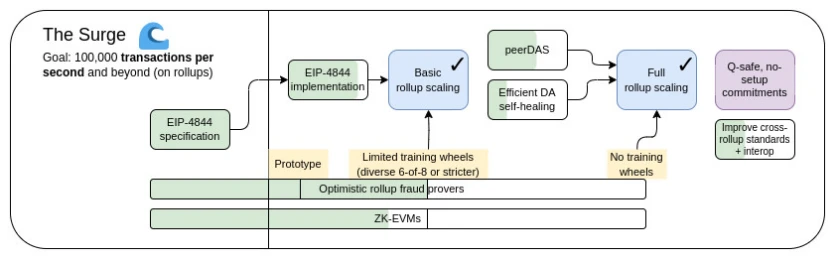

Previously, we have interpreted the first part of the roadmap (The Merge) . This article will continue to interpret the second part of the series, The Surge. In this article, Vitalik focused on the scalability and long-term development of Ethereum. From this stage of the technical roadmap, we can gain insight into how Ethereum will transform into a protocol that can handle huge demands (TPS reaches 100, 000+) while maintaining decentralization and security.

Ethereums core vision

In essence, Ethereum aims to be the base layer of the decentralized Internet. Ethereum supports complex decentralized applications through self-executing smart contract code. This flexibility makes it the preferred blockchain for developers to build decentralized applications including DeFi, NFT, etc.

However, Ethereum has limitations in scalability. Ethereum L1 can only process about 15 to 30 transactions per second, which is far behind traditional payment networks such as Visa. This leads to high gas fees during network congestion and limits Ethereums ability to become a global scale infrastructure. This is exactly the problem that The Surge focuses on solving.

The Surges main goals are as follows:

-Ethereum L1+L2 reaches 100,000+ TPS;

– Maintain the decentralization and robustness of L1;

– At least some L2 fully inherits the core properties of Ethereum (trustless, open, censorship-resistant);

-Maximize interoperability between L2s: Ethereum should be like an ecosystem, not dozens of different blockchains.

A rollup-centric future

The Surge refers to Ethereum鈥檚 plan to significantly increase scalability, primarily through L2 solutions. Rollups are a key component of this strategy. The rollup-centric roadmap proposes a simple division of labor: Ethereum L1 focuses on becoming a strong and decentralized base layer, while L2 takes on the task of helping the ecosystem scale.

Rollup packages transactions off-chain and then submits them back to the Ethereum mainnet, significantly increasing throughput while maintaining security and decentralization. In Vitaliks words, rollup can increase Ethereums scalability to more than 100,000 TPS. This will be a transformative expansion because it allows Ethereum to handle global-scale applications without compromising the spirit of decentralization.

Vitalik emphasized that rollup is not just a temporary solution, but also a long-term expansion solution. Ethereum 2.0 has reduced energy consumption by transitioning from PoW to PoS through The Merge, and rollup is seen as the next important milestone as a long-term expansion solution.

This year, the rollup-centric roadmap has achieved important results: with the launch of EIP-4844 blobs, the data bandwidth of Ethereum L1 has increased significantly, and multiple Ethereum Virtual Machine (EVM) rollups have entered Phase 1. Each L2 exists as a shard with its own internal rules and logic, and the diversity and diversification of shard implementations are now a reality.

Data Availability Sampling (DAS) Further Development

Another key aspect of The Surge is Data Availability Sampling (DAS), a technology designed to solve the data availability problem. In a decentralized network like Ethereum, it is critical that all nodes can verify data without having to store or download everything.

DAS allows nodes to verify data without accessing the full data set, thereby improving scalability and efficiency.

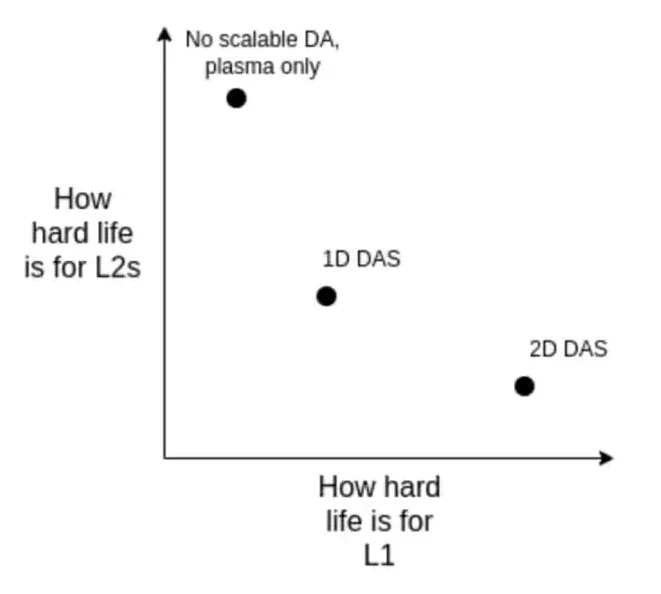

Vitalik highlighted two forms of DAS: PeerDAS and 2D DAS.

PeerDAS is expected to enhance the trust assumption in rollup and make it more secure. 2D DAS performs random sampling not only within blobs, but also between blobs. It exploits the linear property of KZG commitments to expand the set of blobs in a block by a set of new virtual blobs that encode the same redundant information.

With DAS, Ethereum can process larger amounts of data, enabling faster and cheaper rollups without compromising decentralization.

At a further stage in the future, more work is needed to determine the ideal version of 2D DAS and prove its safety properties.

Vitalik believes that the long-term realistic path is:

(1) Implementing an ideal 2D DAS;

(2) stick with 1D DAS, sacrificing sampling bandwidth efficiency and accepting a lower data cap for simplicity and robustness;

(3) Abandon DA and fully accept Plasma as the main Layer 2 architecture.

It is worth noting that this option exists even if one decides to scale execution directly at the L1 layer. This is because if the L1 layer is to handle a large number of TPS, L1 blocks will become very large, and clients will want an efficient way to verify their correctness, so they will have to use the same technology as rollups (such as ZK-EVM and DAS) at the L1 layer.

Plasma and other solutions

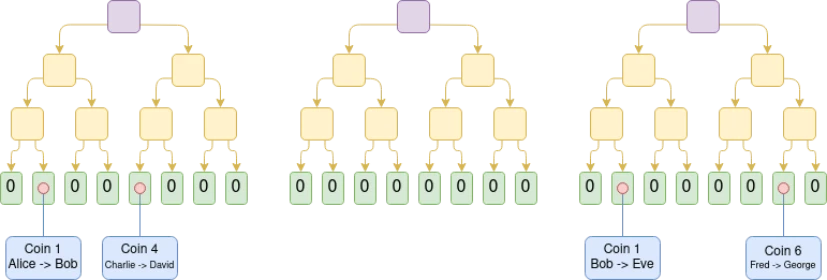

In addition to Rollup, Plasma, one of the early proposed off-chain expansion solutions, is also another L2 solution.

Plasma creates child chains that process transactions independently of the main Ethereum chain and submit summaries to the mainnet at regular intervals. For each block, the operator sends a Merkle branch to each user to prove the changed state of that users assets. Users can withdraw their assets by providing a Merkle branch. Importantly, this branch does not have to be rooted at the latest state.

Therefore, even if there is a problem with data availability, users can still recover their assets by extracting the latest available state. If a user submits an invalid branch (for example, extracting an asset that has been sent to someone else, or the operator creates an asset out of thin air), the legal ownership of the asset can be determined through the on-chain challenge mechanism.

While Plasma development lags somewhat behind rollups, Vitalik still sees it as part of Ethereum鈥檚 broader scalability toolkit.

In addition, Vitalik also discussed improving data compression technology and تشفيرgraphic proofs in the article to further improve the efficiency of rollup and other L2 solutions. The idea is to compress as much data as possible while ensuring that all necessary information is still available for verification by Ethereum nodes. These technical improvements are likely to play a key role in Ethereums efforts to achieve higher throughput.

The above picture is a Plasma Cash chain, where the transaction that spends Coin i is placed in the i-th position in the tree. In this example, assuming that all previous trees are valid, it can be seen that Eve currently has Coin 1, David has Coin 4, and George has Coin 6.

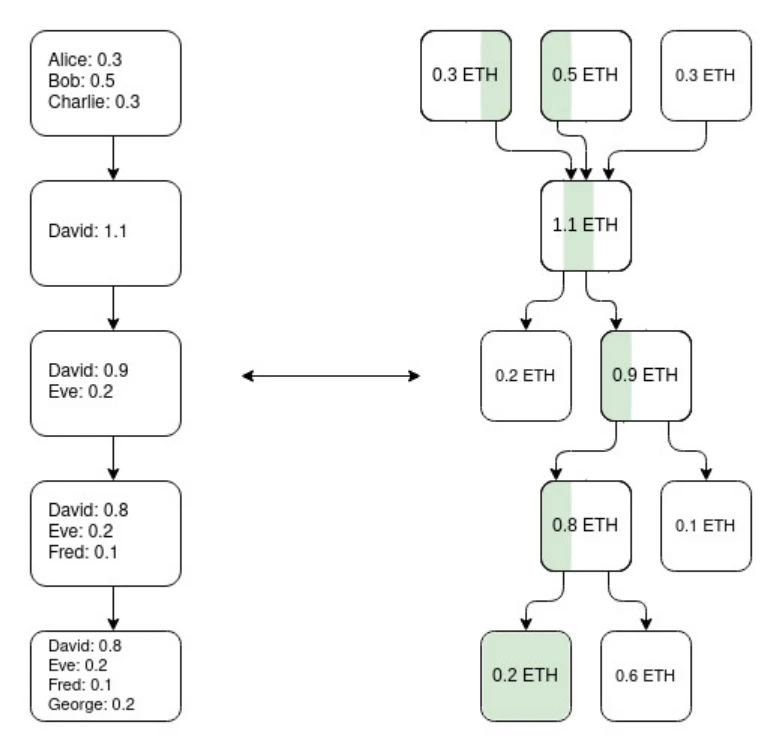

Early versions of Plasma could only handle payment use cases and could not be effectively generalized further. However, if each root was required to be verified with a SNARK, then Plasma would become much more powerful. The process could be greatly simplified because most possible paths for operators to cheat were eliminated. At the same time, new paths were opened up, that is, in the case where the operator does not cheat, users can withdraw funds immediately without having to wait for a week-long challenge period.

The above diagram shows one way (not the only way) to make an EVM plasma chain: Use ZK-SNARK to build a parallel UTXO tree that reflects the balance changes made by the EVM, تحديning a unique mapping of the same coin at different times in history. Then you can build a Plasma structure on top of it.

Plasma performs quite well, which is a key reason why we need to design tricks to overcome its security deficiencies.

Cross-L2 interoperability improvements

A major challenge facing the L2 ecosystem today is the weak cross-L2 interoperability. How to make using the L2 ecosystem feel like using a unified Ethereum ecosystem is an issue that urgently needs improvement.

There are many categories of cross-L2 interoperability improvements. In theory, Ethereum with Rollup as the core is similar to L1 implementation of sharding. The current Ethereum L2 ecosystem is still far from the ideal state in practice.

Chain-specific address: The address should contain chain information (L1, Optimism, Arbitrum, …). Once this is achieved, the cross-L2 send process can be implemented by simply putting the address into the send field, and the wallet can handle how to send it in the background (including using cross-chain protocols).

Chain-specific payment requests: It should be easy and standardized to create messages of the form send me X tokens of type Y on chain Z. This has two main use cases: payments between people or payments between people and merchant services; dApps requesting funds.

Cross-chain swaps and gas payments: There should be a standardized open protocol to express cross-chain operations. ERC-7683 and RIP-7755 are attempts in this area, although both have wider application scope than these specific use cases.

Light Clients: Users should be able to actually verify the chain they are interacting with, rather than just trusting the RPC provider. For example, a16z crypto鈥檚 Helios can do this (for Ethereum itself), but this trustlessness needs to be extended to L2. ERC-3668 (CCIP-read) is one strategy to achieve this.

Shared رمز مميز Bridge Concept: Assuming a world where all L2s are proof-of-validity rollups and each slot is submitted to Ethereum, to transfer assets from one L2 to another L2 in a native state, withdrawals and deposits are still required, which requires paying a large amount of L1 Gas fees.

One way to solve this problem is to create a shared minimalist Rollup whose only function is to maintain which L2 owns each type of token and how much balance each has, and allow these balances to be updated in batches through a series of cross-L2 send operations initiated by any L2. This will make cross-L2 transfers unnecessary to pay L1 gas fees for each transfer, and eliminate the need to use liquidity provider-based technologies such as ERC-7683.

Synchronous composability: allows synchronous calls to occur between a specific L2 and L1 or between multiple L2s. This helps improve the financial efficiency of DeFi protocols. The former can be achieved without any cross-L2 coordination; the latter requires shared ordering. Rollup-based techniques automatically apply to all of them.

Many of the examples above face the standards dilemma of when to standardize and which layers to standardize. If you standardize too early, you risk entrenching a poor solution. If you standardize too late, you risk creating unnecessary fragmentation.

There is a consensus that in some cases there is both a short-term solution that is weaker but easier to implement, and a long-term solution that is ultimately correct but takes years to implement. These tasks are not just technical problems, they are also (perhaps even mainly) social problems that require cooperation between L2 and wallets as well as L1.

Continue to expand Ethereum L1

Vitalik believes that there is great value in scaling Ethereum L1 itself and ensuring that it can continue to accommodate more and more use cases.

There are three strategies for L1 expansion, which can be performed individually or in parallel:

(1) Improve technology (e.g. client code, stateless clients, history expiration) to make L1 easier to verify, and then increase the gas limit;

(2) Reduce the cost of specific operations and increase average capacity without increasing the risk of worst-case scenarios;

(3) Native Rollups (i.e., creating N parallel copies of the EVM).

Each of these different techniques has different trade-offs. For example, native rollups suffer from the same weaknesses in composability as regular rollups: you can鈥檛 send a single transaction to synchronously execute operations across multiple rollups. Raising the gas limit would undermine other benefits that could be achieved by simplifying L1 validation, such as increasing the percentage of users running validating nodes and increasing the number of solo stakers. Depending on the implementation, making specific operations in the EVM cheaper may increase the overall complexity of the EVM.

Decentralization and security

The balance between scalability and decentralization is one of Vitalik鈥檚 recurring themes. Many blockchain projects choose to sacrifice decentralization in exchange for higher throughput. For example, Solana can process thousands of transactions per second, but requires powerful hardware to run nodes, which centralizes the network. Vitalik insists that even as Ethereum continues to scale, it must maintain its commitment to decentralization.

Rollups and DAS are seen as a way to increase Ethereums capacity while maintaining its decentralized nature. Unlike Solana or other high-performance blockchains, Ethereums scaling strategy ensures that anyone can run a node, securing the network in a truly decentralized way. This is critical to Ethereums vision of building a blockchain that can support a global, permissionless financial system.

With greater scalability comes greater responsibility in terms of security. As Ethereum moves towards a rollup-centric future, it becomes critical to ensure that these systems are trustless. Rollups rely on cryptographic proofs to guarantee that off-chain transactions are legitimate when submitted back to Ethereum. While these systems have proven to be effective, they are not without risk. Vitalik acknowledged that the maturity of these technologies will require rigorous testing and iteration, especially as they become more widely adopted.

What鈥檚 next for The Surge?

After The Surge, Vitalik envisioned Ethereum to not only scale but also remain fully decentralized, secure, and sustainable. This vision includes not only scaling Layer 1 through rollups and DAS, but also building more efficient consensus algorithms, improving developer tooling, and fostering a thriving dApp ecosystem.

Ethereum鈥檚 roadmap is optimistic, but also presents many challenges. Implementing rollups at scale, ensuring the security of L2 solutions, and preparing for a quantum future are all complex tasks. However, if Ethereum can successfully overcome these obstacles, it will solidify its position as the core of Web3: a decentralized, user-controlled internet.

Ethereum鈥檚 focus on scalability without sacrificing decentralization is unique in the rapidly evolving blockchain space. If The Surge is successful, it could change the blockchain technology landscape again in the coming years.

This article is sourced from the internet: Analysis of the Prospects of Ethereum Protocol Technology Upgrade (2): The Surge

Related: Ethereum returns to $4,000. Have the fundamentals of the ecosystem really changed?

Original author: Kaori, BlockBeats After the bull market correction phase a few days ago, the price of ETH once again stood at $3,900. Looking back at the development of Ethereum over the past year, there are many complex factors and emotions. On the one hand, the Cancun upgrade was successfully completed and the spot ETF was officially approved, ushering in a new bull market in terms of technology and fundamentals; but on the other hand, as Bitcoin, SOL, and BNB broke through historical highs one after another, the price of ETH is still hovering around the $4,000 mark. From the ETH price trend chart above, we can see that Ethereum has gone through three major stages this year, and the rise in the three stages corresponds to different reasons. At…