Original author: Yinghao, SevenX Ventures (twi: @linsajiao)

ملخص طويل

Xterio has a clear positioning and vision:

• Web3 gaming ecosystem integrating infrastructure, RD, operations, assets and platforms

• Full coverage, integrated RD and operation, end-to-end Web3 game industry chain

• Cross-terminal and cross-category Web3 game factory

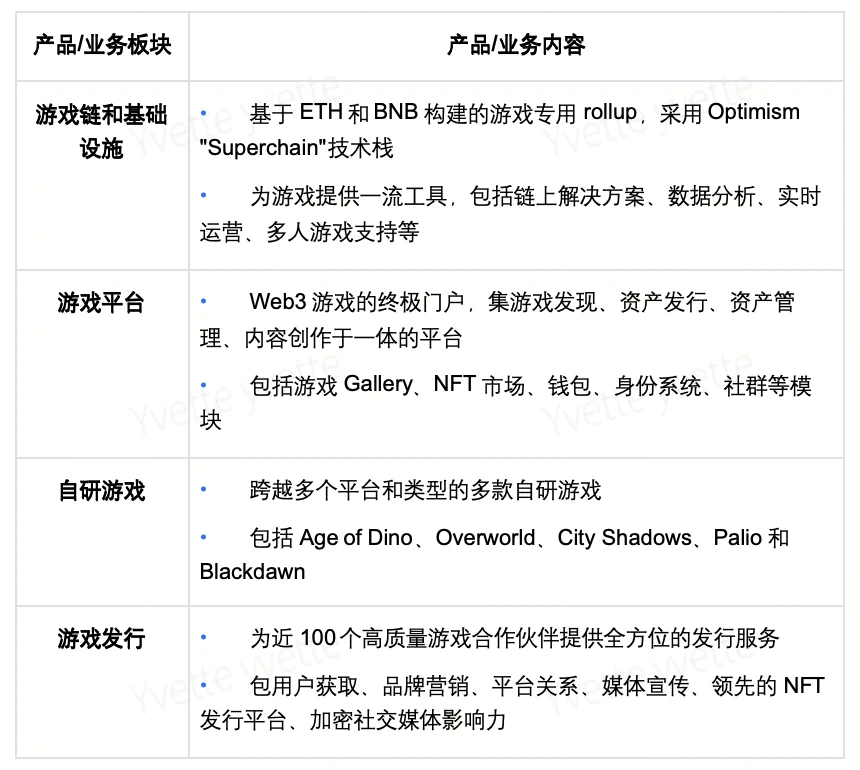

Xterios products include:

• Game chain, game platform, self-developed games, game distribution

• Each product segment has achieved outstanding results

Xterio is an active explorer of AI gaming:

• One of our flagship games, Pailo, combines large language models with AI generation technology to create a game world where players can deeply interact with high-quality AI Agents

• Xterio also applies AI generation technology to NFTs. Users have generated more than 100,000 works using Xter.ai

Xterio already has the core elements to earn a valuation premium:

• It is expected to establish an industry-leading position in this bull market and break the ceiling of Web3 game project valuation

• As the commercialization process deepens, Xterio will show the potential to compete with traditional gaming giants in the future

The Garden of Forking Paths: A Dual Perspective on Dilemmas and Breakthroughs in Web2 and 3 Games

Before we talk about Xterio, let’s jump out of the project and look at what is happening in the Web3 and Web2 gaming industries. In Borges’s The Garden of Forking Paths, time is depicted as an infinitely forked network, with each decision point leading to a different parallel universe. Today’s gaming industry is just like this metaphorical garden: Web3 and Web2 games are on seemingly parallel paths, but they are constantly intertwined and reflecting each other at key nodes in the evolution of the industry.

As an investment institution that has been deeply involved in this field for a long time, we found that the difficulties of Web3 games are concentrated at the track layer, while the difficulties of Web2 games are more inclined towards the industry layer. The two seem unrelated but are closely linked.

The track layer dilemma of Web3 games

Developers and products break through

Web3 games are facing a double squeeze of talent and products. According to the survey, only 7% of game development studios show a strong interest in Web3 technology, and there are less than 50,000 full-time practitioners, which is in sharp contrast to the 3 million practitioners in the traditional game industry. This talent shortage directly affects product quality. According to Footprint data, there are only about 2,000 active games on the mainstream game chain, while the global traditional game market has added more than 100,000 games each year during the same period, a huge gap in quantity.

What is more worrying is the product quality. Most Web3 game studios have a scale of 10-30 people. Due to the limitation of manpower and funds, the quality of games is generally unsatisfactory. The types of games are also too single, mainly concentrated in RPG, SLG and no more than 10 categories, while traditional games on the Steam platform have more than 100 subcategories. This lack of product strength has caused Web3 games to be unable to break through the shackles of simple gameplay such as gold farming and airdrops, and it is difficult to attract real players.

The curse of narrative

The narrative of Web3 games has fallen into a homogenization dilemma. Recently, a large number of projects have upgraded their positioning to platforms or game chains, and even superimposed concepts such as modularization and RaaS, making the market flooded with dozens of similar game chains. At the same time, various projects are scrambling to lay out the traffic migration story of the Web2 platform, from Telegram to Line, Discord, and TikTok, trying to replicate the successful model of explosive content-traffic platform-publisher.

What is more worthy of reflection is the emergence of concepts such as tap to earn. This model is more simplified than play to earn, further weakening the entertainment nature of games and alienating games into a simple tool for making money. The distortion of narratives not only failed to bring breakthroughs to the industry, but also made Web3 games further deviate from the correct development direction.

Commercialization and funding

The commercialization of Web3 games faces the dual challenges of the failure of traditional models and the instability of new models. The mature payment models of traditional games (direct purchase, krypton gold, advertising, etc.) are difficult to implement in the Web3 environment, mainly because users cannot get enough positive feedback on the game experience. The asset issuance and token issuance models unique to Web3 are in trouble because the economic system has failed to close the loop.

The deterioration of the financing environment has further exacerbated this problem. The average financing amount of Web3 games in 2024 fell to less than $3 million, and the survival period of most projects is less than 18 months. This financial pressure, coupled with the uncertainty of the business model, makes it difficult for projects to achieve sustainable development. From $500,000 to $2 million in the angel round, to $3 million to $8 million in the A round, and then to more than $8 million in the B round, the entire financing chain appears extremely fragile.

These three dilemmas have formed a vicious cycle that is difficult to break: lack of talent leads to poor product quality, poor product quality makes commercialization difficult, and commercialization difficulties restrict the attraction of talent, which ultimately affects the healthy development of the entire industry. To break this cycle, we need to work hard in multiple aspects, such as improving product quality, innovating business models, and optimizing the financing environment.

What’s happening in the Web2 gaming world? Are they facing the same dilemma? Let’s take a look.

The Industrial Layer Dilemma of Web2 Games

Industrial chain integration: from dispersion to integration

The fragmentation problem of the Web2 game industry chain is becoming increasingly prominent. Taking game development as an example, according to statistics, the number of independent game studios in the world will exceed 50,000 in 2023, but 90% of them have an annual income of less than 1 million US dollars. In the field of game distribution, except for a few giants, small and medium-sized publishers occupy 80% of the market share, but the average annual release of a single publisher is only 2-3 games, and the market efficiency is low. The supporting service fields such as game engines, cloud services, and advertising realization are also highly fragmented. This fragmentation of the industry chain has seriously restricted the development of the industry.

The efficiency loss caused by the fragmentation of the industrial chain is particularly obvious. According to an industry report in 2023, independent game developers have to conduct business negotiations with 3-5 publishers on average before they can confirm cooperation, and the entire process often takes 6-8 months. What is more worrying is the issue of profit sharing. Surveys show that small and medium-sized developers usually have to give up 50%-70% of their revenue share when cooperating with publishers. Take the phenomenal independent game Hollow Knight as an example. Although global sales have exceeded 3 million copies, due to the high share of the distribution link, the development team finally received only 35% of the total revenue.

The disadvantages of this decentralization have been confirmed in many cases. The highly acclaimed Star Citizen ran into financial difficulties in the early stages of development because it could not find a suitable publisher, and eventually had to turn to a crowdfunding model. Another typical case is Subnautica, which received a 95% positive review rate on Steam in the first month of its launch, but was subject to a 70/30 profit-sharing agreement with the publisher. The development team was almost unable to make a profit after deducting costs, and it was not until the later stage that the situation was reversed through self-publishing.

In contrast, companies with integrated industry chains have shown obvious advantages. Tencent Games has made League of Legends a phenomenal product with annual revenue of more than US$2 billion by integrating RD, distribution, and e-sports event operations. NetEase, relying on a complete industry chain layout, from game development to distribution, from cloud services to e-sports events, has achieved a 23% year-on-year growth in game business revenue in 2023. These successful cases show that industry chain integration can not only improve operational efficiency, but also provide a better development environment for game creators.

The integration of the industry chain has become an inevitable trend in the development of the game industry. Mihoyo started from simple game development and gradually built a complete industry chain including RD, distribution, and community operation. The success of Genshin Impact confirms the correctness of this strategy. A complete industry chain can not only reduce the cost of intermediate links, but also ensure the consistency of product quality and the continuity of user experience. In the future, competition in the game industry will no longer be a contest of a single link, but a competition of industry chain integration capabilities. Those companies that can achieve a full industry chain layout will surely take the lead in this change.

Integration trend: the trend of full terminals and multiple categories

According to the latest data from Newzoo, the market share of PC games has dropped to 23% in 2024, down 8% from five years ago, and console games have also dropped from 31% to 27%. Behind this downward trend is the severe challenge faced by the traditional end-game model. The once glorious World of Warcraft MAU has dropped from 12 million at its peak to less than 5 million, and the Steam platform has an embarrassing situation where 65% of new games have less than 1,000 MAU. All this points to a reality: the era of pure reliance on end-games is over.

However, companies focusing on mobile games also face development bottlenecks. According to the survey, only 23% of users over 45 years old will choose mobile phones as their main gaming platform. This age limitation restricts the further expansion of the mobile game market. The technical limitations are also obvious. The average game time of MMORPG mobile games is less than half of that of PC. The growth data more directly reflects this dilemma: Mihoyo, which once grew rapidly, saw its growth rate drop to 9% in 2023, down from 45% in 2021.

Faced with this double dilemma, game companies began to seek breakthroughs. PC game giants have entered the mobile platform one after another. Activision Blizzard successfully increased the proportion of mobile revenue to 35% through the Call of Duty mobile game. At the same time, mobile game companies are also actively deploying the PC game market. Mihoyos development of Zero and Liliths investment in console games all reflect this trend of two-way integration.

The rapid iteration of categories has further promoted this integration. On the Steam platform, survival games have occupied four seats in the revenue list in 2021, but only one seat in 2023; the number of MMORPG games in the mobile game market has also dropped from five in 2020 to two in 2023. Instead, new categories have emerged, such as the rise of two-dimensional placement games and simulation business games. The rapid pace of this change has put companies that bet on a single category to the test.

سوق data confirms the advantages of a diversified strategy. In 2023, NetEase, which adopts a multi-category layout, achieved a 23% revenue growth, while Perfect World, which focuses on MMORPG, saw a 15% decline. Tencent has achieved steady growth through its layout in multiple categories such as MOBA, FPS, and survival; Mihoyo also started from two-dimensional mobile games and gradually expanded to different directions such as open world RPG and strategy, maintaining a good development momentum.

The future of the gaming industry clearly belongs to comprehensive companies that can achieve full terminal coverage and multi-category layout. This trend is not only an adaptation to market changes, but also a response to user needs. More and more users expect seamless cross-platform gaming experience and are eager to try different types of games in different scenarios. Companies that can meet these needs will surely occupy an advantageous position in future market competition.

Going upstream: Xterio’s “industry chain solution”

Through the above observations, we can see that the Web2 and Web3 game worlds are undergoing changes at different stages: the Web2 game industry is upgrading and restructuring its industry chain based on high-quality content, mature business models, and a large user base, while the Web3 game industry is still building the most basic industry chain structure. These two seemingly parallel worlds actually contain important revelations.

Another perspective on Web3 games

Although the dilemma of Web3 games is only localized on the surface, solutions need to be found from the perspective of the transformation of the Web2 game industry. Web3 games are currently facing the dual challenges of an imbalanced micro-industry chain structure and an inability to integrate with the Web2 game industry chain.

However, Web3 games have unique advantages and are naturally suitable for an integrated industrial chain structure.

• Infrastructure-RD integration: customized performance, nodes, ecological tokens and other infrastructure are required

• Integration of RD, distribution and operation: content and asset distribution need to be synchronized, and operations revolve around assets, tokens and communities

Xterio’s Vision

The emergence of Xterio has brought new hope to the industry. As a startup project with the background of a major Web2 game company, Xterio has put forward a clear vision:

• Build a Web3 gaming ecosystem that integrates infrastructure, RD, operations, assets, and platforms

• Create a full-coverage, integrated RD and operation, end-to-end Web3 game industry chain

• Develop cross-terminal and cross-category Web3 game factories

In the latest industry survey, Xterio was rated as the most anticipated Web3 game project by more than 60 senior Web3 game players. Its uniqueness lies in the use of the Web2 industry chain perspective to build the Web3 game ecosystem, which brings a more scientific production framework to the entire track and creates a higher-dimensional construction method.

This approach not only retains the innovative features of Web3 games, but also solves its shortcomings in the industrial chain, providing new ideas for the healthy development of the entire industry. Xterios practice shows that solving the dilemma of Web3 games from the perspective of industrial chain integration is not only feasible, but also an inevitable development direction.

Just like the garden described by Borges, the development paths of Web3 and Web2 games will eventually intersect at a certain node in time and space. At this intersection, Web3 games will inherit the industrial wisdom of Web2 and create their own new world. Xterio is a pioneer standing at this intersection.

Leopard change: Xterios product exploration

In more than two years, Xterio has continuously expanded its product extensions while consolidating its product core. A gentleman changes his appearance like a leopard – Xterio has formed a product/business matrix supported by four pillars: game chain, game platform, self-developed games, and game distribution.

Game Chain and Platform

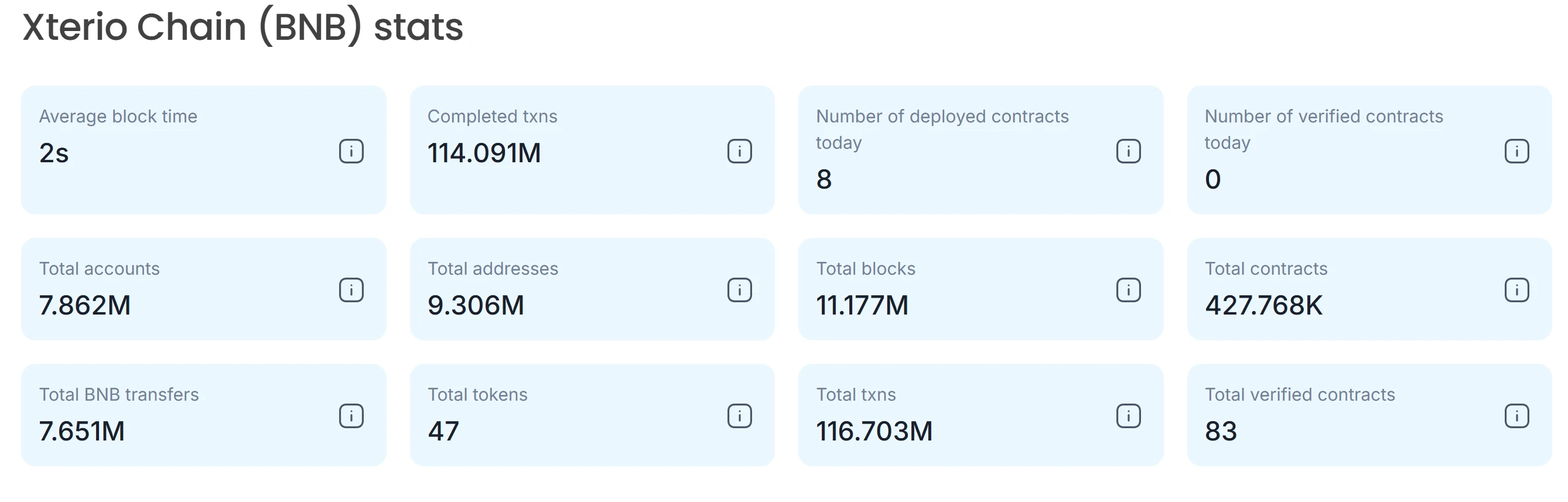

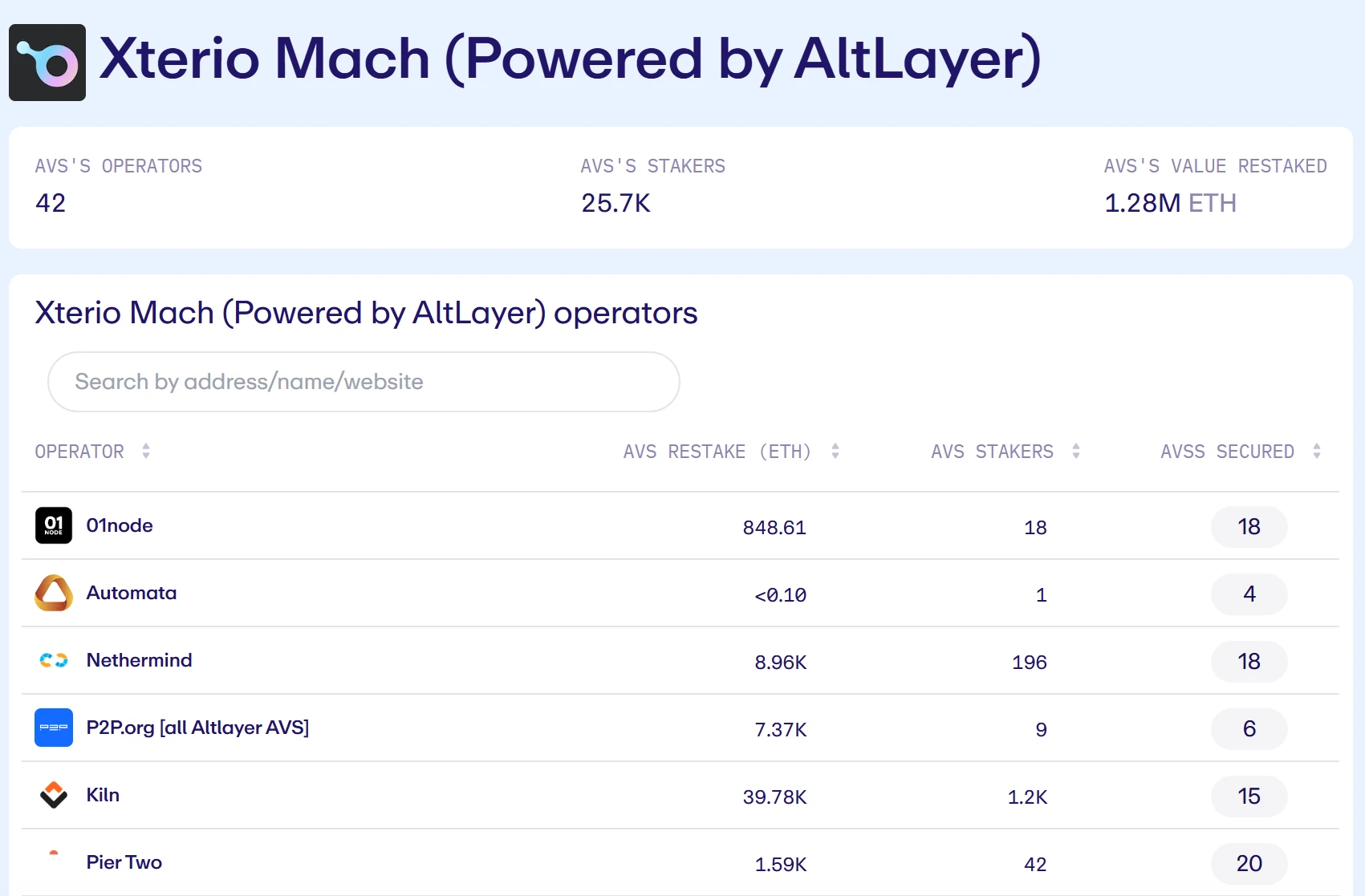

Xterio is building a comprehensive blockchain gaming infrastructure ecosystem. On the technical level, it has worked closely with AltLayer and EigenLayer to jointly develop a SuperChain Rollups solution based on Optimism technology. This solution not only provides high-performance transaction processing capabilities, but also shares liquidity with other SuperChain-based second-layer networks (such as Base), improving the interoperability of the ecosystem.

The most innovative is the adoption of the MACH (Modular Asynchronous Confirmation Handling) technical framework, which enables Xterio Chain to compress transaction confirmation time to less than 10 seconds while maintaining a high degree of security, which is revolutionary for game applications with extremely high real-time requirements. It is worth mentioning that Xterio, as the only game project in the first batch of AVS of EigenLayer, has received re-staking support of approximately 1.28 million ETH, which not only provides support for performance optimization, but also creates a safe and reliable comprehensive game platform by sharing the economic security attributes of Ethereum.

In terms of game platform construction, Xterio has developed into a Web3 game hub with 8 million active users, providing a full range of services for players and developers:

For players:

• One-stop service system: including NFT trading market, digital wallet management, game library and complete identity system

• Innovative account system: Using abstract account (AA) technology, users can manage digital assets simply by email and OTP verification

• Secure payment system: Partner with MoonPay and LayerZero to provide diversified payment options

• Asset protection: Use MPC technology to protect user assets and support cross-chain asset management

• Mobile terminal adaptation: fully comply with mobile terminal compliance requirements to ensure a complete service experience

For developers:

• Complete technical solution: providing intuitive API interface, scalable infrastructure and comprehensive data analysis tools

• Cross-platform support: covers both mobile and desktop, and provides Unity and Unreal Engine SDKs

• Financial support: built-in royalty enforcement system and marketing toolkit to help developers maximize revenue

• Multi-chain deployment: Supports expanding user groups in different blockchain ecosystems

In terms of NFT infrastructure, Xterio has built the most comprehensive NFT issuance platform on the market, providing the following core functions:

NFT platform features:

• Smart Contract System: Provides customized and open source foundry smart contracts with built-in royalty enforcement mechanism

• Complete whitelist system: including native whitelist function, bidding system, lottery system and application system

• Data and community: Provides on-chain data analysis, KOL cooperation, DAO organization docking, guild management and other functions

• Marketing support: providing customized PR activities, marketing event planning, social media community management and other services

With complete functions and diversified services, Xterios NFT platform has sales of more than 5,000 ETH in the first half of 2024, ranking first among issuance platforms. Among the dozens of projects previously released by launchpad, more than 100k independent users have been attracted to participate, and most projects have been minted out within tens of seconds to 72 hours. The success of the issuance is inseparable from the powerful functions of Xterio itself, such as supporting custom smart contract casting, whitelist management, bidding and lottery systems, and providing on-chain data analysis and optimization services. By integrating DAO, guilds, KOLs and blue-chip communities, the platform has effectively improved the market penetration of the project. In addition, Xterio also supports precise reach of multi-chain users, and provides public relations and marketing activities and community operation support, such as customized promotion on Twitter and Discord.

Through collaboration with nearly 100 projects, Xterio has become one of the most powerful issuers at the intersection of Web2 and Web3.

Self-developed games and third-party game distribution

At the game level, Xterios content matrix is divided into two parts: self-developed games and third-party cooperative games.

Self-developed games include Age of Dino, Overworld, City Shadows, Palio and Blackdawn:

The flagship product Age of Dino has always attracted the attention of players in the past year. As an innovative cross-platform strategy game, Age of Dinosaurs has completed a seed round of financing of US$8 million, with support from major lead investors including Xterio, Animoca Ventures and SevenX Ventures, and also attracted participation from well-known investment institutions such as Hashkey Capital, Game 7, and GSR Markets.

In terms of game design, AoD cleverly combines the core gameplay of strategy simulation (SLG) and role-playing (RPG). Players can manage dinosaur bases, explore unknown areas to collect resources, and engage in strategic confrontations with AI-driven hostile forces and mutant dinosaurs. These elements are carefully woven into an engaging game world. In terms of accessibility, AoD achieves seamless integration between mobile (iOS, Android) and PC, and innovatively launches a Telegram applet version, allowing players to enjoy the game anytime, anywhere.

In terms of market performance, AoD showed strong potential as soon as it was launched, and generated more than $300,000 in comprehensive revenue in the first week. In terms of business model innovation, AoD broke the model of traditional strategy games relying on official skins to obtain revenue, and completely opened up the right to create skins to the player community. From the operational data, the average expenditure of each paying user reached $110, far exceeding three times that of other similar blockchain games. What is more noteworthy is that the game achieved a balance between the traditional players fiat currency recharge income and the blockchain users on-chain income in the early stage of its launch.

On the social level, AoD has shown excellent cohesion. The recent Research Institute Battle event is a typical example: this large-scale battle attracted nearly 10,000 players to participate online at the same time and lasted for 8 hours. In this fierce competition, various guilds showed amazing organizational and strategic execution capabilities, and even a single player invested more than 20,000 US dollars in a one-time consumption behavior. This scale of investment is rare in the field of blockchain games, which fully reflects the players high recognition of the game.

The choice of SLG reflects Xterios profound market insight. The latest industry report shows that the revenue of strategy games will exceed the 8 billion US dollar mark in 2023, and the annual new user installation volume will reach 700 million, with the growth rate remaining at a high level of 23.5%. In the strategy game track, the installed capacity of SLG has exceeded 52.1%. From the perspective of business performance, the average user expenditure of this category has reached 11 US dollars, and the annual consumption of heavy players can exceed the million-dollar mark. More importantly, SLG games can generally maintain stable operations for 6-8 years. For example, Clash of Clans has an operation time of nearly 10 years and a cumulative revenue of tens of billions of dollars, which fully proves the commercial potential of this track.

It is worth mentioning that the Web3ization of mature Web2 game types has always been a difficult problem, especially the SLG category. The complexity of game production and the difficulty of acquiring users make few Web3 game teams dare to try. But if this bottleneck can be broken, Web2 users can be continuously brought into the Web3 ecosystem, which is exactly the direction of AoDs efforts.

Another game, Palio, represents the Xterio teams innovative exploration in the field of AI games. This fantasy two-dimensional simulation game, which spans both PC and mobile terminals, takes creating your own unique AI companion as its core concept and shows a unique charm in game design.

On the technical level, Palio has invested a lot of resources in developing a dedicated emotion engine to make the non-player characters (NPCs) in the game show unprecedented realism. Through in-depth cooperation with Reka, the team perfectly combines large language models with AI-generated content technology to create a vibrant virtual world. Here, players can not only build and explore freely, but also have deep emotional interactions with AI characters and experience real and natural social experiences.

Palios innovative concept has received a warm response from the market. In the Meet Your Anima event launched in April this year, the game showed amazing user appeal – it attracted 200,000 new users on the first day, and reached a peak of 450,000 per day on the fifth day. During the entire event, it brought in a total of 7 million new wallet users. This set of impressive data not only verifies the accuracy of product positioning, but also shows the huge development potential of AI games in the field of Web3.

In addition to self-developed games, Xterio has cooperated with nearly 100 third-party games:

Among the games that Xterio collaborates with, some notable features can be found:

• In addition to the top masterpieces, Xterio is also very good at using their deep selection background to support some cutting-edge and independent works, such as the multiplayer shooter Nyan Heroes with more than 20k downloads on the Epic store, the Roguelite RTS card game Apeiron that has attracted more than 140K wallet users, and the evacuation shooter Shrapnel led by Mark Long from the former Halo, Call of Duty, and Star Wars team.

• These games come from the global market, distributed in North America and Europe, and also include many Chinese developers, such as the strategy design game Mad World developed by the former EA and PlayStation teams, the simulation business game Moonfrost developed by the former Stardew Valley team, and the strategy game Fableborne, which currently has more than 100k UAW in 7 days on Dappradar; such as the MOBA game E 4 C: final salvation developed by the team led by the well-known former Riot Games Asia Pacific CEO, the two-dimensional APRG game SpotZero developed by the former Bilibili and Paper Games team, etc.

• These games are distributed across multiple terminals, including PC, mobile, and web versions, such as the PC-based PVP shooting game Lowlife Forms, the mobile-based MMORPG Worldshards

• Diversified categories, covering almost all mainstream categories of Web3, including MOBA game Evermoon, shooting game Farcana, MMORPG World of Dypians, SLG game Outer, party game Party Icon, two-dimensional placement game PotK, ARPG Blade of God X, open world game Wilder World, etc.

• Dare to try new interactions, including Xter.AI gameplay, AI games, full-chain games, Twitter plug-in games, etc., such as AI Arena that allows users to participate in the AI model training process, the full-chain strategy game LEAGUE OF THRONES, and the Twitter plug-in game NANOZAP

Distribution is the traditional strength of the Xterio team. The core team has worked for FunPlus and NetEase, both of which are world-class publishers. In addition, through the practical experience of multiple Web3 distribution, Xterio has built a scientific and systematic distribution service framework. This is an ultimate solution for cross-terminal and cross-category game distribution, dedicated to bridging the gap between Web2 games and Web3 games.

Xterios distribution services are divided into four parts:

• Financial support and expertise. Xterio provides financial support for cooperative projects to help studios make money and grow. Xterio’s experienced team provides full support, covering production, marketing, operations and maintenance, Web3 expertise and other areas

• Production assistance. Xterio helps partner projects improve their market competitiveness. Xterio can help optimize user experience/interface, improve performance, solve technical problems, integrate analysis, social and marketing tools, improve in-game economic systems and token economies, etc.

• Professional marketing. Xterio can mobilize deep marketing resources to provide partners with comprehensive marketing services, including promoting user acquisition and distribution, managing platform relationships and placements, optimizing store materials, localization support, creating optimized ads, and continuously interacting with users before and after release, etc.

• Post-launch operation maintenance and performance improvement. Xterio uses self-developed analytical tools to improve user experience, user retention and monetization capabilities for partner projects to build long-term product success.

رمز مميزs and Business Flywheels

Xterio reached a strategic cooperation with BNB Chain in April 2024, integrating BNB as the fuel fee payment medium of Xterio Chain. In the development blueprint of Xterio Chain, the focus is on integrating AI and Web3 technology into game development. Xterio plans to create a blockchain ecosystem with AAA high-quality games as the core through its native token XTER.

XTER is designed as a universal payment tool within the ecosystem, which can directly serve the consumption needs of various game scenarios and has four core functions:

• Carefully designed integrations: integrated into first-party games for on-chain transactions, purchasing digital assets, unlocking in-game events, participating in exclusive events, and accessing rare mintings

• Dynamic Ecosystem Roles: Built for partnerships across platforms and outside the Xterio ecosystem, increasing token versatility and reach through cross-chain bridging

• Participation Rights: Enjoy targeted benefits and rewards in the Xterio game world. Use tokens to vote on new features, game updates, and community events

• Investment and incubation: Tokens earned and paid for games within the platform ecosystem help return value to XTER

As Xterio continues to launch new game content and expand its user base, each new game launched will create additional demand for token usage. Considering that the total amount of XTER is constant and has a clear deflation plan, the continued growth of this demand will lead to a gradual tightening of supply and demand, which is expected to drive the long-term appreciation of the token value.

In terms of business model, Xterio has three business model pillars:

• Platform revenue: Xterio platform can generate revenue through Xterio Chain fuel fees, NFT issuance platform, trading market, and UGC tools

• Game revenue: NFT sales, in-game transactions, in-game purchases

• Token revenue: partner games issue their own tokens, Xterio will own a large portion of them, etc.

This diversified business model enables Xterio to capture value in all links of the Web3 gaming industry chain, significantly reducing the risk of a single business model. It is worth noting that the platform promises to reinvest profits into ecological construction for technology research and development, game development, token repurchase and ecological marketing to ensure the sustainable development of the platform.

What goes up must converge: Xterios value and potential

As Nietzsche said in Thus Spoke Zarathustra: Everything that rises must converge. When a project has enough upward momentum, various positive factors – whether it is an excellent team, a mature business model, innovative technical capabilities, or a broad market space, will perfectly converge at a certain point in time. We believe that Xterio is at such a critical node.

The OG team that lasts forever

Xterios team has demonstrated unique competitive advantages in todays fast-paced Web3 startup environment. Founder and CEO Michael Tong has 25 years of experience in the gaming industry. He was previously the Chief Strategy Officer of FunPlus and the Chief Operating Officer of NetEase. He is considered the most senior founder in the Web3 gaming field. Co-founder and COO Jeremy Horn has 15 years of experience in the gaming industry. He has served as Vice President of FunPlus and Vice President of Jam City, and has worked as a producer at Gameloft, Origins, Ubisoft and other companies. CFO Ryan Cheung has 15 years of experience in the capital market. He was previously the CFO of Weidian and Youku, bringing rich financial management experience to the team.

The team is unique not only in their resume, but also in their unique thinking framework. In the past twenty years, they have personally experienced and participated in three major changes in the gaming industry, accumulating a deep understanding of the gaming industry. It is this industry accumulation that enables the Xterio team to build a Web3 gaming ecosystem that can cross cycles from an industrial perspective.

Another major feature of the Xterio team is its significant international characteristics. The founding team comes from different countries and has deep industry roots in Asia Pacific, Europe, and the United States. It is worth mentioning that the core members of the team have worked for companies such as FunPlus and NetEase, which are all large game companies with global service capabilities. Their products cover hundreds of millions of users and span more than 200 countries. This global gene allows Xterio to fully play in the Web3 field. Its partner network has covered more than 10 countries around the world, achieving full coverage of the Web3 player group.

The teams big company background is also eye-catching. The core members come from top game companies such as Electronic Arts, Zynga, and Blizzard. This experience not only brings mature market insight, but also accumulates rich experience in resource integration and capital operation. As Web3 games enter the era of regular troops, such an elite team that has withstood the test of a high failure rate is becoming more and more valuable.

Behind the strong team is the support of extremely diverse investors. Xterio has received $80 million in financing, with investors including exchange funds such as Binance Labs, Foresight Ventures, KuCoin Venturess, Web2 game companies such as FunPlus, traditional game funds such as Makers Fund, Web3 game funds such as Animoca Ventures, and full-track Web3 funds such as SevenX Ventures. In addition, well-known public chains, guilds and many first-tier funds have joined. This rich investment structure perfectly reflects Xterios strategic vision in industrial chain integration.

Full Dimension Data Milestone

In more than two years, Xterio has achieved significant milestones in all dimensions, including platforms, games, users, and assets. In terms of chains, Xterio Chain has accumulated more than 8 million wallets/addresses, more than 270,000 daily active addresses, and more than 110 million transactions; there are more than 26,000 pledgers, and the pledged amount exceeds 1.28 million ETH. In terms of platforms, Xterio has issued more than 47 NFT series, with a total mint quantity of more than 7.5 million.

In terms of games, the main game AOD achieved a revenue of more than $300,000 in the first week of public beta, and the APRU was as high as $110. This level is not only 300% of similar Web3 games, but even reaches the level of some Web2 SLG games, with the highest recharge of more than $20,000 per user. The AI platform Xter.AI has generated a total of 100,000 works, with a cumulative transaction number of more than 1.3 million times and a cumulative transaction volume of more than $50.

This milestone is just the beginning, and we look forward to Xterio achieving even more impressive results in the next phase.

Xterios Imagination of Value

Finally, we would like to look forward to the potential of Xterios value. In general, we believe that Xterio is not only a leading project of the new generation of Web3 games, but also has the success factors of traditional game companies, and is expected to further open up the value ceiling of the Web3 game track in subsequent market cycles.

We simply divide the KSF of the top Web2/3 game companies into three dimensions:

First of all, it is a comprehensive business layout, which requires control of the complete chain from IP operation, content development to global distribution, operation and community management. In the field of Web3 games, this integrated layout also needs to extend to infrastructure construction and asset management. The former includes infrastructure such as game chains, while the latter covers the operation of tokens and in-game assets, forming a more three-dimensional business matrix than traditional game companies.

Secondly, top RD capabilities are fundamental. Although the success of a single product cannot be guaranteed, excellent game companies have established a scientific RD system to increase the probability of success through the law of large numbers and continue to create S-level products. For Web3 game companies, the greater challenge lies in exploring true product-market fit (PMF). It is worth noting that Web3 features will eventually become optional modules for games, rather than independent categories. The organic integration of the two is the inevitable direction of industry development.

Third, strong commercialization capabilities are indispensable. An excellent distribution system can maximize the value of content, improve the efficiency of capital use, and ensure that profits are retained in the company to the greatest extent. In the field of Web3 games, this commercialization presents a dual-track feature: in addition to traditional content distribution, it is also necessary to reasonably allocate tokens and game assets to ensure the rights and interests of ecological participants such as communities, players and operators, and build a healthy operation system based on asset consensus.

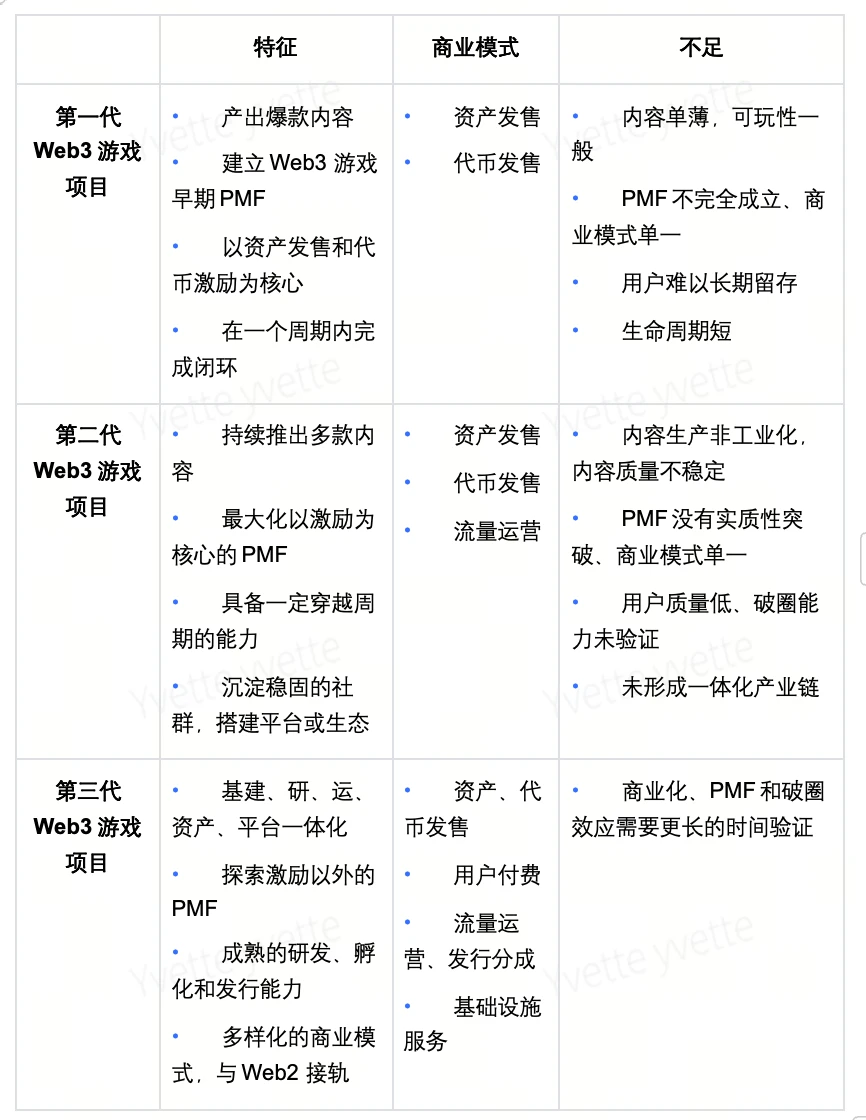

If Xterio can continue to accumulate these KSFs, where will it be in the industry? We believe that Xterio will become the leading project of the third-generation Web3 games:

The first generation of projects successfully ignited the market with their hit content, established a preliminary business model through asset sales, gold farming and token sales, and brought considerable returns to participants in the bull market. However, these projects often have difficulty maintaining long-term user retention and a short game life cycle due to insufficient content depth, poor playability, and especially the fact that the business model is not yet fully mature.

Subsequently, a new batch of project owners entered the market with more sufficient funds and began to produce Web3 games on a large scale. They made innovative optimizations in asset mechanisms, launched a series of high-quality content, and gradually formed the prototype of Web3 game studios. These studios fixed traffic through guilds and communities, and provided cold start, growth and large-scale distribution services for other projects, making the business model more diversified. However, the projects at this stage have not yet achieved a breakthrough in the essence of the game. Although the user scale has increased, the quality still needs to be improved, and it is difficult to attract traditional game players. Since most teams come from independent developers, they also face challenges in industrial chain integration.

As a representative of the third-generation Web3 game project, Xterio entered the market as a professional army. Relying on strong financial strength and shareholder background, combined with the systematic methodology of game giants, they have established a complete RD, incubation and distribution system. Although the market has different views on the integration of Web2 and Web3, Xterio has always been committed to exploring high-quality game content, trying to attract traditional players through innovative business models and excellent playability. More importantly, Xterio has incorporated the industrial upgrading concept of the traditional game industry into its development strategy since its inception, starting with infrastructure, and creating an integrated ecosystem covering infrastructure, RD, operations, assets and platforms. This all-round layout makes its business model more three-dimensional, which can not only realize content and assets, but also create revenue with the help of traffic services, distribution services and infrastructure services. In the current market, many projects have adopted a similar public chain platform + content matrix + publisher model, and Xterio, as a new force, is moving steadily towards the direction of a new industry leader.

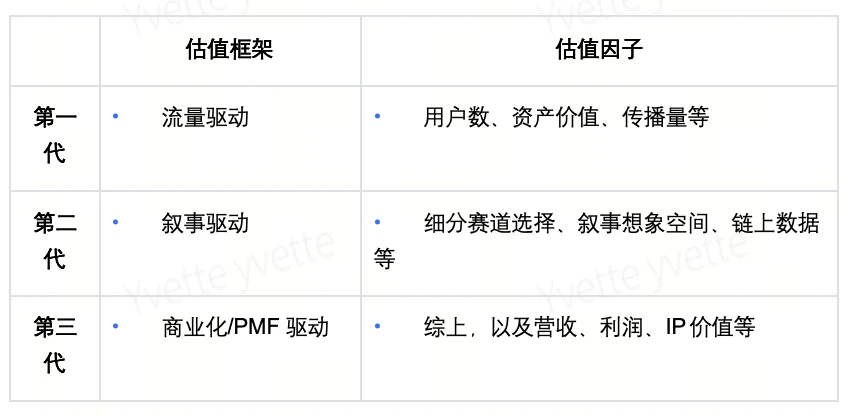

Although there is no very effective valuation framework for Web3 game projects in these three periods (the track is immature and the fundamentals are of low effectiveness), we can observe that the valuation framework and factors are continuously shifting from virtual to real:

The valuation of first-generation projects mainly relies on three core factors: user scale, asset value, and market share. However, these indicators are closely related to short-term market conditions and are highly volatile, which leads to a lack of stability in project valuations, easy formation of bubbles, and significant retracements in the short term.

The valuation logic of the second-generation projects began to revolve around narrative upgrades. The valuation factors of such projects are mainly related to the selection of segmented tracks, narrative imagination space, and on-chain data generated after serving as infrastructure. Although these projects began to generate some fundamental data, with the crowding, homogenization and rotation of narratives, the bubble was gradually squeezed out. When the narrative reaches a stage peak, the valuation also returns to a rational level.

For third-generation projects, we believe that the core of their valuation should shift to commercialization capabilities. As high-quality games attract more users and achieve a closed business loop, the distribution business begins to generate stable cash flow, and high-quality IP is recognized by players, the valuation of Web3 game projects begins to be sustainable. Considering that games are an important carrier for large-scale applications of Web3, we believe that the value imagination space and premium ability of such projects will gradually catch up with the traditional game industry.

Through the analysis of leading listed game companies in China, the United States, Asia, and Europe, we can observe several key features that affect the valuation of traditional game companies: integrated RD and operation, ultra-large-scale operations, diversified business/full industry chain layout, high-quality IP reserves, and technical platform capabilities are all important sources of valuation premiums. In contrast, companies with single business, limited categories, and limited terminals often find it difficult to obtain significant premiums.

Based on these market rules and industry development trends, we are positive about Xterios prospects. From the current Web3 game track, Xterio already has the core elements to obtain a valuation premium and is expected to establish an industry leader in this bull market. More importantly, as its commercialization process deepens, Xterio has shown the potential to compete with traditional game giants. We expect Xterio to become the Tencent and NetEase of Web3 games.

In the Bible, the Book of Exodus tells the epic story of Moses leading the Israelites through the desert and reaching the promised land. Todays Web3 game industry is experiencing its own Exodus moment. Early Web3 games, like people imprisoned in Egypt, were bound by simple graphics, mechanical gameplay and single token incentives. Xterio is like the Moses of the new era, leading the industry on a journey full of hope. They reتحديne Web3 games from the perspective of the industrial chain, split the Red Sea for the industry, and open up new paths.

The journey through the desert is never smooth. But it is these tests that make us more convinced of the existence of the promised land – a new gaming world where Web2 and Web3 are perfectly integrated. There, games will become the carrier of digital value, players will become co-builders of the ecosystem, and developers will create value with the support of a complete industrial chain.

This is not only an evolution of the industry, but also an awakening of digital civilization. Let us witness this great Exodus journey together and witness Web3 games, under the guidance of Xterio, move towards the promised land full of infinite possibilities.

This article is sourced from the internet: SevenX Ventures: Xterio, Exodus

Original translation: Wu said blockchain On November 1, Arthur Hayes, co-founder of BitMEX and chief investment officer of Maelstrom, discussed the potential impact of the 2024 U.S. presidential election on the crypto market on the Unchained podcast. He emphasized that Bitcoin’s liquidity is a safer option amid market volatility, and shared his views on Bitcoin, Ethereum, Solana, decentralized finance (DeFi), and memecoin, arguing that speculative assets could gain due to capital inflows after the election. Finally, Arthur Hayes pointed out that major economies (the United States, the European Union, Japan, and China) have historically expanded their money supply in response to financial challenges, tending to invest in assets such as Bitcoin and gold. He advocates a long-term holding strategy under these global trends. Election-related market expectations? Cryptocurrency will be supported…