The prices of ENA and HYPE continue to soar. What is the logic behind them?

Tale of Two رمز مميزs: What Ethena and HyperLiquid Teach Us

Original article by Diogenes Casares, Crypto Kol

الترجمة الأصلية: zhouzhou, BlockBeats

Editors note: HyperLiquid and Ethena have both successfully executed their respective product visions despite using different financing and token strategies. HyperLiquid focuses on decentralized derivatives, while Ethena has rapidly grown into a leading stablecoin protocol. Both have made decisions that are in line with product development by understanding user needs and dynamically adjusting strategies. The key to success is to مرشد decisions based on a clear vision and belief, rather than a one size fits all approach.

فيما يلي المحتوى الأصلي (لتسهيل القراءة والفهم، تمت إعادة تنظيم المحتوى الأصلي):

HyperLiquid became a top 20 token (if FDV is counted) within weeks of its initial launch, a feat achieved without relying on any major centralized exchange listing. Its supporters are mainly traders and users, whose belief in the product is more like that of BeReal/Instagram fans than “traditional” تشفير finance groups like Link Marines.

The HYPE airdrop did not have (too many) strings attached and did make a lot of people rich, but there were also a lot of people who chose not to sell because they believed in the project, and I think this is one of the core differences between HyperLiquid and many other current projects: people believe in HyperLiquids vision and believe that they will make money.

This holy symbiosis between vision and execution and fundamentals may be unique to HyperLiquid, but it can also be seen to some extent in some of the other most profitable and widely watched DeFi projects this year, such as Ethena Labs.

This article will explore the similarities between Ethena and HyperliquidX, both of which are building core products that are widely used by local users, and will also analyze their differences to help readers understand what factors make the systems successful.

Laying the foundation: Products

A good product is always hard to build, but in crypto, there’s a weird mentality that a good product is “unachievable,” or there’s no product-market fit (PMF), or it’s “not big enough,” or “someone’s already done it,” which are all fallacies.

One of the biggest criticisms of Ethena is that what it does has been attempted before by decentralized protocols like UXD. However, Ethena differentiates itself by leveraging custodians to access centralized liquidity, solving the liquidity problem and being able to earn returns on the underlying stETH/re-collateralized assets. This is a relatively small adjustment, but it makes Ethenas product scalable and stable. Additionally, by using USDe and sUSDe, which is almost equivalent to the relationship between ETH and stETH, Ethenas yield will naturally be higher than if it were to execute the strategy independently.

HyperLiquid is not the first decentralized derivatives platform, far from it. However, HyperLiquid innovates in speed (deposits are processed extremely quickly), liquidity (HLP), and distribution (vaults). HyperLiquids trading platform is very reliable and has almost never crashed, while competitors systems have been down for hours or even days, and one platform even suffered a block reorg, forcing it to ask users how much they lost via a Google form.

This poor user experience also troubles liquidity providers and traders, who never know whether they can deposit or withdraw smoothly. HyperLiquid eliminates this problem and wins the trust and support of users.

The build process: distribution and execution

OK, both Ethena and HyperLiquid have great products, but that doesn’t mean people will automatically find them. So how do you get people to test the product and improve it? In the case of Ethena and HyperLiquid, the answer is: talk to as many people as possible.

On my anonymous account, the Ethena team actually contacted me when their TVL had not yet reached $20 million. At the time, I needed to make a deposit by signing a contract and locking the funds for a certain period of time, in exchange for receiving a fixed minimum rate of return, which I ultimately did not do (of course, this was a big mistake). However, one thing I really admire about the Ethena team is that they are able to leverage other peoples networks (OPNs).

Seraphim (MacroMate8) is a master at this, I was contacted by dcfgod, one of the best angel investors in this field, he contacted me, and also contacted the templedao team, other RFV traders, large traders, basically his entire network.

This is great for DCF God because he believes in the product and the team, so these introductions are great for people in his network. At the same time, this is extremely useful for Ethena, which is why they allowed him to participate as an angel investor. This is also reflected in the participation of CryptoHayes, who is probably one of the best storytellers and one of the best platforms that can communicate with users, and he also happens to invest.

In the case of HyperLiquid, Jeff and the rest of the team cast a very wide net. They reached out to everyone from HsakaTrades to my RFV trading friend burstingbagel. They got as many people on board as possible and started building products the community wanted, including vaults which ultimately helped create HLP, which allowed HyperLiquid to have deep liquidity without market makers, avoiding the high fees that typically come with market maker liquidity trading on DEXs. This direct relationship between users of this product and the HyperLiquid team makes users feel heard, important, and makes them feel like they are part of the project and not just an outside spectator.

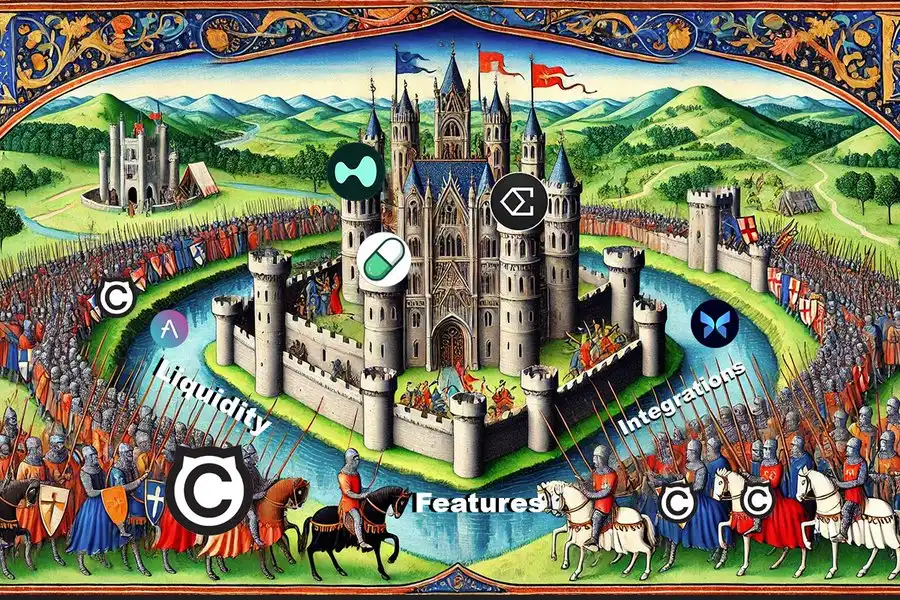

Maintaining Control: Moats and Network Effects

All excellent projects will spawn imitators or competitors, such as Ondo has OpenEden, Eigenlayer has Symbiotic, Morpho and Euler, Aptos and Sui, etc. However, truly excellent projects can identify and consolidate their own moats, thereby strengthening product advantages and improving competitiveness.

Take stETH/Lido, for example, which is the clear market leader, even though its base product is theoretically replicable. It’s not hard to run a validator node, earn yield for users, and create a wrapped token. However, what is difficult to replicate or compete with is the massive liquidity that stETH has and its deep integration with lending protocols and the broader DeFi ecosystem.

These moats make users tend to prefer stETH, even if theoretically the returns may be slightly lower than competitors because they can use stETH for DeFi. Ethena has copied this model and laid out a layout around funding rate arbitrage. It has been integrated with almost all major protocols in ETH DeFi, as well as an increasing number of centralized exchanges. The moats that Ethena has built in terms of liquidity, acceptability/composability, and large-scale high returns provide users with a range of features that greatly enhance user loyalty.

For HyperLiquid, liquidity itself is its core moat. HyperLiquids HLP is designed to provide users with high-quality liquidity, allowing new markets to grow while ensuring that users always have the protection of the last buyer/seller. The more users there are, the better the pricing, which attracts more users, and this positive cycle further strengthens the platforms position.

To consolidate its dominance, HyperLiquid is allowing projects to build on top of it through an independent, EVM-compatible chain that can interact with HyperLiquids spot/derivatives positions. This will provide traders with more seamless and capital-efficient market making and neutral hedging strategies, while increasing user functionality and further strengthening its market position.

Theoretically, HyperLiquid may be forked after being open sourced, but the forked version will not have HLP, all users, and liquidity. Even if it is an excellent product, the key to long-term survival is to build and consolidate the moat. This is why even though Ethena and HyperLiquid have almost completely dominated their respective markets, they are still strengthening their moats.

Point of disagreement: funding path and airdrops

This is where the big differences between Ethena and HyperLiquid start to emerge, and these differences are not just stylistic, but also very different in substance. Ethenas product provides liquidity access to hedge neutral returns, while HyperLiquids product is a decentralized derivatives protocol.

Due to its model, Ethena must rely on existing platforms to scale, and a good way to ensure this is by obtaining investment from exchanges to incentivize them. In contrast, HyperLiquid aims to replace these exchanges, it does not intend to work with them, and therefore does not need to rely on them.

The HyperLiquid team is known for its high-frequency trading (HFT) capabilities and has not needed to raise capital. While the Ethena team is also very successful in their own right, they have not made the tens of millions of dollars that they would have needed to build Ethena, ensure its long-term survival and be able to focus entirely on the product without having to worry about profitability.

In theory, Ethena could have chosen not to raise money, but by raising money, they were able to increase their likelihood of success. From a game theory perspective, and especially from a financial perspective, people are more likely to trust teams that 1) have extensive experience in a particular field (like HyperLiquid) or 2) are highly recommended/backed by authority figures.

While the Ethena team is great, they don’t have the same reputation for understanding exchange infrastructure (a core component of high-frequency trading) as the HyperLiquid team does in terms of hedge neutral trade management. Ethena getting investment from these big players, not only to gain social support and drive them to grow faster, but also to pave the way for eventual protocol integration, may be the best decision for their specific product.

HyperLiquid decided not to raise funds and take the risk of paying for HyperLiquids operating expenses in order to conduct a larger airdrop and avoid systematic selling (such as VC). This decision is likely the best choice they made based on the characteristics of their product. After all, their goal is to compete with most existing exchanges and even hope to replace them.

Ethena’s ENA airdrop was also very successful, with larger holders forced to hold for longer periods of time, while retail users were not so restricted, and remilios were cleverly used to get the community behind Ethena.

Despite this, its response was far less than the HYPE airdrop, which had almost no strings attached and no vesting period for larger accounts. HyperLiquid actually limited the recipients of the airdrop, giving priority to larger accounts that might benefit from the airdrop, giving them a small portion of the initial value, but after the airdrop, these tokens will be fully unlocked.

Ethena’s points system is also clear and designed to guide user behavior, while HyperLiquid’s system seems arbitrary, and while it does disproportionately reward high volume traders/market makers and users who are liquidated, there is no clear formula.

Conclusion: Path Dependence

My conclusion is that I think this is a very important point, even though I haven’t seen it mentioned in any articles about HyperLiquid’s success. HyperLiquid has done an excellent job of executing on its vision and product path.

Ethena has similarly executed impeccably on its product vision, becoming the fastest growing stablecoin protocol. They took a completely different approach to their token and capital raise, but both decisions were based on a belief in their path and a clear vision for the end product.

There is no one-size-fits-all approach to managing airdrops and token economics, they are dynamic equations that must be adjusted with an understanding of the context of your product and the needs of your users. If you can do this and your decisions reflect the ideal path that best suits your product, you will be successful.

This article is sourced from the internet: The prices of ENA and HYPE continue to soar. What is the logic behind them?

Related: Arthur Hayes: Bitcoin will reach $250,000 by the end of 2025

Original translation: Wu said blockchain In a recent interview with the podcast Alpha First, Arthur Hayes shared his bold predictions for the future of the cryptocurrency market. He believes that with the possible rise of the Trump administration, the United States loose monetary policy will trigger a depreciation of the US dollar, which will in turn drive up the prices of Bitcoin and other crypto assets. He also discussed global inflation, sovereign monetary policies, and how to benefit other crypto assets such as Bitcoin and Memecoin. He emphasized that investors need to be vigilant in the bull market and avoid ignoring market risks due to greed. In addition, he looked ahead to future market trends and predicted that Bitcoin could reach the milestone of $250,000 by 2025. Please note: The…