Original source: BitMEX

حقائق سريعة

-

This week is the Thanksgiving holiday in the United States. Mainstream تشفيرcurrencies as a whole are trending sideways. Although market volatility is low, sector rotation is obvious.

-

While memecoins continue to consolidate, traditional technology altcoins lead the gains. Following the gains of XRP and ADA last week, $TIA has become the best performing altcoin this week.

-

In the trading strategy section, we will take a closer look at the ongoing impact of Trump鈥檚 trade on Bitcoin.

Data at a Glance

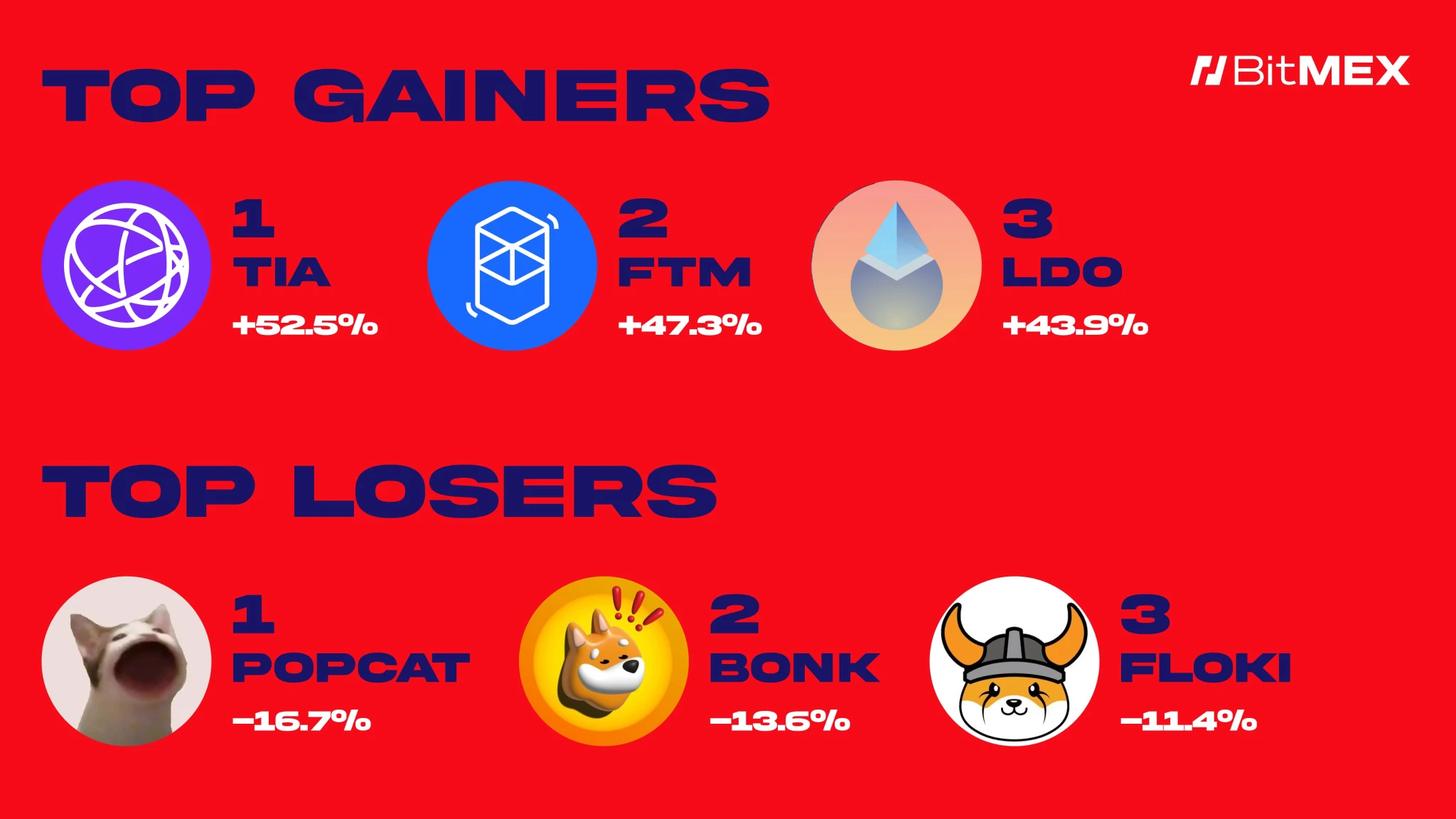

Best performers of the week

-

$TIA (+52.5%) : Despite heavy selling pressure in the past few weeks, it showed strong resilience this week and led the market higher

-

$FTM (+ 47.3%): continued to strengthen, driven by the brand remodeling and mainnet upgrade expectations

-

$LDO (+ 43.9%): Lido DAO 2025 target proposal voting brings new momentum

Poor performance this week

-

$POPCAT (-16.7%): BitMEX meme coin sector led the decline this week

-

$BONK (-13.6%): Following Popcat鈥檚 trend, a pullback occurred

-

$FLOKI (-11.4%) : Down in sync with other meme coins

سوق أخبار

ماكرو

-

ETH ETF inflows this week: $133 million ( مصدر )

-

BTC ETF outflows this week: $451 million ( مصدر )

-

US core PCE grew 2.8% year-on-year in October, higher than the previous value of 2.7% ( مصدر )

-

Vancouver City Government promotes Bitcoin-friendly city plan, will provide policy support for the crypto industry ( مصدر )

-

The number of initial jobless claims in the United States last week was 213,000, lower than the expected 216,000 ( مصدر )

-

Brazilian congressman proposes to establish a national Bitcoin reserve to cope with economic fluctuations ( مصدر )

-

Trump team may nominate former SEC commissioner Paul Atkins as chairman ( مصدر )

-

XT exchange was hacked and all withdrawals were suspended (source)

-

Chinese concept stock SOS announced a $50 million Bitcoin purchase plan, and its stock price surged 47% ( مصدر )

أخبار المشروع

-

Tornado Cash sanctions overturned by US appeals court, TORN surges over 500% ( مصدر )

-

Trump-backed DeFI project WLFI proposes to deploy Aave V3 protocol on Ethereum ( مصدر )

-

Animoca Brands strategically invests in the Fat Penguin NFT project, adding to its Web3 game layout ( مصدر )

-

Emerging DEX pump.funs daily revenue surpasses Ethereum, attracting market attention ( مصدر )

-

Phantom Wallet adds support for the Base network to expand its multi-chain ecosystem (source)

-

Movement Network Foundation announces MoveDrop plan to airdrop 10% of tokens to the community ( مصدر )

-

Line plans to launch mini Dapps in 2024, drawing on the successful experience of Telegram鈥檚 gaming ecosystem ( مصدر )

-

Aave community proposes to establish a strategic partnership with Instadapp and plans to invest in INST tokens ( مصدر )

رؤى التداول

Note: The following does not constitute investment advice. This is just a summary of market news, and we always recommend that you do your own research before executing any trades. The following does not represent any guaranteed returns, and BitMEX cannot be held responsible if your trades do not perform as expected.

How long can Trump鈥檚 influence on Bitcoin last?

Bitcoin has risen more than 40% since Trump won the election on November 7, hitting a record high. While some traders attribute this surge to the so-called Trump rally, a deeper analysis of the Trump administrations cryptocurrency policy framework and the composition of its executive team shows that this may be the most important institutional breakthrough in the history of the cryptocurrency market.

Decoding the Trump Administration鈥檚 Crypto Policy Promises

1. US Bitcoin Strategic Reserve

The most groundbreaking policy commitment is the proposal to include Bitcoin in the national strategic reserve system. The United States currently holds about 207,000 Bitcoins, and the Bitcoin Act proposed by Senator Lummis requires that all Bitcoins held by federal agencies be transferred to the Treasury Department as strategic reserves. The bill also stipulates that the Treasury Department will purchase no more than 200,000 Bitcoins per year for 5 years, a total of 1 million Bitcoins, and hold them for at least 20 years. If the bill is passed, not only will the United States not sell the existing 207,000 Bitcoins, it will also create about $80 billion in buying pressure within 5 years.

2. White House Cryptocurrency Advisor Position

According to Bloomberg, the Trump administration plans to create the first White House cryptocurrency advisory position. The position will:

-

Manage interagency relations: Coordinate cryptocurrency policy between Congress, the White House, and other government agencies.

-

Oversee regulatory framework: responsible for jurisdictional and policy matters related to cryptocurrencies.

-

Direct connection to the industry: Following Trump鈥檚 meeting with Coinbase CEO Brian Armstrong, the position will serve as an important link to the cryptocurrency industry.

The creation of this position marks a major shift in the approach to cryptocurrencies at the federal level.

3. Change of SEC Chairman

With Gary Gensler officially announcing his resignation next year, the appointment of the new chairman of the Securities and تبادل Commission (SEC) indicates that the regulatory direction will be more inclusive:

-

Accelerate crypto ETF approval: lower the threshold for institutional investment.

-

Clarify regulatory guidance: Shift from an enforcement orientation to a more transparent regulatory framework.

-

Improve market stability: Reduce market volatility caused by regulatory uncertainty through clear policies.

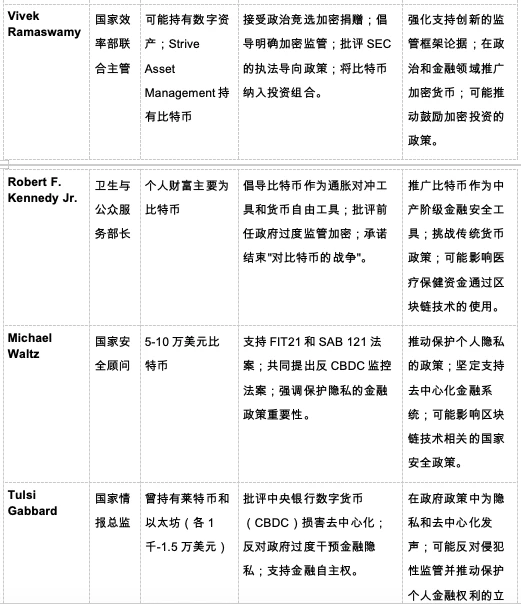

The new government鈥檚 position on crypto assets

An unprecedented number of senior officials in the new government hold large amounts of crypto assets and have deep industry experience. This alignment of interests could significantly affect the intensity and direction of policy implementation.

Key Cabinet Members and Their Cryptocurrency Involvement

Only halfway through the cycle

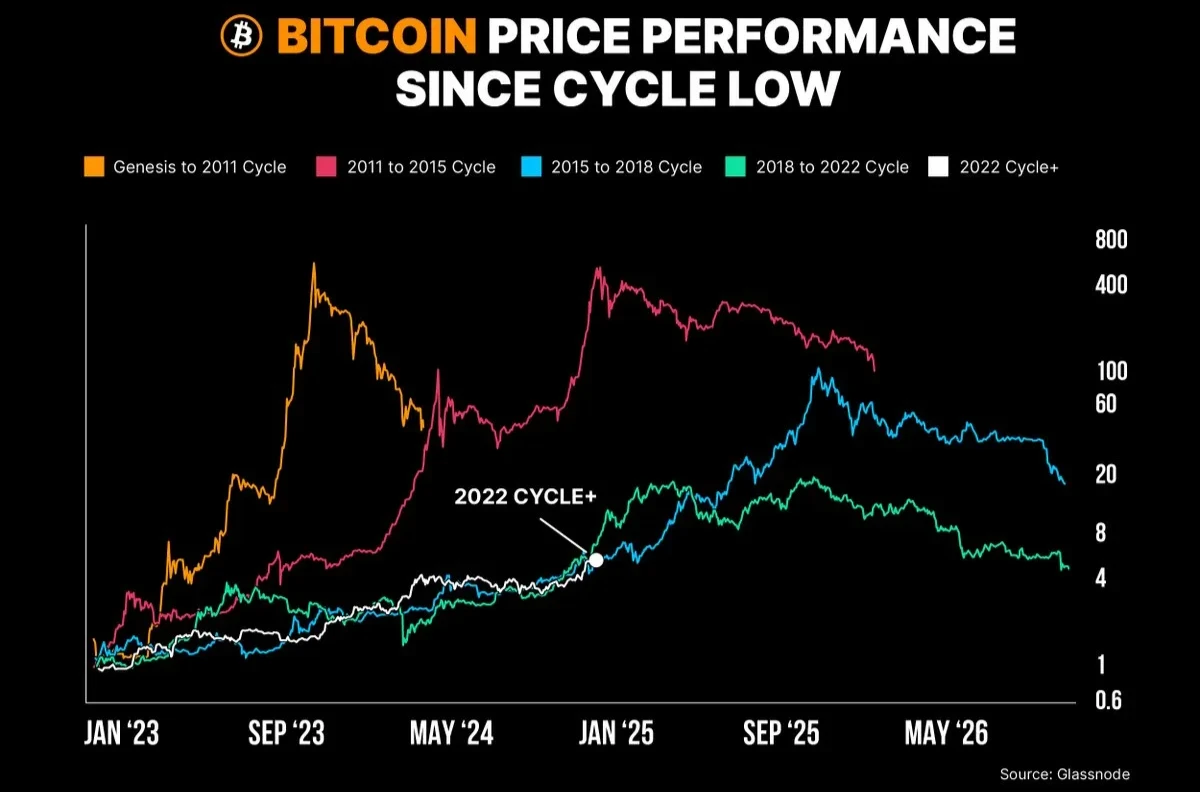

The convergence of policy support, institutional recognition, and market confidence suggests that the cryptocurrency market may have entered a new sustainable upcycle. Unlike previous rallies that were primarily driven by retail speculation, this growth is built on structural changes in regulation and institutional adoption.

It is worth noting that less than a month since Trump won the election, the price of Bitcoin has risen by more than 40%. This rapid rise reflects the markets optimistic expectations for the new governments pro-crypto stance and the expectation of major policy shifts that will benefit the cryptocurrency industry.

Furthermore, Bitcoins current price trajectory has exceeded the growth rate of the 2015-2018 market cycle. The current acceleration indicates that market momentum is stronger than in previous cycles, driven by institutional investment and supportive regulatory developments. Although some investors may worry about missing out, market analysts believe it is not too late to participate in this upward trend. Changes in policy fundamentals and institutional participation may support long-term growth and provide potential opportunities for new entrants.

ختاماً

The impact of the Trump bubble on Bitcoin is more than just a speculative bubble, but could be a fundamental turning point for Bitcoin and the broader cryptocurrency market. The new administrations policies could legitimize crypto assets at the highest levels of government and finance, paving the way for unprecedented growth and integration into the global financial system.

مراجع:

https://coingeek.com/donald-trump-plans-and-support-for-the-crypto-industry/

https://www.panewslab.com/en/articledetails/z33bvmf4.html

This article is sourced from the internet: BitMEX Alpha: Trader Weekly Report (11.23-11.29)

In the past week, BTC began to accelerate its rise, breaking through ATHs of $9,3000 and $94,000. Although the current BTC price has fallen slightly, it is still fluctuating around $93,400, and the highest increase of BTC in 24 hours is over 4.5% (the above data comes from Binance spot, November 20, 17:00). Currently, BTC has become the only investment category in the Trump economy that has not yet given back its gains. Due to extreme long positions and market concerns about continued rising yields, US stocks have given back some of their recent gains. Although geopolitics has heated up recently, under the leadership of Nvidias upcoming earnings report and technology stocks, US stocks closed again on November 19 with relatively flat data, with the Nasdaq and SP 500 rising…