SignalPlus Macro Analysis Special Edition: The Next Inning

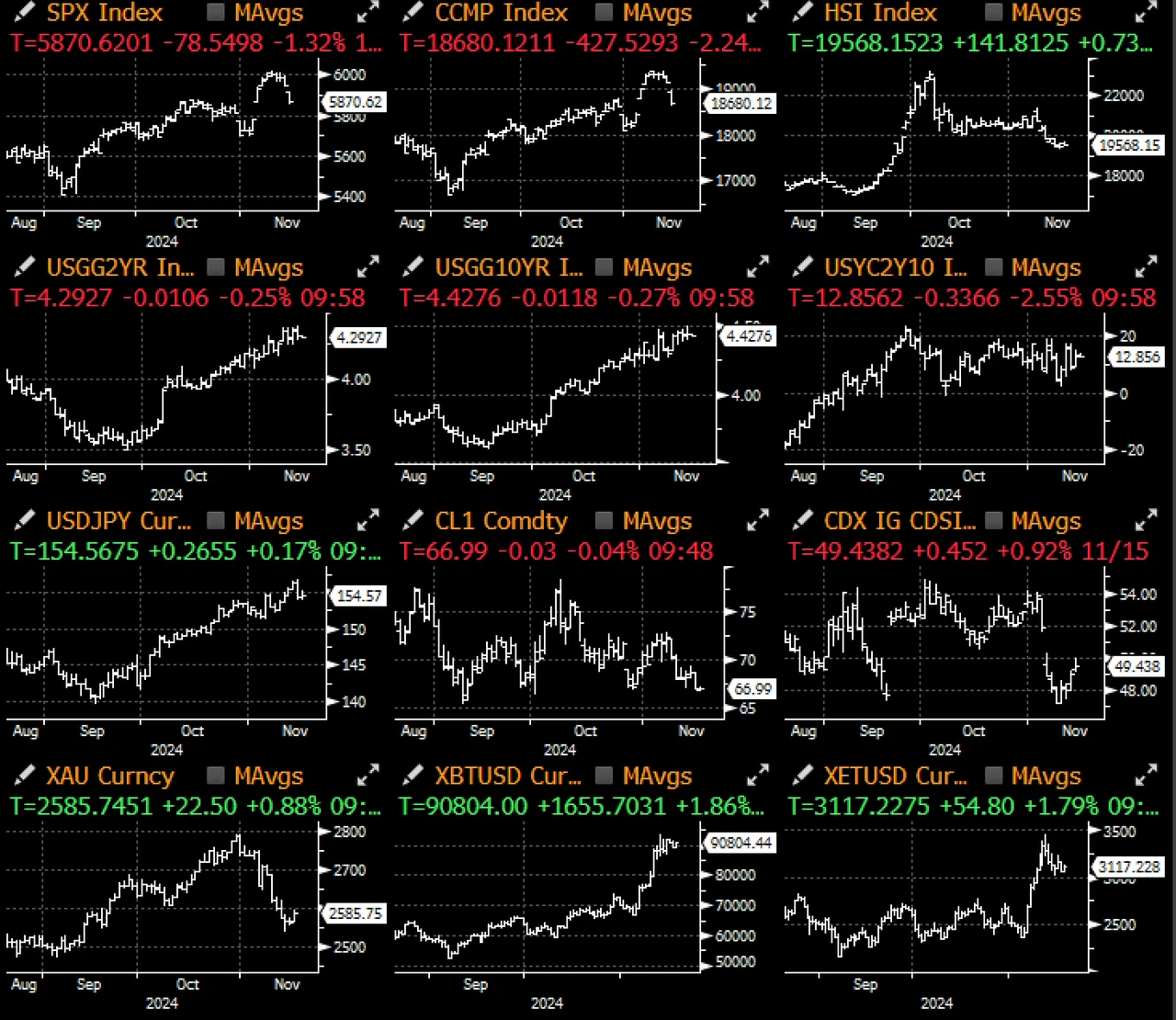

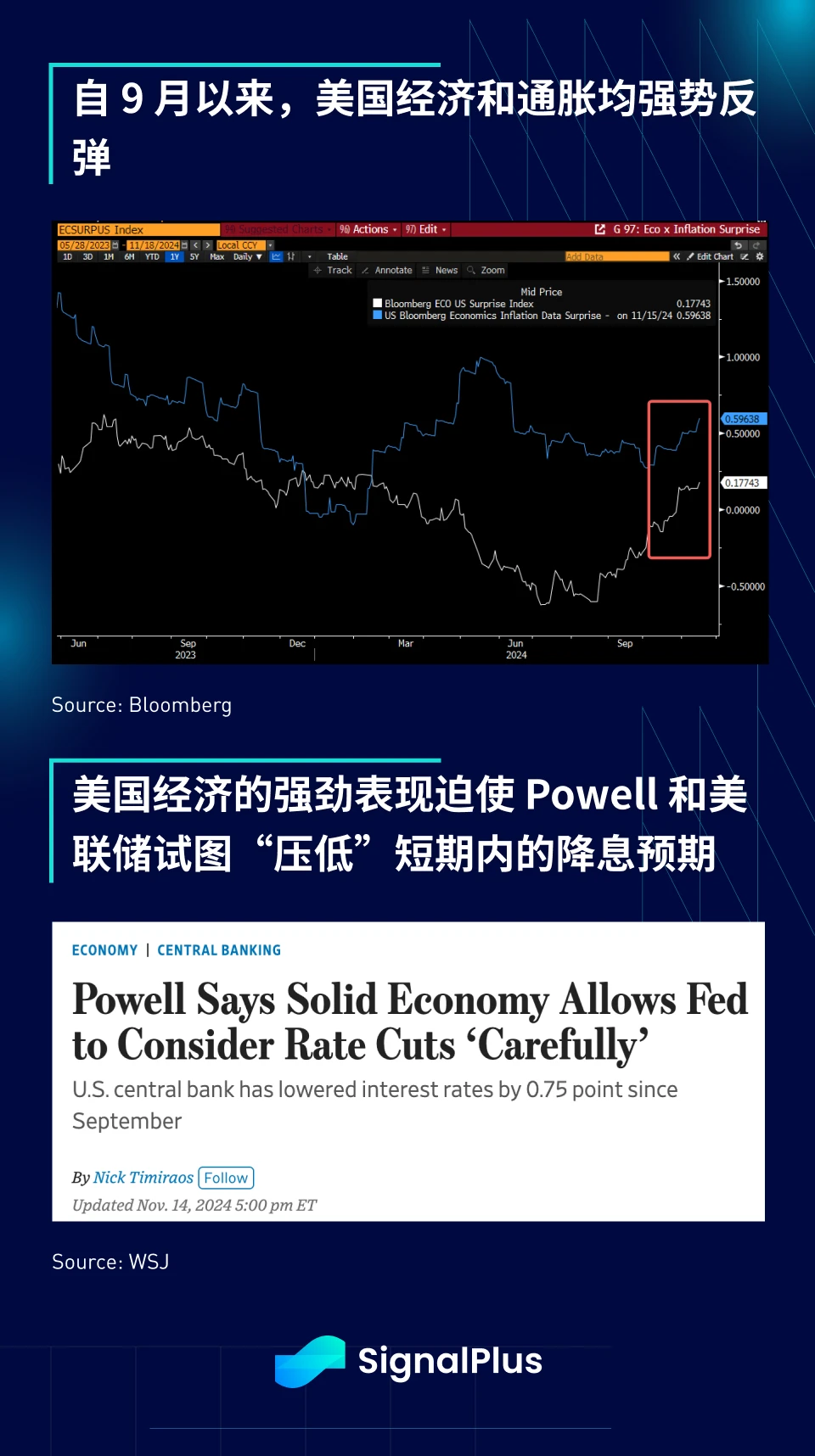

Extreme long positioning and concerns about rising yields (10-year nominal yield ~4.45%, real yield >2.15%) have caused US stocks to give back some of their recent gains (SPX -1.3%, Nasdaq -2.3% on Friday). In addition, Chairman Powell said in a talk last week that the Fed is considering slowing the pace of rate cuts given the strong economic conditions, causing the market to price in a December rate cut probability to drop from a high of nearly 2 in September to just 61%.

The economy is not sending any signals right now that we need to cut rates urgently, Powell said in a talk in Dallas on Thursday. The strength of the economy right now allows us to be more cautious in our decisions. — Jerome Powell

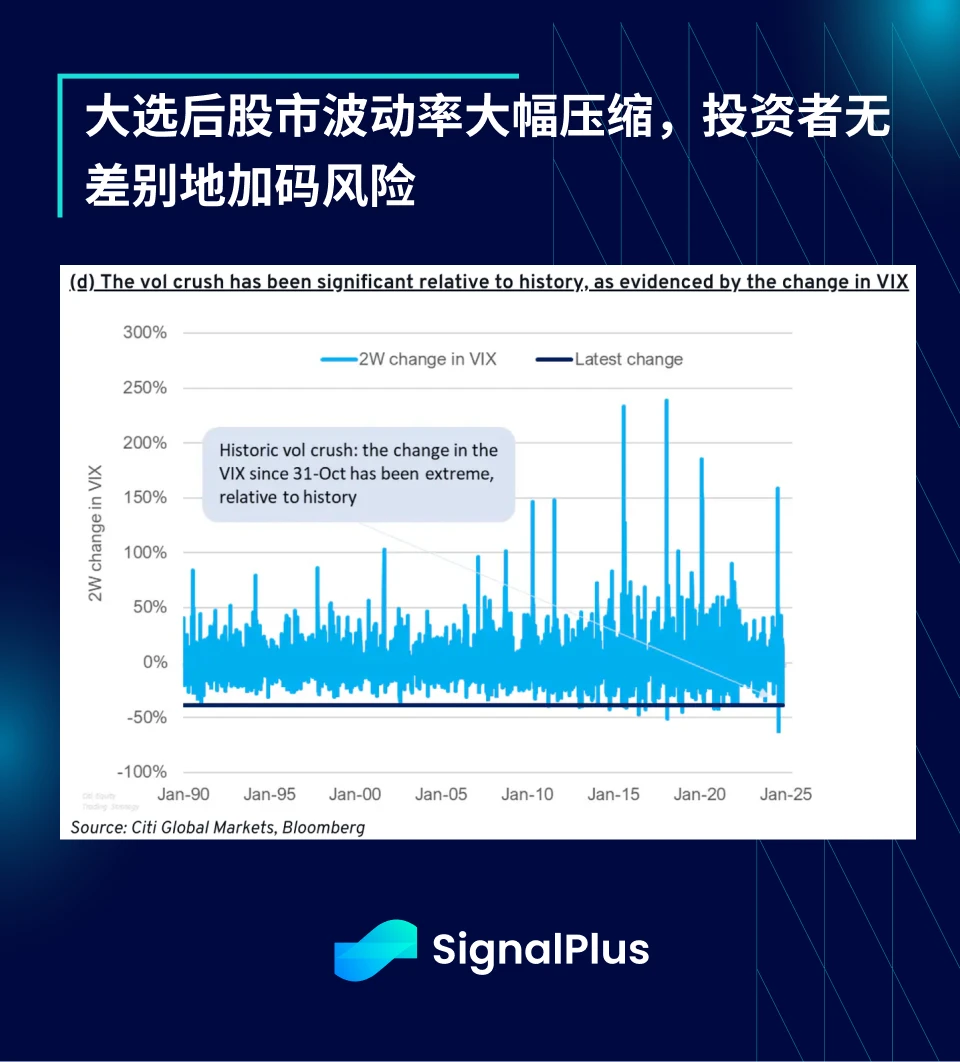

Prior to last Friday’s sharp sell-off, the VIX had already fallen from 23 to 14 following the election, a nearly 40% plunge in two weeks, and while market moves are increasingly rapid as we have seen in both the stock and تشفيرcurrency (memecoin) rallies, we believe the “easy part” of the trade is over and that more volatility and challenges lie ahead.

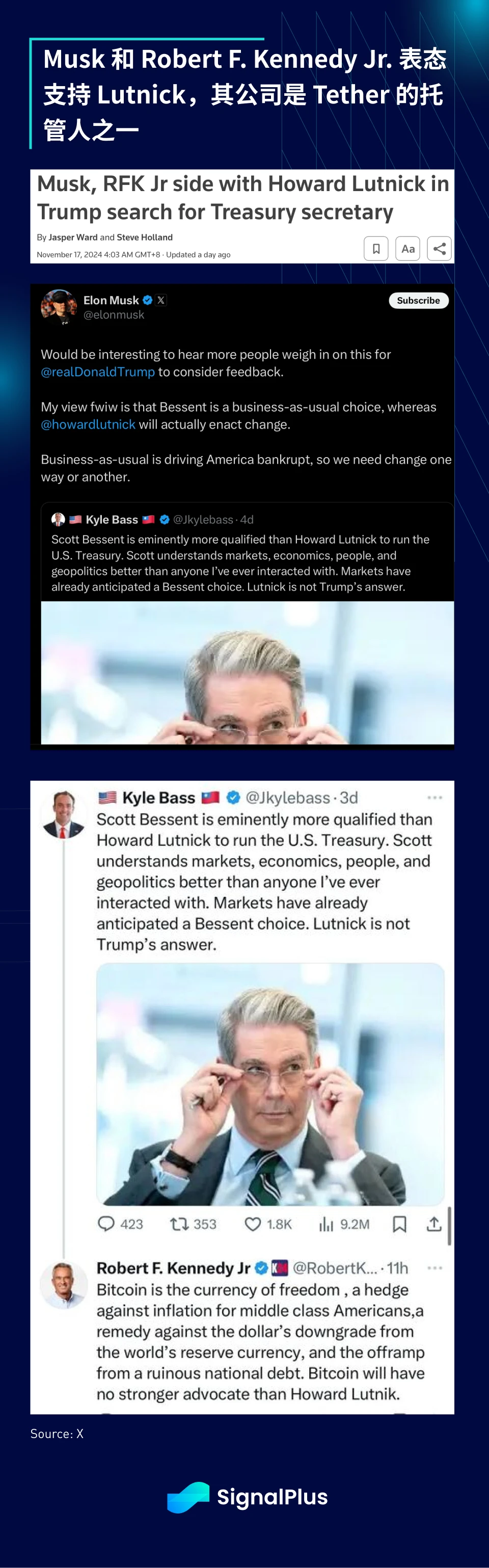

President Biden and Trump have clearly promised a smooth transfer of power. Now the market focus has shifted from the election to policy. The market is paying close attention to the layout of the next cabinet. Several key positions have been clarified, especially in terms of trade and national security, which are more hawkish. One of the remaining key positions is Secretary of the Treasury. The current popular candidates are Scott Bessent (long-term investor and partner of Soros) and Howard Lutnick (CEO of Cantor Fitzgerald).

Bessent is considered a safe card with extensive experience in capital markets, but Lutnicks company is one of the custodians of Tether, so it has attracted special attention from the cryptocurrency community. Regardless of who enters the cabinet, both candidates are seen as supportive of cryptocurrency, and the cryptocurrency industry has the opportunity to continue to receive political support and promote the long-term development of Bitcoin as a reserve asset.

On the policy front, while markets are excited about various initiatives Trump is set to introduce, not all policies will have the same impact, and even with Republican control of Congress, there are still many details that need to be worked out to implement policy.

1. We are currently in a more relaxed phase, where the market is rallying purely on hope and expectations, with investors looking forward to the positive impact of stimulus plans and temporarily ignoring the negative impact of tariffs and tightening immigration policies. Basically, this is an ideal scenario with the best of both worlds, so risk assets have risen sharply.

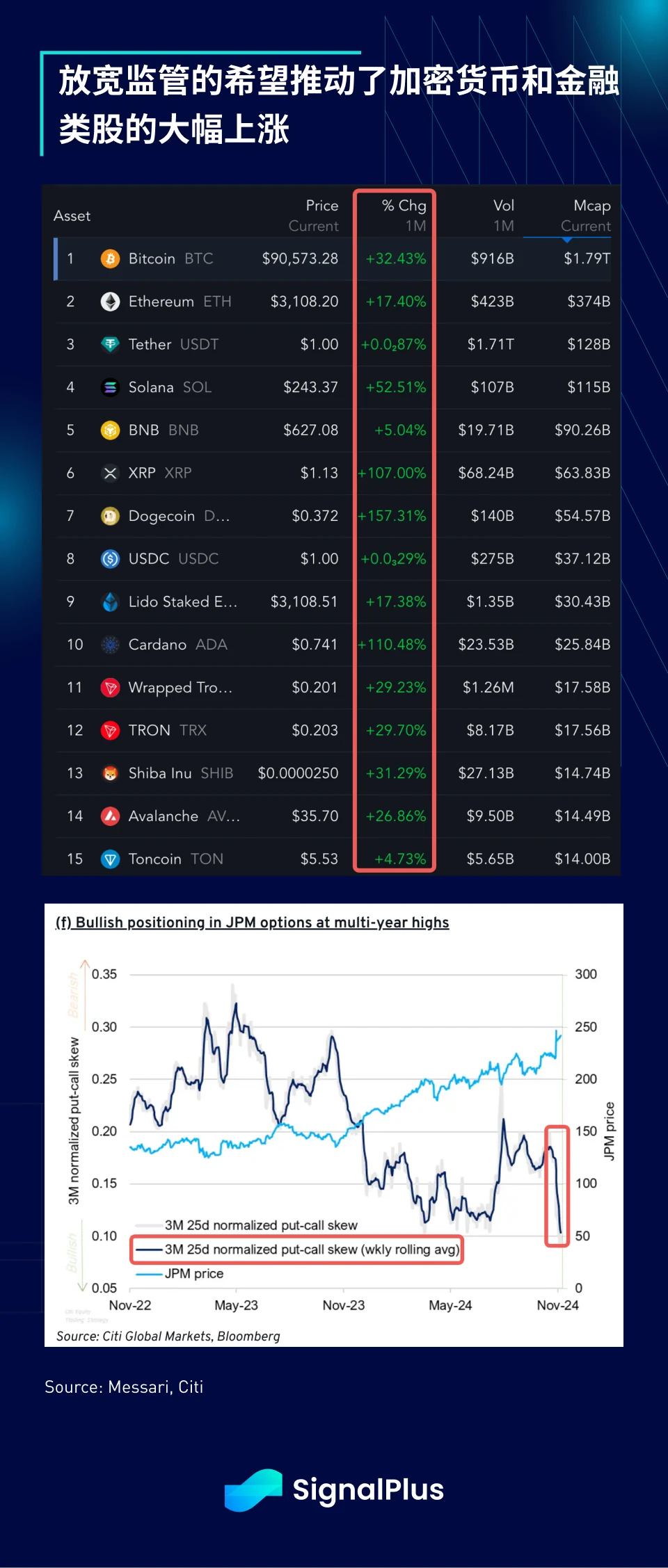

2. Next, the easiest action for the president-elect to take would be deregulation, which can be directly implemented through executive orders, such as various energy projects and withdrawal from the Paris Climate Agreement. Basically, deregulation of banks and cryptocurrencies also falls into this category, but the latter may take some time and require more regulatory clarity to support the current bull market.

3. Next comes the more controversial issue of immigration and tariffs. In terms of immigration policy, strengthening border control and large-scale deportations will face severe challenges in the media and courts, but the Trump administration may promote it as a core campaign policy. These measures may lead to a reduction in the labor supply, especially blue-collar jobs, and then further increase inflation, making the Feds job more difficult in the second half of 2025.

4. On tariffs, the market expects a lot of blockbuster news as early as the first quarter, and Trump, with his experience in the previous term, is likely to target China as a primary target. More extensive tariff measures against Europe and other trading partners may require congressional support and may require Trump to propose a settlement plan as motivation, which may be delayed until the second quarter, while the negative impact of rising costs pushing up inflation is expected to begin to appear in the second half of 2025.

5. Finally, given the soaring U.S. debt balance and the newly established DOGE departments focus on government efficiency and cost reduction, a large-scale fiscal spending plan will be the most difficult initiative for the Trump administration to implement. Any tax cuts and spending plans will require consultation with the Treasury Department and negotiation with Congress. The market is expected to be ultimately disappointed in this regard.

After Trumps election, cryptocurrency has been the hottest asset class, with BTC breaking through $90,000, and even outperforming the leveraged Nasdaq index. BTCs gains mainly came from the US trading session, with mainstream participation in the US increasing, and spot ETFs seeing large inflows of funds, with BTC ETFs receiving $1.7 billion last week and ETH ETFs receiving $500 million.

Another positive sign of mainstream participation is the continued growth of the market value of stablecoins, which has exceeded $160 billion, close to the historical high in 2022. Stablecoins are an important indicator of mainstream participation. The first step of almost all on-chain activities is to convert fiat currency into stablecoins. In addition, the supply of stablecoins grows roughly in sync with M2. If the US government returns to a net expansionary monetary supply policy, it will bode well for the market in the long run.

Overall, we believe that the “easy” part of the market rally is over, and the next phase will be more challenging, with more volatile prices and the possibility of retracements. In addition, despite the resurgence of memecoin mania and some signs of life in ETH, BTC’s dominance is still rising in one direction, similar to the situation of large-cap stocks dominating the SPX index, which is not particularly ideal for the current cryptocurrency ecosystem. In any case, as market sentiment reaches a highly excited level, we will pay close attention to the possible peak decline in the market in the short term. Please be sure to manage risks and be alert to more volatility in the future!

يمكنك استخدام وظيفة التداول SignalPlus في t.signalplus.com للحصول على مزيد من المعلومات حول العملات المشفرة في الوقت الفعلي. إذا كنت ترغب في تلقي تحديثاتنا على الفور، فيرجى متابعة حسابنا على Twitter @SignalPlusCN، أو الانضمام إلى مجموعة WeChat (إضافة مساعد WeChat: SignalPlus 123)، ومجموعة Telegram ومجتمع Discord للتواصل والتفاعل مع المزيد من الأصدقاء.

الموقع الرسمي لـ SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: The Next Inning