بدأت تظهر علامات تدفق رأس المال إلى الخارج. فهل استنزفت الأسهم من دماء صناعة العملات المشفرة؟

المؤلف الأصلي: Phyrex (X: @Phyrex_Ni )

Use data to determine whether A-shares or Hong Kong stocks have sucked blood from the cryptocurrency market and whether it will affect the price and liquidity of the cryptocurrency market.

The topic of A-share bloodsucking has been discussed since before October 1st, which just gives us a seven-day holiday, and October 8th should be the best gamble point, so if you have funds ready to enter A-shares or Hong Kong stocks from the cryptocurrency circle, this is the best time.

Let me first state the conclusion. There are indeed signs of funds leaving the cryptocurrency circle. Although we cannot say that all the funds that left went to A-shares and Hong Kong stocks, considering the current surge in trading volume of Chinese companies listed in the U.S., it can be confirmed that some funds have indeed entered the A-share-related market. However, the size of this part of funds is not large at present, and its influence on the cryptocurrency circle is still very low.

At least so far, there is no clear data proving that the funds transferred into A-shares will affect the cryptocurrency industry, nor is there any clear data showing that A-shares bloodsucking of the cryptocurrency circle is destructive, and there is no trend of large-scale funds transferring from the cryptocurrency circle to A-shares or related industries.

Back to the data, when it comes to the funds in the cryptocurrency circle, the focus is on USDT and USDC. The former is more biased towards Asia and Europe, while the latter is more biased towards American investors. We judge from the market value of the two main stablecoins, the daily net flow of exchanges, the stock of exchanges, and the trading volume with #BTC.

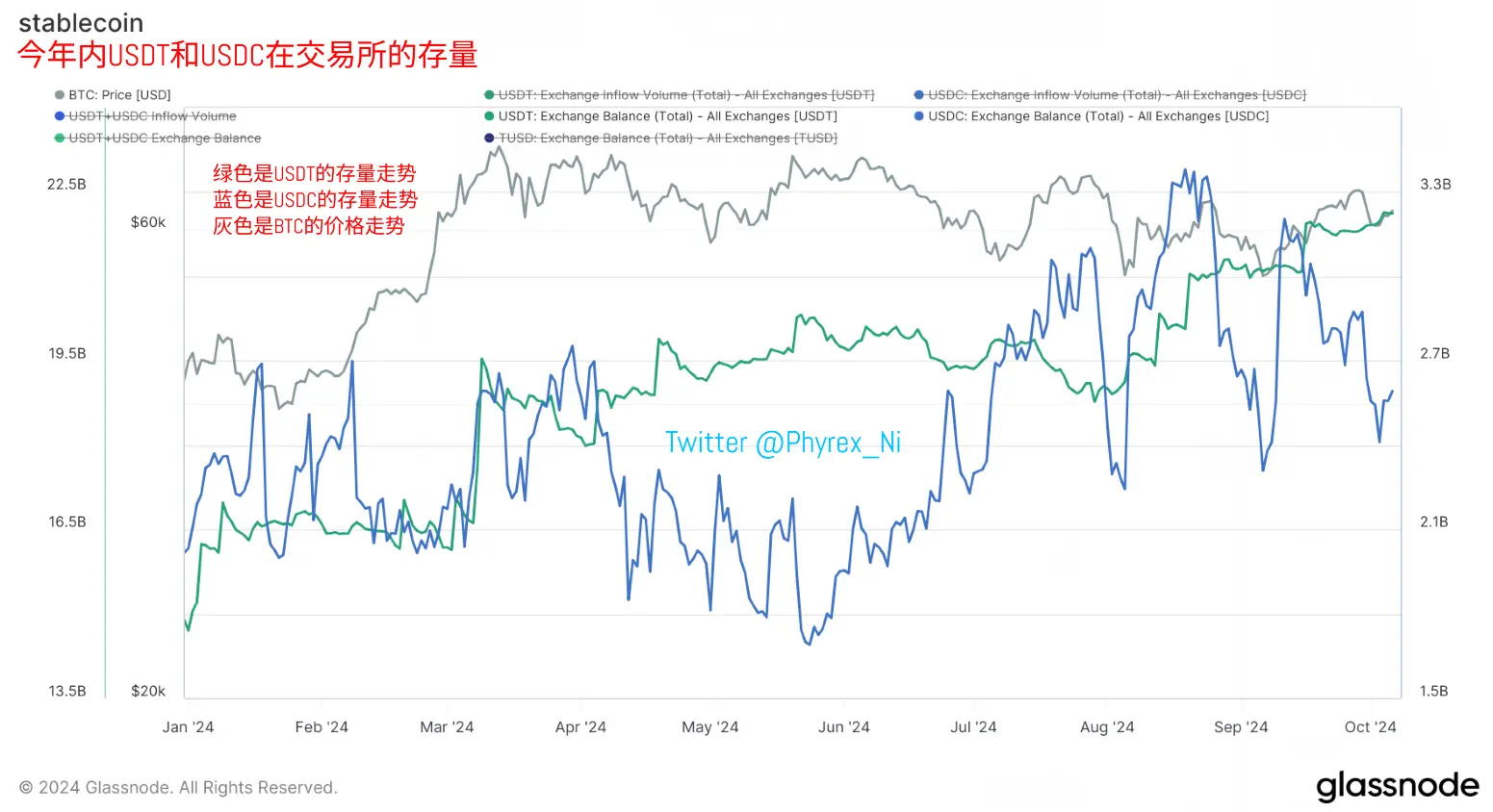

First, let鈥檚 look at the market capitalization of the two main stablecoins. As shown in Figure 1, it corresponds to the changes in the market capitalization of USDT and USDC and the price trend of BTC.

As can be seen from the figure, there has been no significant change in the market value of USDT in the past month, and we know that USDT is used more by investors in Asia and Europe. So if Asian investors want to use funds to invest in A-shares, it should be reflected more in the market value of USDT. In fact, there has not been a significant decline in the market value of USDT. Of course, there has been no significant increase in the market value of USDT in the past week, which can be regarded as a turnover of part of the funds.

But in fact, the amount of funds in this part should not be much. According to the previous weekly growth data, the USDT market value that increased less in the past week was about 40 million US dollars. Even if this amount is really withdrawn from the cryptocurrency circle and transferred to A-shares, the driving effect will not be very large.

Next is the market value of USDC. It can be seen that it has decreased significantly in the past ten days, from the peak to the bottom, it has decreased by about 85 million US dollars, and it has rebounded by about 13 million US dollars in the past four days. The overall decrease is about 72 million US dollars. If the weekly fund increase of USDC is calculated, then USDC has reduced its holdings by about 100 million US dollars in the past ten days.

This amount may not have gone directly to A-shares or Hong Kong stocks, but it is possible that part of it was transferred to the U.S. stock market to track A-share indexes, ETFs or other stocks. This possibility does exist, but just like USDT, even if this $100 million is transferred from the cryptocurrency circle to A-shares, the amount is not large, not to mention that there was a trend of intensified war last week. It is very likely that funds left USDC to seek stability, so the amount of funds that can actually go to A-shares may be even smaller.

So in fact, even according to the most common estimates, the amount of funds transferred from the cryptocurrency circle to the A-share market in the past ten days is about 150 million to 200 million US dollars, and the impact on the price of the currency is minimal. Please see Figure 2 to see why I have such an expectation.

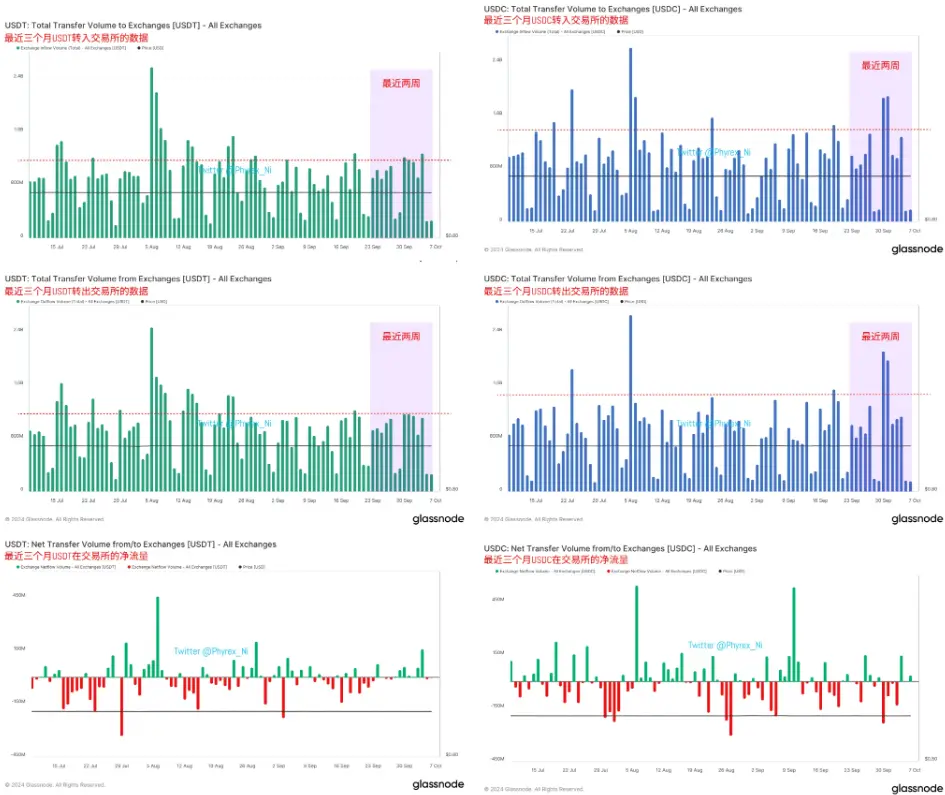

Figure 2 clearly describes the data of USDT and USDC transferred into and out of exchanges in the past two weeks. In the most intuitive sense, the amount of funds transferred into and out of exchanges, whether USDT or USDC, has not been lower than or significantly higher than in the past. This means that even if funds leave the cryptocurrency market and move to A-shares, it is still not enough to affect the amount of funds normally transferred into exchanges at the funding level.

To put it simply, even if the so-called A-shares drain blood from the cryptocurrency market, the impact on cryptocurrencies such as BTC and ETH will be very small.

Going back to Figure 1, there is a very important additional data, which is that we can clearly see that the change in BTC price is related to the change in USDCs market value, and the correlation is very high. It can be said that the change in USDCs market value and BTCs price are mutually positively attracted. If USDCs market value is increasing, BTCs price tends to rise, and when BTCs price falls, the corresponding USDC market value decreases.

Of course, this does not mean that this data is a 100% accurate way of judging, but we must remember what we have always emphasized, that USDC is used more by American investors, and currently the main investors of BTC and ETH are Americans, so USDC is even more of a barometer of American investor sentiment.

Let鈥檚 look at Figure 3

Figure 3 shows that the stock of USDT and USDC in the exchange has not changed substantially. There is no obvious change in the data in the tweet I sent three weeks ago, Using stablecoin data to judge the current investor trend, is it buying or selling? Therefore, I can also know that even if there is USDT and USDC in the exchange, there is no obvious sign of transfer to A-shares. Even if there is some, it is not enough to affect the purchasing power of the currency circle itself.

Finally, we need to look at the changes in trading volume among the two major BTC traders, Binance and Coinbase. Let鈥檚 look at Figure 4.

The upper part of Figure 4 shows the trading volume of BTCUSDT in Binance, and the lower part shows the trading volume of BTCUSD (USDC) . It can be seen that the trading volume of Binance was not significantly different from the past before last Thursday . It dropped slightly on Thursday and Friday, but not seriously. The data of Coinbase is much more normal. Although it also dropped slightly on Friday, the decline rate is lower. Combined with the BTC turnover rate data released last Friday night, the overall turnover is indeed reduced.

Considering the macro sentiment at the time, one of the reasons was that the positive non-agricultural data kept some investors on the sidelines and did not actively participate in the turnover. In fact, the spot ETF data of BTC and ETH were the same. Therefore, judging from the comparison of trading volume, even if some USDT and USDC were transferred from the cryptocurrency circle to A-shares, the transferred amounts were not enough to affect the liquidity of the cryptocurrency circle itself.

Finally, our conclusion is that some funds, especially USDC, have indeed been transferred out of the cryptocurrency circle and may have been transferred into the A-share related market. The total transfer amount should be less than 200 million US dollars. These funds have not had much impact on the prices of BTC and ETH, nor are they enough to affect the overall liquidity of the cryptocurrency circle.

At least so far, there is no clear data proving that the funds transferred into A-shares will affect the cryptocurrency industry, nor is there any clear data showing that A-shares bloodsucking of the cryptocurrency circle is destructive, and there is no trend of large-scale funds transferring from the cryptocurrency circle to A-shares or related industries.

This article is sourced from the internet: Signs of capital outflow are beginning to emerge. Has the cryptocurrency industry been drained of blood by A-shares?

ذات صلة: مقال جديد لأرثر هايز: وزارة الخزانة الفيدرالية، وقرار يلين، وثورة العملات المشفرة سوق جدول

المؤلف الأصلي | آرثر هايز (مؤسس مشارك في BitMEX) تم تجميعه بواسطة Odaily Planet Daily ( @OdailyChine ) المترجم| Azuma ( @azuma_eth ) ملاحظة المحرر: هذه المقالة هي مقالة جديدة بعنوان Water, Water, Every Where نشرها آرثر هايز، المؤسس المشارك في BitMEX، هذا الصباح. في المقالة، يحدد آرثر ميل وزيرة الخزانة الأمريكية يلين لاستخدام سندات الخزانة لسحب أموال إعادة الشراء العكسي من الاحتياطي الفيدرالي واحتياطيات البنوك، ويشرح كيف سيعمل تدفق هذه الأموال على تحسين وضع السيولة في السوق. ذكر آرثر أيضًا تأثير هذا الاتجاه على سوق العملات المشفرة وتوقع الاتجاه التالي للأسواق وأداء أسعار الرموز السائدة مثل BTC وETH وSOL. فيما يلي النص الأصلي لآرثر، مترجمًا بواسطة Odaily. نظرًا لأن أسلوب كتابة آرثر حر وسهل للغاية،...