باحث مساري: نظرة عامة على المنتجات والميزات المختلفة في سوق العملات المستقرة

المؤلف الأصلي: Addy

الترجمة الأصلية: TechFlow

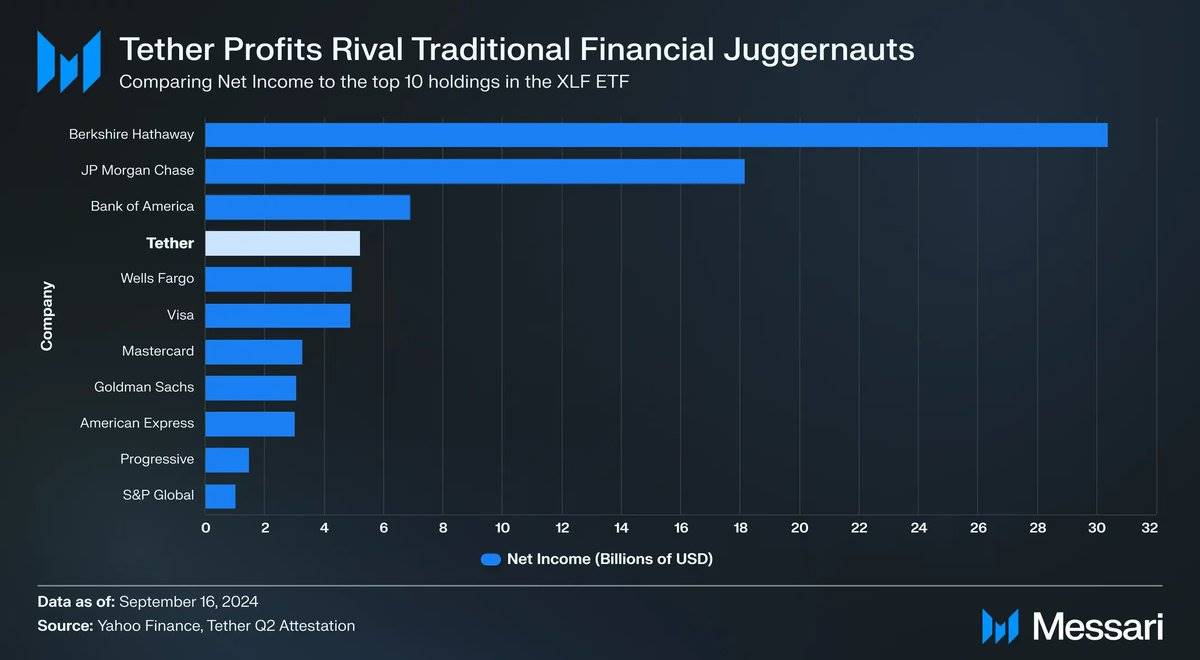

Tether鈥檚 record profits last quarter put it among the giants of traditional finance. But the $5.2 billion profit figure also puts it in the crosshairs of new competitors looking to grab a piece of that market share:

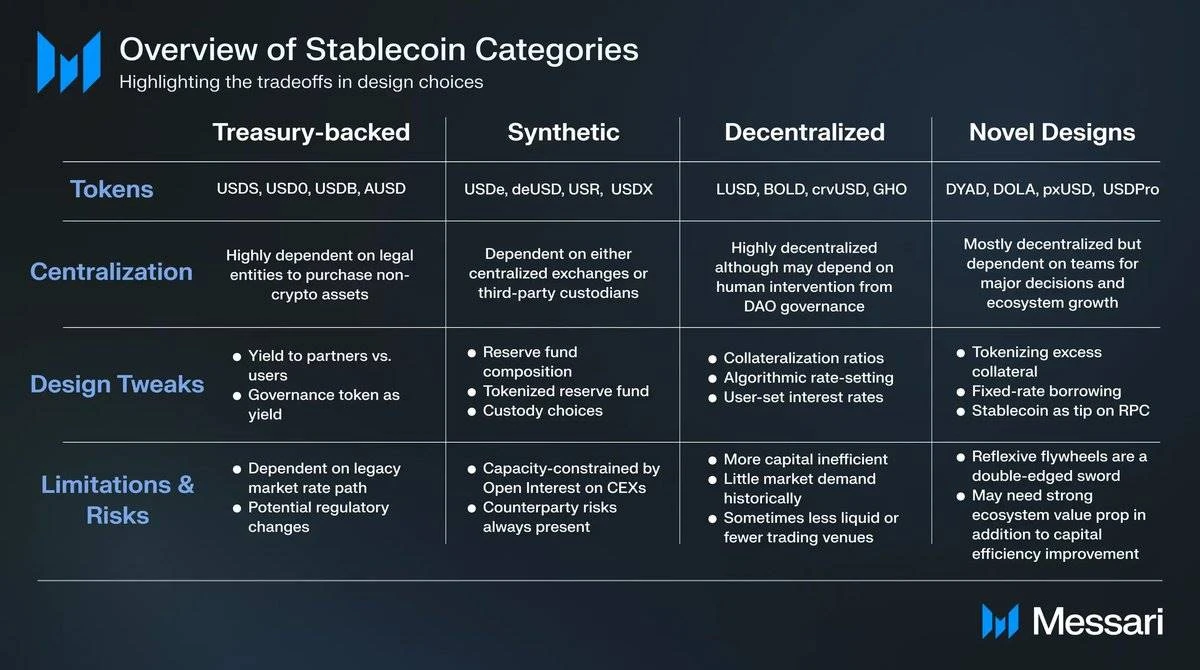

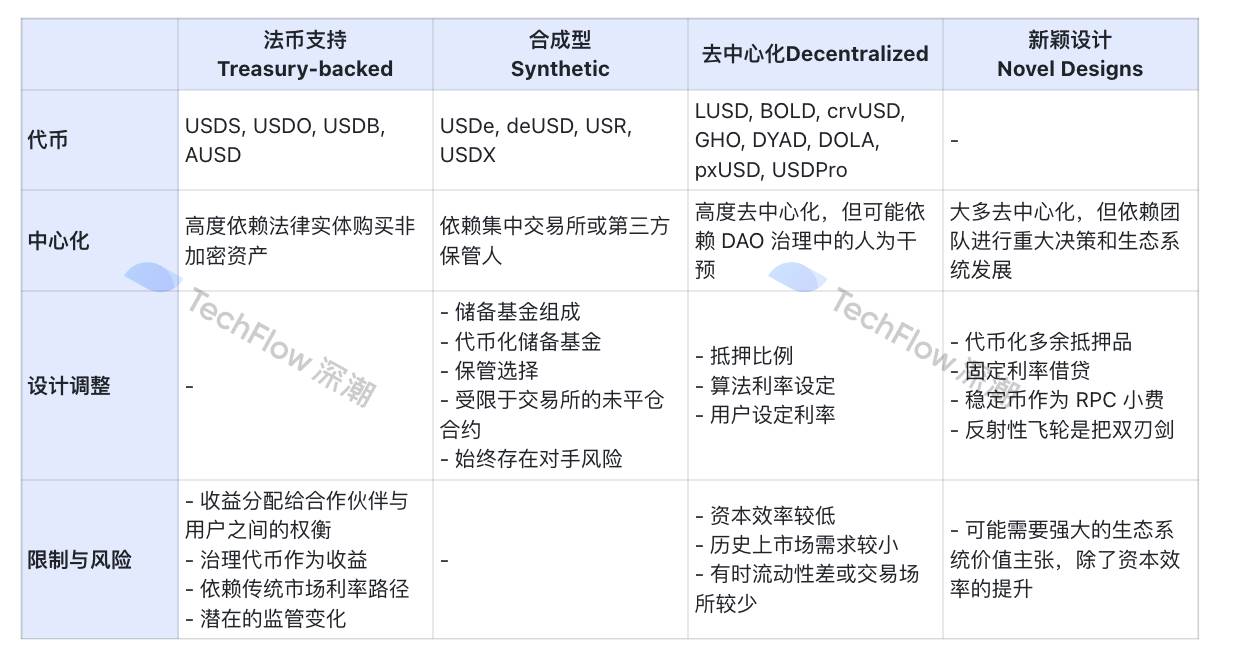

My latest article provides an in-depth analysis of the rapidly evolving stablecoin space, covering both the centralized and decentralized sectors. We divide the space into several main categories:

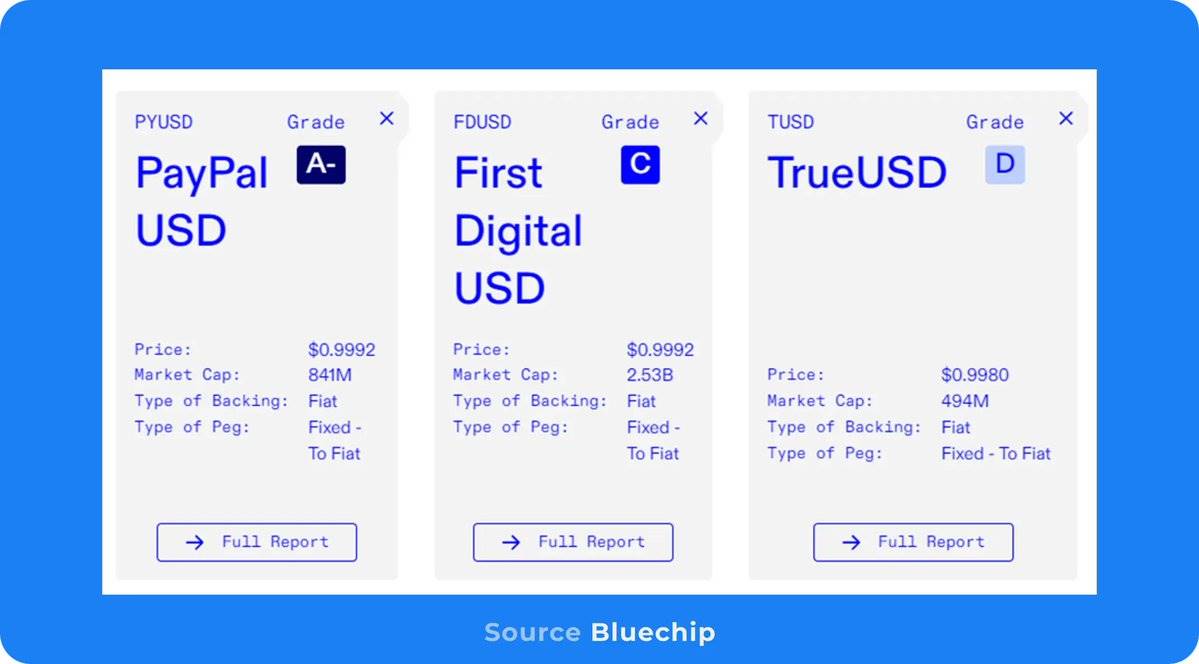

Centralized alternatives often lack transparency and typically only see high volumes when there are clear incentives. PYUSD is one of the few stablecoins that has gained trust and a billion-dollar market cap:

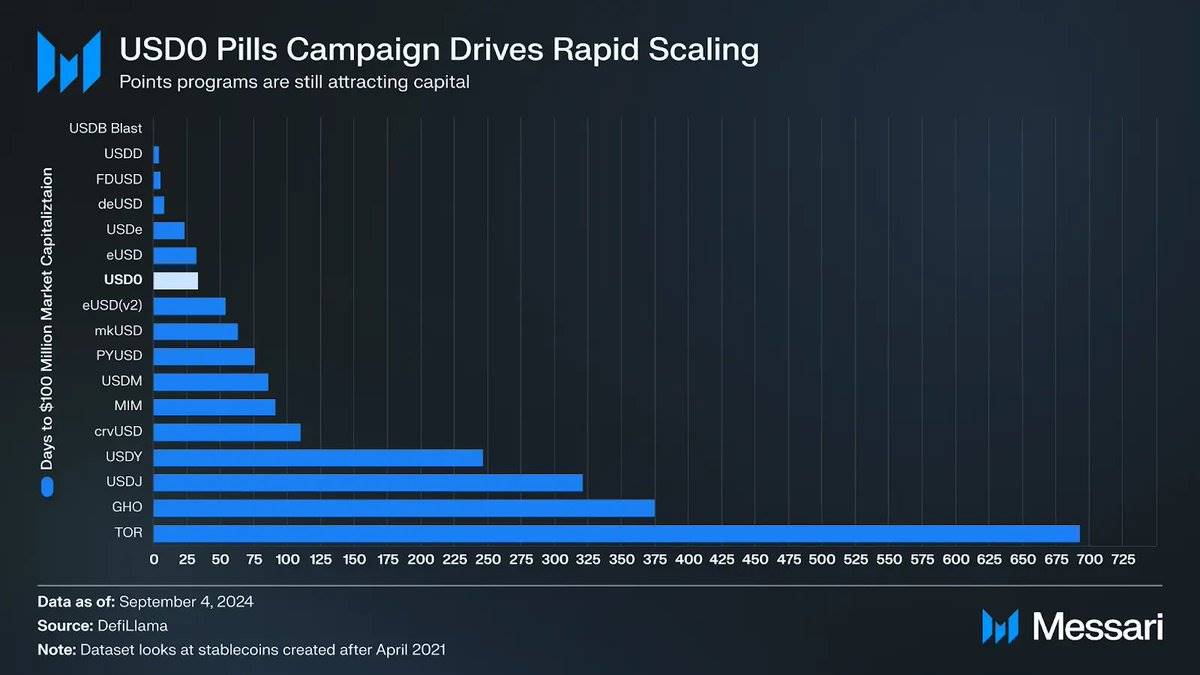

More decentralized treasury-backed stablecoins like USD 0 have grown rapidly through airdrop incentives and partnership integrations with DeFi platforms like Morpho. USD 0 has a market cap of around $250 million and has reached this level quickly:

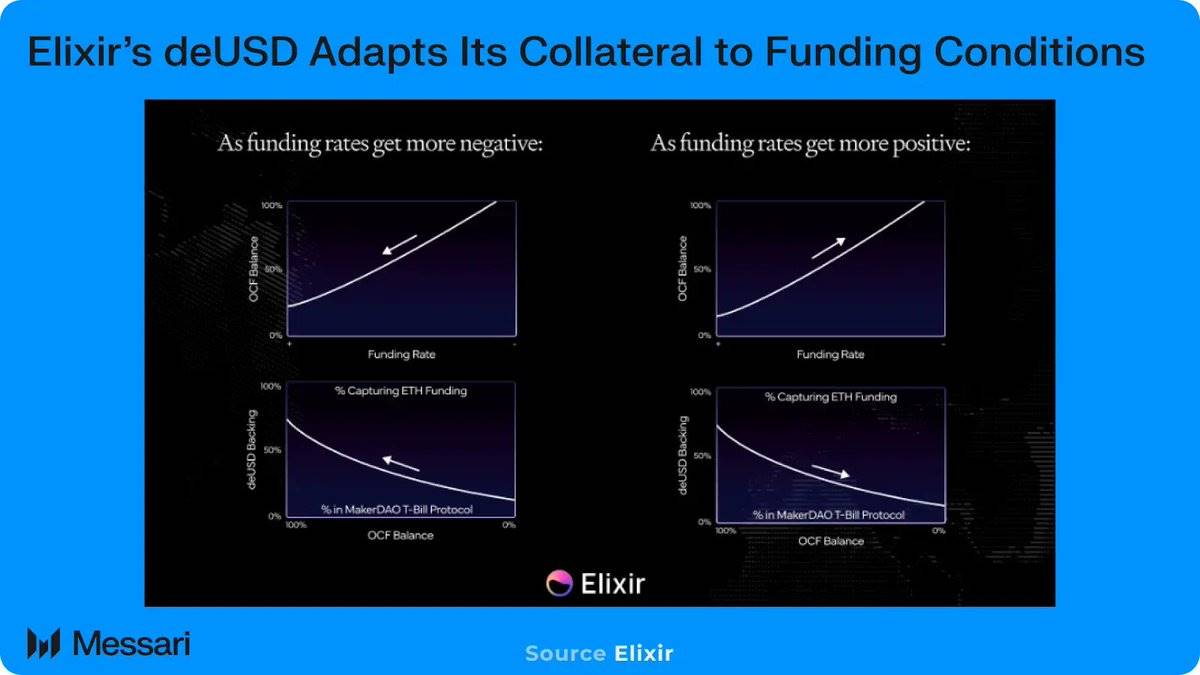

Synthetic stablecoins like USDe maintain their peg by holding both long spot and short futures positions. As the basis narrows, USDe loses market share. But new protocols like Elixir aim to improve on the Ethena model by adjusting their collateral backing:

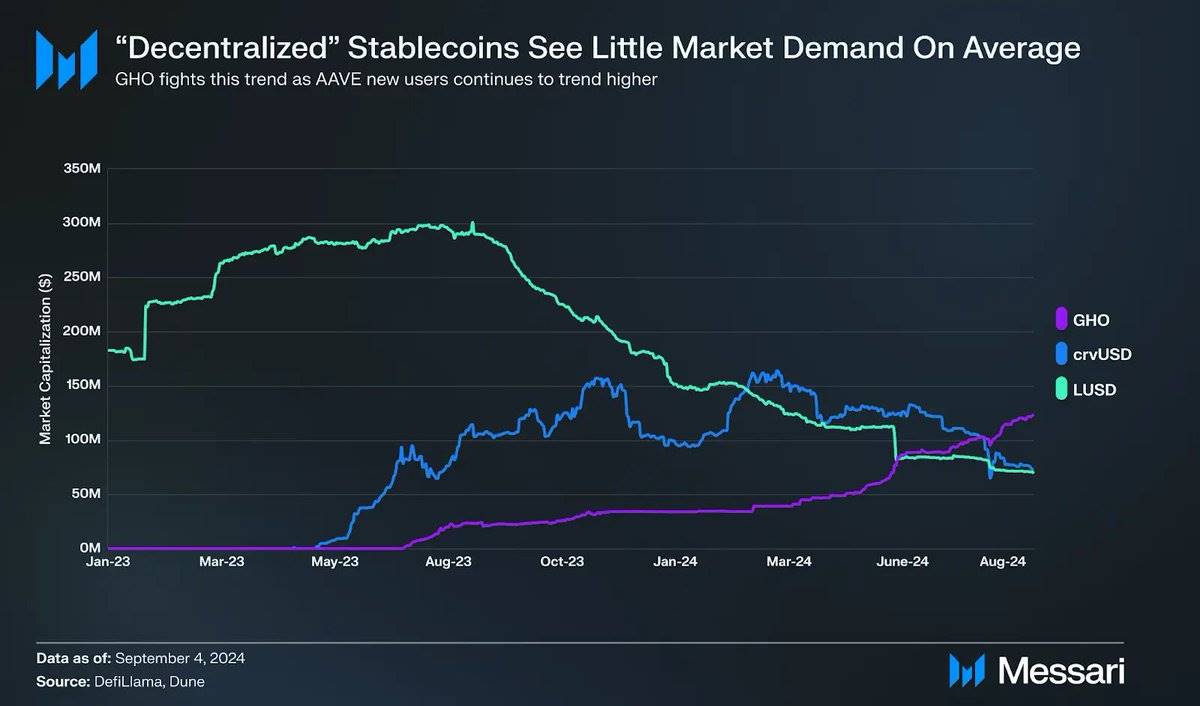

Historically, stablecoins that focus on maximizing decentralization and minimizing human intervention have not been in high demand. GHO may be an exception as it relies on the already growing number of active users on AAVE:

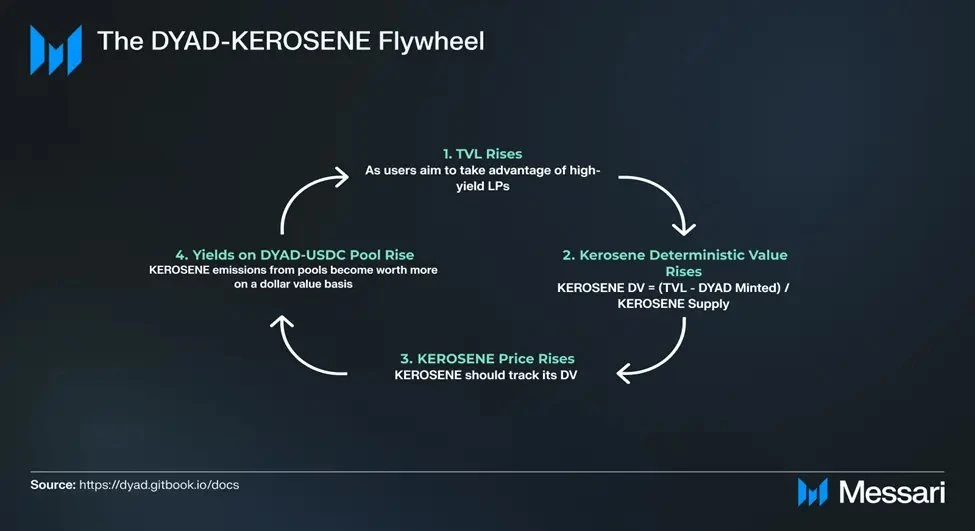

Novel designs often try to implement mechanisms that improve upon the traditional collateralized debt position model. DYAD is one of those stablecoins that seeks to leverage excess collateral in the system through a second-generation token called KEROSENE. KEROSENE allows users to mint more DYAD based on their external capital. The more KEROSENE a user holds on their NFT called NOTE, the more they earn from the liquidity pool:

DYAD-KEROSENE FLYWHEEL

-> 1. TVL rises – TVL (Total Value Locked) rises as users look to take advantage of high-yielding liquidity providers (LPs).

-> 2. KEROSENE Deterministic Value Increases – The Deterministic Value (DV) of KEROSENE is calculated as: KEROSENE DV = (TVL – DYAD Minted) / KEROSENE Supply.

– > 3. KEROSENE price increases – The price of KEROSENE should match its Deterministic Value (DV).

-> 4. DYAD-USDC pool鈥檚 yields rise – KEROSENE emissions from the pool become more valuable based on USD value.

These categories of new stablecoins compete on yield, accessibility, liquidity, stability, and capital efficiency. New designs or tweaks to old ones make different tradeoffs:

Original image source: Messari, translated by TechFlow

The landscape of the stablecoin space is changing with new entrants entering the space every week.

This article is sourced from the internet: Messari Researcher: Overview of the various products and features in the stablecoin market

Related: StoryBlockchain empowers intellectual property

1. Background Huge IP market With the development of the times, more and more people have realized the economic benefits of intellectual property (IP). Intellectual property has become an important asset class, covering a wide range of fields from software codes, works of art to scientific inventions. Figure 1 Incomplete statistics and estimates of the global intellectual property market value (self-made) Global سوق Value: The global IP market was valued at approximately USD 180 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of approximately 8.5% during 2024-2028. Growth in patents and trademarks: In 2020, global patent applications exceeded 3.27 million, an increase of 1.6% from 2019. Trademark applications increased significantly, reaching approximately 17.1 million, a growth rate of 13.7%. These increases show that…