انتقال السلطة في إيثريوم لمدة 10 سنوات: 3 تعديلات داخلية، والآن محاولة لتوديع عصر فيتاليك

المؤلف الأصلي: جليل جياليو ، بلوك بيتس

The car is too heavy and the bank is too scattered. As the worlds 34th largest asset, the price of ETH has stagnated, and Ethereum has ushered in its own midlife crisis.

This year is a special year for Ethereum, as it is the 10th anniversary of ICO. Looking back at the global technology companies, Apple, which was 10 years old, almost went bankrupt, and its market value was only $20 billion at its highest. Microsoft, which has been listed for ten years, has grown its market value from $670 million to $130 billion. Ethereum’s market value is $321 billion. Although Ethereum’s market value has grown rapidly in the first 10 years, it was even once thought to surpass Bitcoin. But in this round of encryption, while Ethereum is stagnant, Bitcoin has repeatedly set new highs, and Solana has reborn from the ashes. After repeatedly reflecting on What happened to Ethereum?, the community truly realized that Ethereum is facing a dilemma of being faced with wolves in front and tigers behind, and it is not irreplaceable.

In fact, the Ethereum Foundation has many shortcomings and its organizational structure is very chaotic. As a decentralized non-profit organization, it is not easy to handle the internal organizational structure of Ethereum. Looking back at the history of Ethereum, the eight founding teams separated due to disagreements, staging an encrypted version of the Silicon Valley Eight Fairies. After only Vitalik was left, this decentralized non-profit organization became the centralized era of this prodigy, and his influence and authority were unprecedented.

Today, the complex relationships and ideological conflicts within the Ethereum Foundation continue, researchers are spitting at each other, and ideologies are subtly changing. After experiencing the changes in the crypto era, the survival and death of the Russo-Ukrainian war, and the realization of life, the 30-year-old Vitalik seems to have started a new script, playing a completely different new role in Ethereum.

Phase 1: Vitalik personally selects the Eight Kings to Advance Politics

The focus of this phase was the split and ideological conflict of the Ethereum founding team, which took place between 2014 and 2015. Vitalik Buterin, a programmer genius who always talks about technology, always answered the eight co-founders when asked what his biggest regret was in the Ethereum journey. Obviously, these eight founders who had long since left were a concern of his.

When Vitalik had nothing but an idea, he welcomed the first 10 developers who responded and wanted to join, and selected 5 of them as the leadership, namely the 5 founders of Ethereum: Vitalik Buterin, Anthony Di Iorio, Charles Hoskinson, Mihai Alisie and Amir Chetrit.

It was obviously a very bad mistake, they looked like good people and they wanted to help, so I thought, why not let them be the leadership? Vitalik said, looking back on his decision at the time.

The co-founders of Ethereum are a controversial topic, with many versions on the Internet, and even the relevant entries on Wikipedia are constantly being edited and modified. After Vitalik personally certified the 8 co-founders, the widely recognized version in the community is: after the 5 founders, three other developers became co-founders in 2014: Joseph Lubin, Gavin Wood and Jeffrey Wilcke.

At this point, Ethereum has completed the formation of its early eight core leaders, which is very similar to the Eight Kings Council implemented in the early Yuan and Qing dynasties to prevent the emperor (Khan) from being arbitrary.

Berlin Pilgrimage, the prequel to Ethereum

In the recently released documentary Vitalik: An Ethereum Story, Vitalik recalled that he began his life as a digital nomad in mid-2013.

That was the prehistoric period of Ethereum, when Bitcoin was only $204, and more than a year had passed since Vitalik founded Bitcoin Magazine with Mihai Alisie. When building Ethereum, he traveled all over the world because he was invited by communities around the world. In 2013 and 2014, Ethereum had headquarters in Switzerland and Berlin, the white paper came out, and Vitalik visited China to crowdfund Ethereum and visit miners.

Berlin is a city where he stays for a long time. “Pilgrimage” is how Vitalik described his active time in the Bitcoin Kiez area in Berlin.

Room 77, now closed, photographed by Vitalik Buterin in 2013

In Berlins Bitcoin Kiez area, cryptocurrency payments are very common. Within a few hundred meters, more than a dozen stores accept BTC payments. The Room 77 restaurant and bar in the heart of the community is also a community center, frequented by a variety of people including technology developers and political activists.

Ethereum rented an office near this area, which is only 1.5 kilometers away from the Room 77 restaurant and bar, and Vitalik can walk there in less than 20 minutes. If you search the address of the Ethereum office Waldemarstraße 37 A, 10999 Berlin on Google Maps, you can still see that this address is marked with Ethereum Network Launch (30/07/2015) and a group photo of the early core members of Ethereum at that time.

In early 2014, most of the core members of Ethereum were basically around Vitalik, and the Ethereum team was in a highly cohesive state.

At the Miami Bitcoin Conference in January of that year, Vitalik and his co-founders stood together for the first time to present their project to the world, and the effect was good, and Ethereum officially entered the public eye. However, this was also the eve of the separation.

The first Ethereum meetup was held in Miami in January 2014. Image source: Internet

Swiss “War I”, a turning point for Ethereum

June 7, 2014, was destined to be a day of separation. All the leadership members of Ethereum were in Switzerland to attend an internal meeting, and the focus of the meeting was on the future direction of Ethereum.

The meeting was held at the Spaceship house in Switzerland, the birthplace of ETH and the first headquarters of Ethereum.

Spaceship house. Image source: Mihai Alisie

In fact, before this meeting, this topic had been debated for a long time, and even factions had already emerged. The relationship within Ethereum became tense, and should we take money from venture capital funds or crowdfund from all ordinary people? Should we take the profit route and become the Google of the crypto world, or a pure non-profit organization? became a constant debate.

Vitalik recalled this memory: “I was once persuaded to take Ethereum towards a more corporate route. But this never made me feel more comfortable, and even made me feel a little dirty.”

It is said that this meeting that decided the life and death of Ethereum lasted a whole day, and Vitaliks decision was to choose a decentralized and non-profit route. I was trying to shirk responsibility throughout the process because I really didnt want to take responsibility, and in the end I had to clear some people out.

This decision became the first turning point in the history of Ethereum, directly leading to the first major split in the team. Charles Hoskinson, Joseph Lubin, Amir Chetrit and Anthony Di Iorio all left one after another.

Charles Hoskinson is the most visible opponent of this conflict. He has been advocating that Ethereum should become a commercial company, obtain funding through venture capital, and then develop into a profitable technology giant. A horizontal power structure, then the cleaners and the top management will be in the same position, which is crazy.

After leaving Ethereum, Charles founded the development company IOHK (later reorganized into a venture capital studio) and launched a PoS public chain Cardano. This has been the leader of the copycat for many years. Because of its early focus on the Japanese market, it is called Japanese Ethereum. It is also the first generation of Ethereum killers and its market value has been in the top ten cryptocurrencies for many years.

Following Charles Hoskinson, Joseph Lubin also decided not to participate in core development and turned to founding the incubator ConsenSys. In 2022, it completed a $450 million Series D financing with a valuation of $7 billion. The financing parties included ParaFi Capital, Temasek, SoftBank Vision Fund II, Microsoft and other top VCs. Over the years, ConsenSys has incubated a large number of blockchain startups and built a batch of rich ecological projects for Ethereum. The most successful one is the plug-in wallet MetaMask, the most commonly used wallet in the Ethereum ecosystem, with a weekly income of $300,000 and a total income of nearly $300 million.

Similar to Joseph Lubin, Anthony is also a second-generation rich man with a strong family background. The reason for participating in Ethereum is to make more money. Therefore, after Ethereum established a non-profit operating model, Anthony began to gradually retreat to the second line and was in a semi-retired state. He created Decentral and developed the Jaxx digital wallet (finally decided to leave Ethereum in December 2015). The 2018 Forbes ranking estimated his net worth at US$750 million to US$1 billion, making him one of the top 20 richest people in the cryptocurrency field. However, in 2021, he announced that he had decided to clear and withdraw from the circle based on personal safety considerations, and would no longer fund any blockchain projects. He plans to devote himself to charity and other causes in the future.

Amir Chetrit left the Swiss conference due to criticism from other developers and founders for his lack of commitment to Ethereum, and later devoted himself to other industries. Because he has always been anonymous and focused on privacy protection, there is very little information about him.

When the dust settled at the end of 2014, only four of the original eight co-founders remained on the team: Vitalik Buterin, Gavin Wood, Mihai Alisie and Jeffrey Wilcke.

Vitalik also reflected that he was too eager to select the team and failed to consider the deep-seated differences between the members. The conflict of ideas and the collision of interests were far more complicated than he had imagined. I did realize at that time that people in the cryptocurrency field were not all fighting for their ideals like me. Many people really just wanted to make a lot of money. The relationship between people is a realistic problem.

Phase 2: Ethereum’s Cryptocurrency Version of the Silicon Valley Exodus

After the first reshuffle, more than half of the co-founder team had been lost. Fortunately for Vitalik, however, the foundation is taking over more work, and Gavin Wood, his most important technical partner, is still fighting alongside him.

Not only Ethereum, but the entire 2014 was not so ordinary for the cryptocurrency circle. The theft and bankruptcy of Mentougou caused the price of Bitcoin to fall sharply, from a peak of $951.39 to $309.87, a drop of 67%. It was also in this year that CZ sold his house in Shanghai and took the position of OK CTO with a price of $600. SBF, who had just graduated from MIT, was applying for a resume on Wall Street.

Vitaliks work continued, and Ethereum began a large-scale recruitment. On November 28, 2014, Ethereum held an important conference, DEVCON 0, in the Berlin office. Most members of the Ethereum project team gathered in Berlin. Most of the project members had previously communicated via Skype, and this was the first time they met.

DEVCON 0th meeting, source: Ethereum Foundation

At that time, Vitalik and Gavin still maintained a close cooperative relationship. In the photos left by the meeting, the two stood side by side as always, symbolizing the closeness of that period. However, no one expected that the leader of the Ethereum engineering team and the author of the Ethereum Yellow Paper would be the next to leave.

Gavin Wood chose to leave in October 2015, believing that Ethereum needed a more centralized engineering management model to be more efficient. However, Vitalik once again said NO. The huge disagreement eventually prompted Gavin to leave the team and founded his own company, Parity (Ethcore). Parity soon became an important node operator of the Ethereum network, and at one point controlled more than 40% of the network nodes. Subsequently, Gavin fully promoted the development of Polkadot and was one of Ethereums important competitors for a long time.

Gavins departure directly weakened Ethereums ability in engineering implementation. His leadership and technical expertise were crucial in the early development of Ethereum. With his departure, the teams efficiency problems were gradually exposed. Ethereums Geth client developers are distributed all over the world, and team management and coordination problems frequently occur, which affects the development progress.

Vitalik, Jeff, Gavin, Image source: Vitalik

However, after Gavin left, the only two remaining co-founders, Mihai Alisie and Jeffrey Wilcke, both left during this period.

Mihai Alisie was one of Vitalik’s earliest partners. The two co-founded Bitcoin Magazine. He helped Ethereum set up a legal framework in Switzerland and served as vice chairman of the foundation. Mihai’s departure was relatively natural. He did not have a fierce conflict with the team, but the core force of Ethereum’s early construction was further reduced.

Jeffrey Wilcke gradually withdrew after The Dao was hacked and a huge amount of ETH was stolen, causing Ethereum to fork. He handed over the development work and technical supervision of the Ethereum Go client Geth to his assistant Péter Szilágyi, and turned his attention to game development and spending time with his family. It was probably in March 2018.

Jeffrey Wilcke takes care of his children, picture source network

With the departure of these founding members, Vitaliks loneliness in Ethereum has grown day by day. A developer revealed that 2015 was a lonely and difficult year for Vitalik, and he often spent the night in his office in Berlin.

Interestingly, at the EthCC 7 conference in Brussels in July this year, after Vitalik’s speech, the three former core founders of Ethereum, Vitalik Buterin, Joseph Lubin and Gavin Wood, took a group photo of the century, which was considered to be a decent end and reconciliation to the previous breakup.

The era of centralization of Vitalik Buterin

At the same time, with the disintegration of the core team, Vitaliks influence and control over Ethereum is unprecedented. If you were asked to name an Ethereum developer other than Vitalik, 90% of the ordinary community members would not be able to do it. The authority of V God alone can represent the entire Ethereum.

Unlike Bitcoin’s “off-chain technical elite governance”, Ethereum relies more on Vitalik’s personal leadership. Although on the surface, Ethereum adopts “off-chain founding authority governance” and technical improvements must be unanimously agreed upon by the community, in fact, Vitalik’s appeal can often promote the rapid passage of proposals.

For example, after the DAO incident in 2016, the hard fork proposal led by Vitalik received 85% of the votes in favor, which is in stark contrast to Bitcoins more decentralized decision-making mechanism. Ethereum has gone from a decentralized community to a one-man show company controlled by Vitalik and the Ethereum Foundation.

Lane Rettig, one of the core developers at the time, bluntly criticized the decision-making mechanism of the foundation. The Ethereum Foundation often showed excessive caution when making important decisions, fearing favoring one party or even worrying about legal liability. This indecision led to the foundation being slow to release new platform improvement plans, pay developers, and even unable to respond to community needs in a timely manner.

Ethereums governance has failed and is effectively expert rule: a small group of technical experts have the final say over protocol updates, Lane Rettig criticized.

In this context, Ajian, who was once a hardcore content contributor to the Ethereum Chinese community, also said in the article Ethereums Hidden Concerns|Prophet Weekly Report #130: The Ethereum Foundation has never regarded itself as a patcher and maintainer of this paradigm, nor has it ever felt that there should be any limits on its power.

From Ajian’s perspective, there is no sign that the Ethereum Foundation believes that its power should be limited. It only sees them arbitrarily using this power and disrespecting other people who participate in the Ethereum blockchain. Therefore, Ajian switched from the Ethereum Chinese community to the Bitcoin Chinese community BTCStudy. Lane Rettig and Ajian’s attitudes represent the voices of many people in the community.

Even Consensys, which has been extremely supportive of the Ethereum ecosystem in the past, told the truth. In the research report paper Interpreting the Consensys Paper: Is Ethereum Becoming Increasingly Centralized? , researchers used a variety of data and indicators to analyze and conclude: The results clearly show that the entire Ethereum ecosystem shows centralized elements of control, which may be much less than the community expects.

It was also from this time that people, especially in the Chinese community, began to resist calling Vitalik V God. Centralization of power brought him down from the altar.

The Foundation stumbled during its infancy

At the same time, the Ethereum Foundation is still in its stumbling “infancy”, with many foundation members being appointed on a temporary basis.

For example, Kelley Becker and Frithjof Weinert briefly served as the COO and CFO of the Ethereum Foundation, respectively, responsible for the daily operation and financial management of the Foundation, and ensuring that the Foundation had sufficient funds to support the development and operation of Ethereum. However, their tenures were short and they soon left the Foundation.

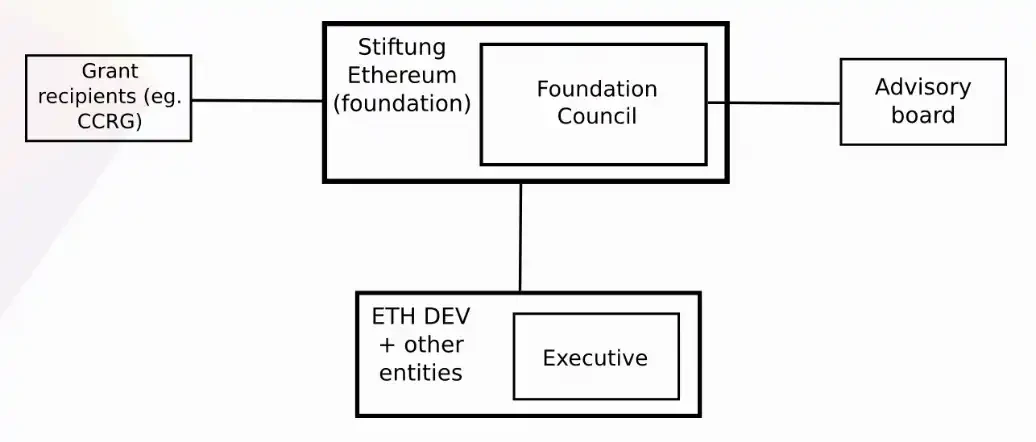

It was not until April 10, 2015 that the Ethereum Foundation began to operate and gradually got on track, becoming an important pillar supporting technology development and governance decisions. The Ethereum Foundation started the selection of the board of directors, and the foundations initial organizational structure: the centers in Switzerland and Berlin were the largest.

In mid-2015, Ming Chan, who has many years of experience in IT and management consulting, was appointed as the new executive director of the Ethereum Foundation to handle the daily operations of the foundation, ensure its standardized management, and ensure that technical development and community operations proceed smoothly within the legal and regulatory framework.

The internal structure of the foundation has also been further clarified. In addition to Vitalik remaining as a core figure in technology and the community, Lars Klawitter, Vadim Levitin and Wayne Hennessy-Barrett have also joined the foundations board of directors.

Lars Klawitter is responsible for the integration of technology and innovation in the foundation. He was active as an entrepreneur during the Internet revolution in his early years and served as the head of innovation business of Rolls-Royce. Vadim Levitin is a technical expert who has worked for the United Nations and has extensive international experience. He helps the Ethereum Foundation expand its influence globally. Wayne Hennessy-Barrett is another board member who brings a global perspective to the foundation and has rich operating experience in emerging markets in Africa.

With the addition of these new members, the Ethereum Foundation has gradually improved its governance structure, and the foundations core mission has gradually shifted from technology development to community coordination and resource allocation. At the same time, the foundation also holds a large amount of ETH assets and supports the development of the Ethereum ecosystem by funding various research projects and developer teams.

The core developers of Ethereum were assigned to the research group of the Ethereum Foundation. July 30, 2015 marked the historic moment when the Ethereum mainnet was launched. In the Berlin office, a photo of great historical significance was taken, recording some of the core members at that time. So far, Ethereum has basically completed its second reshuffle.

The people in the same frame with Vitalik include Gustav Simonsson, Christian Reitwiessner, Christoph Jentsch, etc. Several core developers worth mentioning include:

Gustav Simonsson was an early security consultant for Ethereum and played a vital role in the security of the Ethereum mainnet. After leaving Ethereum, he joined Dfinity and continued to delve into the field of decentralized computing networks.

Christian Reitwiessner is the developer of the Solidity programming language, which provides the basis for Ethereum to run smart contracts.

Liana Husikyan is also an important member of the Solidity development team. She is one of the main developers of Remix IDE. Remix is an integrated development environment for writing and deploying smart contracts, which helps simplify the development process of smart contracts.

Meanwhile, Christoph Jentzsch is the founder of Slock.it and one of the initiators of The DAO. Although a security vulnerability led to a fork in 2016, The DAO is still one of the most important experiments in the history of blockchain, promoting the exploration of decentralized governance models.

In addition, there are Fabian Vogelsteller, the author of ERC 20 and ERC 725, Vlad Zamfir, who promoted Ethereums transition from Proof of Work (PoW) to Proof of Stake, and Jutta Steiner, the head of security at the Ethereum Foundation (who later became the CEO of Parity Technologies founded by Gavin).

Phase 3: Ethereum’s “midlife crisis” and attempts to de-Vitalikize

The third reshuffle of Ethereum’s core members began in 2018.

At this time, the cryptocurrency market had experienced the ICO explosion and the 94 crash, and the regulatory liquidation year of cryptocurrencies began. The price of Bitcoin fell from a high of $19,870 to a low of around $3,000, and Binance became the worlds largest trading platform. It will take two years for Solana, the Ethereum killer that focuses on high performance, high efficiency, and high throughput, to be released.

When people talk about Ethereum, there are basically two things that they mention: one is the upgrade of Ethereum 2.0, and the other is that the Ethereum Foundation is selling coins again.

The supply of ETH controlled by the foundation has been decreasing and being sold off over the years, and community members have shown more negative emotions. However, some members of the Ethereum Foundation said that this is one of the manifestations of the foundations intention to decentralize. EF consciously wants to reduce its influence and role, which is a good thing.

Indeed, since Aya Miyaguchi succeeded Ming Chan as the new executive director of the Ethereum Foundation in 2018, the Foundation has no longer been the central hub for all development work as it was initially, but has instead shifted its focus to supporting and coordinating communication and collaboration between different projects, as well as expanding the Foundation’s collaboration with external partners, such as ConsenSys.

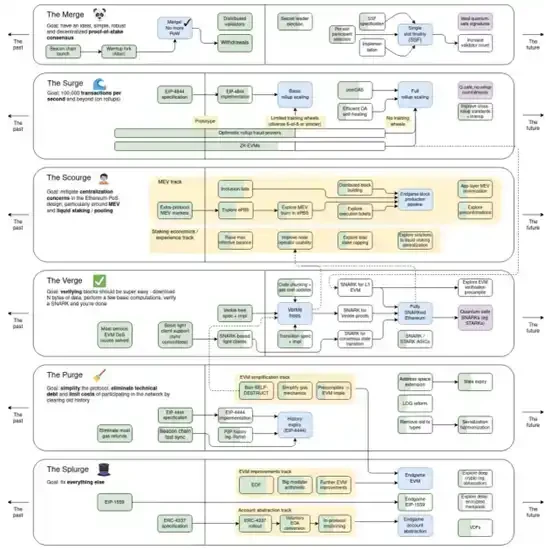

After Aya Miyaguchi took office, the EFs responsibilities became more clearly defined, mainly limited to:

1. Hold Devcon or Devconnect once a year;

2. Maintain an execution client Geth, but do not maintain any consensus client;

3. Providing tens of millions of dollars in no-strings-attached funding to the broader community each year;

4. Host conference calls: such as All Core Devs (ACD) hosted by Tim Beiko, All Devs Consensus (ACDC) hosted by Alex Stokes, etc.

5. Do research: This may be one of the departments that remains centralized, but it is possible that some EF research teams will become independent;

6. Roadmap development: Vitalik updated the roadmap diagram, and then dozens of tasks were developed in parallel by different teams;

Image source: Vitalik tweet

The Ethereum Foundation’s official website currently discloses only three members of the leadership team. In addition to Aya Miyaguchi and Vitalik, there is also a board member, Patrick Storchenegger.

During this period, several new generation core developers in the Ethereum Foundation gradually emerged and became key figures in Ethereum 2.0 and the entire ecosystem. The following is a list of people I personally think are very important in Ethereum: Danny Rya, Justin Drake, Tim Beiko, Dankrad Feist, Christian Rwitqiessner and Péter Szilágyi, the creators of Solidity, etc. (In my opinion, there is no specific order, and I won’t list them one by one)

Danny Ryan is a core member of the Ethereum 2.0 team and is known as the chief engineer of Ethereum 2.0 by the community. He played a crucial role in coordinating the development of Ethereum 2.0, especially in the launch and merge upgrade of the beacon chain. He was also the first Ethereum Foundation researcher to appear in the documentary Vitalik: An Ethereum Story. (Note: During the writing of this article, Ryan announced on September 13 that he would withdraw from Ethereum development indefinitely for personal reasons, ending his seven-year Ethereum development career)

Since joining the Ethereum Foundation in 2017, Justin Drakes main work has also been Ethereums transition to Proof of Stake (PoS), and he played a key role in the execution of the ETH merger. In addition, Justin Drake is also one of the main spokespersons in the community on Ethereums future technical roadmap, and often participates in podcasts and interviews to educate the public, such as the Ethereum Foundations Reddit AMA, where Justin Drake is also one of the main speakers and has a very good foundation in the community.

Tim Beiko joined the Ethereum Foundation full-time in 2018 and became one of the core developer leaders in 2021. He is responsible for organizing ACD conference calls and is an important bridge between Ethereum core developers. As a protocol engineer, his work covers the advancement of multiple Ethereum improvement proposals.

Dankrad Feist is an important researcher at the Ethereum Foundation, focusing on the research of statelessness and data availability. The concept of Danksharding he proposed is in the sharding technology route of Ethereum, so the expansion plan finally selected by the Ethereum mainnet is named after Dankrad Feist. At the same time, his research on the MEV (maximum extractable value) problem also provides new insights into the security of Ethereum. However, on this issue, he and Péter Szilágyi, the current development director of Geth, had a public dispute, which eventually forced Vitalik to mediate. Related reading: The Ethereum Foundation is caught in internal and external troubles: researchers and engineers debate fiercely, and members serving as EigenLayer consultants may have conflicts of interest .

After completing the stabilization of team members, from 2018 to 2022, the expansion of the Ethereum ecosystem has gained mainstream recognition. In 2019, DEXs such as Uniswap, Compound, and SushiSwap provided generous returns to any DeFi user who provided liquidity, and DeFi Summer made Ethereums TVL grow rapidly. In 2021, it is the first year of the century of the metaverse. Facebook changed its name to Meta, paving the way for the explosion of NFT. In 2022, the currency circle experienced the Lehman moment, Luna and FTX fell one after another, the Solana ecosystem was hit hard, and Ethereum successfully switched from PoW to PoS. The Layer 2 track was booming and it was in its heyday, completing its own outbreak period.

Ideological crisis: EF parliamentarization

However, the moon waxes and wanes, the water overflows, everything rises and falls, everything reaches its limit and then reverses, yin and yang transform, waxing and waning, waxing and waning.

Finally, Ethereum has reached its midlife crisis.

This year marks the second anniversary of the transition to PoS, and the price of ETH has stagnated. Although the price once broke through $4,000 at its highest point, compared with BTC and SOL, its performance in this round of market cycle is extremely poor. The decline of ETH against BTC is about 48.70%, and the decline of ETH against SOL is about 63.55%.

The most obvious thing is that after Bitcoin reached a new high this year, Ethereum is still hovering between $2,300 and $3,000. As the 34th largest asset in the world, Ethereum is too heavy and too scattered. At this scale, Ethereums growth is very difficult, almost fighting against gravity.

There is another rule in the financial world that when an asset reaches 300 billion or 500 billion US dollars, it will face a growth bottleneck. Ethereum is at this bottleneck stage. Not only is it a price bottleneck, Ethereum is also facing the crisis of ideological change.

Preventing Ethereum from becoming rigid and ideological changes in the Ethereum Foundation have also become issues frequently discussed by foundation members.

Continuing with the topic just mentioned by Dankrad Feist, the controversy caused by Dankrad Feist was not only about the MEV issue with Péter Szilágyi, but also rose to the issue of neutrality as a member of the Ethereum Foundation.

On May 21, Justin Drake and Dankrad Feist disclosed that they had become consultants of EigenLayer and would receive EIGEN tokens as compensation that may exceed their current wealth.

Although both researchers claimed that they participated in the advisory role in a personal capacity and would be ready to end their advisory positions if EigenLayer went against the interests of Ethereum, the community obviously did not buy it. When the potential income may exceed the total of ones existing wealth, it is difficult for a person to guarantee that he would treat money as dirt.

Obviously, in this reshuffle period, the Ethereum Foundation is like the Congress of Ethereum. The EIP written by researchers can directly change the direction and pattern of Ethereum and affect the ecological industry worth hundreds of millions of dollars. As the number and size of ecological participants continue to grow, EIP involves more and more interests. Every participant hopes that he can get special care in the upgrade like L2, but it is impossible for everyone to be consistent with the interests of Ethereum, so EF researchers have become parliamentarians that must be won over in the eyes of capital.

This explains why EigenLayer is willing to spend a lot of money to hire members of the Ethereum Foundation, because they spent money to buy a lobbyist from EF. Related reading: EF has no dreams .

For projects, in order to gain ecological legitimacy, they must try their best to establish good relations with EFs in various ways. If there is someone close to EFs around, it will be much easier to do things on and off the stage. For VCs, establishing good relations with EFs is a convenient channel to get in touch with high-quality investment targets earlier. With projects recommended by EF researchers, it is not only easier to get shares, but also a layer of insurance in terms of legitimacy.

Whether they like it or not, EF researchers are surrounded by various investors, who either appoint them as consultants or directly sponsor their personal research, and the researchers themselves do not seem to mind this. With the increasingly obvious modularization trend of EigenDA, Celestia, etc., this situation may be manifested in a faster and more obvious way. More teams will have their own parliamentary teams in EF, and EF itself will undergo ideological changes due to the unbundling of interests of all parties and embark on the path of parliamentarization.

Ethereum without Vitalik

As the Ethereum Foundation moves toward congressionalism, there are also signs of de-Vitalikization.

In the recollection of Vitalik’s father, when Ethereum was first established, Vitalik did not want to be a leader. He thought more like, “Hey, I came up with a cool idea. Let me write it down first, and then maybe some smart and influential people will do something about it.”

But then, things changed a little bit, and a lot of people joined the project and told Vitalik: You are the one who should drive this project. So people pushed him to the position of leader, but all this was not natural. For him, this was outside his comfort zone, and it is still one of the biggest challenges he faces.

Vitalik almost perfectly satisfied our societys deepening image of technology founders, the worship of youth, and the obsession with a certain innocence yet powerful power, said Nathan Schneider, an economics professor who has interviewed Vitalik many times.

But in 2024, Vitalik will be 30 years old.

While working on Zuzalu in Montenegro, he saw people a full decade younger than him taking on leadership roles in various projects, either as organizers or developers; at a hacker meetup in South Korea with around 30 people, he became the oldest person in the room for the first time.

Vitalik satisfies the imagination of a large number of programmers about their ideal selves: young and legendary. Vitalik is a symbol. He is no longer young and is no longer suitable for such a role, and he himself is aware of this.

Ten years ago, he wanted to do something cool, and many people praised him as one of the young prodigies who changed the world like Zuckerberg. Now, after experiencing the changes in the crypto era, the Russo-Ukrainian war, life and death, Vitalik has a new understanding: I am now playing a completely different role, and its time for the next generation to take over the mantle that once belonged to me. Related reading: Vitaliks 30-year-old life insights: Its time for the next generation to take over the mantle that once belonged to me .

Im curious if Ethereum can survive without Vitaliks leadership? 9 months ago, a related discussion post on Ethereum reddit received a lot of discussion: In the past few years, Vitalik has indeed not led Ethereum as people imagined, I even heard that Vitalik is not even the best person to explain the Ethereum roadmap.

Marco Castignoli, who works at the Ethereum Foundation, also expressed his personal opinion: Although I am not one of them, I know clearly that Vitalik is just a member of the EF research team. The research team is composed of a group of very smart brains, and Vitalik is just average among them.

Several new core members mentioned above (Danny Rya, Justin Drake, Tim Beiko, Dankrad Feist, Christian and Péter Szilágyi, etc.) have gradually emerged and become core developers in the Ethereum community.

Moreover, according to statistics from Electric Capital, there are currently 99 active Ethereum core developers, which is far ahead of other blockchain projects such as Bitcoin, Cardano, EOS or Tron. Looking at a larger scope, the Ethereum network currently has more than 250,000 developers and researchers, making it one of the most decentralized blockchain development communities.

When young Vitalik was abandoned by Blizzard, he was able to create a new world with his own technology, and it seemed that everything was created by technology. However, after several rounds of reshuffles of Ethereum team members, he found himself finally powerless, and Vitaliks self began to be deconstructed from then on.

As he wrote at the end of his 30-year-old life reflections: communities, ideologies, scenes, countries, or very small companies, families or relationships – they are all created by people.

It is not created by technology. Besides, Vitalik is no longer the youngest, smartest or even the most representative technical researcher in Ethereum. Vitaliks role will continue to weaken, and one day, Ethereum will become Ethereum without Vitalik.

Perhaps it’s time to imagine Ethereum without Vitalik.

Authors note: This article attempts to summarize the changes in the core organization members of Ethereum, but the members of Ethereum are much richer than I know. Putting them all in one article structure requires omitting many details, so there are some omissions. It is best to regard this article as a rough summary rather than a detailed historical and technical explanation. Thanks to everyone who provided information and other feedback.

This article is sourced from the internet: Ethereum’s 10-year power transition: 3 internal reshuffles, now trying to bid farewell to the Vitalik era

Related: SignalPlus Macro Research Special Edition: Intermission

Despite a turbulent start to last week, U.S. stock futures on Friday returned to where they closed the previous week, before Monday’s plunge, and Treasury yields actually rose slightly, though they remain well below July levels. Was all this turmoil just a false alarm? Looking further down, we can see a more obvious rebalancing trend, with high-priced stocks underperforming, and the equally-weighted SPW index outperforming the market-cap-weighted SPX index for the fifth consecutive week. This week, the market will focus on corporate earnings reports, especially the consumer sector, to confirm whether the trend of slowing consumer spending can be confirmed by corporate earnings data. The unexpected drop in first-time unemployment claims last week helped boost market sentiment. There wasn’t much important economic data this week other than PPI/CPI, but the…

“If you’ve lost money fraudulently to any company, broker, or account manager and want to retrieve it, contact www.Bsbforensic.com They helped me recover my funds!”