ألعاب Meme وTon تستحوذ على السوق، فهل هذه عملية تنظيف للصناعة تتجاوز CEX؟

Original author: JiaYi

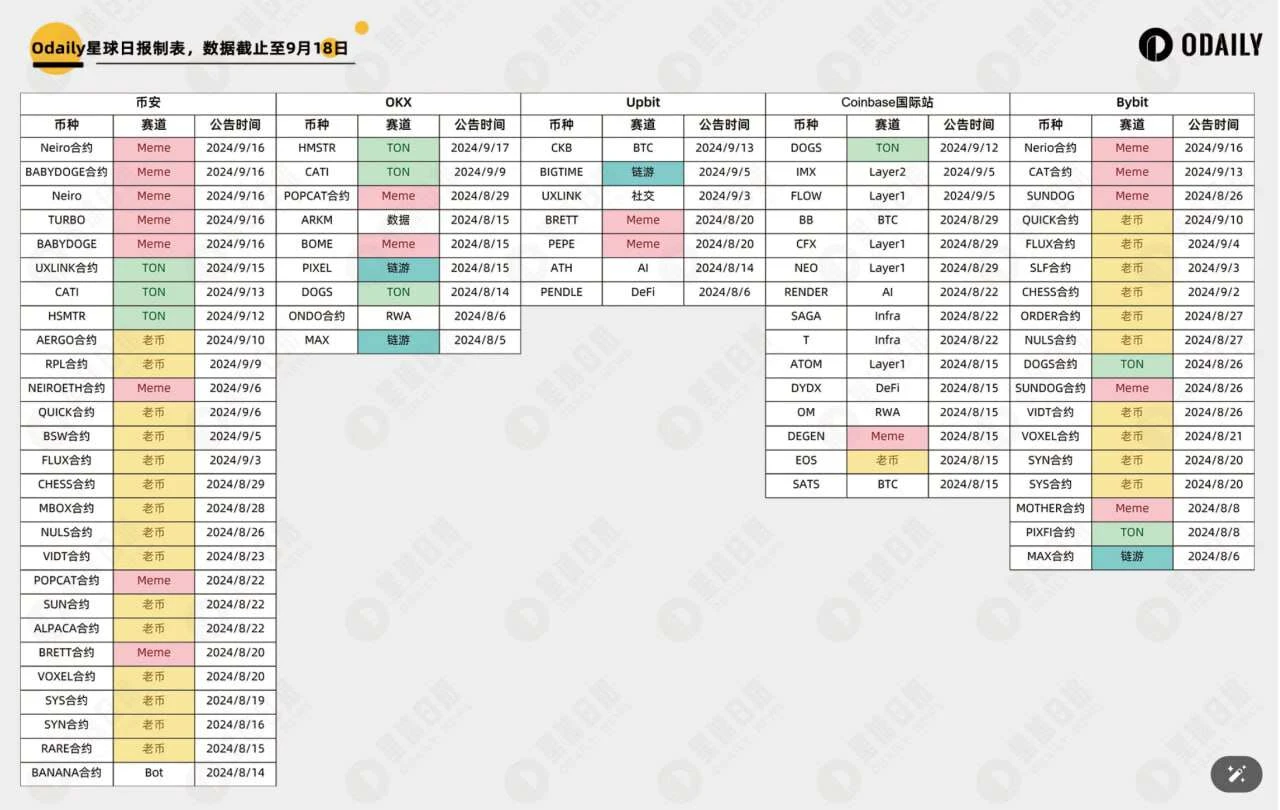

This chart from Odaily is very interesting. From the users perspective, the endless stream of Meme and Ton mini-game projects have almost swallowed up the market. Many people point the finger at Binance, thinking that it has corrupted the atmosphere. However, after checking one by one, it turns out that the big exchanges are surprisingly in step with each other. The big brother does not laugh at the second brother.

To put it bluntly, this is not just a problem for any CEX, but the entire market is going through a period of adjustment pain.

It’s just that Binance’s externalities are too large, and its every move directly affects everyone’s nerves and becomes a weather vane. Therefore, when the market is systematically in trouble, it becomes the biggest and most natural target. This also shows that everyone has the highest expectations for Binance.

The Crypto Industry is Accelerating Clearance

So what exactly is the problem?

In my opinion, the entire Crypto industry is experiencing an internal circulation of accelerated liquidation. In fact, we only need to ask ourselves: In addition to mainstream coins, have you traded more Meme or VC coins this year?

The answer is undoubtedly that since 2023, everyone has been flocking to Meme coins, which they know are worthless but are still creating a myth of wealth. This is a fact…

The actual voting of funds will not deceive people. Crypto itself is the industry closest to money. Users, entrepreneurs, and project parties instinctively tend to opportunities and hot trends that can bring tangible benefits. That’s why everyone used to criticize CEX for supporting those VC projects with a valuation of billions that only tell stories but lack real value, and let retail investors take over. As a result, Meme was hyped as a symbol of grassroots resistance to VC.

It’s just that Meme and Ton mini-games are like lighting a box of gorgeous fireworks. The user flow, incremental funds, and attention are all immediate. It looks good on the books for a while, but it is also accelerating the draining of market liquidity and overdrawing users’ trust in exchanges and Crypto. So things are changing, and now the voices criticizing Meme are getting louder and louder.

The exchange is not the referee

This moment is just like that moment.

In the final analysis, the core of a project before listing should be to build its own community consensus. If you don’t believe in your own project and tokens, and just want everyone to take over and cash out yourself, then the atmosphere of the entire community will completely collapse:

This is the consensus of the community of big FDV projects now. I am just here to try it out. After the launch, as long as the FDV is high and I have a lot of airdrops, I will sell it immediately.

Therefore, the entire market is now in a confused state of involution and loss of focus, and the exchange is not the referee. It looks at the emotional value of the community and retail investors. When the communitys attention is on Meme and Ton mini-games, when this consensus becomes mainstream, the exchange will become timid and dare not launch large projects.

After all, for CEX, they can make money no matter what, so following the trend of the community is naturally the smoothest choice. It is precisely because of this situation that some really good builders are buried. To put it bluntly, there is a problem with the underlying logic of the market, and CEX has at most stepped on the accelerator.

So everyone stopped pretending and directly embraced Memes and mini-games, like products that were quickly matured by fanatical beliefs. Even if they were not recognized by the market as expected, at this juncture, who would care about belief recharge? Being able to make money and not taking over is the highest principle.

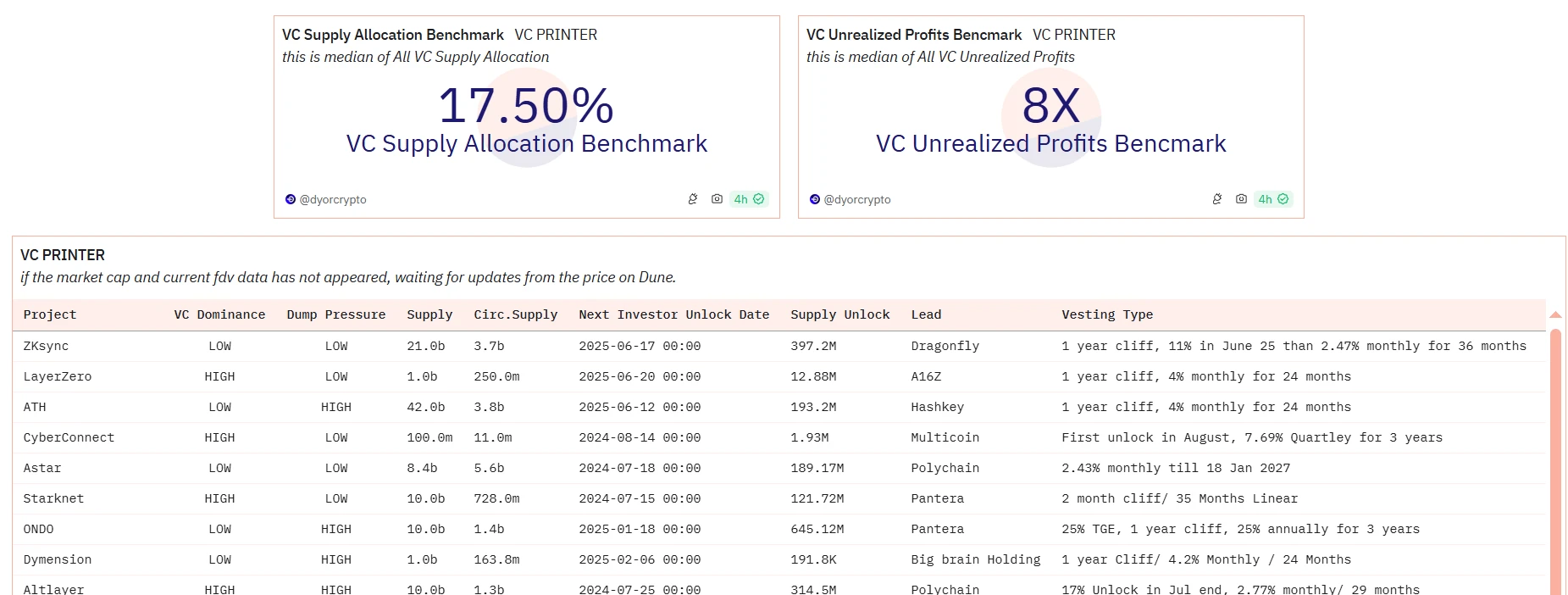

As shown in the above figure, even when the market continues to fall, major VCs still have floating profits of dozens or even hundreds of times the book value of their investments in these tokens, and the overall unrealized profits of VCs are still as high as 8 times.

Breaking the impasse requires tacit understanding among three parties

So how can the industry escape from this spiral?

To be honest, this first requires the project owners to work hard to create truly valuable projects, rather than chasing after flashy concepts for short-term benefits. Only then will the community gradually stop blindly following the trend and use their own voices and actions to support those potential and sincere projects. Only when the project owners and the community work together can the exchange recognize the real needs of the market and make the decision to drive out bad money with good money.

I asked myself, what is a good project? A project that provides value? What is value? Simply put, it makes users believe in you; makes users think that they can make money by holding your tokens; makes users reluctant to sell your tokens; it makes users make money.

بالطبع، in this chaotic moment in the market, CEX needs a heavyweight who can make the final decision, stand up, withstand the pressure, and become the baton of the industry, telling everyone: Look, as long as the project truly works with sincerity, is committed to promoting the progress and innovation of Web3, and creates value for users, then they will be able to reap the due rewards and deserve to make money.

We need more project owners and founding teams who “deserve to make money”.

Only such a guiding star that has both the ability and willingness (to be honest, at present only Binance can stand up and do something) can use the money-making effect as a baton and be willing to sacrifice itself to ensure that those projects with real strength and potential receive more attention and support, and drive the entire industry to re-examine its own development model, gradually restore market confidence, and slowly return investors to rationality.

However, this requires a tacit understanding among the project owner, the community, and CEX.

Of course, the worst case scenario will also give birth to the brightest opportunities – in the final analysis, it is just another complete clearance, this brutal joy will end brutally , a long dark storm has passed, everything is clean, the horse still runs, the dance still goes on, at most the protagonist has changed.

ملخص

Finally, I’d like to tell you a secret: when Nerio was launched on Binance, I bought it while cursing, and then I made money shamefully… It’s really good.

This is the market right now.

This article is sourced from the internet: Meme and Ton games are eating up the market, is this an industry cleanup that goes beyond CEX?

Related: BTC Volatility: Week in Review August 26 – September 2, 2024

Key indicators (August 26, 4:00 pm -> September 2, 4:00 pm Hong Kong time) : BTC/USD -9.8% ($63, 600 -> $57,400), ETH/USD -12.2% ($2,735 -> $2,400) BTC/USD December (end of year) ATM volatility -1.4 v (62.2->60.8), December 25 day risk reversal volatility +0.2 v (2.1->2.3) Overview of spot technical indicators After an unsuccessful attempt to break through the $64-65k range resistance, BTC price quickly fell back to the short-term support level of $57k. A break below $57k could trigger a steeper decline that could challenge the $53-54k price range support. We believe the risk-reward is likely to trade further lower in the very short term, but a strong reversal signal could form a solid bottom that could set the stage for upside momentum into the next FOMC meeting and the…