انخفضت معنويات الاستثمار في الأسهم الخاصة في العملات المشفرة إلى نقطة التجمد، إلى أين ستتجه في المستقبل؟

المقال الأصلي بواسطة Hootie Rashidifard

الترجمة الأصلية: TechFlow

Currently, private crypto VC sentiment is the worst since Q4 2022.

As we enter the final fundraising sprint of the year, here are some thoughts on the current situation and what to focus on in the future.

Average protocol valuations have dropped significantly over the past quarter. Pre-seed valuations are now stable between $10 million and $20 million, while Seed valuations are between $20 million and $30 million.

These valuation levels are a stark contrast to the first quarter of 2024, when valuations were nearly double what they are today.

So, what causes this situation?

-

Shortage of venture capital

-

VCs holding funds become cautious

-

Venture coins underperform in public markets

-

Investors feel there is a lack of innovation

-

Elections bring significant risk factors

1. Many VCs are nearing the end of their fund lifespans and have either not yet raised a new fund or are having trouble raising one. Many limited partners (LPs) are waiting for distributions before reinvesting.

Since VCs have no clear expectations about profit distribution, they become very selective about how they use the remaining funds.

2. VCs who were cautious in ’22/’23 felt they missed out when the market picked up in Q4 ’23. They overinvested in the hot market in Q1 ’24 and are now suffering the consequences.

Even if they have funds in hand, they still take a wait-and-see attitude towards the market, waiting for better investment opportunities.

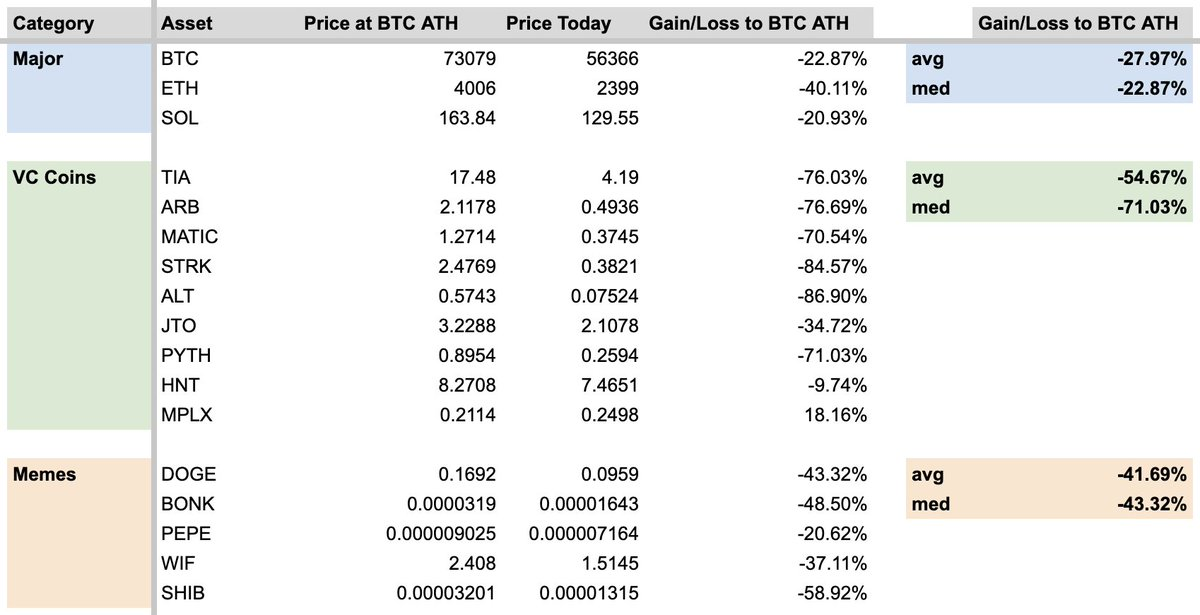

3. Venture coins perform far worse than mainstream coins (even memecoins), which confuses venture capitalists about the direction of investment.

-

Private markets swallowed up most of the gains

-

Low circulation and high FDV bring great inflation risk

-

The price of venture capital tokens continues to be sluggish in the open market

4. Investors feel there is a lack of innovation

Discussions on the CT timeline revolve around network expansion vs. L2, modularity vs. monolithic, L1 vs. L2 fees, etc., which are all signs of a zero-sum game.

If the ecosystem is growing, we work hard to attract new users and look for funding opportunities to drive innovation.

5. LPs and VCs are waiting to see what happens next

Gensler shows no signs of slowing down. It’s not a good sign when the incoming administration threatens to keep pressuring your industry for four more years.

If I have a great idea and want to raise funding, what should I do?

Dont hesitate, but be careful with your fundraising.

Ultimately, fundraising is about building the demand side of an order book. As a founder, you need to balance valuation, dilution, and quality of partners, but you don’t know what the market will ultimately price your project at.

Many founders set their valuation before they even talk to investors.

In the current market environment, this is extremely dangerous.

If your expectations for valuation are too high, you will waste a lot of time only to find out that the market is actually pricing lower than you expected. In the process, you will miss a lot of venture capital opportunities and may end up having to accept lower prices and less than ideal partners.

Going back to your ideal investor at a lower valuation is a losing strategy.

95% of VCs will automatically reject you if you lower your valuation because 1) it sends a signal that other investors have already seen it and rejected it, and 2) they are already looking for the next opportunity.

Instead, you can set a lower valuation than expected, or let the market decide.

The price can always go up when you start to gain traction. Interestingly, those investors who have already committed will feel that paying a higher price is worth it because they “won” the deal.

Some founders might say “I’ll wait until the fundraising environment is better”.

OK, but that could take 6, 12, or even 18 months. It’s not worth waiting and wasting time when you could raise some money, test your idea, and move on if it doesn’t work.

It’s easy to focus on the negative, but there are many reasons to be optimistic

1. Areas such as stablecoins, decentralized infrastructure (depin), and decentralized finance (defi) have emerged from the trough of disillusionment. These areas have taken more than 5 years to mature.

2. We are on the verge of falling interest rates, which will significantly increase liquidity in the market. Bitcoin and Ethereum ETFs (and soon maybe Sol ETFs?) are ready to receive new institutional inflows.

3. Founders begin to reconsider whether raising huge amounts of money and launching protocols at high valuations is good for the long-term community.

I know of some well-known projects that are actively turning down new funding and launching at reasonable valuations.

3a. This is a response to point 6 and a healthy adjustment to the balance of supply and demand in the private market.

I hope this is a growing trend that founders take seriously to ensure the long-term sustainability of their projects.

4. Negative sentiment has eliminated all crypto speculators, removed leverage, and all that remains are long-term builders (mostly reachable via email!).

Now is the perfect time to collaborate with like-minded people and inspire yourself among so many great people.

This article is sourced from the internet: Cryptocurrency private equity investment sentiment has dropped to freezing point, where will it go in the future?

In the past 24 hours, many new popular currencies and topics have appeared in the market, which may be the next opportunity to make money, including: The sectors with relatively strong wealth-creating effects are: Curve-related tokens (CRV, CVX), Meme sector (NEIRO); Hot search tokens and topics by users are: Morpho, Aptos; Potential airdrop opportunities include: Symbiotic, Mezo; Data statistics time: August 2, 2024 4: 00 (UTC + 0) 1. Market environment The US ISM manufacturing PMI fell far more than economists expected in July, causing interest rates to fall to multi-month lows across the board. In addition, the number of first-time unemployment claims in the United States jumped to the highest level in about a year. Taken together, these data further confirm that the United States is on the verge…