معهد أبحاث Bitget: معنويات السوق لا تزال منخفضة، وعمليات الإنزال الجوي لعملة Grass

In the past 24 hours, many new popular currencies and topics have appeared in the market, which may be the next opportunity to make money , including:

-

Sectors with strong wealth creation effects are: U-based financial management pool with high annualized return and low risk, and DeFi blue chip sectors (AAVE, 1INCH);

-

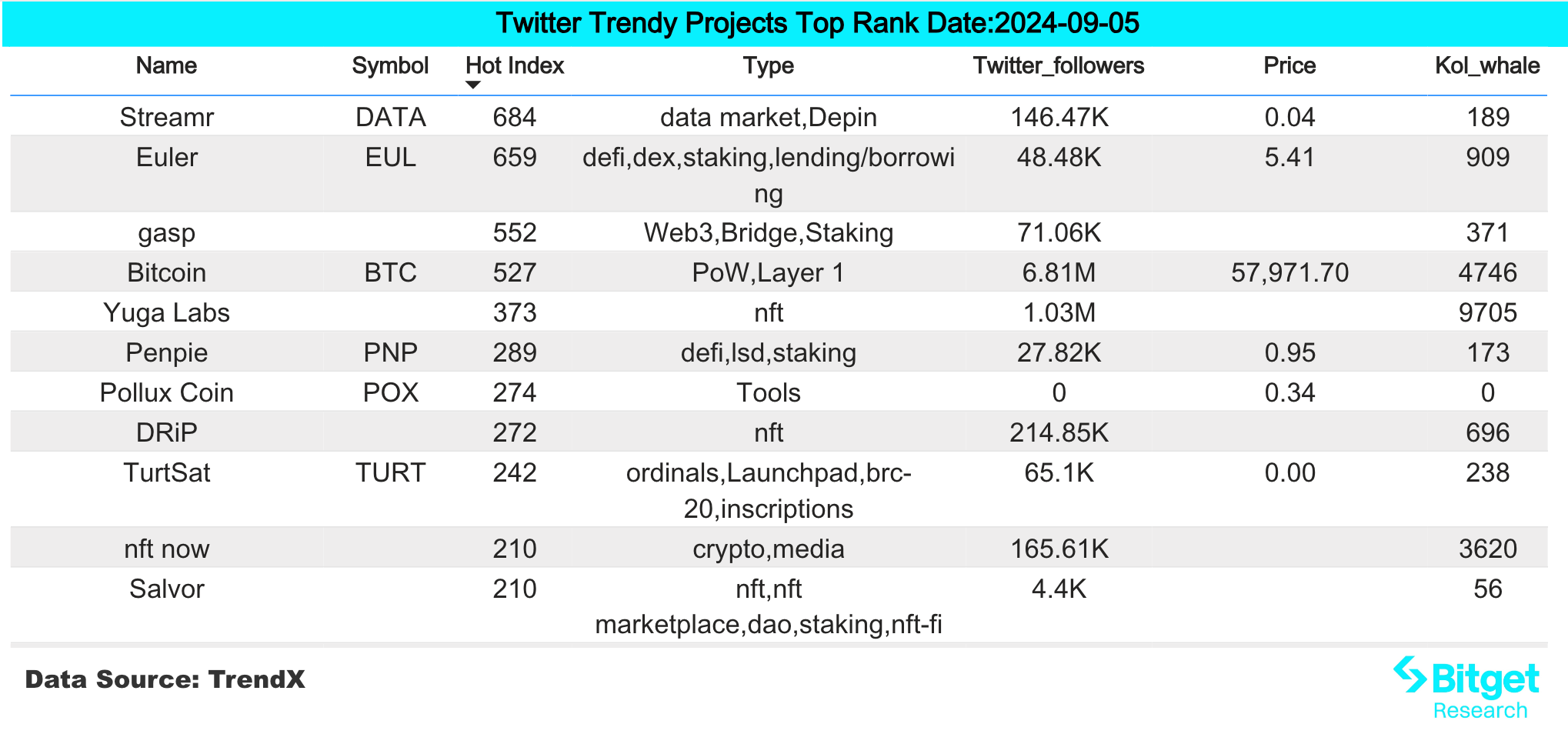

The most popular tokens and topics searched by users are: World Liberty Financial, Yuga Labs;

-

Potential airdrop opportunities include: Story Protocol, Elixir;

Data statistics time: September 5, 2024 4: 00 (UTC + 0)

1. بيئة السوق

After a brief recovery from the fall yesterday, the crypto market remained sluggish, with both trading volume and trading activity still at a low level. The overall market is still in a downward trend with no obvious signs of a rebound.

In terms of ETFs, Bitcoin ETF has maintained a net outflow for 6 consecutive days, with a net outflow of 37.2 million US dollars yesterday. Ethereum ETF is still in a net outflow state, with a net outflow of 37.5 million US dollars yesterday, and many ETFs have maintained a zero net inflow state for many consecutive days. From the ETF data, it can be seen that users of many ETFs are in a cautious wait-and-see state.

In terms of crypto ecology, the well-known project Grass released an airdrop query page yesterday. The query page only reflects the distribution of the test Alpha season and seasons 1-7, excluding the ongoing reward season and the distribution to be announced. The total supply of GRASS tokens is 1 billion, of which 10% is for the first airdrop.

2. Wealth-creating sector

1) Recommended: U-standard financial management pool with high annualized return and low risk

سبب رئيسي:

-

The market sentiment is in panic and it is difficult to see a big rebound in the short term. Before the main uptrend comes, it is recommended to save a large amount of stablecoins and wait and see, waiting for the market to stabilize before making right-side transactions.

Recommended Projects:

-

Kamino: Currently the lending protocol with the highest TVL on Solana. The APY of Supply USDC on the platform is 13%, and the APY of Supply PYSUD is 19%;

-

NAVI Protocol: Currently the protocol with the highest TVL on SUI. The APY of Supply USDC on the platform is 10.6%, and the APY of Supply USDT is 7.7%. The yield is relatively stable.

2) Sectors that need to be focused on in the future: DeFi blue chip sector (AAVE, 1INCH)

سبب رئيسي:

-

There has been a large number of repurchases in DeFi blue-chip projects recently, such as the 1INCH team. Since July 5, the 1inch team has spent a total of 2.993 million USDT to buy 11.454 million 1INCH, with an average price of 0.26 USD. In the traditional market, this phenomenon is considered to be a companys confidence in its own companys stocks and taking practical actions to repurchase, which has a positive effect on boosting market confidence.

العوامل المؤثرة على توقعات السوق:

-

Total asset size of the protocol: The cash flow output of this type of protocol mainly depends on the asset size of the protocol. As the asset size accommodated by the protocol gradually increases, the income that the protocol can generate will also gradually increase, and the corresponding currency price will also have a strong performance.

-

Policy impact: As the cryptocurrency industry gradually passes various legislations and social recognition gradually increases, policies that are favorable to this track will also be one of the main factors for the rise of tokens in this track. As more asset management giants enter this field, I believe that the subsequent development of this field will steadily improve.

3. عمليات البحث الساخنة للمستخدم

1) التطبيقات اللامركزية الشعبية

World Liberty Financial (Dapp)

Yesterday, the draft white paper of the Trump familys crypto project World Liberty Financial showed that up to 70% of the projects tokens will be reserved for founders, teams and service providers, and the founding team will also receive a portion of the profits from the remaining 30% of tokens allocated through public sales.

According to the white paper, all WLFI will be non-transferable and locked indefinitely in a wallet or smart contract, and WLFI will be unlocked through the protocol governance process in a manner that does not violate applicable laws. As Trump is considered a crypto-friendly presidential candidate, the project has received widespread attention from crypto users.

2) تويتر

مختبرات يوجا

NFT publisher Yuga Labs has launched the sequel to the Dookey Dash game, Dookey Dash: Unclogginged, and is offering a $1 million prize. The app is now available for pre-download on mobile app stores. The first Dookey Dash game was released in 2023 and featured the Sewer Pass NFT, which was airdropped to Ape NFT holders at different levels.

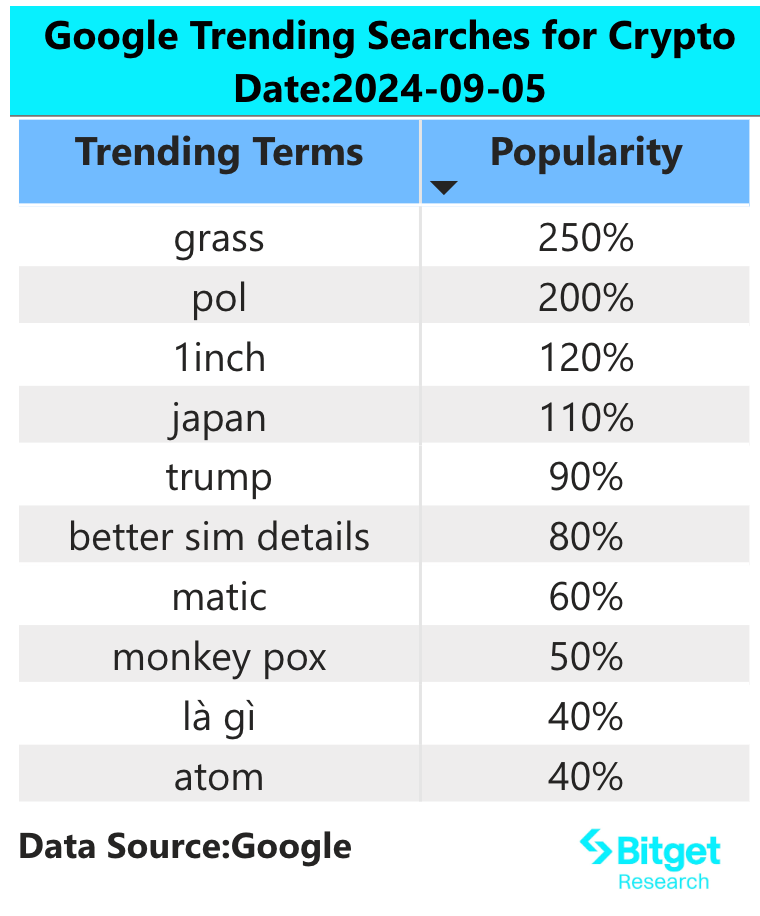

3) منطقة بحث جوجل

من منظور عالمي:

POL:

Polygon developers have begun converting MATIC tokens to POL, which is now the native Gas and staking token on the Polygon PoS chain. MATIC holders on Polygon PoS do not need to take any steps, and the upgrade to POL will be automatic. However, MATIC holders on Ethereum, Polygon zkEVM, or centralized exchanges must actively migrate their tokens to POL through the migration contract. POL will maintain MATICs existing token economy, distribution, and total supply of 10 billion tokens. The initial exchange ratio of MATIC to POL is set at 1:1, and the unlocking amount will gradually increase by 2% over ten years to support growth. So far, top exchanges such as Upbit, Binance, and Coinbase have announced support for MATICs currency swap operations.

من عمليات البحث الساخنة في كل منطقة:

(1) The search volume for POL and MATIC in Europe, America and the English-speaking region has increased significantly: Solana appeared in the hot search terms in the UK, and AI, MEME and other sectors appeared in the hot search terms in Canada, Australia and Poland;

(2) There are no obvious hot spots in Asia, Latin America and other regions, and the hot search terms are scattered. A few countries mentioned meme coins such as FLOKI and PEPE.

محتمل إنزال جوي فرص

بروتوكول القصة

بروتوكول القصة هو بروتوكول لإدارة الملكية الفكرية. يهدف المشروع إلى تغيير الطريقة التي يسجل بها البشر التاريخ من خلال الاستفادة من تقنية blockchain، وتسجيل المحتوى والملكية الفكرية على سلاسل الكتل المختلفة وربطها.

أكمل المشروع مؤخرًا تمويلًا من الفئة B بقيمة $80 مليون دولار بقيادة a16z Crypto، مع مؤسسات مشاركة أخرى بما في ذلك Foresight Ventures و Hashed، إلخ. حتى الآن، جمعت PIP Labs، الفريق المفتوح وراء Story Protocol، $140 مليون دولار، بقيمة $2.25 مليار دولار. الاهتمام بالسوق مرتفع للغاية، وقد يصبح مشروعًا رائدًا في المسار الجديد لسلسلة الكتل.

طريقة المشاركة المحددة: تعاونت Story Protocol مع مشاريع متعددة، بما في ذلك Colormp، وما إلى ذلك. يمكن للمستخدمين المشاركة في عملية إطلاق NFT لهذه المشاريع، ومواصلة الحفاظ على تقدم المشروع وإكمال المهام المقابلة، وقد يحصلون على عمليات إنزال جوي مستقبلية لرموز IP.

Elixir

Founded in 2022, Elixir is a modular DPoS liquidity network that enables anyone to provide liquidity directly to the order book, bringing liquidity to long-tail crypto assets and allowing exchanges and protocols to bootstrap liquidity on their ledgers.

On March 12, 2024, Elixir completed an $8 million Series B financing round with a valuation of $800 million; on October 18, 2023, Elixir completed a $7.5 million Series A financing round; on January 17, 2023, Elixir completed a $2.1 million seed round of financing; investors include Hack VC, GSR, Sui, and Amber Group.

How to participate: Earn points by participating in Apothecary. You can deposit at least $100 in ETH to mint elxETH to unlock the treasure chest. elxETH is a native yield token backed by ETH at a 1:1 ratio. After the mainnet is launched, it will become a full-chain LP token to power the order book liquidity of the exchange. At the same time, you can provide liquidity to Elixir-supported protocols through https://agg.elixir.xyz/.

الرابط الأصلي: https://www.bitget.fit/zh-CN/research/articles/12560603815248

إخلاء المسؤولية: السوق محفوف بالمخاطر، لذا كن حذرًا عند الاستثمار. لا تشكل هذه المقالة نصيحة استثمارية، ويجب على المستخدمين التفكير فيما إذا كانت أي آراء أو وجهات نظر أو استنتاجات في هذه المقالة مناسبة لظروفهم الخاصة. الاستثمار بناءً على هذه المعلومات هو على مسؤوليتك الخاصة.

This article is sourced from the internet: Bitget Research Institute: Market sentiment continues to be low, Grass airdrops

Related: Ethereum spot ETF starts trading today. How big is the inflow and selling pressure?

Original author: Nianqing, ChainCatcher On Monday, local time in the United States, according to regulatory documents and announcements from related companies, the U.S. SEC officially approved the listing and trading applications of Ethereum spot ETFs from multiple companies. The Ethereum spot ETF has officially come into effect, and 424(b) forms are being released one after another. Now we just have to wait for the relevant ETFs to be listed at 9:30 a.m. Eastern Time on Tuesday (21:30 p.m. Beijing Time on July 23). The first batch of Ethereum spot ETF application issuers include: BlackRock’s spot Ethereum ETF has a fee of 0.25% (0.12% for the first $2.5 billion or the first 12 months), and the ticker is ETHA; The Fidelity Spot Ethereum ETF has a fee of 0.25% (no management…