Original author: Thor Hartvigsen

الترجمة الأصلية: لوفي، فورسايت نيوز

A few days ago, I tweeted that “over 50% of my personal on-chain portfolio is in Solana.” The tweet was more controversial than I initially expected and prompted a series of interesting responses such as “I’m not afraid of God, I’m afraid of this.”

I am not a chain/ecosystem maximalist, I am concerned about revenue. And right now, the Solana ecosystem is a great source of revenue. Many people have asked me: What are the revenue opportunities worth paying attention to in Solana? Today, I want to analyze them in detail in this article.

The total supply of Solana stablecoins has been steadily increasing since the beginning of this year.

العملات المستقرة

Kamino

Kamino is the premier money market on Solana and the second largest app by TVL after Jito. With over $1.5 billion in TVL, Kamino accounts for nearly 30% of all liquidity on Solana.

باي بال PYUSD

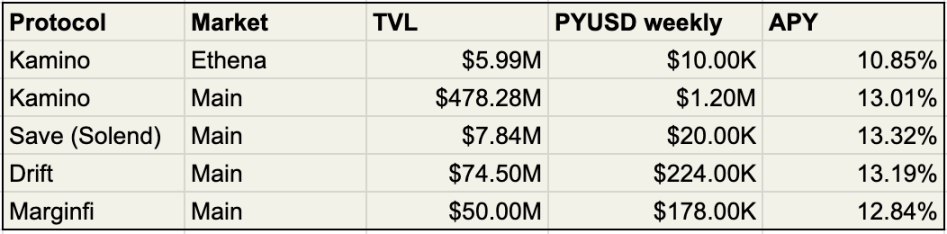

PayPal has made great strides in the cryptocurrency space this year, with its native stablecoin PYUSD (PayPal USD) having surpassed $1 billion in supply and a 65/35 split between Solana and Ethereum mainnet. PayPal has seen rapid growth over the past two months since launching its incentive program on Solana. One of the biggest beneficiaries of these incentives has been Kamino. Since June, PYUSD lenders on Kamino have been earning 10-20% per year, paid out in PYUSD. There are two markets funded on Kamino, the PYUSD Ethena market (10.85% APY) and the PYUSD Main Market (13.01% APY).

There are a few other applications that have also received PYUSD rewards, including Drift and Save (formerly Solend).

PYUSD Rewards for Applications on Solana

سول

Holding spot SOL has been a good strategy this year, outperforming BTC and ETH. For SOL holders, there are several ways to earn additional returns while maintaining exposure to spot assets. The lowest-risk strategy is to simply stake SOL using one of the liquidity staking solutions in the ecosystem. These liquidity staking tokens (LST) are ranked in order of TVL, namely jitoSOL (Jito), mSOL (Marinade), INF (Sanctum), JupSOL (Jupiter) bSOL (Blaze Stake), LST (MarginFi), etc. It is worth noting that about 7-8% of the APY comes from SOL inflation, which means that the actual yield is close to 1-2% per year.

However, the SOL staking strategy can be taken a step further, as most LST is integrated by various Solana money markets and can be used as collateral. On Kamino, users can cycle through the following methods to increase staking returns:

-

Deposit SOL LST as collateral

-

Use this as collateral to borrow SOL

-

Convert SOL to more SOL LST

-

Repeat the above steps

Currently, the highest yield can be obtained by using JupSOL LST, with an APY of 8.3%. After 5 cycles of the above operation, an APY of up to 16.4% can be obtained. This strategy can be automatically completed using Kamino Multiply, and users only need to deposit SOL or JupSOL.

Keep in mind that circular staking exposes users to greater liquidation risk. When JupSOL depreciates significantly, positions may be liquidated, and the higher the leverage, the greater the risk.

-

At 5x leverage, if the decoupling rate of JupSOL exceeds 11%, the position will be liquidated

-

At 4x leverage, if the decoupling rate of JupSOL exceeds 16%, the position will be liquidated

-

At 3x leverage, if the decoupling rate of JupSOL exceeds 25%, the position will be liquidated

-

At 2x leverage, if the decoupling rate of JupSOL exceeds 44%, the position will be liquidated

JLP

We recently conducted a comprehensive analysis of Jupiters JLP, covering the underlying design, sources of revenue, and risks to consider. You can find the report هنا .

In short, JLP is a liquidity solution on Jupiter, a token basket consisting of SOL, ETH, BTC, USDC and USDT. The performance of JLP depends on the price of its underlying assets, the profit and loss of traders, and the fees generated by Jupiter perpetual traders. As shown in the figure below, the decline in trading volume in the past two weeks, coupled with the increase in deposits flowing into the JLP pool, has caused JLPs APY to drop to about 22%.

Despite the recent decline in fees flowing to JLP, it may still outperform BTC, ETH, and SOL. If the market heats up, Jupiters trading volume may also rise, which will allow JLP holders to earn higher returns. Note: JLP holders earn returns through JLP price appreciation.

Like SOL LST, JLP can also be cycled on Kamino. Since the borrowing rate for this cycle strategy is about 20%, it is not a very profitable strategy.

ختاماً

All aspects of Solana are developing steadily. As more applications are launched and liquidity is added, new and exciting opportunities will continue to emerge.

This article is sourced from the internet: Liquidity is pouring in, here are some of the most noteworthy revenue opportunities on Solana

Headlines Trump: Gary Gensler will be fired on first day in office Trump said in a speech at the 2024 Bitcoin Conference that he would fire current SEC Chairman Gary Gensler on his first day in office. Bitstamp: BTC and BCH distribution to Mt. Gox creditors has been completed, UK customers will have a separate distribution plan Cryptocurrency exchange Bitstamp announced on X-Platform that the assets in trust that Bitstamp distributed to creditors of Mt. Gox and stored with Bitstamp are now fully available following the completion of a security check. A separate distribution plan will be drawn up for customers in the UK. Once more information is received from the Mt. Gox trustee, relevant customers will be notified immediately. Michael Saylor: Bitcoin may rise to $13 million by 2045,…