أصبحت شركات رأس المال الاستثماري في Ethereum مهووسة بالبنية التحتية وتتجاهل التطبيقات، وهو ما أصبح مشكلة طويلة الأمد

المقال الأصلي بواسطةYash Agarwal

تم تجميعها بواسطة Odaily Planet Daily Golem ( @web3_غولم )

ملخص

-

Stop listening to VCs forcing infrastructure narratives;

-

Now is the opportunity for liquid funds to rise;

-

Build products for users, embrace speculation, and pursue income;

-

Solana is the best place to experiment because of its low startup costs.

“Let your opponents speak, and they will weave a web that will keep them safe.”

Two weeks ago on “ The Chopping Block ,” Haseeb and Tom from Dragonfly made a series of arguments in a segment on Ethereum vs. Solana that went something like this:

-

Solana’s VC ecosystem is incomplete;

-

The amount of capital on Solana is much lower than Ethereum, and aside from memecoin, there are few successful players in the Solana ecosystem;

-

Solana is seen as a memecoin chain, perhaps a DePIN chain. Solana’s TVL is only $5 billion, limiting its TAM (total addressable market);

-

Launching on Ethereum is like “starting a business” in the US because it has a higher EV value;

-

Solana has a higher Gini coefficient (greater inequality).

In this article, we will revisit the above arguments, highlighting the structural problems of large funds and how these problems push them to invest in infrastructure, while also trapping founders in the quagmire of bad advice. Finally, we will share advice on how to avoid falling into EBOLA (EVM Bags Over Logic Affliction) . (Odaily Note: EBOLA was originally the name of an infectious virus, which means that Ethereum VCs enthusiasm for infrastructure is like a disease and contagious.)

Ethereum VCs are stuck in EBOLA

مثل Lily Liu said, EBOLA (EVM Bags Over Logic Affliction) is a disease affecting Ethereum VCs, and it is a structural problem, especially for large tier-one VC firms.

Take a large fund like Dragonfly, which raised $650 million in 2022 from Tier 1 LPs including Tiger Global, KKR and Sequoia, most likely because it made an infrastructure-focused thesis.

Large funds like Dragonfly are structurally incentivized to deploy their capital within a defined period (e.g., two years). This means that they will gradually be willing to fund larger rounds and at higher valuations. If they don’t fund larger rounds, they won’t be able to deploy the capital and will have to return it to their LPs.

GPs (general partners) make money every year through management fees (2% of capital raised) and success fees on exit (20% of returns). Therefore, from a risk-adjusted perspective, funds have an incentive to raise more funds to accumulate fees. Given that infrastructure projects (such as rollups/interoperability/re-hypothecation) can easily achieve FDVs of $1 billion+, especially with billions of dollars of successful infrastructure exits in 2021-2022, the EV value of deploying funds to infrastructure projects is positive. However, this is a narrative of their own creation, driven by the capital and compliance engine of Silicon Valley.

Here is the narrative logic of infrastructure:

-

The money network exists to succeed in the information network. That’s why it’s called Web3;

-

People would have “invested” in TCP/IP or HTTP in the 1990s if they could, but now we can invest in infrastructure through network tokens;

-

Blockchain infrastructure is this generation’s “TCP/IP and HTTP protocols” and people are betting on it.

It’s a pretty attractive narrative, and there’s some substance to that narrative. But the question is whether in 2024, when we see the birth of an EVM L2 that specifically increases TPS to support the NFT community’s ultra-high market potential, we have strayed from the original intention of building TCP/IP facilities for global currency. Or whether this original intention is driven by the fund economics of large crypto funds (such as Paradigm/Polychain/a16z crypto).

EBOLA is leading founders and LPs into a wrong situation

Because this infrastructure narrative can drive high valuations, we have seen many mainstream EVM applications announce or launch L2 to push up the valuation of the project. The markets pursuit of EVM infrastructure has been close to crazy, so much so that even top NFT projects like طيور البطريق البدينة have had to launch L2.

Take EigenLayer on Ethereum, for example, even with $171 million in funding, it is still far from having any significant impact, let alone generating revenue, but it will make some VCs and insiders (who hold 55% of the tokens) rich. Low circulation, high FDV projects have received reasonable criticism, what about the criticism of low impact, high FDV projects?

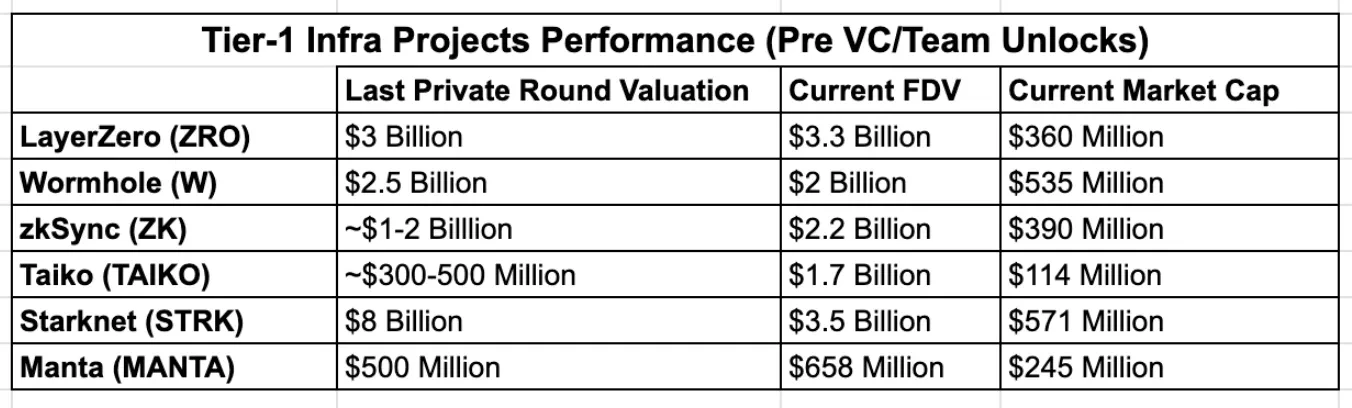

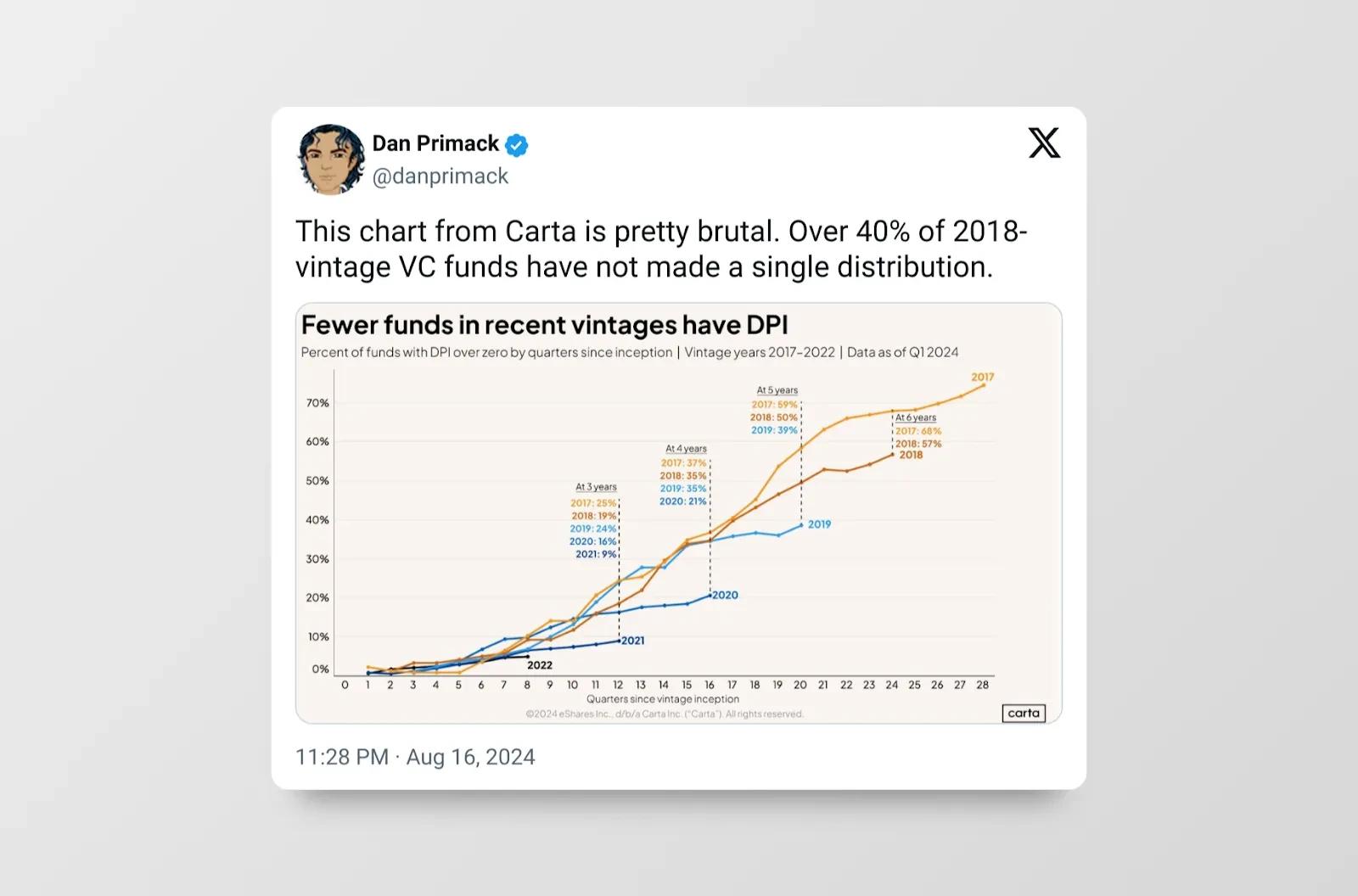

The infrastructure bubble has begun to burst, and many first-tier infrastructure projects have issued tokens below their private round valuations in this cycle. With major unlocking in 6-12 months, VCs will be in trouble and it will become a competition to see who can run faster.

There is a reason why there is a new wave of anti-VC coin sentiment among retail investors. More VC = more high-FDV, low-circulation infrastructure.

Bad VC advice can lead to project graves

EBOLA also victimizes promising applications/protocols, with VCs influencing founders to build on chains that do not match their product vision. Many social applications, user-centric applications, or high-frequency DeFi applications will never be realized on the Ethereum mainnet due to its low performance and ridiculously high gas fees.

However, despite the availability of alternatives, these applications are still built on Ethereum, which results in them being conceptually promising but unable to make further progress due to the infrastructure they rely on failing to pass “proof of concept”. Examples of this are numerous, from Enzyme Finance (2017) to more recent SocialFi applications such as Friend Tech , Fantasy Top ، و Quail Finance (2024).

Take بروتوكول العدسة , for example, which raised $15 million and is running on Polygon due to funding (now switching to zkSync due to another grant ) while maintaining their L3. Infrastructure fragmentation led to the failure of Lens Protocol, which could have otherwise become a foundational social graph. In contrast, Farcaster took a light infrastructure approach, which is a more Web2-oriented path.

A recent example is the IP blockchain بروتوكول القصة , which has completed a total of $140 million in financing, led by a16z. Even when they have been pushed to the edge, Tier 1 VCs are still doubling down on infrastructure narratives. However, keen observers may have noticed new exit paths: the evolution of narratives from infrastructure to specific application infrastructure, but they are often built on unproven EVM stacks (such as OP) rather than the proven Cosmos SDK.

The structurally collapsed venture capital market

The current venture capital market is not allocating capital efficiently. Crypto ventures manage billions of dollars in assets that collectively need to be deployed into specific rounds, from private seed to Series A, within the next 24 months.

Liquid capital allocators, on the other hand, are highly sensitive to global opportunity costs, whether it’s from “risk-free” treasuries to holding crypto assets. This means that liquid investors will be more efficient than risk investors.

Current market structure:

-

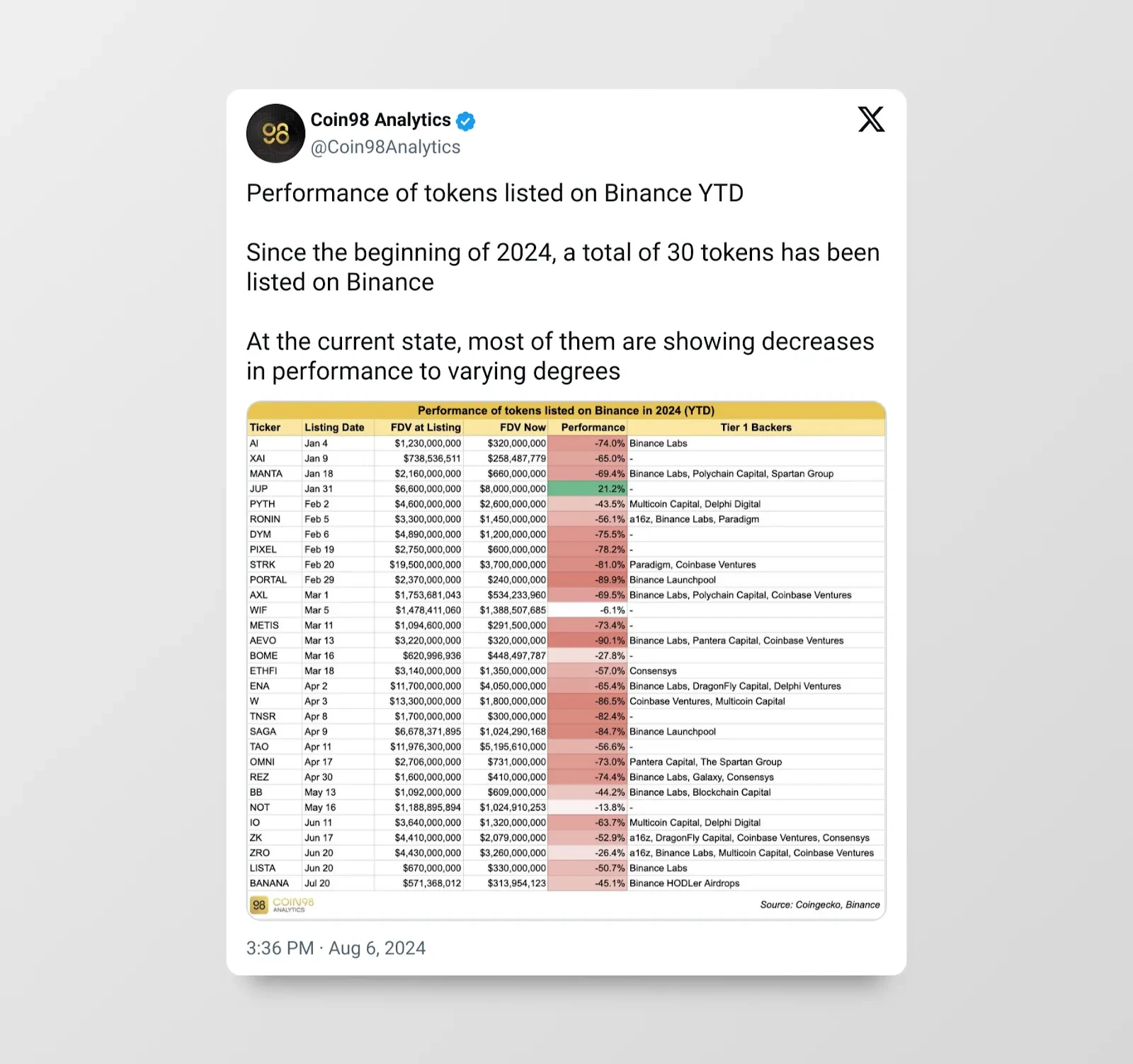

Public market: insufficient capital supply and oversupply of high-quality projects

-

Private equity market: excess capital supply and insufficient supply of high-quality projects

Insufficient public market capital supply leads to poor price discovery, as evidenced by this year’s token listings. High FDV issuance is a major issue in the first half of 2024. على سبيل المثال , the total FDV of all tokens issued in the first six months of 2024 is close to $100 billion, accounting for half of the total market capitalization of all top 10 to 100 tokens.

The private venture capital market has been shrinking. Haseeb acknowledged that these funds are smaller than previous funds, and there must be a reason for that, otherwise Paradigm would have raised the same size as its previous fund if it could.

A structurally broken venture capital market isn’t just a cryptocurrency problem.

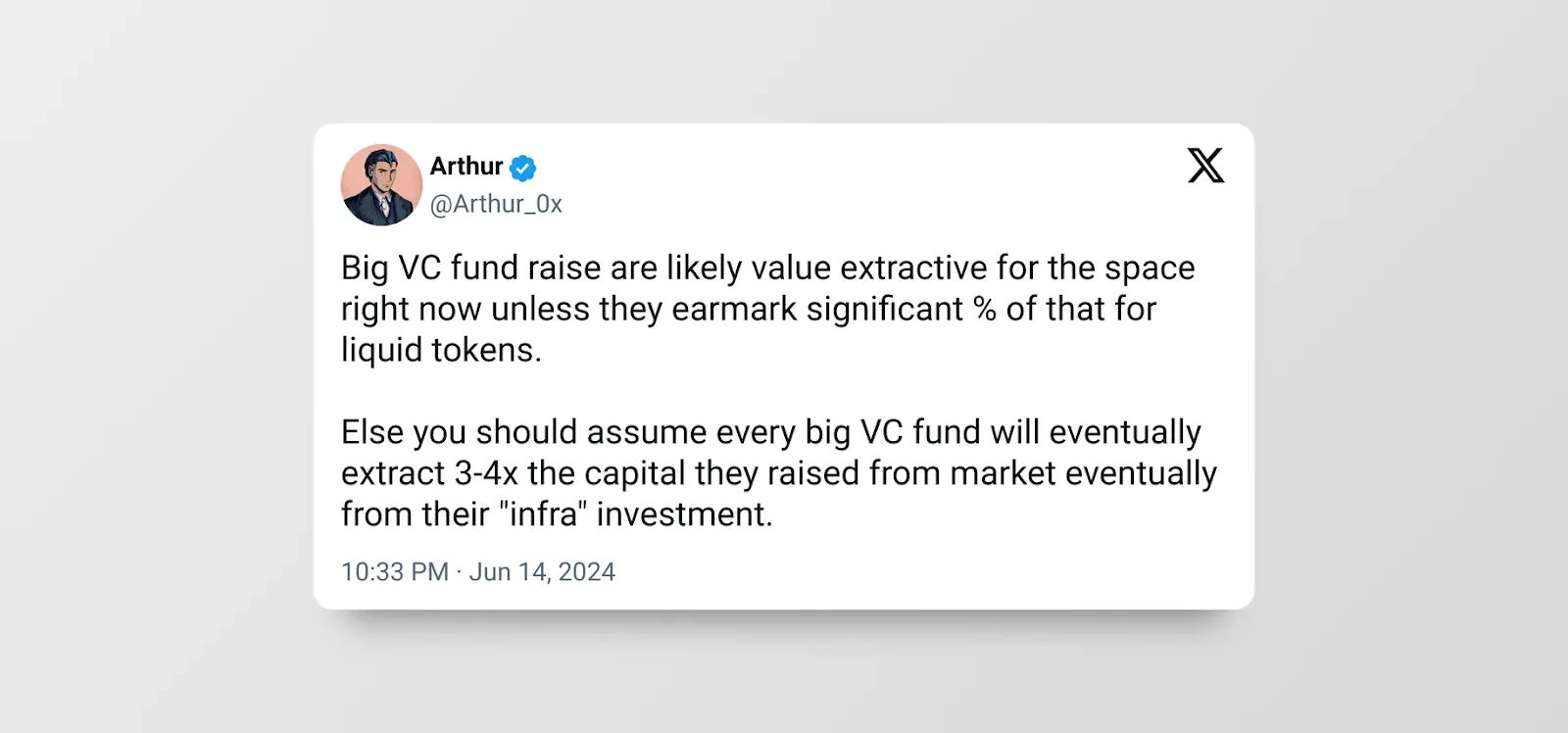

The cryptocurrency market clearly needs more liquid funds as structural buyers in the public markets to address the problems of the collapsed venture capital market.

How to fight EBOLA

Enough of the problems, now let’s talk about potential solutions and what needs to be done as an industry — both for founders and investors.

For investors – adopt a liquidity strategy that expands by embracing public markets, not fighting them

Liquidity funds essentially invest in or hold publicly traded liquid tokens. مثل Arthur from DeFiance points out, an efficient liquid cryptocurrency market requires the presence of active fundamental investors, which means there is plenty of room for liquid crypto funds to grow. To be clear, we are currently discussing spot liquid funds; leveraged liquid funds (or hedge funds) have performed poorly in the last cycle.

Tushar and Kyle of Multicoin grasped this concept 7 years ago when they founded Multicoin Capital. They believed that a liquidity fund could achieve both venture capital economics (investing in early tokens to obtain excess returns) and the liquidity of the public market.

This approach has several advantages, such as:

-

Public market liquidity enables them to exit at any time as their thesis or investment strategy changes;

-

The ability to invest in competing protocols to reduce risk. It is often easier to invest in trends than to pick specific winners within those trends, so liquid funds can invest in multiple tokens within a particular trend.

While typical venture capital funds provide more than just capital, liquidity funds can also provide various forms of support. For example, liquidity support can help solve the cold start problem of DeFi protocols, and these liquidity funds can also play a practical role in protocol development by actively participating in governance and providing input on the strategic direction of the protocol or product.

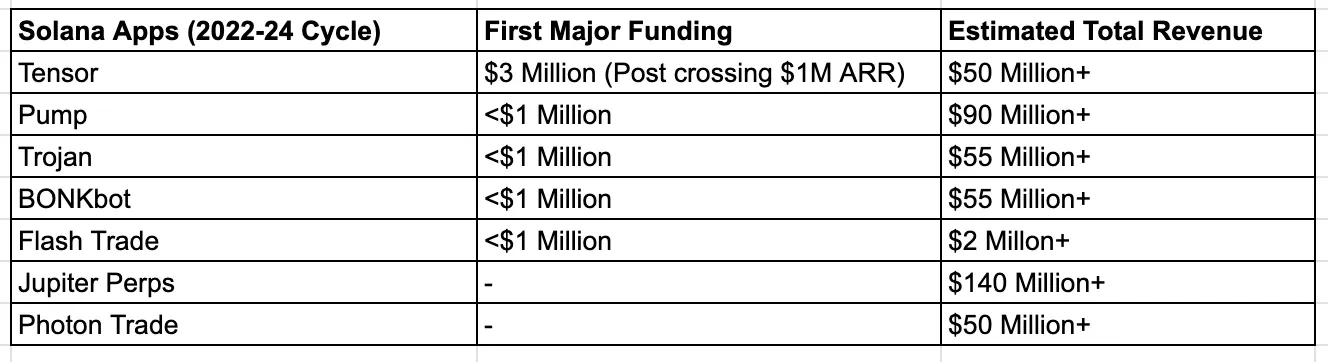

In contrast to Ethereum, Solana has a smaller average round size in 2023-2024, with the exception of DePIN; almost all first major rounds are rumored to be less than $5 million. Major investors include Frictionless Capital , 6 MV , Multicoin , Anagram ، و Big Brain Holdings , in addition to Colosseum , which runs Solana Hackathons and launched a $60 million fund to support founders building on Solana.

Solana Liquidity Fund Opportunities

Compared to 2023, Solana now has a large number of liquid tokens in the ecosystem, and people can easily start liquidity funds to invest in these tokens early. For example, on Solana, there are a bunch of tokens with a market cap of less than $20 million, each with its own characteristics, such as MetaDAO , ORE , SEND , UpRock , etc. Solana DEX is now battle-tested, with a larger trading volume than Ethereum, and has active token launch platforms and tools, such as Jupiter LFG , Meteora Alpha Vault , Streamflow , Armada ، إلخ.

As the liquidity market on Solana continues to develop, liquidity funds are a contrarian investment option for both individuals (seeking angel investment) and smaller institutions. Larger institutions should start looking at larger liquidity funds.

For founders — choose an ecosystem with low startup costs until you find product-market fit

مثل Naval Ravikant said, you have to stay small until you find a business model that works. He said that entrepreneurship is about finding a scalable and repeatable business model. So what founders are really doing is finding work, and until you find a business model that can be repeated and expanded, you have to stay very small and very, very low cost.

Solana’s Low Startup Costs

مثل Tarun Chitra points out, Ethereum has much higher startup costs than Solana. He points out that in order to be innovative enough and ensure a good valuation, a lot of infrastructure development is usually required (e.g. the entire application becomes a rollapp fan). Infrastructure projects are inherently more resource-intensive because they are highly research-dependent and need to hire a team of researchers and developers, as well as numerous ecosystem/BD experts to convince a small number of Ethereum applications to integrate.

But applications on Solana don’t need to care too much about infrastructure, which is taken care of by Solana infrastructure startups (such as Helius / جيتو / Triton or other protocol integrations). Generally speaking, applications don’t need a lot of capital to start, such as Uniswap, Pump.fun, and Polymarket.

Pump.fun is a perfect example of how Solana’s low transaction fees have enabled the “fat app theory”; a single application, Pump.fun, has surpassed Solana in revenue over the past 30 days, and even surpassed Ethereum in 24-hour revenue on some days. Pump.fun originally started on Blast and Base, but quickly realized that Solana had better capital velocity. As Alon from Pump.fun said, both Solana and Pump.fun are committed to reducing costs and barriers to entry.

مثل Mert pointed out, Solana is the best place to build a startup due to community/ecosystem support, scalable infrastructure, and a philosophy of rapid delivery. With successful user-oriented applications like Pump.fun on the rise, we have seen more and more new entrepreneurs (especially user-oriented founders) gravitate towards Solana.

Solana Is Not Just For Memecoins

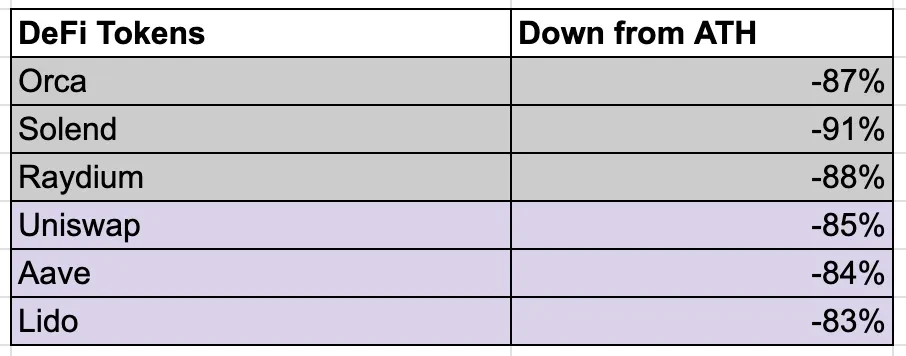

“Solana is only for memecoins” has been the biggest argument against Solana by ETH maximalists in the past few months, memecoins do dominate Solana activity, and Pump.fun is officially core. Many people think that DeFi on Solana is dead, and blue chip tokens on Solana such as Orca and Solend are not performing well, but statistics show otherwise:

-

Solana’s DEX volume is comparable to Ethereum’s, and most of the top 5 trading pairs on Jupiter 7 D volume are not memecoins. In fact, memecoins only account ل about 25% of DEX volume on Solana (as of August 12), while Pump.fun accounts for 3.5% of daily trading volume on Solana.

-

Solana’s TVL ($4.8 billion) is 10x smaller than Ethereum’s ($48 billion), which still enjoys higher capital leverage with its 5x market cap, deeper DeFi penetration, and a proven protocol. However, this does not limit the TAM for new projects on Solana. Two of the best examples are:

(1) Kamino Lend, grew to $1.4 billion in just 4 months.

(2) PayPal USD reached $450 million in 3 months, surpassing Ethereum’s $360 million supply, despite having existed on Ethereum for a year.

With many EVM blue chip tokens deployed on Solana, TVL is only a matter of time.

While one could argue that the Solana DeFi token’s price has fallen dramatically, so too have Ethereum’s DeFi blue-chip tokens, and that this is essentially a structural problem with the value accumulation of governance tokens.

Solana is undoubtedly the leader of DePIN, with more than 80% of major DePIN projects built on Solana. Perhaps it can be concluded that all emerging meta (DePIN, Memecoins, consumers) are developed on Solana, while Ethereum remains the leader of meta (money market, liquidity mining) in 2020-2021.

Advice for App Founders

For founders, the larger the fund, the less you should listen to them . They will incentivize you to financialize your product before you achieve product-market fit. Uber’s Travis does a great job explaining why you should stop listening to the advice of large VCs. While it is certainly profitable to pursue Tier 1 VCs and high-credibility valuations, you don’t necessarily need large VCs to launch. Especially before you have found product-market fit, this approach can lead to valuation burdens that trap you in a cycle of needing to raise money and launch at higher FDVs. Poor performance when you actually launch makes it more difficult to truly build a distributed community around your project.

Raising funds – Smaller rounds, more community-oriented

-

Raising money from angel groups through platforms like Echo is an underrated way of doing things right now: you trade valuation for distribution and a strong launch. Find relevant founders and KOLs and work to bring them on board. This way, you build an early supporter community/network of high-quality builders and influencers who fully support you. Prioritize the community over secondary/tertiary VCs. Shoutout to some of the Solana angel investors like Santiago , Nom , Tarun , Joe McCann , Ansem , R 89 Capital , Mert ، و Chad Dev .

-

Choose an accelerator like AllianceDAO (best for consumer projects) or Colosseum (Solana native fund) that is non-predatory and more aligned with your vision. Leverage Superteam for all your startup needs; it’s a shortcut.

Going to consumers – embracing speculation and attracting attention

-

Attention Theory: Jupiter has received $8 billion in FDV on the public market, which is a strong proof that the market has begun to value front-ends and aggregators. The point is that they have not received any VC funding, but are still the largest applications in the entire cryptocurrency field.

-

The rise of application-focused VCs: When VCs see billion-dollar exits here, they will likely follow the same infrastructure playbook for consumer apps. We’ve already seen many applications valued at $100 million in ARR.

This article is sourced from the internet: Ethereum VCs are obsessed with infrastructure and ignore applications, which has become a long-term problem

On August 1, 2024, OKX Ventures, the investment arm of leading crypto asset exchange and Web3 technology company OKX, and Aptos Foundation, a global blockchain leader, announced that they will jointly launch a new $10 million fund to support the growth of the Aptos ecosystem and the widespread adoption of Web3. The fund will be used to develop an accelerator program, operated in partnership with Ankaa, to drive the growth of quality projects and applications based on Aptos. Aptos is a scalable Layer 1 PoS blockchain that uses the Move programming language to make on-chain transactions more reliable, easy to use, and secure. The accelerator will provide selected Aptos ecosystem projects with risk support, focused guidance, market exposure, and a joint network of experts from OKX, Ankaa, and the Aptos…