ينفق PYUSD $6.5 مليون دولار شهريًا. ما هي المشاريع الأخرى ذات العائد السنوي التي تستحق الاهتمام؟

As the market value of PayPal USD (PYUSD), the US dollar stablecoin launched by Paypal and issued by Paxos, has exceeded the $1 billion mark, the market value of this stablecoin supported by the giant PayPal has increased by 327% compared to the beginning of 2024.

Such a huge increase has triggered extensive discussions in the community. The reason why PYUSD issuance has achieved such a rapid growth is mainly due to the high incentive strategy recently launched by PYUSD. According to the authors estimation based on the current TVL and APY of PYUSD on the chain, the interest paid to users by PYUSD incentive activities alone exceeds 6.5 million US dollars per month.

As of the time of writing, the APY yield of PYUSD on the DeFi protocol on the Solana chain is generally higher than 13%. Taking Kamino, the largest lending platform on Solana, as an example, 470 million PYUSD enjoy an annualized return of 13.24%, while another lending platform Marginfi has an APY return of 13.46%. Such generous rewards also allowed PYUSD on the Solana chain to surpass the Ethereum chain in mid-August and become the largest issuance platform for PYUSD.

The actual source of PYUSDs high APY is highly controversial in the community. Some community members يعتقد that the Solana Foundation pays incentives to encourage users to use Sol chains PYUSD. However, core members of the Solana community, Helius founder Mert and Multicoin managing partner Kyle both clearly stated that the Solana Foundation did not pay any incentives, and all PYUSD incentives came from PayPal.

هناك سمة مميزة لسوق العملات المشفرة: يتحدث الجميع عن كيفية كسب المال ومقدار الأموال التي حققها الآخرون، لكن قلة من الناس يتحدثون عن كيفية التحكم في عمليات السحب، وكيفية التعامل مع العملات المستقرة المكتسبة، وكيفية الحصول على تدفق نقدي أكثر معقولية.

Therefore, Rhythm also sorted out some APY projects that have received high attention from the community recently, mainly stablecoins, in addition to PYUSD, and explained the corresponding sources of income. The main source of DeFi is the subsidy of the protocols own tokens, and CEXs financial management projects come from the cooperative subsidies between CEX and projects. Among them, the highest-yielding activity APY is as high as 200%. Although it has ended temporarily, the idea can still be used as a reference.

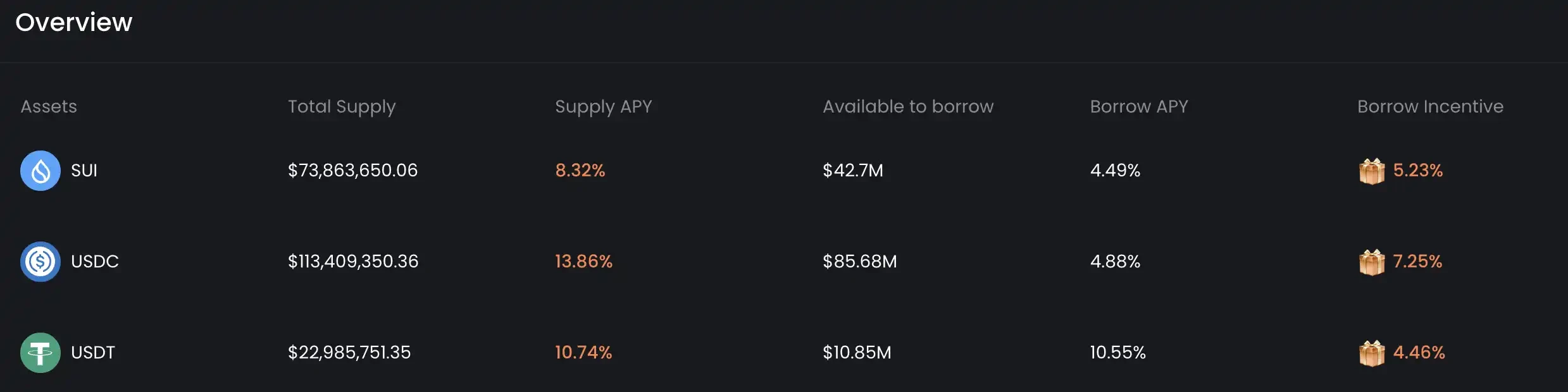

USDC-سوي

As a popular Sol Killer recently, in addition to technological development, Sui has never stopped promoting the development of DeFi on its own network. As the largest lending platform on the Sui network, USDC on NAVI currently has a TVL of over 100 million US dollars and provides an APY return of 13.89%. Similarly, most of the income comes from Suis incentives to users.

Since the current entry and exit of the USDC network requires cross-chain methods such as Wormhole, and Wormhole has performance restrictions on cross-chain, users who want to participate in the Sui network need to plan their time reasonably and leave time margin.

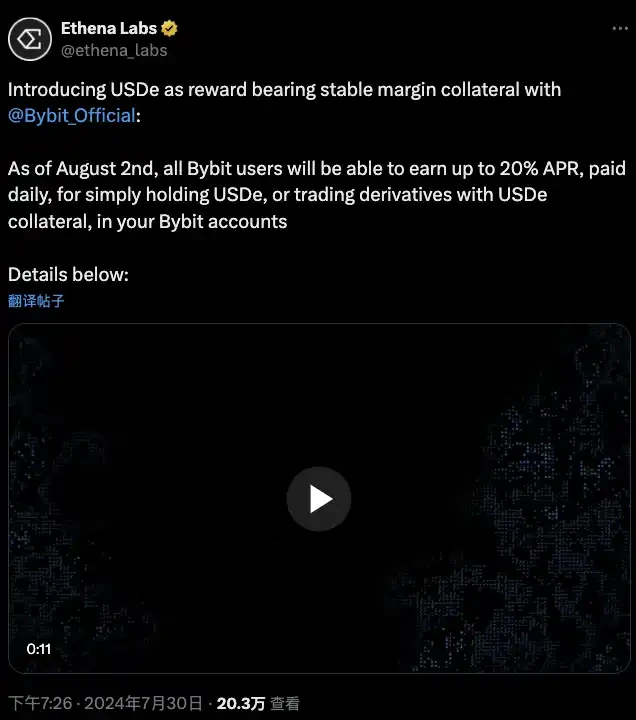

بايبت-USDE

كما ذكرت Rhythm سابقًا، في 30 يوليو، أعلنت Ethena Labs أنه بدءًا من 2 أغسطس، يمكن لجميع مستخدمي Bybit كسب ما يصل إلى 20% دخل APY، يتم دفعه يوميًا، ببساطة عن طريق الاحتفاظ بـ USDe في حسابات Bybit الخاصة بهم أو استخدام USDe كضمان للمشاركة في معاملات المشتقات المالية.

As of todays posting, Bybits USDe APY is 12.25%, which is still competitive. However, according to the event announcement, the total prize pool for this event is 3.3 million USDe. If users still want to participate in the USDe event, they should reasonably estimate the event stop time to avoid concentrated sales after the event stops, which may cause potential slippage of USDe.

آفي غو

Aave, one of the benchmarks of DeFi protocols, is also providing incentive subsidies for its stablecoin GHO. This incentive plan has increased GHOs APY to more than 20%. Currently, about 78 million GHO are staked in it.

بعد وضع GHO في المراهنة، يحتاج المستخدمون إلى المطالبة بهذا الجزء من مكافأة الحافز على واجهة الجدارة التي بناها المجتمع.

ولكن من الجدير بالذكر أن فترة فتح GHO التي تعهد بها البروتوكول هي 20 يومًا، مما يجعل مرونة السيولة لـ GHO أقل من تلك الخاصة بالبروتوكولات الأخرى.

باينانس-تون

Binance Launchpool not only launched Toncoin, but also launched a series of financial activities related to TON. The most notable one is the Super Earn activity that has ended. The activity provides TON holders with a high annualized APY of 300%, even if each user only deposits a maximum of 1,350 TONs and the activity market is 20 days. But the expected income is more than 200 TONs. Super Earn reached the subscription limit within a few minutes after it was opened.

Since the activity requires the deposit of non-stable coins, in order not to be affected by the rise and fall of tokens. Users can pledge stable coins on CEX to borrow Ton, and get this APY without considering the rise and fall of Ton. If you are a DeFi Degen, you can pledge USDT on the Ton network to borrow Ton. In this case, you don鈥檛 even need to pay the borrowing APY, because USDT鈥檚 APY is higher. This method can be widely used in scenarios that require non-stable coins.

تلخص المقالة أعلاه بعض طرق الإدارة المالية المستقرة التي نوقشت على نطاق واسع في المجتمع. أما بالنسبة لطرق كسب عائدات APY أعلى، مثل المجموعة الثانية لـ DeFi وطريقة اللعب Airdrop في LuMao Studio، فإن استقرار العائدات ومصدر العائدات ووقت الاسترداد غير مؤكد، لذا فهي غير متورطة بعد.

By continuously looking for risk-free returns like this, any user familiar with cryptocurrencies will have the opportunity to participate and enter a Fire-like state where income covers daily expenses. I hope that this basic stablecoin APY income strategy will allow everyone to have the last piece of land for themselves while facing the anxiety of the myth of getting rich quickly.

لا تشكل هذه المقالة نصيحة استثمارية. يجب على المستخدمين أن يفكروا فيما إذا كانت أي آراء أو وجهات نظر أو استنتاجات في هذه المقالة مناسبة لظروفهم الخاصة. الاستثمار بناءً على هذه المعلومات يكون على مسؤوليتك الخاصة.

This article is sourced from the internet: PYUSD spends $6.5 million every month. What other APY projects are worth paying attention to?

Related: Will all applications develop towards Appchain?

Original author: Pavel Paramonov Original translation: Alex Liu, Foresight News Is everything really moving towards AppChains? Yes and no. The main reason dApps turn to building their own sovereign chains is that they think they are being exploited. This is not far from the truth, as most dApps do not make money. You can consider the recent example of @zkxprotocol ceasing operations, and many other applications in the past like @utopialabs_, @yield , @FujiFinance , and many more. But is this because their business model is bad, or are the protocols truly exploitative? The main (and often only) source of revenue for a dApp is fees. Users pay the fees because they directly benefit from them. However, users are not the only beneficiaries of the rise in dApp usage. There…