المؤلف الأصلي: HANGRY

الترجمة الأصلية: TechFlow

Note: The content of this article only represents the original authors views, please DYOR.

Good morning, fellow furry friends!

Some might say the era of triple-digit annualized returns is over, but they just don’t know where to look.

Here are our Humble Farm recommendations this week.

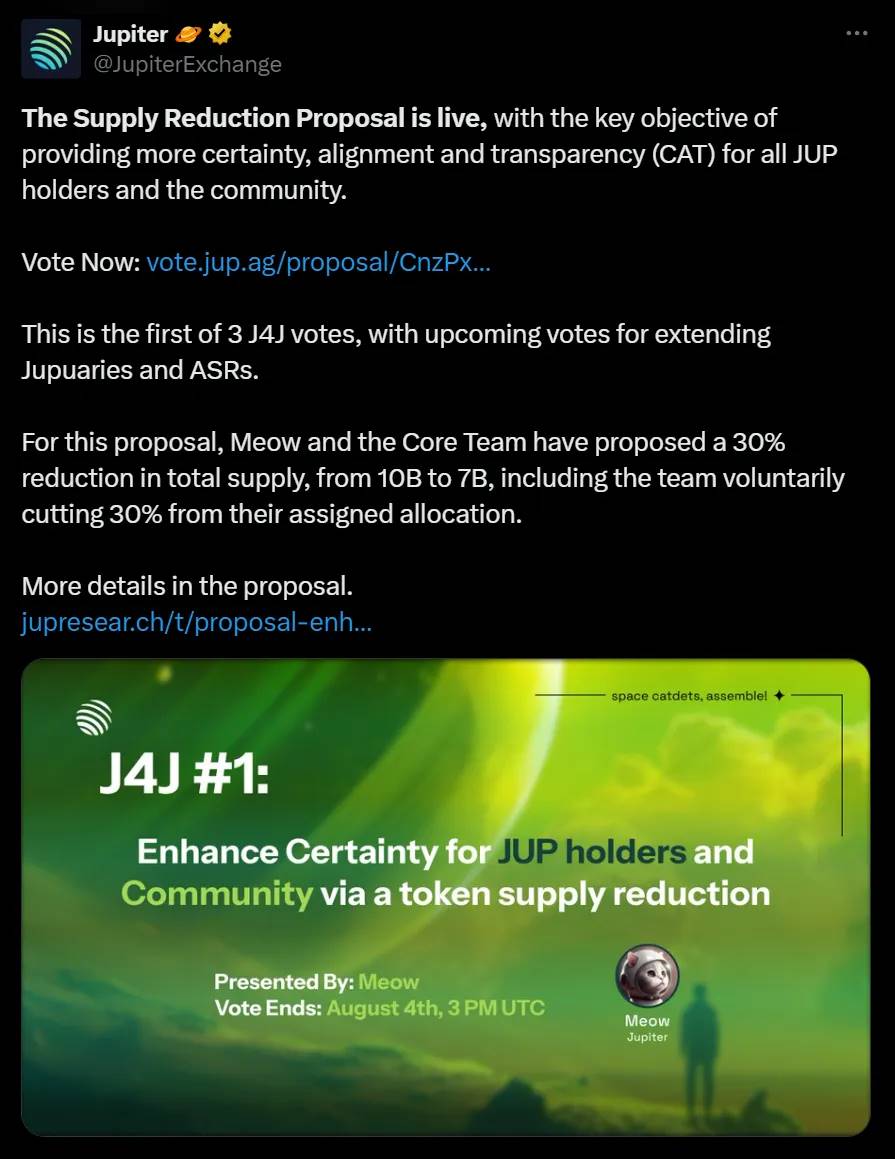

1. كوكب المشترى

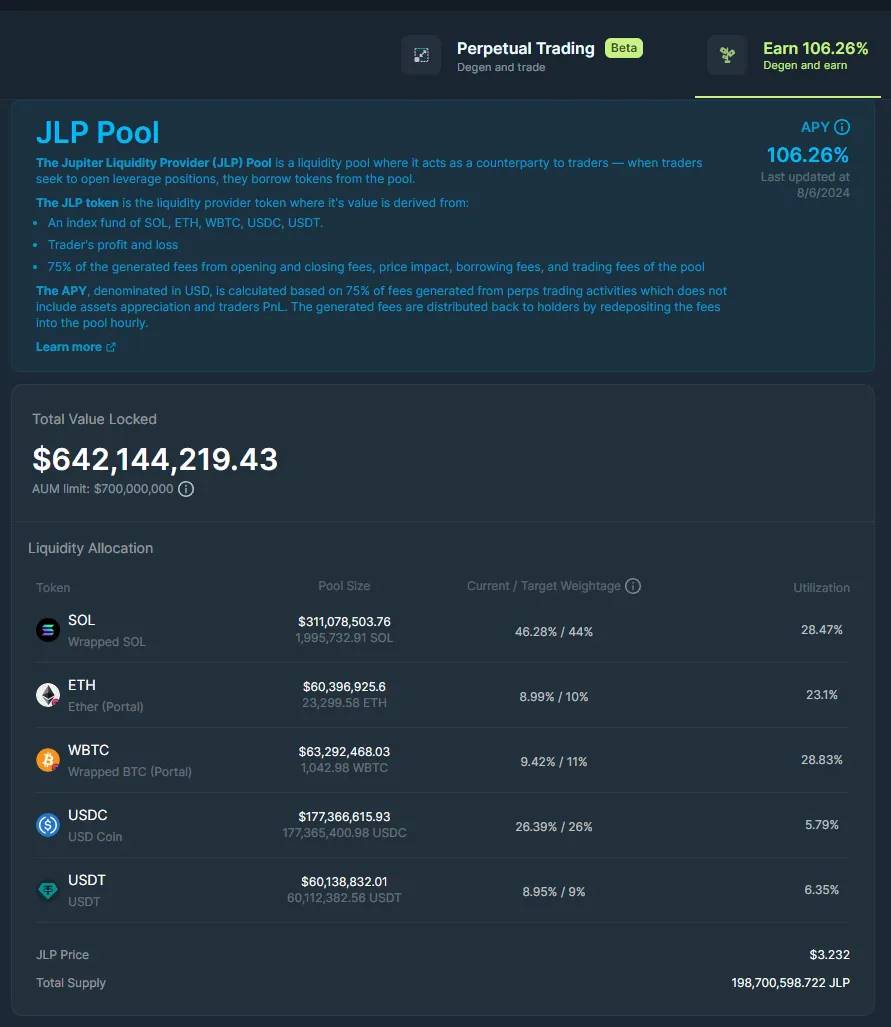

Our first opportunity to staking this week is Jupiter, the leading DEX aggregator and perpetual exchange on Solana.

Over the past year, Jupiter has solidified itself as a blue chip protocol on Solana, with JLP proving to be a safe haven during market volatility.

Currently, liquidity providers (LPs) are earning triple-digit annualized returns while maintaining exposure to major assets such as BTC, ETH, and SOL.

In addition to earnings, providing liquidity may also qualify you for Jupiter’s next airdrop round in January.

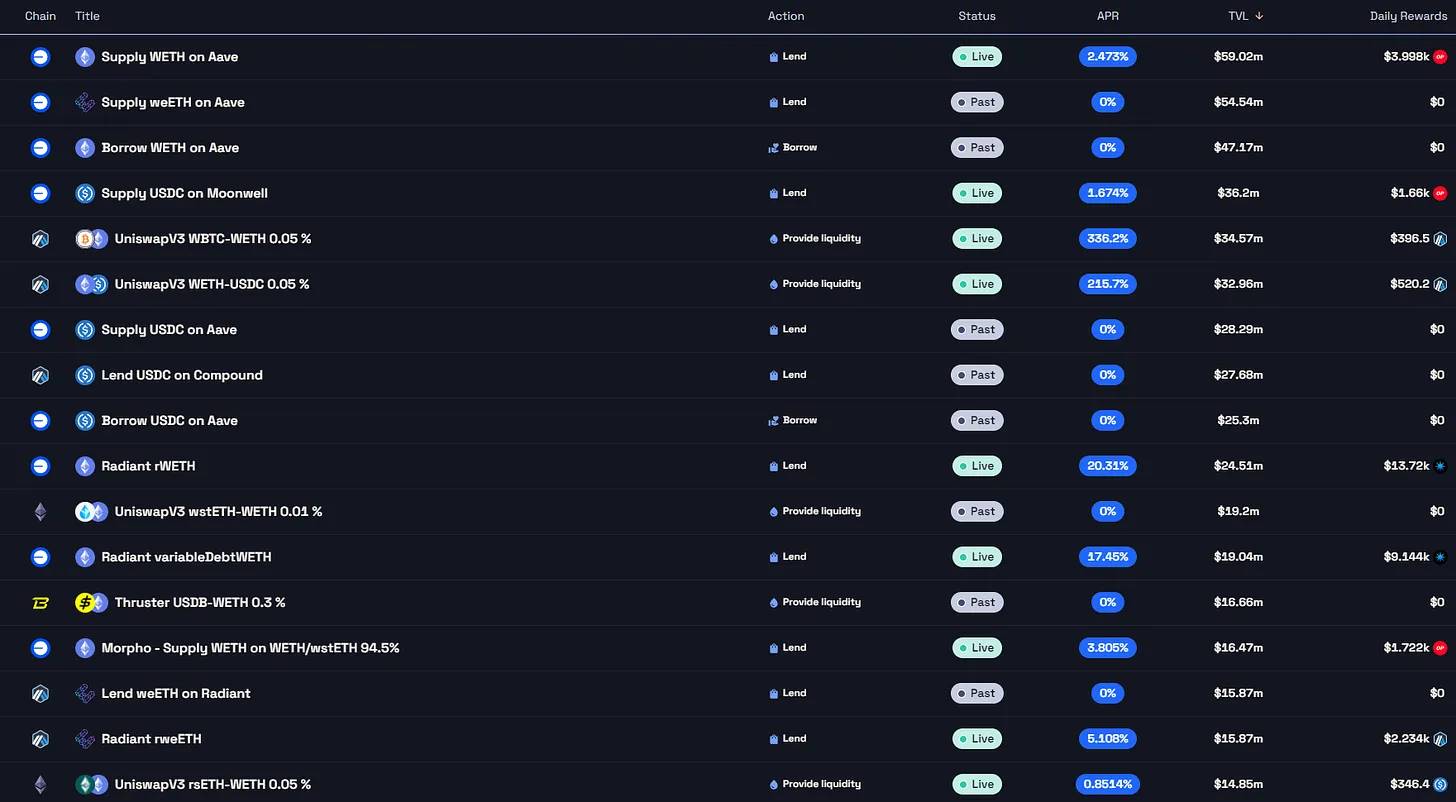

2. Merkl

Next up is Merkl, a rewards hub designed to explore and distribute token rewards for liquidity pools across various chains.

Optimism Superfest rewards are being distributed via Merkl, along with incentives for many other events.

Merkl is one of our favorite places to look when looking for new liquidity pools to provide liquidity.

Some of our favorite liquidity pools currently include:

• tBTC/WETH @ 90% APR

• wBTC/uniBTC @ 31% APR

• wstETH/ezETH @ 25% APR

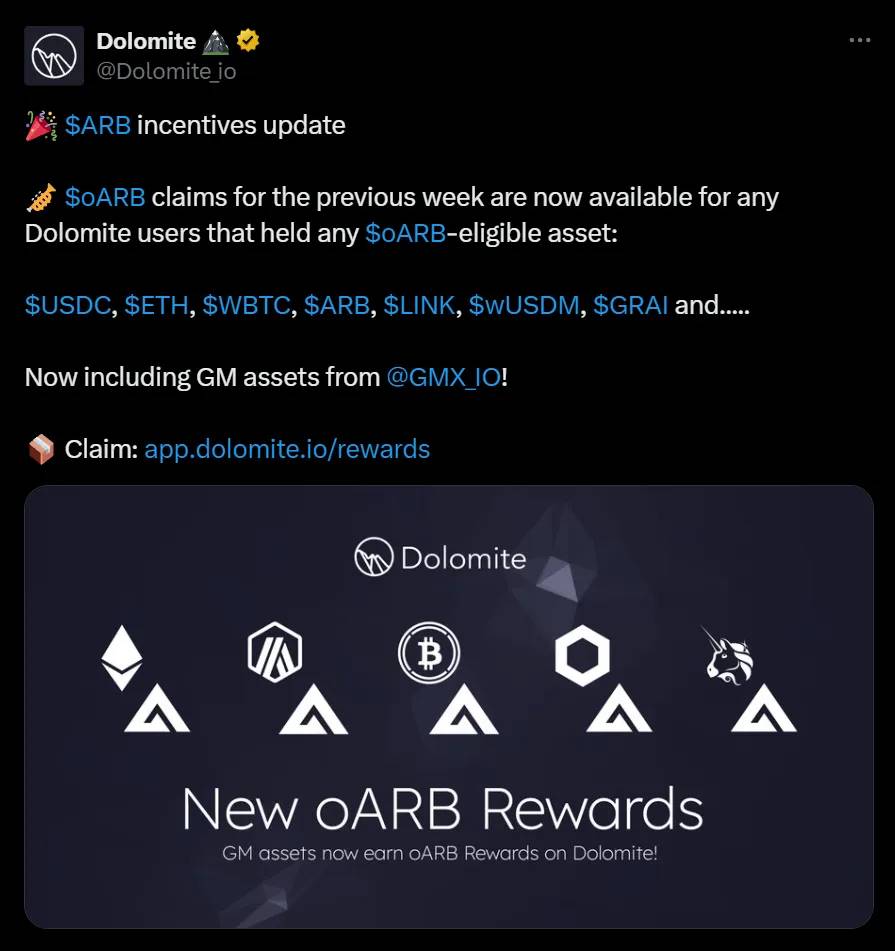

3. الدولوميت

Our next opportunity this week is Dolomite, a multi-chain money market and margin trading protocol.

Dolomite serves as a unified platform to earn additional yield on your tokens while being able to borrow on margin against your portfolio.

With Dolomite, you can deposit various assets on Arbitrum and Mantle to accumulate earnings, points, and Dolomite ore.

Depositing assets such as GLP, DAI, and USDM currently offers annualized yields between 20-40%, while also allowing users to borrow against their portfolios.

4. Brahma

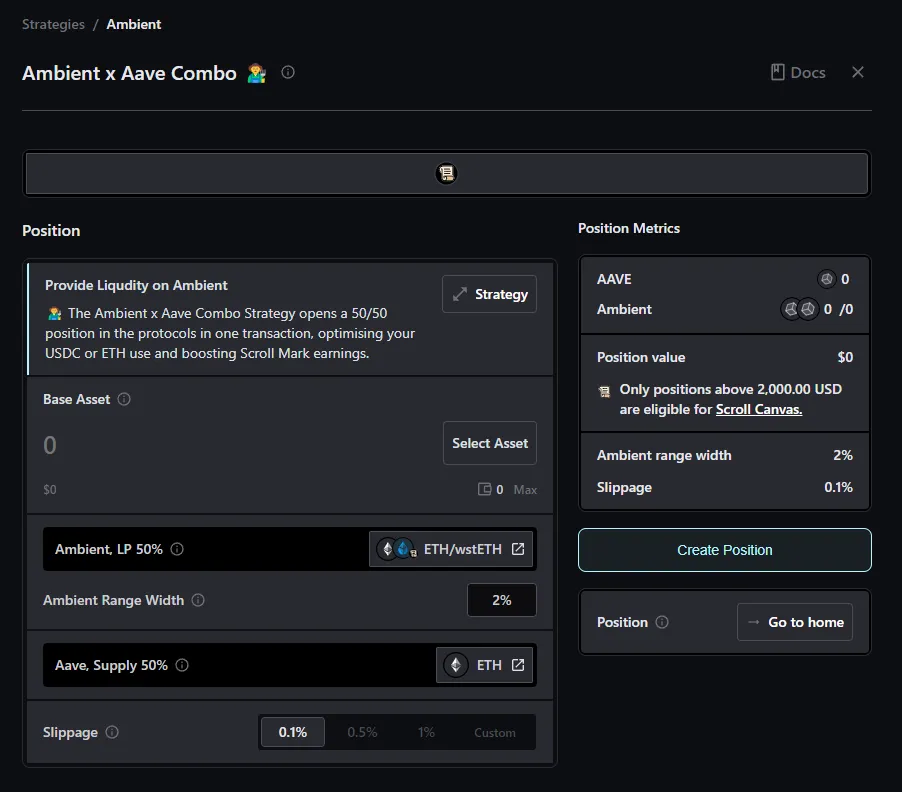

Next up is Brahma, a platform designed to simplify and integrate the decentralized finance experience.

Through the Console, users can securely store and manage their funds while gaining access to a variety of protocols and one-click strategies.

Brahma has just launched a Scroll strategy that improves yield efficiency through Aave and Ambient, which is worth a try if you are doing Scroll farming.

Additionally, users who hold assets in Brahma until the end of this month will receive additional ARB incentives.

5. Kamino

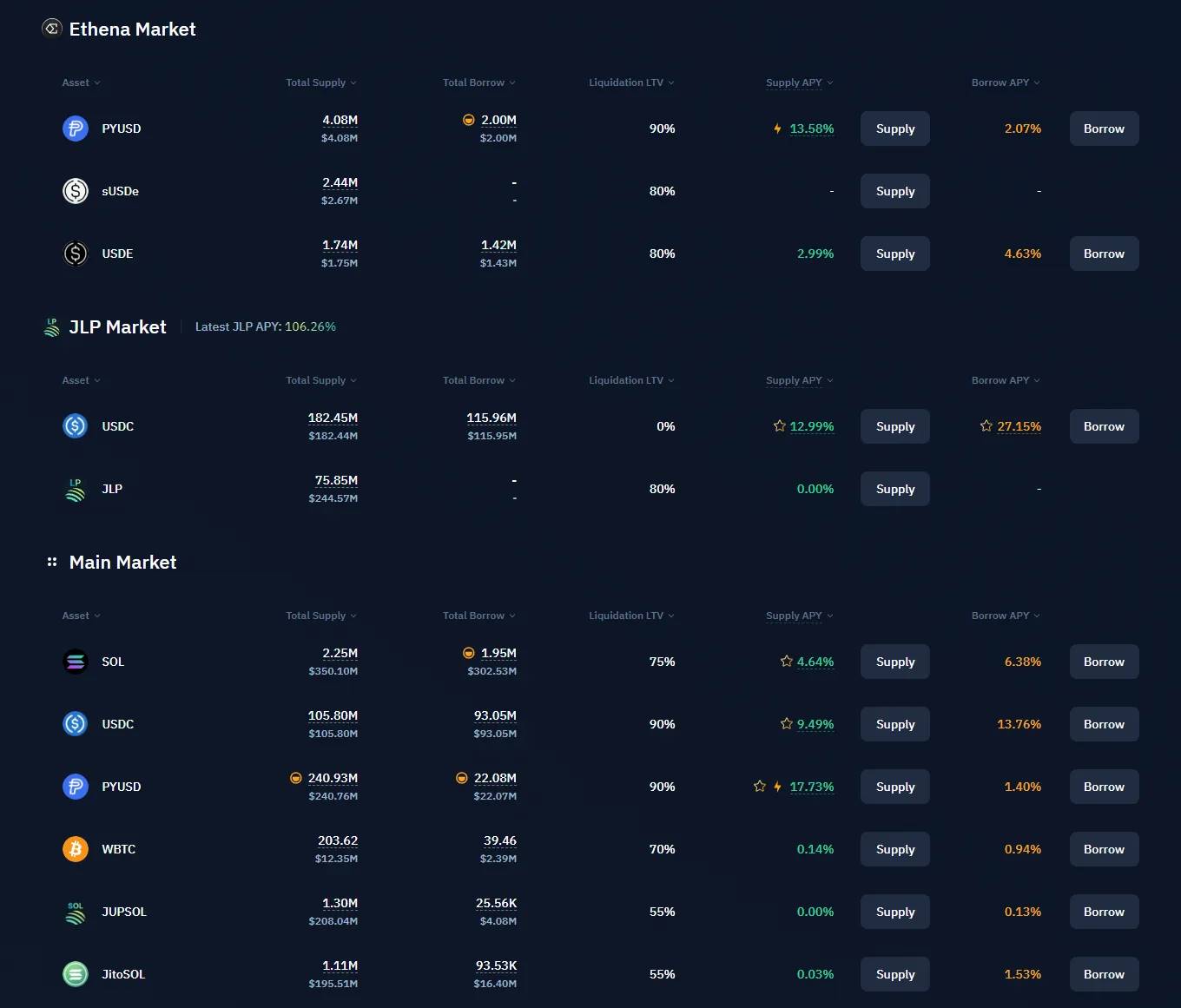

Our final opportunity this week is Kamino, a lending, liquidity, and leverage protocol built on Solana.

Even after the token was launched, TVL (total value locked) continued to grow, thanks to Kamino’s points program and the launch of new products.

Kamino offers a variety of yield opportunities, from lending to liquidity provision and even revolving lending.

Here are some of our favorite opportunities right now:

• JLP @ 285% APY (leveraged)

• pyUSD @ 83.2% APY (leveraged)

• sSOL/SOL @ 27.3% APY

This article is sourced from the internet: List of 5 good places for mining profits this week

Related: SignalPlus Volatility Column (20240626): Panic subsides

Yesterday (JUN 25), Bitcoin spot ETFs finally stopped outflows, and the uncertainty reflected in the options market also basically fell. Since the Mentougou Compensation Trustee announced on June 24 that repayments would be initiated in early July, the price of Bitcoin has fallen for a short time due to market panic. Alex Thorn, head of Galaxy Research, said in a post that the number of tokens ultimately allocated to individual creditors in the bankruptcy case was less than people thought, about 65,000 BTC (far lower than the 140,000 previously announced by the media), and the resulting Bitcoin selling pressure will be less than expected. This is mainly because some creditors chose debt acceptance (similar to FTXs packaged sale of debt) and received early payment, and the money eventually flowed to…