مقدمة

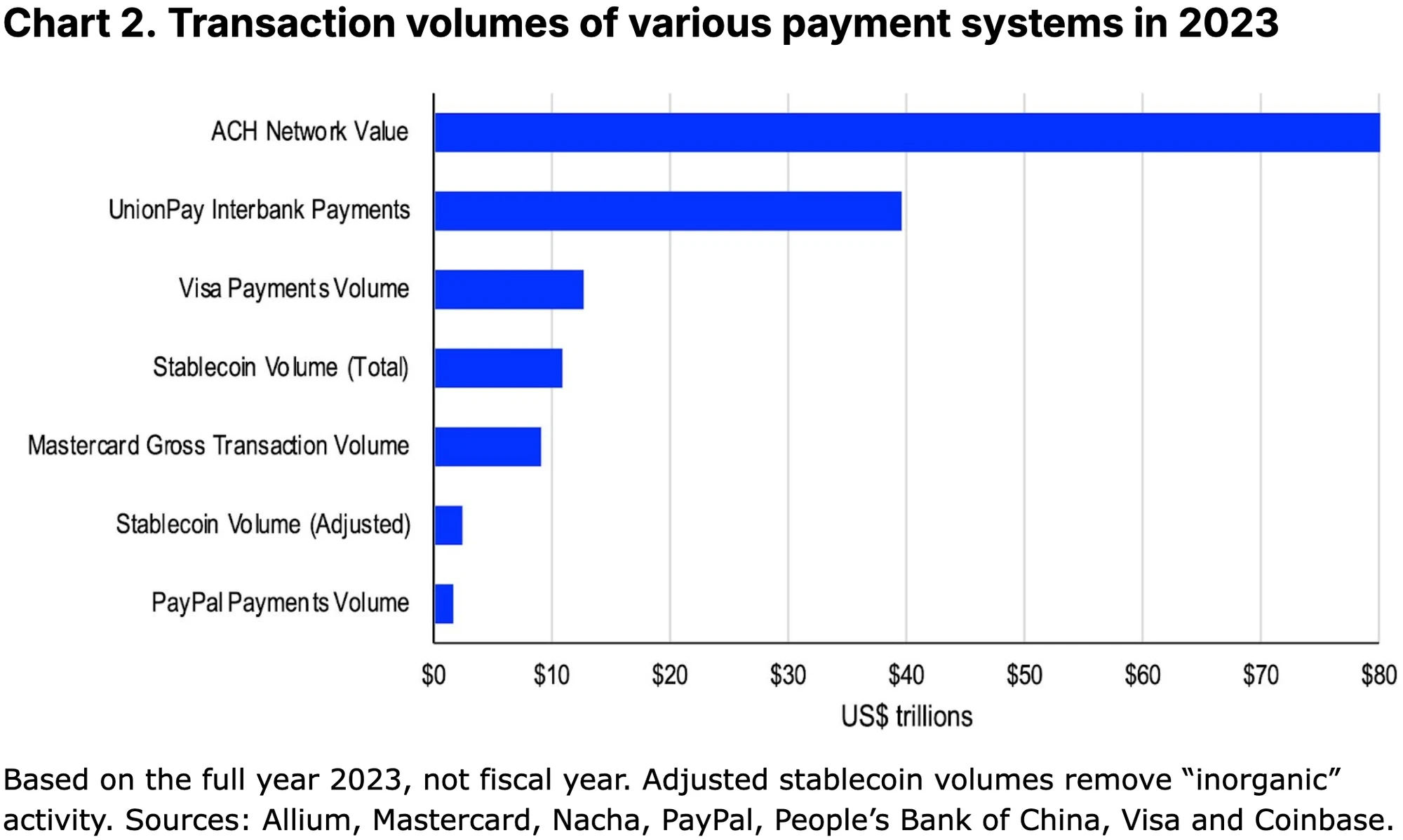

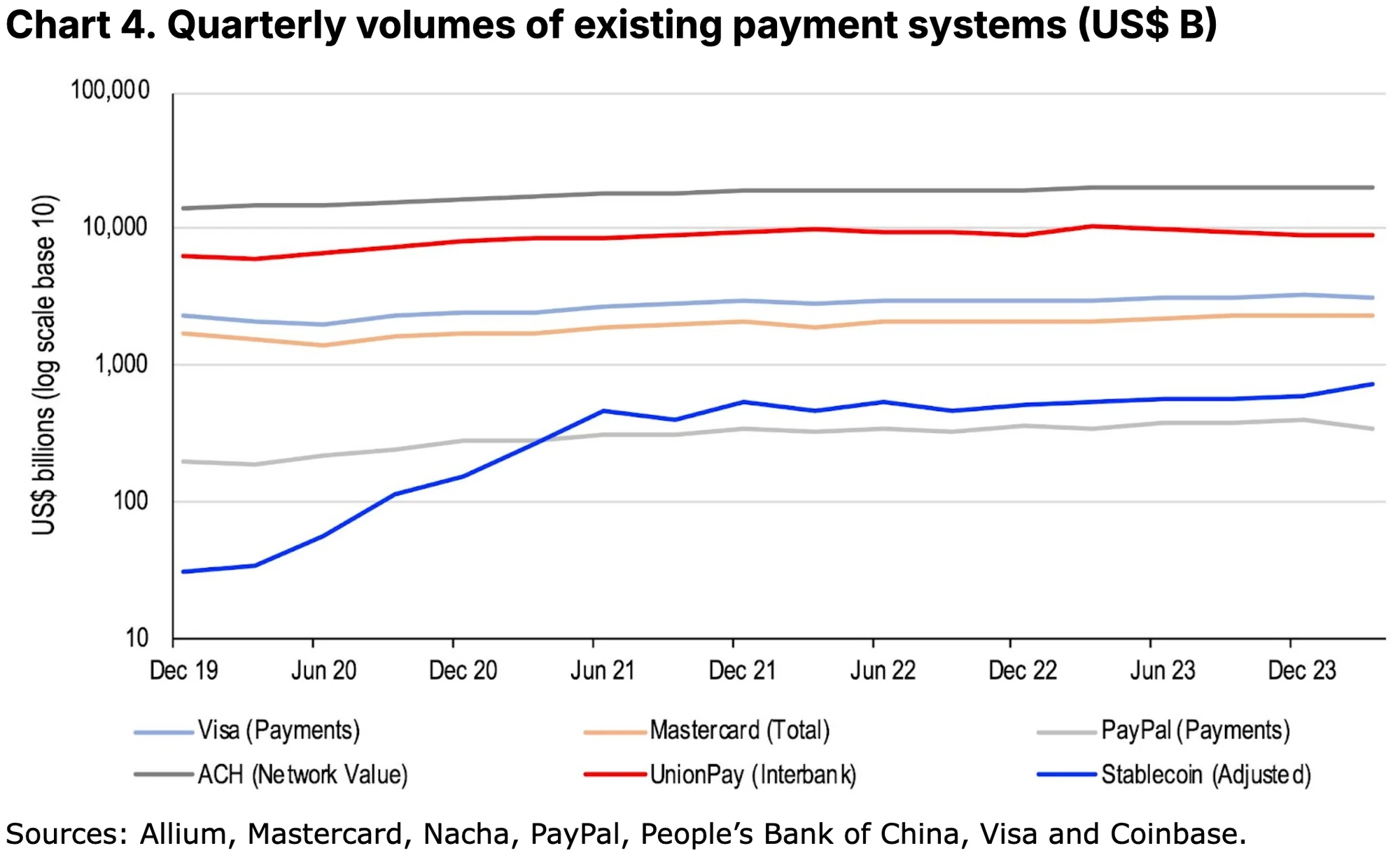

Currently, the global payment infrastructure is being modernized and improved, which will provide users with faster and cheaper payment methods. Stablecoins are increasingly being used to build robust crypto payment systems, facilitate remittance payments and simplify cross-border transactions. In 2023, the total transaction volume settled in the stablecoin market exceeded $10.8 trillion – $2.3 trillion if unnatural transactions, such as robots or automated transactions, are excluded. On an adjusted basis, transaction volume increased by 17% year-on-year, which means that stablecoins are quickly catching up with todays largest existing payment networks.

Although existing payment networks enjoy some important advantages in terms of liquidity and network effects, as competition has increased, the average cost of remittance payments has fallen by more than a third over the past 15 years, according to the World Bank. However, the current average cost of sending $200 globally is still 6.35% of the remittance amount, totaling approximately $54 billion per year. In contrast, the average transaction cost of sending remittances using stablecoins is much lower, at only 0.5% to 3.0% of the remittance amount, and there is potential for further reductions due to the continuous innovation of new technologies.

As technology makes it easier for merchants and users to adopt new payment methods, existing payment networks become more vulnerable to FinTech challengers. The integration of stablecoins into existing payment systems is an example of the increasing adoption of cryptocurrencies in the real economy. However, we believe that expanding the role of stablecoins requires simplifying some of the technical complexities of blockchain and clearer regulation to ensure consumer protection and promote broader financial inclusion.

The future king?

Stablecoins have become a hot topic recently, especially after the Markets in Crypto-Assets (MiCA) regulation came into effect in Europe on June 30. USDC became the first MiCA-compliant dollar stablecoin in the region, while Circle’s euro stablecoin EURC also met MiCA compliance requirements. Traditional financial institutions are also deploying stablecoins in the region or planning to do so. This includes Societe Generale’s digital asset unit Forge, which launched an institutional version of the EURCV stablecoin, and Deutsche Bank’s asset management team DWS, which manages about 1 trillion euros (about $1.09 trillion) in assets, plans to launch a new euro stablecoin in 2025.

These developments could have a significant impact on efforts to establish an intra-European digital payments network. Other jurisdictions are also preparing their own regulatory frameworks for stablecoins, such as Hong Kong, which will enact relevant legislation after a public consultation period. Meanwhile, the United States is working to develop rules in this area, with relevant bills in both the House and Senate. Former House Speaker Paul Ryan pointed out in an opinion piece in the Wall Street Journal that stablecoins can not only help maintain the dominance of the US dollar, but also solve the problem of growing national debt. Former Comptroller of the Currency Brian Brooks (formerly Coinbase Chief Legal Officer) has a similar view, saying in the Wall Street Journal that stablecoins can help maintain the US dollars status as the worlds reserve currency.

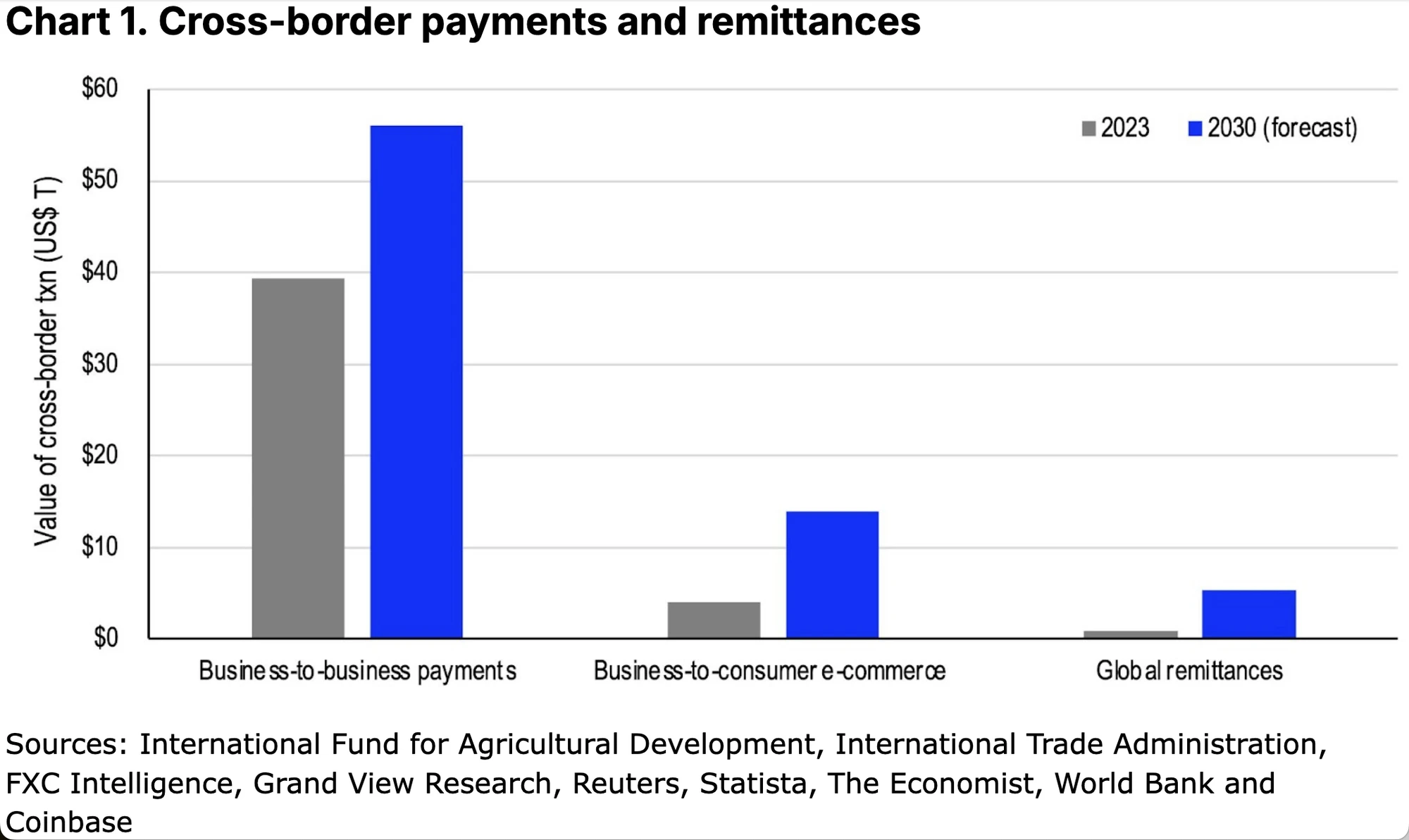

As a result, stablecoins have become an important new tool to enhance the existing global payment system. In 2023 alone, cross-border commercial transactions, international commerce (retail), and global remittances will involve a staggering $45 trillion in financial flows. (See Figure 1) As these markets continue to grow, estimates by category from the International Fund for Agricultural Development, FXC Intelligence, and Statista suggest that this amount could rise to $76 trillion by 2030. Today, the traditional infrastructure that handles such large cross-border financial flows has many inefficiencies that increase costs and slow the flow of funds across borders.

Unite now

The existing payment landscape consists of a variety of different entities, but we can roughly divide them into four categories. While many of these players represent existing systems, some are working to embrace (or at least try to) incorporate stablecoins into their existing workflows. The main four categories include:

-

Automated Clearing House: An electronic network used to process bank transfers and other financial transactions, primarily within domestic or sovereign borders.

-

Large credit card networks: such as Visa, Mastercard and American Express in the United States, or UnionPay in China,

-

International bank payment networks: such as the Society for Worldwide Interbank Financial Telecommunication (SWIFT) and the Cross-Border Interbank Payments System (CIPS),

-

Mobile payment systems: such as PayPal/Venmo in the United States, Alipay (and WeChat Pay) in China, and the Unified Payments Interface (UPI) in India, which provide digital payment solutions and peer-to-peer (P2P) transactions.

It’s important to note that although the Fedwire funds transfer system settled $1.09 quadrillion in 2023, we excluded it from our list because the network primarily serves Federal Reserve System member institutions, including large banks, corporations, and U.S. government agencies. It primarily settles large and time-sensitive transfers in real time and does not handle small retail payments or remittances, which is what this report focuses on.

analyze

Electronic networks, such as ACH (Automated Clearing House) in the United States or SEPA (Single Euro Payments Area) in the Eurozone, are among the largest payment systems on our list. In many countries, such systems help facilitate interbank fund transfers across large networks of domestic financial institutions. They typically include direct deposits and bill payments, but in recent years many have also added peer-to-peer (P2P) and business-to-business (B2B) transactions.

According to Nacha (formerly the National Automated Clearing House Association), in 2023, the ACH network in the United States settled $80.1 trillion in transactions, up 4% from the previous year. Historically, ACH transactions were settled within 1-2 business days, but same-day settlement options are increasingly available. It is important to note that China also has a credit card payment processing system called UnionPay, which also operates a large Chinese interbank network. UnionPays interbank payment system processed 279.5 trillion RMB (about $39.5 trillion) in transactions in 2023.

Meanwhile, credit cards top our list of “payment dominance” because they are deeply embedded in the spending habits of many consumers, especially in developed countries. The process of borrowing money from credit cards is streamlined in many places, and users often receive attractive sign-up bonuses. However, these payment giants can charge retailers fees of up to 3.5%, which are increasingly passed directly to consumers. In addition, users can pay an average annual percentage rate (APR) of 20% in interest charges (in the United States) on outstanding credit card debt.

Credit card companies also typically charge users a 1% international fee on cross-border transactions, making these payment entities very lucrative for overseas spending. Visa reported in its 2023 annual report that it processed $12.3 trillion in payment volume last year (for the fiscal year ending September 2023) (excluding $2.5 trillion in cash withdrawals), while Mastercard reported in its 2023 annual report that it processed $9.0 trillion in total dollar volume.

Traditional bank payment networks such as SWIFT and CIPS currently dominate cross-border interbank payments, and remittances are often made through these networks. SWIFT is a secure messaging platform that connects more than 11,000 financial institutions in more than 200 countries. However, unlike an automated clearing house, SWIFT does not perform settlements (fund transfers).

These networks are used only to send and receive secure messages, provide each party with transaction details that need to be confirmed, and allow them to update their respective ledgers. CIPS was launched by the Peoples Bank of China in 2015 to compete with SWIFT and improve the efficiency of cross-border RMB transactions. For many years, SWIFT and CIPS have jointly supported most cross-border payments between financial institutions around the world.

Finally, mobile payment systems are the newest entrants, offering peer-to-peer (P2P) transactions both domestically and internationally. Convenience is one of their biggest advantages, as they often offer a more user-friendly interface than traditional banking methods for transferring money. Some mobile payment systems also integrate social media components. Mobile payments are often real-time, which is a major advantage for both senders and receivers, as it reduces the risk of chargebacks. However, P2P payments only appear to be instant because they often exist within a closed ecosystem, so such transactions are simply adjustments to the vendors ledger.

However, the downside is that these systems often require a pre-existing banking relationship and/or credit card to work, so users remain dependent on the traditional financial system. This poses a barrier to low-income people who may not have access to such services. Mobile platforms may also collect large amounts of personal and financial data, which raises privacy concerns.

Decentralized lightness

These traditional systems have built the networks and infrastructure that process most of the global transaction volume. However, they also have some important disadvantages, such as high transaction costs, slow settlement times and limited transparency. For example, bank transfers involve multiple intermediaries. Stablecoins run on public blockchains and rely on transparent processes to prevent fraud and resolve disputes in a decentralized manner through consensus. This is often cheaper, faster and easier to trace.

Of course, there are trade-offs to using stablecoins. For example, stablecoins run on a blockchain, providing nearly instant settlement, but this makes fraudulent transactions difficult to reverse. The proliferation of multiple blockchains can also lead to fragmented stablecoin liquidity, which can expose users to the costs and risks of bridging from one chain to another. Finally, the user experience (UX) of cryptocurrencies can itself be cumbersome and overly complex for the average user. The good news is that this complexity is beginning to be abstracted away through smart wallets and payer architectures that shift gas fees from users to decentralized applications. Still, we expect it may be years before users are fully comfortable with these systems and use stablecoins end-to-end.

At the same time, the existing system still enjoys huge advantages, such as considerable transaction volume brought by a large user base. That is, network effects are very important because it is easier to make payments using a platform that already has a large number of users. A report by McKinsey Company showed through surveys that banks have an advantage over fintech companies in maintaining consumer trust. For stablecoins to be widely accepted, not only regulatory issues need to be resolved (see the killer application section below), but also user trust needs to be established.

Fortunately, technology has lowered the cost for users and merchants to adopt new payment methods. This has left traditional payment giants vulnerable to fintech challengers. In fact, according to the World Bank, increased competition has reduced the average cost of remittance payments by more than a third over the past 15 years. (See Figure 3) Recent tests by the Bank for International Settlements show that tokenization can facilitate faster and more secure cross-border transactions. However, the average cost of sending $200 across borders is still 6.35% of the amount sent, with annual fees totaling about $54 billion.

In contrast, the average transaction cost for remittances using stablecoins is much lower, at only 0.5-3.0% of the remittance amount. The wide range of this reflects that although the direct costs of transferring stablecoins on some networks (such as Ethereum Layer-2) may be very low, there may be other costs. For example, converting local fiat currency to stablecoins or vice versa may incur exchange and/or conversion fees when the platform provides services. However, as the network size and/or adoption increase, this may also reduce future fees by increasing transaction volume and reducing the cost per transaction for providers. Therefore, the overall cost of stablecoin transactions may continue to be optimized.

Filtering noise

Stablecoins are often referred to as the “killer app of cryptocurrency” due to their potential for mainstream commercial adoption and comparative advantages over traditional payment rails, such as speed and cost. This label is intended to convey the promise of stablecoins to attract a wider consumer base to blockchain technology.

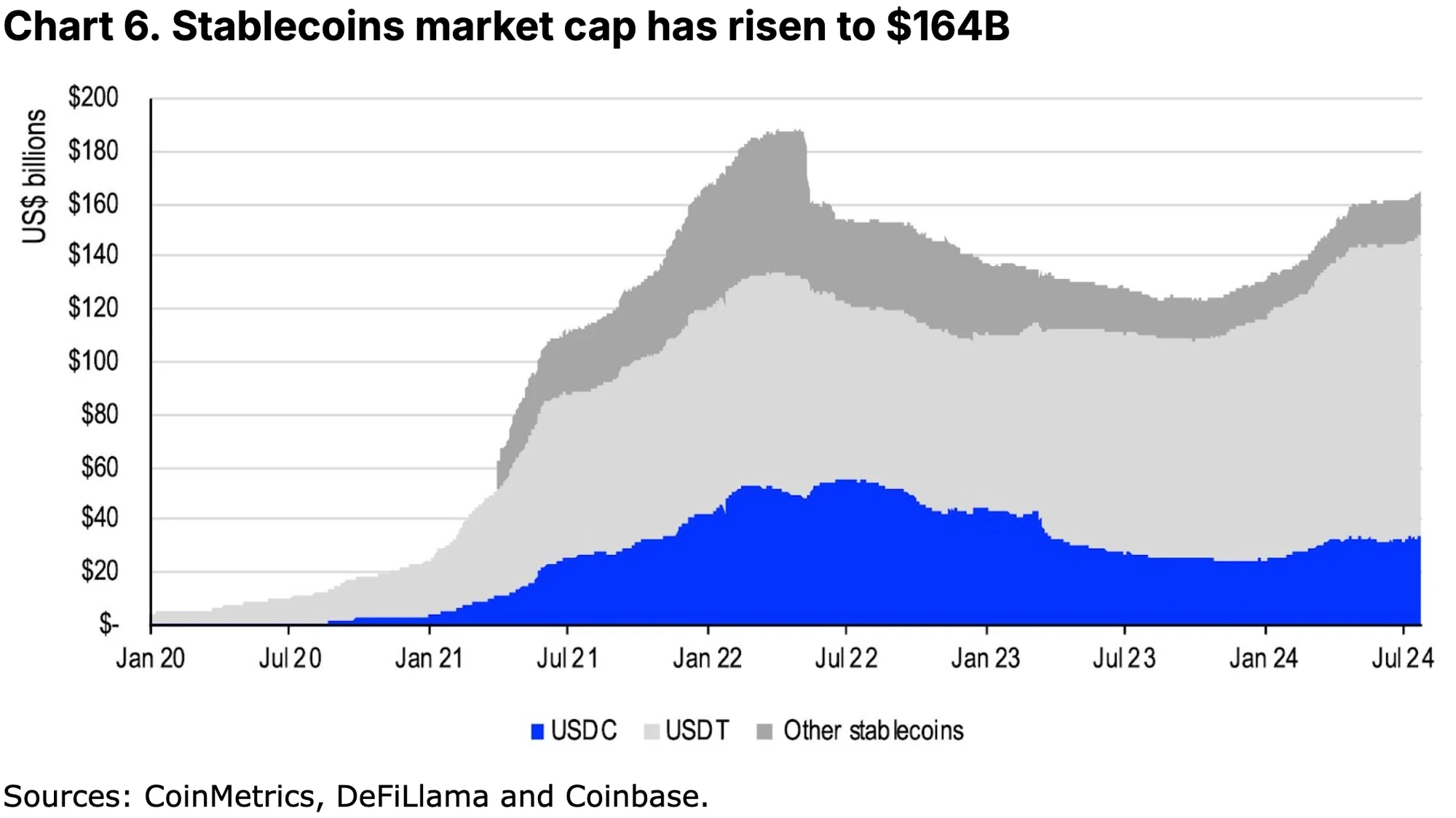

However, the reality is that the primary use case for stablecoins today is to allow crypto investors to trade digital assets between centralized and decentralized exchanges. This is why the market capitalization of stablecoins is often used as a proxy for liquidity in the digital asset market, as its growth equates to increased depth and price stability in the broader crypto market. Of the $10.8 trillion in transactions settled by all stablecoins in 2023, most of the volume tends to be used for trading purposes.

To take a more conservative approach, we filter total transaction volume based on the criteria outlined in a blog post published by Visa in April 2024, in response to Nic Carter of Castle Island Ventures. They argue that stablecoin transaction data can be noisy due to “inorganic activity and other artificial inflationary behavior.” Therefore, they “adjust” stablecoin transaction volume by (1) removing duplicate transactions from smart contract activity and (2) filtering out bot-driven and automated transactions. To achieve the latter, they only include transactions from accounts that “initiated less than 1,000 stablecoin transactions with less than $10 million in transfer value” in a 30-day period.

It’s important to note that Visa’s on-chain analytics dashboard only publishes 30 days of data, which makes comparisons with other payment systems difficult. So we did the heavy lifting, applying their criteria to filter stablecoin transaction data over the past five years in hopes of gaining valuable insights. In 2023 alone, we found that stablecoins still settle over $2.3 trillion per year in “organic” transactions, which may still include trading but are more concentrated in payments, P2P transfers, and remittances. Of this adjusted amount, for example, cross-border B2B transactions on blockchains only account for $843 million, but Statista predicts that this will grow to $1.2 billion in 2024.

These adjusted volumes are up 18% in 2022 and 17% in 2023. This is faster growth than any of the payment systems listed above, and exceeds PayPal’s payment volumes in absolute terms. In fact, even after adjusting for “inorganic activity,” stablecoins processed about a fifth of Visa’s payment volume last year and more than a quarter of Mastercard’s, representing a huge increase since the advent of stablecoins. Notably, adjusted stablecoin volumes are around $1.7 trillion so far this year (roughly 10% of total stablecoin volume), compared to $1.3 trillion in the first seven months of last year — a 28% increase in organic activity already, with growth continuing to accelerate.

Killer Apps

Despite the huge volume associated with stablecoins, the market cap of this space remains relatively modest at $164 billion, despite having grown 26% since the beginning of the year. (See Figure 6.) Despite this, stablecoins currently only account for 7% of the $2.3 trillion crypto market cap. Some market analysts have speculated that the stablecoin market could grow to nearly $3 trillion over the next five years. While this number seems high, as this estimate is close to the current size of the entire crypto market, we believe it is still within the realm of possibility when considering that this figure is only equivalent to 14% of the US M2 money supply ($21 trillion) (currently 0.8%).

The biggest obstacle to achieving these predictions remains regulation. Back in 2020, the Financial Stability Board (FSB) published a set of “High-Level Recommendations on the Regulation, Supervision and Monitoring of Global Stablecoin Arrangements” (final report due in July 2023), under the mandate of the G20. These recommendations are shaping the development of stablecoin regulation in many jurisdictions. In fact, MiCA has already legalized the issuance of stablecoins in Europe, based on its strict rules and operational guidelines. In Asia, several places either already have stablecoin frameworks, such as Singapore and Japan, or plan to launch them soon, such as Hong Kong. Nonetheless, consistent regulation across borders is likely to increase user confidence and lead to a more predictable market environment overall.

In the United States, there are currently two bills that have not yet been passed in the House of Representatives and the Senate: the Payment Stablecoin Clarity Act of 2023 (CPSA 23) and the Loomis-Gillibrand Payment Stablecoin Act (LGPSA). While both bills set specific reserve requirements for stablecoin issuers and include extensive customer protection provisions, they differ in their specific regulatory approaches. CPSA 23 stipulates that stablecoin issuers should be regulated by appropriate federal or state regulators, while LGPSA provides a comprehensive federal regulatory system. More specifically, LGPSA sets a maximum limit of US$1 billion on stablecoins issued by non-depository trust companies. Entities exceeding this amount need to register and obtain approval from depository institutions, and their supervision will be more similar to that of banks.

ختاماً

As the payment landscape continues to evolve, traditional banking systems, credit cards and even mobile payments are under greater pressure to adapt to changing customer demands. Stablecoins aim to bridge the volatile world of cryptocurrencies with traditional finance by maintaining price stability (mostly pegged to the US dollar). However, these tokens have really only started to be used on a large scale in the past 2-3 years for low-cost money transfers, despite the formal launch of this space in 2015. Despite having some key comparative advantages over existing systems in terms of speed and cost, stablecoins still need to be integrated with the existing financial system to facilitate their use in everyday transactions.

We believe stablecoins represent the next big leap in payments and capital flows, especially as it becomes increasingly easier for merchants and other entities to integrate the technology into their economic workflows — even compared to just a few years ago. Recently, Coinbase announced a partnership with payments provider Stripe to offer USDC for crypto payments and fiat-to-crypto conversions on Base, and Visa, Mastercard, and PayPal have also launched their own stablecoin initiatives in recent years. Others worth mentioning include Shift 4, Nuvei, Worldpay, and Checkout.com. That being said, stablecoins need clearer regulation and a smoother cryptocurrency user experience to more firmly establish their potential.

This article is sourced from the internet: Coinbase Research Report: Stablecoins and the New Payment Landscape

Related: Full record of Odaily editorial department investment operations (July 1)

This new column is a sharing of real investment experiences by members of the Odaily editorial department. It does not accept any commercial advertisements and does not constitute investment advice (because our colleagues are very good at losing money) . It aims to expand readers perspectives and enrich their sources of information. You are welcome to join the Odaily community (WeChat @Odaily 2018, Telegram exchange group , X official account ) to communicate and complain. Recommended by: Asher (X: @Asher_ 0210 ) Introduction : Low-market-cap copycats, long-term ambush, blockchain games, gold farming, and freeloading share : BTC market, todays wave of rise has taken advantage of the fact that half of the 61500 orders mentioned last week have been closed. Currently, in the short term, it is expected to rebound…