تقرير أبحاث معنويات سوق العملات المشفرة (2024.07.26-08.02): انخفاض عملة البيتكوين مع استمرار بنك الاحتياطي الفيدرالي في توجيهها

Bitcoin falls as Fed remains on hold

Since inflation has fallen less quickly than expected, the Federal Reserve has kept its interest rate target range between 5.25% and 5.5% since the end of July last year, the highest level in 23 years. After the interest rate meeting, Bitcoin fell to as low as $62,300 and then rebounded.

As the third quarter draws to a close, most market participants expect the Federal Reserve to cut interest rates. If the fight against inflation continues to make good progress, a rate cut could be announced as early as this years September meeting. This could be a positive factor for risk assets such as Bitcoin.

Historically, a lower interest rate environment is good for cryptocurrencies as investors tend to seek higher-yielding assets. Despite the uncertain economic outlook, the prospect of looser monetary policy has boosted positive sentiment toward Bitcoin. However, investors need to be mindful of the risk of price volatility in the short term.

There are about 47 days until the next Federal Reserve interest rate meeting (September 19, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

التحليل الفني لبيئة السوق والمشاعر

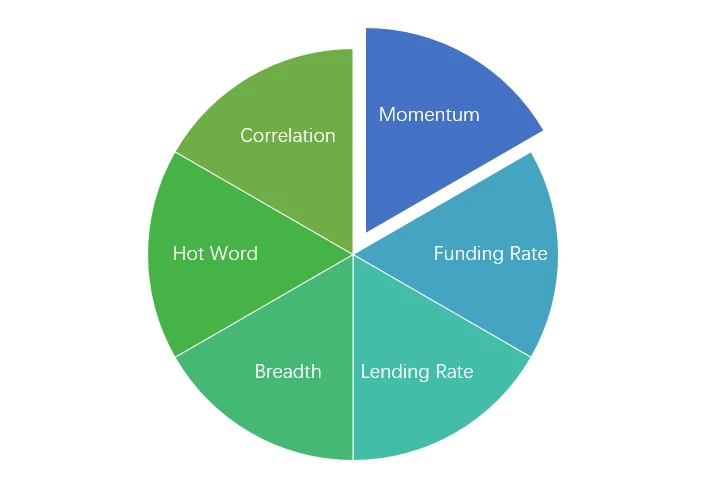

مكونات تحليل المشاعر

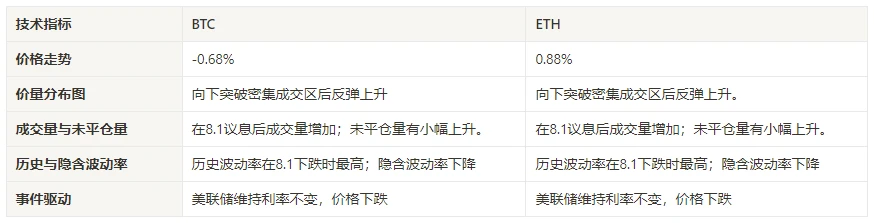

المؤشرات الفنية

اتجاه السعر

BTC price rose -0.68% and ETH price rose 0.88% over the past week.

الصورة أعلاه هي الرسم البياني لسعر BTC في الأسبوع الماضي.

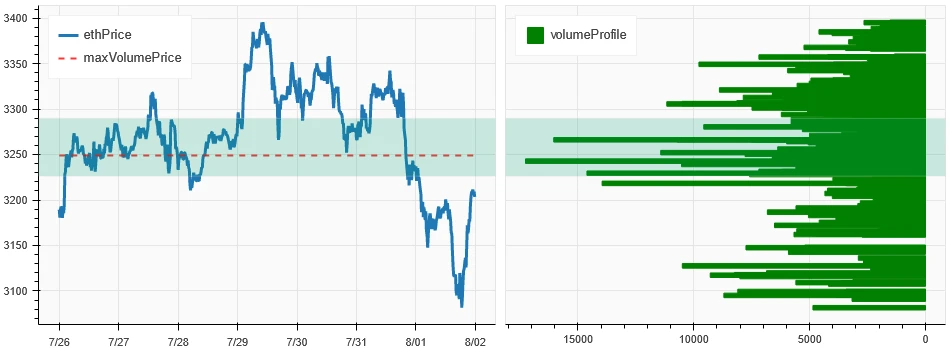

الصورة أعلاه هي الرسم البياني لسعر ETH في الأسبوع الماضي.

ويبين الجدول معدل تغير الأسعار خلال الأسبوع الماضي.

pctChange1Day3Day5Day7Daybtc_pctChange1.12% -2.14% -3.74% -0.68% eth_pctChange-0.91% -3.44% -1.4% 0.88%

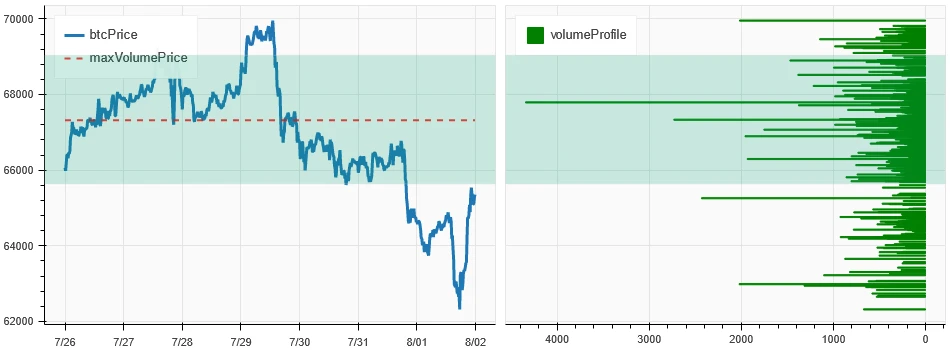

مخطط توزيع حجم السعر (الدعم والمقاومة)

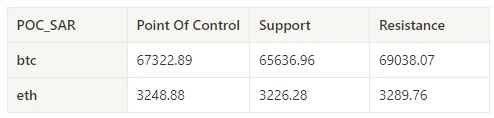

In the past week, BTC and ETH broke down from the concentrated trading area and then rebounded.

توضح الصورة أعلاه توزيع مناطق التداول الكثيفة لـ BTC في الأسبوع الماضي.

توضح الصورة أعلاه توزيع مناطق التداول الكثيفة لـ ETH في الأسبوع الماضي.

يوضح الجدول نطاق التداول الأسبوعي المكثف لـ BTC و ETH في الأسبوع الماضي.

الحجم والفائدة المفتوحة

In the past week, the trading volumes of both BTC and ETH increased after the August 1 interest rate meeting; the open interest of both BTC and ETH increased slightly.

يظهر الجزء العلوي من الصورة أعلاه اتجاه سعر BTC، ويظهر الوسط حجم التداول، ويظهر الجزء السفلي الفائدة المفتوحة، والأزرق الفاتح هو متوسط يوم واحد، والبرتقالي هو متوسط 7 أيام. يمثل لون خط K الحالة الحالية، والأخضر يعني أن ارتفاع السعر مدعوم من حجم التداول، والأحمر يعني إغلاق المراكز، والأصفر يعني تراكم المراكز ببطء، والأسود يعني حالة الازدحام.

يُظهر الجزء العلوي من الصورة أعلاه اتجاه سعر ETH، والوسط هو حجم التداول، والأسفل هو الفائدة المفتوحة، والأزرق الفاتح هو متوسط يوم واحد، والبرتقالي هو متوسط 7 أيام. يمثل لون الخط K الحالة الحالية، والأخضر يعني أن ارتفاع الأسعار مدعوم بحجم التداول، والأحمر يعني إغلاق المراكز، والأصفر يتراكم المراكز ببطء، والأسود مزدحم.

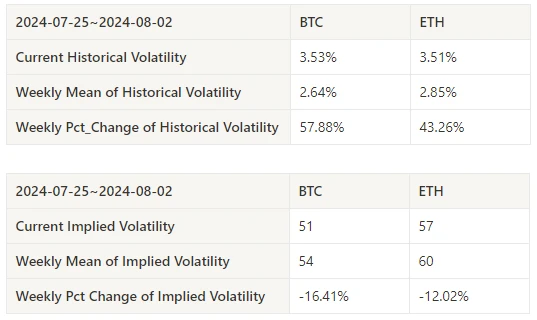

التقلبات التاريخية مقابل التقلبات الضمنية

Historical volatility for BTC and ETH was highest this past week at 8.1; implied volatility for both BTC and ETH fell.

الخط الأصفر هو التقلب التاريخي، والخط الأزرق هو التقلب الضمني، والنقطة الحمراء هي متوسطه على مدى 7 أيام.

الحدث مدفوعة

The Federal Reserve kept interest rates unchanged this past week, and after the interest rate meeting, Bitcoin fell to a low of 62,300.

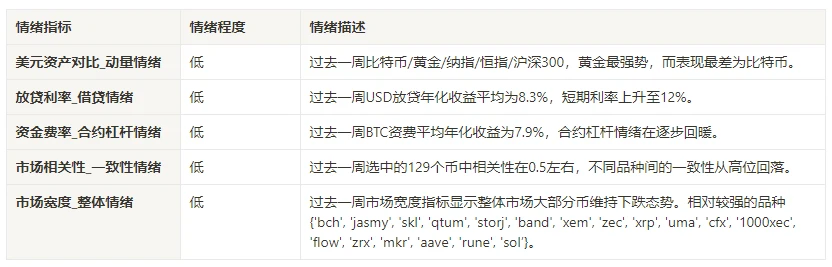

المؤشرات العاطفية

معنويات الزخم

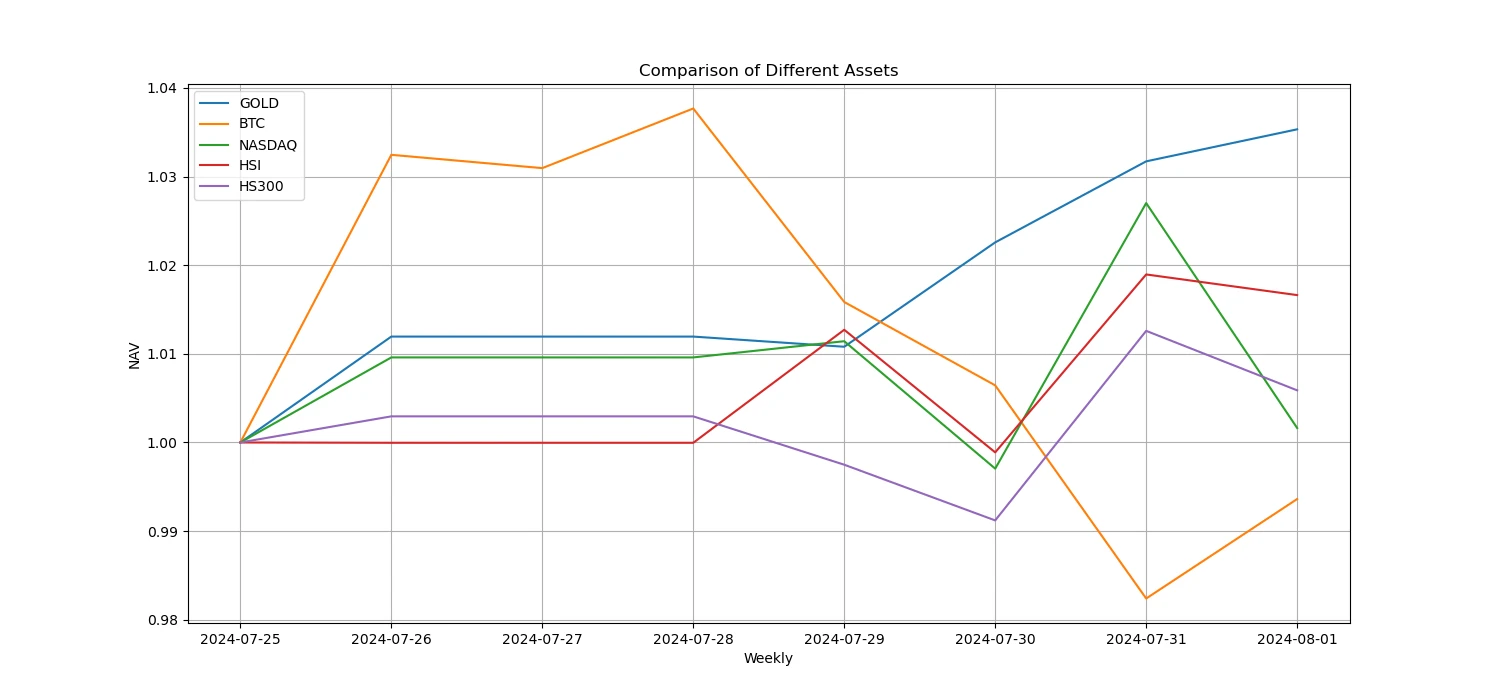

خلال الأسبوع الماضي، كان الذهب هو الأقوى بين مؤشرات البيتكوين/الذهب/ناسداك/هانغ سنغ/SSE 300، في حين كان أداء البيتكوين هو الأسوأ.

الصورة أعلاه توضح اتجاه الأصول المختلفة في الأسبوع الماضي.

معدل الإقراض _ معنويات الإقراض

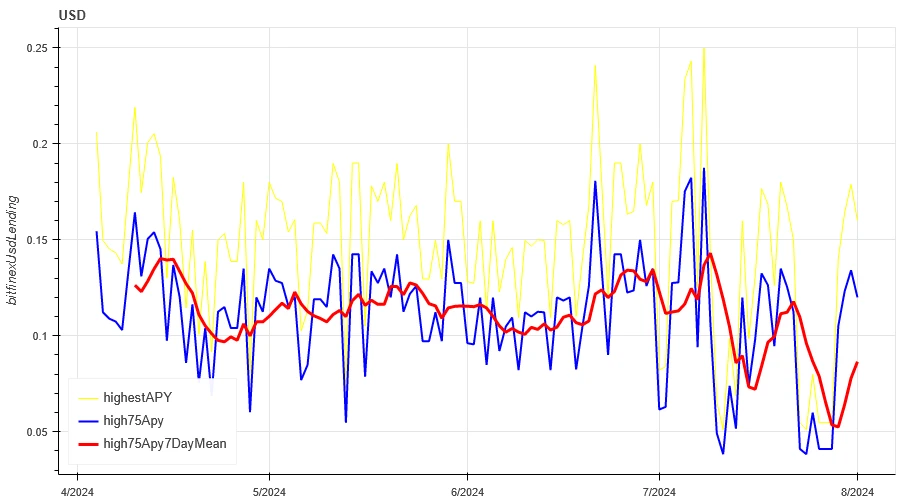

The average annualized return on USD lending over the past week was 8.3%, and short-term interest rates rose to 12%.

الخط الأصفر هو أعلى سعر لسعر الفائدة بالدولار الأمريكي، والخط الأزرق هو 75% من أعلى سعر، والخط الأحمر هو متوسط 7 أيام من 75% من أعلى سعر.

يوضح الجدول متوسط عوائد أسعار الفائدة بالدولار الأمريكي في أيام الاحتفاظ المختلفة في الماضي

معدل التمويل_معنويات الرافعة المالية للعقد

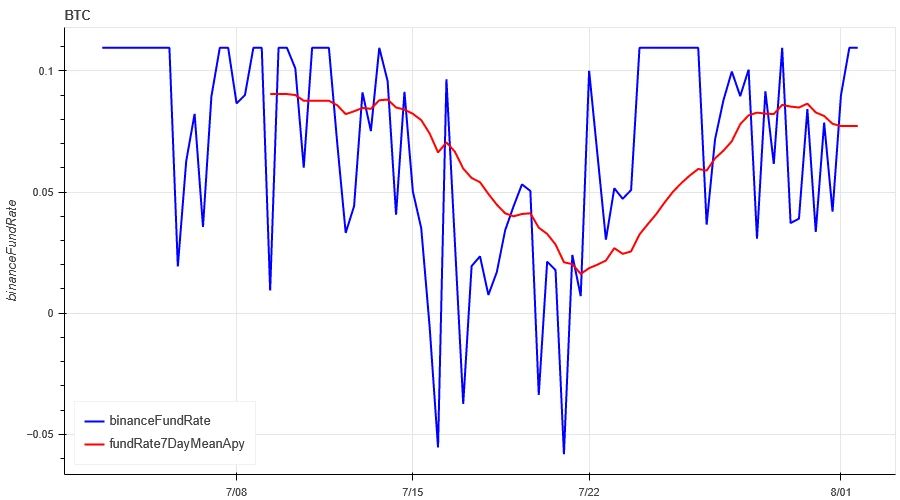

The average annualized return on BTC fees in the past week was 7.9%, and contract leverage sentiment is gradually recovering.

الخط الأزرق هو معدل تمويل BTC على Binance، والخط الأحمر هو متوسطه على مدار 7 أيام

يوضح الجدول متوسط عائد رسوم BTC لأيام الاحتفاظ المختلفة في الماضي.

ارتباط السوق_الإجماع الشعور

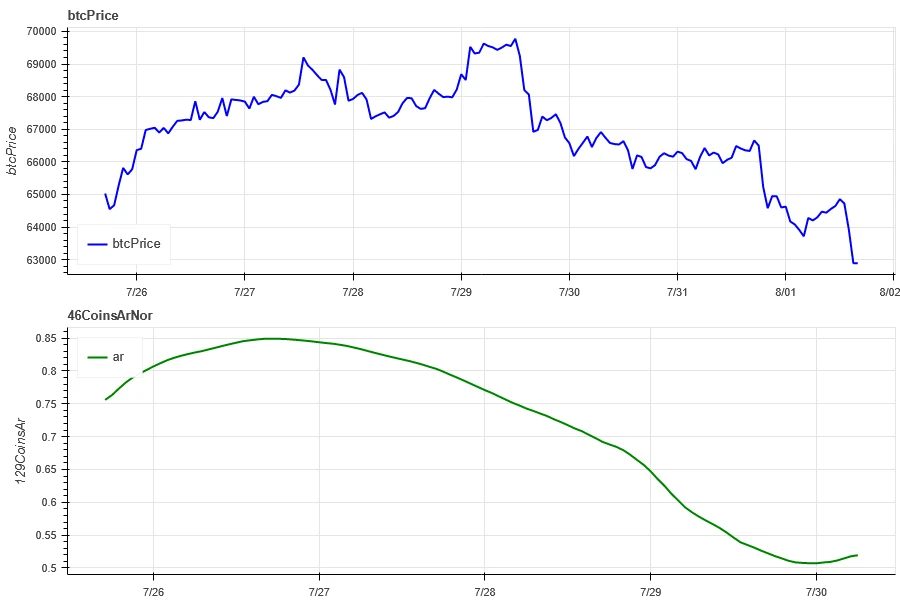

The correlation among the 129 coins selected in the past week was around 0.5, and the consistency between different varieties fell from a high level.

في الصورة أعلاه، الخط الأزرق هو سعر البيتكوين، والخط الأخضر هو [1000 floki، 1000 lunc، 1000 pepe، 1000 shib، 100 0x ec، 1inch، aave، ada، agix، algo، ankr، ant، ape، apt، arb، ar، astr، atom، audio، avax، axs، bal، band، bat، bch، bigtime، blur، bnb، btc، celo، cfx، chz، ckb، comp، crv، cvx، cyber، dash، doge، dot، dydx، egld، enj، ens، eos، إلخ، eth، fet، fil، flow، ftm، fxs، gala، gmt، gmx، grt، hbar، hot، icp، icx، imx، inj، iost، iotx، jasmy، kava، klay، ksm، ldo، link، loom، lpt، lqty، lrc، ltc، luna 2، magic، mana، matic، meme، mina، mkr، near، neo، Ocean، one، ont، op، pendle، qnt، qtum، rndr، rose، rune، rvn، sand، sei، sfp، skl , snx , sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, wave, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] الارتباط العام

اتساع السوق_المعنويات العامة

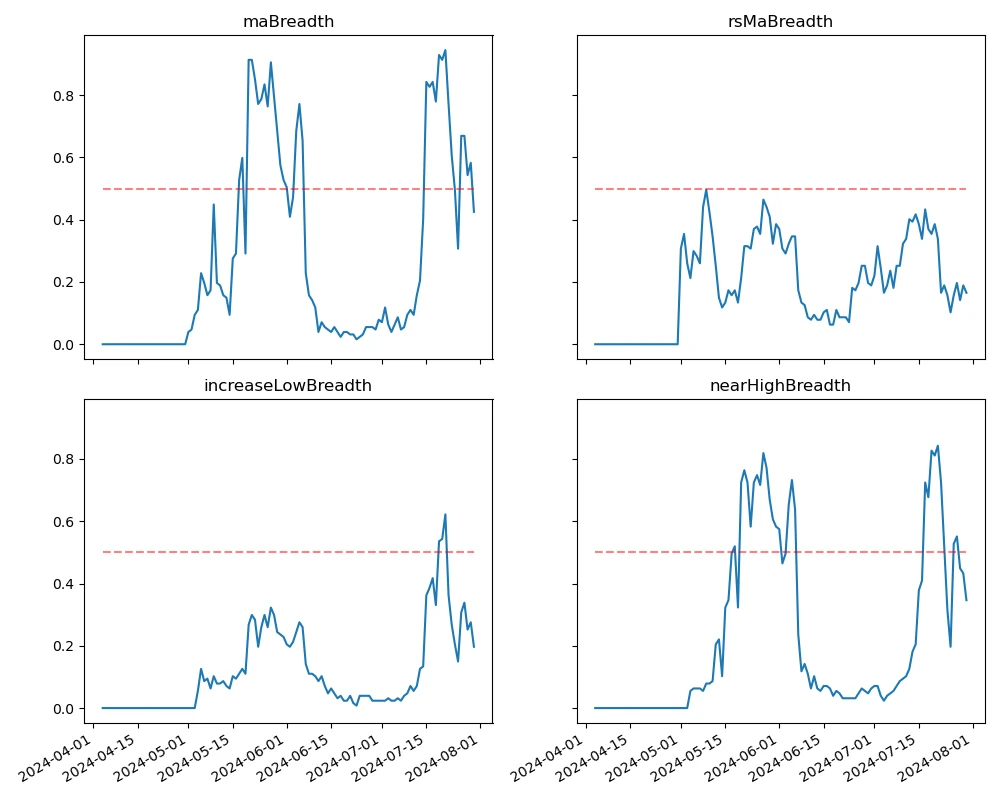

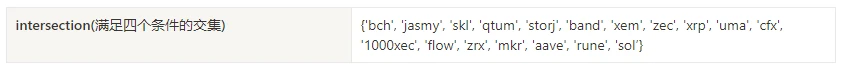

Among the 129 coins selected in the past week, 42.5% of the coins were priced above the 30-day moving average, 16.5% of the coins were priced above the 30-day moving average relative to BTC, 20% of the coins were more than 20% away from the lowest price in the past 30 days, and 35% of the coins were less than 10% away from the highest price in the past 30 days. The market breadth indicator in the past week showed that most coins in the overall market maintained a downward trend.

الصورة أعلاه هي [bnb، btc، sol، eth، 1000 floki، 1000 lunc، 1000 pepe، 1000 sats، 1000 shib، 100 0x ec، 1inch، aave، ada، agix، ai، algo، alt، ankr، ape، apt، arb، ar، astr، atom، avax، axs، bal، band،bat، bch، bigtime، Blur، cake، celo، cfx، chz، ckb، comp، crv، cvx، Cyber، Dash، doge، dot، dydx، egld، enj، ens، eos،etc، fet، fil،flow، ftm، fxs، gala، gmt، gmx، grt، hbar، hot، icp، icx، idu، imx، inj، iost، iotx، jasmy، jto، jup، kava، klay، ksm، ldo، link، loom، lpt، lqty، lrc، ltc، luna 2، السحر، مانا، مانتا، قناع، ماتيتش، ميمي، مينا ، mkr، قريب، neo، nfp، محيط، واحد، ont، op، ordi، pendle، pyth، qnt، qtum، rndr، robin، rose، rune، rvn، sand، sei، sfp، skl، snx، ssv، stg , storj, stx, sui, sushi, sxp, ثيتا, tia, trx, t, uma, uni, vet, waves, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec، zen، zil، zrx] نسبة 30 يومًا لكل مؤشر عرض

لخص

In the past week, the prices of Bitcoin (BTC) and Ethereum (ETH) fell after the interest rate meeting, while the volatility and trading volume of these two cryptocurrencies increased after the interest rate meeting on August 1. The open interest of Bitcoin and Ethereum has increased slightly. In addition, the implied volatility of Bitcoin and Ethereum has decreased simultaneously. Bitcoins funding rate has rebounded slightly from a low level, which may reflect the gradual recovery of market participants leverage sentiment towards Bitcoin. Market breadth indicators show that most cryptocurrencies have retreated, indicating that the overall market has continued to fall in the past week.

تويتر: @ https://x.com/CTA_ChannelCmt

موقع إلكتروني: قناة سمت.كوم

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.07.26-08.02): Bitcoin Falls as Fed Keeps Steering

Related: Hack VC: A hacker who invests in hackers, an infrastructure maniac in crypto VC

Original author: TechFlow In the crypto market of 2024, there is one crypto VC that you cannot ignore. Prefers lead investors, with 50% of the projects invested this year being lead investors, including the familiar io.net, Initia, AltLayer, imgnAI, etc. Prefer infrastructure, with one-third of the projects invested being infrastructure, including Berachain, EigenLayer, Movement, Babylon, SUI, Eclipse, etc. In addition to funds, they also have technology and developer communities that can empower the projects they invest in for the long term; The name of this VC is Hack VC . As the name suggests, they are a group of tech geeks invested in hacking. This article will give you an inside look at the story behind Hack VC and its founding partner Alexander Pack. Starting from Hong Kong, connecting the…