معهد أبحاث Bitget: أصول تعويضات Mt.gox لا تزال تُباع، وظروف السوق قصيرة الأجل سيئة

خلال الـ 24 ساعة الماضية، ظهرت العديد من العملات والموضوعات الجديدة الشائعة في السوق، والتي قد تكون الفرصة التالية لكسب المال، مشتمل:

-

The sectors with relatively strong wealth-creating effects are: Curve-related tokens (CRV, CVX), Meme sector (NEIRO);

-

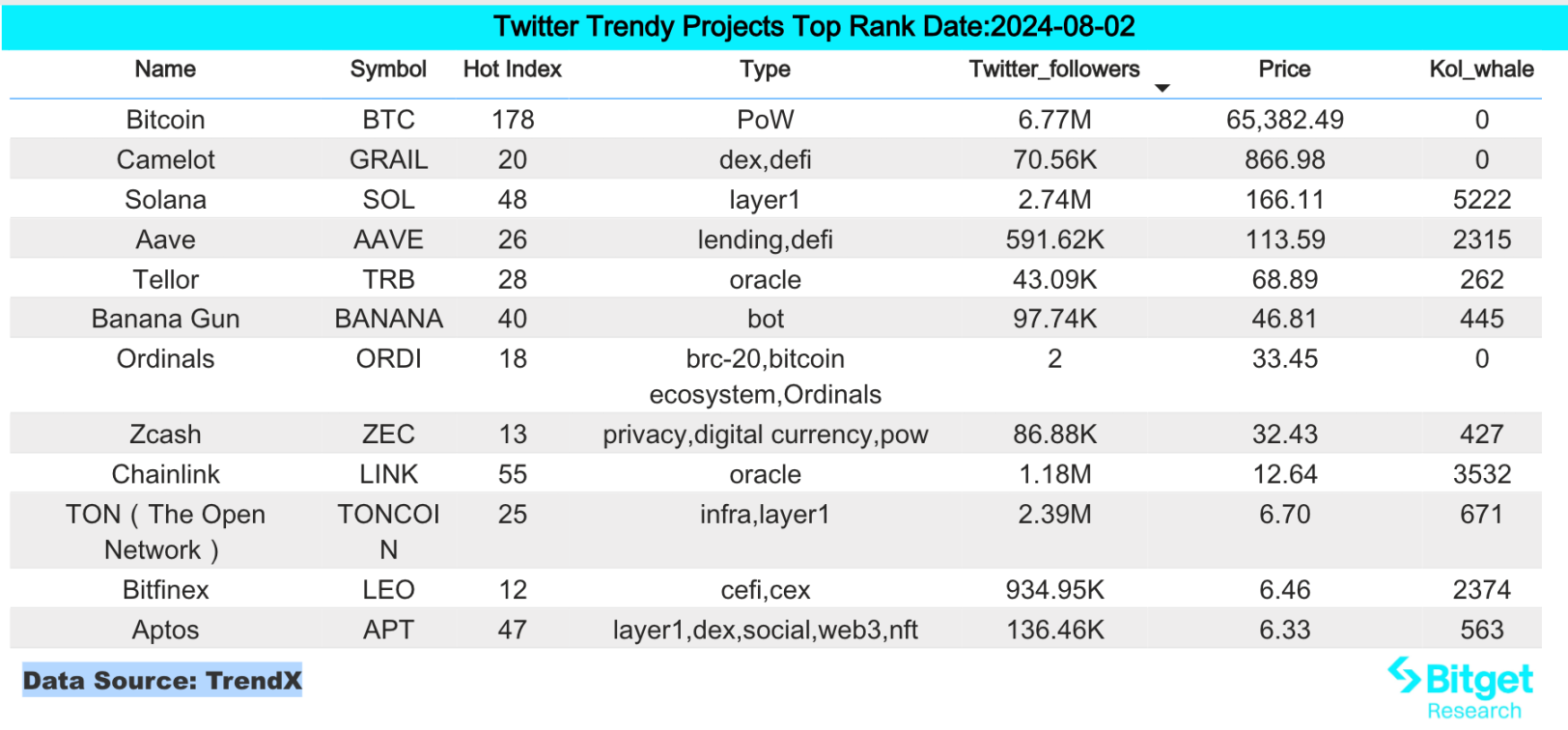

Hot search tokens and topics by users are: Morpho, Aptos;

-

تشمل فرص الإنزال الجوي المحتملة ما يلي: Symbiotic، Mezo؛

Data statistics time: August 2, 2024 4: 00 (UTC + 0)

1. بيئة السوق

The US ISM manufacturing PMI fell far more than economists expected in July, causing interest rates to fall to multi-month lows across the board. In addition, the number of first-time unemployment claims in the United States jumped to the highest level in about a year. Taken together, these data further confirm that the United States is on the verge of a monetary easing cycle by the Federal Reserve, which is a positive for risk markets in a sense.

Although the U.S. spot Ethereum ETF had a net inflow of $26.2 million and the spot Bitcoin ETF had a net inflow of $50.4 million yesterday, Bitcoin still maintained its downward trend and continued to fall sharply after reaching $70,000 this week. The price fell to a two-week low of $62,700 last night, and the short-term market conditions are poor.

2. Wealth-creating sector

1) Sector changes: Curve-related tokens (CRV, CVX)

سبب رئيسي:

-

The whale has withdrawn a total of 18 million CRV (US$4.68 million) from Binance and OKX in the past 30 hours, with an average price of US$0.26. At the same time, the whale who withdrew CRV from CEX yesterday withdrew another 5.5 million CRV (approximately US$1.51 million) from Binance.

Rising situation: CRV and CVX rose by 7.46% and 5.38% respectively in the past 24 hours;

العوامل المؤثرة على توقعات السوق:

-

Curve is still one of the best places for stablecoin bulk transactions, and it still maintains a good real profit. Its biggest problem is that its narrative is too old, and there are no new products or operations that excite the market. At the same time, the previous accidents and this liquidation decline inevitably make the market full of concerns. However, the price of CRV bought by many whales in OTC before was higher than 0.3 US dollars, so the current price of CRV is still attractive.

2) Changes in the sector: Meme sector (NEIRO)

سبب رئيسي:

-

NEIRO has received a lot of support from KOLs, especially those in Japanese. With the help of KOLs with tens to hundreds of thousands of fans, such as @apipiro 22, @mikky_ 8080, @yukimaru_potty, @BrotherMKT, @KookCapitalLLC, and @OfficialTravlad, the price of NEIRO has also risen.

Rising situation: NEIRO rose 15% + against the trend on the day;

العوامل المؤثرة على توقعات السوق:

-

On-chain activity: The valuation of DeFi infrastructure depends on whether the chain can have a stable market share, that is, the number of active on-chain users and DEX trading volume, which has a huge impact on DEX, PERP, language machine, and liquidity staking projects of different public chains. Investors should pay close attention to this type of data so that they can judge the markets upward and downward revisions to their valuations;

-

Impact on funding: After the launch of the Ethereum ETF, market funds began to gradually increase the liquidity of ETH. Affected by the increase in liquidity, related meme tokens may rise further in the future due to capital transmission.

3. عمليات البحث الساخنة للمستخدم

1) التطبيقات اللامركزية الشعبية

-

مورفو

DeFi lending protocol Morpho has completed a $50 million financing round led by Ribbit Capital, with participation from a16z crypto, Coinbase Ventures, Variant, Pantera, Brevan Howard, BlockTower and Kraken Ventures. The specific valuation information has not been disclosed. Morpho is a lending protocol that combines the current liquidity pool model used in Compound or AAVE with the capital efficiency of the P2P matching engine used in the order book. Morpho-Compound improves on Compound by providing the same user experience, the same liquidity, and the same liquidation parameters, but with an increased APY due to peer-to-peer matching.

2) تويتر

-

ابتوس

Yesterday, OKX Ventures and Aptos Foundation, a global blockchain leader, announced that they will jointly launch a new $10 million fund to support the growth of the Aptos ecosystem and the widespread adoption of Web3. The fund will be used to develop an accelerator program in partnership with Ankaa to drive the growth of high-quality projects and applications based on Aptos. Aptos is a scalable Layer 1 PoS blockchain that uses the Move programming language to make on-chain transactions more reliable, easy to use, and secure. The accelerator will provide selected Aptos ecosystem projects with risk support, focused guidance, marketing exposure, and a joint network of experts from OKX, Ankaa, and the Aptos Foundation.

3) منطقة بحث جوجل

من منظور عالمي:

Why is down today fear and greed index:

Yesterday, the US July ISM Manufacturing PMI fell far more than economists expected, causing interest rates to fall to multi-month lows. The VXX index rose by 13.55%, the markets risk aversion heated up, and crypto assets followed suit.

من عمليات البحث الساخنة في كل منطقة:

(1) Hot topics in the CIS region include Tapswap. TapSwap is a Tap2Earn Mini App that was once liked by Telegram founder Pavel Durov. It was launched at the end of 2023 and was initially released on the Solana network. It was later transferred to the TON ecosystem. The overall popularity of the project is extremely high.

(2) There are also no obvious hot spots in Asia, but the Philippines has shown interest in US stocks such as Tesla and Nvidia.

(3) Latin America showed a higher interest in SOL and ETH, and AI project tracks appeared on the hot searches in Colombia and Argentina.

محتمل إنزال جوي فرص

-

تكافلي

Symbiotic هو مشروع إعادة تعيين عام الغرض يمكّن الشبكات اللامركزية من تمهيد أنظمة بيئية قوية وذات سيادة كاملة. وهو يوفر طريقة للتطبيقات اللامركزية، المسماة خدمات التحقق النشط أو AVS، لضمان أمن بعضها البعض بشكل جماعي.

أتمت شركة Symbiotic مؤخرًا جولتها التمويلية الأولية، بمشاركة Paradigm وCyber Fund في الاستثمار، بمبلغ تمويل قدره $5.8 مليون دولار أمريكي.

How to participate: Go to the project鈥檚 official website, link your wallet, and deposit ETH and ETH LSD assets.

-

ميزو

Mezo هو مشروع BTC Layer 2 يركز على نظام BTC البيئي، ويساعد حاملي BTC على تحويل الأموال وإدارتها على السلسلة، ويقود تطوير نظام BTC DeFi. أعلنت Mezo مؤخرًا عن اكتمال جولة تمويل بقيمة $21 مليون دولار، بمشاركة مؤسسات بما في ذلك Pantera Capital وHack VC وMulticoin Capital ومؤسسات رائدة أخرى في الصناعة.

The official has already disclosed its BTC asset pledge plan and introduced a referral mechanism. There are strong expectations for the projects airdrops and it is currently in the initial stages of early operations.

طرق المشاركة المحددة: 1) قم بزيارة الموقع الرسمي للمشروع وابحث عن رمز الدعوة في Discord؛ 2) أدخل رمز الدعوة وربط محفظة unisat؛ 3) قم بإيداع BTC.

مزيد من المعلومات حول معهد أبحاث Bitget: https://www.bitget.fit/zh-CN/research

يركز معهد أبحاث Bitget على التركيز على البيانات الموجودة على السلسلة واستخراج الأصول القيمة. فهو يستخرج استثمارات القيمة المتطورة من خلال المراقبة في الوقت الفعلي للبيانات الموجودة على السلسلة وعمليات البحث الإقليمية الساخنة، ويوفر رؤى على المستوى المؤسسي لعشاق العملات المشفرة. حتى الآن، زودت مستخدمي Bitgets العالميين بأصول قيمة في المرحلة المبكرة في العديد من القطاعات الشائعة مثل [Arbitrum Ecosystem] و[AI Ecosystem] و[SHIB Ecosystem]. من خلال البحث المتعمق المعتمد على البيانات، فإنه يخلق تأثيرًا أفضل للثروة لمستخدمي Bitgets العالميين.

إخلاء المسؤولية: السوق محفوف بالمخاطر، لذا كن حذرًا عند الاستثمار. لا تشكل هذه المقالة نصيحة استثمارية، ويجب على المستخدمين التفكير فيما إذا كانت أي آراء أو وجهات نظر أو استنتاجات في هذه المقالة مناسبة لظروفهم الخاصة. الاستثمار بناءً على هذه المعلومات هو على مسؤوليتك الخاصة.

This article is sourced from the internet: Bitget Research Institute: Mt.gox compensation assets continue to be sold, and the short-term market conditions are poor

Related: Viewpoint: Web3 needs Mass Admission, not Mass Adoption

Original author: Cryptoskanda (X: @thecryptoskanda ) Old investors know that every time the market is down, people will blame the market for not attracting Web2 users, so no new funds come in. This is the so-called Mass Adoption narrative, that is, Cryptos Web3 products must cater to Web2s non-profit-oriented users. This logic is like African children will starve to death because you waste food in China, which makes sense but is illogical. Mass Adoption – First understand who Mass is? Who are MASS? Don’t just generalize to traditional Web2 users — Bullshit. “Mass” is a group of different but categorizable individuals. The blind man does not drive a domestic electric car, not because he does not support domestic products, but because he does not have a drivers license (no demand).…