تساؤلات حول تعليق ZKX: صناع السوق متهمون، $7.6 مليون دولار تم استخدامها بطريقة غير معروفة

المؤلف الأصلي: Jin Kang ، التشفير كول

الترجمة الأصلية: فيليكس، PANews

On July 30, the derivatives DEX ZKX announced that it would stop operating, saying that it could not find an economically viable protocol path. However, some community users questioned the suspension of operations. It was announced more than a month ago that it had raised $7.6 million, and the suspension of TGE just a few weeks after it started seemed unreasonable.

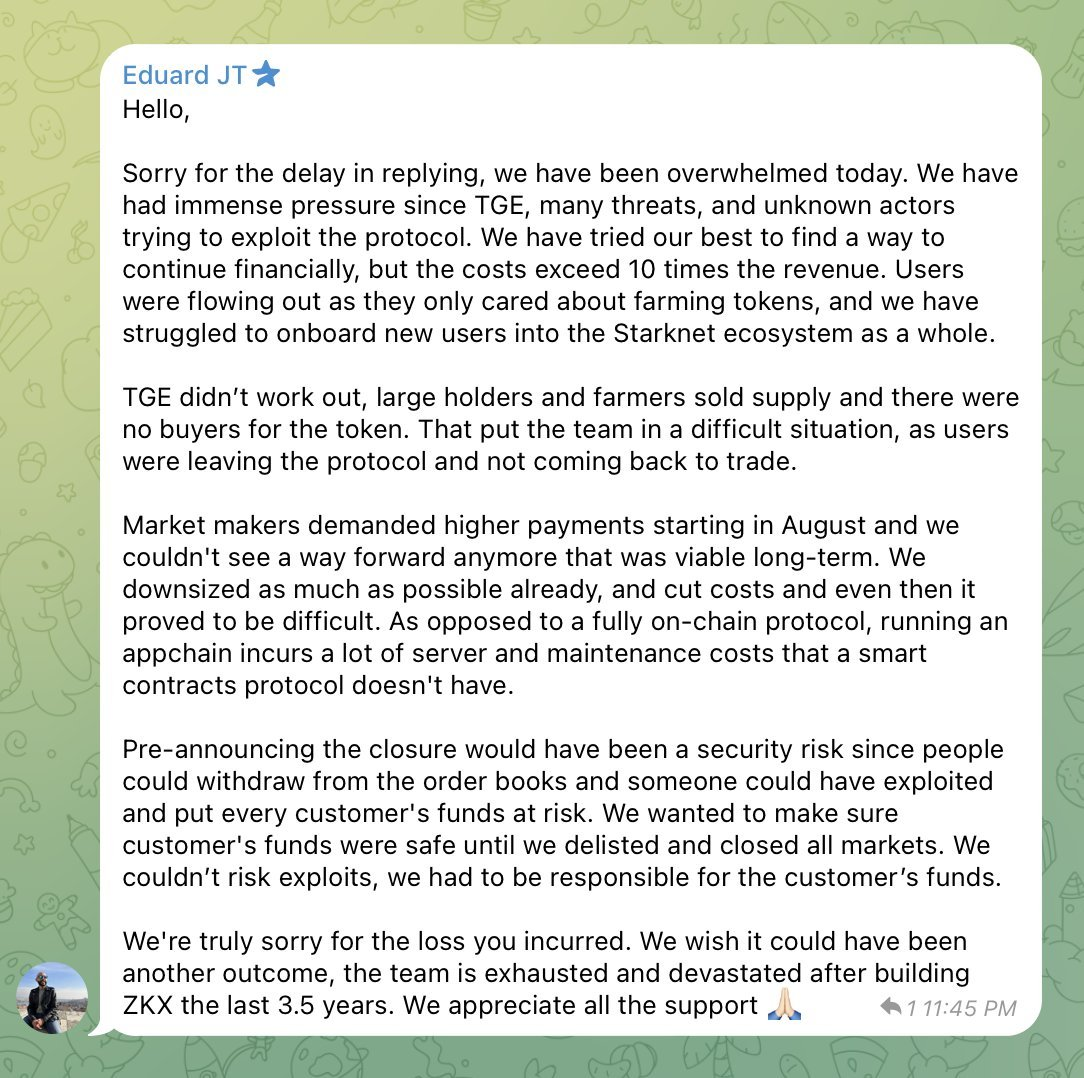

Founder Eduard responded on the X platform that the previous $7.6 million in financing was raised from 2021 to 2024 to support a team of 30 people to build a dedicated blockchain for expansion perps, including multiple code audits with Nethermind, TGE listing costs, etc. All user funds have been refunded and more than 80% of users have withdrawn from the agreement. The core founders did not sell any of their allocated tokens.

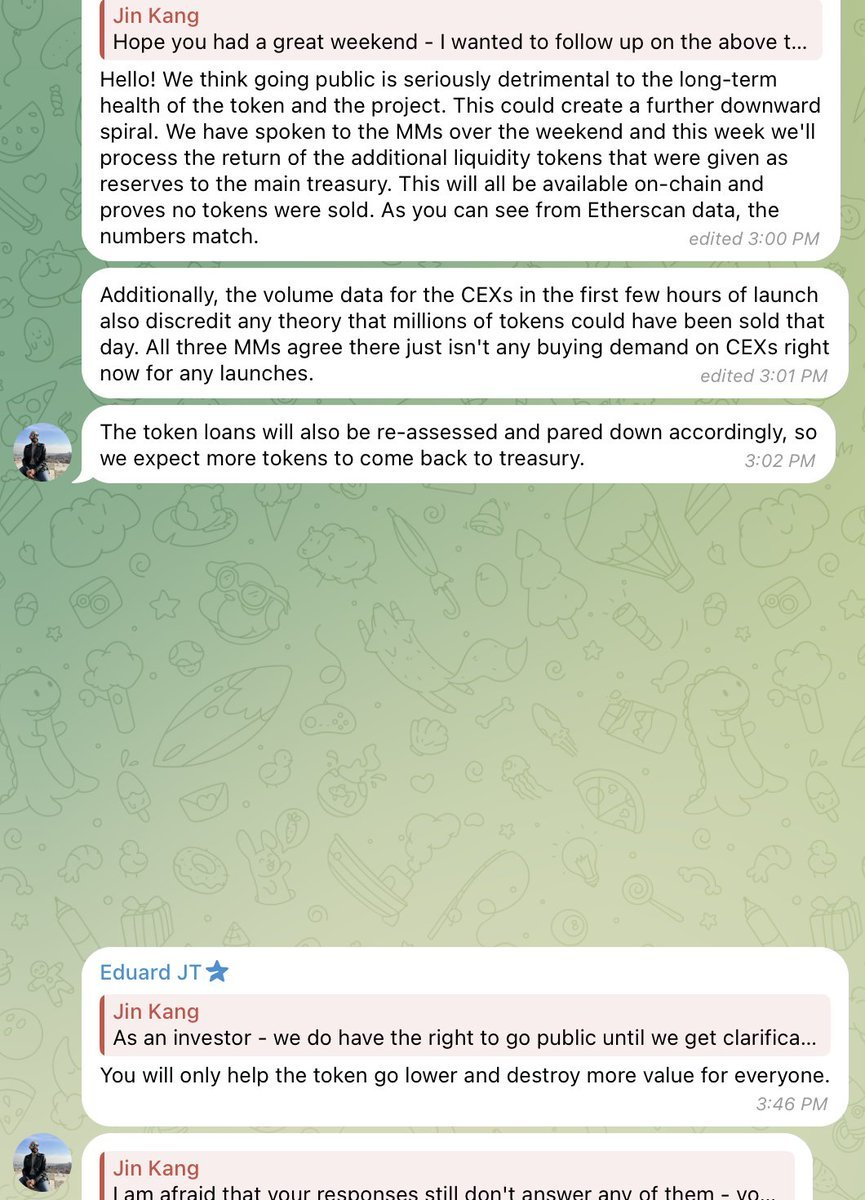

However, this response did not shut up the public, and crypto KOL Jin Kang broke the news on the X platform today, questioning the teams opacity and other issues, and publicly disclosed the dialogue with the ZKX team, hoping that investors would speak out and asking relevant market makers and CEX to give explanations. The following is the content details.

If this isnt a scam, then what is it?

-

The team closed 6 weeks after the TGE due to inability to find an economically viable agreement path

-

Token ownership changed at TGE

-

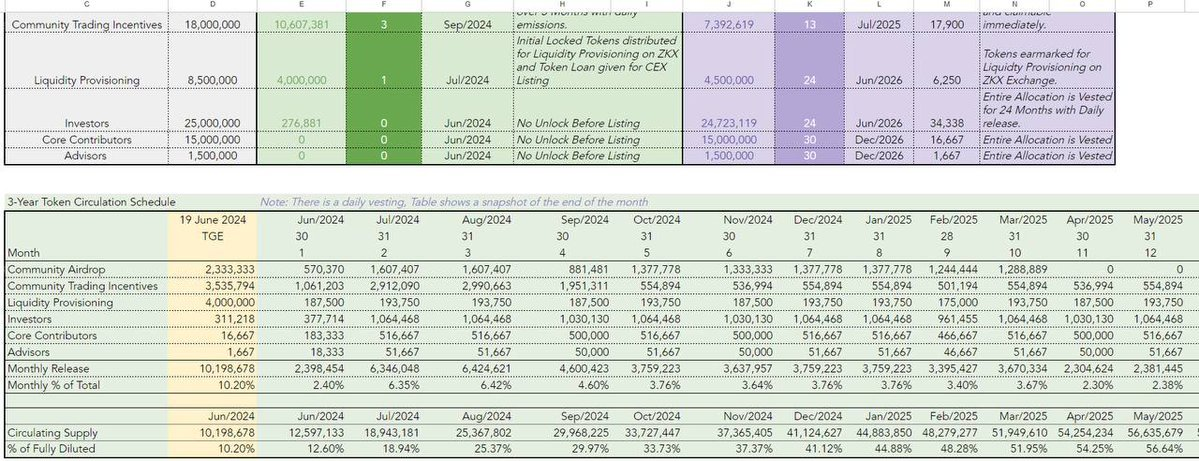

Circulating supply increased at TGE (relative to whitepaper), causing price to plummet

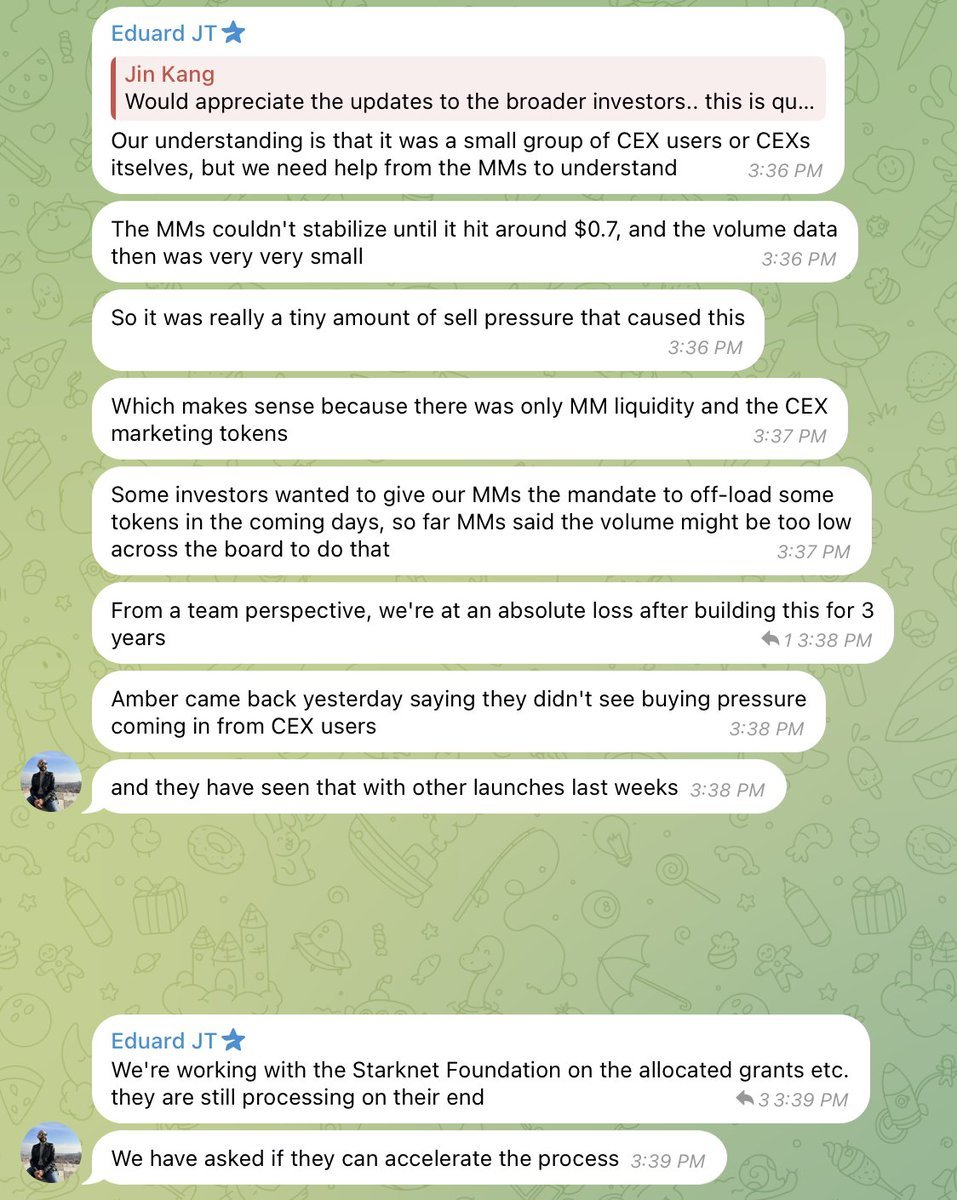

When ZKX TGE, the price dropped by more than 50% in the first 24 hours.

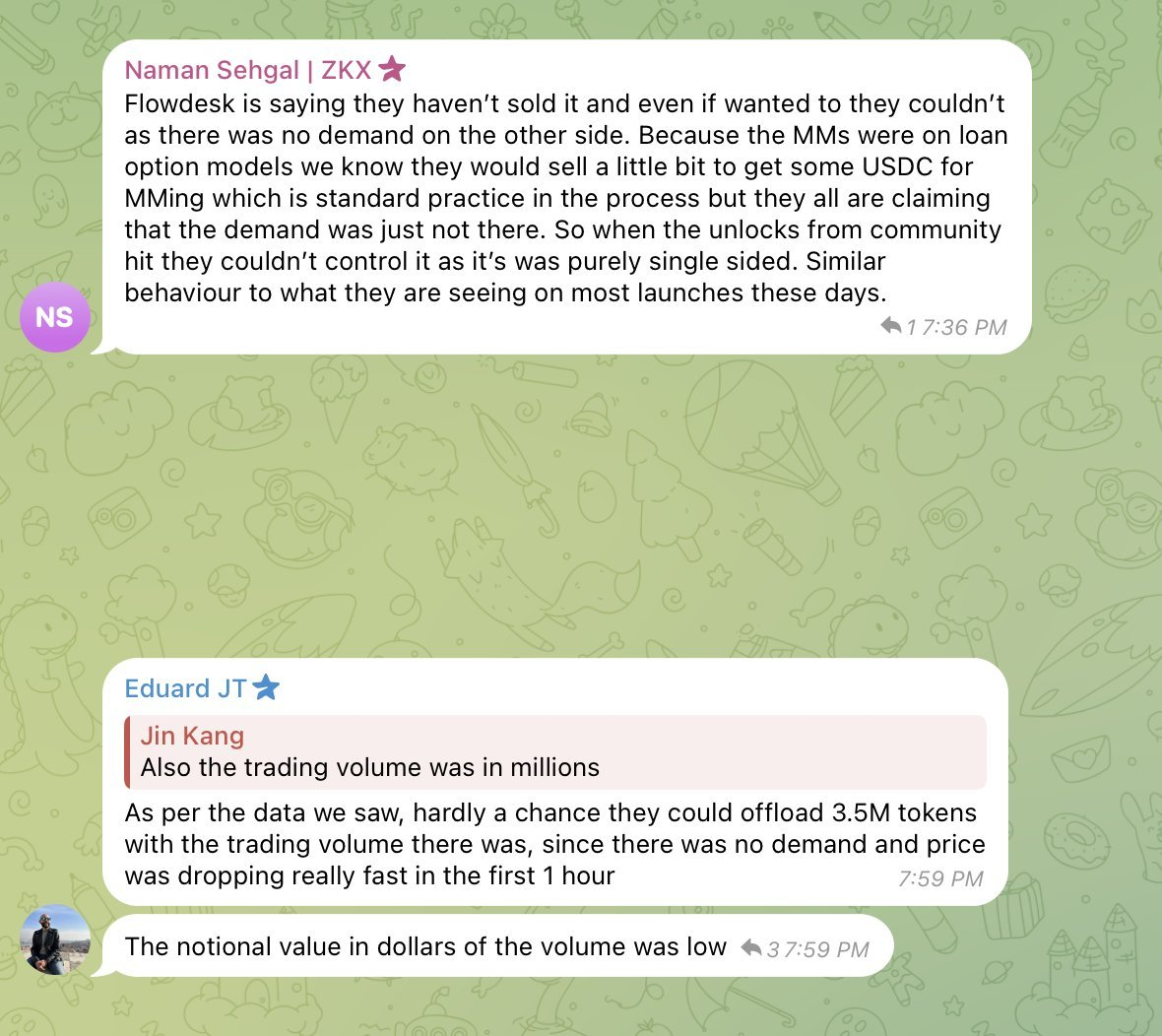

The team explained that market makers such as Amber Group, Flowdesk, and IMC were unable to stabilize the price at $0.7 because a small number of users were selling.

They say they are waiting for a grant from the Starknet team to fix the problem.

The team mentioned that they are working with the Berachain team on a potential migration and hinted that they could spend $1 million if necessary, but that they would be happy to do a bootstrapped launch regardless.

But within six weeks, they أعلن they were ceasing operations.

The ZKX team concealed key facts and blamed the price crash on market makers:

-

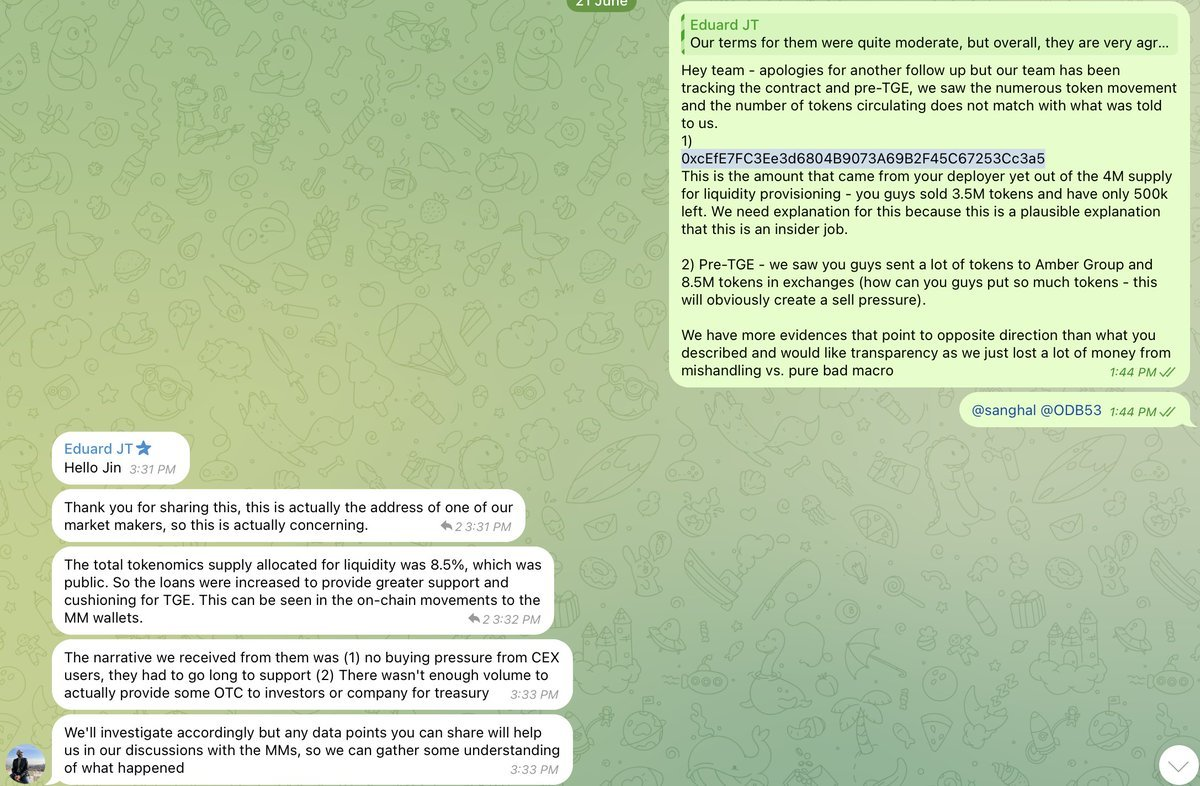

Claims that one of the market makers sold 3.5 million of the 4 million tokens at the TGE: https://etherscan.io/address/0xcEfE7FC3Ee3d6804B9073A69B2F45C67253Cc3a5#tokentxns

-

Increase lending to market makers to support liquidity

The first picture below is a snapshot of the wallet before the TGE. The second picture is the token economics, before the TGE, there were more than 10 million tokens in circulation (which does not match the token economics). The third picture is the marketing incentives of CEX, Gate, KuCoin, Bitget need to confirm this.

Notably, during the first 9 hours after the TGE, the ZKX team blocked all ZKX transfers from Starknet to the mainnet.

All transactions during this time period were from the team/market makers/CEX. About 1 million tokens were sold during this time period. The team denies this.

Because market makers need liquidity, the token economics were changed at the last minute of the TGE to increase the market maker allocation from 4% to 8.5%.

During the first 9 hours when only the CEX/market maker/team owned ZKX, nothing was known about what caused the CEX price to crash. Investors were not informed of the entire process.

The worst part was that they were given time to clarify, but a month later they shut down the project citing lack of funds and said they were dealing with threats (from nowhere).

The team did not explain how the $7.6 million had been spent over the past three years, nor did it explain why the TGE failed.

If market makers Amber Group, Flowdesk, and IMC require loans that are twice as large as the actual amount (over-loans), then these market makers should give an explanation.

CEX platforms CoinEx Global, Gate, KuCoin, and Bitget should explain whether they sold marketing incentive tokens.

If not, then the ZKX team is lying.

During the communication process with the team, the ZKX team was not transparent.

$7.6 million in less than 3 years due to high costs (no subsidies from Starknet?) and 30+ people on the payroll? Never heard of that happening.

Hopefully, other ZKX investors will speak out and make their opinions known. The crypto industry needs to eliminate this kind of opaque behavior, and the Starknet team needs to explain why they support this project.

This article is sourced from the internet: ZKX suspension questioned: market makers blamed, $7.6 million in funds used in unknown way

ذات صلة: عمود التقلبات في SignalPlus (20240611): 36 ساعة أساسية

ستعقد الولايات المتحدة جولة جديدة من اجتماعات اللجنة الفيدرالية للسوق المفتوحة صباح يوم الخميس، وقبل ذلك، ستصدر بيانات التضخم الثقيلة لأسعار المستهلك مساء الأربعاء، مما جعل السوق العالمية تجلس على دبابيس وإبر. وفقًا لجينشي، قال المتحدث باسم بنك الاحتياطي الفيدرالي نيك تيميراوس إن معظم خبراء الاقتصاد من جانب المشترين وغيرهم من المراقبين المحترفين لبنك الاحتياطي الفيدرالي يتوقعون الآن أن يخفض بنك الاحتياطي الفيدرالي أسعار الفائدة مرة أو مرتين في سبتمبر أو ديسمبر. هناك خطران في هذه المرحلة. الأول هو أن بنك الاحتياطي الفيدرالي سيعتبر النشاط الاقتصادي السليم إشارة إلى أن السياسة ليست مشددة بما فيه الكفاية وأن سعر الفائدة المرتفع لن يتم الحفاظ عليه لفترة كافية؛ والخطر الآخر هو أن محاولة بنك الاحتياطي الفيدرالي لضربة استباقية قد تشعل السوق. المصدر: SignalPlus، Economic…