بدون بنوك: لماذا لا تزال SOL مقومة بأقل من قيمتها الحقيقية مقارنة بـ ETH؟

Original source: Bankless

Original translation: Peyton, SevenUpDAO Overseas Returnees Association

Bankless is a global community dedicated to helping individuals regain sovereignty over the financial system through cryptocurrency and blockchain technology, breaking away from the control of traditional banks and technology companies. By providing educational resources and support, Bankless encourages users to explore the crypto space in depth, pursue financial independence and self-sovereignty, while warning of the risks of crypto investment. This community not only focuses on short-term trading opportunities, but also strives to build an Internet-based property rights system to solve broader social problems.

Michael Nadeau is a cryptocurrency analyst who can help us answer the question, “How undervalued is Sol?” His analytical approach is not technical, nor is he a decentralization maximalist, nor does he represent any particular faction. Instead, he looks at current on-chain fundamentals, such as daily active users, fee revenue, and Total Value Locked, to provide insights.

This show explores why fundamentals are crucial when analyzing crypto assets like ETH and SOL. It reviews the data from 2024 to see who is winning and examines the catalysts for ETH and SOL. In addition, Michael shares his price predictions for ETH and SOL in this cycle and provides insights on which asset will perform better in the second half of the bear market.

Is Fundamental Analysis Making a Renaissance in Crypto?

Ryan: All right, lets jump into this episode. Were super excited to introduce Michael Nadeau. Hes the founder of DeFi Report and writes some of my favorite crypto analysis. He focuses on traditional fundamentals, analyzing tokens and crypto assets similar to cash flow analysis of stocks and capital assets. He models the demand for crypto assets as currencies and focuses more on overall fundamentals than attention metrics. Its a great combination of crypto native knowledge and financial analysis. I wish the crypto world would look at crypto assets the way Michael does in his report.

Ryan: Lets start with a leading question. Were going to be talking about Solana (SOL) versus Ethereum (ETH), which might be a little inflammatory to some people. You wrote a report titled Should Solana be trading at an 83% discount to ETH, which is roughly whats happening right now. Well get back to that in a bit. First, I want to ask an overarching question: Are fundamentals having a renaissance in crypto? Recall that I define fundamentals as cash flows and how, like, a stock analyst might view these crypto assets. Weve seen Maker, the blue chip DAI token, perform well this year. Is fundamental analysis having a renaissance in crypto?

مايكل: I’m glad to hear that. It’s been fun to see this narrative start to emerge on Twitter. At DeFi Report, everything we do is data-driven, even for meme coins. You can analyze token holder growth and social metrics on platforms like Twitter. Fundamentals is a broad term that is easier to understand in a bear market. Today we’re going to talk about Solana vs Ethereum, and what initially attracted me to Solana was studying how it performed in a bear market. As Warren Buffett said, when the tide goes out, you can see who’s been swimming naked. In a bear market, you can see what’s likely to last. We work with data firms that focus on fundamentals and believe this is where the industry is headed. It’s great to see this narrative being mentioned. MakerDAO is one of the projects with excellent fundamentals.

Ryan: Thats great. Its interesting that we mentioned fundamentals as narrative, although thats somewhat ironic given how volatile crypto markets are. What is the overarching theory of fundamentals? Is it as simple as Warren Buffetts view that in the long run, markets are a weighing machine, but in the short run, they play a narrative game? Do fundamentals matter in the long run and are they reflected in price over time?

مايكل: Yeah, thats basically it. The market needs some key performance indicators (KPIs) for relative valuation. Today, I dont think anyone would argue that crypto assets are traded based on cash flow. But I think thats where were going. Even though we dont trade based on cash flow right now, we have benchmarks like Bitcoin and Ethereum that everything else is valued relative to. The market always needs to understand fundamentals and key performance indicators. We are sorting out what those KPIs are. Security analysis is a socially constructed process, and the market coalesces around a shared set of ideas because we can understand them. Discounted cash flow analysis (DCF) works for stocks and equities. So will it work for crypto assets? Maybe, maybe not. We are looking at that today.

Ryan: What’s interesting is that you need to believe in the fundamentals and get other investors to believe in them as well. It’s almost a game of coordination and consensus. One reason to be more bullish on fundamentals in the coming months and years is the increasing involvement of traditional finance (TradFi) in the crypto space. Traditional finance looks at capital assets through a fundamental lens, and they will bring that lens to the crypto space. I am impressed by the analysis of institutions such as VanEck. They deeply study crypto assets from a fundamental perspective. You can disagree with their variables and assumptions, but their price predictions and analysis are based on fundamentals.

مايكل: Absolutely. Different types of assets have different fundamentals. You wouldnt use the same metrics to analyze a basket of banks versus commodities or other asset classes. Crypto, as an emerging asset class, involves data-based fundamentals, but its also very social and exists on the internet and on crypto Twitter. These nuances make fundamental analysis in the crypto space unique.

Ryan: I started with these questions to help our listeners understand your perspective on assets and investment approaches. This framework is valuable for our conversation. You released a report last week that caught my attention. It is a great topic for applying fundamental analysis to Ethereum and Solana, two assets that have gained a lot of attention in this cycle. The title of your report intrigued me, Should Solana be trading at an 83% discount to Ethereum? You looked at this from a market cap perspective, and Solana is indeed trading at an 83% discount to Ethereum. Should it be? This is a data-driven survey, and I appreciate your objective, data-centric perspective that avoids infighting and debates between decentralization and centralization.

مايكل: Yes, we look at a variety of core data points when analyzing L1 tokens like Ethereum (ETH) and Solana (SOL). This comparison dates back to late 2022, when we began to seriously look at Solana after the FTX debacle. We compared it to ETH in January 2018 and saw similarities in the data. We analyzed total locked value, number of users, transaction volume, developer and application activity. We also considered venture capital funding flows. By December 2022, Solanas metrics were similar to Ethereums in early 2018, which prompted us to dive into Solana when many had already given up on it. Our analysis started with the fundamentals and layered on the nuances unique to crypto.

لخص

Michael believes that fundamental analysis is experiencing a renaissance in the crypto space and is key to crypto asset research. Although the current crypto asset market is still not entirely based on cash flow, fundamentals and key performance indicators (KPIs) are very important for relative valuation. By comparing the fundamental data of different assets, such as Solana and Ethereum, Michael advocates a data-driven approach to analysis, which helps understand the long-term value of crypto assets.

Solana’s 83% Discount

Ryan: I started with these questions to help our listeners understand your perspective on assets and investment approaches. This framework is valuable to our conversation. You released a report last week that caught my attention. Its a great topic for applying fundamental analysis to Ethereum and Solana, two assets that have gained a lot of attention in this cycle. The title of your report intrigued me, Should Solana be trading at an 83% discount to Ethereum? You looked at this from a market cap perspective, and Solana is indeed trading at an 83% discount to Ethereum. Should it be? This is a data-driven investigation, and I appreciate your objective, data-centric perspective.

مايكل: When we analyze L1 tokens like Ethereum (ETH) and Solana (SOL), we look at a variety of core data points. This comparison dates back to late 2022, when we began to seriously look at Solana after the FTX debacle. We compared it to ETH in January 2018 and found similarities in the data. We analyzed total locked value, number of users, transaction volume, developer and application activity. We also considered venture capital funding flows. By December 2022, Solanas metrics were similar to Ethereums in early 2018, which prompted us to dive into Solana when many had already given up on it. Our analysis started with the fundamentals and layered on the nuances unique to crypto.

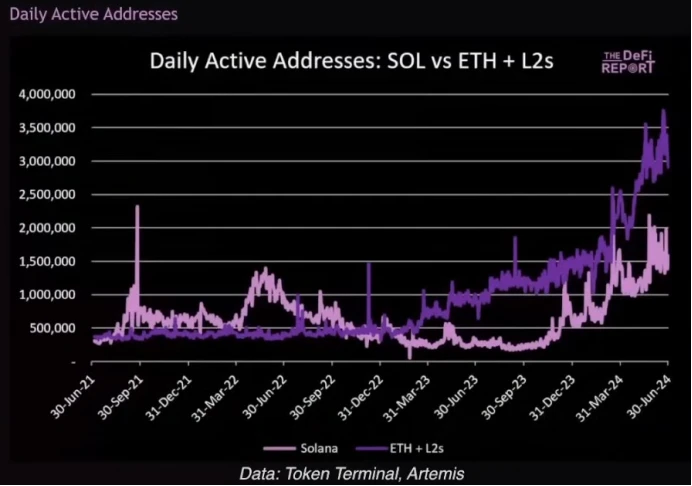

Daily Active Addresses

Ryan: You mentioned using fundamental analysis in the depths of the bear market in December 2022, which led you to see a price dislocation. At the time, Solana’s market cap was only 3% of Ethereum’s. You decided that this was not right, shared your research, and went long Solana. Since then, Solana’s market cap has risen to 17% of Ethereum’s, making the ETH-Solana ratio a winning trade this cycle. The question now is whether this trend will continue. Will Solana continue to establish itself in value relative to ETH?

Let’s start by discussing the data with daily active addresses. This chart compares Solana to Ethereum and its layer 2s. Can you briefly explain this chart?

مايكل: This chart combines Ethereum with its top 12 Layer 2s, starting in June 2021. We are looking at Ethereums growth relative to Solana. Ethereums growth looks fantastic, but we want to understand how Solana is doing. In Q2, Solana had an average of 1.3 million daily active users, which is about half of Ethereum and its Layer 2 combined.

Ryan: That’s pretty impressive. The chart for Ethereum and its layer 2 is purple, while Solana is pink. Solana currently has about half the daily active addresses of Ethereum. How much of this activity is bots or fake activity, and does that impact your analysis?

مايكل: Artemis does a good job of detecting fake activity in its data. There is a lot of bot activity, but bots pay fees. Although there is a view that bots are not actual users, in traditional finance, more than 60% of trading comes from algorithms. Bots are also users who contribute to product-market fit by using the tools and paying fees. Therefore, I would not ignore their activity.

Ryan: Yeah, we should remember that the definition of a user here is similar to active addresses. A bot can have multiple addresses, a person can have multiple addresses. We basically think of an active address as a user, similar to an active bank account. An interesting observation from the chart is that during the last bull cycle in 2021-2022, Solanas daily active addresses were actually higher than Ethereum, not just slightly higher, but significantly higher.

مايكل: Yes, correct. Solana had significantly higher daily active addresses than Ethereum during the peak of the last cycle. This happened at or just before the peak of the crypto market, before the Terra Luna crash and its aftermath. There was a lot of hype around Solana at that time, which indicated that there was something substantial there. However, after the FTX crash, Solana user activity dropped significantly. The blockchain went through a reorganization and has since re-emerged. Hype usually has some underlying signals, and in bear markets, fundamentals tend to become more apparent.

cost

Ryan: Let’s discuss another fundamental metric that we hold in high regard at Bankless: fees. Fees represent block space purchased, essentially showing demand for blockchain services. We are looking at a chart comparing Solana to Ethereum and its top layer 2 fees. The bottom line is that in Q2, Solana generated $15.1 million in fees, which is 27% of Ethereum and its top layer 2 fees. Can you explain this chart? It shows that Solana’s fees (pink) are higher than Ethereum’s fees (purple), but based on your summary, this seems a bit counterintuitive.

مايكل: Yes, this chart can be a little misleading because it uses two different axes. If we only used one axis, Ethereum’s fees would far exceed Solana, making Solana’s growth less noticeable. Ethereum’s fees are still significantly higher than Solana, but this chart highlights Solana’s rapid growth over the past six months.

In the last cycle, despite Solana’s high transaction volume (around 20 million transactions per day), fees were very low, typically only a few thousand dollars per day. Now, we are seeing a significant increase in Solana’s fees. In Q2, Solana’s fees were approximately 27% of Ethereum and its top-tier Layer 2. The increase in fees may indicate that demand and usage for Solana is growing, even as it maintains low transaction costs.

Interestingly, Solana’s narrative has been about keeping fees low. However, as activity increases, we may see fees rise due to potential bottlenecks, similar to what Ethereum has experienced. This will be especially noteworthy when future innovations on Solana, such as the Fire Dancer update, come into play later in the cycle.

Cost Generation and MEV

Ryan: Fees are a fundamental metric that I take very seriously because they represent real activity. Users are willing to pay for a service, indicating real demand. Fees are relatively resilient to Sybil attacks. I wanted to ask about the composition of fees. Blockchains can generate fee revenue in two ways: first, by selling block space, and second, by selling transaction ordering within blocks. MEV, which you mentioned earlier, is related to the second way. MEV involves paying for transaction priority in a block. What is the difference between Solana and Ethereum in terms of generating fees? I was under the impression that a large portion of Solanas fee revenue comes from MEV. How does this compare to Ethereum?

مايكل: Yes, Solana’s MEV-related fees account for over 50% of its total fee revenue, primarily through Jito validators, who share MEV with participants in the validation process. There is an interesting view that all fees may eventually converge to zero as tier-one blockchains become commoditized. In this view, MEV will become the primary value accrual mechanism, focused on prioritizing access to block space. This is similar to traditional finance, where transaction fees are negligible and value is extracted from transaction ordering.

We are starting to see this dynamic on Ethereum, especially after the implementation of EIP-4844, which significantly reduced transaction fees on Layer 2. This has also impacted Level 1 fees. Our recent Ethereum Quarterly Report highlighted the main story of EIP-4844, which dramatically reduced fees on L2 and impacted L1. The new block space supply may be filled as demand picks up, but MEV is likely to play a key role in the monetization of these networks in the future.

Ryan: So, MEV is likely to be the main value driver for both networks as they evolve?

مايكل: Absolutely. As transaction fees on the first and second layers decrease, competition for MEV will become more important. This shift reflects how traditional financial markets work and could be a key factor in how blockchain networks generate value in the future.

Ryan: This is interesting and highlights the different design strategies of Ethereum and Solana. While Ethereum outsources some execution and block ordering tasks to layer 2, Solana retains all MEV. This raises questions about the long-term viability of MEV on these chains and how it will shape the future.

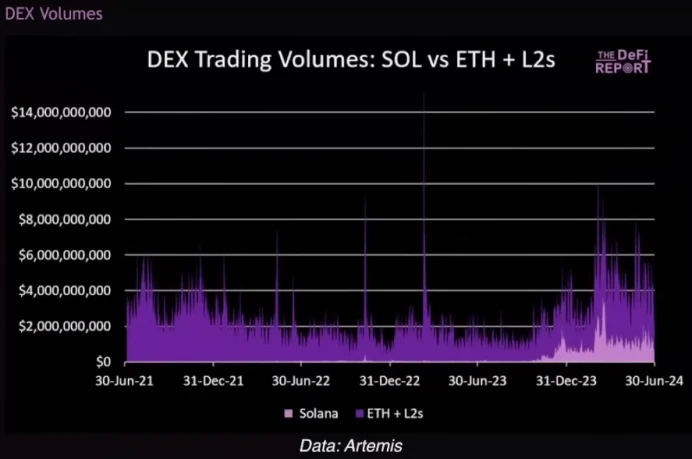

DEX Trading Volume

Ryan: Let’s move to the third fundamental metric, which is DEX volume. We are looking at Solana’s DEX volume versus Ethereum and its layer 2. Solana’s DEX volume is very impressive, reaching $108 billion in Q2, accounting for 36% of Ethereum and its layer 2. This is in stark contrast to the previous cycle when Solana’s volume was almost zero. What do you think of this chart?

مايكل: This chart shows that DeFi on Solana barely existed a few years ago. Today, most of the activity is happening on Jupiter. If you compare Jupiter to Uniswap, Jupiter is about 90% of Uniswap in terms of active users. The massive growth in DEX volume on Solana indicates increased user engagement and trading activity.

At an overall level, Solana’s DEX volume is still significantly lower than Ethereum and its Layer 2, but the growth is noteworthy. I personally use Jupiter to buy and sell assets on Solana because its user experience is smooth and avoids many of the UX challenges and bridge issues faced by Ethereum. This may attract more retail users to switch directly to Solana instead of using centralized exchanges like Coinbase. We need to pay attention to the development of this trend.

Ryan: So, the increased DEX volume on Solana could be an indication of a shift in user preference toward decentralized platforms on Solana due to their better user experience, which could impact how new users enter the crypto space?

مايكل: Exactly. If Solana continues to improve its user experience and attract more DEX volume, it could become a more attractive option for new users looking for decentralized trading platforms. This could challenge centralized exchanges and even affect how new users enter the crypto space.

Ryan: What insights do you have into the composition of traders on Solana and the assets they trade? One impression is that activity on Solana is more retail skewed, with smaller trades but larger numbers of participants. The asset composition also seems to be heavily skewed towards memecoin. How does this compare to other networks?

مايكل: Indeed, there are more memecoin transactions on Solana, which is primarily driven by speculative bull assets. However, there is also considerable stablecoin activity, which we will discuss later. This indicates that transaction velocity is high. Solanas total locked value (TVL) has always been lower than Ethereum, but its transaction velocity is higher. This reflects Solanas user experience – low fees and ease of use – which encourages smaller, more frequent transactions, including meme transactions at low transaction volumes.

Stablecoin transaction volume

Ryan: Since you mentioned stablecoin activity, let’s dig a little deeper into that. This cycle, Solana’s stablecoin volume has increased significantly compared to the previous cycle. In Q2, Solana’s stablecoin volume reached $4.7 trillion, surpassing Ethereum’s stablecoin volume. This seems to highlight the high velocity of transactions on Solana. Can you explain these numbers in more detail?

مايكل: The $4.7 trillion in stablecoin trading volume in Q2 is indeed a staggering number, driven primarily by DEX activity on Solana. This surge, especially in the past six months, highlights the high velocity of transactions on Solana. Solana users appear to be transacting much more frequently than Ethereum users.

Ryan: That $4.7 trillion number is double what Ethereum and its layer 2 have seen over the same period. You mentioned that a lot of this activity involves memecoins and algorithmic trading. Why do you think this is a positive sign and not something to worry about?

مايكل: My view is that bots and algorithms are a core part of the trading ecosystem. Over 60% of trading volume in traditional finance is algorithmically driven. On Solana, this reflects the high-velocity, automated trading in traditional finance. Solana aims to create a blockchain version of Nasdaq, and high trading volume — even from memecoins and speculative assets — indicates that the system is being widely tested and used. This activity, regardless of its speculative nature, is a positive sign of network participation and functionality.

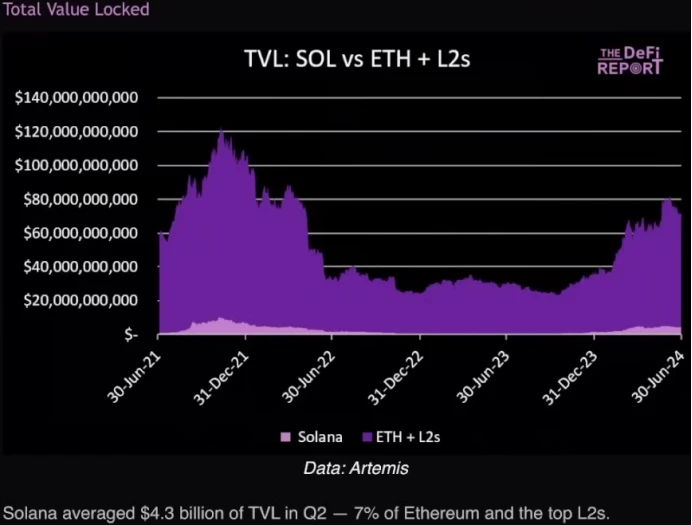

Total locked value

Ryan: Bots are people, memes are assets — that’s kind of the Solana narrative. Let’s discuss this chart, which shows a more complicated picture than other bullish indicators. This chart shows Solana’s total value locked (TVL) versus Ethereum and its Layer 2 over time. It’s worth noting that Ethereum and Layer 2’s TVL (purple line) have not yet returned to their all-time highs from the previous cycle, suggesting there’s room to grow. However, Solana’s TVL (pink line) has not exploded like the other indicators. In fact, Solana’s TVL is roughly comparable in percentage to Ethereum and Layer 2’s TVL over the previous cycle. Solana’s TVL averages $4.3 billion, or 7% of Ethereum and the top Layer 2. What do you think of this situation?

Michael: This shows that the Ethereum ecosystem is more mature and capital efficient than Solana. Ethereum has a much larger amount of ETH locked in DeFi than Solana, reflecting its more advanced stage. One reason for this is that Ethereum was originally launched as a proof-of-work blockchain and later moved to proof-of-stake, while Solana has been proof-of-stake from the beginning. Currently, Solanas staking rate is about 80%, while Ethereums staking rate is 27%, which has risen from close to zero in recent years.

Solanas high staking rate means that a large amount of SOL is locked up in validators rather than circulating in DeFi. Solana has been trying to move value into DeFi through liquid staking solutions and incentives. In order to increase its TVL, Solana needs to mobilize more staked SOL into DeFi.

Overall, the difference in TVL highlights the maturity of Ethereum and the progress of its ecosystem relative to Solana.

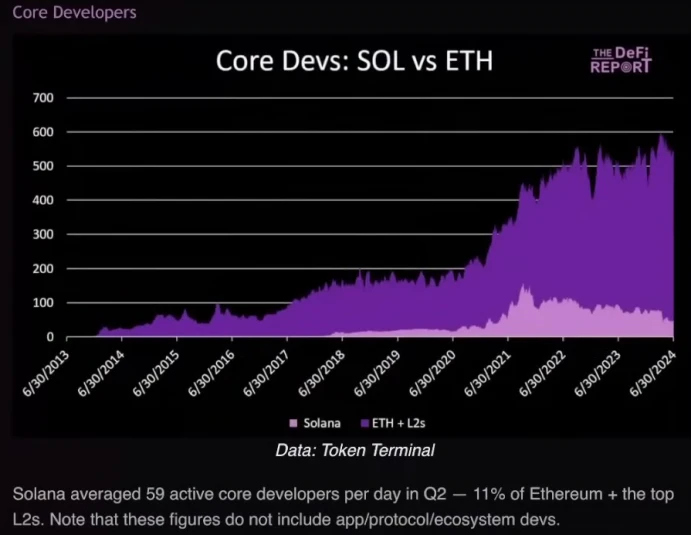

Number of core developers

Ryan: Here’s an off-chain metric from your report: core developers. For Solana, there were 59 active core developers in Q2, which is about 11% of Ethereum and its top Layer 2s. This number is up from Solana’s early days, but has not yet reached the peak of the last cycle. What insights can we get from this metric?

مايكل: This data comes from Token Terminal and focuses only on core developers — those who work directly on the blockchain protocol itself, not the broader ecosystem or applications. Solana’s core developer count has grown, but it still lags behind Ethereum. If you include ecosystem developers, Solana’s total is about one-third of Ethereum’s.

Generally speaking, a growing number of core developers can indicate the maturity and expansion of an ecosystem. However, a high number of core developers is not always necessary for a healthy ecosystem. Once a project’s core infrastructure is stable, much of the development work can shift to applications and protocols built on top of it. Solana’s numbers are improving, indicating that development work is continuing, although it still lags behind Ethereum. Ethereum’s core developer count continues to rise, reflecting its continued expansion and maturity.

To me, the core developer metric serves as a warning sign. If an ecosystem has otherwise good metrics but very few developers, that can be a cause for concern. But for Solana and Ethereum, there are no warning signs here; both are showing solid development activity.

Q2 performance summary and value accumulation

Ryan: Let’s summarize the performance of the second quarter and then discuss the value appreciation. Solana’s indicators in the second quarter are:

-

50% of Ethereum users (daily active addresses)

-

27% of Ethereum fees

-

36% of Ethereum Dex transaction volume

-

190% of Ethereum stablecoin trading volume

-

7% of Ethereum’s Total Value Locked (TVL)

-

11% of Ethereum core developers

Solana is trading at a discount of approximately 83% to Ethereum. With these fundamentals in mind, we turn to the discussion of value accretion. When evaluating how a blockchain captures value, it is key to note that creating value does not always mean being able to capture it. For example, early peer-to-peer protocols like BitTorrent or Napster created a lot of value but failed to effectively capture that value in their business models. This distinction is important when evaluating the value capture of assets like Solana and Ethereum.

مايكل: Absolutely, you make a good point. The key difference between Ethereum and Solana in terms of value addition is their architectural approach:

1. Ethereum is developing into a modular technology stack. Users interact with Layer 2 (L2) solutions, which have their own independent fee structure. These fees are distributed: part goes to the L2 sequencer, and the other part is settled to Ethereum Layer 1 (L1). As an Ethereum validator or ETH holder, you will get a piece of this pie.

2. In contrast, Solana operates as a more monolithic technology stack. Validators capture 100% of fees directly, with no intermediary layers like L2. Solana’s current setup means that all value created by transactions on the network is captured directly by validators and their SOL tokens by extension.

3. In summary, Solanas model provides a clearer and more direct way to capture value. However, Solana may face scalability challenges in the future, which may require L2 solutions similar to Ethereum. Both ecosystems are building strong network effects, with Ethereums effect being the most mature and Solana following closely behind.

Bullish Thesis for Ethereum

Ryan: Let’s dive into the core issue. One reason Ethereum has performed relatively flat during the bull run is due to its architectural decisions. Ethereum outsources the execution layer to Layer 2 (L2) solutions like Arbitrum and Optimism, while Solana retains execution within its own ecosystem. As a result, Solana’s token directly benefits from settlement, execution, and fee capture, while Ethereum sacrifices a portion of revenue in terms of decentralization and scalability by scaling via L2. Ethereum aims to be a more neutral settlement layer, allowing it to serve as a base layer for settlement while enabling Ether to function as a monetary asset in the emerging L2 economy. This approach is seen as a strategic bet on long-term benefits, favoring decentralization and neutrality over short-term revenue capture. This distinction is critical to understanding the current market landscape.

مايكل: Yes, that is exactly the case. Ethereum’s approach may have caused some confusion in the market. Analyzing Q2 data shows that the impact of EIP 4844 has significantly increased the supply of block space. Historically, excess resources are eventually utilized, often leading to new development and innovation. This situation is similar to Ethereum’s “broadband moment”, where the increase in block space may be filled by new entrepreneurial activity. Currently, Ethereum’s low fees and increased competitiveness may have created uncertainty among investors about whether to invest directly in Ethereum or through its L2 solutions. Despite this confusion in the short term, I believe that Ethereum’s strong network effects will eventually lead to value capture across the entire technology stack, including from L2 and other protocols. I remain optimistic about this long-term narrative, although it may appear confusing in the short term.

Ryan: This is a compelling long-term perspective. However, current on-chain fundamentals may suggest that Ethereum is struggling, as if it is inadvertently weakening itself by moving the execution layer. From a fundamental perspective, this shift could be viewed as a negative decision by the end of Q2 2024. It does appear that Ethereum is cannibalizing its own revenue opportunities by outsourcing execution. In this context, the bull case for Ethereum should be examined, especially in terms of value accumulation compared to Solana tokens.

Ethereum supporters might argue that the execution layer is becoming a commoditized area and various solutions are competing for Ethereums position in this area. Ethereums role as the primary settlement layer may put it in a unique position as competition for execution increases between different L2s and rollups. For example, the Coinbase-backed rollup Base is competing with Solana for the execution market. This competition may make execution a more commoditized aspect of the ecosystem. What are your thoughts on this?

مايكل: I think that’s a valid point. Ethereum’s focus on decentralization and long-term benefits may indeed give it a strategic advantage. Coinbase’s participation through Base and possible participation from other platforms such as Robinhood’s partnership with Arbitrum may bring more users into the Ethereum ecosystem and decentralized finance (DeFi). These developments may contribute to Ethereum’s bullish narrative. Solana aims to become the NASDAQ of the blockchain world and compete in the traditional asset space, but it also faces significant competitive pressure. Both ecosystems have their unique advantages, and competition will play a major role in shaping their future.

Ryan: Michael, did you get a chance to watch the debate between Anatoly and Justin Drake on Bankless a few weeks ago?

مايكل: Yes, I watched some of it, though not the entire debate. It was a great discussion and I followed the key passages.

Ryan: An interesting theme in that debate was the prediction aspect. My challenge to Justin and Anatoly was to come up with a prediction and look back in 3-5 years to see which viewpoint will prove to be correct. As an Ethereum supporter, Justin argues that Solana’s centralized design, due to its monolithic structure, may undermine its ability to serve as the basis for a truly decentralized, corruption-resistant Layer 2 solution. He suggests that even if it appears to be beneficial in the short term, this centralization may be detrimental in the long term. On the other hand, the Solana camp may argue that Ethereum’s focus on decentralization is a narrow interpretation and that Solana is decentralized in its own way. What are your thoughts on this?

مايكل: Ethereum is undoubtedly more decentralized. It is easier and cheaper to set up a node on Ethereum than on Solana, which has higher hardware requirements. Ethereums higher decentralization is obvious. However, Solana still has sufficient decentralization considering the number of validating nodes and geographical distribution. While I do not have as deep technical knowledge as Anatoly and Justin Drake in these debates, I appreciate the depth and importance of these discussions. From an investors perspective, decentralization is important, but it is not currently a major factor in my evaluation. I agree that these debates are valuable for long-term consideration, although there may be issues that are not obvious at the moment.

Ryan: Let me throw out a thought and see if you agree. My theory is that the trade-offs and decisions made by each network will ultimately be reflected in its fundamentals . For example, if Solana faces transaction attacks or centralization issues that distort economic incentives, it may lead to a decrease in activity and revenue generation. Conversely, if Solana maintains sufficient decentralization and attracts a lot of activity, this will also be reflected in its fundamentals. While I support decentralization, I recognize that fundamentals play a key role in investing. In my opinion, these debates are likely temporary and the real impact will be reflected in the long-term fundamentals. What are your thoughts on this?

مايكل: I think that’s a valid point. Users, especially those new to the space, may not care too much about these technical debates. What’s more important is how these factors affect the overall usability and performance of the network. While we in the cryptocurrency community may focus on the technical details, broader adoption will depend on the actual results. When I heard Anatoly and Justin debate these topics, I was mainly looking for potential warning signs that I might not be fully aware of. As for Solana, I found it interesting that Jump Crypto was involved in the development of the Fire Dancer validator node as a major market maker. The involvement of market makers in the development of validators raises concerns about the potential risk of market manipulation. This, along with other factors, suggests that there are still unresolved issues that need attention.

لخص

Michaels point can be summarized as follows: Ethereum outsourcing the execution layer to Layer 2 solutions may lead to reduced short-term revenue, but its strategy aims to maintain decentralization and neutrality in the long term, which helps enhance network effects and the overall value of the technology stack. Although current market data may show that Ethereum faces challenges, he is optimistic about its long-term potential. Solana keeps the execution layer in its own ecosystem and directly benefits from settlement and fee capture, but also faces huge competitive pressure. Michael believes that although Solana is not as decentralized as Ethereum, its sufficient decentralization and high performance are still valuable. He pointed out that although technical discussions are important, the ultimate impact will be reflected in the actual performance and fundamentals of the network.

Upcoming Catalysts

Ryan: I have similar concerns about the Fire Dancer client, although Solana backers have assured me that it is open source and open to public audit and scrutiny. Hopefully, fundamentals will eventually reflect the results of these decisions. Now, let’s discuss some of the upcoming catalysts for both networks. For Solana, you mentioned the Fire Dancer client as a short- to medium-term catalyst. What are the key takeaways from this development?

مايكل: The Fire Dancer client, developed by Jump Crypto, is significant because it introduces redundancy to Solana’s blockchain infrastructure. Currently, Solana relies on a single validator client, which presents a single point of failure risk. Fire Dancer aims to address this issue and may improve the reliability of the blockchain over time . If it proves stable and continues to operate effectively, it may help Solana overcome its early problems and gain long-term credibility. If Solana demonstrates increased security and reliability over a longer period of time, then this may attract more institutional interest, such as BlackRock.

Ryan: Now let’s discuss “Blinks”. What are they and why might they be a bullish catalyst for Solana?

مايكل: Blinks are similar to what we have seen with products like the Farcaster Framework. They bring the Web3 wallet experience directly into the browser, especially within social media platforms. For example, Blinks allows for stablecoin payments directly through a social media interface. If we go through another hype cycle, this could gain traction as users may share these links involving meme coins and other assets. KOLs may share links that facilitate transactions directly from social media feeds. In the long term, “Blinks” could have a significant impact on consumer behavior and e-commerce, changing how users interact with Web3 technology.

Ryan: There are other notable catalysts, but we don’t have time to dive into all of them. The Decentralized Physical Infrastructure Network (DePIN) is carving out a unique niche on Solana, and there are other social applications developing. Turning the focus to Ethereum, the prospect of an Ethereum ETF is a big catalyst. I hope this is our last week without an ETF. The potential launch of an Ethereum ETF is an important development. If Solana gets an ETF, it will be a longer term goal. Ethereum is about to get an ETF, and the impact could be huge, similar to the effect of Bitcoin.

مايكل: The Ethereum ETF is indeed a major development that will significantly impact the development of this cycle. I expect the effect of the ETF may exceed expectations. Based on predictions from institutions such as Bloomberg, I expect that the inflow of Ethereum may reach 10-20% of Bitcoin. The narrative around Ethereum is still not fully understood, but the concept of Ethereum as an open source application store with cash flow potential is compelling. Although the ETF will not initially include staking income, in my opinion, Ethereum has greater market potential than Bitcoin. As institutional investors on Wall Street gain a better understanding of Ethereum, this may enhance its market presence. Our quarterly reports on the Ethereum Investment Framework may gain traction when the ETF is launched. The story of Ethereum is very convincing, and its impact may be surprising once trading begins.

Ryan: Another important catalyst is the focus on real world assets (RWAs). You mentioned BlackRock’s involvement in tokenized treasuries and other financial products on Ethereum. This activity highlights Ethereum’s role in handling important assets. Can you elaborate on how this serves as a catalyst for Ethereum?

مايكل: The involvement of major financial institutions like BlackRock is critical. BlackRock’s upcoming ETF aims to make Ethereum a platform for financial products. They have already tokenized a money market fund on Ethereum, and I expect to see more similar initiatives. BlackRock CEO Larry Fink may go on platforms like CNBC to discuss the benefits of on-chain assets, which could attract significant attention. This real-world application of blockchain technology – creating efficiencies and improving market liquidity – is a core use case for cryptocurrencies. BlackRock’s endorsement and mainstream media attention could spark a positive feedback loop for Ethereum, potentially leading to significant price volatility and market performance later in the cycle.

Ryan: Retail participation is also a factor that has yet to fully emerge. Once retail investors begin to participate, they will likely do so through exchanges such as Coinbase, which will direct them to Ethereum’s Layer 2 solutions such as Base. Solana has been through several years of execution, including an entire bull cycle. However, Base has yet to experience a bull cycle in the retail market. Will this be a major catalyst for Ethereum?

مايكل: Yes, Base represents another important catalyst for Ethereum. While we have not yet seen Solana levels of memecoin trading on Base, there is significant activity, especially in high volume applications like Uniswap. As Base grows, Coinbase facilitates the migration of users to on-chain solutions, which could provide a significant boost to Ethereum.

Qualitative differences

Ryan: Finally, lets discuss the qualitative differences. Currently, Solanas UX is considered superior to Ethereums Layer 2 solutions, with fewer issues. Ethereum faces fragmentation across various Layer 2 solutions, resulting in a lack of cohesion. In contrast, Solanas message and UX are more unified. The Solana ecosystem has a more centralized, Silicon Valley style, while Ethereum is more open source and decentralized, similar to Linux. Feedback from ETHCC suggests that the Ethereum community may also feel divided, with various Layer 2 solutions vying for attention. In contrast, Solanas unified approach, focused on applications and tokens, may provide a more consistent experience. What are your thoughts on these qualitative differences?

مايكل: You describe it well. From a user perspective, Solanas wallet experience is currently more streamlined and avoids the need for a bridge. Ethereum is expected to address these issues through account abstraction and integration with platforms like Robinhood. Although Ethereums current experience is not as user-friendly as Solana, this should improve over time. Solanas centralized, well-organized approach contrasts with Ethereums more decentralized, fragmented structure. Large financial institutions may find it easier to interact with Solana because its support channels are more direct. However, Ethereums broader philosophy and potential improvements may ultimately solve these challenges.

Price Target

Ryan: We have reached the moment we have been waiting for: evaluating whether Solana (SOL) should trade at an 83% discount to Ethereum (ETH). Historically, in November 2022, Solana’s market cap was only 3% of Ethereum’s market cap. Currently, it is at 17%, still an 83% discount. Should Solana trade at this level to Ethereum? What are your predictions for the next 6-18 months?

مايكل: My conclusion is that Solana is currently trading at too much of a discount. I think Solanas market cap could rise to ~25% of Ethereums market cap during this cycle. This is a speculative view, not investment advice. In my personal portfolio, I have increased my exposure to Solana, but have not sold any Ethereum. Many people have swapped Ethereum for Solana, but I think Ethereum will outperform Solana in the short term because of ETFs. Solana could perform better later in the cycle as altcoins rotate. Ethereum typically does well later in the cycle, but new market participants like Wall Street could change that dynamic. Assuming a total crypto market cap of $10 trillion, Ethereums market cap could be ~$1.8 trillion, which works out to about $15,000 per ETH. Solana could reach a market cap of $400 billion to $500 billion, which would put the price of SOL at around $900. While Solana may not outperform Ethereum, it could perform better relative to its current discount.

Ryan: So, you have a slightly higher allocation to Solana than Ethereum, but you don’t think Solana will outperform Ethereum in this cycle. You’re targeting Solana’s market cap to be about 25% of Ethereum’s. That means if Ethereum’s market cap reaches $1.8 trillion, the potential high for SOL is $900, while ETH is $15,000.

مايكل: Exactly. I don’t expect Solana to surpass Ethereum. Ethereum may eventually surpass Bitcoin, but the competition between Solana and Ethereum will continue. I believe there will be four or five major layer 1 platforms, three of which are investable. Solana may outperform Ethereum in this cycle, but it will not surpass it.

Ryan: You have a higher allocation to Ethereum than Bitcoin and a higher allocation to Solana than Ethereum. That’s interesting. Finally, could you please provide price estimates for ETH and SOL based on the market caps you mentioned.

مايكل: Absolutely. For a $1.8 trillion market cap Ethereum, the price per ETH would probably be just under $15,000. For Solana at a $450 billion market cap, the price of SOL would probably be over $900. These estimates are based on a strong second half of a bull cycle. You can adjust these estimates based on whether the market cap reaches $8 trillion or if Ethereum outperforms Bitcoin.

Ryan: If this cycle deviates from historical patterns, such as AI attracting more attention or crypto markets not seeing the expected bull run, what are the chances of this happening? Do you think crypto markets could be sidelined? Or are you going to bet on cycles similar to the past?

مايكل: Crypto markets tend to reflect human behavior. Even if retail investors were hurt in the last cycle, they usually return when prices rise. Wall Street may experience similar FOMO in this cycle. I am not worried that AI will overshadow the crypto market. Historically, the market peaked in the fourth quarter and we are still in the stage of preparing for a strong finish. Factors such as the election cycle, global liquidity, and possible rate cuts from the FED help create a favorable crypto environment. I advise not to overthink and bet on historical patterns and human behavior.

Ryan: So, you’re betting on historical patterns and human psychology, which tend to repeat themselves. By the way, I’ve also noticed an increase in interest in crypto from my family. Finally, can you share where people can access the DeFi Report and your podcast?

مايكل: All of our research can be found at https://thedefireport.io/, where there are written reports and podcasts.

This article is sourced from the internet: Bankless: Why is SOL still undervalued relative to ETH?

في الآونة الأخيرة، تسببت التقلبات الحادة في أسعار BTC في انخفاض حاد في معظم العملات البديلة، لكن TON ارتفعت ضد الاتجاه واخترقت $8 اليوم، مسجلة أعلى مستوى قياسي جديد. في الوقت نفسه، انتعشت عملة NOT من Notcoin، وهي لعبة شهيرة في نظام TON البيئي، بشكل كبير بعد هبوطها إلى $0.015، والسعر الحالي هو $0.0184. إذا تمكنت من اختراق مستوى المقاومة من $0.02 إلى $0.021 بشكل فعال، فقد نتوقع أن تصل إلى أعلى سعر في التاريخ مرة أخرى. بالنسبة لأولئك الذين فاتهم لعبة Notcoin، فإن لعبة Pixelverse في نظام TON البيئي تستحق الاهتمام. فيما يلي، سيقدم Odaily Planet Daily الأسباب التي تجعل Pixelverse تستحق الاهتمام ومشاركة ...