يبدأ تداول صندوق Ethereum spot ETF اليوم. ما حجم التدفقات والضغوط البيعية؟

Original author: Nianqing, ChainCatcher

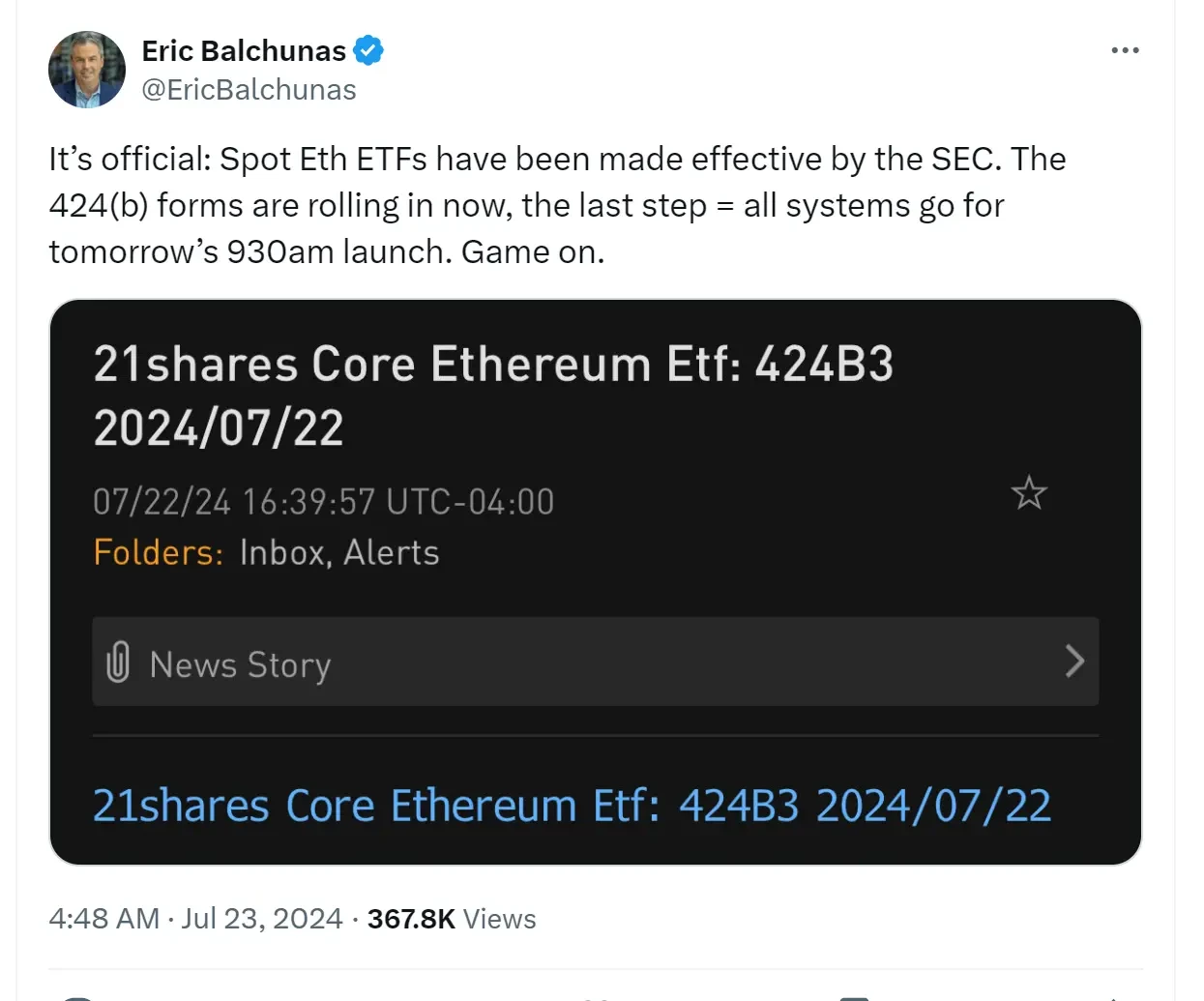

On Monday, local time in the United States, according to regulatory documents and announcements from related companies, the U.S. SEC officially approved the listing and trading applications of Ethereum spot ETFs from multiple companies. The Ethereum spot ETF has officially come into effect, and 424(b) forms are being released one after another. Now we just have to wait for the relevant ETFs to be listed at 9:30 a.m. Eastern Time on Tuesday (21:30 p.m. Beijing Time on July 23).

The first batch of Ethereum spot ETF application issuers include:

-

BlackRock’s spot Ethereum ETF has a fee of 0.25% (0.12% for the first $2.5 billion or the first 12 months), and the ticker is ETHA;

-

The Fidelity Spot Ethereum ETF has a fee of 0.25% (no management fee for the entire year of 2024), and the ticker is FETH;

-

The Bitwise spot Ethereum ETF has a fee of 0.2% (0% for the first $500 million or the first 6 months), and the ticker is ETHW;

-

21 Shares Spot Ethereum ETF has a fee of 0.21% (0% for the first $500 million or first 12 months), and the ticker is GETH;

-

VanEck Spot Ethereum ETF has a fee of 0.2% (0% for the first $1.5 billion or the first 12 months), and the ticker is ETHV;

-

The Invesco Galaxy Spot Ethereum ETF has a fee of 0.25% and the ticker is QETH;

-

Franklin Spot Ethereum ETF has a fee of 0.19% (0% before January 31, 2025 or the first $10 billion), and the ticker is EZET;

-

Grayscale’s spot Ethereum ETF has a fee of 2.5% and its ticker is ETHE;

-

Grayscale Ethereum Mini Trust ETF has a fee of 0.15% and the ticker is ETH.

It is worth mentioning that, like Grayscales GBTC, Grayscale will convert the existing Grayscale Ethereum Trust ETHE into an ETF, still continuing the previous fee rate of 2.5%. In October last year, Grayscale and NYSE Arca jointly applied to convert Grayscales Ethereum Trust Fund into an Ethereum spot ETF.

According to data from Grayscales official website, the ETHE Trust was established in December 2017, listed in June 2019, and listed as an ETF on July 23. Currently, ETHE holds 2.63 million ETH. Because it was established earlier, the average cost of Grayscale holding ETH is only a few hundred dollars. In addition, the fee rate remains at 2.5% after ETHE is converted into an ETF. Some people believe that since ETHE was previously a trust and redemption was not allowed during its existence and there was a 6-month lock-up period, coupled with the high fee rate of ETHE, which is 10 times higher than that of its competitors, this will lead to a large outflow.

Although Grayscale introduced the Grayscale Mini Trust ETF to prevent capital outflow (the fee was reduced from 0.25% to 0.15%, free for the first 6 months, and currently the ETF with the lowest fee), it is still difficult to avoid selling pressure like that after GTBCs listing.

Opinion: ETHE’s selling pressure will not be as great as GBTC’s

ETHE Trust was launched in 2019. Like GBTC, it is one of the earliest funds tied to ETH in the US market. Previously, ETHE was a closed-end fund. Because of its structure, the fund price was at a premium or discount to the net asset value, which provided certain arbitrage opportunities. However, due to a series of bankruptcies such as FTX and DCG, trusts such as GBTC were once criticized by the market as the initiators of institutional bubbles and collapses.

In addition, compared with trust products, ETFs have higher transparency, stronger liquidity, lower thresholds and redemption risks, and are more easily accepted by mutual fund managers and pension funds. Therefore, they are more likely to be popular in the market. Therefore, while other institutions are applying for crypto asset spot ETFs, Grayscales trust products such as GBTC and ETHE have eventually been converted into ETF products in order to avoid being gradually marginalized.

Because the selling pressure after GBTC was successfully converted into a Bitcoin spot ETF lasted for more than a month, the market is also concerned about the potential large-scale outflow after ETHE is listed.

According to Farside Investors data, GBTC has been facing capital outflows, with a cumulative net outflow of $18.49 billion as of July 22. Although Grayscales 2.63 million ETH (worth about $9.3 billion) is much smaller than GBTC, it is conceivable that ETHEs high fees will still lead to some outflows.

لكن، @Analyst Theclues believes that there are huge differences between ETHE and GBTC, and the selling pressure after ETHEs listing will not be as intense as that of GBTC.

She believes that there were no twists and turns before the BTC ETF was passed, and expectations were stable. It rose nearly 100% in the three months before January 10.

The ETH ETF has been full of twists and turns, especially the huge reversal from “cannot pass in the short term” to “pass in July”. The expected speculation started again from 2800, and it has increased by 21% so far. The motivation for Sell news comes from the expected profit of the speculation funds. In comparison, the motivation for ETH being sold is incomparable to that of BTC.

In addition, although ETHE also has arbitrage profit-taking (buying at a 40% discount), there is a big difference between ETHE and GBTC. Before GBTC was converted to an ETF, its weekly trading volume was only more than 100 million US dollars, while ETHE currently has a weekly trading volume of more than 400 million US dollars, which has lasted for several weeks. In addition, the ETHE premium narrowed to less than 6% very early, while the premium gradually recovered two weeks before GBTC was converted to an ETF. Therefore, ETHE arbitrage has enough space and market depth to sell ETHE shares. She believes that many predictions of market crashes are based on the view that the predicted subject is static and is very subjective.

In addition, even if ETHE is under selling pressure and market crash in the short term, it will be absorbed by other Ethereum ETFs in the long term. We can see from the inflow and outflow trends of Bitcoin spot ETFs that although GBTC has a large outflow, as of July 22, the net inflow of Bitcoin spot ETFs has exceeded US$17 billion. And from the perspective of price performance, selling pressure has not had much impact on Bitcoin prices.

Another key move for ETHE compared to GBTC is that Grayscale has spun off the Mini Trust ETF from ETHE. According to its official website, as of July 18, 2024, 10% of the underlying ETH of the Grayscale Ethereum Trust (ETHE Trust) was split at the same time as the creation of the Grayscale Ethereum Mini Trust (ETH Trust). Therefore, the net asset value of ETHE Trust shares will be 10% lower than the net asset value on the previous day on July 18, 2024 (without considering any potential increase or decrease in the price of ETH). ETHE Trust shareholders do not need to take any action to obtain the spin-off proceeds and will be entitled to ETH Trust shares at a 1:1 ratio. Therefore, their overall exposure to ETH will remain unchanged.

That is, Grayscale currently has two ETFs, ETHE and ETH. ETHE holds 90% of the initial ETH and has a management fee of 2.5%, which is more suitable for institutions and professional investors. ETH holds 10% of the initial ETH and has a lower management fee to reduce user loss and reduce potential selling pressure.

Therefore, compared to GBTC, ETHE outflows will be more modest as holders transition to the Mini Trust ETF.

Grayscale’s Mini Trust ETF can also help long-term holders reasonably avoid taxes, which helps ETHE holders find a good middle ground between not reducing income and selling, especially those holders who are hit by potential capital gains taxes.

Estimated inflow scale of ETH ETF

At present, many institutions have estimated the inflow scale of ETH ETF:

البحث في درجات الرمادي expects that the demand for US spot Ethereum ETFs will reach 25%-30% of the demand for spot Bitcoin ETFs. A large portion of Ethereum supply (such as staked ETH) may not be used for ETFs.

ASXN Digital Asset Research believes that when the ETH ETF goes live, ETHE holders will have 2 months to exit at a price range close to par. This is a key variable that will help prevent ETHE outflows, especially exit flows. ASXNs internal estimate is that $800 million to $1.2 billion will flow in per month. This is calculated by taking a market-cap-weighted average of monthly Bitcoin inflows and multiplying it by the market cap of ETH.

Bloomberg ETF analyst Eric Balchunas predicts that the Ethereum spot ETF could gain 10% to 15% of the assets gained by the Bitcoin spot ETF, reaching $5 billion to $8 billion.

Galaxy expects the net inflows of the ETH ETF to reach 20-50% of the net inflows of the BTC ETF in the first five months, with a target of 30%, which means a net inflow of US$1 billion per month.

Shenyu predicts that the main capital inflows in the initial listing period between June and December may come from retail investors, accounting for 80 to 90% of the total funds, with less participation from institutional users. Considering that ETHE is similar to GBTC, the market may face some arbitrage and selling pressure, and whether it can withstand such selling pressure remains to be seen. After December, institutional investors may gradually enter the market.

But the market generally believes that the inflows brought by ETH ETF are limited.

JPMorgan’s Nikolaos Panigirtzoglou predicted in late May that Ethereum ETF inflows would likely be only a fraction of Bitcoin’s.

Citigroup expects ETF inflows to account for 30%-35% of Bitcoin inflows, which could amount to $4.7 billion to $5.4 billion over the next six months, CoinDesk cited in the report.

Both banks believe that Bitcoin has a first-mover advantage and emphasize that the functions provided by Ethereum cannot be achieved through ETFs, thus limiting demand.

How will ETH price be affected?

At present, the general view in the market is that since the approval of the Ethereum spot ETF appeared in May, the phenomenon of Sell the News appeared, and the SEC had a long enough waiting time between approving the 19-b and S-1 application documents, which led to the fact that the impact of the ETF on the market may have been digested, so the ETH ETF will not bring too much fluctuation to the price of ETH.

In addition, there are some more optimistic views that Ethereum will outperform Bitcoin after the first batch of ETFs are launched.

Research from analysis firm Kaiko shows that the upcoming ETH ETF should enhance ETHs performance relative to BTC. Kaiko said that since regulators approved the ETF in May, the ETH to BTC ratio (a metric used to compare the two major cryptocurrencies) has risen sharply, from 0.045 to 0.05, and has remained high. In other words, it takes more Bitcoin to buy one ETH, and this trend will only deepen when the ETF goes online. Although the price of ETH has fluctuated up and down since May, the ratio shows that ETH is ready to rise.

Rachel Lin, CEO of SynFutures, said in May that in addition to demand factors, supply changes will also bring upside, which will lead to a tightening of the price ratio of BTC to ETH. She believes that the markets attitude towards Ethereum is not optimistic enough now , and all indicators show that ETH will see a massive bull run in the coming months.

This article is sourced from the internet: Ethereum spot ETF starts trading today. How big is the inflow and selling pressure?

Related: 53 facts about Vance and Thiel

Original author: Lonely Brain The following information is compiled from the Internet. 01. Some people believe that Elon Musk, Peter Thiel, and David Sacks, the three leaders of the PayPal Mafia, have made another successful bet. 02. The PayPal Mafia is the largest group in Silicon Valley. Most of the key PayPal employees have left since it was sold to eBay in 2002, but they still maintain close contact. They even gave their group a name – PayPal Mafia. 03. What are the characteristics of the “Paypal Mafia”? “We initially hired mostly people from our own circle,” Thiel recalls. “I hired my friends from Stanford, and Levine hired his friends from the University of Illinois.” They were looking for a certain type of employee: someone who was competitive, knowledgeable, multilingual,…