إصدار خاص من SignalPlus Macro Research: عبور الروبيكون

The assassination attempt on former President Trump while he was giving a speech in Pennsylvania undoubtedly dominated the news over the weekend. After the failed assassination attempt, the former presidents chances of winning the election further jumped to around 70%.

While the United States may be a divided country with increasingly polarized views, the country is united on issues involving homeland security and attacks on politicians. The failed assassination attempt on former President Reagan in 1981 likely contributed to his subsequent landslide victory, and with just a few months left before the November vote, there is a greater chance of a repeat. Now that the election outcome seems to depend almost entirely on whether Trump can maintain his current advantage, the liberal media and opposition will have to tone down their harsh criticism in the rest of the campaign.

Macro markets are likely to trade on a Trump victory as a pre-condition, which would have significant implications for all asset classes. While we are not political experts, we believe a second term Trump administration would likely adopt a more hawkish approach.

Currently, Republicans and Trump supporters believe that:

-

Opposition attempts political witch hunt, sentences former president to 700 years in prison

-

The recent push for noncitizen voting rights could give Trumps opponents a large share of the immigrant vote.

-

An assassination attempt occurred in broad daylight, and it is clear that there were serious security gaps

If Trump is re-elected, the market may expect:

-

Aggressive fiscal spending and profligate taxation

-

US-China tensions escalate

-

Put more pressure on Europe to pay more than $200 billion for NATO protection, especially in light of the ongoing Russia-Ukraine conflict

-

Block illegal immigration

-

A conservative Supreme Court turn similar to the first term, with an aggressive “purge” of key civil servants, government employees, and others in the Washington ecosystem

The aggressive spending plan will further exacerbate the already severe bond supply and budget deficit situation, and bond yields are likely to experience a steep bearish trend. During Trumps first term, the 10-year yield rose by about 200 basis points in 18 months.

As Trump may win a second term, both U.S. economic growth and inflation are slowing. Last weeks CPI data fell to the lowest level since 2021 as housing costs finally slowed. The core CPI rose 0.1% from May, the slowest growth in three years, and the overall indicator fell for the first time since the epidemic.

The market definitely sees last Thursdays CPI as a watershed moment in the current cycle, with the market now expecting a 95% chance of a rate cut in September, and we can imagine that the Trump administration will certainly put pressure on the Federal Reserve to implement more aggressive interest rate easing in 2025 as a means of stimulating the next wave of the economy.

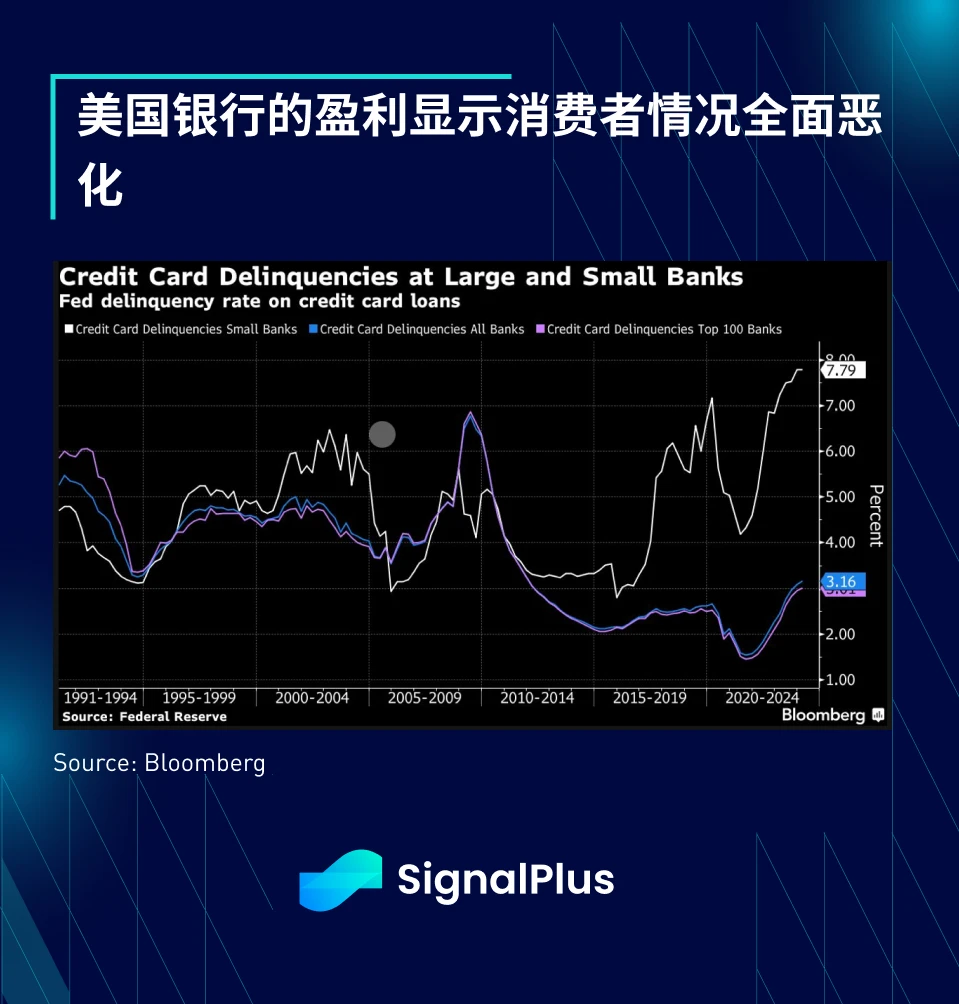

Speaking of a slowing economy, earnings from the largest U.S. banks confirm a general deterioration in consumer conditions, with most banks setting aside more cash to deal with customer defaults, and Citigroup/Wells Fargo/JPMorgan Chase all seeing an uptick in loan charge-offs as consumers deplete their pandemic savings. Credit card delinquencies at smaller banks have risen to a 30-year high, and for the banking industry as a whole to a 10-year high.

Last Friday, the University of Michigan Consumer Confidence Index also fell short of expectations for the fourth consecutive month, with respondents saying that a weak job market and high prices have dampened overall confidence. The official survey report noted: Nearly half of consumers spontaneously complained that high prices are eroding their living standards, approaching the record high set two years ago.

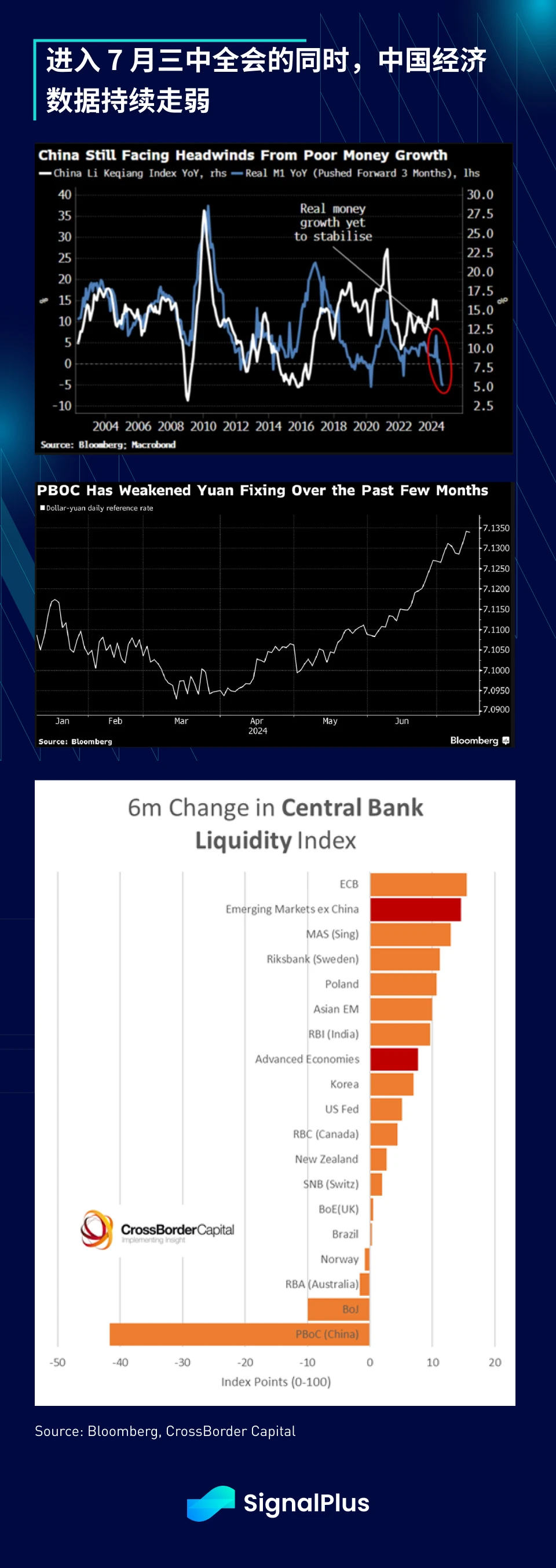

Outside the United States, economic data last week also confirmed the weak recovery of the Chinese economy, with CPI up 0.2% year-on-year, lower than the expected 0.4%. Loan and credit growth both hit record lows in June, with weak end-user demand. In addition, new RMB loans, social financing scale and import data (-2.3% year-on-year, lower than the expected +2.5%) were also sluggish. As we enter the Third Plenary Session of the 18th CPC Central Committee in July, the Chinese government is undoubtedly disappointed with the pace of recovery.

Back to the US stock market, the SPX index continues to hover near all-time highs, and shorts are capitulating. JPMorgan estimates that long equity futures positions are back to their highest level in the past 10 years (as a percentage of open interest), while cash allocations have broken through the lowest level since 2000. However, despite the higher stock prices, global new stock supply remained negative for the third consecutive year, and the IPO market remained closed to most issuers.

Interestingly, macro bears may be surprised to learn that the bond-equity correlation (yields don’t always move unilaterally with stock prices) shows that the US economy has never been at risk of a recession over the past two years, with the correlation swinging between soft landings, no landings, and occasional expansionary expectations during strong data bursts. This is a reminder that while macro assets are extremely forward-looking and self-correcting, it is often the interaction between assets that tells the full story, not the absolute level of a single variable (such as an inverted yield curve). Keep an eye out for when yields fall along with stock prices, that’s the first real sign that the market is finally convinced that we are heading into a slowdown phase.

In terms of cryptocurrencies, prices have clearly benefited from the increased probability of Trumps victory, with BTC rebounding to around $62,500, rebounding more than 10% after the previous sell-off. The Bitcoin Conference confirmed that Trump will still attend the conference in Nashville at the end of July, and will continue to support cryptocurrencies as stated in his campaign statement.

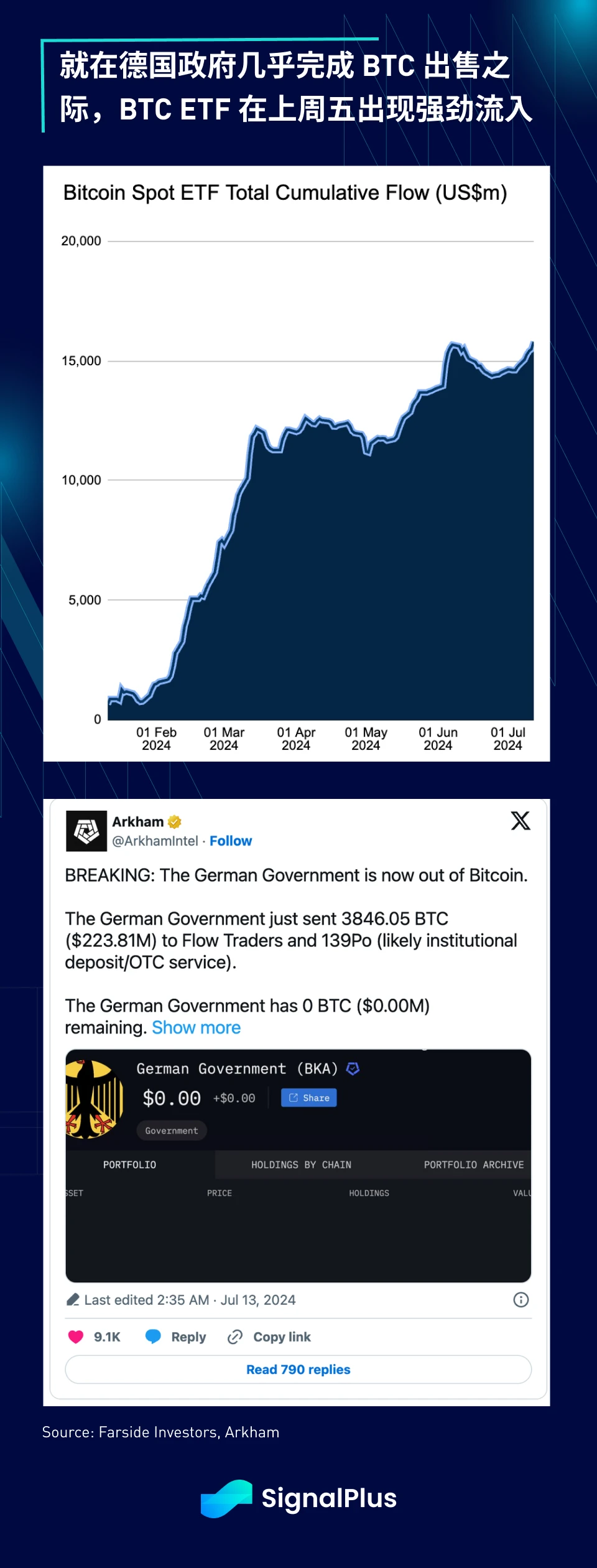

In terms of capital flows, BTC spot ETFs saw a large inflow last Friday, totaling $310 million, the largest inflow since June 5. According to Arkham data, investors believe that the German government has sold all BTC and returned to the buy-on-dip mode. Despite this, the market still needs to deal with the repayment issue of Mt. Gox. It is expected that about 140,000 BTC (worth $8.5 billion) will hit the market. However, there is always light at the end of the tunnel. The upcoming September rate cut and Trumps possible victory are expected to provide further support for cryptocurrencies.

In terms of price action, it is reassuring that BTC has managed to hold the $50,000 region during the recent sell-off, which was the breakout area after BTC was approved in January, and market sentiment may shift to selling puts/buying on dips.

I wish you all a smooth transaction!

يمكنك البحث عن SignalPlus في متجر المكونات الإضافية لـ ChatGPT 4.0 للحصول على معلومات التشفير في الوقت الفعلي. إذا كنت ترغب في تلقي تحديثاتنا على الفور، يرجى متابعة حسابنا على Twitter @SignalPlus_Web3، أو الانضمام إلى مجموعة WeChat الخاصة بنا (أضف مساعد WeChat: SignalPlus 123)، ومجموعة Telegram ومجتمع Discord للتواصل والتفاعل مع المزيد من الأصدقاء. الموقع الرسمي لـ SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Research Special Edition: Crossing the Rubicon

Related: Pixelverse Completes $5.5 Million Funding to Promote Global Web3 Gaming

Startup entertainment studio and gaming ecosystem Pixelverse has completed a new round of financing, which was led by a Tier 1 venture capital fund and prominent founders from gaming and Web3, raising a total of $5.5 million. The new funds will be used to fund the development of the Pixelverse gaming ecosystem. Notably, the ecosystem has attracted more than 15 million users in less than a month of operation. This round of financing was led by Delphi Ventures, Merit Circle and Mechanism Capital, and other investors included Bitscale Capital, Ghaf Capital, Big Brain Holdings, LiquidX, Foresight Ventures, The Sandbox founder Sébastien Borget, Luca Netz, Dingaling, DCF GOD, Grail and James Kwon. The funding round comes at a time of growth for Pixelverse, which has more than 15 million registered users…