أخبار سولانا الأخيرة: استكشاف التطبيقات المبتكرة لصناديق الاستثمار المتداولة، وActions and Blinks، وTipLink

المؤلف الأصلي: dt

This weeks crypto market still failed to break the downward trend, and the overall market continued to be sluggish. Many people began to doubt whether the future and potential of cryptocurrencies are still bright. To explore the future, whether it can really achieve large-scale adoption is definitely the key. The SOLANA roadmap development direction, which has been supported by ETF news recently, is currently the project that has made the most efforts in this regard.

In this issue of Cryptosnap Dr.DODO, we will take you to understand the latest updates of the SOLANA public chain and its various applications in large-scale adoption.

Solana ETF

When talking about Solanas recent events, VanEcks application for the first Solana ETF must be mentioned. Although the market generally believes that the news is more symbolic than practical, it still gave Solana a shot in the arm. VanEck believes that the current US Securities and Exchange Commission (SEC) is wrong to regard $SOL as an unregistered security, but rather believes that SOL is a commodity similar to Bitcoin and Ethereum. After Bitcoin and Ethereum ETFs have been approved, the application for $SOL ETF is also reasonable.

Most people in the market think that this application is unlikely to be approved under the current environment. The SEC has previously made it clear that $SOL is a security. VanEck is more of a prediction for the US election in the second half of the year. The current SEC Chairman Gary Gensler will step down by then. Cryptocurrency voters may play a key role in the election, and the regulatory environment in Washington is moving in the direction of supporting cryptocurrencies.

Source: https://www.sec.gov/Archives/edgar/data/2028541/000162828024030249/vanecksolanatrusts-1.htm

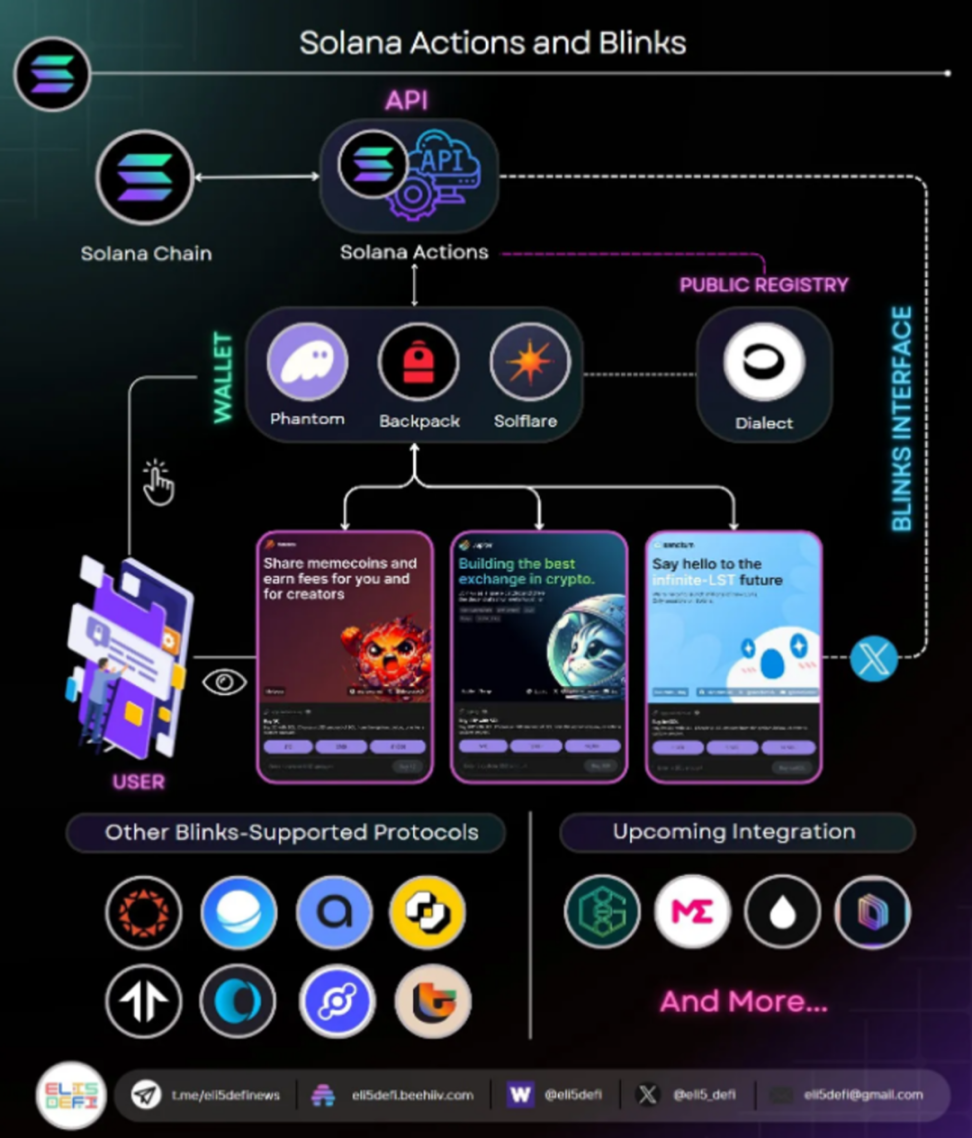

Actions and Blinks

After talking about the major news at the token market level, another big news in the Solana ecosystem is Solana Actions and Blinks. Actions and Blinks are a new type of on-chain interaction function launched by the Solana Foundation in collaboration with Dialect.

Simply put, Actions is a set of standardized APIs for transactions on the Solana blockchain for developers. Any project party can adapt its own protocol based on the documentation; and Blinks is an interactive front-end for users. Blinks can convert any Solana Action into a shareable, metadata-rich link. You can put the link on X (Twitter) or Discord to generate a button option for on-chain interaction.

The launch of Actions and Blinks is the best reflection of Solana鈥檚 efforts towards mass adoption, lowering the threshold for using blockchain by one level. Retail investors can complete on-chain operations by simply swiping on social media and clicking buttons, without the need to jump to websites to connect to wallets, etc.

Source: https://x.com/eli5_defi/status/1805877572238295296

Tiplink

When talking about Solanas route to large-scale adoption, we have to mention the wallet application TipLink. The author believes that TipLink is the most user-friendly and has the lowest threshold of all wallets. TipLink is also a project strongly supported and sponsored by the Solana Foundation. In 2023, it received financing from Multicoin, Solana Venture, Sequoia Capital, and two major stablecoin companies Paxos and Circle.

TipLink is a custodial wallet. Users do not need to write down the note words. They only need to register and log in with a Google account, which is very similar to the experience of many Web2 applications. There is no need to install plug-ins or apps. Just open the web page and connect to the Google account. In the early days, TipLink was a reward application that only supported payment functions, but now it has become a very mature wallet product comparable to Phantom. With the latest function update of TipLink Adaptor and the mainstream applications on the Solana chain, they can connect to the wallet and interact with it, which is no different from other wallets.

Source: https://tiplink.io/

رأي المؤلفين

The author believes that Solana is indeed the most suitable chain for beginners to use at present. With low transaction fees, quick-to-use wallets and simple and clear front-end interactive interfaces, it can be easily used by intuition. In addition, the clear route of the Solana Foundation can drive a number of ecological applications on the chain to keep up with the pace. The function of Blink is the best example this time. Basically, at the same time when the Solana Foundation issued a tweet announcement, all projects on the chain, regardless of size, forwarded the tweet. Phantom/Solflare/Backpack wallets supported Blink interaction at the first time, and Jupiter/Tensor/Sanctum, these Defi Dapps, also prepared the Actions API early, and users can use it immediately.

The Solana Foundations clear development path and its unanimous cooperation with ecological projects are what I believe to be Solanas strongest moat at present. At the same time, I also strongly agree with Solanas development direction towards large-scale adoption. Compared with hot topics such as exquisite financial products, advanced technologies, or the pursuit of artificial intelligence, the current priority of the blockchain circle is to lower the threshold and allow more people to join!

This article is sourced from the internet: Solana Recent News: Exploring the Innovative Applications of ETFs, Actions and Blinks, and TipLink

Related: The re-staking war heats up: Do we really need so many re-staking players?

Original author: Donovan Choy, Crypto Analyst Original translation: Golden Finance xiaozou 1 Introduction The restaking war is heating up. Challenging EigenLayer’s monopoly is another new Lido-backed protocol, Symbiotic. The latest entrants have competitive advantages in protocol design and BD partnerships. Before we delve into the latest competitive dynamics in the restaking space, we need to understand what key risks exist in the space. 2. Current issues with re-staking Today, re-staking works like this: Bob deposits ETH/stETH into a liquidity re-staking protocol like Ether.Fi, Renzo, or Swell, which delegates it to an EigenLayer node operator, who then ensures that one or more AVSs return part of the proceeds to Bob. There is a compounding risk in the current situation because of its one-size-fits-all nature. EigenLayer node operators handle thousands of assets…