10 تحيزات نفسية عليك التغلب عليها

المؤلف الأصلي: Koroush AK

الترجمة الأصلية: TechFlow

Your biggest trading mistakes are not technical, but psychological. These biases destroy countless traders.

Avoid the following at all costs:

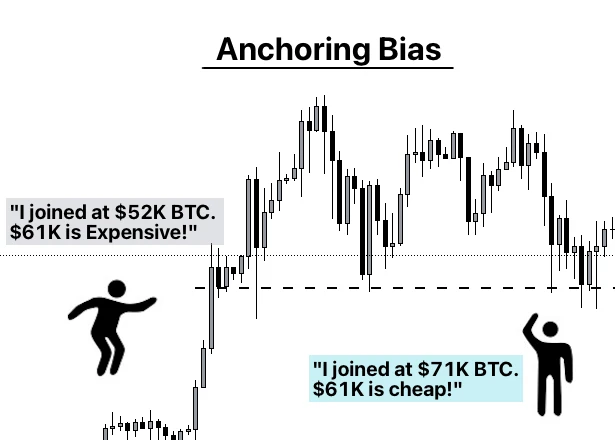

1. Anchoring Bias

-

Traders focus on one price (anchor), which may influence their decision making.

-

If Trader A got into crypto when BTC was at $52,000, then $61,000 BTC would seem expensive.

-

If Trader B gets into crypto when BTC is at $71,000, then BTC at $61,000 seems like a bargain.

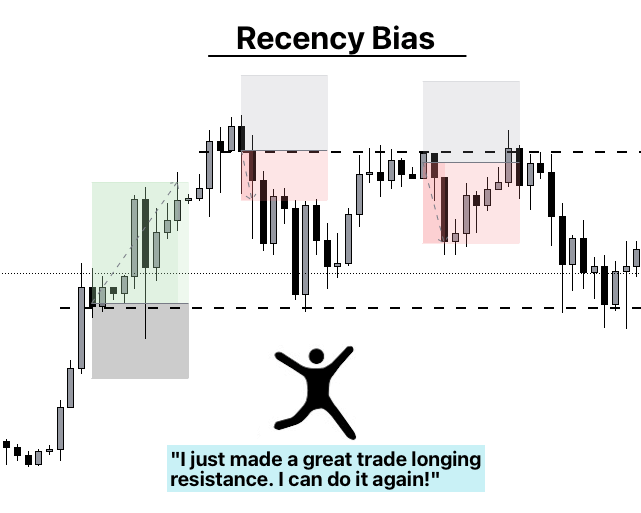

2. Recency Bias

This is the tendency to remember the most recent information and to value it most.

Traders may carry information from recent trades into the next trade, which can lead to overconfidence and losses.

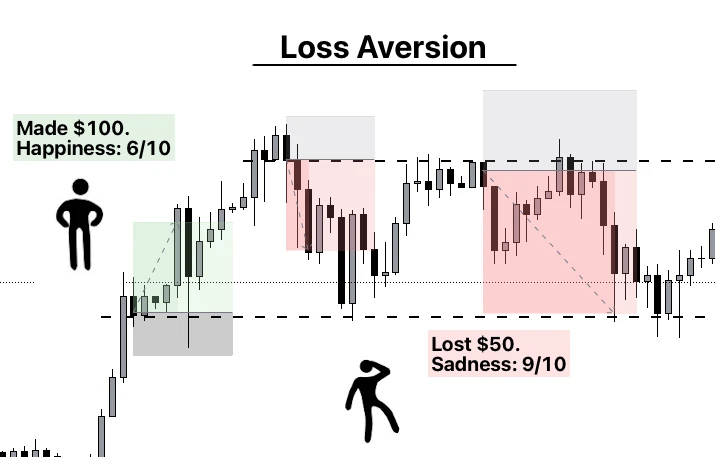

3. Loss Aversion

Traders feel their losses more acutely than their gains.

The pain of losing $100 may be greater than the pleasure of making $100.

This bias can cause traders to give up profits too early because they worry that these gains will turn into losses.

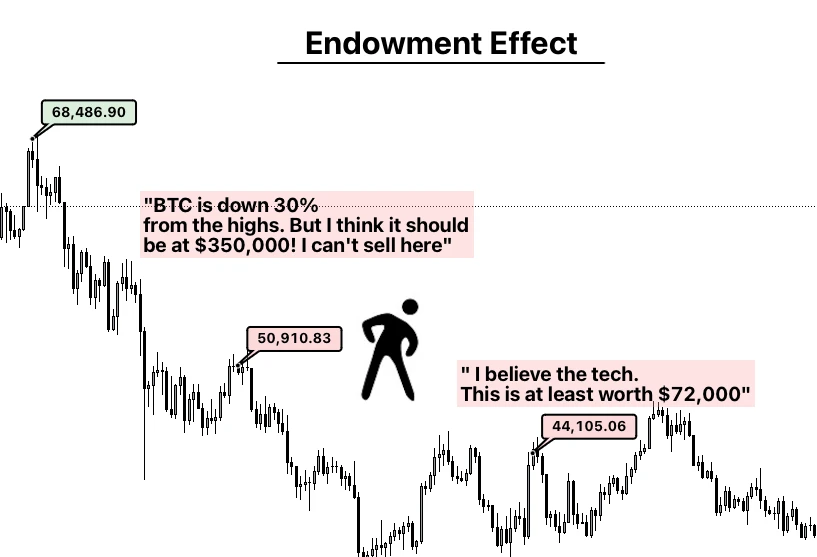

4. Endowment Effect

When traders hold onto an asset, they tend to overestimate its value.

This emotional attachment makes it difficult for them to sell at a loss, or even at a fair price, because they rely more on their own expectations than on market realities to judge the future price of the asset.

5. Herd Mentality

There are risks whether you blindly follow the crowd or deliberately go against the crowd.

Stick to your trading plan and avoid acting impulsively based on the behavior of the crowd.

The behavior of the crowd should only be taken into account when conducting an objective market sentiment analysis.

6. Availability Heuristic

Traders tend to place too much weight on information that is most emotionally charged or recent.

For example, the recent market crash may make traders overly cautious, even though market conditions have changed.

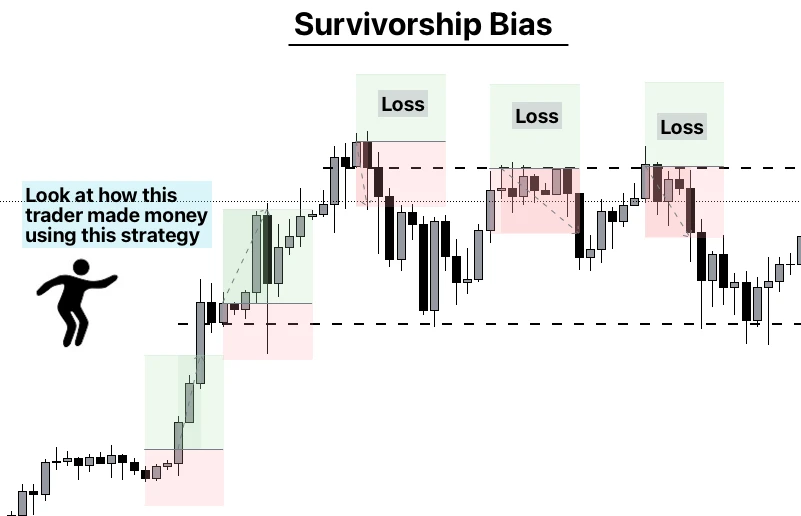

7. Survivorship Bias

Systematically overestimate the probability of success.

We often see stories of success, while stories of failure are often forgotten.

8. Framing Effect

The way information is presented influences decision making.

Traders emotions and confidence can influence their risk assessment.

Positive emotions may lead to underestimation of risk, while negative emotions may lead to overestimation of risk.

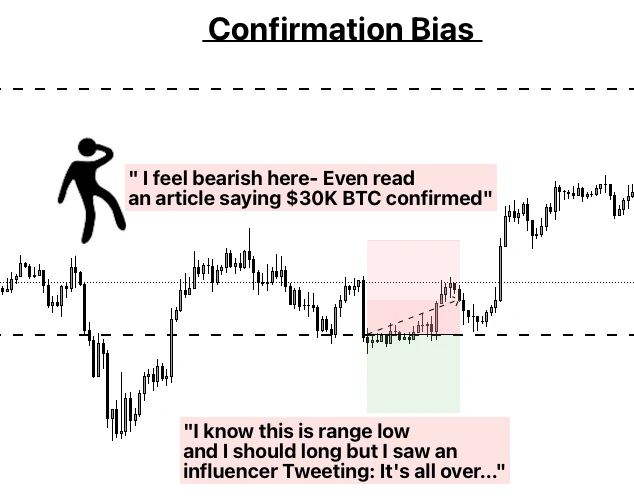

9. Confirmation Bias

Traders tend to look for data that supports their beliefs.

If you are bullish on an asset, you will look for all the information that supports the bullishness of that asset and ignore the bearish data.

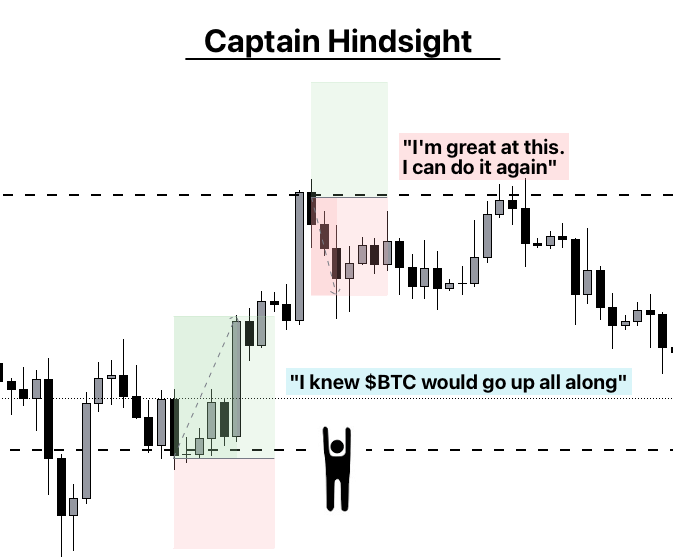

10. Captain Hindsight

In hindsight, it鈥檚 all obvious.

After an event occurs, traders often feel that they had foreseen the outcome.

This bias can lead to overconfidence in future forecasts and unrealistic expectations about one鈥檚 own trading abilities.

This article is sourced from the internet: The 10 psychological biases you need to overcome

أعلنت مؤخرًا طبقة الألعاب الفائقة Zentry (المعروفة سابقًا باسم GuildFi) عن أحدث معلومات الخزانة للنصف الأول من عام 2024. اعتبارًا من 22 مايو 2024، يبلغ إجمالي خزانة Zentry $151,367,382، بزيادة قدرها حوالي 44% منذ بداية عام 2024. يتكون توزيع خزانة Zentry من جزأين: الاحتياطيات السائلة والاستثمارات، بما في ذلك: - إجمالي الاحتياطيات السائلة $78,105,000، بما في ذلك العملات المستقرة والعملات المشفرة الرئيسية، بما في ذلك $17,850,000 في العملات المستقرة، موزعة في USDC وUSDT، المستخدمة في مختلف بروتوكولات الإقراض وتوليد العائد، و$60,255,000 في العملات المشفرة، بما في ذلك ما يقرب من 16,000 ETH، موزعة عبر بروتوكولات متعددة. - تشمل الاستثمارات رموز البذور والأسهم والرموز السائلة ورموز NFTs، بإجمالي $73,262,382. خزينة Zentry ممتلئة، مما يوفر دعمًا ماليًا قويًا لتطوير المشروع. هذه البيانات الضخمة للخزانة ليست مجرد رقم، بل تمثل أيضًا نفوذ Zentry و...