تشتعل حرب إعادة الرهان: هل نحتاج حقًا إلى هذا العدد الكبير من اللاعبين الذين يعيدون الرهان؟

Original author: Donovan Choy, Crypto Analyst

Original translation: Golden Finance xiaozou

1 Introduction

The restaking war is heating up. Challenging EigenLayer’s monopoly is another new Lido-backed protocol, Symbiotic. The latest entrants have competitive advantages in protocol design and BD partnerships. Before we delve into the latest competitive dynamics in the restaking space, we need to understand what key risks exist in the space.

2. Current issues with re-staking

Today, re-staking works like this: Bob deposits ETH/stETH into a liquidity re-staking protocol like Ether.Fi, Renzo, or Swell, which delegates it to an EigenLayer node operator, who then ensures that one or more AVSs return part of the proceeds to Bob.

There is a compounding risk in the current situation because of its one-size-fits-all nature. EigenLayer node operators handle thousands of assets that are used to validate multiple AVS. This means that Bob has no say in the potential risk management associated with which AVS the node operator chooses.

To be sure, Bob can try to choose a “safer” node operator, but there are hundreds of operators competing against each other who want your re-staked collateral and are all incentivized to validate as many AVS as possible to maximize your returns.

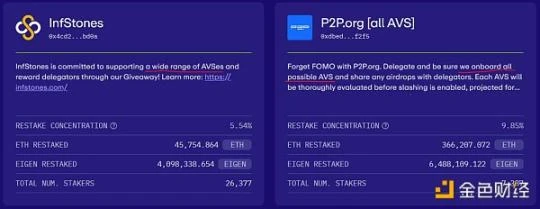

Taking a quick look at the node operator page on EigenLayer, we can see many very obvious advertisements like the one below.

This competitive situation may lead to a bad result that no one wants: each node operator verifies the AVS that they believe is absolutely reliable. When the AVS operation is interrupted and a penalty event occurs, no matter which operator Bob chooses, he will be affected.

3. Understand Mellow Finance

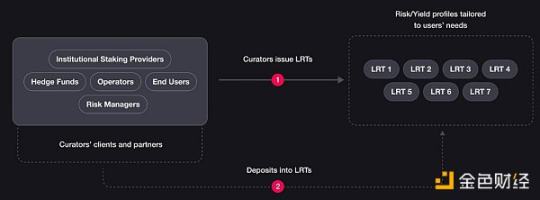

Mellow solves this problem (to some extent). Mellow, also known as modular LRT, is the middleware of the re-staking technology stack.

(middleware) layer, providing customizable liquidity re-pledge vaults. With Mellow, anyone can become their own Ether.Fi or Renzo and build their own LRT vault. These third-party managers on Mellow will have full control over which re-pledge assets to accept, and users will then choose assets based on their risk preferences and pay a certain fee for it.

Here’s a ridiculous example: Alice is a DOGE fanatic and is investing in DOGE for yield. She sees a vault on Mellow called DOGE 4 LYFE. She deposits her DOGE into this DOGE 4 LYFE vault, gets re-staking yield, and she pays a small fee to the operator to get LRT called rstDOGE, which she can then use as DeFi collateral elsewhere. This is not possible at the moment because DOGE is not on EigenLayer’s whitelist. Even if EigenLayer founder Sreeram turns his sights on DOGE, the incentive misalignment problem faced by node operators mentioned earlier still remains.

If all this sounds familiar, it’s because similar services have already emerged in the DeFi lending space, such as Morpho, Gearbox, or (DeFi veterans from the last cycle may remember) the now-deprecated Fuse protocol developed by Rari. In the case of Morpho, it allows the creation of lending vaults with custom risk parameters. This allows users to borrow assets from vaults with unique risk profiles, rather than the one-size-fits-all lending pools on Aave. In the upcoming V4 upgrade, Aave also plans to upgrade the protocol with separate lending pools.

4. Mellow x Symbiotic x Lido Strategy

Since Mellow is just a middleware re-staking protocol, the assets in its vault must be re-staking somewhere. Interestingly, Mellow did not align strategically with EigenLayer, but chose to launch the upcoming re-staking protocol Symbioti, which is backed by Lido’s venture capital firm cyber•Fund and Paradigm (Paradigm also backed Lido).

Unlike EigenLayer or Karak, Symbiotic supports multi-asset deposits of any ERC-20 token, making it the most permissionless token to date. Any asset, from ETH to meme coins, can be used as re-hypothecated collateral to secure the AVS. This could open the door to the worst kind of crypto degradation: imagine a Symbiotic AVS secured by re-hypothecated DOGE collateral.

While all this is technically possible, it ignores the modular nature of the Mellow product, which allows for infinite composability designed by third-party vault managers. Here, the rationale for Mellow’s integration with Symbiotic becomes clear, as the assets can still be used on other re-staking protocols such as EigenLayer or Karak.

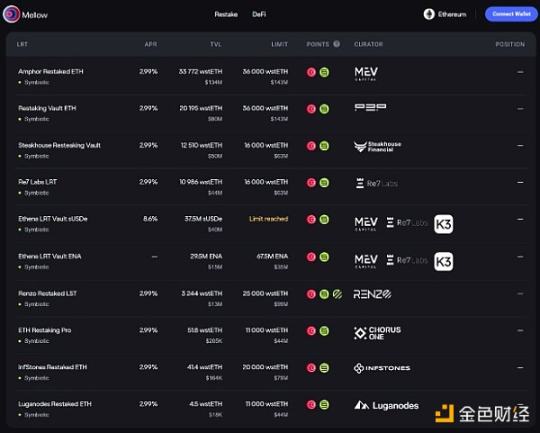

So far, many managers have opened their own LRT vaults on Mellow. Unsurprisingly, given Lido’s close collaboration with Mellow (more on that later), most of them will use stETH as collateral.

The exception is the two Ethena vaults that accept sUSDe and ENA. Indeed, Mellow has accomplished an amazing feat — its first sUSDe vault is already full.

The final step in Mellow’s strategy is to participate in the recently announced “Lido Alliance,” an official association of Lido projects. Mellow benefits through Lido’s stETH direct deposit channel, which explains why it has pledged 10% of its MLW token supply (100 B) to facilitate the partnership. On the other hand, Lido also benefits from this as it attempts to recapture stETH capital from liquidity re-staking competitors. Since the re-staking climate took shape in 2024, Lido’s growth has been stagnant due to liquidity being taken away by LRT competitors.

5. Market traction

Symbiotic’s competitive advantage over EigenLayer or Karak comes from its tight integration with Lido. The core idea is that Lido node operators can issue their own LRT through Mellow/Symbiotic and internalize an additional wstETH yield layer in the Lido ecosystem, returning value to the Lido DAO.

Depositing stETH into a Mellow vault now earns four more layers of returns in addition to the corresponding vault’s LRT tokens:

-

stETH APY

-

Mellow Points

-

Symbiotic Points

-

Re-staking APY (after AVS runs on Symbiotic)

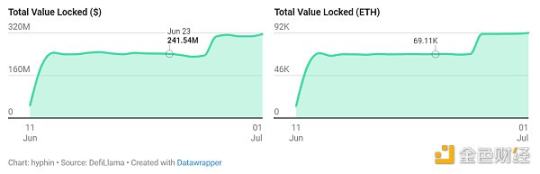

In less than two weeks since Symbiotic opened deposits, it has accumulated $316 million TVL.

Symbiotic TVL

The total locked value of assets on Symbiotic (including all chains) denominated in USD and ETH is as follows:

Mellow, on the other hand, has a TVL of $374. Both of these are fairly early positive signs that Lido is going to be on to something here.

Mellow LRT TVL

The total locked value of assets (liquidity re-collateralization tokens) denominated in USD and ETH on Mellow (including all chains) is as follows:

As of June 20, four Mellow pools have been launched on Pendle:

Currently, only Mellow points are eligible for access to these pools until the Symbiotic cap is raised. To compensate, Mellow awards 3x points for deposits (1.5x if you deposit directly on Mellow). Given the extremely short expiration dates, the liquidity of these pools is also quite low, so if you try to buy YT, the slippage will be quite high. The best strategy at the moment is probably PT Fixed Yield, which is a fairly high yielder, with an APY of 17%-19% across all four vaults.

6. Overview of the re-staking ecosystem

The re-staking battlefield is becoming more and more complicated. Lets make a brief summary. As of today, there are three major re-staking platforms. In order of TVL, they are EignLayer, Karak, and Symbiotic.

Re-staking agreement TVL

The total value of locked assets on EigenLayer, Karak, and Symbiotic (including all chains) is as follows:

All three re-pledge platforms offer to sell security for AVS. Given ETH’s dominance and deep liquidity, stETH becomes an obvious choice for EigenLayer collateral. Karak has already expanded the range of re-pledge collateral from ETH LST to stablecoins and WBTC collateral. Now, Symbiotic is pushing the envelope and supporting the use of any ERC-20 collateral.

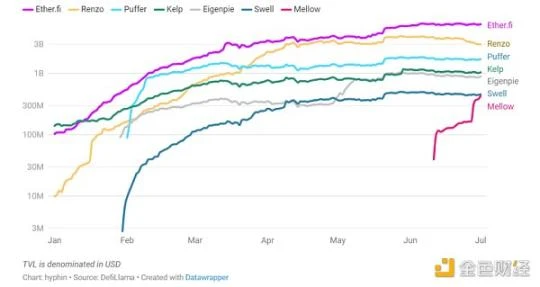

At the same time, LRT protocols like Ether.Fi, Swell, and Renzo saw an opportunity and began to compete with Lido with their own points activities.

Liquidity re-staking token TVL

The total value of assets locked in liquidity re-staking protocols (including all chains) so far this year is as follows:

Lido has enjoyed a dominant position in the DeFi space with stETH, but this time it has begun to lose market share, which has flowed into the LRT protocol. For Lido, the simple response might be to strategically position stETH from LST to an LRT asset. But the reality is that Lido still holds stETH as LST, but will cultivate its own re-staking ecosystem while retaining stETH. To this end, Lido is strongly supporting Symbiotic and Mellow to become part of the Lido Alliance to provide a permissionless, modular re-staking product. To summarize the sales strategy is as follows:

-

Dear projects with tokens, don’t wait for EigenLayer to whitelist your tokens, come to Symbiotic and issue your own LRT in a permissionless way.

-

Dear users, stop depositing your wstETH with LRT competitors, give it to Mellow and you can get better risk-adjusted returns.

7. الخاتمة

As competition in the re-pledge space heats up, here are a few points worth considering:

-

How big is the demand for re-staking AVS? Do we really need so many re-staking players? As of today, only EigenLayer has real-time AVS. The TVL is about 5.33 million ETH, and there are about 22.6 million ETH re-staking in 13 AVS at a mortgage rate of about 4.24 times.

-

The main trend among re-staking platforms is the race to integrate as many assets as possible to support re-staking. Latecomers, competitors like Karak, have tried to differentiate themselves from other competitors by using WBTC collateral, stablecoins, and Pendle PT assets. Symbiotic has gone a step further by allowing any ERC-20 token to be used, but leaving asset management to third-party Mellow vault creators. Despite the most stringent restrictions, EigenLayer still maintains a huge lead in TVL. In addition, the jury is still out on whether it is a wise move to allow non-ETH assets to be used for chain security.

-

What does this mean for the LRT Protocol? To be sure, there is nothing stopping them from doing a similar integration with Symbiotic, and in fact Renzo has already done so. Not only is Symbiotic designed to support maximum permissionlessness, the LRT Protocol has no reason to remain loyal to EigenLayer, and before Mellow can gain a monopoly in the secondary market, the LRT Protocol will want to gain some market share in Lidos re-staking ecosystem. However, is there fierce competition? As mentioned above, Lidos goal is to reaffirm its stETH dominance, and Symbiotic and Mellow are both projects backed by the liquidity staking giant. This goal fundamentally conflicts with Symbiotic eETH, ezETH, swETH considerations. It will be interesting to see how Lido weighs the pros and cons.

-

From a builder’s perspective, it’s getting easier to bootstrap the economic security of your own chain. EigenLaye makes this easy and convenient, but permissionless vaults in the Mellow x Symbiotic ecosystem are taking it a step further and making it even more convenient. Major players like Ethena have announced plans to support sUSDe and ENA re-staking in Symbiotic to secure their upcoming Ethena Chain, rather than expecting EigenLayer or Karak to whitelist ENA as re-staking collateral.

-

What does this mean for Lido DAO and LDO token holders? The DAO charges a 5% fee on all stETH staking rewards, which are split between node operators, the DAO, and the insurance fund, so more ETH staked in Lido (rather than the LRT protocol) means more revenue for the DAO. However, there is no clear path for Lido to accumulate value, either in building its own re-staking ecosystem or in the LDO token itself, which is still just a governance token.

This article is sourced from the internet: The re-staking war heats up: Do we really need so many re-staking players?

Related: A $13 million ETF dispute

Original|Odaily Planet Daily Author: Azuma In the early morning of May 24th, Beijing time, the U.S. Securities and Exchange Commission (SEC) officially approved the 19 b-4 forms of all eight spot Ethereum ETFs applied for by BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark Invest, Invesco Galaxy and Franklin Templeton, opening the door for ETH to enter the traditional financial market. It should be noted that although the 19 b-4 forms of the above-mentioned spot Ethereum ETFs have been approved, the ETFs still need their S-1 registration statements to take effect before they can officially start trading. Given that the SEC has just started discussions with issuers on S-1 and it will take time for consultation and revision, it is unclear how long this process will take – Bloomberg ETF analysts speculate…