المؤلف الأصلي: CHARLES

الترجمة الأصلية: TechFlow

This cycle has been called the “memecoin cycle” by some, and some even call it the “memecoin supercycle.” We’ve seen new memecoins like WIF soar from zero to billions of dollars in market cap in a matter of months. We’ve also seen various products built around the memecoin phenomenon, such as the launch of fun . Like it or not, memecoin can’t be ignored.

Most active crypto players will be acutely aware that memecoins have performed extremely well this cycle, outperforming all others as a sector by a wide margin. When we hear stories of traders making multiples on memecoins, the question is always, “How did they identify that particular memecoin?” There is certainly an element of survivorship bias, but are there other factors at play?

Generally speaking, at HFAResearch, we focus on fundamentals-driven ideas from an investment, trading, and mining perspective. This makes it difficult for us to cover the memecoin sector – like NFTs, the investment logic of memecoins is often more vague and more dependent on the vibe and the memes themselves, which makes fundamental analysis more difficult. At least, this is what we thought before we discovered what we call the Memeccoin TVL Pull Theory.

The Memecoin TVL pump theory states that a major memecoin or a basket of major memecoins will act as a leveraged bet for on-chain TVL. Before we list various examples from the past, let’s first understand why this makes sense.

We know that as the TVL on a chain increases, a certain percentage of funds will flow into certain applications or destinations on that chain…like X% will go to the money markets, Y% will go to the major decentralized exchanges (DEXs), etc. Therefore, it is reasonable to assume that a small portion of funds will want to find a way to bet on the highest beta of the chain. How do they do that? By buying the major memecoin or a basket of major memecoins. Maybe this is obvious to some of you, but we think this provides a valuable and potentially reduced risk way to participate in memecoins because it provides some fundamental methods to evaluate the performance of memecoins in the future (whether it is up or down).

Let’s look at a few examples from history of this happening:

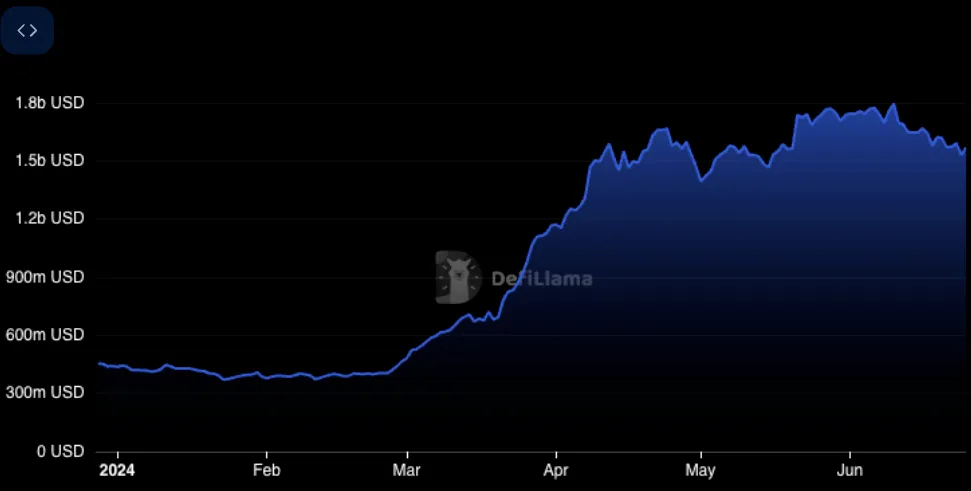

قاعدة

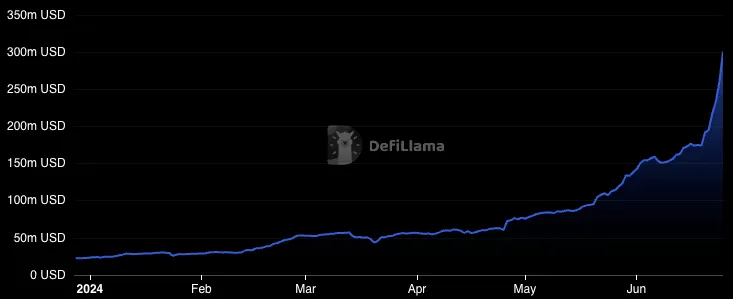

Base TVL

TOSHIs performance began to sync with Base TVLs growth in March

Both of BRETT’s parabolic price increases occurred during an uptrend in Base TVL

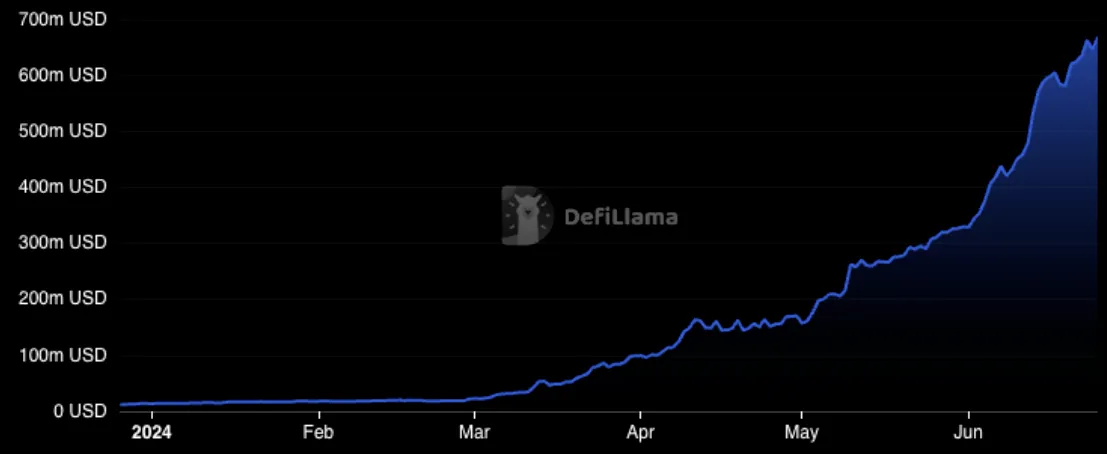

طن

TON TVL

REDO is the main memecoin on the TON network

The above example clearly shows that; TVL inflow = major memecoin performance. If you can predict that TVL will increase, then you can take a position on the major memecoin on that chain as a leveraged bet on the TVL prediction.

Critics of this strategy would say that the strategy is designed to reduce returns because it requires knowing which are the most important memecoins in order to determine where the TVL should flow. This criticism is valid, and this strategy certainly does not allow you to snipe a memecoin at a $100k market cap and have it rise 1000x to $100m, but it can be very effective in finding some slightly larger, slightly more mature memecoin and have it rise from there. For example, between late February and early April, Base experienced a parabolic run in TVL, and Toshi went from a $40m market cap to a $300m+ market cap, with barely lackluster returns in less than 2 months.

Predicting TVL growth can be broken down into two categories: long-term and short-term. Long-term predictions are really just predicting where TVL is going over multiple months. We might point to Base as a funnel for retail users to onboard, and that’s why TVL growth will remain steady. We can look at the near-incestuous closeness between TON and Telegram to see what the impact of all 900 million Telegram monthly active users on-chain would have on TVL. We might mention Solana and its superior on-chain UX and mobile wallet as reason to believe TVL will join them as well. You get my point; in the long term, to predict TVL growth over longer time spans, you have to look at the deeper distribution base on the chain. Then you’d look at the primary memecoin or memecoins on that chain and bet accordingly.

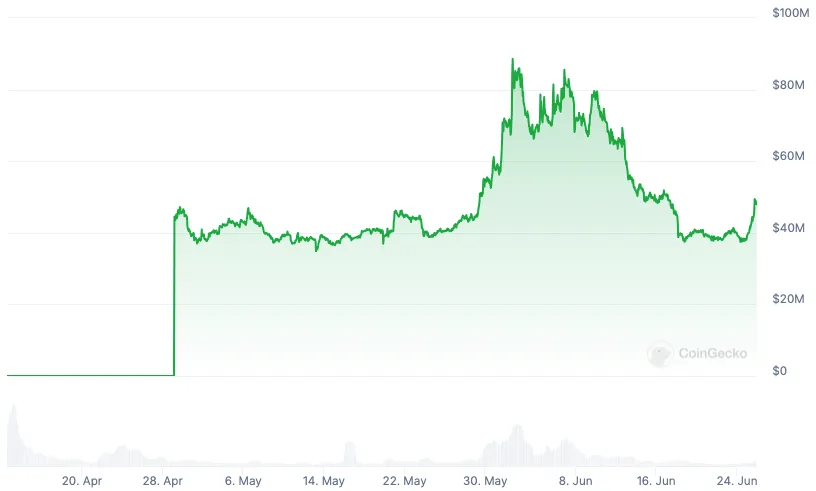

The short-term approach sees short-term catalysts such as points programs or airdrops as the reason for TVL growth. For example, $FOXY, the leading memecoin on Linea, performed extremely well in the ensuing TVL inflow after announcing its surge points program:

Linea TVL and Surge were released in mid-May

$FOXY Market Cap

The short-term approach requires a more active focus on the market and where capital might flow based on incentive programs. This is similar to the game some of us played last cycle; entering Pool 2 of the top DEX on a new chain to bet on the TVL growth brought by the incentive program.

A more specific example is Scroll. We have seen explosive growth in its TVL after the introduction of its latest points program. Could Scroll be the next ideal target for short-term strategies?

We think this approach offers a more systematic and less risky way to participate in the memecoin space, but we’re still fairly new in this space so we’d love to hear your feedback!

This article is sourced from the internet: How to choose Meme coins with potential based on TVL changes?

The latest research from Matrixport Research Institute shows that the recent focus is on: BTC鈥檚 realized volatility is approaching multi-year lows, and options investing may be a good idea at the time. The SEC is more likely to approve the S-1 application, and ETH spot holdings surge BTC options trading shows bullish sentiment, and expectations for market growth in 2025 are rising As the market enters a summer consolidation phase, the decline in volatility allows investors to purchase options at a lower cost without taking on excessive market risk. The demand signals for fiat-to-cryptocurrency conversions have weakened, indicating that a period of calm may be coming, and the fear of missing out (FOMO) sentiment is relatively low. Therefore, investors should adopt a rational positioning strategy. BTC鈥檚 realized volatility is approaching…