الفصل الأخير من تعقب الأموال الذكية على السلسلة: قائمة بأهم 10 عناوين لخبراء كمين العملات الإيكولوجية

الأصل | Odaily Planet Daily ( @أوديلي تشاينا )

المؤلف: وينسر ( @وينسر2010 )

In the previous two articles Tracking Smart Money on the Chain: Top 10 Meme Coin PVP Expert Addresses and Their Performance و Tracking Smart Money on the Chain: Collection of Top 10 Value Coin Position Building Expert Addresses , we briefly analyzed and shared the smart money addresses in the Meme coin and value coin fields, and summarized their respective operating characteristics.

On this basis, we will briefly analyze and introduce the ecological token projects (referring to tokens related to a vertical ecology, such as DEGEN of the Base ecology, NOT of the TON ecology, etc.) and related smart money address operations in this article for readers reference and learning. At the end of the article, we have also updated the on-chain tracking tools again and added some new tools to facilitate readers to dynamically adjust their operation strategies.

Base Ecosystem: DEGEN

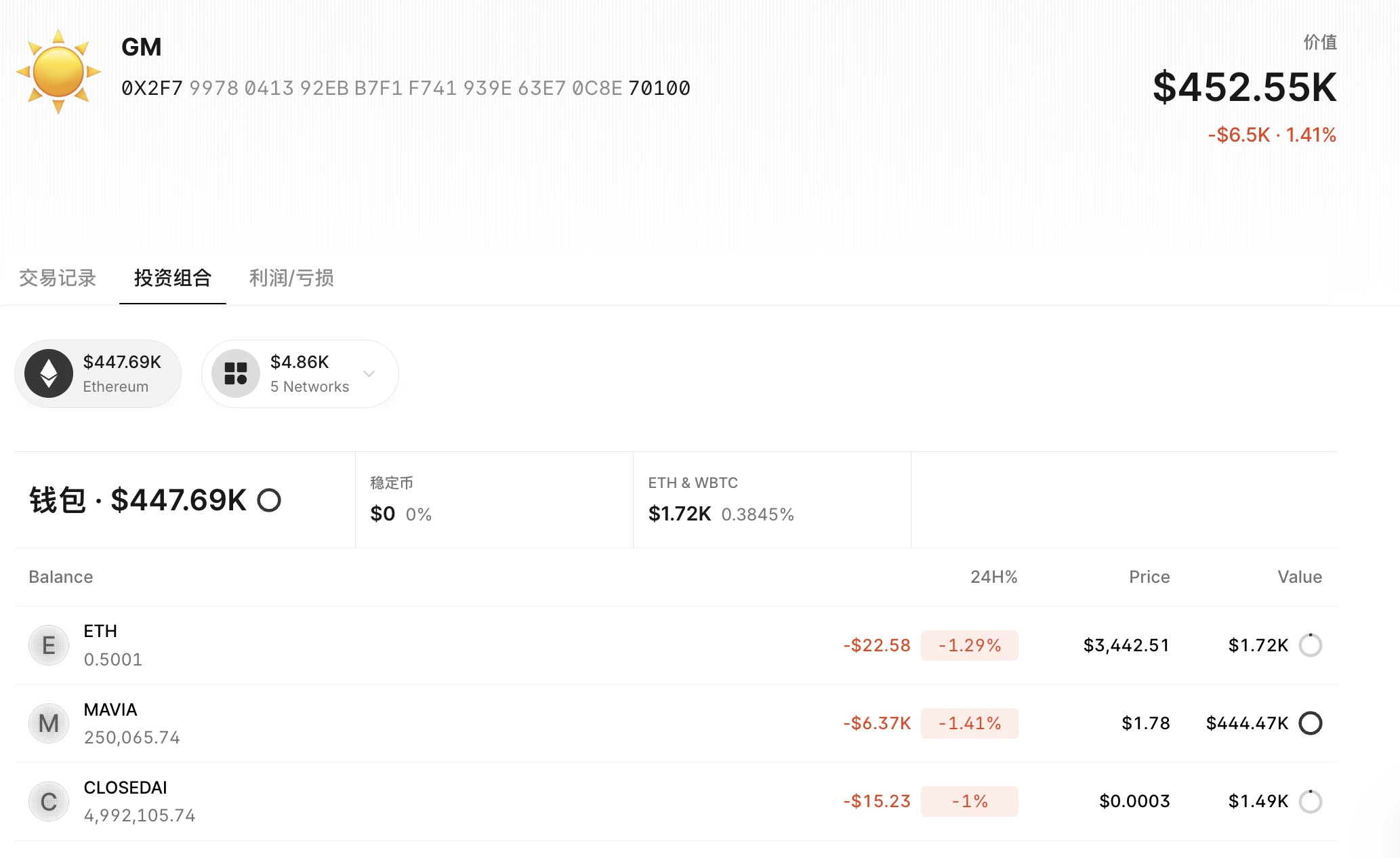

At the end of March, when the Base ecosystem took over the Solana ecosystem and set off a Meme coin craze, the smart money 0x2f7…70100 continued to build a position in DEGEN from February 8 to March 25 this year, with a floating profit of 12.7 million US dollars at that time. It is understood that the address has invested a total of 964.1 WETH to buy 323 million DEGEN, with an average cost of 0.0095 US dollars per token; at that time, it was the third largest address in DEGEN holdings, and now the address has cleared its DEGEN positions.

عنوان المحفظة: 0x2F79978041392EbB7f1f741939E63E70c8e70100 ;

Wallet balance: Mainly MAVIA spot, worth $452,000;

عنوان التتبع على السلسلة: https://app.mest.io/wallets/0x2f79978041392ebb7f1f741939e63e70c8e70100

واجهة الموقع

Base Ecosystem: BRETT

On May 30, according to Spot On Chain monitoring, a trader turned $556 into $7.48 million in three months through BRETT, realizing a 13,453-fold return. Just 30 minutes after the token minting was opened on February 24, the address spent 0.19 ETH (about $556) to exchange for 82.66 million BRETT. On May 30, after the price of the currency rose by 76% in 7 days to a new high, the address deposited 23.45 million BRETT (about $2.12 million) to Gate.io, and still held 59.21 million BRETT (about $5.36 million) at the time. The cumulative profit of the address has now reached $10.86 million. Because it bought at an extremely early time, it is suspected to be an insider or even the project party.

عنوان المحفظة: 0xafed93d81473f2b75b74f3a9777a5edd29bbe3a5 ;

Wallet balance: mainly more than 28.917 million BRETT, with total assets of 4.743 million US dollars.

عنوان التتبع على السلسلة: https://platform.spotonchain.ai/en/profile?address=0xafed93d81473f2b75b74f3a9777a5edd29bbe3a5

واجهة الموقع

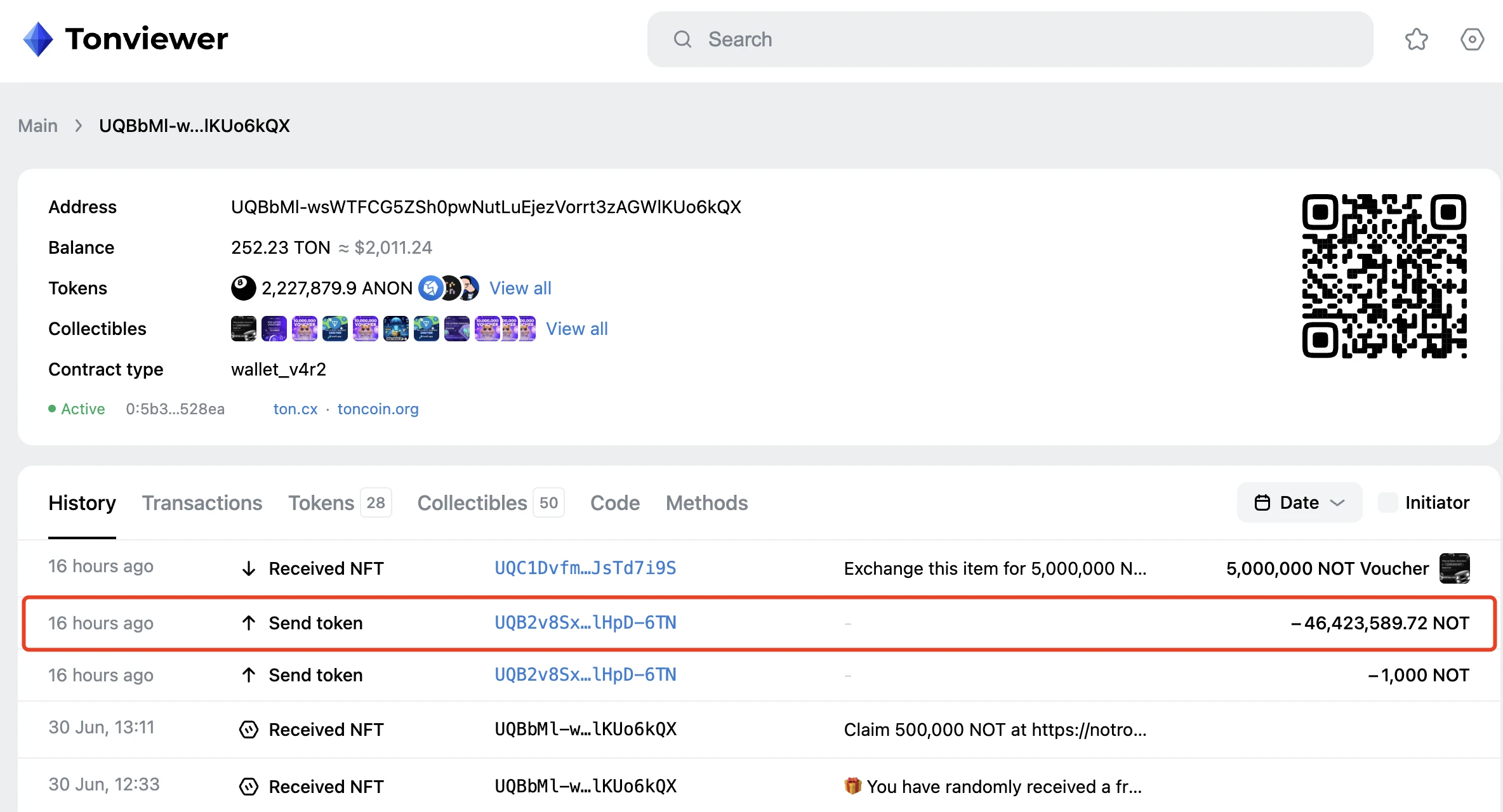

TON Ecosystem: NOT

On June 3, according to Lookonchain monitoring, the price of Notcoin ( NOT ) rose by more than 400% in the past 7 days. It is understood that before NOT went online, a certain address spent 50,550 TON (about 278,000 US dollars) to buy 46.4 billion wNOT. According to the ratio of 1,000 wNOT to 1 NOT, on May 21, the address exchanged all 46.4 billion wNOT for 46.4 million NOT and held it until the floating profit was about 862,000 US dollars. 16 hours ago, the address transferred 46.42 million NOT to UQB2v8SxM7-VvqZ417iWZkjS3HTW030Gt8r9QpjnlHpD-6TN to complete the liquidation of NOT.

عنوان المحفظة: UQBbMl-wsWTFCG5ZSh0pwNutLuEjezVorrt3zAGWlKUo6kQX ;

Wallet balance: 252.3 TON, worth about US$2,000. Other tokens include ANON, STON and other ecological tokens.

عنوان التتبع على السلسلة: https://tonviewer.com/EQBbMl-wsWTFCG5ZSh0pwNutLuEjezVorrt3zAGWlKUo6hnS

On-chain records

Solana Ecosystem: JUP

On February 1, a smart money spent 6.64 million USDC to buy 13.34 million JUP, with an average price of only $0.49. Subsequently, the address distributed all tokens to 4 new addresses. According to the on-chain price at that time, the address had a floating profit of 1.81 million US dollars. Currently, 2 of the 4 addresses have sold 1.08 million tokens, and the remaining 12.36 million tokens are still held, worth 7.81 million US dollars. At present, the latest operation record of this address is 8 days ago, and the wallet has completed the liquidation.

The distribution addresses include: 3ktPdtLCtkB7bDcY9mEmbZXXtP6rtQ8SPK4GpoGD1xsA;t8QjVwh8eWYx8osp8JQiUXUHbcvqusM2u8RZyaX6VJC;3MX7YQqvynDzzAmCTybWCT3fE1zFiCtyVhTQrMatB2w8;4AxcEjSZHacHghAsAgFnD9crKvMUryZKYXUJjaqhyfd7.

عنوان المحفظة: MWKpvtFpvXWnSbe8Pe5CajXnKFQucD6VDYyBvt7fYEi ;

عنوان التتبع على السلسلة: https://gmgn.ai/sol/address/ MWKpvtFpvXWnSbe 8 Pe 5 CajXnKFQucD 6 VDYyBvt 7 fYEi

Clearance interface

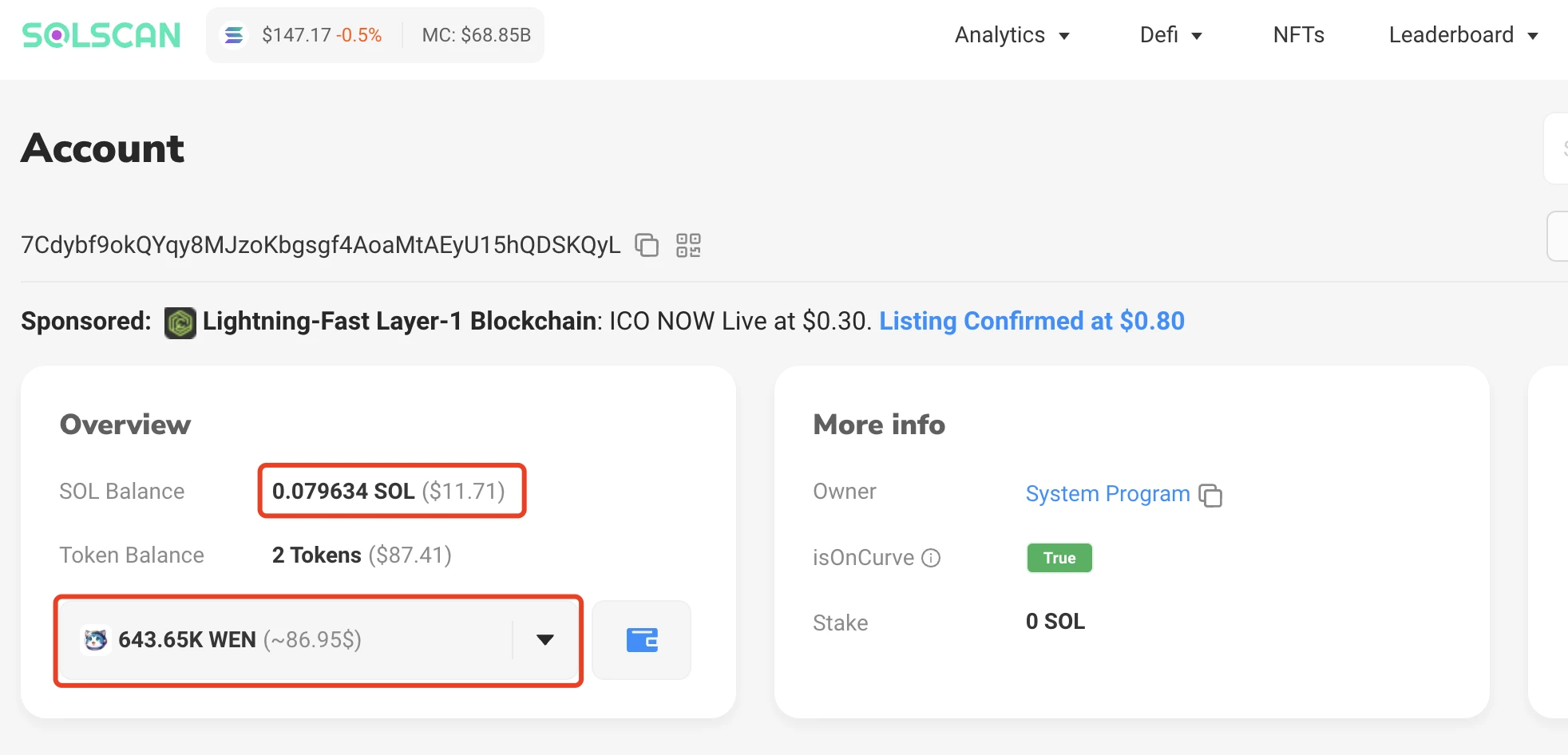

Solana Ecosystem: WIF

On March 8, according to Lookonchain monitoring, a trader spent $1,749 to buy 5.1 million WIF on November 30 last year and has held it until now, which was worth $10.9 million at the time. It is understood that the trader tried to sell WIF at the upper limit price of Jupiter, but because the limit price was too high, the order failed to be executed, so he finally canceled the limit order and transferred the WIF to a new wallet Fz3n1ed2xS2rhZG2qJPW2y7Z89iVQ3EHrBUdHx2d7hCr . At present, the traders two addresses have been completely liquidated.

عنوان المحفظة: 7Cdybf9okQYqy8MJzoKbgsgf4AoaMtAEyU15hQDSKQyL ;

عنوان التتبع على السلسلة:

https://solscan.io/account/ 7 Cdybf 9 okQYqy 8 MJzoKbgsgf 4 AoaMtAEyU 15 hQDSKQyL #splTransfers ;

Wallet balance interface

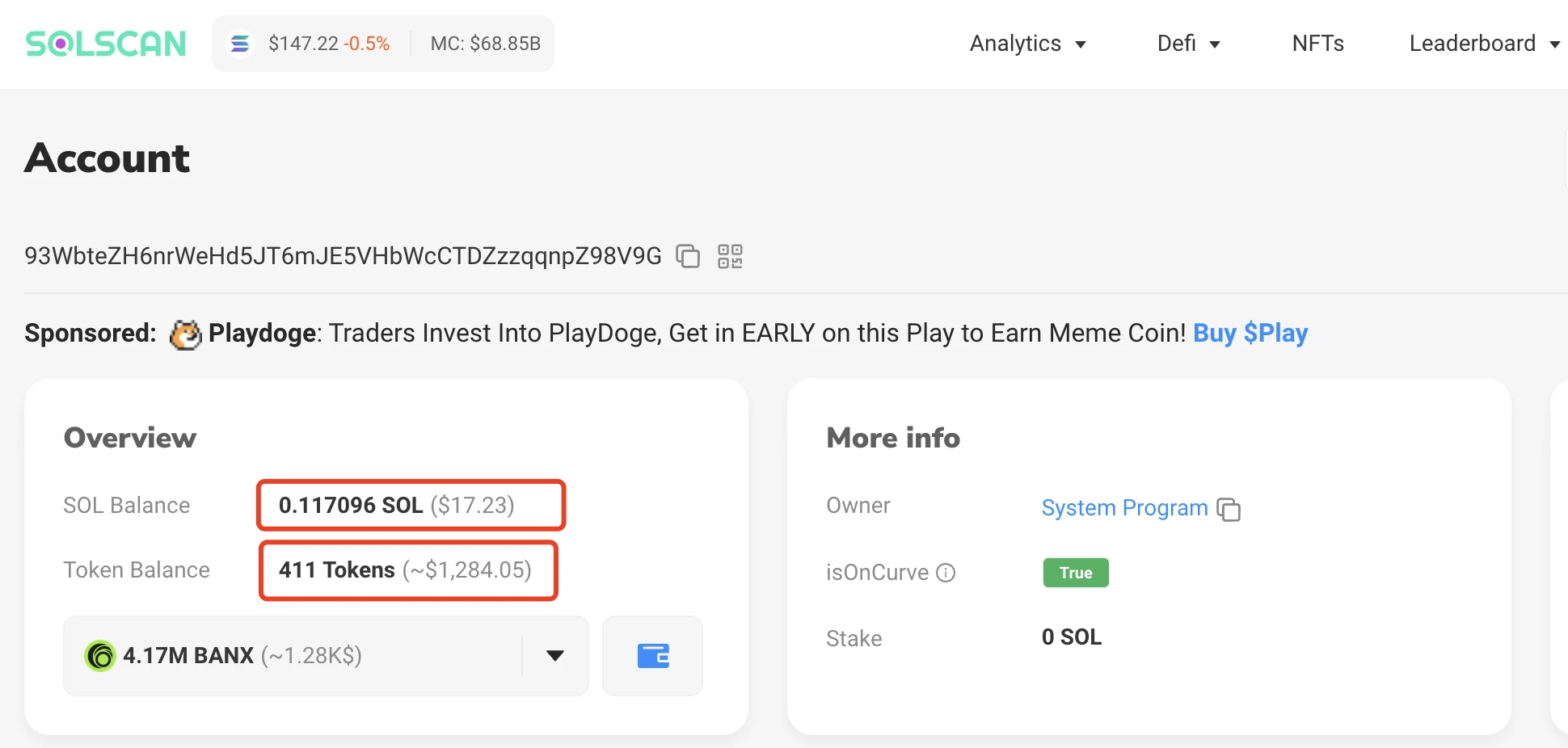

Solana Ecosystem: WEN

On January 27, according to Lookonchain monitoring, a trader earned more than $1.6 million in 14 hours by trading WEN. Analysis found that when WEN opened, the trader spent 125,500 USDC to buy 20 billion WEN and sold 12.5 billion WEN for 807,000 USDC, realizing a profit of $682,000. At that time, the trader still held 7.6 billion WEN (US$941,000), with an unrealized profit of $941,000. At present, the address has been fully liquidated.

It is worth mentioning that the WEN project team recently bought the largest cat-themed account @ShouldHaveCat on the X platform (with more than 4 million followers), and announced that it will create a global cat-themed brand in the future.

عنوان المحفظة: 93WbteZH6nrWeHd5JT6mJE5VHbWcCTDZzzqqnpZ98V9G ;

عنوان التتبع على السلسلة: https://solscan.io/account/93 WbteZH 6 nrWeH d5JT6mJE5VHbWcCTDZzzqqnpZ98V9G

Wallet balance interface

Etheruem Ecosystem: ENA

On April 12, a certain ENA whale locked up 11.17 million ENA (worth $15.9 million) in Ethena, becoming the ENA staker with the largest position at the time, accounting for 6% of the total locked amount. This address transferred 11.17 million ENA from Binance at an average price of $1.42 in the past two days, with a floating profit of $425,000 at the time. At present, the address has been liquidated, and the wallet balance is only $500. According to on-chain analysis data, the address completed the liquidation of ENA 3 weeks ago, with a total profit of $1.08 million; but lost $218,000 on MOG.

عنوان المحفظة: 0x886b70db1A5Ec9DA60231D3A059b640dB7f116ed ;

عنوان التتبع على السلسلة: https://app.mest.io/wallets/0x886b70db1a5ec9da60231d3a059b640db7f116ed?pnlType=allrange=1 Y

Profit and loss interface

Ethereum Ecosystem: LDO

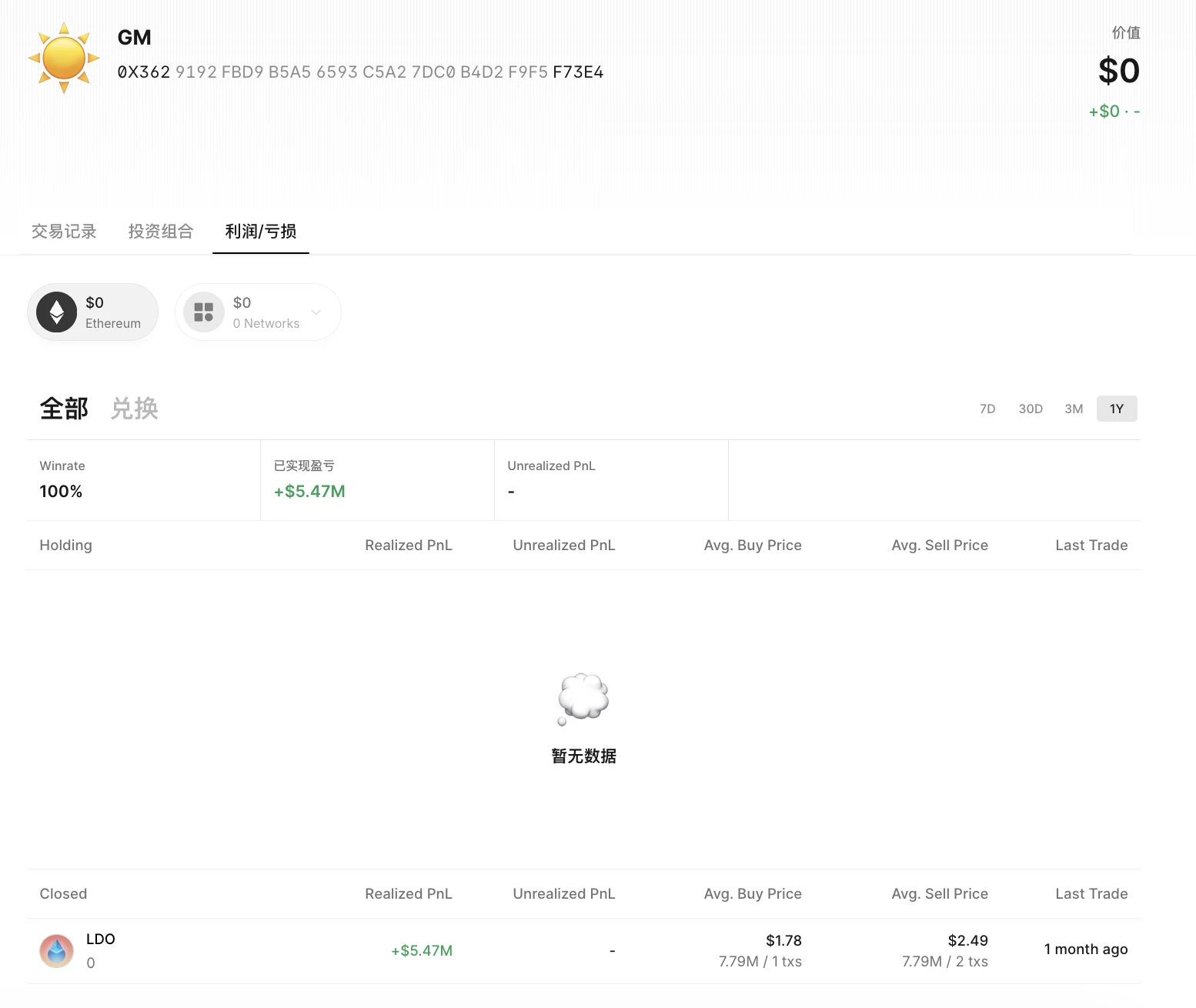

From October 2022 to May 2023, a certain address accumulated a total of 31.76 million LDOs, and recharged 7 million LDOs (worth $13.01 million) to Coinbase on May 14. If all were sold, a profit of $2.17 million would be made. It is understood that the cost of opening a position for this address is $1.36. Currently, a total of 9.6 million LDOs have been recharged to the exchange and a profit of $3.17 million has been made. The remaining 7.79 million tokens have been transferred to the new address 0x3629192FBd9B5A56593C5a27dC0b4d2F9F5F73E4 . On May 28, the new address transferred all LDOs to Coinbase, completing the liquidation and accumulating a profit of $5.47 million.

عنوان المحفظة: 0x8d2C21beFcE4dD414017F3B12698a4a76476239f ;

عنوان التتبع على السلسلة:

https://app.mest.io/wallets/0x8d2c21befce4dd414017f3b12698a4a76476239f ;

https://app.mest.io/wallets/0x3629192fbd9b5a56593c5a27dc0b4d2f9f5f73e4 .

Profitability Record

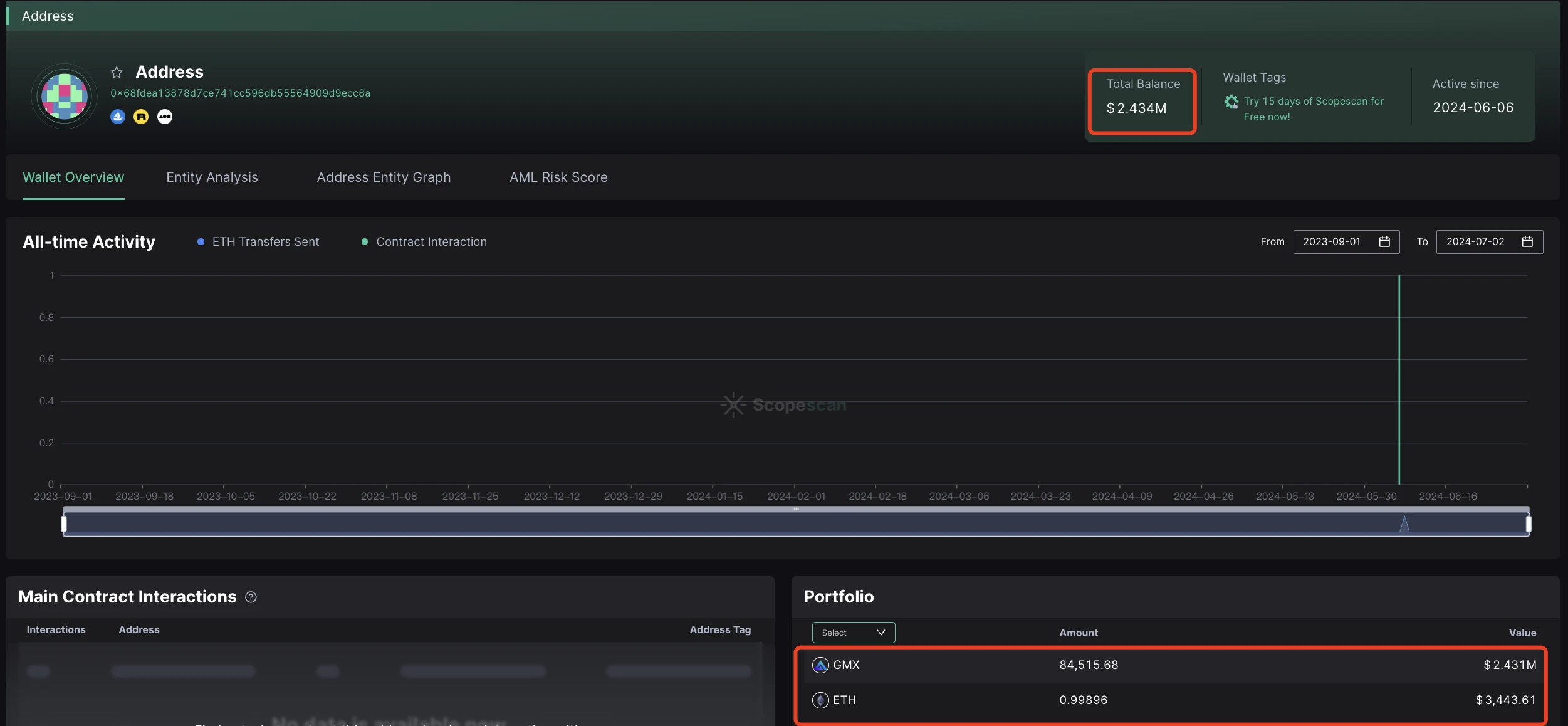

Arbitrum Ecosystem: GMX

On June 6, according to Scopescan, GMX rose from $36 to $44. Subsequently, a whale withdrew 84,500 GMX (worth $3.7 million) from Binance, and the address has been holding the position since then. Currently, the price of GMX has fallen back to around $28.65.

عنوان المحفظة: 0x68fdea13878d7ce741cc596db55564909d9ecc8a ;

Wallet balance: mainly GMX spot, worth $2.434 million;

عنوان التتبع على السلسلة: https://scan.0x scope.com/address/0x 68 fdea 13878 d 7 ce 741 cc 596 db 55564909 d 9 ecc 8 a?network=arbch=tw

واجهة الموقع

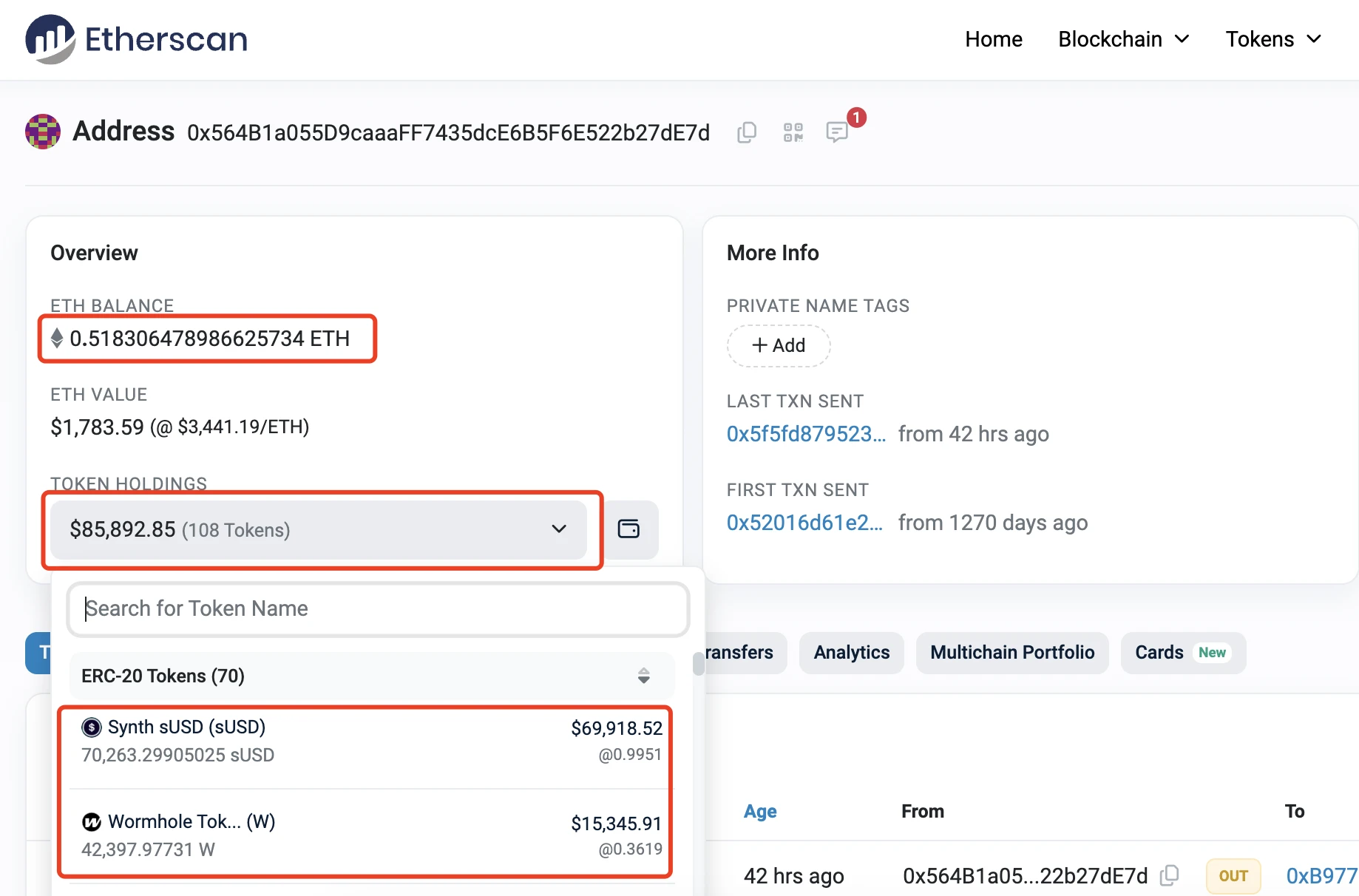

Optimism Ecosystem: SNX

On February 28, a whale transferred 1.16 million SNX (4.54 million USD) to Binance. The whale withdrew 1.11 million SNX from Binance at an average price of $2.26 between December 2022 and May 2023, and transferred it to Binance at $3.9 on the same day, with an estimated profit of $1.9 million (+75%). Currently, the address still holds 108 stablecoins and altcoins including sUSD and W, and is still active, with operations still taking place 42 hours ago.

عنوان المحفظة: 0x564b1a055d9caaaff7435dce6b5f6e522b27de7d ;

Wallet balance: including 0.5 ETH, sUSD (Synth sUSD) worth nearly $70,000, and $15,000 in W, totaling about $85,000.

عنوان التتبع على السلسلة: https://etherscan.io/address/0x564b1a055d9caaaff7435dce6b5f6e522b27de7d

واجهة الموقع

Summary: There are no eternal believers, only profit-seeking gamblers

Looking at the above eco-coin players, they are all masters with a clear sense of profit-seeking, rather than falling in love with the ecology or project and accompanying its growth for a long time.

Whether it is Selling the News when the market is bustling or selling in time when the market reaches its peak, these eco-coin players will not forget their original intention of coming to the cryptocurrency industry because of the short-lived market enthusiasm – the original intention is to make quick money – although many times making money requires ambushing for more than ten hours, weeks or even months, but when to stop profit is a skill that everyone should learn.

After all, if you sell flying, you will always make money, but if you lose money, you can only comfort yourself by saying that you served as fuel for the promotion of the cryptocurrency industry.

As the last article in the Trilogy of Articles Tracking Smart Money on the Chain, the message I want to convey to everyone at the end of this article is that the chain is a seemingly decentralized, but in fact it is a completely dark forest. Therefore, most of the smart money addresses mentioned will abandon the address after a certain token or project stops making profits. Although the probability of accidents and additional risks is extremely low, chain security is still something that deserves attention, including guarding against possible chain poisoning incidents (referring to the act of making small transfers to a wallet with an address with the same first and last digits, and directly sending funds to that address when transferring funds at that address).

Therefore, I hope that these words can serve as an introduction for readers to conduct on-chain operations and explorations, and I also look forward to seeing you among the ranks of these smart money addresses or trading experts in the future.

أخيرًا، إليك أدوات التتبع الرئيسية على السلسلة للرجوع إليها:

موقع gmgn.ai :اقتنص عملات معدنية جديدة، وقم بالشراء والبيع، وكشف Pixiu، وما إلى ذلك، فقط انقر للتسجيل ;

سولسكان : متصفح بلوكتشين شبكة سولانا أدخل عنوان المحفظة أو عنوان العقد لعرض المعلومات ذات الصلة؛

مِست :موقع ويب معلوماتي متكامل لتتبع المحفظة والمشاريع الشهيرة ومعلومات الأمان وما إلى ذلك. يمكنك التتبع عن طريق إدخال العنوان؛

أركام :منصة رئيسية لتتبع البيانات على السلسلة تعتمد على الذكاء الاصطناعي في نظام EVM البيئي. وقد أصدرت رمز ARKM وهي مدرجة على Binance.

سييلو : An on-chain data tracking platform tool that can also be bound to a Telegram account, which can be used as a supplement;

سكوبيسكان : An on-chain data tracking platform developed by the Scope Protocol team. It is a paid subscription platform with some analytical functions.

Spotonchain : An on-chain data tracking platform developed by the Spot On Chain team, which also supports a variety of on-chain analysis functions;

نانسن : A professional on-chain data analysis platform that will issue some blockchain industry reports and whale dynamic tracking analysis;

اثيرسكان : A blockchain browser for the Ethereum network that can be used to query wallet addresses and smart contract-related interactions. It is one of the basic blockchain tools.

This article is sourced from the internet: The final chapter of tracking smart money on the chain: a list of the top 10 addresses of eco-coin ambush experts

Related: Killing the Points System, Will Berachain’s Proof Of Liquidity Mechanism Be the Future?

Original|Odaily Planet Daily Author: Wenser On June 24, Infrared Finance, the Berachain ecosystem liquidity pledge protocol , announced the completion of a new round of financing, with Binance Labs participating in the investment. The specific amount has not been disclosed. According to Raito Bear, the anonymous co-founder and CEO of Infrared, this round of financing is a strategic round of financing in which Binance Labs participated as the only investor. In May , Jack Melnick, former head of Polygon Labs DeFi, joined Berachain to be responsible for the construction of the DeFi ecosystem. In April, Berachain announced that the scale of its Series B financing had increased to US$100 million, led by Brevan Howard Digitals Abu Dhabi branch and Framework Ventures, with participation from Polychain Capital, Hack VC, Tribe Capital…