الحديث عن تجريد السلسلة: هل هو حقًا أسهل في الاستخدام، أم أنه مجرد كلمة طنانة جديدة؟

المقال الأصلي بواسطة: BRIDGET HARRIS

الترجمة الأصلية: TechFlow

Chain abstraction has become a hot topic right now, and it’s easy to see why — all of us in the crypto space should be excited about tools that make on-chain participation easier for consumers.

But a lot of the discussion doesn’t focus on how we got here, and I think it starts with the fact that developers are consumers too . And right now, they’re forced to choose between different ecosystems, technology stacks, and communities. This creates a lock-in that sometimes deflects developers from focusing on the right problems because of perverse and unsustainable incentives. Developers are users too, and they shouldn’t be forced to choose where to build.

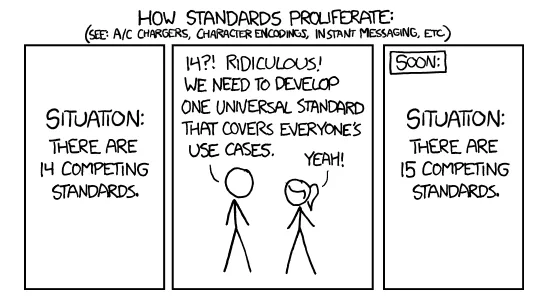

A core challenge for developers is trying to integrate their applications with a bunch of different technology stacks and underlying infrastructure, or building infrastructure that works across a variety of applications and dealing with community loyalty across ecosystems. It also doesn’t help that there are what feels like countless different standards in crypto.

(Image credit: xkcd: Standard )

Historically, this has often forced developers to choose only one ecosystem to build on, and the ecosystems creators know this and actively compete for developer attention, leading to further lock-in and unsustainability. The result is that projects choose half-hearted multi-chain expansion or go deep into a single isolated ecosystem. Both have problems, and chain abstraction hopes to solve these problems.

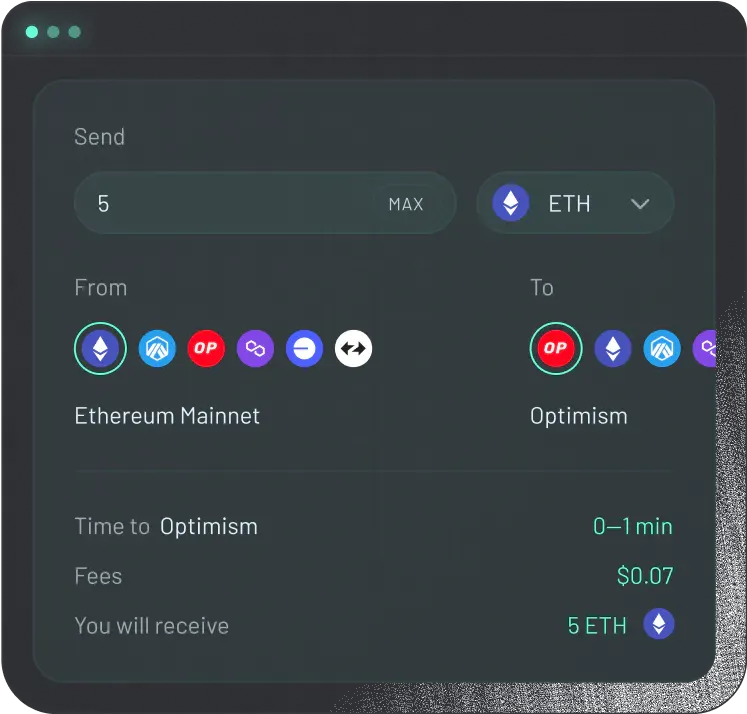

The ultimate goal of chain abstraction is simple : developers can deploy anywhere because they no longer need to reach users, and users can interact seamlessly across ecosystems, using any liquidity and any chain. Convenience is key, and the biggest beneficiaries are likely to be the (increasingly centralized) interfaces where users submit their order flow.

Chain abstraction as a concept is broad, loosely defined, and some even argue that it is completely bogus. Rather, it is simply a collection of primitives, infrastructure, and tools that make operations easier for users and developers — many things fit under the umbrella of “chain abstraction.” I agree with the latter view, while viewing these advances as positive and necessary steps overall.

Below, I’ll give a non-exhaustive overview of some of the companies building chain abstraction solutions and share my predictions for the future.

CEX as part of chain abstraction

The most commonly used chain abstraction platform, though limited in the number of assets offered and centralized, is probably Coinbase itself. Through one interface, users can buy and sell a variety of tokens on different chains, albeit in a custodial manner. This is one of the main reasons why Coinbase has seen strong adoption and revenue, which bodes well for the entire chain abstraction space. It proves that there is a market for convenience, and that users value and are willing to pay for functionality and simplicity in one interface.

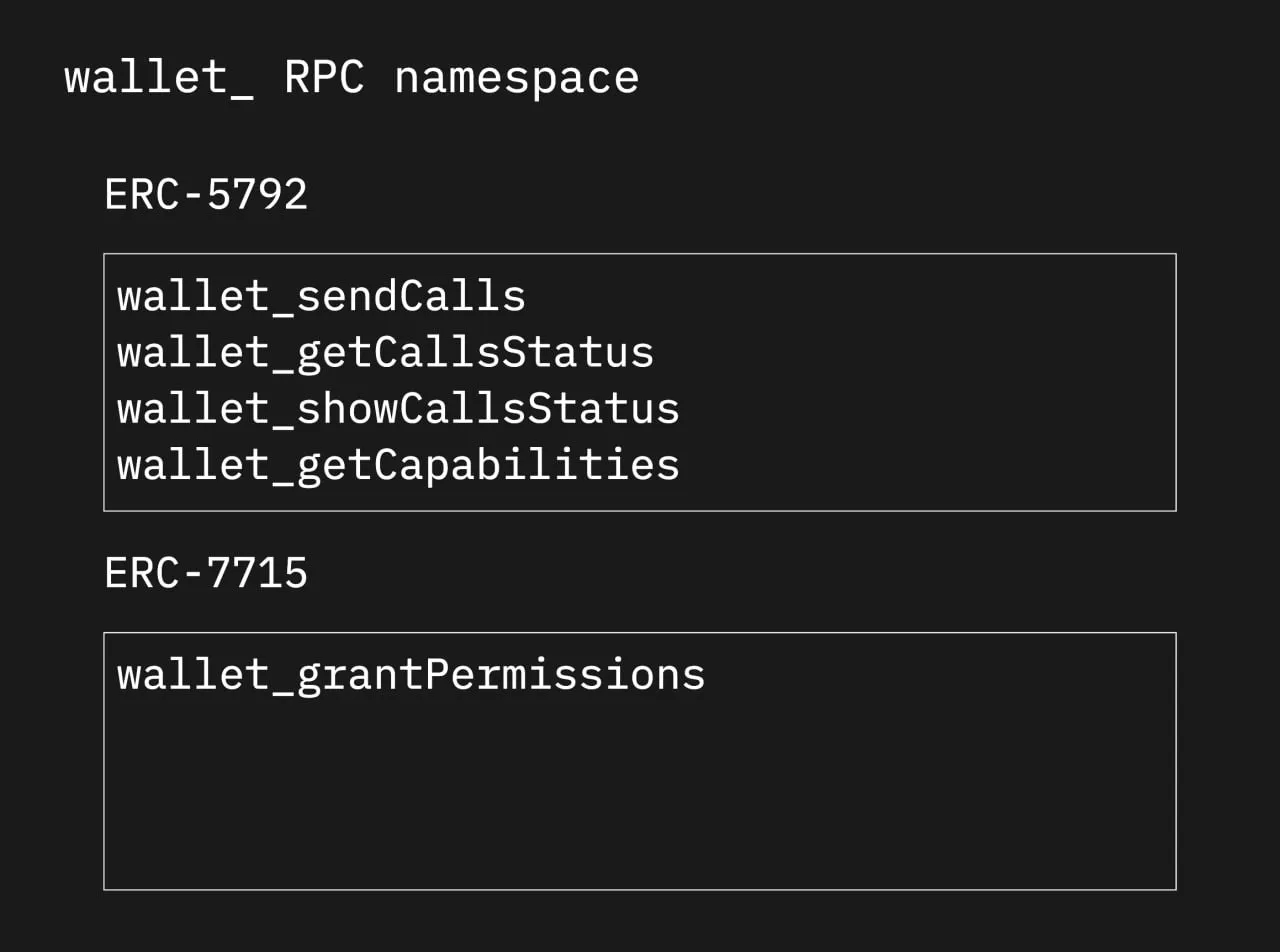

Core infrastructure

In order for chain abstraction to really take off, some argue that fundamental changes to established standards in crypto are needed. One such example is OneBalance , which is natively enhancing the existing JSON RPC (a cryptocurrency industry standard) so that the new standard allows applications to communicate directly with wallets. Their new API is largely backwards compatible with Ethereum, Bitcoin, Solana, and any assets and smart contracts on those chains. In addition to transacting across the three major chains, this architecture, dubbed the CAKE framework , also includes gas abstraction, social recovery, and identity verification. Users benefit from fast state transitions, as solvers can request state transitions on the target chain without waiting for finality on the original chain. The ultimate goal is to have wallets, particularly Metamask, integrate their account model so that users can directly benefit from this new architecture. Specifically, this means that users can theoretically purchase WIF with ETH at the speed of Solana (rather than the speed of Ethereum).

OneBalance RPC method extension

Another company, Orb Labs, aims to be a provider that solves the chain abstraction problem at the node level rather than the account level. Their system consists of OrbyEngine (a smart RPC endpoint that can be used by wallets to aggregate and orchestrate account states across all chains) and OrbyKit (a dapp SDK that provides the same functionality for application frontends). OrbyEngine uses a combination of a general intent protocol and a special node (called an account unification node) to aggregate and orchestrate account states.

Together, they allow any wallet or dapp to implement chain abstraction, gas abstraction, and more with just five lines of code. This dynamic fundamentally changes how users interact with wallets, applications, and chains, so they no longer need to worry about bridging across ecosystems and manually moving assets. Chains simply disappear because no matter where the user is, they can transact with all their accounts and assets from other chains. This fundamentally changes the idea of a wallet as a medium to connect to a specific chain to a chain-agnostic connection mechanism that is entirely focused on managing the relationship between users, assets, and dapps.

قريب is also on the core infrastructure side and has natively integrated chain abstraction into their L1. Through their chain abstraction stack, developers can:

-

Immediately choose to subsidize gas fees for users, including cross-chain transactions through NEAR’s multi-chain gas relay .

-

Leveraging NEAR’s multi-chain signature service allows users to use their NEAR accounts to conduct transactions on other chains.

-

Using FastAuth, users can register (or recover) NEAR accounts using their email addresses, providing a familiar Web2 experience.

These primitives are critical to providing a more seamless experience for developers, which positively extends to users through what these types of stacks create.

Unification through bridging

At a higher level, there are a number of bridge providers working on chain abstraction, the most notable of which is Across . The protocol has a fully functional (published) intent engine where transporters compete to satisfy user orders via the best execution path.

Today, Across is the only live, cross-chain intent-driven bridge protocol that actually works for both large and small amounts. The market is responding: Across has processed nearly $10 billion worth of volume and 6 million+ transactions. Developers can also easily integrate their bridge abstraction framework, Across+, into dapps to natively enable chain abstraction . This is an early proof-of-concept of what chain abstraction can do and how the market values it.

Socket , maker of بنجي (a bridge aggregator), is also working on chain abstraction solutions through modular order flow auctions, where users submit intents and solvers compete to fill. Through SocketPlugin, developers can add a widget to integrate بنجي (Sockets bridge aggregator that supports cross-chain asset transfers) directly into their projects. Most of the time, Bungee is actually routed through Across , which reached a volume share of about 50% at the end of June 2024. Across was cited as the cheapest bridge between Socket and other aggregators, accounting for about 78% of the time .

Integrated Interaction

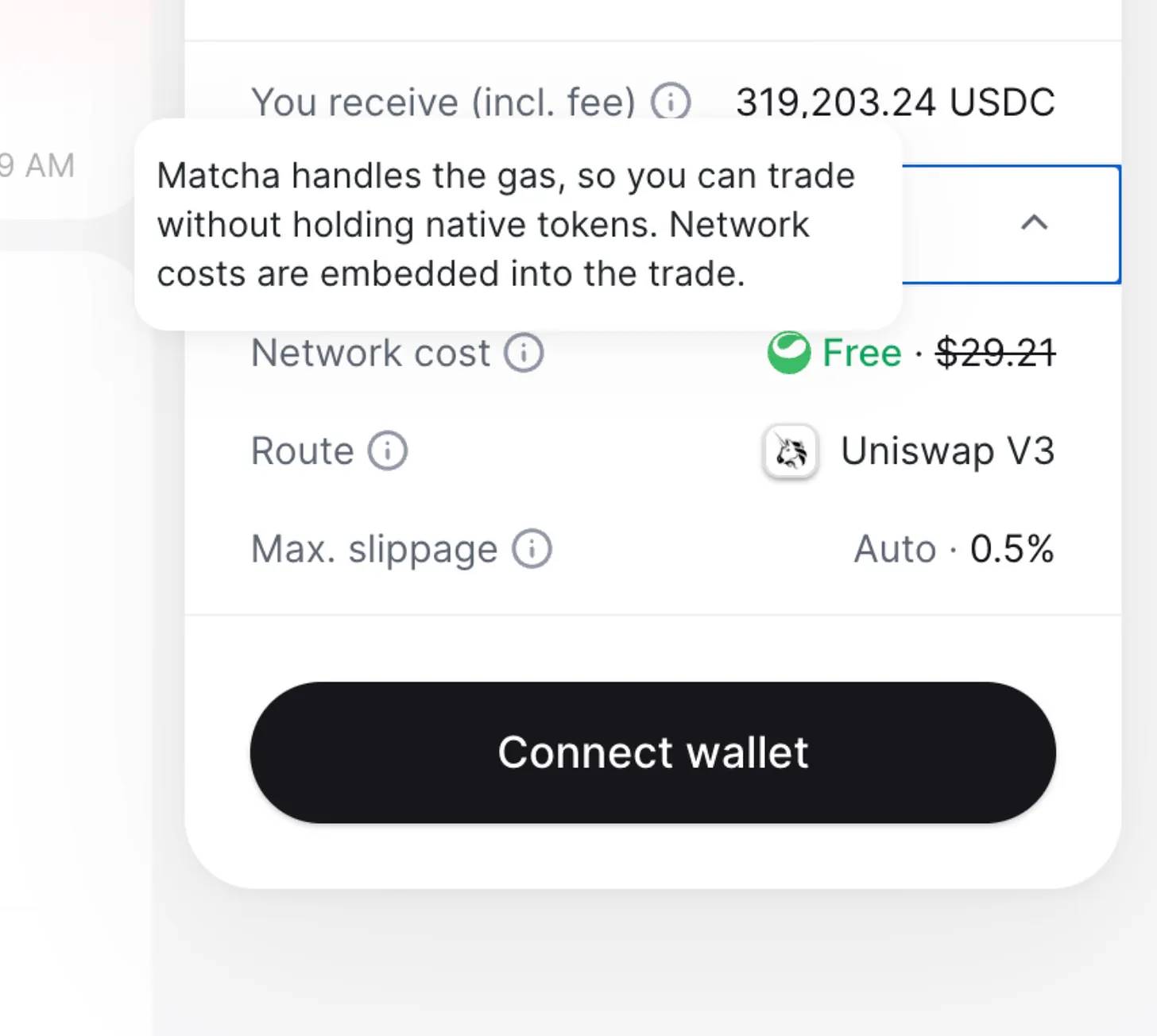

Aside from bridging (and staking, minting, lending, …), swaps are the most popular operation users perform on-chain, and therefore the largest TAM that projects can tap into. Platforms like UniswapX و Matcha focus on swaps, aiming to abstract away gas, aggregate sources of liquidity for cheaper trades, and enable efficient cross-chain trading. Typically, this involves some sort of solver, which competes to satisfy order flow in the most efficient way. Solvers pay for gas on behalf of swappers, which improves efficiency by batching orders together to try to get a better price, and users benefit from not having to worry about gas tokens.

Middleware framework and interface

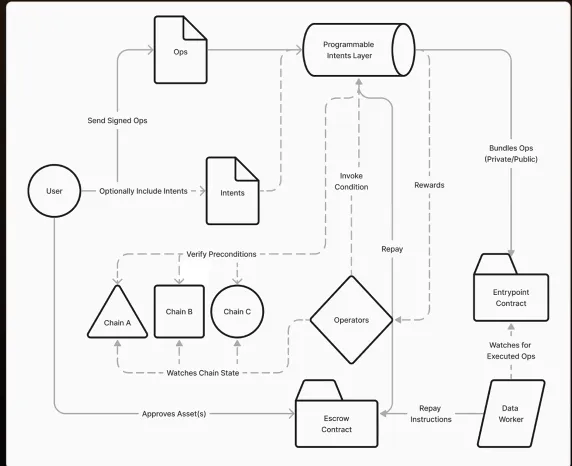

Some teams are building layers to support these protocols. For example, Light could sit on top of other cross-chain interoperability protocols (including potentially Across, UniswapX, …) and serve as middleware for chain abstractions that users interact with. Notably, Light supports any configuration — conditions, DCA, intent graphs, etc. — expressed within the EVM across multiple chains, whereas most intent-based protocols initially only support limit orders. Additionally, Light uses order flow auctions, where users can programmatically define conditions, security, and settlement of cross-chain trades, helping to ensure best execution.

Another project in this space, Genius , is working with Lit Protocol to build a chain abstraction solution, with Lit as the underlying signature scheme for the Genius liquidity architecture. Initially, they will support EVM, SVM, and Bitcoin, and focus on launching a decentralized transmitter and aggregated liquidity, rather than going the intent route.

Intent as part of the chain abstraction

The intention is usually focused on exchanges, with the ultimate goal of allowing users to trade across any chain with any asset without the need for a bridge. These projects have caught my attention recently:

-

Slingshot is an intent-based on-chain application that allows users to trade across different chains in a bridgeless, non-custodial manner. By creating an extremely simplified user experience – no gas tokens, no connect wallet button, no bridge, can log in on any device, one-click buy and sell – users are more willing to participate on-chain. The downside here is that users are ultimately limited by the amount of funds held in the vaults of each supported chain, but regardless, this architecture encourages more on-chain activity.

-

بلاكوينج is developing a decentralized trading abstraction layer using Initia. Their advantage is to enable liquidation-free leveraged trading by using Uniswap LP positions as collateral. This effectively reduces the downside risk of significant losses while also accelerating gains.

-

Essential is developing its own intent-based Optimistic L2, where solvers directly propose their solutions in the form of new states. In this case, fraud proofs are very concise, as it only requires proving that a constraint is not satisfied, which will be published to L1. Developers can directly leverage Essentials DSL (domain-specific language) to write applications with built-in intent frameworks, which enables a wider range of more complex applications to exist and interoperate on their L2.

Enabling mass adoption through abstraction

Just as you can access any website no matter which browser or operating system you are using, you should also be able to access any cryptocurrency ecosystem no matter which chain it is built on. And no matter what technology stack a developer is building on, they should not be disadvantaged by not being able to access certain users in a different ecosystem. Achieving this is definitely easier said than done, but once it happens, I believe it will be a major catalyst for mass cryptocurrency adoption.

Pedro Gomes wrote on Twitter: Chain abstraction is the shift in software design from chain-centric to user-centric. Let the chain work for people, rather than teach people how to use the chain.

This article is sourced from the internet: Talking about chain abstraction: Is it really easier to use, or is it just another new buzzword?

Original author | francesco Compilation | Golem Arbitrum’s upcoming Stylus upgrade will allow developers to program in other languages such as Rust, C, and C++ while being fully compatible with EVM languages such as Solidity. This article will introduce the necessity of Stylus, its working principle and its significance to Arbitrum. Why do you need Stylus? EVM programming languages like Solidity have been the foundation (and initial development language) of the blockchain technology stack. However, this language also has limitations because it is relatively new compared to other mature programming languages and has a limited number of developers. It is estimated that there are about 20,000 developers using Solidity, compared to 3 million developers using Rust and 12 million developers using C++ (as of August 2023). Currently, if developers want…