بدأت السلسلة في التباطؤ. ما هو الترياق الذي سيقود نظام البيتكوين إلى الخروج من الحضيض؟

النسخة الأصلية من صحيفة Planet Daily Daily

المؤلف: جوليم

A few months ago, the Bitcoin ecosystem was hot due to the transactions of inscriptions and runes. When the chain was congested, the fees were often hundreds of satoshis/byte, and a large number of new projects and users actively poured into this track. However, the cycle of the Bitcoin ecosystem seems to be particularly short. Recently, the Bitcoin chain has fallen into silence, and the fee rate has returned to the average level of 10 satoshis/byte. Compared with the currently hot TON ecosystem and Solana ecosystem, the Bitcoin ecosystem is cool (and is once again close to the undervalued zone).

So, can inscriptions and runes return to their glory? What is the antidote to break the cyclical silence of Bitcoin? In this article, Odaily Planet Daily will briefly sort out the current status of inscriptions and runes from a data perspective, and further explore what the ecological antidote will be.

Since this year, the inscription has gradually dropped to freezing point

Inscription was once the protagonist of the Bitcoin ecosystem, and it is also the asset issuance protocol that is most recognized by users on the main network and has the most complete infrastructure. In the past year, although countless new asset issuance protocols have been born in the Bitcoin ecosystem, such as Atomicals, Tap, Taproot Assets, etc., none of them has shaken Inscriptions dominant position in the Bitcoin ecosystem.

However, since the second wave of Inscriptions market gradually ended in February this year, and then in April, when the Runes protocol, which had been preheated for more than half a year, further snatched away the markets heat, Inscription has dropped to a freezing point.

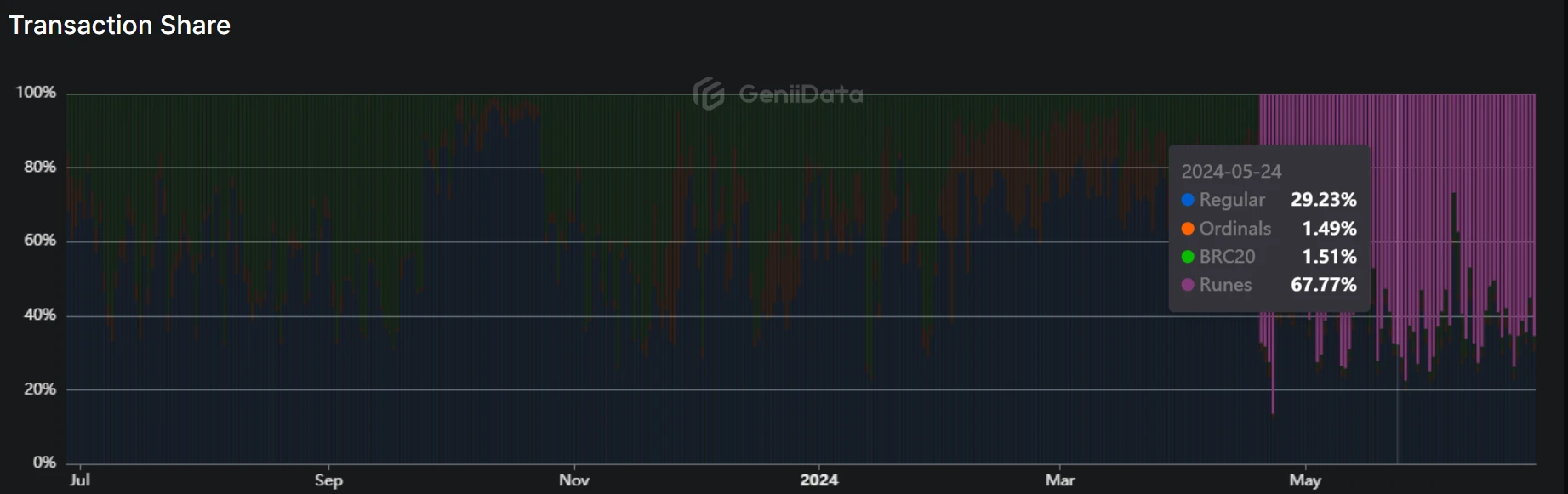

As shown in the figure below, Geniidata data shows that the second wave of the Inscription market started in November 2023. The daily transaction share of BRC 20 and Ordinals on the Bitcoin chain averaged more than 50%. However, in February of this year, the market took a sharp turn for the worse. The Inscription transaction chain was sluggish, and conventional Bitcoin transactions regained more than 60% of the transaction share on the chain, which also marked the end of the Inscription market that had been crazy for more than 3 months.

The second wave of inscriptions in February ended

At the same time, with the Bitcoin halving on April 20, the Runes protocol was officially launched, and the Bitcoin ecosystem became lively again. In order to grab the top rune numbers, many project parties raised the on-chain Gas to over 2,300 satoshis/byte. The fierce competition also caused the miners handling fee income on that day to hit a record high of 1,070 BTC/day.

We are of the same origin, why are we so eager to fight each other? Although the founders of the Inscription Protocol and the Rune Protocol are both كيسي , Runes have not spread their popularity to Ordinals. As shown in the following figure, Geniidata data shows that since the launch of the Runes Protocol, Runes has accounted for more than 50% of the daily transaction share on the Bitcoin chain, while Ordinals transaction share has further decreased, averaging only about 5% per day.

Judging from the data, the freezing point reached by Inscriptions today is similar to that in October 2023, except that Inscriptions was only silent for more than a month at that time. However, with the addition of Runes in this cycle, it has become more difficult for Inscriptions to regain its popularity.

Runechain is active, but the market is not good

Although Rune has remained active on the chain since its launch, with a daily trading share of over 50%, Rune鈥檚 current market conditions are actually not good.

في Runes market value has reached a new high, but why are my friends and I losing money? , we analyzed and concluded that even though the new high in the market value of Rune has led to a short-term boom in the primary new market, there are still few people in the secondary market who take over these new assets. 80% of the new targets will return to zero after minting, and most of the funds are concentrated in the top few Rune projects.

However, since the market value of Rune hit a new high in early June, it has immediately started to fluctuate and fall. Not only has the trading volume shrunk, but the top assets are also experiencing a daily decline.

The fundamental reason for the contrast between on-chain activity and price action is that the entire ecosystem is in a bear market, with no new funds entering, and only old players are left playing PVP. At the same time, on social media, players who still insist on playing Golden Dog on the Rune Track have also summarized a set of methodologies:

-

Before making a move, check the total volume and overseas community atmosphere. If the total volume is too large, the current amount of funds cannot digest it. Without the participation of overseas communities, there may be huge selling pressure.

-

If you are lucky enough to encounter a block during the game and the on-chain handling fee increases, the rising cost will make those who minted early make money;

-

After the game, see if there are any celebrities or project owners supporting the project to see if there is hope of attracting attention.

In essence, this strategy is also a helpless move made when the market is in a deep bear market and there is no new capital entering.

New narrative and new gameplay are the antidote

So, with inscriptions dropping to freezing point and rune prices not doing well, what is the antidote to break the silence of the Bitcoin ecosystem? Based on past experience, the answer is new narratives and new gameplay.

Looking back at the Bitcoin ecosystem bull market, the first large-scale Bitcoin bull market from May to July 2023 was caused by BRC 20. This was the first large-scale dissemination of the Bitcoin ecosystem asset issuance narrative, which attracted a large number of users, projects and investors;

The second wave of large-scale Bitcoin bull market from November 2023 to February this year was caused by the narrative that BRC 20 was listed and all chains could be inscribed. Binance launched ORDI and other top BRC 20 assets, making the inscription gameplay no longer confined to the chain. The issuance of inscriptions by all chains transferred the wealth effect of inscriptions to various chains, and the public chain gained a lot of traffic and attention.

The short-lived third wave of large-scale Bitcoin bull market in April 2024 was caused by the launch of the Runes protocol and the airdrop gameplay. The biggest innovation of the Runes protocol was the creation of pre-mining and large-scale community airdrop gameplay, but because it took nearly half a year to warm up, the Runes protocol digested all the positive factors and market sentiment within one month of its launch, causing this bull market to end quickly.

In summary, it can be seen that every explosion in the Bitcoin ecosystem is driven by new narratives, new gameplay or new innovations. In each cycle, there will always be assets with super high odds or even exceeding the returns of previous top targets.

We currently need such innovations to break the silence of the Bitcoin ecosystem and attract new users and funds. Many projects are also trying various innovations, such as Unisat鈥檚 first large-scale airdrop of 5-character BRC 20 pizza and the recently discussed programmable runes.

According to past experience, the Bitcoin ecosystem has a fast cycle, with something new appearing every 3-6 months of silence.

This article is sourced from the internet: The chain is cooling down. What will be the antidote to lead the Bitcoin ecosystem out of the trough?

ذات صلة: الفهم المنهجي لـ EigenLayer: ما هي مبادئ LST وLRT والاستعادة؟

المقدمة: تعد عملية الاستعادة والطبقة الثانية من الروايات المهمة لنظام الإيثريوم البيئي في هذه الدورة. يهدف كلاهما إلى حل المشكلات الحالية للإيثريوم، لكن المسارات المحددة مختلفة. بالمقارنة مع ZK، وإثبات الاحتيال والوسائل التقنية الأخرى ذات التفاصيل الأساسية المعقدة للغاية، فإن عملية الاستعادة تتعلق أكثر بتمكين المشاريع النهائية من حيث الأمن الاقتصادي. ويبدو أنها تطلب فقط من الناس التعهد بالأصول والحصول على المكافآت، ولكن مبدأها ليس بهذه البساطة التي نتصورها بأي حال من الأحوال. يمكن القول أن الاستعادة هي بمثابة سيف ذو حدين. أثناء تمكين النظام البيئي للإيثيريوم، فإنه يجلب أيضًا مخاطر خفية هائلة. حاليًا، لدى الناس آراء مختلفة حول الاستعادة. يقول البعض إنها جلبت الابتكار والسيولة إلى إيثريوم، بينما يقول آخرون إنها نفعية للغاية وتسرع...