frxETH TVL plummets, variables hidden behind the LSD points war

Original author: StableScarab

Original translation: Tyler

As the ETH LSD with the highest return, why did frxETH launched by Frax Finance suddenly reduce its TVL by 100,000 ETH in the past 3 months?

This article aims to help everyone understand the fiercely competitive ETH staking market and the deep-seated factors behind Frax Finance.

What is frxETH?

frxETH is an Ethereum stablecoin launched by Frax Finance. It is generated by directly staking ETH, and frxETH (sfrxETH) adopts a dual-token design, which also helps it become the ETH liquidity staking derivative (LSD) with the highest yield at present:

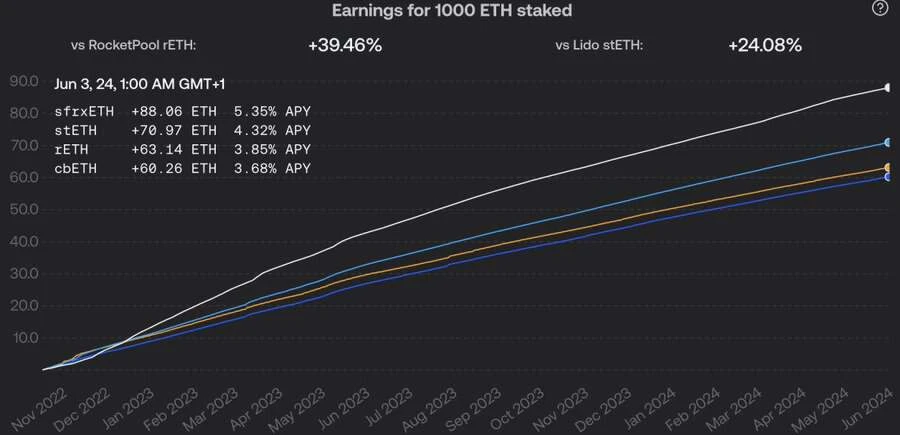

Because in addition to traditional staking forms, other use cases of frxETH will also increase the annualized yield (APY) of sfrxETH, so since its launch in November 2022, the yield of sfrxETH is not only 24% higher than stETH in the same period, but even 40% higher than rETH.

So why did frxETHs TVL fall so sharply despite its high yield?

It’s very simple, points, points, and more damn points!

The re-staking craze has swept the LSD market – Eigenlayer offers reward points to users who lock up ETH, attracting a huge amount of TVL, and the liquidity re-staking yield is even higher.

So from the data chart, the time point when Eigenlayer opened deposits on February 5th was also the highest point of frxETH TVL.

Arbitrage balance between frxETH and sfrxETH

Why would some frxETH users not choose secondary staking and are willing to transfer their earnings to sfrxETH users?

Because Frax Finance provides frxETH users with another income option – deposit frxETH into Curves frxETH/ETH liquidity pool and reap LP income.

From the users perspective, Frax Finance actually provides two profit paths for frxETH:

-

First, pledge ETH as frxETH, then deposit it into the frxETH/ETH liquidity pool to earn Curve income, while transferring your own frxETH pledge income;

-

First pledge ETH as frxETH, and then pledge it again as sfrxETH. In this way, while obtaining your own pledge income, you can also obtain the additional frxETH pledge income transferred by the first part of users;

Theoretically, choosing Curves frxETH/ETH liquidity pool (frxETH) and choosing secondary staking (sfrxETH) will gradually form a dynamic arbitrage balance due to the difference in yields, thereby keeping the yields of the two different options in the same range.

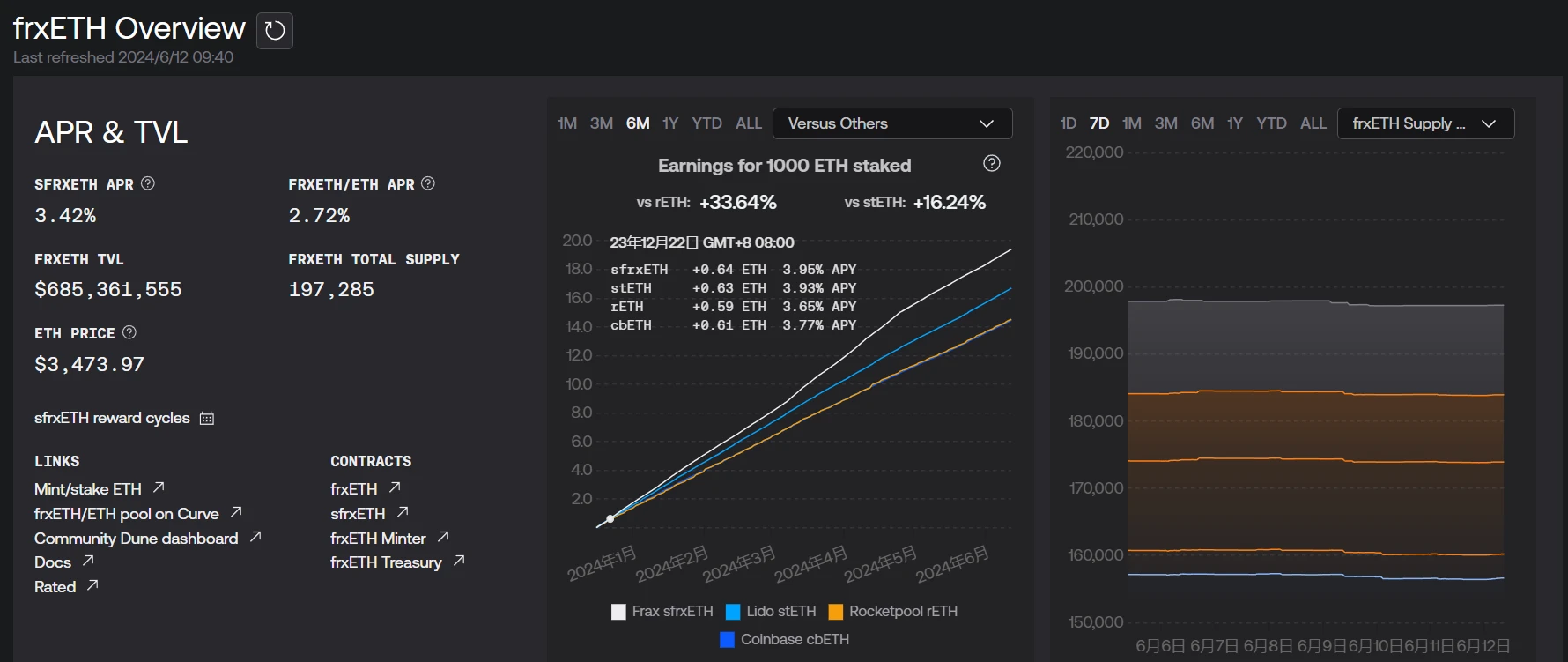

According to data from Frax Finance’s official website, as of June 12, the yields of the two were indeed quite close: Curve’s frxETH/ETH liquidity pool (frxETH) was 2.72% , and the secondary pledge (sfrxETH) was 3.42% , and the proportions of the two were basically close.

Behind the LSD Points War

In the LSD competitive landscape, points fall into the category of “incentives,” which are temporary rewards used to attract investors to a project, which are useful for launching a project but are not meant to be permanent.

Everyone knows that points will not last long, and all point models are unsustainable strategies – points will eventually be converted into other assets, causing users attracted by high incentives to switch to other projects.

However, re-staking itself is a very effective technical narrative that can provide additional benefits to users, and Frax Finance also plans to provide native re-staking services directly in frxETH v2.

In this process, whether a suitable incentive system can be designed determines whether the service can continue to function. This is also the underlying reason why Frax Finance designed the Flox mechanism. Flox is a block space incentive plan for Frax Finances new L2 Fraxtal, which is mainly distributed with the tail tokens of FXTL.

Since Flox checks users assets and on-chain interactions, any user can easily earn FXTL by holding frxETH on Fraxtal.

According to the latest official documentation, Fraxtal, as an L2 network, is also a modular Rollup blockchain with a roadmap of “fractal scaling”. Its functions and features include:

-

EVM equivalence. Fraxtal uses the OP stack as its smart contract platform and execution environment, allowing project owners to deploy applications as quickly, securely, and cheaply as Optimism and Base;

-

Modular Rollup. Fraxtal will have multiple components and middleware for other chains and networks to use, connect, deploy L3 and build on them. Currently, Fraxtal uses a separate data availability (DA) module developed by the Frax Finance core team;

-

Blockspace incentives (called Flox). This feature is used to reward users and developers – any account and smart contract that spends Gas and interacts with any smart contract on the network will be rewarded with Fraxtal Point System (FXTL) points according to the Flox algorithm, which can later be converted into tokens;

-

frxETH is used as Gas payment token;

In addition, according to official disclosures, Fraxtal will be launched together with major Ethereum infrastructure providers, including Etherscans Fraxscan and various DeFi-related services such as Safe, Chainlink, Axelar Network and LayerZero.

So why do I think frxETH will recover? In addition to the native re-staking function, frxETH v2 will also introduce the following new features:

-

Decentralized validators;

-

Higher node capital efficiency;

-

Performance incentives for node operators;

Most importantly, Fraxtal will use frxETH as Gas fee, and burning frxETH can increase the annualized rate of return (APR) of sfrxETH.

Good things come to those who wait. It will be worth observing in depth whether frxETH can become an outlier in the Ethereum liquidity staking track in the future.

This article is sourced from the internet: frxETH TVL plummets, variables hidden behind the LSD points war

أصلي | أوديلي بلانيت ديلي المؤلف | محرر آشر | تشين شياو فنغ في الأسبوع الماضي، كان سوق العملات المشفرة بشكل عام بطيئًا نسبيًا، ولكن لا يزال هناك العديد من المشاريع الشهيرة في قطاع GameFi التي أصدرت تحركات كبيرة. ربما مع تعافي السوق، سيأتي دوران العملات البديلة إلى قطاع GameFi. لذلك، قامت Odaily Planet Daily بتلخيص وتصنيف مشاريع ألعاب blockchain التي حظيت بشعبية كبيرة مؤخرًا أو التي لها أنشطة شائعة. أداء السوق الثانوي لقطاع ألعاب blockchain وفقًا لبيانات Coingecko، انخفض قطاع الألعاب (GameFi) بمقدار 9.8% في الأسبوع الماضي؛ القيمة السوقية الإجمالية الحالية هي $ 19,853,737,045، لتحتل المرتبة 22 في تصنيف القطاع، بانخفاض مكان واحد عن تصنيف إجمالي القيمة السوقية للقطاع الأسبوع الماضي. في الأسبوع الماضي ارتفع عدد الرموز...