المؤلف الأصلي: عارف

الترجمة الأصلية: البلوكشين العامية

ستقدم هذه المقالة اليوم بعض مزودي RaaS (Rollups-as-a-Service) الرئيسيين ووجهات نظر المؤلف حول Restaking.

1. حول Rollup

يعد RaaS (Rollup-as-a-Service) موضوعًا مثيرًا للجدل نظرًا لوجهات النظر حول Rollups (L2 وL3). من ناحية، يزعم المؤيدون أن منصات مثل Caldera وConduit تجعل من السهل جدًا بناء Rollups، وهو أمر إيجابي لتطوير النظام البيئي بأكمله. من ناحية أخرى، يزعم بعض الأشخاص أننا لدينا بالفعل مساحة كتلة كافية وأن هذه الأدوات تصبح غير ذات صلة. رأيي الشخصي في مكان ما بين هذا وذاك، وهناك بعض الحجج القوية على كلا الجانبين. أعتقد أن البنية الأساسية لـ Rollup إيجابية للفضاء، سواء كان كبيرًا أو صغيرًا، ولكن يمكنني أيضًا أن أفهم سبب تشكك الناس في هذه التكنولوجيا التي تدفع تبني العملات المشفرة.

تسرد L2 Beat حوالي 55 من العملات المشفرة النشطة، وتمثل العملات الخمس الأولى (Arbitrum وOptimism وBase وBlast وMantle) 82.74% من السوق حتى كتابة هذه السطور. لست متأكدًا مما إذا كان ينبغي النظر إلى هذا باعتباره أحد أعراض تصميم العملات المشفرة المبكر غير المتمايز في مجال التشفير، أو افتقارًا عامًا للاهتمام بمعظم العملات المشفرة - ربما يكون مزيجًا من الثلاثة.

Arbitrum وOptimism هما بسهولة أكثر مجموعات التجميع نضجًا، وهما حاليًا أشبه بالسلاسل الحقيقية (بدلاً من سلاسل الشركات التابعة لـ Ethereum). تتمتع Base بمجتمع نشط للغاية وربما تكون أفضل مجموعة تجميع في الوقت الحالي، على الرغم من أن قيمتها المقفلة أقل. ينطبق موقف مماثل على Blast، على الرغم من أنني لست متأكدًا مما إذا كانت قيمتها المقفلة الأعلى أكثر جاذبية من المجتمع الذي بناه Base، والذي تم بناؤه بدون برنامج نقاط ترفيهي. حتى أن Base صرحت صراحةً أنها لن تصدر رموزًا، لكن لم يهتم أحد لأنها كانت أول مجموعة تجميع تشهد نشاطًا عفويًا - تم تعدين Arbitrum وOptimism بكثافة حتى قبل إعلان الإنزال الجوي.

Mantle عبارة عن نظام تجميعي لا أعرف عنه الكثير، ولكنني ألقيت نظرة سريعة على النظام البيئي وأعتقد أنه في وضع أفضل من Mode وManta وحتى Scroll. يعتمد تطويره المستقبلي بالكامل على تدفق القيمة المقفولة ونشر التطبيقات الجديدة، وكلاهما سيتم تحديده قبل المزيد من التطوير.

تتضمن قائمة L2 Beat لمشاريع التجميع القادمة 44 مشروعًا، وهو أمر أكثر إثارة للقلق من مشاريع التجميع النشطة البالغ عددها 55 مشروعًا الموجودة حاليًا. تستخدم هذه المشاريع التجميعية الـ 44 مجموعة متنوعة من التصميمات المختلفة، مثل Optimiums وValidiums، ولكنها في النهاية تتنافس جميعها على نفس السوق. إنه موقف مقلق أن القليل جدًا من مشاريع التجميع النشطة قادرة على "القفز" من "طبقة التنفيذ المعيارية/سلسلة فرعية Ethereum إلى السلسلة المهيمنة، والتي تصادف أنها L2".

تنجح L1s عندما تتراكم سنوات من موهبة المطورين في طبقة أساسية مستقرة بشكل أساسي، مما يوفر فرصة لتشكيل المجتمع وإنشاء النظام البيئي (فكر في أيام كازينو Memecoin لـ Solana، أو اندفاع DeFi الصيفي لـ Ethereum، أو حتى الترتيبات على Bitcoin). تأتي فائدة Rollup من أمانها المشترك مع الطبقة الأساسية، والتي تكون Ethereum في ذلك الوقت، ما لم تكن تتحدث عن L2 لـ Solana وتكاليف المعاملات المنخفضة نسبيًا.

لا أعتقد أن التكنولوجيا وحدها كافية لجعل Rollup مهمًا من الناحية الأيديولوجية أو حصة السوق، كما يتضح من حقيقة أن بعض التقنيات "الأقوى" (مثل Scroll وTaiko وPolygon zkEVM) لم تحقق تقدمًا كبيرًا في لعبة القيمة المقفولة. ربما تشهد هذه الفرق زيادة في القيمة المقفولة على المدى الطويل، ولكن بناءً على المشاعر الحالية والافتقار إلى السعي، لا أرى أن هذا سيحدث. لا، لا يريد مستخدموك الثمانية حضور حدث Galxe آخر، وهم بالتأكيد لا يريدون نقاطًا يمكن استبدالها برموز غير قابلة للتحويل.

إذا كان بإمكانك وضع نفسك في مكان مستثمر جديد تمامًا في العملات المشفرة، فكيف ستشعر تجاه Rollups؟ ما لم يكن لديه بعض memecoin يمكنك جني الأموال منه، فأنا لست متأكدًا من أنك ستسعد برؤية شيء مثل Rollup الخامس عشر الذي لا يعرف شيئًا وبديل zkEVM لـ EVM.

يبدو هذا التحليل الموجز (نظرة سريعة على L2 Beat) هبوطيًا إلى حد ما، ولكن طالما أنني لا أضع أموالي في L2 أو L3، فأنا بخير مع ذلك. لا أعتقد أن المزيد والمزيد من عمليات التجميع هي بالضرورة أمر سيئ للمساحة، ولكن يجب أن نكون أكثر صراحة بشأن الفائدة التي تجلبها. على مدار الأشهر القليلة الماضية، أصبحت العديد من التطبيقات سلاسل خاصة بالتطبيقات (Lyra وAevo وApeX وZora وRedstone)، وأظن أن هذا الاتجاه سيستمر حتى يصبح الجميع من Uniswap إلى Eigenlayer L2.

لذا، في حين لا يمكننا إيقاف عدد عمليات التجميع الجديدة التي يتم نشرها، يمكننا على الأقل أن نحاول أن نكون صادقين بشأن التأثير الذي تخلفه على العملات المشفرة. لدينا مساحة كتلة كبيرة لدرجة أن الشبكة الرئيسية لإيثريوم لا تحتاج حتى إلى أي مساحة كتلة إضافية - ربما يكلف إكمال معاملة واحدة في الوقت الحالي ما يصل إلى $10 كحد أقصى، وقد كان الأمر على هذا النحو لعدة أسابيع.

من الصعب جدًا التمييز بين موفري خدمات RaaS مثل Conduit وCaldera، وأقول هذا بثقة كبيرة لأنني آمل أن يصحح لي شخص ما الخطأ الذي ارتكبته. فيما يلي نظرة عامة سريعة على عمليات نشر Rollup الخاصة بكل منهما:

-

تقدم شركة Conduit منتجات OP Stack وArbitrum Orbit؛ وتقدم شركة Caldera منتجات Arbitrum Nitro وZK Stack وOP Stack.

-

يقدم Conduit Ethereum وArbitrum One وBase كطبقات تسوية؛ ولا يسرد Caldera طبقة تسوية، ولكن أتخيل أنها ربما تكون متشابهة جدًا.

-

تتضمن عروض DA الخاصة بشركة Conduit كل من Ethereum وCelestia وEigenDA وAnyTrust DA الخاصة بشركة Arbitrum؛ وتقدم Caldera كل من Celestia وEthereum، ولكنها تخطط لدمج Near وEigenDA قريبًا.

-

يتيح لك Conduit استخدام أي ERC-20 كرمز غاز أصلي؛ ويتيح لك Caldera استخدام DAI وUSDC وETH وWBTC وSHIB.

بشكل عام، المنصتان متشابهتان للغاية. أعتقد أن الاختلاف الوحيد قد يأتي من الخبرة الاستشارية الفعلية مع الفريقين. لم أتحدث إلى أي من الفريقين بعد، لذا أعتذر إذا بدا أي من هذا متسرعًا أو غير مدروس، لكنني أعتقد أنهم سيقدرون نظرة صادقة إلى RaaS والحالة الحالية للصناعة.

لقد فكرت في إنشاء Rollup خاص بي، فقط من أجل المتعة، ولكن لا يمكنني إنفاق مبلغ $3000 شهريًا للحفاظ على سلسلة افتراضية (ما لم يرغب أحد المستثمرين في إرسال رسالة خاصة لي ويمكننا التحدث).

بشكل عام، أؤيد التجميع كخدمة (RaaS) وآمل أن يستمر كل من يعمل في هذا المجال في العمل عليه. لا أرى أي مشكلة في ذلك وأعتقد أن الحجة القائلة بأن "هناك عددًا كبيرًا جدًا من التجميع" لا معنى لها بالنظر إلى الحالة الحالية لصناعتنا.

2. حول إعادة التخزين

وبينما نحن نتحدث عن حالة صناعتنا، فهذا هو الوقت المناسب لمناقشة بعض الشكاوى التي لدي بشأن Restaking، وLRT، وAVS، وEigenlayer بشكل موجز.

اعتبارًا من اليوم، فإن كمية الإيثريوم المودعة في Eigenlayer ضخمة، عند حوالي 5.14 مليون. في البداية، اعتقدت أن معظم الأموال ستضيع بعد انتهاء برنامج النقاط، لكنني أشعر بخيبة أمل لأن إعلان الإنزال الجوي الأخير لم يؤد إلى تدفق الأموال إلى أماكن أكثر قيمة، بل زادها في الواقع. بالنسبة لأولئك الذين توقعوا أن يزيد الإنزال الجوي لـ Eigenlayer رأس المال بسهولة بمقدار 20-25 ضعفًا، أعتقد أنهم ربما كانوا مخادعين لأنفسهم بعض الشيء، لكنني لم أتوقع منهم حظر جميع البلدان الرئيسية تقريبًا بعد ذلك. كان هناك العديد من التغريدات التي تعبر عن عدم الرضا عن معايير Eigenlayer المزدوجة (بما في ذلك تغريدة واحدة مني)، لكنني لا أعتقد حقًا أن هناك أي فائدة من مناقشة هذه القضية بعد الآن.

كما أصدر الفريق ورقة بيضاء ضخمة تشرح كيفية عمل EIGEN وتقدم مفهومًا جديدًا يسمى المنفعة بين الأشخاص. في الواقع، لا أحد يعرف حقًا ما يعنيه هذا ولا أحد يناقشه لأن EIGEN لن تكون قابلة للتحويل في البداية، وهو أمر غير مقبول على الإطلاق بالنسبة للأشخاص الذين يريدون بناء مجتمع حول بروتوكولهم. إذا لم يتمكن الناس من الثراء من خلال الرموز أو النظام البيئي المحيط بالرموز، فسوف يتجه الناس إلى مجالات ذات إمكانيات لكسب المال (مثل memecoins).

لا توجد لدي مشكلة مع Eigenlayer أو الفريق نفسه، أريد توضيح ذلك في البداية. ومع ذلك، لدي مشكلة مع إعادة التخزين وسلة AVS المدرجة حاليًا في القائمة البيضاء على Eigenlayer. نظرًا لأكثر من 5 ملايين ETH التي تم إيداعها لدى Eigenlayer، فقد تعتقد أن الناس سيكونون قادرين على كسب عائد مرتفع للغاية، أليس كذلك؟ أنا هنا لأخبرك أن هذا الافتراض خاطئ.

عندما تفكر في فائدة إعادة الإيداع، فأنت تستخرج بشكل افتراضي الأمن الاقتصادي من مجموعة المدققين الأكثر استقرارًا اقتصاديًا في العالم. تقوم بإيداع أنواع مختلفة من stETH في منصة إعادة الإيداع مثل Eigenlayer (أو Karak، وفي النهاية Symbiotic) في مقابل عائد أعلى على عائد stETH الجذاب بالفعل. مشكلتي هي أنه لا يوجد توليد عائد متأصل في إعادة الإيداع نفسها، يجب أن يأتي العائد من AVSs المقدمة داخل Eigenlayer. إذا كنت من المودعين الذين يودعون 10 stETH في Eigenlayer ويفوضون تلك ETH المودعة إلى مشغل مثل ether.fi، فأنت بحاجة إلى الوثوق بهم لاختيار سلة AVSs المناسبة لتوليد العائد لك.

ولكن من أين تأتي هذه الفوائد؟

في الواقع، لا يعد Ethereum على مستوى البروتوكول بأن المشاركين في ETH سيحصلون على المزيد من المكافآت إذا وضعوا مخاطرهم في بروتوكول إعادة المشاركة. لا يمكن أن يأتي الدخل إلا من مكان واحد: الرمز الذي أصدرته AVS نفسها.

لست خبيرًا، ولكنني أجد صعوبة أيضًا في فهم سبب عدم طرح أحد لهذا السؤال على تويتر. بالطبع، تحظى قضايا أكثر أهمية مثل عمليات الإنزال الجوي السيئة والمخاطر التي تهدد أمن الإيثريوم بمزيد من الاهتمام. ولكن لماذا لا يطرح أحد سؤالًا بسيطًا حول ما قد يحدث بعد إطلاق Eigenlayer وتفعيل آلية العقوبة أخيرًا؟

أين الحافز للاحتفاظ بأصولي المودعة عندما لا يناقش الفريق الأرقام الفعلية بشأن توليد العائد المحتمل ولا يحمل $10M في الأصول، ولكن لديه أكثر من $500M أو أكثر في ETH المعاد ضمانها؟

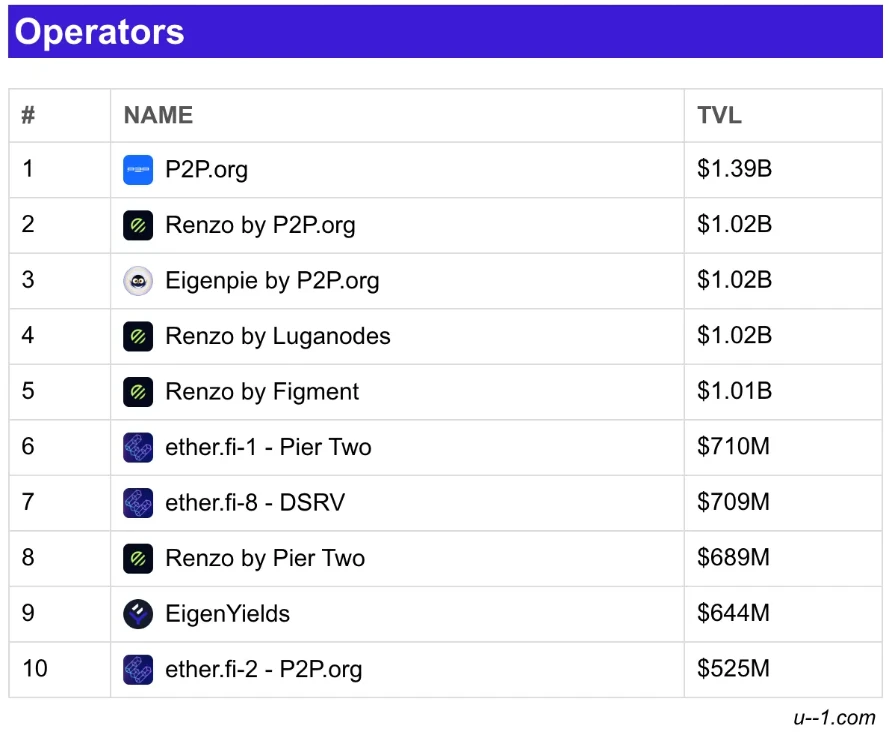

نحن في موقف مثير للاهتمام حيث أن أفضل 10 مشغلين على Eigenlayer لديهم في المتوسط 5 AVS مسجلين لكل منهم، وهناك تداخل كبير بينهم. أعلن Eigenlayer بحكمة أن آلية العقوبة لن يتم تمكينها لمدة عام تقريبًا للسماح للجميع بالتكيف مع واقع إعادة الرهان الجديد. بالنظر إلى أن لا أحد يناقش مخاطر إعادة الرهان باستثناء Gauntlet و Mike Neuder، فهذا قرار حكيم. على الرغم من أن كلا المقالين جيدان جدًا، إلا أنهما لا يقدمان في الواقع أي أمثلة محددة لأن AVS الحالي ليس له تأثير يذكر.

كما قلت من قبل، فإن مزايا Eigenlayer واضحة. ولكن هل من الضروري تزويد كل بروتوكول ناشئ بما يقرب من مليار دولار من ETH Restaking للمستخدم وتعريضه لمخاطر مستقبلية؟ على الرغم من أن آلية العقوبة لم يتم تفعيلها بعد، إلا أنها ستُفعَّل في أقل من عام - فهل يدرك المشغلون تمامًا مخاطر Restaking والمخاطر المتزايدة مع كل تسجيل AVS لاحق؟

لست متأكدًا من هذا. ربما سنرى بعض منصات إعادة المراهنة الأخرى تستهلك تدريجيًا حصة Eigenlayer في السوق، ومن الناحية المثالية مع اكتسابها ملاءمة المنتج للسوق وتوفير كميات أصغر من إعادة المراهنة على ETH إلى AVS بدلاً من العكس.

تم الحصول على هذه المقالة من الإنترنت: Crypto Talk: بعض الأفكار حول RaaS و Eigenlayer

ذات صلة: توقعات أسعار عملة Dogecoin: ارتفاع آخر بمقدار 25% في الأفق

باختصار يحاول سعر Dogecoin الإغلاق فوق $0.16، وهو أمر أساسي لبدء مسيرة التعافي إلى $0.20. شهد الاهتمام المفتوح زيادة بنحو $200 مليون في 48 ساعة، مع ترقب المتداولين لارتفاع السعر. عملة meme بعيدة كل البعد عن ملاحظة قمة السوق حيث أن أقل من 84% من المعروض المتداول منها هو أرباح. تعافى سعر Dogecoin DOGE من أدنى مستوياته عند $0.12 بعد انخفاضه إليه في بداية شهر مايو. على الرغم من أن عملة meme الرائدة عالقة تحت حاجز $0.16، إلا أنه يمكن تجاوزه. ارتفاع متوقع لسعر Dogecoin يشهد سعر Dogecoin ارتفاعًا في الاتجاه الصعودي على أيدي المستثمرين. يمكن رؤية المتداولين وهم ينشئون عقودًا طويلة الأجل، مما أدى إلى ارتفاع الاهتمام المفتوح بنسبة 100%.