النسخة اليومية الأصلية من Planet Daily

المؤلف: أزوما

On June 5th, Beijing time, Solana ecosystem LST staking protocol Sanctum officially announced basic information about the token economic model, and explained some detailed plans about the points activities and airdrop plans through subsequent community AMA.

As the top project in the second phase of Jupiter LFG Launchpad voting, Sanctum has always received high community attention in the Solana ecosystem. In the past one or two months, Sanctum has achieved rapid growth in data with the help ofthefirst season points eventSanctum Wonderland S 1.As of the time of writing, the TVL is temporarily reported at US$1.03 billion, making it the fourth DeFi protocol in the Solana ecosystem in terms of TVL.

Project Analysis

In April, Sanctum announced the completion of its seed round of extended financing, led by Dragonfly, with participation from Sequoia, Solana Ventures, CMS Holdings, DeFiance Capital, Genblock Capital, Jump Capital, Marin Digital Ventures and others. Although the amount of this round of financing was not disclosed, Sanctum revealed that the total financing of the project has reached US$6.1 million.

Unlike conventional liquidity staking protocols, what Sanctum is doing is more like helping Solana build a more unified liquidity staking paradigm to solve the liquidity fragmentation problem of major liquidity staking tokens in the current Solana ecosystem (LST, such as Sanctum own INF and other tokens such as jitoSOL, mSOL, bSOL, etc.).

By building a unified liquidity layer around liquidity staking scenarios, Sanctum can use multiple modules such as Reserve (supports instant unstaking services for all LSTs), Router (supports conversion between two LSTs that usually have no transaction path), and Infinity (supports conversion between all LSTs) to help users achieve extremely fast and lossless redemptions, or convert between major LSTs with extremely low wear and tear.

النموذج الاقتصادي الرمزي

Last night, Sanctum founder FP Lee simultaneously disclosed the project token economic model.

Sanctum protocol token will be called CLOUD. In addition to basic governance utility, FP Lee also mentioned that potential partners may need CLOUD to qualify for Sanctum verification program, which also adds a certain practical value to CLOUD.

The total supply of CLOUD will be 1 billion, with the following distribution:

- Community Reserve 30% : The community reserve should be used strategically to expand Sanctum market share. The community will ultimately decide how to use this reserve.

- Strategic Reserve 13% : The team will use this part of the reserve to develop the Sanctum ecosystem, such as future acquisitions, strategic investments, ecological partners, donation programs, market making, etc.

- 25% for the team : locked for one year, and then released linearly over the next 24 months.

- Investors 13% : Sanctum has sold some tokens in the past at valuations of 50 million and 60 million, most of which were sold in 2021. These tokens will also be locked for one year and then released linearly over 24 months.

- Initial airdrop 10% : will be distributed to the community during the CLOUD TGE.

- LFG Launch 8% : used to inject initial liquidity into CLOUD鈥檚 Launchpad in Jupiter.

- LFG donates 1% : This portion of the share will be donated to Jupiter LFG. According to past practice, Jupiter will generally airdrop it to LFG voting participants.

In terms of circulation, CLOUD can achieve a maximum initial circulation rate of 18% at the beginning of TGE , including 10% initial airdrop share and 8% LFG Launch share, but the unsold tokens in Jupiter Launchpad will be transferred back to the strategic reserve.

Points Activities

Currently, Sanctums first season points activity has officially ended, which attracted the participation of more than 300,000 addresses in total.

However, some details about the first season points event are still to be confirmed, including the utility information of cupcakes and the users final points situation – Sanctum said it is still finalizing the statistics, so the scores displayed on the front end may change slightly.

As for the second season, FP Lee originally planned to launch it immediately after the first season, but later decided to postpone the launch to allow for a richer design in order to give users a different experience. As for the specific launch time of the second season, there is no specific information yet, but it is certain to be after TGE.

إنزال جوي Program

The current confirmed information about the airdrop is that 10% of the CLOUD tokens (100 million) will be distributed to participants in the first season of the event. FP Lee also revealed that certain witch screening will be carried out to distinguish between farmers and true believers.

As for when the TGE and airdrop will take place, there is no specific timeline for now. The official only mentioned that the airdrop qualifications will be disclosed and available for collection in the next few weeks.

It is also worth mentioning that although the 10% CLOUD used for the initial airdrop has been included in the initial circulation range, FP Lee also mentioned that some additional rules may be designed for specific collection to ensure that true believers can have certain liquidity advantages – such as setting 50% of the airdrop shares to be unlocked immediately and the rest to be unlocked within 7 days – but this plan is still to be determined.

Where to trade?

In addition to airdrops, another direct channel to obtain CLOUD is to participate in Jupiters LFG Launchpad.

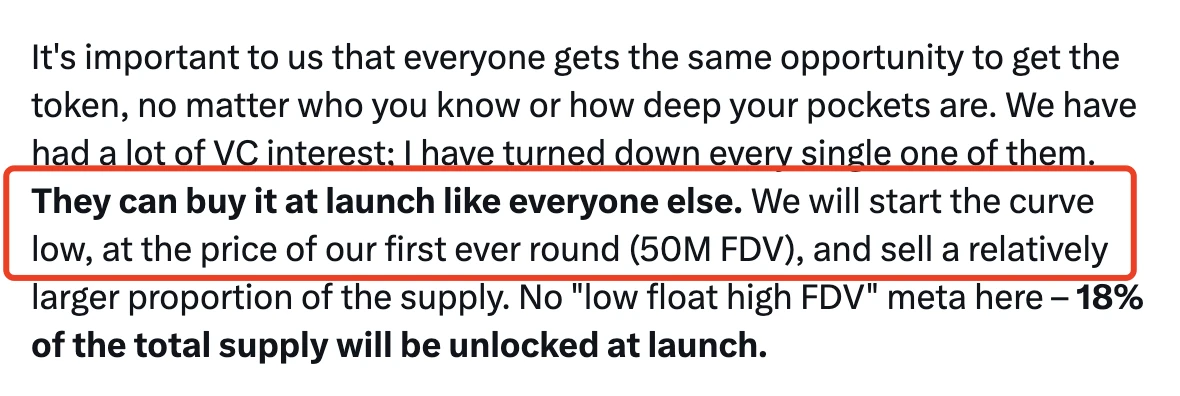

A total of 8% of CLOUD will be invested in Jupiters Launchpad pool as initial liquidity. FP Lee mentioned that the initial price curve of CLOUD will start with a FDV of 50 million US dollars , which is still a very attractive price.

فضلاً عن ذلك، FP Lee also emphasized that he would not pay listing fees to any centralized exchange (CEX) because he would rather give the money to the community.

In summary, FP Lee said that CEX is welcome to choose to list on CLOUD, but will not force them to pay. This may cause CLOUD to be unable to land on more mainstream CEXs in the early stage of TGE, so the on-chain market may be the main battlefield for CLOUD.

This article is sourced from the internet: Get the latest information on Sanctum tokens and airdrops

ذات صلة: تشفير a16z: انتقاد Memecoin

العنوان الأصلي: كيف تفضل السياسة السيئة الميمات على المادة المقال الأصلي بقلم: كريس ديكسون تاريخ الإصدار: 20.04.2024 مع وصول أسعار العملات المشفرة إلى أعلى مستوياتها على الإطلاق مؤخرًا، هناك خطر الإفراط في المضاربة في سوق العملات المشفرة، خاصة مع الأحداث الأخيرة الضجيج حول العملات ميمي. لماذا يستمر السوق في تكرار هذه الدورات بدلاً من دعم الابتكارات التحويلية القائمة على تقنية blockchain؟ عملات الميم هي في الأساس عملات ميمي تم إنشاؤها بواسطة أشخاص في مجتمعات الإنترنت الذين يفهمون الميم. ربما تكون قد سمعت عن Dogecoin، الذي يعتمد على ميم الكلب القديم الذي يعرض صور Shiba Inu في مجتمع الإنترنت. عندما أعطاها شخص ما عملة مشفرة ذات قيمة اقتصادية لاحقة، شكلت مجتمعًا أوسع عبر الإنترنت. تعكس هذه العملة الميمية تنوع ثقافة الإنترنت، ومعظمها غير ضار، بينما…