تحليل موجز للنقاط الرئيسية في Aave V4 – طبقة السيولة الموحدة

Original author: Backlash developer Madiha

تم تجميعها بواسطة: Odaily Planet Daily Azuma

Editors Note: Aave, the veteran DeFi leader, is actively promoting the V4 protocol upgrade. Combined with previously disclosed information, the upgrade content of Aave V4 is to build a unified liquidity layer (ULL), thereby aggregating liquidity from multiple networks within a single protocol.

In terms of time planning, The Defiant previously وأفادت التقارير أن Aave plans to start prototyping the V4 protocol in the fourth quarter and plans to complete the code in the second quarter of 2025. This morning, the latest X speech by Aave founder Stani Kulechov reconfirmed and even shortened this expectation – Stani first revealed that Aave will launch Aave Network after the V4 version, and in response to the communitys questions about the time, he said : I am sure this will happen next year, or even earlier.

The following content is an overview and analysis of the Aave V4 core upgrade content Unified Liquidity Layer by Backlash developer Madiha, compiled by Odaily Planet Daily.

The main upgrade content of Aave V4 is the unified liquidity layer. In essence, this function is an extension of the Portal concept of Aave V3.

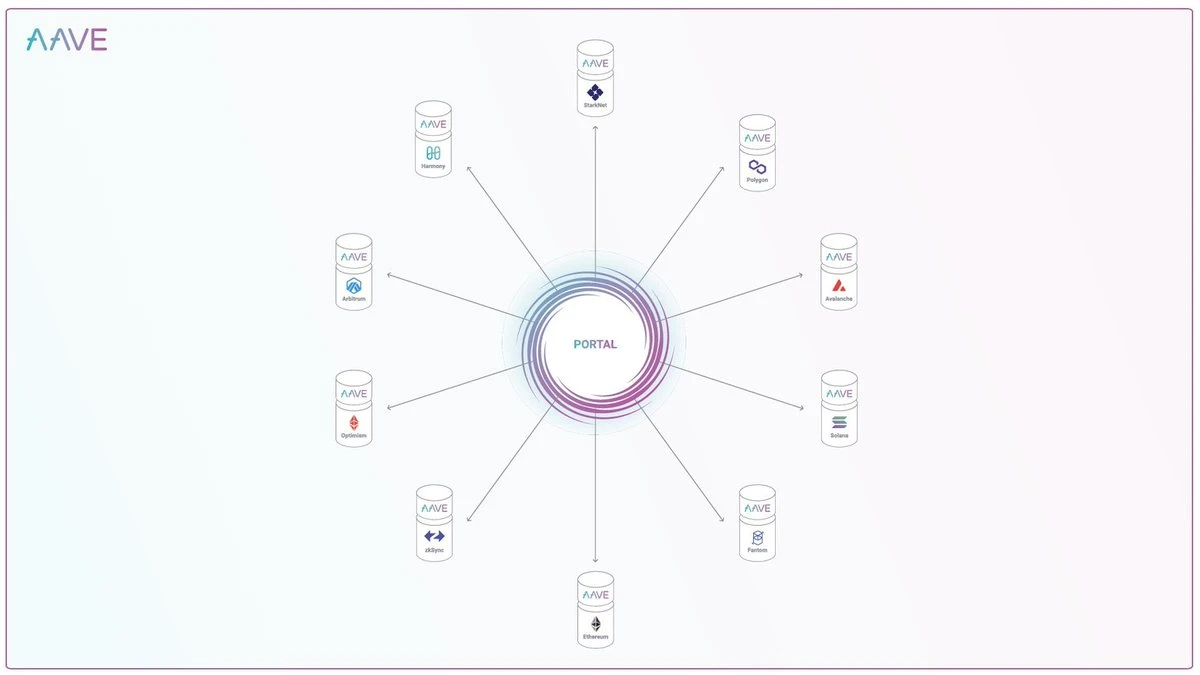

The so-called Portal was originally a function in Aave V3 that was applied to the cross-chain field, but in fact most users did not know or use this function. Next, let us gradually analyze how Portal evolved into a unified liquidity layer.

Portal was originally designed to achieve cross-chain bridging of supply assets on different blockchains covered by Aave. This function allows whitelisted bridge protocols to destroy aTokens on the source chain and instantly mint aTokens on the target chain.

For example, Alice has 10 aETH on Ethereum, and she wants to move these 10 aETH to Arbitrum. Once Alice submits the transaction to the whitelisted bridge protocol, the bridge protocol will start to execute the following steps.

-

On the target chain (Arbitrum in this case), 10 aETHs with “no underlying asset support yet” (actually there is, but it has not been transferred to the target chain yet) are minted through an intermediate contract.

-

The intermediary contract then transfers 10 aETH to Alice on Arbitrum.

-

Batch multiple bridge transactions and move 10 ETH as the underlying asset to Arbitrum.

-

Once funds are available on Arbitrum, the whitelisted bridge contract on Arbitrum will supply 10 ETH into the Aave pool to support the 10 aETH previously minted.

In the above example, Aave can move Alices 10 aETH from Ethereum to Arbitrum, but in the real world, this function can actually handle a variety of situations, such as general cross-chain asset transfers, or allowing Alice to withdraw 10 ETH directly on the Arbitrum network.

The Portal function allows users who are looking for higher interest rates between different blockchains to perform cross-chain operations more conveniently. For example, the pool on Optimism is relatively small during a certain period of time, but the deposit interest rate is higher than the pool on Ethereum . Users can simply operate through the Portal to migrate their deposits from Ethereum to Optimism and enjoy a higher deposit interest rate.

However, although Portal can turn Aave V3 into a DeFi protocol that ignores the liquidity barriers between chains, its operation requires certain trust assumptions. In short, users need to submit bridge transactions to some whitelisted bridge protocols (such as Connext) instead of the Aave V3 core protocol. Once again, end users cannot currently use Portal only through Aaves own core protocol.

This brings up the concept of a unified liquidity layer, which is also the most important architectural change from Aave V3 to V4. As shown in the figure below, the unified liquidity layer will adopt a modular design to uniformly manage supply/borrowing limit, interest rate, assets and incentives, and allow each module to extract liquidity from it.

By consolidating the management of liquidity, the “unified liquidity layer” will allow Aave to make more efficient use of all available assets, meaning that liquidity can be dynamically allocated to where it is most needed, thereby improving overall funding efficiency.

In addition, the modular design also means that Aave will be able to add new modules or features (such as isolated pools, RWA modules or CDP) while maintaining the normal operation of the entire system, or easily introduce new modules or retire old modules without migrating flows.

In Aave V3, Portal allows assets to move between different networks covered by the Aave protocol, thereby activating the cross-chain function of liquidity. The unified liquidity layer covers this function by creating a more flexible and abstract infrastructure that can also be used to support a more diverse liquidity supply needs.

Under the framework of the Unified Liquidity Layer, Aave will use Chainlinks Cross-Chain Interoperability Protocol (CCIP) to build a Cross-Chain Liquidity Layer (CCLL), allowing borrowers to instantly access all liquidity across all networks supported by Aave. This improvement is expected to develop Portal into a full-fledged cross-chain liquidity protocol, and I am looking forward to seeing how Aave V4 uses this new infrastructure to find new potential sources of revenue.

The above is Madiha’s full analysis of the “unified liquidity layer”.

It is worth mentioning that in addition to the unified liquidity layer, Aave is expected to introduce improvements such as dynamic interest rate mechanism, liquidity premium mechanism, smart account, dynamic risk parameter configuration, and non-EVM ecological expansion in the V4 version upgrade, and will use the stablecoin GHO and the Aave lending protocol itself as the core hub to build the Aave Network.

As a long-established DeFi leader, Aave has occupied about 50% of the DeFi lending market in the past three years . If fork projects are included, about 75% of the value in the DeFi lending market is locked in projects that utilize the Aave codebase version.

Aave has high expectations for the V4 version in the relevant proposal: These improvements are designed to significantly promote further adoption of the Aave ecosystem and help DeFi achieve further expansion, thereby serving 1 billion potential new users.

This article is sourced from the internet: A brief analysis of the key points of Aave V4 – Unified Liquidity Layer

Related: Why can’t retail investors make money in the current crypto market?

Original article by Regan Bozman Original translation: TechFlow Why is there so much talk of the cycle being over? Why is everyone so miserable? We can boil it all down to this: retail investors can no longer make real money in the current market structure. Some random thoughts on returning to basics and getting out of the current cycle The answer to why there are no retail investors in this round is actually very simple – its because the traditional cryptocurrency market (such as infra tokens) no longer has a 500x price. Now there is a more interesting casino with a better meme at their fingertips. We are essentially reproducing what happens in the VC/IPO markets where companies stay private longer, which means more of the upside stays “private” (e.g.…