معهد أبحاث Bitget: هيئة الأوراق المالية والبورصات الأمريكية توافق على صندوق Ethereum spot ETF 19b-4، ومن المتوقع أن تتعاون ETHFi والأصول البيئية الأخرى

Cryptocurrency prices saw significant volatility on Thursday, with liquidations of all leveraged crypto derivatives positions surging to over $360 million that day, the highest level since May 1:

-

The sectors with strong wealth-creating effects are: RWA sector and Ethereum staking sector;

-

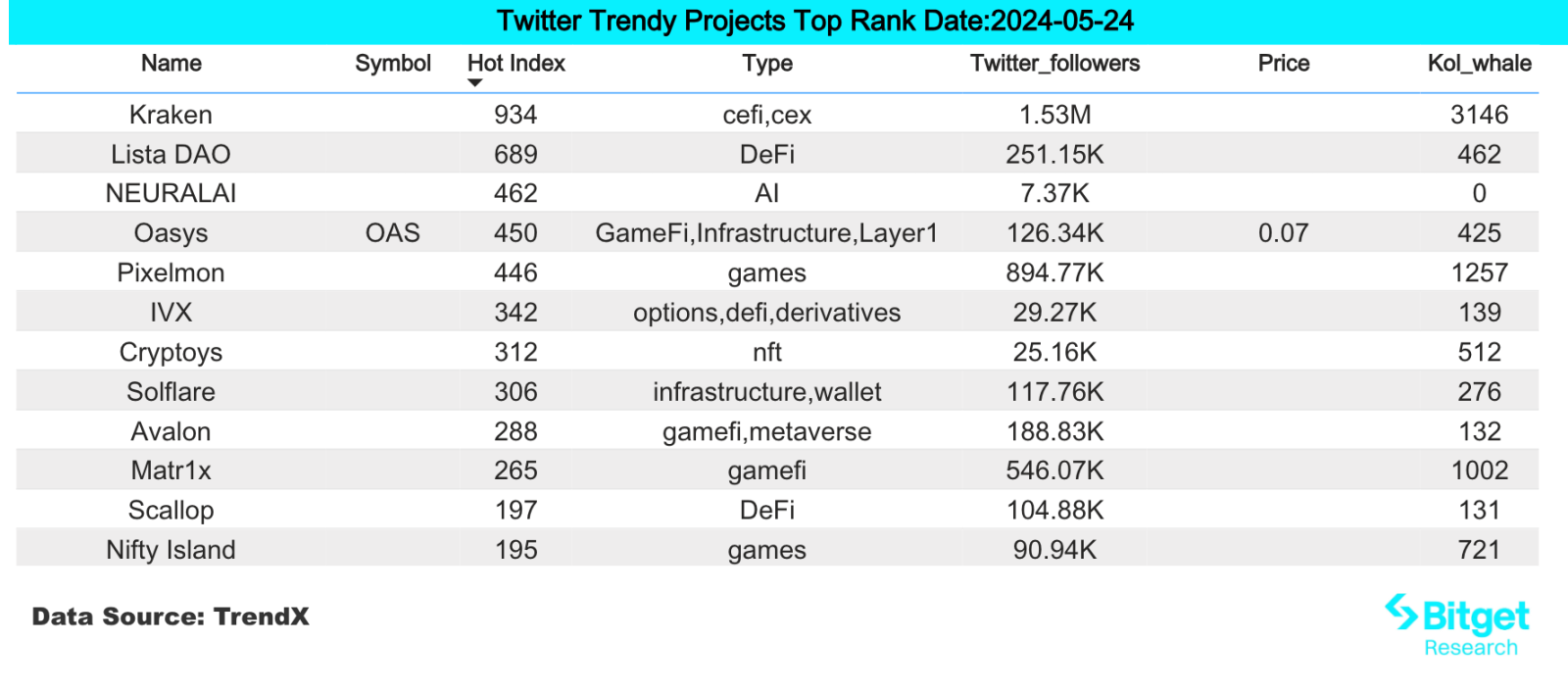

Hot search tokens and topics by users are: Plume Network, Lista (LISTA);

-

Potential airdrop opportunities include: Sanctum, Synthr;

Data statistics time: May 24, 2024 4: 00 (UTC + 0)

1. بيئة السوق

Cryptocurrency prices saw significant volatility on Thursday. Before the approval, ETH first fell to $3,500 around the closing time of the traditional U.S. market, then soared to around $3,900, and finally stabilized above $3,800 after confirmation. Bitcoin also fell to a low of $66,000, then soared to $68,300 before falling back below $68,000.

According to data from CoinGlass, during this turbulent period, liquidations of all leveraged crypto derivatives positions soared to more than $360 million that day, the highest level since May 1. Most of the liquidated positions were long positions, worth about $250 million, indicating that highly leveraged traders were concentrated on betting on an immediate surge after the ETF was approved. ETH traders were hit the hardest, with liquidations reaching $132 million.

2. قطاع صناعة الثروة

1) Sector changes: RWA sector (ONDO)

Main reason: This bull market mainly originated from the traditional market buying brought by ETFs. As a way to introduce traditional financial markets, RWA has been constantly updating its products and raising funds. Recently, RWA layer 2 network Plume Network completed a $10 million seed round of financing.

Rising situation: ONDOs daily increase today is 13.46%;

العوامل المؤثرة على توقعات السوق:

-

التغيرات في السياسة النقدية الكلية: فيما يتعلق بالبيئة الكلية، فإن الارتفاع في عائد سندات الخزانة الأمريكية لأجل 10 سنوات يدعم أساسيات مسار RWA؛ نحن بحاجة إلى الانتباه إلى التغييرات اللاحقة في مؤشر الدولار الأمريكي وعوائد سندات الخزانة الأمريكية وسوق العملات المشفرة، وضبط استراتيجيات التداول ديناميكيًا؛

-

التغييرات في مشروع TVL: يتم دعم مشاريع مسار RWA بشكل أساسي بواسطة TVL. يمكنك الانتباه إلى التغييرات في TVL لمسار RWA. إذا استمرت قيمة TVL للمشروع في الارتفاع/الارتفاع المفاجئ، فعادةً ما تكون هذه إشارة للشراء؛

2) Sector changes: Ethereum staking sector (LDO, SSV, ETHFI)

Main reason: The U.S. Securities and Exchange Commission today approved the 19 b-4 forms of multiple Ethereum spot ETFs, including those from BlackRock, Fidelity and Grayscale. Since ETFs only allow Ethereum tokens and do not allow staking, this regulation greatly reduces the attractiveness to ETF investors, so the Ethereum re-staking sector will usher in substantial benefits.

Rising situation: LDO rose 10.8% in the past 4 days, SSV rose 7.97% in the past 7 days, and ETHFI rose 22.85% in the past 4 days;

العوامل المؤثرة على توقعات السوق:

-

Fund inflow after ETH ETF is approved: At present, the ETF is in the countdown for listing after approval. If a large amount of funds flow in after approval, it will further push up the ETH price.

-

Protocol trends: The cash flow of staking sector projects is relatively stable and easy to predict. They are a type of project whose token prices can be estimated more accurately. The main influencing factors are the protocol TVL, income distribution method, token destruction, etc.

3) The sector that needs to be focused on in the future: TON ecosystem

سبب رئيسي:

-

قد يصل استثمار Panteras في TON إلى ما لا يقل عن $250 مليون دولار أمريكي، وهو أكبر استثمار لشركة Panteras في العملات المشفرة في التاريخ.

-

تم إدراج مشروع Notcoin، وهو مشروع يتمتع بحركة مرور عالية في نظام TON البيئي، على Binance، لكن رمز TON نفسه لم يتم إدراجه بعد على Binance. يتوقع السوق أن الأمر مجرد مسألة وقت قبل إدراج TON على Binance.

-

البنية الأساسية لنظام TON البيئي في مراحله المبكرة. حاليًا، ظهرت مشاريع ذات حركة مرور عالية مثل Notcoin وCatizen، مما يدل على وجود قاعدة مستخدمين ضخمة تدعمها Telegram.

-

أدى ارتفاع إصدار العملات المستقرة في النظام البيئي إلى جلب حيوية مالية. وصل المعروض من USDT على سلسلة TON إلى 130 مليونًا في غضون أسبوعين، مما يجعلها ثامن سلسلة بلوكشين من حيث إصدار USDT.

قائمة المشاريع المحددة:

-

TON: The native token of the Ton chain, currently listed on exchanges such as OKX and Bitget.

-

FISH: Ton ecosystem head meme token.

-

REDO: A dog-themed meme coin on the Ton chain.

3. عمليات البحث الساخنة للمستخدم

1) التطبيقات اللامركزية الشعبية

Plume Network:

Modular RWA L2 network Plume Network announced its launch on Arbitrum Orbit. Plume is a modular L2 blockchain dedicated to real-world assets (RWA), integrating asset tokenization and compliance providers directly into the chain. Plume Network team members come from companies and projects such as Coinbase, Robinhood, LayerZero, Binance, Galaxy Digital, JP Morgan, dYdX, etc. Yesterday, it completed a $10 million seed round of financing, led by Haun Ventures, and participated by Galaxy Ventures, Superscrypt, A Capital, SV Angel, Portal Ventures and Reciprocal Ventures. The funds raised will be used to recruit more employees in engineering design, marketing and community functions. The Plume Network open incentive testnet will be launched in the next few weeks, followed by the mainnet later this year.

2) تويتر

Lista (LISTA):

Binance Megadrop will launch Lista (LISTA), a liquidity staking and decentralized stablecoin protocol. The maximum supply of the token is 1 billion, the initial circulation is 230 million (23% of the supply), and the total Megadrop is 100 million (10% of the supply). Binance will list LISTA after the Megadrop is completed, and the specific listing plan will be announced separately. Lista DAO is a liquidity staking and decentralized stablecoin lending protocol. Users can stake and liquidity stake on Lista, as well as borrow lisUSD using a range of decentralized collateral. The report also introduces the LISTA token: LISTA is the governance token of Lista DAO, which is used for the following functions: governance, protocol incentives, voting, and fee sharing. The protocol consists of the following main parts that work together: decentralized stablecoin lisUSD and BNB liquid staking token slisBNB.

3) منطقة بحث جوجل

من منظور عالمي:

ETH ETF: A new compliance milestone in the crypto world: Ethereum spot ETF finally approved. On May 23rd, local time in the United States, the U.S. Securities and Exchange Commission (SEC) officially approved all Ethereum ETFs, providing investors with a new opportunity to invest in Ethereum through traditional financial channels. This decision is seen as a major endorsement of the cryptocurrency industry, becoming the second cryptocurrency ETF approved by the SEC after the spot Bitcoin ETF. After approval, the price of Ethereum rose slightly and fluctuated around $3,800, reaching a high of $3,856. It is currently reported at $3,807, a 24-hour increase of 1.3%. After the news landed, the fluctuation was not as large as in the previous few days, but it caused a lot of attention on the entire Twitter social media.

من عمليات البحث الساخنة في كل منطقة:

(1) Europe and CIS regions show a certain degree of interest in MEME:

As the crypto market rebounded significantly, PEPE tokens continued to hit new highs, and users began to buy back their chips into MEME coins to gain higher returns. From the searches of European users, it can be seen that European users generally search for MEME coins more frequently, which also means that users in the European market are more involved in the MEME coin market.

(2) The Asian region has shown a clear increase in attention to BTC, ETH ETFs, etc.:

Influenced by Bloombergs report that Hong Kong may pass BTC and ETH ETFs this week, searches in the Asian region have clearly increased their attention to the event. As the core region of Asian finance, Hong Kong has always been at the forefront of financial innovation. With the passage of ETFs, it has once again become the focus of Asia. Traditional finance and large funds can enter the encryption field through this channel, which has a positive impact on both industry development and retail investment.

محتمل إنزال جوي فرص

الحرم

Solana Ecosystem LST Protocol Sanctum officially announced the launch of the loyalty program Sanctum Wonderland. According to reports, Sanctum Wonderland aims to make full use of SOL to gain benefits through a gamified experience. Users can collect pets and earn experience points to upgrade by staking SOL, and earn EXP through pets.

Previously, the Solana ecosystem liquidity staking service protocol Sanctum completed its seed round extension round of financing, led by Dragonfly, with participation from Solana Ventures, CMS Holdings, DeFiance Capital, Genblock Capital, Jump Capital, Marin Digital Ventures and others. The total financing has now reached US$6.1 million.

Specific participation method: open the link, connect the wallet, fill in the invitation code, ② exchange Sol for Infinity, deposit at least 0.122 SOL + 0.05. The deposit wallet needs to prepare at least 0.172 SOL, and deposit at least 0.11 SOL. The pet will automatically grow and earn EXP. Once the LST balance is lower than 0.1 SOL, the pet will enter hibernation and stop earning EXP. Those who are capable are recommended to deposit more than 1 SOL. 1 SOL will earn 10 EXP per minute, which can be withdrawn at any time, and the GAS fee is extremely low.

Synthr

Synthr is a full-chain synthetic protocol that allows cross-chain minting and transfer of synthetic assets without the need for cross-chain bridges. The project mints assets on-chain through synthetic assets (Synthetix), which means that its technology can easily bring RWA to the chain, such as real estate, bonds or stocks, for cross-chain transactions and transfers.

The project raised $4.25 million from top funds including MorningStar Ventures, Kronos Research, and Axelar Fdn.

Specific participation method: The project has just been opened for testing. Users can participate in early interactions by entering the test network, registering a wallet, and receiving test coins through the faucet. Continue to pay attention to the subsequent progress of the project and actively participate in various on-chain interactions.

مزيد من المعلومات حول معهد أبحاث Bitget: https://www.bitget.fit/zh-CN/research

يركز معهد أبحاث Bitget على التركيز على البيانات الموجودة على السلسلة واستخراج الأصول القيمة. فهو يستخرج استثمارات القيمة المتطورة من خلال المراقبة في الوقت الفعلي للبيانات الموجودة على السلسلة وعمليات البحث الإقليمية الساخنة، ويوفر رؤى على المستوى المؤسسي لعشاق العملات المشفرة. حتى الآن، زودت مستخدمي Bitgets العالميين بأصول قيمة في المرحلة المبكرة في العديد من القطاعات الشائعة مثل [Arbitrum Ecosystem] و[AI Ecosystem] و[SHIB Ecosystem]. من خلال البحث المتعمق المعتمد على البيانات، فإنه يخلق تأثيرًا أفضل للثروة لمستخدمي Bitgets العالميين.

【إخلاء المسؤولية】السوق محفوف بالمخاطر، لذا كن حذرًا عند الاستثمار. لا تشكل هذه المقالة نصيحة استثمارية، ويجب على المستخدمين التفكير فيما إذا كانت أي آراء أو وجهات نظر أو استنتاجات في هذه المقالة مناسبة لظروفهم الخاصة. الاستثمار بناءً على هذه المعلومات هو على مسؤوليتك الخاصة.

This article is sourced from the internet: Bitget Research Institute: US SEC approves Ethereum spot ETF 19b-4, ETHFi and other ecological assets are expected to continue to rise

Original | Odaily Planet Daily Author | Asher In the past week, with the strong rebound of Bitcoin prices, the GameFi sector has also seen a good increase. Perhaps now is a good time to invest in the GameFi sector. Therefore, Odaily Planet Daily has summarized and sorted out the blockchain game projects that have been popular recently or have popular activities. Secondary market performance of blockchain gaming sector According to Coingecko data, the Gaming (GameFi) sector rose 6.9% in the past week; the current total market value is $20,475,708,280, ranking 28th in the sector ranking, down three places from the total market value sector ranking last week. In the past week, the number of tokens in the GameFi sector increased from 360 to 365, with 5 projects added, ranking…