Original article by: Mat铆as Andrade, Tanay Ved

الترجمة الأصلية: لوفي، فورسايت نيوز

Key Takeaways:

-

Market Growth: The stablecoin market has grown from less than $10 billion in 2020 to over $160 billion today, with USDT and USDC making significant contributions.

-

Use and adoption: Stablecoins are widely used for transactions, and the size of transfers is affected by blockchain transaction fees. As of April, adjusted weekly transfers exceeded $50 billion.

-

Global Utility: USDC on Ethereum has moderate activity during Hong Kong Stock Exchange (HKSE) and London Stock Exchange (LSE) trading hours. In contrast, USDT on Tron shows higher and more evenly distributed trading activity.

يقدم

The U.S. dollar has long been the world鈥檚 reserve currency. However, this status is being challenged as BRICS countries such as China, Brazil and Russia explore alternatives to international trade and central banks diversify their reserves into assets such as gold to replace U.S. Treasuries. In contrast, the emergence of stablecoins (digital tokens issued on the blockchain and backed by fiat currency, cash equivalents or crypto assets) is driving demand for dollars and Treasuries across the financial ecosystem.

Stablecoins are not only vital to the United States, but also to dollar-starved economies and emerging markets facing currency instability or limited access to financial services. Currently, the market size has exceeded a staggering $160 billion, providing a variety of stablecoins and infrastructure support for consumer applications and commercial applications such as cross-border payments, and the demand for stablecoins for U.S. Treasuries is only behind the top 15 countries, exceeding the vast majority of countries in the world.

In this week鈥檚 State of the Network, we assess the growth and usage patterns of stablecoins, and provide a broad and in-depth analysis of stablecoins through our newly developed dashboard.

Overview: Diversity and expansion of stablecoins

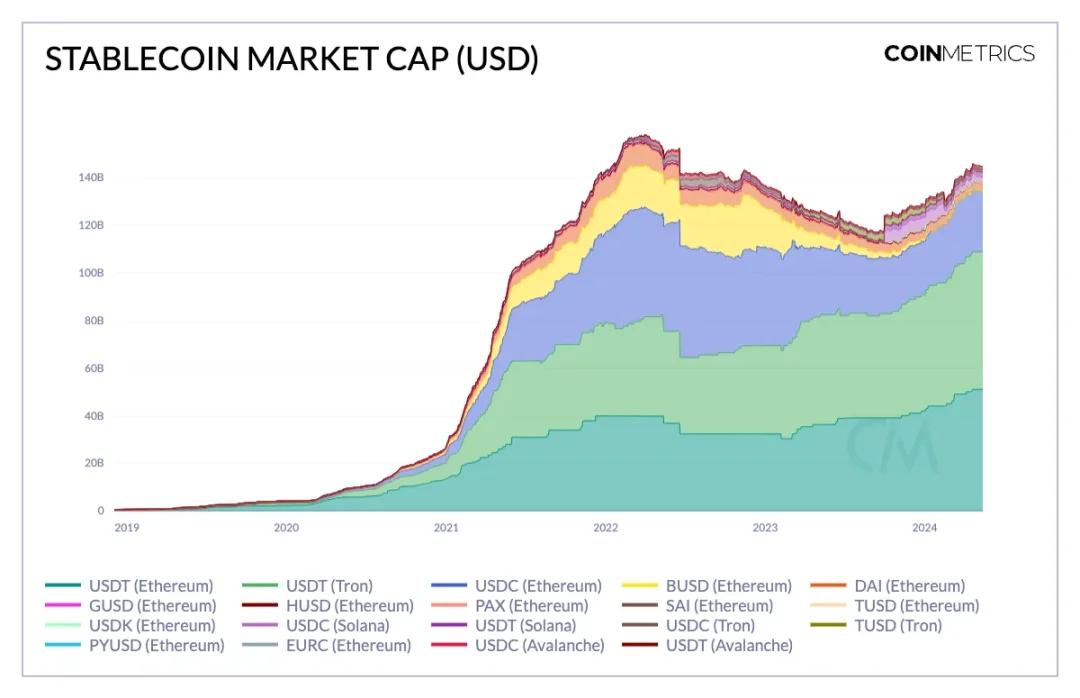

Stablecoins are gradually gaining global influence, with total market capitalization growing from less than $10 billion in 2020 to more than $160 billion today. Despite the decline in stablecoin supply in 2023 caused by a liquidity crunch caused by central bank tightening policies and the chain reaction of the Terra Luna collapse, the recent rise may reflect the renewed demand for crypto assets, thanks to the launch of a Bitcoin spot ETF in the United States.

USDT, the fiat-backed stablecoin issued by Tether, continues to dominate, with $51 billion (44%) circulating on Ethereum, $58 billion (52%) on the Tron network, and the rest on Solana and Avalanche. Tethers first quarter report for 2024 showed a net profit of $4.52 billion, doubling from the previous quarter. This impressive feat highlights the advantages of the business model of stablecoin issuers such as Tether and Circle, which issue tokens backed by reserves of low-risk assets such as U.S. Treasury bills and cash, while also holding investments such as Bitcoin or gold that can generate income in the current interest rate environment.

As of March 2024, Tether and Circle hold $10 billion and $74 billion in U.S. Treasuries, respectively, as part of their reserves, with Tether鈥檚 holdings being held by Cantor Fitzgerald and Circle鈥檚 holdings managed by BlackRock through money market funds.

Source: Coin Metrics Network Data Pro

While the offshore entity Tether took advantage of the ambiguity of US regulation, which posed challenges to Circle last year, USDC has made a good start in 2024. USDCs growth seems to stem from its deep strategic ties with Coinbase and cross-chain expansion to networks such as Solana and Ethereum Layer 2, which has increased its market influence and liquidity. In addition, Circles integration with BlackRocks BUIDL tokenized fund allows investors to convert their shares into USDC, which may broaden the USDC ecosystem and drive wider adoption.

The stablecoin market remains dominated by fiat-collateralized products like USDC and USDT, meeting widespread demand for USD-pegged assets. The success of established issuers has attracted a wave of high-profile new entrants, such as PayPal鈥檚 issuance of PYUSD on Ethereum. Crypto stablecoins collateralized by a basket of crypto assets and real-world assets (RWA), such as MakerDAO鈥檚 DAI, have also gained traction. In addition, synthetic or algorithmic stablecoins like Ethena鈥檚 USDe have emerged, which use dynamic hedging strategies to maintain a peg to the dollar without the need for overcollateralization. This category also includes stablecoins issued by DeFi protocols that have become core to their business models, such as Aave鈥檚 GHO and Curve鈥檚 crvUSD. These different stablecoins cover a range of reserve-backed models, each with their own unique risk and return characteristics.

Source: Coin Metrics Network Dats Pro (Note: This chart does not include stablecoins issued on Ethereum Layer 2)

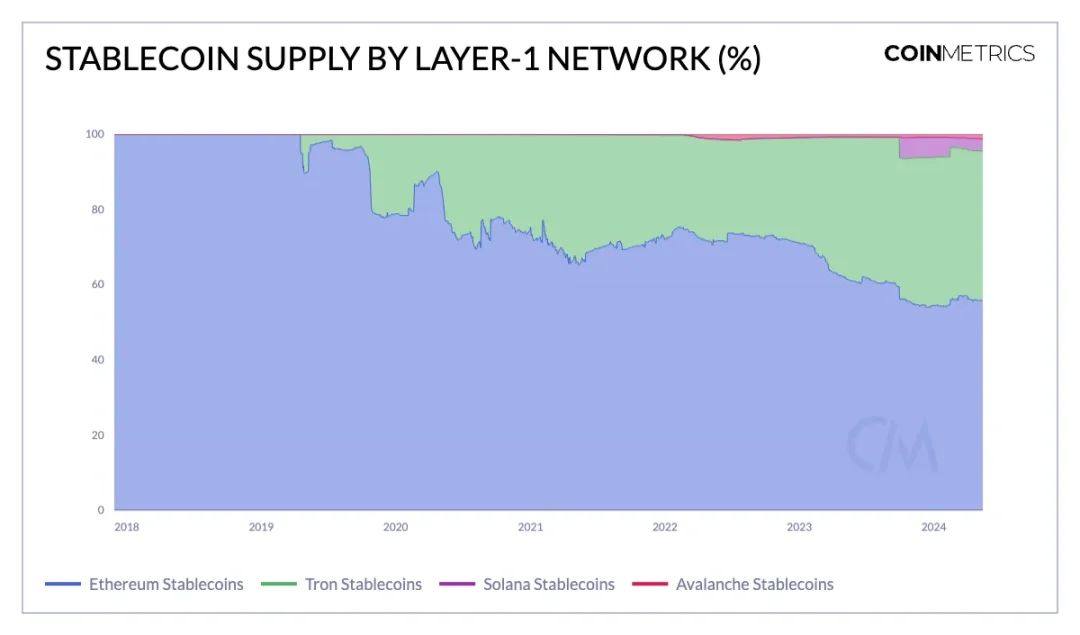

Currently, the largest circulating market for stablecoins (55%, $81 billion in circulating supply) is on Ethereum. The most widely adopted and liquid stablecoins have gained traction on Ethereum early on, leveraging its security and the large developer base around the Ethereum Virtual Machine (EVM) ecosystem to deepen its network effects.

Tron has established a strong position in the stablecoin market, accounting for 39% of the market share, while other stablecoins such as Solana and Avalanche are also making progress. Faster transactions and lower transaction fees on chains such as Solana make them attractive for high-frequency and low-value stablecoin use cases, such as the payment system revealed in Stripe鈥檚 recent announcement. Similarly, Ethereum Layer 2 (such as Arbitrum and Base) has also seen growth in stablecoins as lower fees drive user activity groups towards these scalability solutions.

Characteristics of Stablecoin Adoption

While the boom in stablecoins is clear, there are still some questions surrounding the nature of their use and adoption. For example, to what extent do stablecoins promote real economic value? Are stablecoins held as a store of value, or are they used for transaction purposes? What is the typical size of stablecoin transfers, and which groups of people are served? While these questions are difficult to answer with clear answers, the transparency of blockchain data can help us better understand the characteristics of stablecoin activity.

Source: Coin Metrics Network Data Pro

In April, weekly adjusted transfer volume between different stablecoin addresses exceeded $50 billion. 48% of this activity came from USDT on Ethereum and Tron, while DAI also set a record of $22 billion in transfer volume on April 19. Although this metric has seen several spikes, it reflects the utility of stablecoins as a settlement method.

When looking at transfer volume relative to the stablecoin鈥檚 circulating supply, we can get a better idea of the velocity, or turnover, of stablecoins. However, it鈥檚 important to interpret this metric in the right context. USDC on Tron shows the highest velocity, likely due to Circle鈥檚 decision to phase out support for it, which reduced supply but increased USDC transfers to other blockchains.

While supply has declined, DAI has clearly reached peak velocity as usage continues to increase due to a strong on-chain footprint and the DAI Savings Rate (DSR), a smart contract that effectively acts as a savings account for deposited DAI. MakerDAO governance frequently implements strategic adjustments to drive DAI usage, such as the recent increase in interest earned on the DSR. USDC on Ethereum and USDT on Tron are currently at similar velocities, and USDC may see greater turnover on networks such as Avalanche, Solana, and Layer 2.

Source: Coin Metrics Network Data Pro

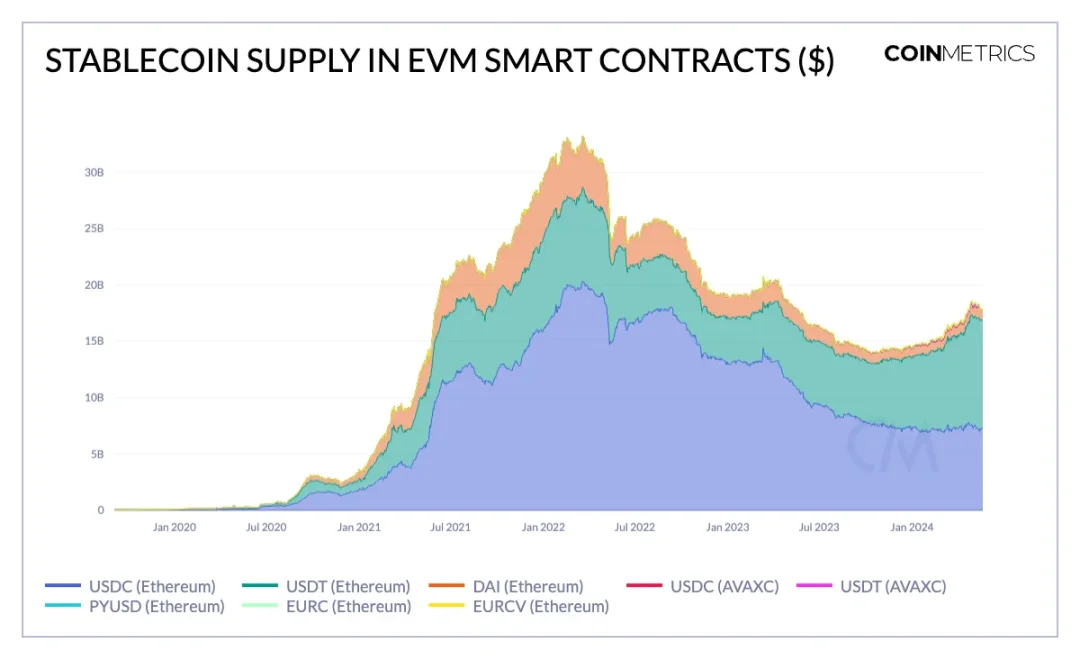

We can also tell the extent to which stablecoins are used as a store of value or on-chain by looking at the supply held by smart contracts and externally owned accounts (EOAs). For example, while EOAs hold $41 billion in USDT (Ethereum), the amount of USDT stored in smart contracts has more than doubled to $9.6 billion since January 2023. In fact, USDC now has over $2.3 billion in smart contracts. This suggests that in addition to acting as a store of value or a hedge against inflation, stablecoins are playing an increasingly important role in facilitating transactions on public chain infrastructure such as decentralized financial applications.

Source: Coin Metrics Network Data Pro

The median transfer value of stablecoins helps understand the typical size of transfers. This metric is highly influenced by the fees and transaction capacity of the blockchain on which it is issued. For example, USDC and USDT on Ethereum have the highest median transfer value, averaging $500 per transfer. On the other hand, the median transaction size of USDT on Tron is $230, and stablecoins on Solana show the smallest transfer value, indicating that high-frequency, low-value transfers are prevalent, which is due to Solana transaction fees as low as $0.01.

Temporal characteristics of stablecoin activity

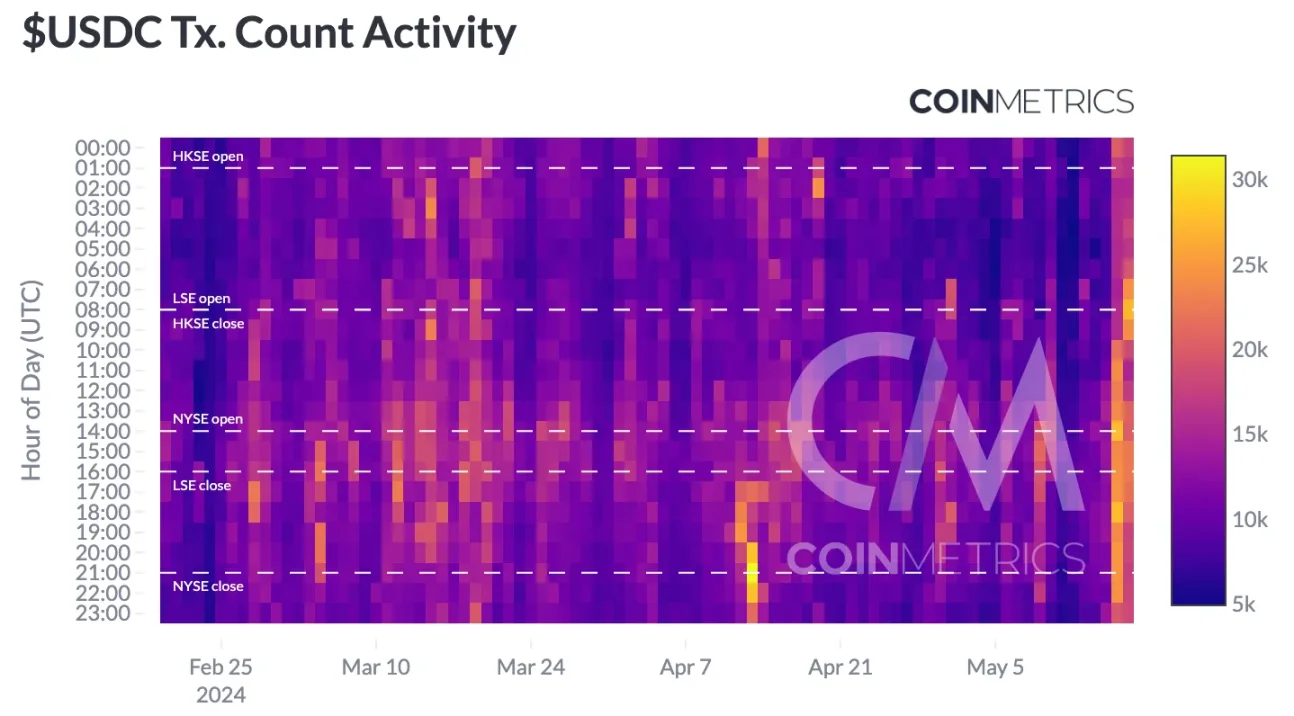

One of the most important value propositions of stablecoins is their global utility, enabling 24/7 value transfer. Our past analysis of stablecoin geographic dominance showed that North America and Western Europe tend to use USDC, while USDTs trading volume is mainly in Asia, Africa, and Latin America. However, using Coin Metrics ATLAS 1-hour trading data, we can also discern time patterns in activity, revealing the hours when activity is most active.

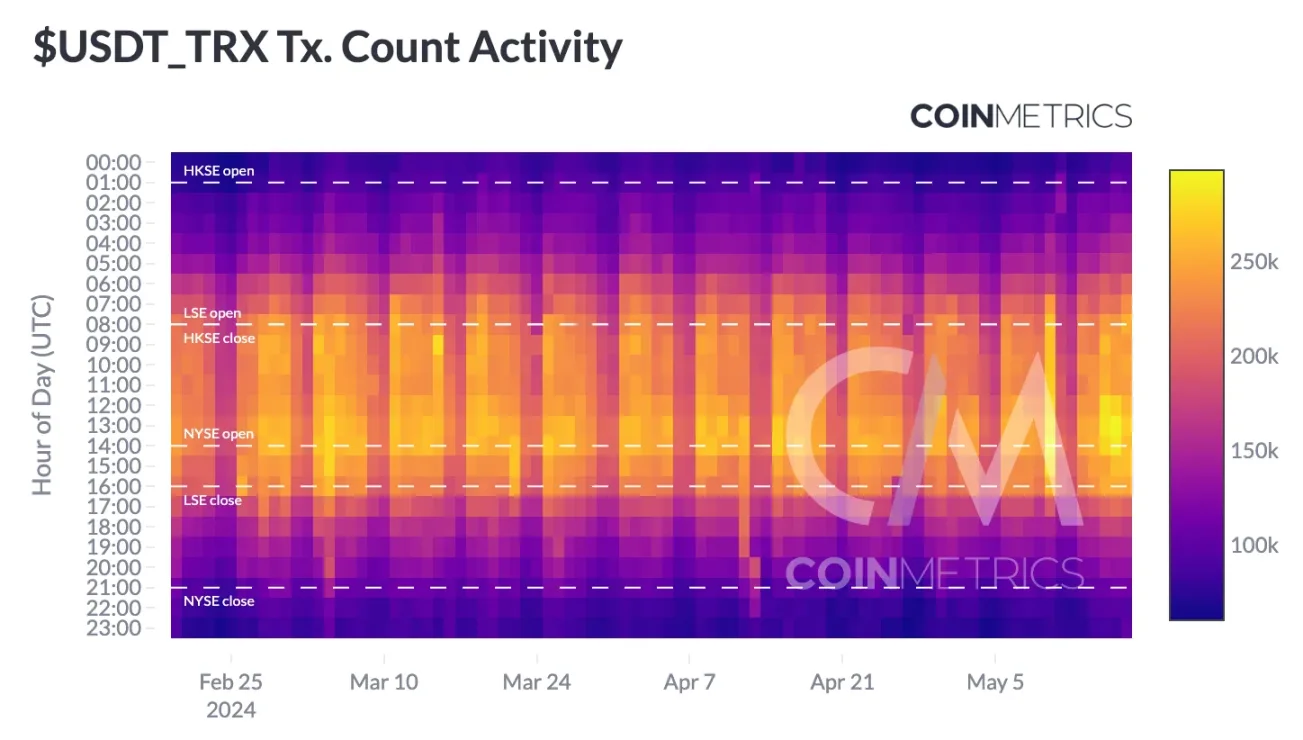

Source: Coin Metrics ATLAS, Coin Metrics Stablecoin Dashboard

The heat map shows the hourly trading activity of USDC on Ethereum and USDT on Tron over the past 3 months, overlapping with major stock market trading hours. USDC activity appears to be relatively dispersed, with moderate activity during the Hong Kong Stock Exchange (HKSE) and London Stock Exchange (LSE) trading hours. The most prominent peaks occur at the opening and closing of the New York Stock Exchange (NYSE), indicating a stronger influence in the US market.

Source: Coin Metrics ATLAS, Coin Metrics Stablecoin Dashboard

On the other hand, USDT trading activity on Tron is significantly larger and appears to be more evenly distributed. USDT trading activity concentration has been gradually increasing since the opening of the Hong Kong Stock Exchange, and has continued to increase during the London Stock Exchange trading hours and until the close of the New York Stock Exchange. Notably, both stablecoins have seen higher concentrations of trading activity over the past week.

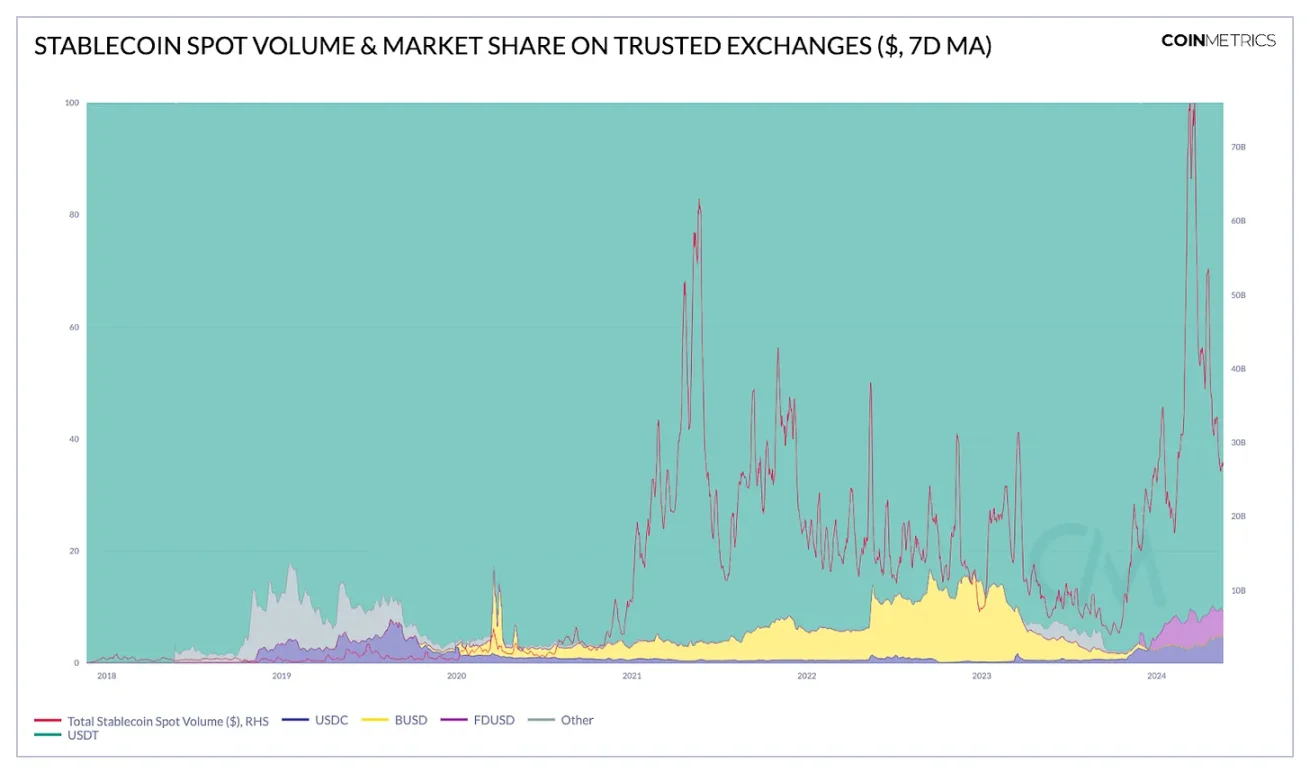

Role in Centralized and Decentralized Exchanges

As the main base currency for digital asset transactions, stablecoins play a huge role in traditional spot and derivatives exchanges and decentralized exchanges (DEX). In March 2024, stablecoins added $75 billion to the spot trading volume (7-day average) of trusted centralized exchanges. Today, USDT accounts for 90% of spot trading volume, USDC and FDUSD each account for 5%, while BUSDs market share has shrunk.

First Digital USD (FDUSD), a stablecoin issued by First Digital Trust Limited, a Hong Kong digital asset custodian, has gained significant market share and liquidity on Binance. With the launch of Coinbase International, the market presence and liquidity of USDC-related trading pairs have also been improved, with the share of the spot market rising from 0.6% in October to nearly 5% today.

المصدر: بيانات سوق Coin Metrics

Although stablecoins have lower trading volumes than traditional fiat currencies, they are an important part of DEX liquidity pools, Layer 1 and Layer 2 trading activities. Uniswap v3s ETH-USDC market and Curve Finances 3 Pool stablecoin liquidity pool facilitate a considerable portion of on-chain transactions. Compared to traditional exchanges, USDC has a 45% market share on DEXs, while USDTs share has recently risen to 42%.

Source: Coin Metrics DEX market data

ختاماً

Stablecoins are becoming an important part of the global financial system, facilitating transactions and acting as a store of value. Their adoption patterns are influenced by blockchain transaction fees, highlighting their usefulness in cross-border payments and DeFi applications. As stablecoins develop, their importance in the financial sector will continue to expand.

This article is sourced from the internet: Coin Metrics: Decoding Stablecoin Adoption Characteristics

Related: Bitcoin Halving Alert: How Are Whales Reacting to the Upcoming Event?

In Brief Bitcoin whales intensively analyzed ahead of halving event. Despite bearish sentiment, whales are accumulating Bitcoin. Whales’ behavior suggests bullish outlook amidst anticipation for reduced supply post-halving. As the Bitcoin (BTC) community anticipates the upcoming halving event, cryptocurrency whale behavior – investors holding large amounts of Bitcoin – has been intensely scrutinized. Analysts and market observers are keen to understand how these major players are positioning themselves ahead of a milestone that historically impacts Bitcoin’s price and market dynamics. Despite Bearish Conditions, Whales are Buying Recent data from blockchain analytics platforms like CryptoQuant and Santiment reveals a notable shift in whale activity. According to a tweet from CryptoQuant, there has been an increase in Bitcoin accumulation by whales, suggesting a bullish outlook from those anticipating the supply squeeze post-halving.…