معهد أبحاث Bitget: انخفض GAS على سلسلة ETH إلى 2 Gwei، وتم فتح تطبيق EIGEN airdrop

خلال الـ 24 ساعة الماضية، ظهرت العديد من العملات والموضوعات الساخنة الجديدة في السوق، ومن المحتمل جدًا أن تكون الفرصة التالية لكسب المال.

-

القطاعات التي يجب التركيز عليها في المستقبل: قطاع الذكاء الاصطناعي، ونظام TON البيئي

-

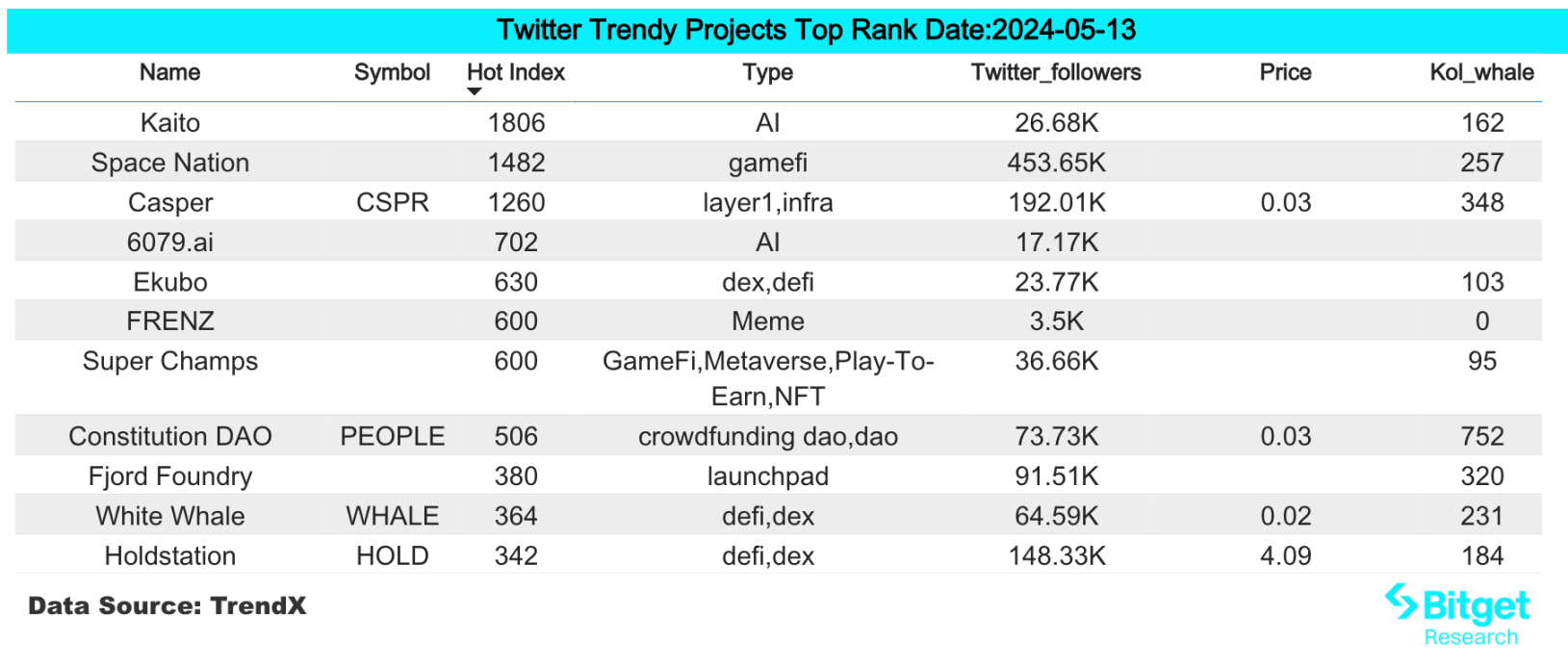

الرموز والموضوعات الأكثر شعبية التي يبحث عنها المستخدمون هي: Kaito، NOT، TON

-

تشمل فرص الإنزال الجوي المحتملة ما يلي: UXLINK وLi.Finance

وقت إحصائيات البيانات: 13 مايو 2024 4:00 (UTC + 0)

1. بيئة السوق

تقلبت سوق العملات المشفرة خلال عطلة نهاية الأسبوع حيث انتظرت السوق بيانات مؤشر أسعار المستهلك الأمريكي في 15 مايو. كان المتداولون يتجنبون المخاطرة بشكل واضح وافتقرت السوق إلى النقاط الساخنة. انخفض سعر ETH/BTC إلى 0.047، وانخفضت رسوم غاز شبكة ETH إلى نقطة التجمد عند 2 gwei. في العامين الماضيين، كانت قيعان غاز ETH الثلاثة السابقة أيضًا هي النطاقات الدنيا لسعر ETH.

لا تزال عمليات الإنزال الجوي وعمليات TGE للمشاريع المعروفة محط اهتمام السوق: منذ أن فتحت EigenLayer تطبيق الإنزال الجوي لرمز EIGEN، تجاوز عدد العناوين المشاركة في تطبيق الرمز 130.000 وما زال يتزايد بسرعة. وقد جذبت إعلانات الإنزال الجوي لـ BounceBit وio.net وNotcoin وLayerZero وما إلى ذلك انتباه السوق.

2. قطاع صناعة الثروة

1) القطاعات التي يجب التركيز عليها في المستقبل: قطاع الذكاء الاصطناعي

سبب رئيسي:

-

يتمتع قطاع الذكاء الاصطناعي وقطاع الحوسبة الموزعة بإجماع قوي في هذه الجولة من السوق، مع مكاسب قوية وتراجع أقصى أصغر من القطاعات الأخرى، مما يوفر دعمًا معينًا. اليوم، شهد قطاع الذكاء الاصطناعي تصحيحًا معينًا، ويمكنك انتظار فرصة دخول جيدة.

-

وتشير الشائعات المتداولة في السوق إلى أن شركة أبل تقترب من التوصل إلى اتفاق مع شركة OpenAI لتطبيق ChatGPT على هواتف iPhone. وفي الوقت نفسه، سيبدأ مؤتمر Apple Worldwide Developers في العاشر من يونيو/حزيران، حيث قد تعلن شركة أبل عن خطتها لتحديث Siri باستخدام تقنية الذكاء الاصطناعي.

-

من المتوقع أن يتم إطلاق ChatGPT-5 رسميًا في شهر يونيو.

قائمة المشاريع المحددة: TAO، RNDR، AR، ARKM، WLD، FET، AGIX

2) القطاع الذي يجب التركيز عليه في المستقبل: نظام TON البيئي

سبب رئيسي:

-

قد يصل استثمار Panteras في TON إلى ما لا يقل عن $250 مليون دولار أمريكي، وهو أكبر استثمار لشركة Panteras في العملات المشفرة في التاريخ.

-

تم إدراج مشروع Notcoin، وهو مشروع يتمتع بحركة مرور عالية في نظام TON البيئي، على Binance، لكن رمز TON نفسه لم يتم إدراجه بعد على Binance. يتوقع السوق أن الأمر مجرد مسألة وقت قبل إدراج TON على Binance.

-

البنية الأساسية لنظام TON البيئي في مراحله المبكرة. حاليًا، ظهرت مشاريع ذات حركة مرور عالية مثل Notcoin وCatizen، مما يدل على وجود قاعدة مستخدمين ضخمة تدعمها Telegram.

-

أدى ارتفاع إصدار العملات المستقرة في النظام البيئي إلى جلب حيوية مالية. وصل المعروض من USDT على سلسلة TON إلى 130 مليونًا في غضون أسبوعين، مما يجعلها ثامن سلسلة بلوكشين من حيث إصدار USDT.

قائمة المشاريع المحددة: TON، FISH، UP

3. عمليات البحث الساخنة للمستخدم

1) التطبيقات اللامركزية الشعبية

الطبقة الذاتية:

Eigenlayer هو بروتوكول مبتكر يمكن تكوينه بشكل متكرر ويعمل على تعزيز شبكات blockchain من خلال إعادة استخدام أمان الطبقات الأساسية مثل Ethereum. يتيح هذا النهج تحسين الحوسبة وزيادة قابلية التوسع من خلال الاستفادة من الأمان الراسخ لسلسلة الكتل الأساسية، مما يضمن عدم المساس بالوظائف المحسنة للأمان، وبالتالي الحفاظ على الثقة والموثوقية.

مؤخرًا، فتحت EigenLayer خدمة airdrops. يمكن لجميع المستخدمين على السلسلة الذين شاركوا في إعادة التخزين من قبل استلام رموز EIGEN، ولكن لا يمكن نقل رموز EIGEN في الوقت الحالي. يمكن للمستخدمين الذين يتلقون حاليًا رموز EIGEN المشاركة في تخزين رموز خدمات AVS والمشاركة في تطوير نظام المشروع البيئي.

2) تويتر

كايتو:

تهدف Kaito AI إلى بناء محرك بحث ذكاء اصطناعي لصناعة التشفير لجمع المعلومات المجزأة في مجال التشفير. لقد أنشأت Kaito واحدة من أكثر قواعد البيانات المعلوماتية شمولاً في مجال التشفير. من خلال الجمع بين هذه القاعدة البيانات وتكنولوجيا الذكاء الاصطناعي الخاصة بنا مع نماذج اللغة المتقدمة ChatGPT/GPT-3s، تهدف Kaito إلى توفير تجربة بحث أفضل من البدائل الموجودة في السوق.

أعلنت شركة Kaito AI، وهي محرك بحث يعتمد على الذكاء الاصطناعي، عن إتمامها تمويلًا بقيمة 1.10 تريليون دولار أمريكي. وقد قادت هذه الجولة التمويلية شركة Dragonfly Capital، بمشاركة من Sequoia China وJane Street وAlphaLab Capital وشركات أخرى.

يتميز Kaito AI بقدرته على التقاط المعلومات الساخنة في صناعة التشفير وقد جذب مؤخرًا انتباه مجتمع التشفير، وهو أمر مفيد جدًا لمتابعة ديناميكيات مجتمع التشفير. في الوقت نفسه، لم يصدر المشروع عملات معدنية بعد، لذلك يمكن للمستخدمين المشاركة بنشاط في التفاعل.

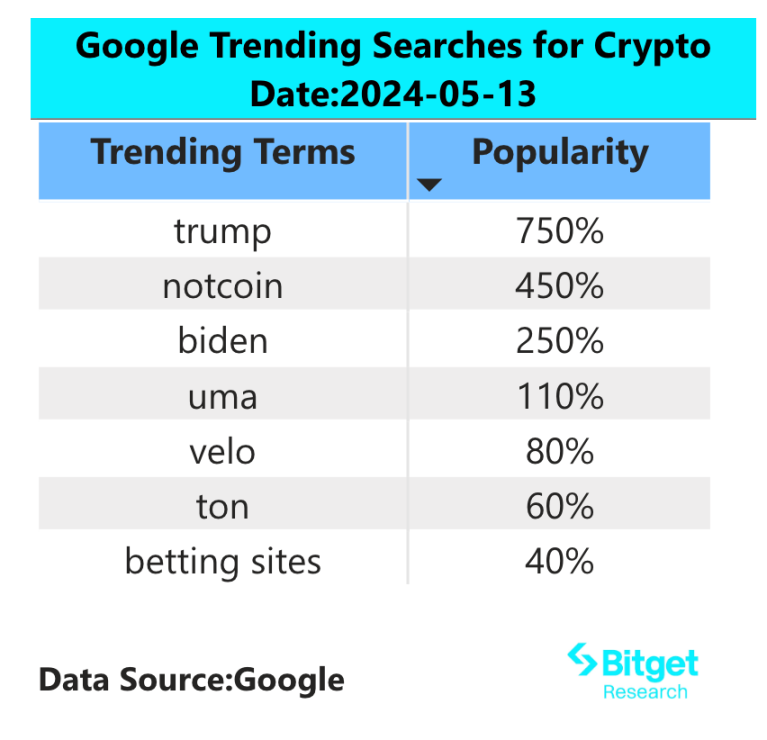

3) منطقة بحث جوجل

من منظور عالمي:

Notcoin (NOT): Notcoin هي لعبة تعتمد على Telegram، حيث يمكن للمستخدمين كسب الرموز المميزة داخل اللعبة من خلال النقر على صور العملات المعدنية. على غرار مفهوم اضغط لكسب. قبل Notcoin TGE، تم استخدام القسائم لتمثيل عملة Notcoin في اللعبة، والتي يمكن استبدالها بـ $NOT بعد TGE. يحتوي المشروع على سوق تداول ما قبل السوق الخاص به: https://getgems.io/notcoin، وتظهر البيانات أن 640,000 مستخدم لا يمتلكون رموز ما قبل التسويق. وقد تم تأكيد إدراجه في Binance Launchpool وOKX.

من عمليات البحث الساخنة في كل منطقة:

(1) ركزت عمليات البحث الساخنة أمس في مناطق مختلفة من آسيا بشكل أساسي على الموضوعات الساخنة الأخيرة: الذكاء الاصطناعي، والخيال الاجتماعي، والميم

تشمل الرموز المميزة المتعلقة بالذكاء الاصطناعي الحديثة على السلسلة ما يلي: OLAS وFET وما إلى ذلك؛ وتشمل رموز SocialFi التي جذبت الانتباه Farcaster وDegen وPump.fun وما إلى ذلك؛ وتشمل رموز MEME التي جذبت الانتباه Shiba Inu وFloki وما إلى ذلك.

(2) لا توجد نقاط ساخنة مهمة في أفريقيا ورابطة الدول المستقلة والمناطق الناطقة باللغة الإنجليزية

تظهر الشعبية الإقليمية في هذه المنطقة أداءً متناثرًا نسبيًا، حيث تظهر BTC وETH وSolana بشكل متكرر في عمليات البحث الساخنة. سيهتم بعض المستخدمين بالسرديات حول موضوعات مثل الذكاء الاصطناعي والميم، ويُظهر السوق الإجمالي تمايزًا في الموضوعات.

4. المحتملة إنزال جوي فرص

UXLINK

UXLINK is a groundbreaking web3 social system designed for mass adoption, allowing users to build social assets and trade cryptocurrencies. It includes a series of highly modular Dapps, from onboarding to graph formation, group tools to social trading, all seamlessly integrated in Telegram.

أعلنت شركة UXLINK مؤخرًا عن تمويل بقيادة SevenX Ventures و Ince Capital و HashKey Capital، بإجمالي تمويل قدره $15 مليون دولار أمريكي.

طريقة المشاركة المحددة: مشروع البنية التحتية الاجتماعية Web3 UXLINK يصدر IN UXLINK WE TRUST سلسلة NFT كقسائم إنزال جوي. وفقًا لمساهمة مجتمع المستخدمين والتفاعل على السلسلة وحالة الأصول، يتم تقسيمها إلى أربعة مستويات: MOON وTRUST وFRENS وLINK، والتي تتوافق مع الحقوق والمصالح المختلفة وعدد عمليات إنزال الرمز المميز UXLINK.

لي فاينانس

Jumper Exchange عبارة عن مجمع سيولة متعدد السلاسل يدعم وظائف التبادل عبر السلاسل وتبادل رسوم الغاز لمعظم سلاسل الكتل السائدة، ويدعمها تقنيًا LI.FI.

أتمت شركة LI.FI المطورة لعملة البيتكوين جولة تمويلية من الفئة A بقيمة $17.5 مليون دولار، بقيادة CoinFund وSuperscrypt.

طريقة المشاركة المحددة: إتمام معاملات متعددة عبر سلسلة على Jumper Exchange. يمكن أن يشير مبلغ المعاملة المحدد وعدد المعاملات والوقت النشط وما إلى ذلك إلى معايير الإنزال الجوي لبورصات DEX الأخرى في الماضي.

الرابط الأصلي: https://www.bitget.com/zh-CN/research/articles/12560603809478

إخلاء المسؤولية: السوق محفوف بالمخاطر، لذا كن حذرًا عند الاستثمار. لا تشكل هذه المقالة نصيحة استثمارية، ويجب على المستخدمين أن يفكروا فيما إذا كانت أي آراء أو وجهات نظر أو استنتاجات في هذه المقالة مناسبة لظروفهم الخاصة. الاستثمار بناءً على هذا يكون على مسؤوليتك الخاصة.

تم الحصول على هذه المقالة من الإنترنت: معهد أبحاث Bitget: انخفاض GAS على سلسلة ETH إلى 2 Gwei، وتم فتح تطبيق EIGEN airdrop

ذات صلة: الموجة الجديدة من العملات المستقرة ذات الفائدة: الآليات والميزات والتطبيقات

المؤلف الأصلي: 0x Edwardyw تولد العملة المستقرة الجديدة ذات الفائدة المدفوعة عائدًا من ثلاثة مصادر مختلفة: أصول العالم الحقيقي، والملكية الرمزية للطبقة الأولى، ومعدلات تمويل العقود الدائمة. تقدم Ethena أعلى عائد ولكن أيضًا أكبر تقلب، في حين أن بروتوكولات Ondo وMountain تقيد الوصول إلى المستخدمين الأمريكيين لتقليل المخاطر التنظيمية من أجل توزيع دخل الفوائد. يقوم نموذج Lybras بإعادة توزيع دخل $ETH على حاملي العملات المستقرة وهو النموذج الأكثر لامركزية، لكنه يواجه مشاكل في الحوافز. استنادًا إلى عدد المالكين وسيناريوهات استخدام التمويل اللامركزي، تقود Ethenas USDe و Mountains USDM في اعتماد العملات المستقرة. الجزء الأول: مصادر الدخل المتنوعة على عكس دورة صعود العملات المشفرة الأخيرة، عندما اعتمدت العملات المستقرة الخوارزمية على الإعانات أو تضخم الرمز الأصلي لتوفير عوائد عالية جدًا ولكنها غير مستدامة، مما أدى في النهاية إلى انهيار المشاريع...