SignalPlus Macro Analysis (20240513): The market continues to be sluggish, and BTC ETF had a net outflow of US$264 milli

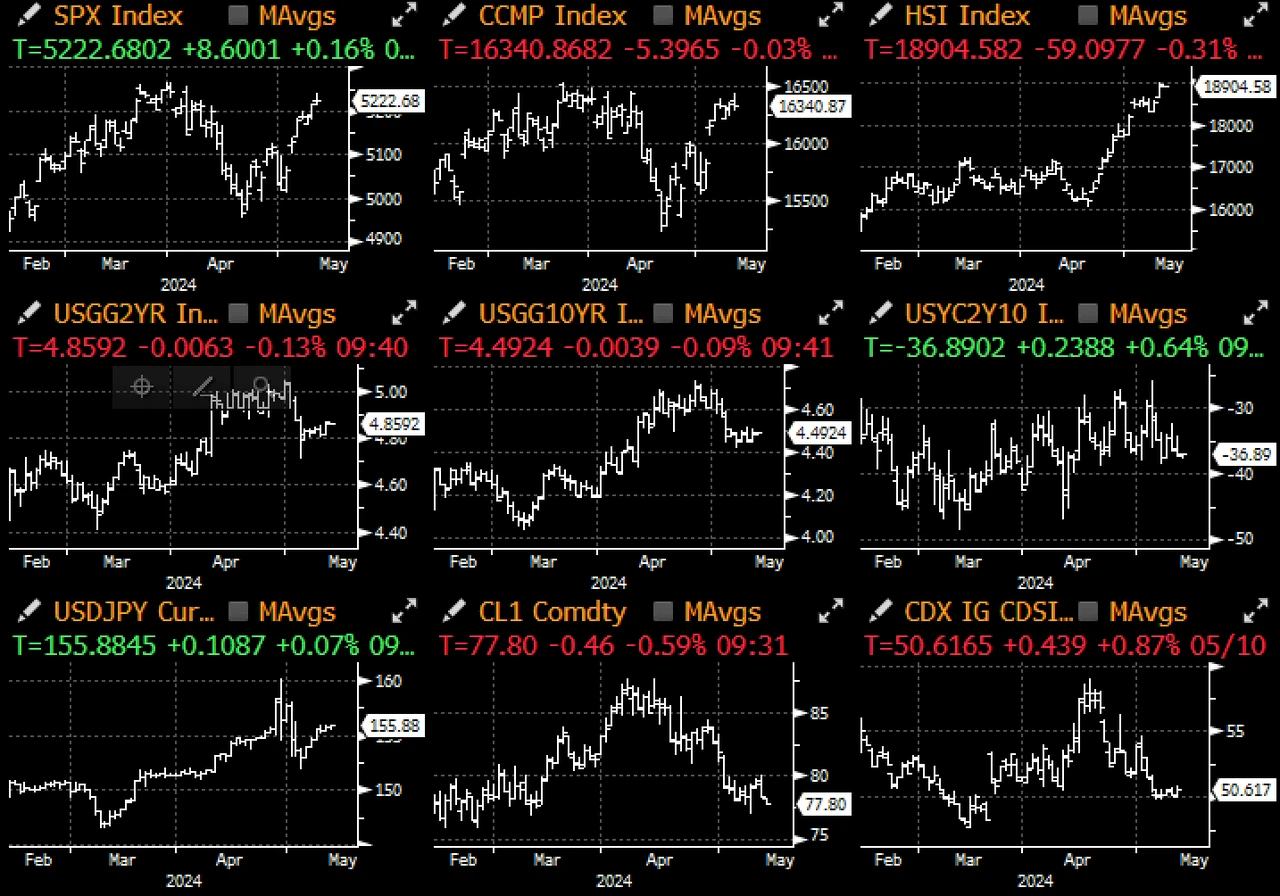

Risk assets had a solid week as financial conditions continued to ease following the recent soft jobs data. Stocks shrugged off weaker U-M consumer confidence and inflation expectations data, with consumer confidence falling to 67.4 from 77.2 last month, while 1-year inflation expectations jumped to 3.5% from 3.2%.

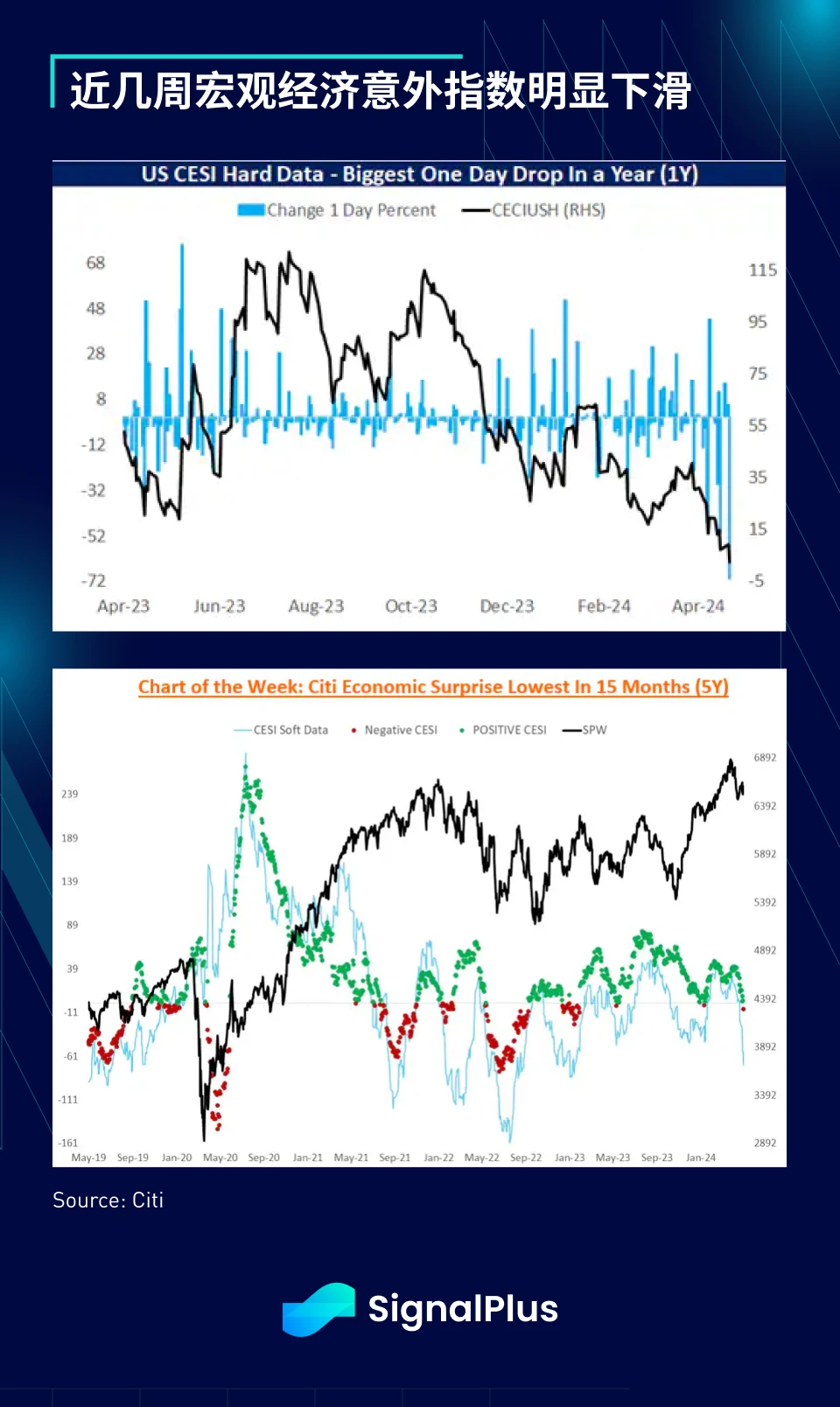

Overall, the Macroeconomic Surprise Index has fallen to its lowest level in 1.5 years, and Citis hard data indicator had its largest one-day drop in a year last week. Although it is too early to assert a hard landing, the US consumer is indeed entering a weak phase as consumer savings decline, PMI continues to be sluggish, high interest rates drag on credit demand, and the job market is finally slowing down.

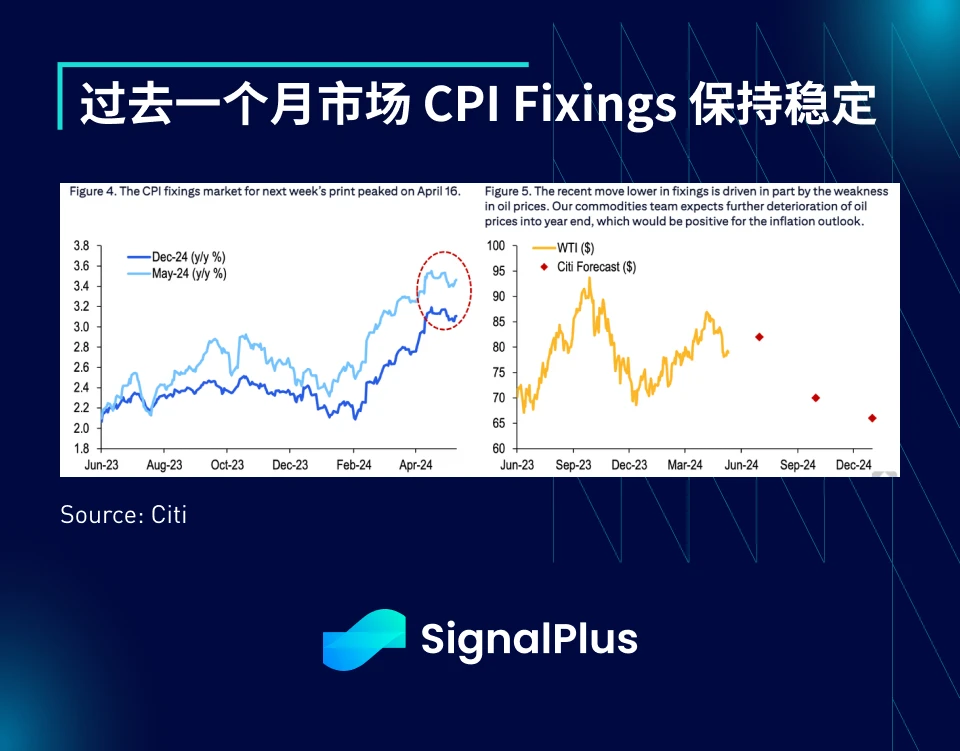

Market focus will be on the CPI data this Wednesday, which could be a key driver of medium-term price movements. While markets do want lower inflation data to guide the narrative of slowing inflation back, the market-led CPI fixing has been fairly stable recently, with traders expecting CPI growth of around 3.4% year-on-year in May and possibly slowing further to around 3.1% in December. The easing of financial conditions in the short term will offset the weakness in consumer credit demand, while oil price movements could drive inflation trends and expectations towards the end of the year.

Cryptocurrency price action was disappointing, with BTC pulling back sharply from 63.5k to 60.5k during New York trading on Friday, ETFs seeing a small outflow of 85m, while major global CEXs reported a drop in spot volumes in April, the first decline in about 5 months. With spot prices consolidating for much of the past 1-2 months, price action appears heavy, and existing investors naturally remain biased towards the long side. In addition, implied volatility has fallen significantly as trend traders sell call options for additional income and long-term players have returned to using volatility to generate returns during the current period of low sentiment.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis (20240513): The market continues to be sluggish, and BTC ETF had a net outflow of US$264 million last week

Related: Cardano (ADA) Faces Downward Pressure: Lack of Conviction to Blame?

In Brief Cardano’s price failed a breakout earlier this week and is now set to fall to $0.40. Lack of conviction is visible among ADA investors, with Whales selling nearly $1 billion in ADA in the past two weeks. Long-term holders are also moving their holdings around, fueling a potential decline. Cardano’s (ADA) price at the time of writing falls back after failing to breach a resistance trend line. Combined with the bearish cues from the investors, it appears that ADA might be looking at a further decline. Cardano Investors Back Up Cardano’s price has slightly dropped in the last few days but is holding above a key support line. However, this did not sit well with the investors, who continued to act bearish. ADA Whales, in particular, have continued the onslaught of selling their…