I. Introduction

Modular blockchain is an innovative blockchain design paradigm that aims to improve the efficiency and scalability of the system through specialization and division of labor. Before the advent of modular blockchain, a single (Monolithic) chain needed to handle all tasks, including the execution layer, data availability layer, consensus layer, and settlement layer. Modular blockchain solves these problems by treating these tasks as freely combinable modules, each focusing on a specific function.

Execution layer : responsible for processing and verifying all transactions and managing blockchain state changes.

Consensus layer : reach agreement on the order of transactions.

Settlement layer : used to complete transactions, verify proofs, and build bridges between different execution layers.

Data Availability Layer : Responsible for ensuring that all necessary data is available to participants in the network for verification.

The trend of modular blockchain is not only a technological change, but also an important strategy to promote the entire blockchain ecosystem to meet future challenges. GeekCartel will analyze the concept of modular blockchain and related projects, aiming to provide a comprehensive and practical interpretation of modular blockchain knowledge to help readers better understand modular blockchain and look forward to future development trends. Note: The content of this article does not constitute investment advice.

2. Celestia, the pioneer of modular blockchain

In 2018, Mustafa Albasan and Vitalik Buterin published a groundbreaking article that provided new ideas for solving the scalability problem of blockchain. Data Availability Sampling and Fraud Proofs introduced a method by which the blockchain can automatically expand storage space as the network nodes increase. In 2019, Mustafa Albasan further researched and wrote Lazy Ledger , proposing a concept for a blockchain system that only deals with data availability.

Based on these concepts, Celestia was born as the first data availability (DA) network with a modular structure. It is built using CometBFT and Cosmos SDK and is a proof-of-stake (PoS) blockchain that effectively improves scalability while maintaining decentralization.

The DA layer is critical to the security of any blockchain because it ensures that anyone can inspect the transaction ledger and verify it. If a block producer proposes a block without all the data available, the block can reach finality but contain invalid transactions. Even if the block is valid, block data that cannot be fully verified will negatively impact users and the functioning of the network.

Celestia implements two key features, Data Availability Sampling (DAS) and Namespace Merkle Tree (NMT). DAS enables light nodes to verify data availability without downloading the entire block. NMTs allow block data to be partitioned into separate namespaces for different applications, which means that applications only need to download and process data relevant to them, greatly reducing data processing requirements. Importantly, DAS allows Celestia to scale as the number of users (light nodes) increases without compromising the security of end users.

Modular blockchains are making it possible to build new chains in an unprecedented way. Different types of modular blockchains can work together for different purposes and in different architectural ways. Celestia has officially proposed several ideas and examples for modular architecture design, showing us the flexibility and composability of modular blockchains:

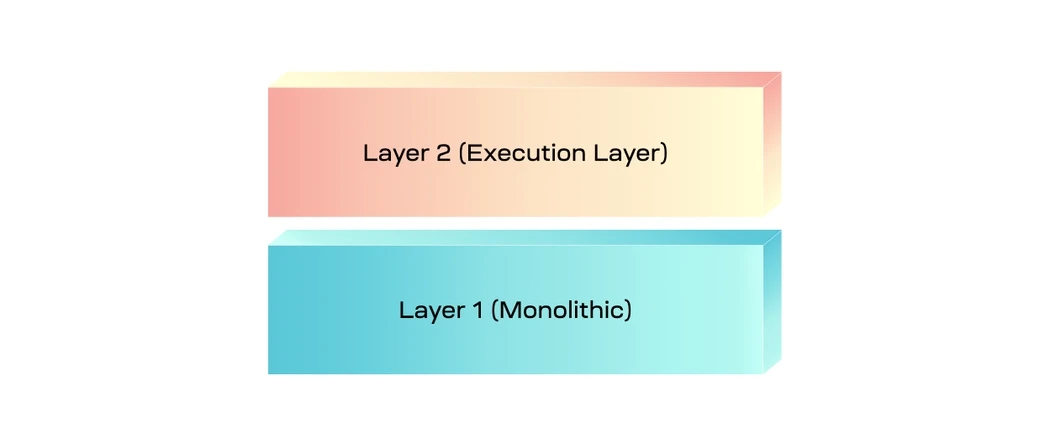

Figure 1 Layer 1 and Layer 2 architecture

Layer 1 and Layer 2 : Celestia calls it simple modularity, originally built for the scalability of Ethereum as a monolithic Layer 1, with Layer 2 focusing on execution and Layer 1 providing other key functions.

-

Celestia supports chains built on the Arbitrum Orbit , Optimism Stack , and Polygon CDK (coming soon) technology stacks to use Celestia as the DA layer, and existing Layer 2 can use Rollup technology to switch its data from being published on Ethereum to being published on Celestia. Commitments to blocks are published on Celestia, which is more scalable than the traditional method of publishing data on a single chain.

-

Celestia supports RollApp (a chain dedicated to applications) constructed based on Dymension technology components as the execution layer. Similar to the concepts of Layer 1 and Layer 2 of Ethereum, the settlement layer of RollApps relies on Dymension Hub (which will be explained later), the DA layer uses Celestia, and the chains interact through the IBC protocol (IBC is based on Cosmos SDK, a protocol that allows blockchains to communicate with each other. Chains using IBC can share any type of data as long as it is encoded in bytes).

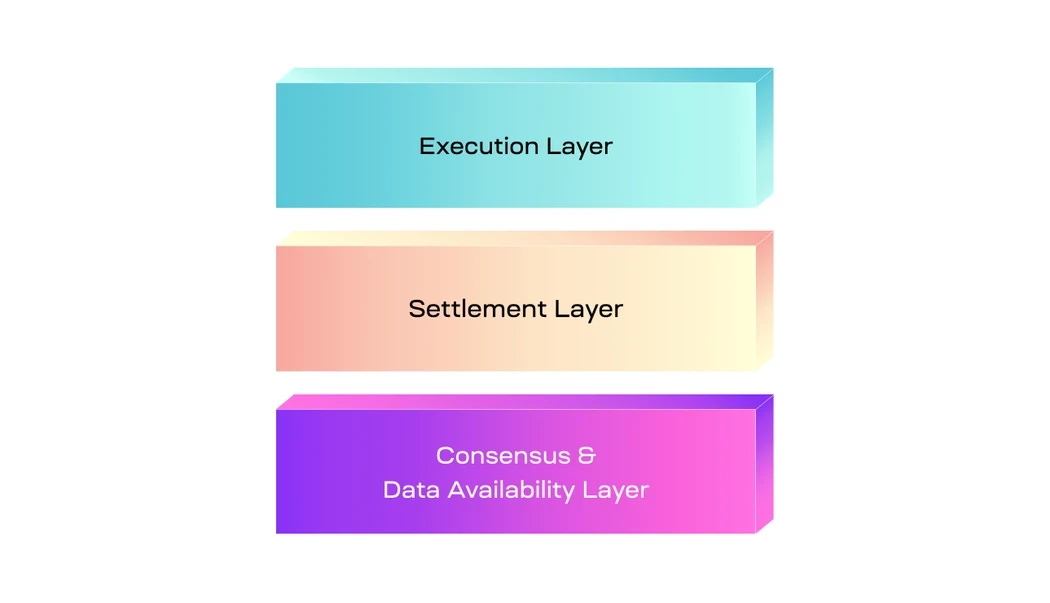

Figure 2: Execution, Settlement and DA Layer Architecture

Execution, Settlement, and Data Availability: Optimized modular blockchains, such as decoupling the execution, settlement, and data availability layers between specialized modular blockchains.

Figure 3: Execution and DA layer architecture

Execution and DA: Since the purpose of implementing a modular blockchain is to be flexible, the execution layer is not limited to publishing its blocks to the settlement layer. For example, it is possible to create a modular stack that does not involve a settlement layer, but only an execution layer on top of the consensus layer and the data availability layer.

Under this modular stack, the execution layer will be sovereign , which publishes its transactions to another blockchain, typically for ordering and data availability, but handles its own settlement. In the context of the modular stack, the sovereign Rollup is responsible for execution and settlement, while the DA layer handles consensus and data availability.

The difference between sovereign Rollup and smart contract Rollup is:

-

Smart Contract Rollup transactions are verified by the settlement layer’s smart contracts. Sovereign Rollup transactions are verified by sovereign Rollup nodes.

-

Compared to smart contract Rollup, the nodes of sovereign Rollu have autonomy. In sovereign Rollup, the ordering and validity of transactions are managed by the Rollups own network, without relying on a separate settlement layer.

Currently, Rollkit and Sovereign SDK provide a framework for deploying a sovereign Rollup testnet on Celestia.

3. Explore modular solutions in the blockchain ecosystem

1. Modularization of the execution layer

Before introducing the modularization of the execution layer, we should understand what Rollup technology is.

Currently, the execution layer modularization technology mainly relies on Rollup, which is a scaling solution that runs outside the Layer 1 chain. This solution executes transactions outside the chain, which means it takes up less block space and is also one of Ethereums important scaling solutions. After executing the transaction, it will send a batch of transaction data or execution proof to Layer 1 and settle it at Layer 1. Rollup technology provides a scalability solution for the Layer 1 network while maintaining decentralization and security.

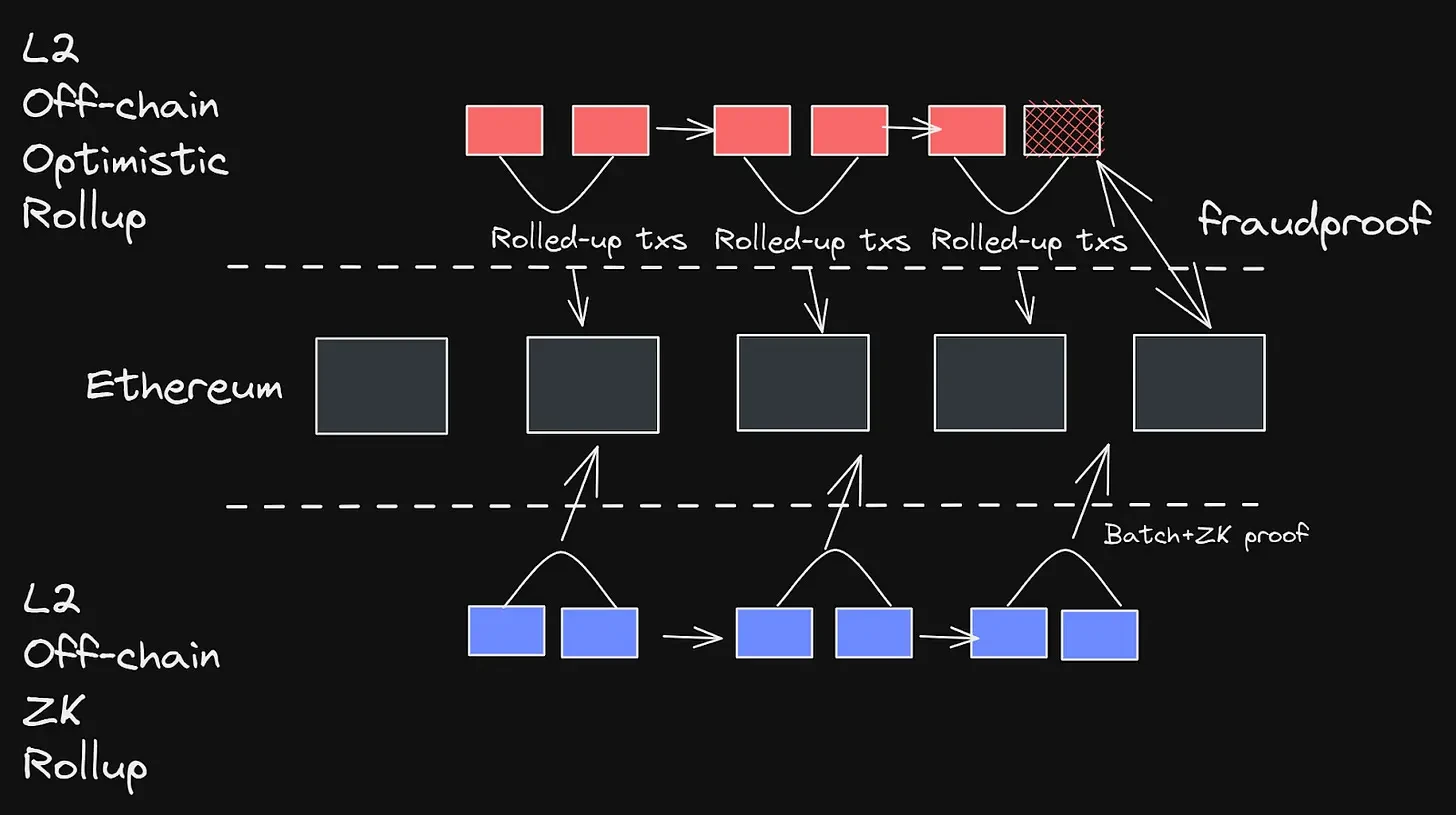

Figure 4: Rollup technical architecture

Taking Ethereum as an example, Rollup technology can further improve performance and privacy by using ZK-Rollup or Optimistic Rollup.

-

ZK-Rollup uses zero-knowledge proofs to verify the correctness of packaged transactions, thereby ensuring the security and privacy of transactions.

-

Optimistic Rollup first assumes that these transactions are valid before submitting the transaction status to the Ethereum main chain. During the challenge period, anyone can calculate fraud proofs to verify the transactions.

1.1 Ethereum Layer 2: Building Future Scaling Solutions

Ethereum initially adopted sidechain and sharding technology for expansion, but the sidechain sacrificed some decentralization and security to achieve high throughput; Layer 2 Rollups have developed much faster than expected and have already provided a lot of expansion, and will provide more after Proto-Danksharding is implemented. This means that shard chains are no longer needed and have been removed from Ethereums roadmap.

Ethereum outsources the execution layer to Layer 2s based on Rollup technology to reduce the burden on the main chain. EVM provides a standardized and secure execution environment for smart contracts executed on the Rollup layer. Some Rollup solutions are designed with compatibility with EVM in mind, so that smart contracts executed on the Rollup layer can still take advantage of EVMs features and functions, such as OP Mainnet , Arbitrum One , and Polygon zkEVM .

Figure 5: Ethereum’s Layer 2 Scaling Solutions

These Layer 2s execute smart contracts and process transactions, but still rely on Ethereum to:

Settlement: All Rollup transactions are finalized on the Ethereum mainnet. Users of Optimistic Rollups must wait for the challenge period to pass or for the transaction to be deemed valid after anti-fraud calculations. Users of ZK Rollups must wait until validity is proven.

Consensus and data availability: Rollups publish transaction data to the Ethereum mainnet in the form of CallData, allowing anyone to execute Rollup transactions and reconstruct their state if necessary. Optimistic Rollups require a large amount of block space and a 7-day challenge period before being confirmed on the Ethereum mainchain. ZK Rollups provide instant finality and store data available for verification for 30 days, but require a lot of computing power to create proofs.

1.2 B² Network: Pioneering Bitcoin ZK- Rollup

B² Network is the first ZK-Rollup on Bitcoin, which increases transaction speed without sacrificing security. Using Rollup technology, B² Network provides a platform capable of running Turing-complete smart contracts for off-chain transactions, thereby improving transaction efficiency and minimizing costs.

Figure 6: B² Network Architecture

As shown in the figure, B² Networks ZK-Rollup Layer adopts the zkEVM solution, which is responsible for the execution of user transactions within the Layer 2 network and the output of related proofs.

Unlike other Rollups, B² Network ZK-Rollup consists of multiple components, including account abstraction module, RPC Service, Mempool, Sequencers, zkEVM, Aggregators, Synchronizers and Prover. The account abstraction module implements native account abstraction, which allows users to flexibly program higher security and better user experience into their accounts. zkEVM is compatible with EVM, and it can also help developers migrate DApps from other EVM-compatible chains to B² Network.

Synchronizers ensure that information is synchronized from the B² node to the Rollup layer, including details such as sequence information, Bitcoin transaction data, etc. The B² node acts as an off-chain validator and is the executor of multiple unique functions in the B² network. The Bitcoin Committer module in the B² node builds a data structure to record the B² Rollup data and generates a Tapscript called a B² inscription. The Bitcoin Committer then sends a UTXO of one satoshi to a Taproot address containing a $B^{ 2 }$ inscription, and the Rollup data will be written to Bitcoin.

In addition, Bitcoin Committer sets a time-locked challenge, allowing the challenger to question the commitment verified by the zk proof. If there is no challenger during the time lock or the challenge fails, the Rollup is finally confirmed on Bitcoin; if the challenge succeeds, the Rollup will be rolled back.

Whether it is Ethereum or Bitcoin, Layer 1 is essentially a single chain that receives extended data from Layer 2. In most cases, the capacity of Layer 2 also depends on the capacity of Layer 1. Therefore, the implementation of the Layer 1 and Layer 2 stack is not ideal for scalability. When Layer 1 reaches its throughput limit, Layer 2 will also be affected, which may lead to higher transaction fees and longer confirmation times, affecting the efficiency of the entire system and user experience.

2. DA layer modularization

In addition to Celestia’s DA solution being favored by Layer 2s, other innovative solutions focusing on DA have emerged one after another, playing a key role in the entire blockchain ecosystem.

2.1 EigenDA: Empowering Rollup Technology

EigenDA is a secure, high-throughput, and decentralized DA service inspired by Danksharding . Rollup is able to publish data to EigenDA to obtain lower transaction costs, higher transaction throughput, and secure composability across the entire EigenLayer ecosystem.

When building decentralized temporary data storage on Ethereum Rollup, data storage can be handled directly by EigenDA operators. Operators are responsible for processing, verifying, and storing data, and EigenDA can scale horizontally with the growth of stake and operators.

EigenDA combines Rollup technology and transfers part of the DA to off-chain processing to achieve scalability. Therefore, the actual transaction data no longer needs to be copied and stored on each node, reducing the demand for bandwidth and storage. The chain only processes metadata and accountability mechanisms related to data availability (accountability enables data to be stored off-chain and its integrity and authenticity can be verified when necessary).

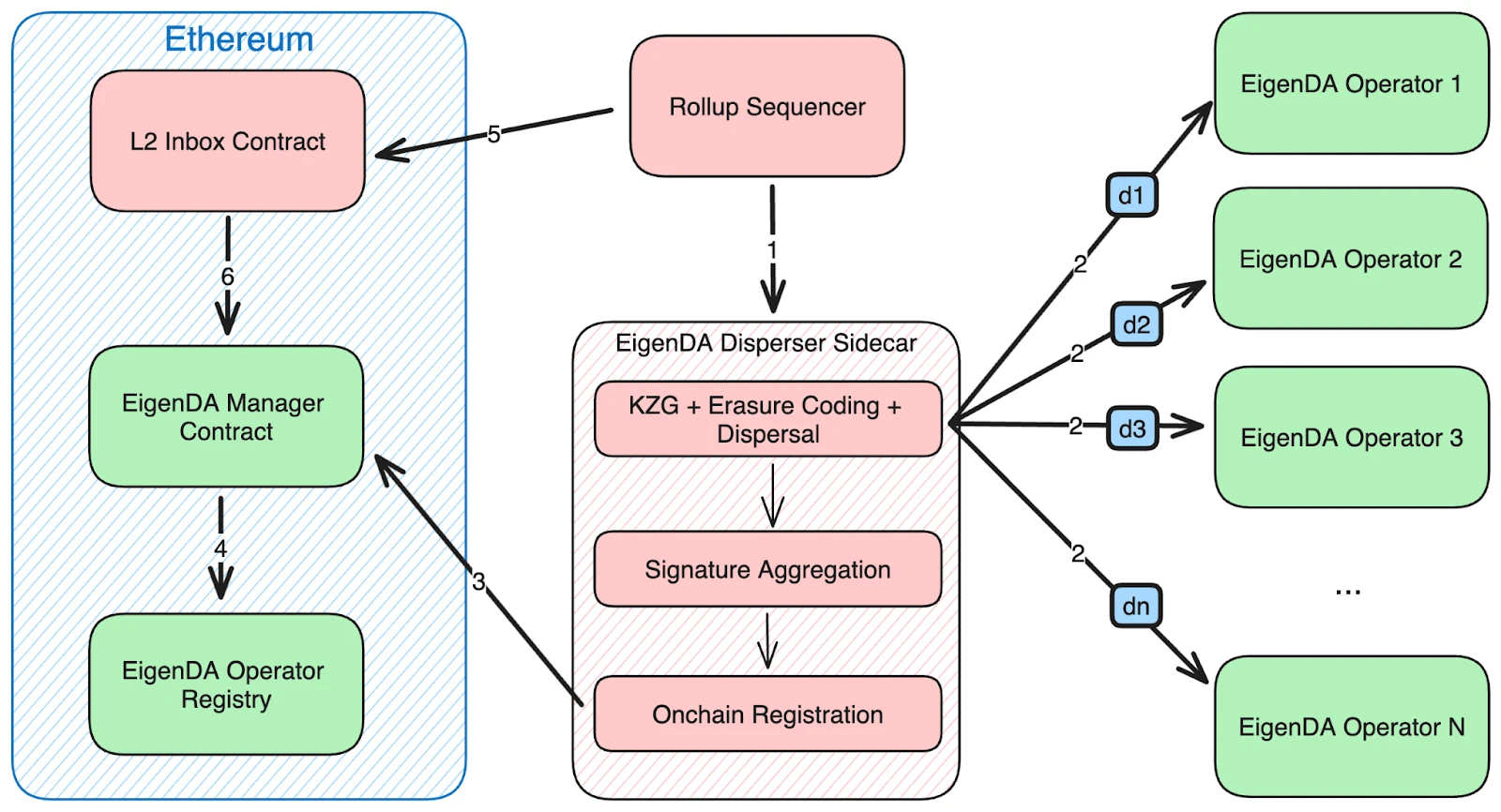

Figure 7: Basic data flow of EigenDA

As shown in the figure, Rollup writes transaction batches to the DA layer. Unlike systems that use fraud proofs to detect malicious data, EigenDA splits the data into blocks and generates KZG commitments and multi-disclosure proofs. EigenDA requires nodes to download only a small amount of data [O (1/n)] instead of downloading the entire blob . Rollups fraud arbitration protocol is also able to verify whether the blob data matches the KZG commitment provided in the EigenDA proof. When performing this verification, the Layer 2 chain ensures that the transaction data of the Rollup state root is not manipulated by the sorter/proposer.

2.2 Nubit: The First Modular DA Solution on Bitcoin

Nubit is a scalable, Bitcoin-native DA layer. Nubit is pioneering the future of Bitcoin native, aiming to increase data throughput and availability services to meet the growing needs of the ecosystem. Their vision is to bring the vast developer community into the Bitcoin ecosystem and provide them with scalable, secure, and decentralized tools.

Nubits team members are professors and doctoral students from UCSB (University of California, Santa Barbara), with outstanding academic reputation and global influence. They are not only proficient in academic research, but also have rich experience in blockchain engineering implementation. The team wrote a paper on modular indexers with domo (the creator of Brc 20 ), added the design of the DA layer to the indexer structure of the Bitcoin meta protocol, and participated in the establishment and formulation of industry standards.

Nubits core innovations: consensus mechanism, trustless bridging, and data availability . It uses innovative consensus algorithms and lightning networks to inherit Bitcoins fully censorship-resistant features and uses DAS to improve efficiency:

-

Consensus Mechanism: Nubit explores an efficient consensus based on PBFT (Practical Byzantine Fault Tolerance) powered by SNARK for signature aggregation. The PBFT scheme combined with zkSNARK technology significantly reduces the communication complexity of signature verification between validators, and verifies the correctness of transactions without accessing the entire data set.

-

DAS: Nubit’s DAS is achieved by performing multiple rounds of random sampling of small portions of the block data. Each successful round of sampling increases the probability that the data is fully available. Once a predetermined confidence level is reached, the block data is considered accessible.

-

Trustless Bridge: Nubit uses a Trustless Bridge that leverages the Lightning Network ’s payment channels. This approach is consistent with native Bitcoin payment methods without adding additional trust requirements. It provides lower risk to users than existing bridge solutions.

Figure 8: Basic components of Nubit

We further use a specific use case to review the complete system life cycle shown in Figure 8. Assume that Alice wants to use Nubits DA service to complete a transaction (Nubit supports multiple data types , including but not limited to inscriptions, Rollup data, etc.).

-

Step 1.1: Alice first needs to pay the gas fee through Nubits trustless bridge to continue the service. In particular, Alice needs to get a public challenge from the trustless bridge, denoted as X(h) (X is the cryptographic hash function from the hash range of the verifiable delay function (VDF) to the challenge domain, and h is the hash value of a certain height block).

-

Step 1.2 and Step 2: Alice must obtain the evaluation result R of the VDF relevant to the current round and submit R along with her data and transaction metadata (such as address and nonce) to the validator so that it can be merged into the memory pool.

-

Step 3: The process by which validators propose blocks and their headers after reaching consensus. The block header includes a commitment to the data and its associated Reed-Solomon Coding (RS Code), while the block itself contains the original data, the corresponding RS Code, and basic transaction details.

-

Step 4: The lifecycle ends with Alice’s data retrieval. The light client downloads the block header, while the full node fetches the block and its header.

Light clients undertake the DAS process to verify data availability. In addition, after a threshold number of blocks are proposed, a checkpoint of this history is recorded on the Bitcoin blockchain via a Bitcoin timestamp. This ensures that the validator set can prevent potential remote attacks and support fast unbinding.

3. Other solutions

In addition to chains that focus on modularizing specific layers, decentralized storage services can provide long-term support for the DA layer. There are also some protocols and chains that provide developers with customized and full-stack solutions that allow users to easily build their own chains without even having to build code.

3.1 EthStorage – Dynamic Decentralized Storage

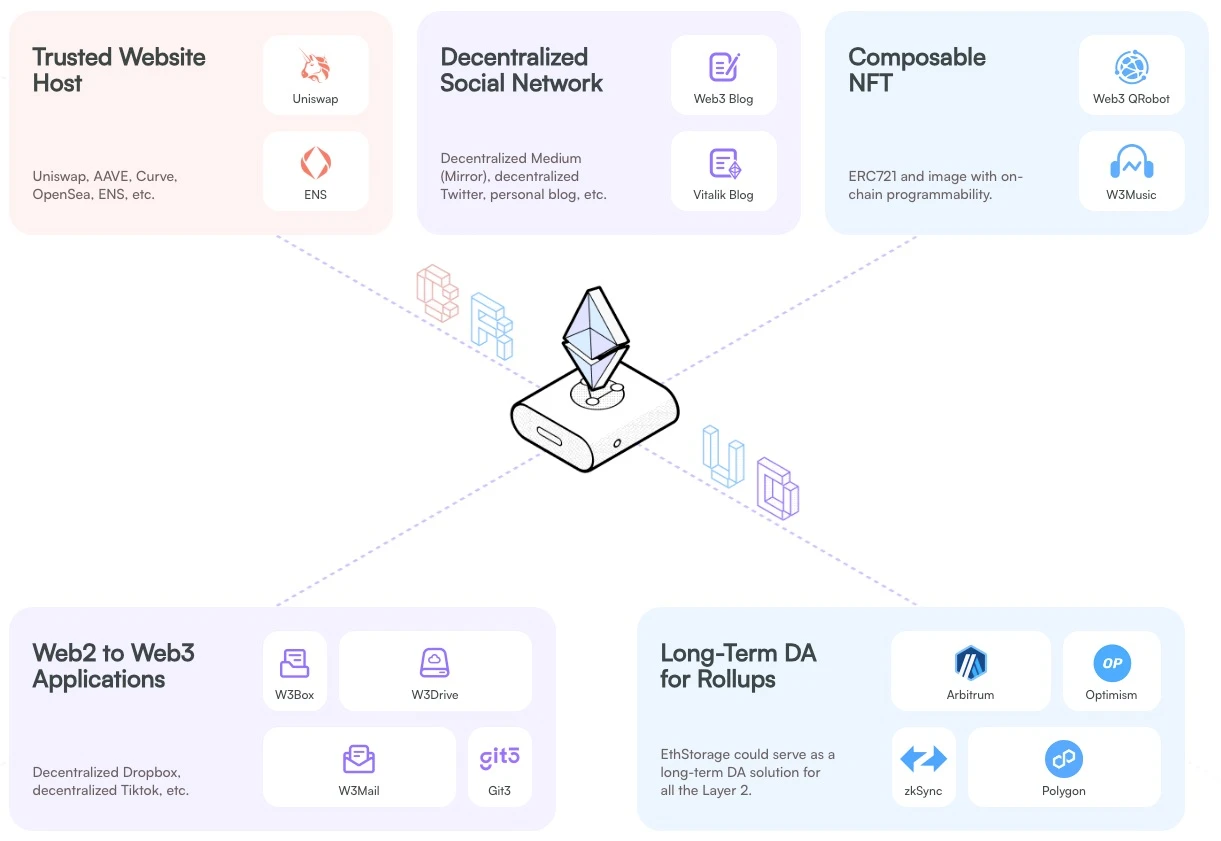

EthStorage is the first modular Layer 2 that implements dynamic decentralized storage, providing programmable key-value (KV) storage driven by DA, which can expand programmable storage to hundreds of TB or even PB at 1/100 to 1/1000 of the cost . It provides a long-term DA solution for Rollups and opens up new possibilities for fully on-chain applications such as games, social networks, and AI.

Figure 9: Application scenarios of EthStorage

Qi Zhou , the founder of EthStorage, has been fully committed to the Web3 industry since 2018. He holds a Ph.D. from Georgia Institute of Technology and has worked as an engineer at top companies such as Google and Facebook. His team has also received support from the Ethereum Foundation.

As one of the core features of the Ethereum Cancun upgrade, EIP-4844 (also known as Proto-dank sharding), temporary data blocks (blobs) for Layer 2 Rollup storage are introduced, which improves the scalability and security of the network. The network does not need to verify every transaction in the block, but only needs to confirm whether the blob attached to the block carries the correct data, which greatly reduces the cost of Rollup. However, the blob data is only temporarily available, which means that it will be discarded within a few weeks. This has a significant impact: Layer 2 cannot unconditionally derive the latest state from Layer 1. If a piece of data can no longer be retrieved from Layer 1, it may not be possible to synchronize the chain through Rollup.

With EthStorage as a long-term DA storage solution, Layer 2s can get complete data from their DA layer at any time.

Technical features:

-

EthStorage can achieve decentralized dynamic storage: Existing decentralized storage solutions can support the upload of large amounts of data, but they cannot be modified or deleted, and can only re-upload new data. EthStorage uses an original key-value storage paradigm to implement CRUD functions, namely create, update, read, and delete stored data, thereby significantly enhancing the flexibility of data management.

-

Layer 2 decentralized solution based on DA layer: EthStorage is a modular storage layer. As long as there is EVM and DA to reduce storage costs, you can run it on any blockchain (but many Layer 1s currently do not have a DA layer), even on Layer 2.

-

Highly integrated with ETH: The EthStorage client is a superset of the Ethereum client Geth, which means that when running an EthStorage node, you can still participate in any Ethereum process normally. A node can be an Ethereum validator node and an EthStorage data node at the same time.

EthStorage workflow:

-

Users upload their data to the application contract, which then interacts with the EthStorage contract to store the data.

-

In the EthStorage Layer 2 network, storage providers are notified about data waiting to be stored.

-

Storage providers download data from the Ethereum Data Availability Network.

-

Storage providers submit storage proofs to Layer 1, proving that there are a large number of replicas in the Layer 2 network.

-

The EthStorage contract rewards storage providers who successfully submit storage proofs.

3.2 AltLayer – Modular Customization Service

AltLayer provides a versatile, code-free Rollups-as-a-Service (RaaS) service. The RaaS product is designed for a multi-chain and multi-virtual machine world, supporting EVM and WASM. It also supports different Rollup SDKs, such as OP Stack, Arbitrum Orbit, Polygon zkEVM, ZKSyncs ZKStack and Starkware, different shared sorting services (such as Espresso and Radius ), and different DA layers (such as Celestia, EigenLayer) and many other modular services at different layers of the Rollup stack.

AltLayer enables a versatile Rollup stack. For example, a Rollup designed for an application can be built using Arbitrum Orbit , using Arbitrum One as the DA and settlement layer, while another Rollup designed for general purposes can be built using ZK Stack, using Celestia as the DA layer and Ethereum as the settlement layer.

Note : You may be wondering why the settlement layer can be implemented by OP and Arbitrum? In fact, the current Rollup stacks of these Layer 2s are implementing similar interchain work proposed by Cosmos to achieve interconnection: OP proposed Superchain, and OP Stack, as a standardized development stack supporting Optimism technology, integrates different Layer 2 networks and promotes interoperability between these networks; Arbitrum proposed the Orbitchain strategy, which allows the creation and deployment of Layer 3, also known as application chain, on the Arbitrum mainnet based on Arbitrum Nitro (technology stack). Orbit Chains can be settled directly to Layer 2s or directly to Ethereum.

3.3 Dymension – Full stack modularization

Dymension is a modular blockchain network based on the Cosmos SDK that aims to ensure the security and interoperability of RollApp by using the IBC standard.

Dymension divides blockchain functions into multiple layers. Dymension Hub acts as the settlement layer and consensus layer to provide security, interoperability, and liquidity for RollApp, and RollApp acts as the execution layer. The data availability layer is the DA provider supported by the Dymension protocol, and developers can choose the appropriate data availability provider according to their needs.

The settlement layer (Dymension Hub) maintains the RollApps registry and corresponding important information, such as status, sequencer list, currently active sequencer, execution module checksum, etc. The Rollup service logic is fixed in the settlement layer, forming a center of native interoperability. As a settlement layer, Dymension Hub has the following characteristics:

-

Providing Rollups services natively on the settlement layer: Provides the same trust and security assumptions as the base layer, but with a simpler, more secure, and more efficient design space.

-

Communication and Transactions: Dymensions RollApp enables inter-RollApp communication and transactions on the settlement layer through embedded modules, providing a trust-minimized bridge. In addition, RollApps can communicate with other IBC-enabled chains through the Hub.

-

RVM (RollApp Virtual Machine): The Dymension settlement layer launches the RVM in case of fraud disputes. The RVM is able to resolve disputes in various execution environments (such as the EVM), expanding the power and flexibility of the RollApp execution range.

-

Censorship resistance: Users who have undergone Sequencer review can issue a special transaction to the settlement layer. This transaction is forwarded to the Sequencer and requested to be executed within a specified time frame. If the transaction is not processed within the specified time, the Sequencer will be penalized.

-

AMM (Automated Market Maker): Dymension introduces an embedded AMM in the settlement center, creating a core financial center. Providing shared liquidity for the entire ecosystem.

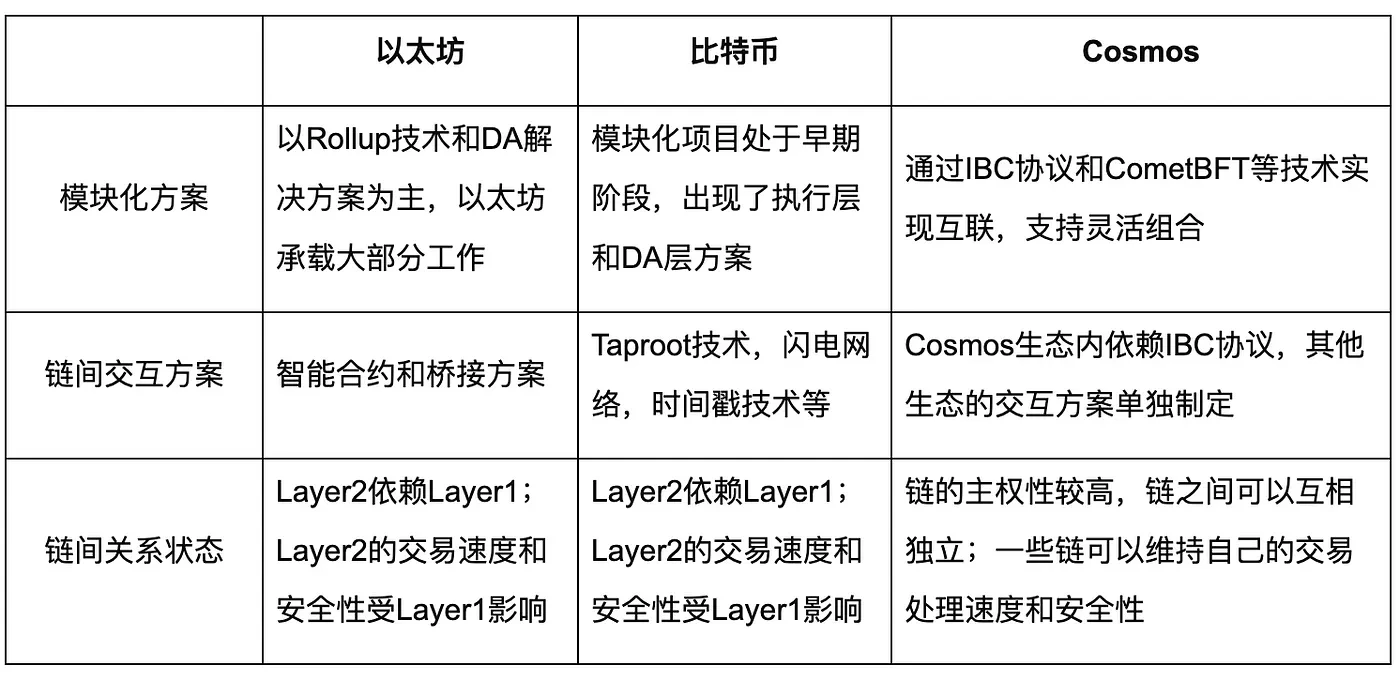

4. Comparison of multi-ecological modular blockchains

In the previous article, we explored in depth the modular blockchain system and many representative projects. Now we will shift our focus to the comparative analysis between different ecosystems, aiming to objectively and comprehensively understand the modular blockchain.

V. Summary and Outlook

As we can see, the blockchain ecosystem is moving towards modularization. In the past blockchain world, each chain operated in isolation and competed with each other, which made it difficult for users, developers and assets to flow between different chains, limiting the overall development and innovation of the ecosystem. In the WEB3 world, problem discovery and solution are a process of joint efforts. At the beginning, Bitcoin and Ethereum attracted a lot of attention as single chains, but as the problems of single chains were exposed, modular chains gradually attracted attention. Therefore, the outbreak of modular chains is not accidental, but an inevitable development.

Modular blockchains improve the flexibility and efficiency of the chain by allowing each component to be independently optimized and customized. However, this architecture also faces challenges, such as communication delays and increased complexity of system interactions. In fact, the long-term benefits of modular architecture, such as improved maintainability, reusability, and flexibility, usually outweigh its short-term performance losses. In the future, as technology develops, these problems will find better solutions.

GeekCartel believes that the blockchain ecosystem has the responsibility to provide a reliable base layer and common tools throughout the modular stack to facilitate smooth direct links between chains. If the ecosystem can be more harmonious and interconnected, users will be able to use blockchain technology more easily, and more new users will be attracted to Web3.

6. Extended reading: Restaking Protocol — Injecting native security into heterogeneous ecosystems

At present, some Restaking protocols have also emerged, which effectively aggregate scattered security resources through the re-staking mechanism to improve the overall security of the blockchain network. This process not only solves the problem of fragmented security resources, but also enhances the networks defense capabilities against potential attacks, while providing additional incentives for participants to encourage more users to participate in network security maintenance. In this way, the Restaking protocol has opened up a new way to improve network security and efficiency, and has effectively promoted the healthy development of the blockchain ecosystem.

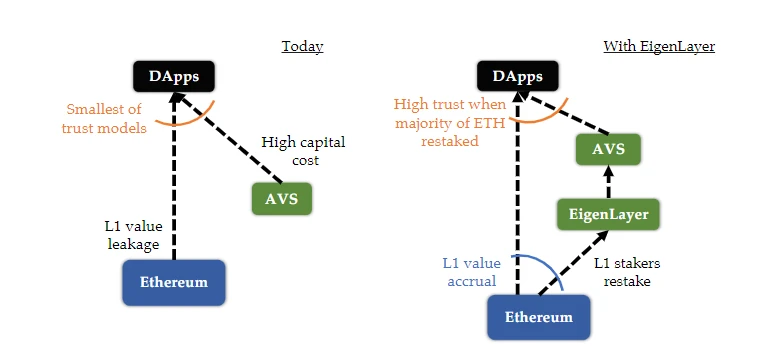

1. EigenLayer: Decentralized Ethereum Restaking Protocol

EigenLayer is a protocol built on Ethereum that introduces the Restaking mechanism, a new primitive for cryptoeconomic security. This primitive allows ETH to be reused on the consensus layer, aggregates ETH security between all modules, and improves the security of DApps that rely on modules. Users who stake ETH natively or use Liquid Staking Tokens (LST) can choose to join the EigenLayer smart contract to re-stake their ETH or LST and extend cryptoeconomic security to other applications on the network to receive additional rewards.

When Ethereum shifted to a Rollup-centric roadmap, the applications that could be built on Ethereum expanded significantly.

However, any module that cannot be deployed or proven on the EVM cannot absorb the collective trust of Ethereum. Such modules involve processing inputs from outside Ethereum, so their processing cannot be verified in the Ethereum internal protocol. Such modules include sidechains based on new consensus protocols, data availability layers, new virtual machines, oracle networks, bridges, etc. Usually, such modules need AVS with their own distributed verification semantics to verify. Usually, these AVS are either protected by their own native tokens or have permissioned nature.

There are some problems with the current AVS ecosystem:

-

Security Trust Assumptions. Innovators developing AVS must bootstrap a new trust network to achieve security.

-

Value leakage. As each AVS develops its own trust pool, users must pay fees to these pools in addition to transaction fees paid to Ethereum. This deviation in the flow of fees leads to value leakage from Ethereum.

-

Constituent Burden. For most AVS operating today, the capital cost of staking far exceeds any operating costs.

-

DApp has a low trust model. The current AVS ecosystem has created a problem. Generally speaking, any middleware dependency of a DApp may become a target of attack.

Figure 10: Comparison between current AVS services and EigenLayer

On the EigenLayer architecture, AVS is a service built on the EigenLayer protocol, leveraging Ethereums shared security. EigenLayer introduces two novel approaches, centralized security through staking and free market governance, which help extend Ethereums security to any system and eliminate the inefficiencies of existing rigid governance structures:

-

Providing collective security through re-staking. EigenLayer provides a new collective security mechanism by enabling re-staking of ETH instead of their own tokens to secure modules. Specifically, Ethereum validators can set their beacon chain extraction credentials to the EigenLayer smart contract and opt-in to new modules built on EigenLayer. Validators download and run any additional node software required by these modules. These modules can then impose additional penalty conditions on the staked ETH of validators who opt-in to the module.

-

Open market provides rewards. EigenLayer provides an open market mechanism for managing the security provided by validators and how AVSs are consumed. EigenLayer creates an environment in the market where individual modules will need to sufficiently incentivize validators to allocate re-staked ETH to their own modules, and validators will help decide which modules are worthy of this additional collective security.

By combining these approaches, EigenLayer acts as an open market where AVS can leverage the pooled security provided by Ethereum validators, encouraging validators to make more optimal trade-offs between security and performance through reward incentives and penalties.

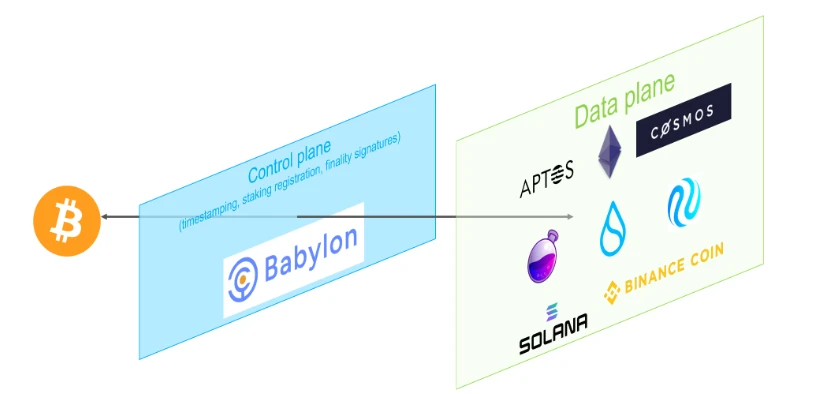

2. Babylon: Providing Bitcoin Security to Cosmos and Other PoS Chains

Babylon is a Layer 1 blockchain founded by Professor David Tse of Stanford University. The team consists of researchers from Stanford University and experienced developers and business consultants. Babylon proposed a Bitcoin staking protocol , which is designed as a modular plug-in for many different PoS consensus algorithms, providing a primitive that can re-stake the protocol.

Babylon is based on three aspects of Bitcoin – timestamp service, block space and asset value – and is able to transfer the security of Bitcoin to all numerous PoS chains (such as Cosmos, Binance Smart Chain, Polkadot, Polygon and other blockchains that already have a strong, interoperable ecosystem), creating a more powerful and unified ecosystem.

Bitcoin timestamp solves PoS long-distance attack :

Long-distance attacks take advantage of the possibility that after the validators in the PoS chain unstake, they return to a historical block where they were still stakers, and start a forked chain. This problem is inherent in the PoS system and cannot be completely solved by simply improving the consensus mechanism of the PoS chain itself. Both Ethereum and Cosmos PoS chains face this challenge.

After the introduction of Bitcoin timestamp, the on-chain data of the PoS chain will be stored on the Bitcoin chain in the form of a Bitcoin timestamp. Even if someone wants to create a fork of the PoS chain, its corresponding Bitcoin timestamp will definitely be later than the original chain, so long-distance attacks will be ineffective at this time.

Bitcoin staking protocol:

The protocol allows Bitcoin holders to stake their idle Bitcoins to increase the security of the PoS chain and earn returns in the process.

The core infrastructure of the Bitcoin staking protocol is the Control Plane between Bitcoin and the PoS chain, as shown in the figure below.

Figure 11: System architecture with control plane and data plane

The Control Plane is implemented in the form of a chain to ensure that it is decentralized, secure, censorship-resistant, and scalable. This control plane is responsible for various key functions, including:

• Provide Bitcoin timestamping services for PoS chains to enable them to synchronize with the Bitcoin network.

• Act as a market place, matching Bitcoin stakes with PoS chains, and tracking stake and verification information, such as registration and refresh of EOTS keys;

• Record the final signature of the PoS chain;

By staking their BTC, users can provide verification services for PoS chains, DA layers, oracles, AVS, etc. Babylon can now also provide services for Altlayer, Nubit, etc.

References

picture:

-

https://celestia.org/learn/modular-architectures/the-modular-stack/#layer-1-and-2

-

https://celestia.org/learn/modular-architectures/the-modular-stack/#execution-and-data-availability

-

https://celestia.org/learn/sovereign-rollups/an-introduction/#what-is-a-smart-contract-rollup

-

https://docs.eigenlayer.xyz/eigenda/overview#how-rollups-integrate

-

https://docs.eigenlayer.xyz/assets/files/EigenLayer_WhitePaper-88c47923ca0319870c611decd6e562ad.pdf

-

https://docs.babylonchain.io/assets/files/btc_staking_litepaper-32bfea0c243773f0bfac63e148387aef.pdf

text:

-

https://celestia.org/learn/modular-architectures/the-modular-stack/

-

https://celestia.org/learn/sovereign-Rollups/an-introduction/

-

https://github.com/Sovereign-Labs/sovereign-sdk/tree/stable/examples/demo-Rollup

-

https://ethereum.org/en/developers/docs/scaling/optimistic-Rollups

-

https://docs.bsquared.network/architecture/Rollup_layer#synchronizer

-

https://docs.bsquared.network/architecture/da_layer/b2_nodes

-

https://docs.bsquared.network/architecture/da_layer/b2_nodes#bitcoin-committer-module

-

https://ethereum.org/en/roadmap/danksharding/#how-are-blobs-verified

-

https://www.halborn.com/blog/post/what-is-practical-byzantine-fault-tolerance-in-blockchain

-

https://docs.nubit.org/overview/architecture/trustless-bridge

-

https://lorenzo-protocol.gitbook.io/lorenzoprotocol/lorenzo-bitcoin-l2-as-a-service

-

https://docs.arbitrum.io/launch-orbit-chain/orbit-gentle-introduction

-

https://docs.arbitrum.io/for-devs/concepts/public-chains#arbitrum-one

Acknowledgements

There is still a lot of research and work to be done in this emerging infrastructure paradigm, and there are many areas not covered in this article. If you are interested in any related research topics, please contact Chloe .

Many thanks to Severus and Jiayi for their insightful comments and feedback on this article.

This article is sourced from the internet: Modular blockchain: The final piece of the Web3 puzzle

Related: Dogecoin, Solana, and XRP’s Open Interest Declined: Is This a Bearish Signal?

In Brief Dogecoin’s open interest plummeted 64%, Solana and XRP also saw major drops. Open interest across major cryptos, including DOGE, SOL, and XRP, fell by 51%. Decline hints at reduced trading activity and potential market sentiment shift. Recent data highlights a significant downturn in the open interest of major cryptocurrencies such as Dogecoin (DOGE), Solana (SOL), and Ripple (XRP). With a combined drop of 51%, these altcoins spark debate over the implications for their future market positions. Open Interest Declines Across the Crypto Market Open interest, a crucial indicator of market sentiment and liquidity, reflects the total value of outstanding futures contracts yet settled. For cryptocurrencies, these metrics provide insights into investor behavior and market dynamics. Dogecoin led the recent decline, with its open interest plummeting by 64% to…