Merlin Chain founder Jeff: Capacity expansion, interest generation and asset swaps, how does Merlins native innovation e

At the BitcoinAsia conference in May, Merlin Chain founder Jeff delivered a speech titled From Bitcoin L1 to Merlin Chains Native Innovation, which explored in depth how Merlin Chains native innovation can empower the Bitcoin ecosystem. He reviewed the evolution of the Bitcoin ecosystem and explored in depth how Merlin Chains native innovation will promote the development of the Bitcoin ecosystem.

The following is the full text of the speech, compiled based on the on-site recording.

Before 2023, Bitcoin was always seen as digital gold for value storage, and no one was creating new concepts and applications around Bitcoin. But after the Ordinals craze in mid-2023, more and more people began to create NFT-related content on the Bitcoin network, issuing assets such as BRC-20, BRC-420, and ORC-20, and then Atomicals and Runes also entered everyones field of vision. People gradually discovered that there were many things that could be done on the Bitcoin network, and they heard more and more voices, and began to discuss the expansion and re-staking of the Bitcoin network.

Subsequently, IDO, fair launch and other activities brought Bitcoin assets to Layer 2. Merlin started preparing for Layer 2 in February this year, and heard a lot of voices saying that Bitcoin Layer 2 is not practical, a scam, etc. But in fact, there are a lot of Bitcoin Layer 2s now, and there are also many supporters and builders in our industry, all of whom are using EVM and similar Bridge technologies. My point is that users have a strong demand for Bitcoin Layer 2, and they hope to trade Bitcoin ecosystem assets faster and at a lower cost. Merlin wants to bring new possibilities to the entire ecosystem and empower Layer 1 assets, that is, if you hold Runes, BRC-20, NFT and other assets on Layer 1, what Merlin wants to do is to enable these assets to play a unique value in DeFi, GameFi, SocialFi and other fields.

Merlins Phantom Token Swap

We have brought many new ideas to the entire Bitcoin ecosystem. Merlins Phantom will be officially launched this month, and we will be able to freely exchange various assets such as NFTs and tokens, Runes and BRC-20. We will define various permissionless asset swaps through standardized contracts. For example, you can define a standard for exchanging NFTs for tokens, and then you can freely stake this token to become an LP to obtain income. I can also exchange 10,000 MERLs for NFTs and hold them. Of course, these assets can also be exchanged back at any time. Therefore, I believe that although assets are born in Layer 1, Layer 2 is where these assets can be freely traded, exchanged, and so on. In fact, Layer 2 has unlimited possibilities.

Merlin Yields: Introducing low-risk yield on Bitcoin on a holding basis

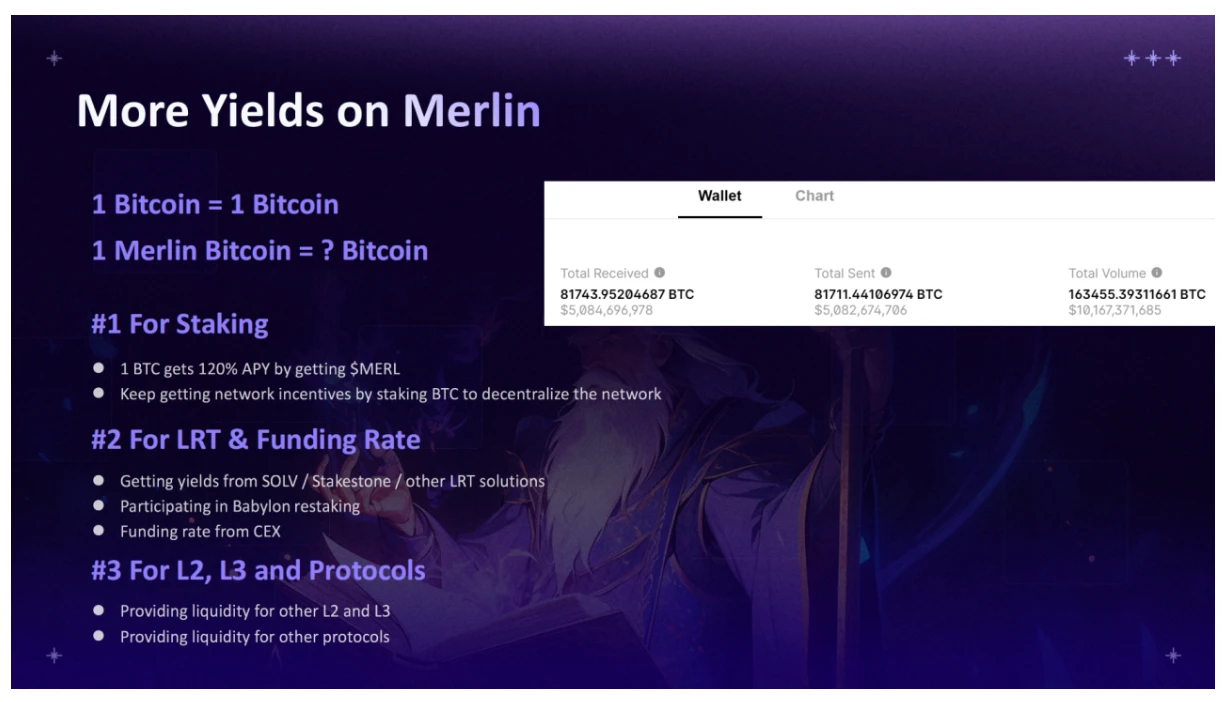

This chart shows the data of Merlin BTC Bridge. In the past month, a total of 163,400 Bitcoins have been transferred in and out of Merlin, which is equivalent to 10.167 billion US dollars. Looking at the Bitcoin transaction records on all cross-chain bridges and exchanges such as OKX and Binance, I don鈥檛 think any platform can exceed this number. Our transaction volume exceeds 10 million times, with a total number of users in the millions. At the same time, our cross-chain bridge can run smoothly without any errors during the transfer process. This is the fundamental guarantee for us to introduce Bitcoin into the EVM ecosystem.

Now, if you hold one Bitcoin in Layer 1 or Binance, then at the end of the year, you will still have only one Bitcoin in your address. But if you hold one Merlin Bitcoin, what will be your balance at the end of the year? I mean, unless the Bridge is no longer functioning properly or there are other security issues, the BTC in your hands will be more than 1 because of the added value of the Merlin network.

First, for staking, we have cooperated with many projects and will also open our PoS system. Therefore, if you hold a Merlin BTC and participate in staking, after the lock-up period, not only will the staked Bitcoin receive additional income, you will also receive additional network incentives and token airdrops from all cooperative projects. For Bitcoin stakers of Merlins Seal, they received the MERL airdrop at the highest APY of 120%.

Secondly, if you stake Merlin Bitcoin in projects such as StakeStone or Solv, you will undoubtedly receive tokens from these projects, and you will also be able to re-stake through Babylon to obtain additional staking points and project tokens. In addition, you will also obtain funding agency income through other agencies such as Antalpha, that is, 50% BTC APY from CEXs such as Binance.

Finally, there are many application scenarios for SolvBTC exchanged by staking Merlin BTC in Solv Protocol. We have cooperated with 10 Ethereum Layer 2s, and will announce cooperation with Linea, ZKLink, Arbitrum and other networks in the near future. You can also obtain re-staking income by introducing SolvBTC to other Layer 2 networks. Since other ecosystems urgently need Bitcoin ecosystem users and transaction volume, but they have no choice in obtaining liquidity, cooperation with Ethereum Layer 2 is a natural choice for the ecosystem.

I think all the above benefits are very important for Bitcoin. Bitcoin should not be just for holding. What Merlin is doing now is to introduce low-risk returns to Bitcoin on the basis of holding. In short, I think all the innovations that have taken place on Bitcoin Layer 1 and Layer 2 are very important. I am also very happy to see that there are so many builders in the ecosystem working with us. We are all fellow travelers who want to introduce these fun things into the Bitcoin ecosystem.

This article is sourced from the internet: Merlin Chain founder Jeff: Capacity expansion, interest generation and asset swaps, how does Merlins native innovation empower the Bitcoin ecosystem?

Related: Fidelity Warns Against Rising Selling Pressure, Updates Bitcoin Outlook to ‘Neutral’

In Brief Fidelity revises Bitcoin outlook to neutral from positive. Analysis shows Bitcoin not “cheap” since Q1, 2024. ETF growth and small investor accumulation persist. Fidelity Digital Assets, a leading issuer of spot Bitcoin ETFs in the US, has revised its medium-term outlook on Bitcoin from positive to neutral. This shift, detailed in their Q1 2024 Signals Report released on April 22, stems from several concerning trends in Bitcoin’s market performance. Why Fidelity Changed Its Bitcoin Medium-Term Stance? The Fidelity Wise Origin Bitcoin Fund (FBTC) has seen impressive growth, amassing over $8 billion in inflows. It stands as the second-fastest growing Bitcoin ETF since its launch. Despite this success, recent analyses point to a significant shift in Bitcoin’s valuation outlook. The Bitcoin Yardstick, or Hashrate Yardick, serves as a key…