Detailed explanation of Berachain: New Meme Paradise or DeFi Utopia?

Original author: Arnavs Musings

Original translation: TechFlow

A team that attended crypto conferences wearing giant, hilarious bear masks successfully raised seed funding at a $420.69 million valuation, all to build another L1, but this time themed around bears smoking marijuana. Yes, I totally understand the skepticism about this idea, in fact, I also thought it was pretty stupid when I first heard about it.

It wasn’t until I took the time to understand Proof of Liquidity and the power of the Bera community that my perspective changed — not only on Berachain, but on how communities can fundamentally be nurtured, sustained, and independently thrive.

Introduction

Berachain is an Ethereum Virtual Machine (EVM)-compatible L1 built on the Cosmos SDK, born from the Bong Bears NFT series in 2021. From these memes was born Proof of Liquidity, which is core to Berachain’s mission.

Before you get skeptical about Berachain, ask yourself why you would invest in other tokens? Why do some tokens maintain ridiculously high fully diluted valuations (FDVs) despite having only a handful of users? The answer is simple, I think all tokens fall within this range:

-

Cult = the time + effort + money a community invests in an asset

-

PMF = ongoing demand for a given protocol (or a guess at the PMF)

-

Quadrant A = Send to Valhalla

-

Quadrant B = Most of the high FDV tokens in current cryptocurrencies

-

Quadrant C = You should probably move to AI

-

Quadrant D = Many of the upcoming middleware/infrastructure tokens

Many cryptocurrencies have FDVs in the billions simply due to strong community support. Take Cardano for example, despite having no users and total locked value (TVL), it has a high FDV of about $18 billion, but the Cardano community has somehow continued to grow and gain acceptance in the retail market. Other examples of assets that are mainly focused (besides memes) include Litecoin, Cronos, etc.

Is this a bad thing? Just like the protocols of the Internet (HTTPS, TCP/IP, etc.), blockchain itself will eventually become synonymous, which means that the main difference in launching a successful blockchain is the brand. People trust brands, so blockchain can either become the brand or die.

Bera Community

It goes without saying that Berachain has one of the strongest brands in the cryptocurrency space. But how strong is it?

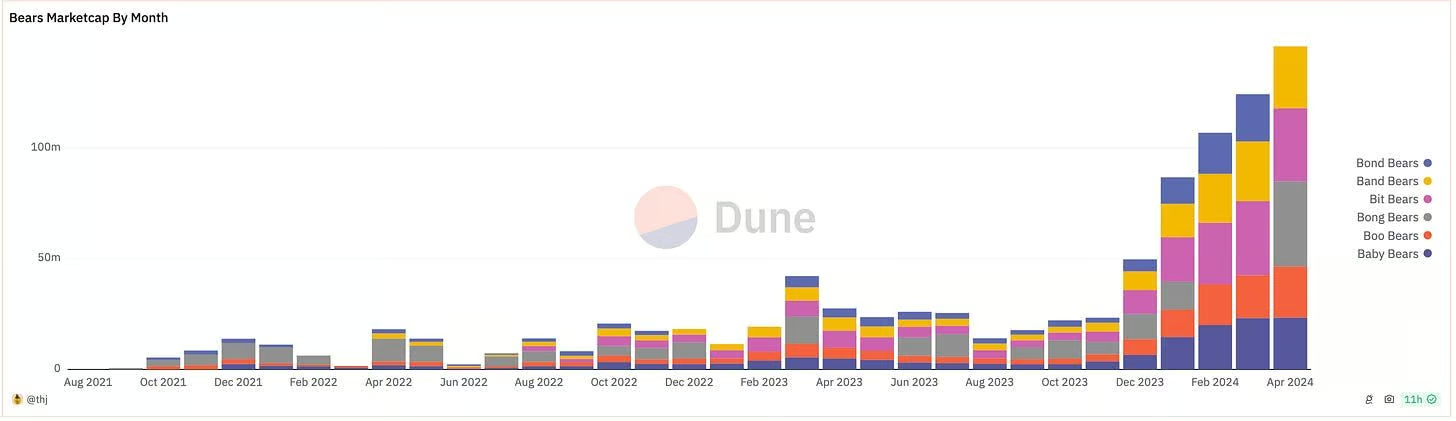

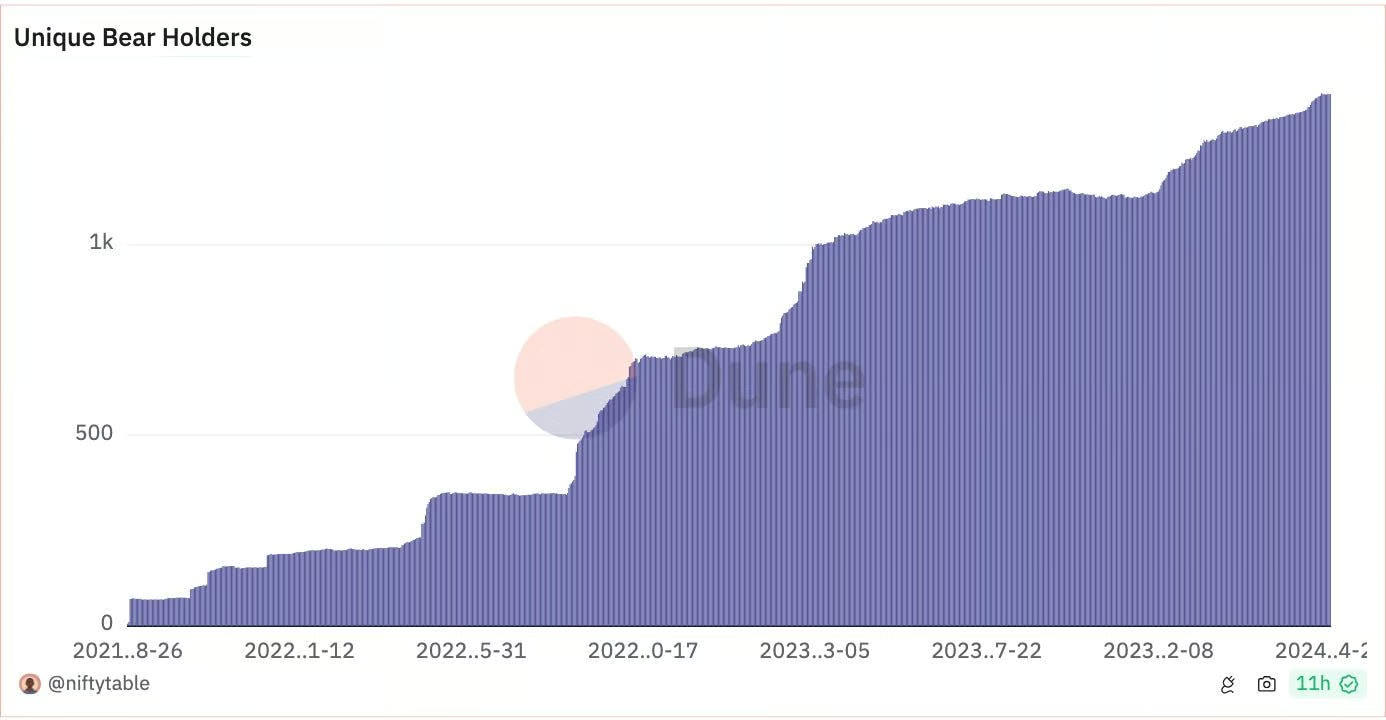

The market value of the Bong Bear Genesis Series and its new versions is approximately $150 million+, with price, quantity and holdings continuing to grow over the past 2 years.

One interesting thing to note is that early holders are rewarded handsomely (e.g. Chainlink, Axie, etc.) and you have a community that thrives autonomously and almost forms a life of its own. Take “ The Honey Jar ” for example, a Berachain community run project led by Janitoor . Jani started out as a Bong Bear holder and now runs a team of over 20 people and has attracted over 100,000 users to the Berachain ecosystem.

The Honey Jar

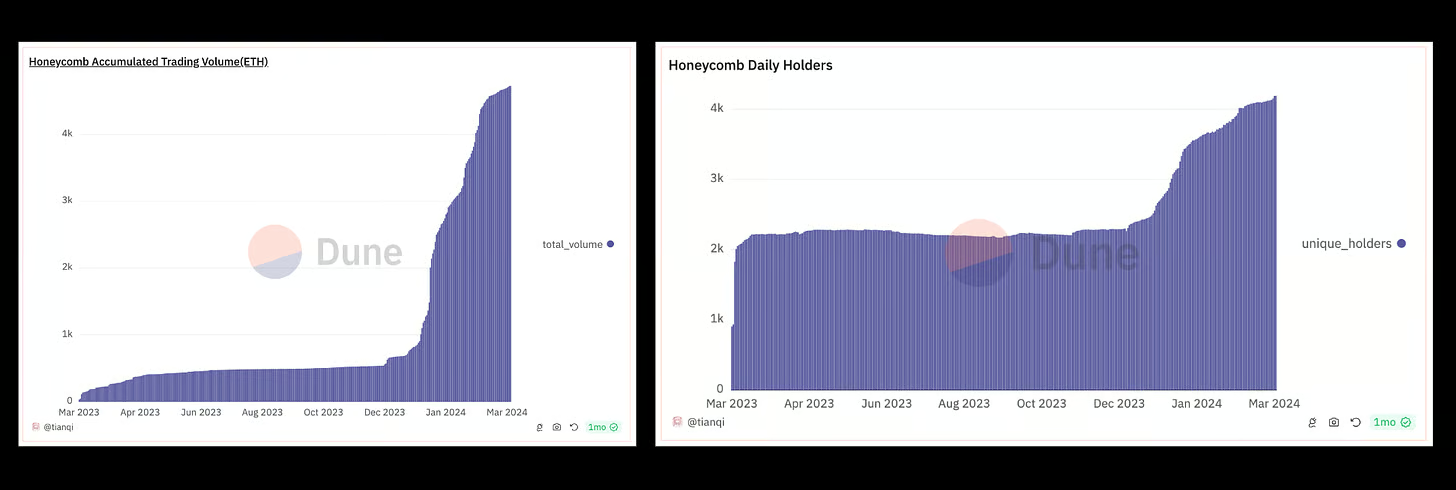

The Honey Jar, or THJ, is the core of the Berachain community and was founded by Jani in January 2023. During the bear market, THJ worked as hard as any other project, creating countless legendary articles , competitions, podcasts, spaces, NFT casting, etc., gradually building one of the most prolific communities in the crypto space. At the core of this community is an NFT collection called Honeycomb, with a total of 16,420 NFTs, which serves as a welfare aggregator for the THJ ecosystem.

An interesting statistic about NFT collection: 4229 people received NFT for free, of which 1569 held it for more than a year despite the price reaching more than 0.6 ETH. In addition to NFT collection, the community also ran many social experiments on Mirror and Zora, where community members could mint THJ legendary articles/assets. THJ quickly became the highest-paid author on Mirror, with more than 25% of all Mirror fundraising being THJ assets.

The THJ community also dominates Base and Optimism on Zora

Basically, THJ’s community (and by extension Berachain) has demonstrated a higher “cult” index than any other project: they are willing to spend a lot of time, energy, and money.

But why go through all this trouble before mainnet?

Janitoor (@deepname 99) said “THJ’s strategy has always been to create outposts in large communities and protocols and L1s, creating wormholes to Berachain (‘Berachain is the destination chain’) by letting others experience Beraculture and Berapil and giving them a chance to get some fur in the game”

Jani made this argument more than a year ago, that being prepared for the influx of new users and capital and providing them with rich content is crucial. A year later, this thesis has been proven.

Whats the takeaway? All I can say is that few projects, if any, have a superweapon like THJ.

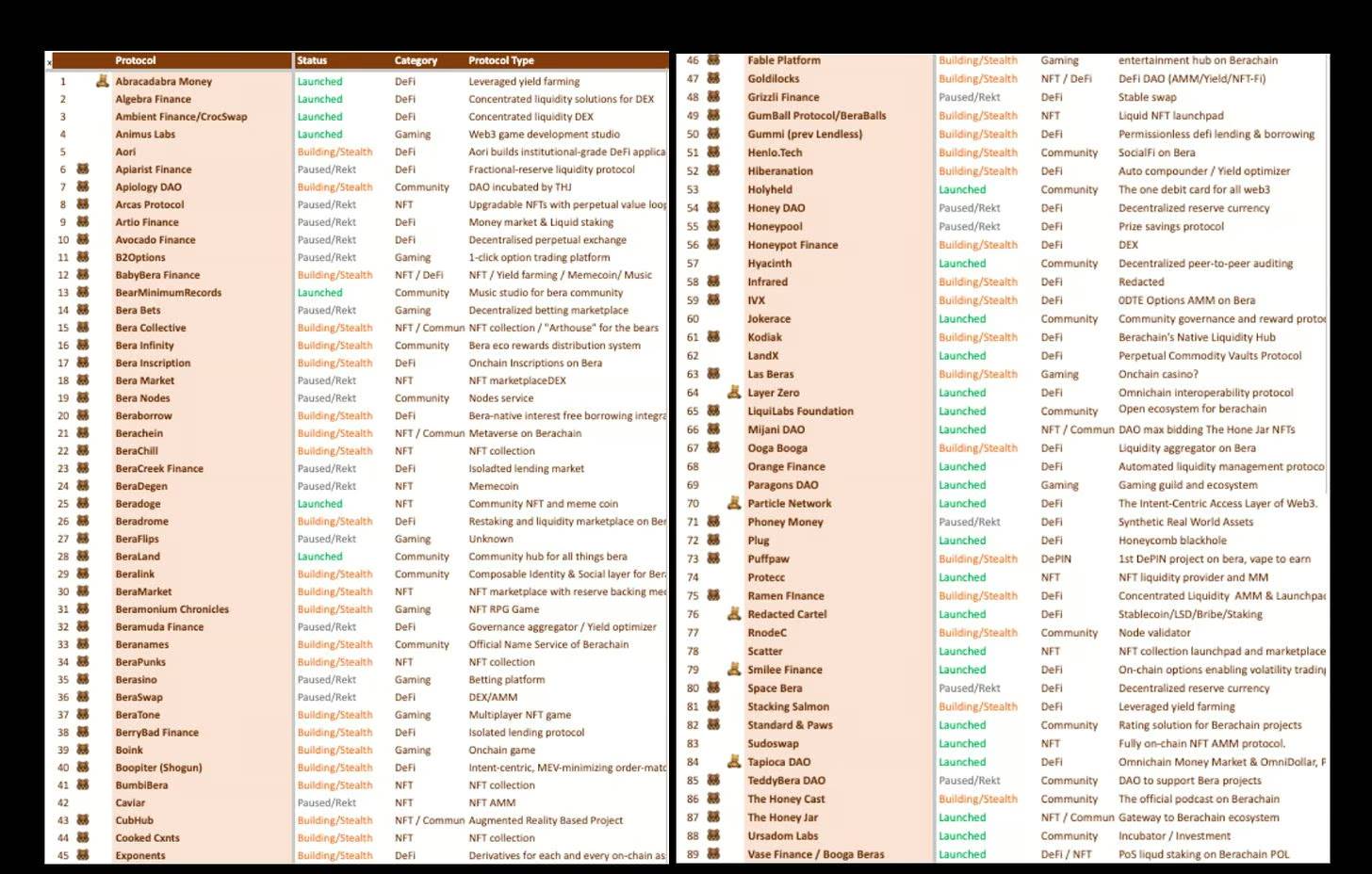

ecosystem

There is a rich community of over 60 Berachain-exclusive projects: from restaking protocols, indie games, money markets, NFT AMMs, liquidity aggregators, launchpads, etc. In addition, there are many venture-backed Berachain-native projects, including Infrared Finance , Kodiak , Beraborrow , Gummi , Beratone , etc.

Examples of other Berachain community efforts include The HoneyCast , a Berachain native podcast that has been recording shows for about 2 years; Beraland , the community-run Berachain Discord hub/project aggregator, etc.

In addition to the thriving Bera native ecosystem, any existing EVM dApp can be easily ported to Berachain. Some multi-chain deployments include Ambient, Thetanuts, Concrete… and more are yet to be announced.

Of course, it’s hard to talk about the Bera ecosystem without mentioning Berapalooza, the hottest event at ETH Denver and now a core hotspot for Framework, which co-led its latest funding round.

Okay, Berachain has memes, so what?

I’m not going to sit here and sell you a groundbreaking EVM-compatible CometBFT chain. I think building EVM compatibility and integrating with the existing tech stack is key. However, I can say that Proof of Liquidity (PoL) is a generational experiment in DeFi.

ELI 5 Proof of Liquidity

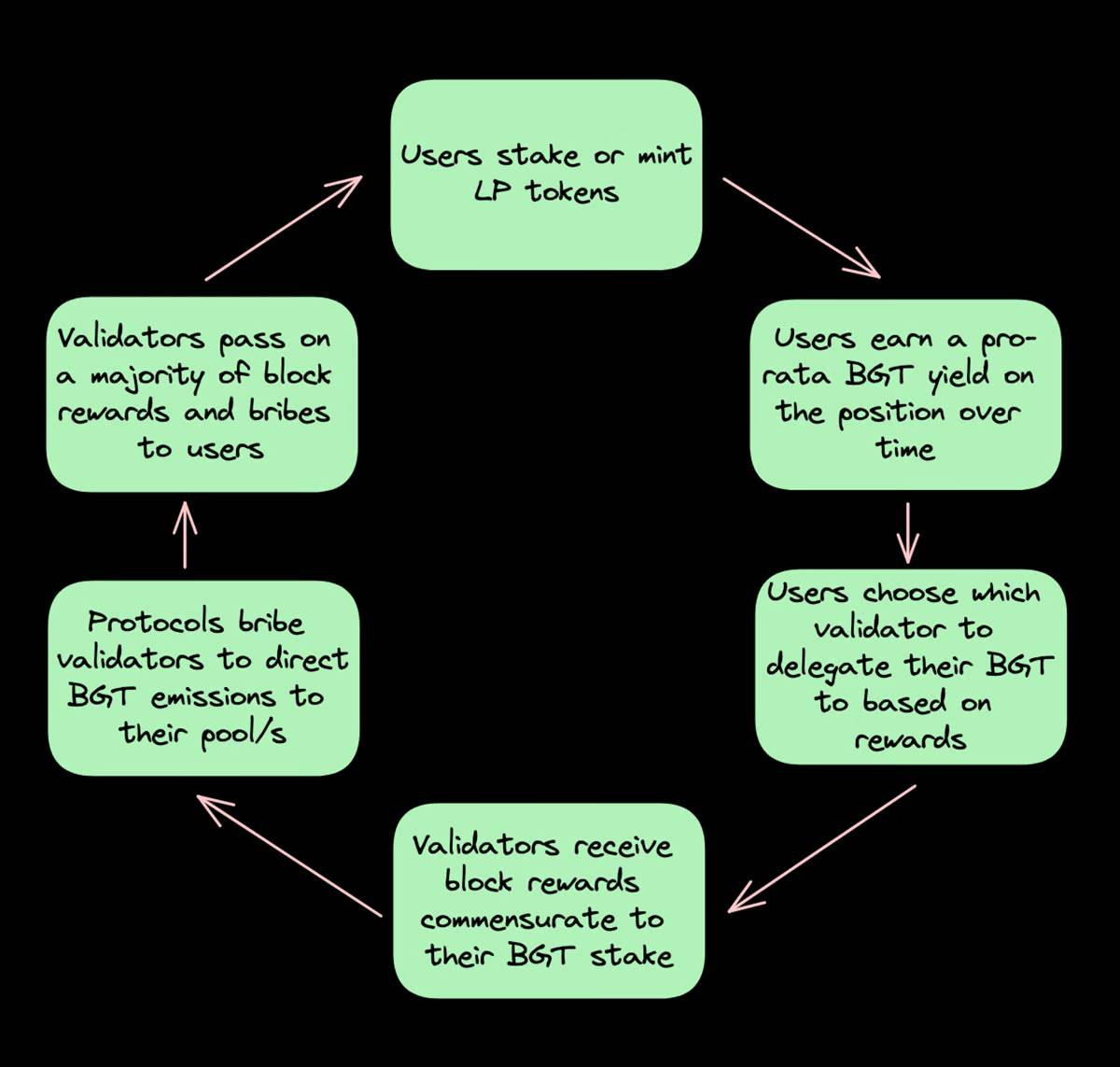

PoL is a novel reward mechanism for aligning users, dApps, and validators. In short, users hold/mint LP tokens and earn BGT, which can be delegated to validators, who receive block rewards commensurate with their BGT stake. Therefore, security is directly tied to liquidity. More specifically, please refer to:

There are still some limitations of Proof of Stake (PoS) networks:

-

Increasing the economic security of a chain will reduce ecosystem liquidity

-

Concentration of interests in a few players (LSTs/NoOps)

-

Lack of coordination between dApps and underlying protocols

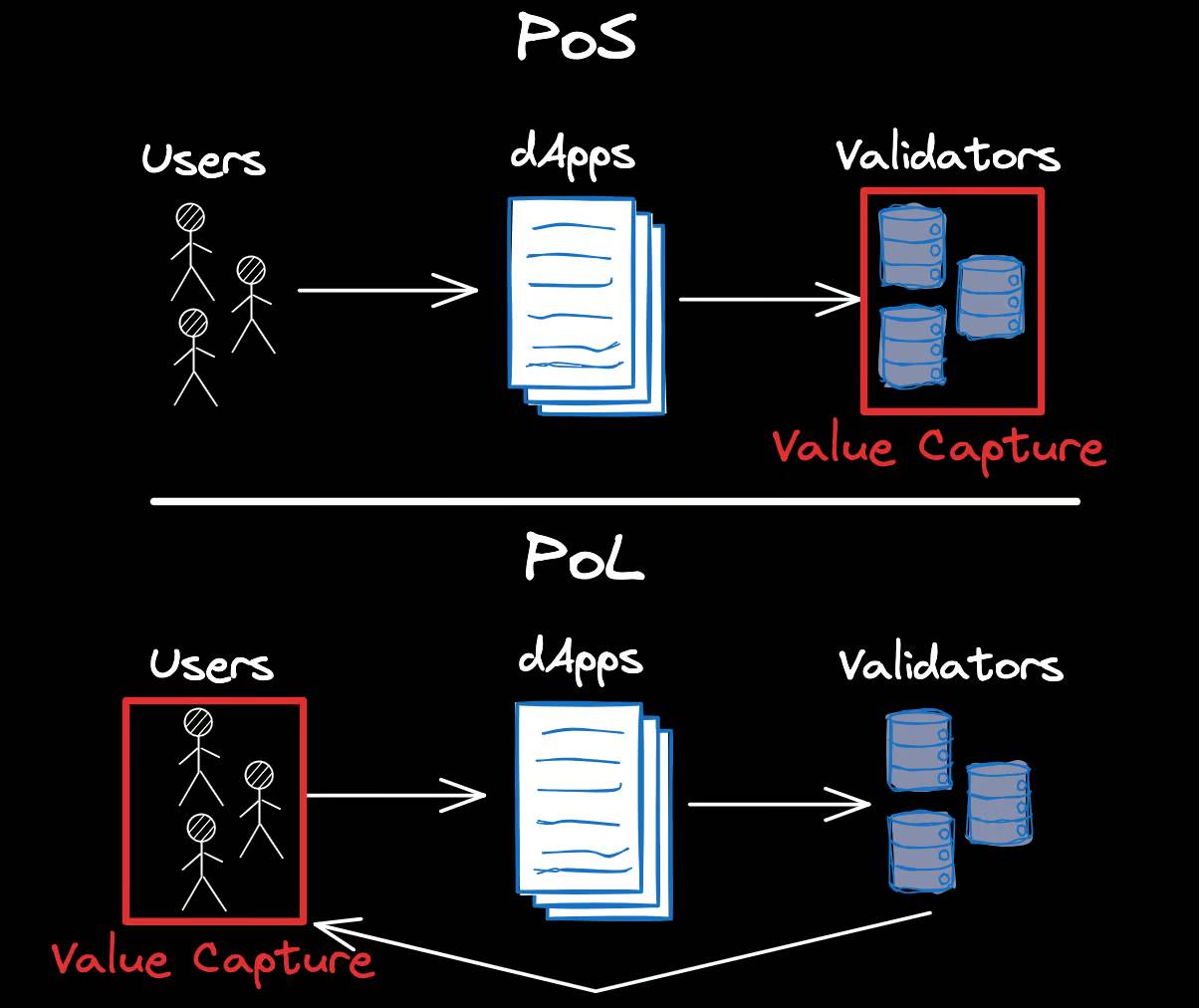

PoL aims to solve the problems associated with PoS by introducing a two-token model that separates the network token (BERA) and the governance token (BGT). With this separation, we can:

-

Systematically building liquidity while improving security, which helps facilitate efficient transactions and sustainable network growth

-

Aligning protocols and validators to enable superior alignment of incentives via LP pools, bribes, governance tokens, and more.

The most exciting part about PoL is that it enables any dApp to “accelerate” its growth in a utilitarian way, with the decision being made by the people who initially provide “value” or liquidity to the ecosystem, the BGT holders (i.e. users).

To clarify, the goals of ETH and Berachain are fundamentally different. ETH aims to be the WW 3 censorship-resistant layer where all value is deposited, while Berachain aims to be the canvas for infinite economic games. In addition, Berachain has stated that it is an ETH adjacent chain.

This is great, but won’t the chain suffer greatly from impermanent loss?

I’ve heard many people who know about PoL say, won’t Berachain be hit hard by impermanent loss because the network security relies on staking/minting LP tokens?

First, let me say that there is no silver bullet solution to the LP profitability problem. DEX designs are improving rapidly, and we are also seeing the rise of MEV-aware designs that return value to the application layer, but the LP profitability problem remains fundamentally unsolved.

So will Berachain collapse over time? I think not, for the following reasons:

-

In addition to providing liquidity to DEXs, there are other ways to earn BGT. Various venues will be whitelisted (WL) for BGT emission, whether it is a money market, options protocol, etc. *Note that any dApp (whether native or not) can be WLed for BGT emission.

-

Contrary to the MEV-Boost paradigm on ETH where there is a proposer monopoly, PoL incentivizes validators (and even the protocol) to return most of their profits to users. So, while LPing itself may not be profitable, LPs may receive sufficient kickbacks through validator bribes or increased block rewards. Therefore, I believe Berachain is a canvas for infinite economic games because the users money will eventually return to the user.

-

Finally, there are options to hedge temporary losses on LPs generated by BGT. Smilee Finance and GammaSwapLabs have already committed to providing such products on Berachain.

*Note that there will also be stability pools providing a secure source of yield.

What if most of the liquidity leaves the ecosystem?

BGT will not stop being produced. Instead, it will flow to a smaller, more concentrated group of LPs at a very high annual interest rate. Therefore, speculators are likely to keep Berachain in some kind of balance.

In contrast to PoS networks, where network rewards are primarily accrued by experienced actors, PoL brings value to its users, thereby promoting the long-term health of the DeFi ecosystem as liquidity attracts liquidity.

So will Berachain work? Doubtful of 0.1 trillion FDV

Honestly, I don’t know if Berachain will work. I have several concerns:

-

I think PoL can only work as intended in an efficient market.

-

Similar to the LRT, I wonder how much behind the scenes dealing goes on to get more BGT authorizations/emissions.

-

There may be concentration of interests around a single LST provider.

But heres what I will say. As someone who has been working in the DeFi space for over 6 years, Berachain is one of the largest and most advanced DeFi experiments I have seen. While we dont know what games will be played yet, I am very much looking forward to seeing what these Beras push for crypto.

This article is sourced from the internet: Detailed explanation of Berachain: New Meme Paradise or DeFi Utopia?

Related: Dogecoin Update: What 10 Billion DOGE Nearing Profits Means for Holders

In Brief Dogecoin’s price has been moving sideways for the past ten days, a sign of potential bullishness. This would translate to profits for 9.91 billion DOGE bought under $0.168, 6% above the trading price. MVRV ratio exhibits potential optimism arising out of the investors as they might accumulate more DOGE. Dogecoin’s (DOGE) price hints at the potential upside and the chances of initiating an uptrend are significantly high. This is primarily due to the greed of the investors, as billions of dollars worth of DOGE are at the cusp of becoming profitable. Dogecoin Investors See Gains Dogecoin’s price, trading at $0.159 at the time of writing, is observing considerable room for growth supported by its investors. The primary reason behind this motivation is the 9.91 billion DOGE sitting in…