SignalPlus Macro Analysis (20240510): Market data is generally favorable for risk assets

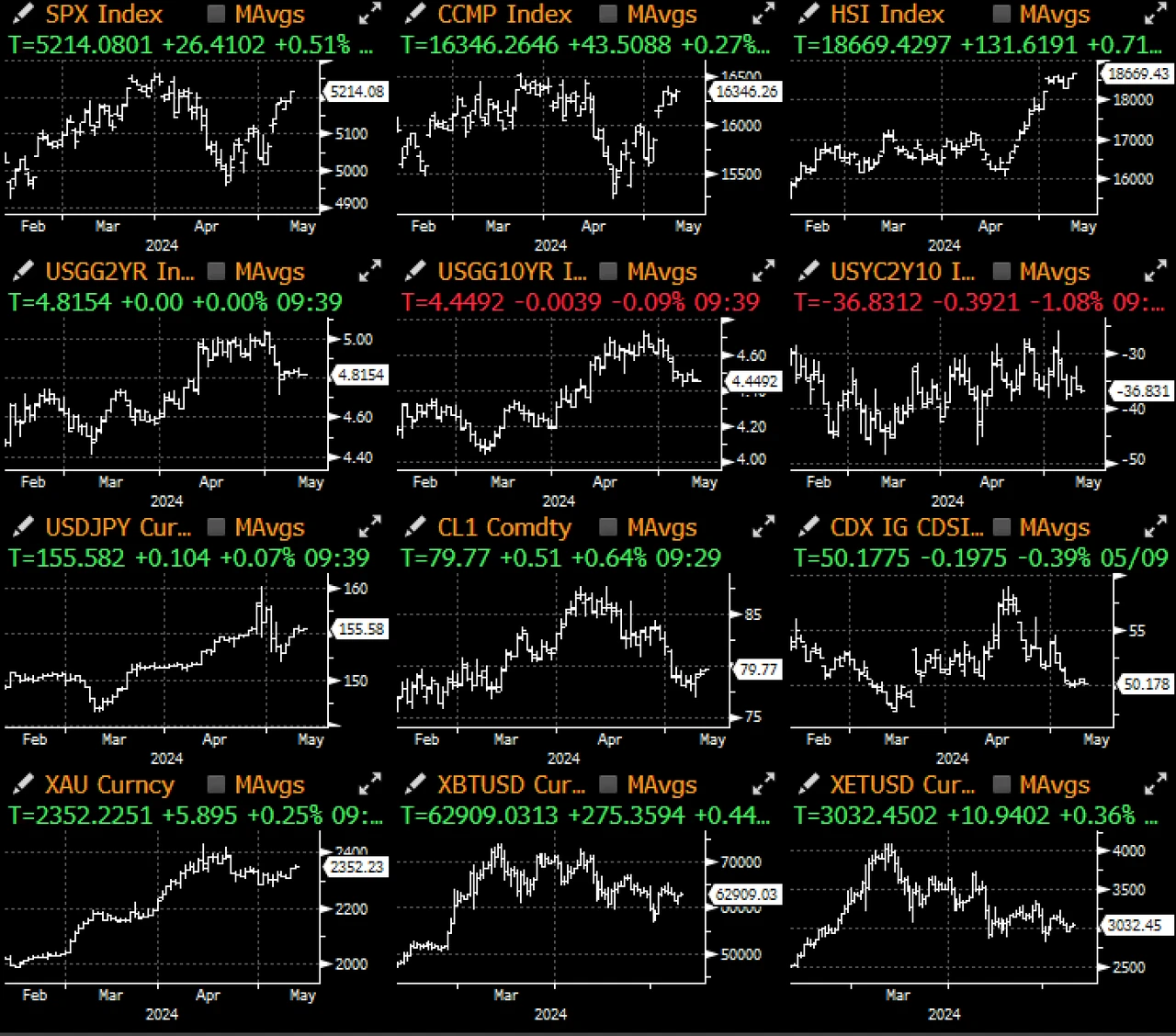

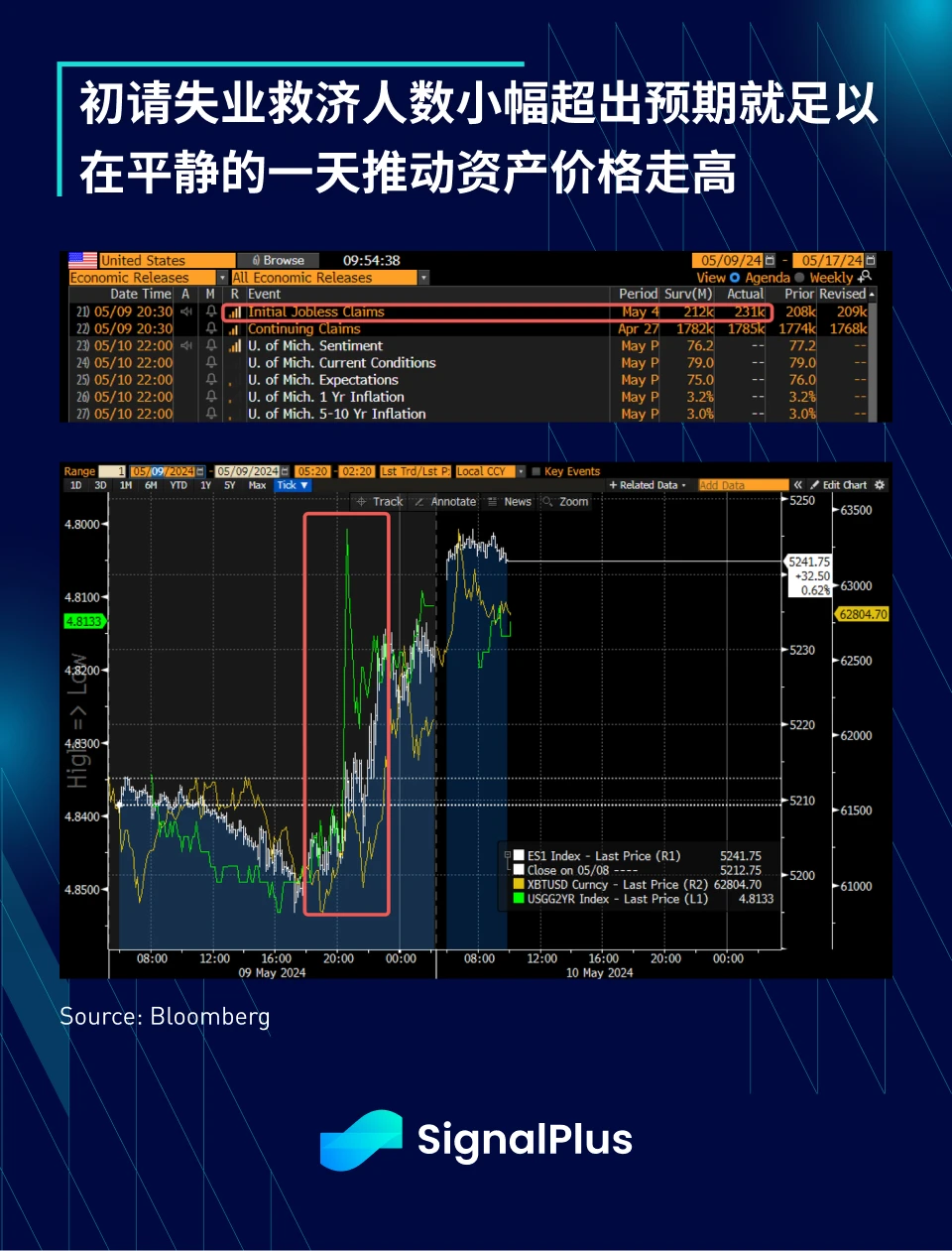

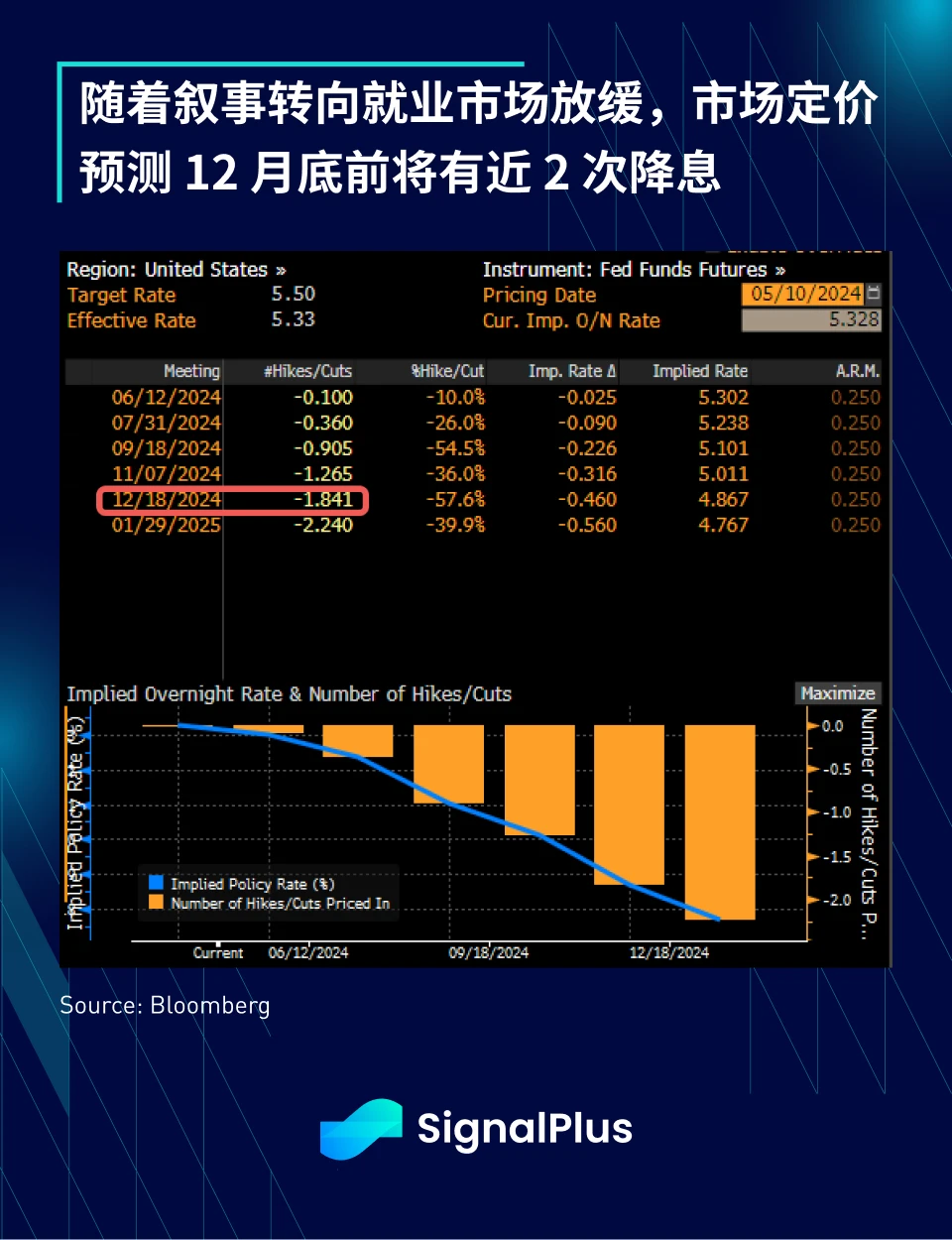

Obviously nothing big happened this week, just the small-beating-than-expected weekly jobless claims (231k vs 212k) was enough to push all major asset classes higher in unison, and given the Fed鈥檚 recent shift to focus on the weakness in the job market, the market undoubtedly took this information very seriously and tried to find all signs of a slowdown in the job market to rekindle hopes of a rate cut. As mentioned earlier, the current asymmetric risk-reward setup (the Fed ignores high inflation and looks for signs of a slowdown in employment) should generally favor risky assets, so stocks, bond prices and even BTC all rose in tandem after the release of the unemployment benefit data.

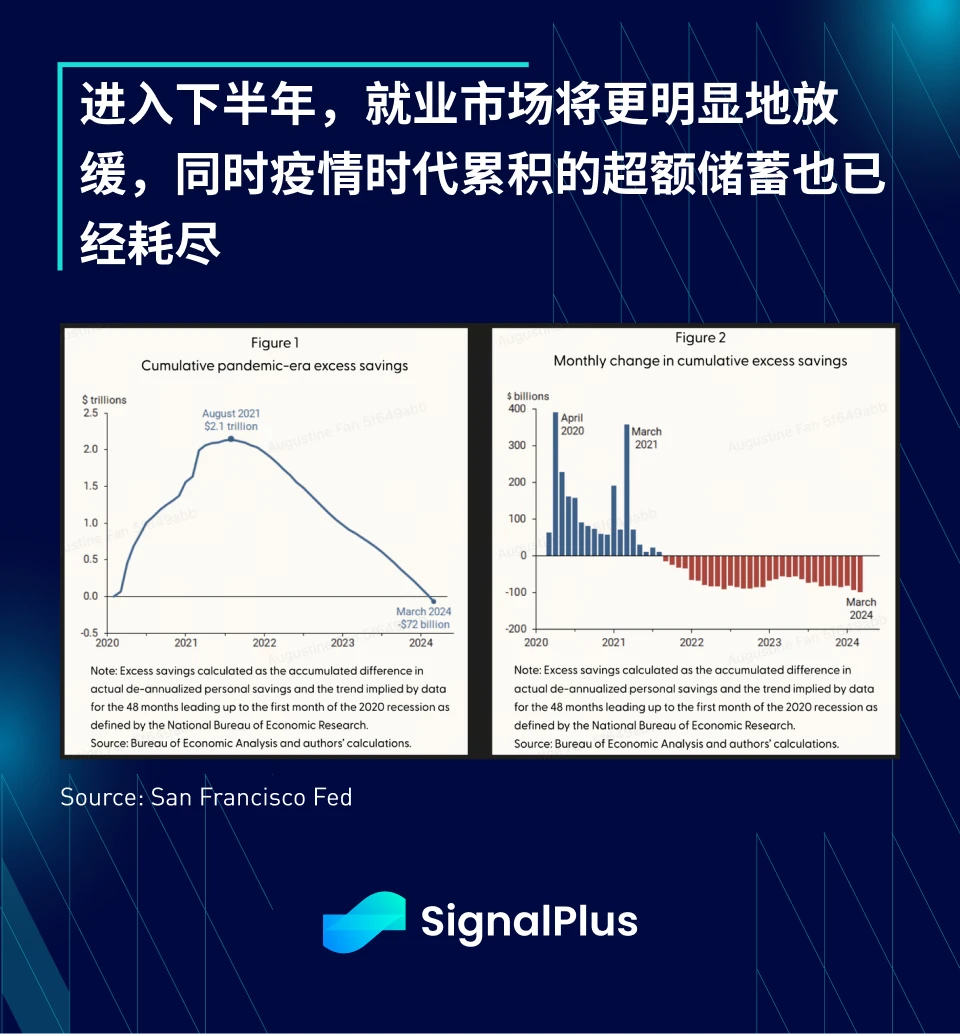

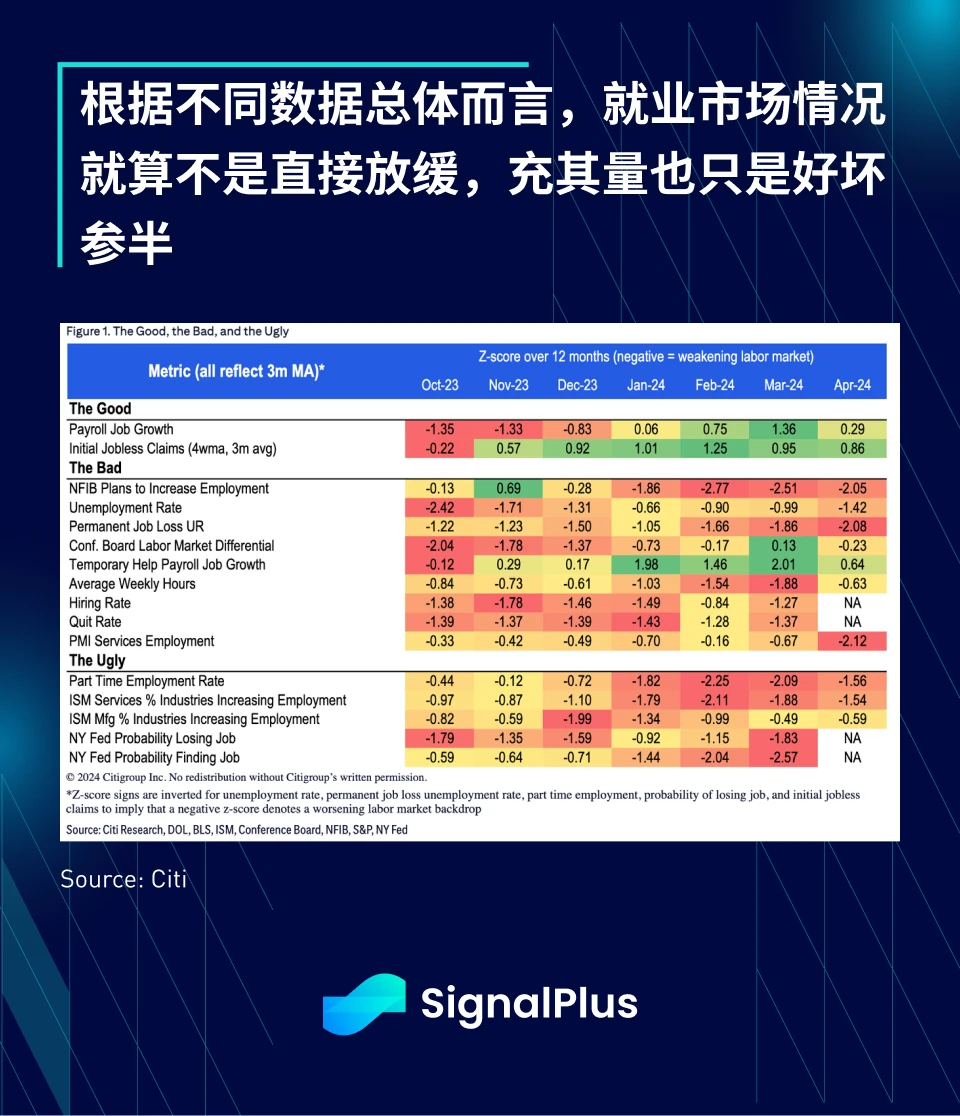

Looking more closely at recent employment data, while nonfarm payrolls are still relatively healthy at 175,000 a month, and the unemployment rate is still low at 3.9%, some alternative job market indicators are beginning to show some cracks, with Powell himself specifically mentioning the decline in hiring rates and weak employment surveys as signs of weakening labor demand in his QA. In addition, other sub-indicators, such as an increase in permanent unemployment, a decline in the quits rate, a decrease in hiring plans, and a widening hard-to-find job ratio, all suggest that the U.S. economy may fall into a more pronounced job market slowdown in the second half of the year, while the excess savings accumulated during the pandemic era have also been exhausted.

Next week, the CPI data will be released, and the market should become active again and challenge the recent ideal prosperity of the market. I wish you all a happy weekend!

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin ), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis (20240510): Market data is generally favorable for risk assets

Related: Capital Rotates from Bitcoin Into These Three Altcoins

In Brief Altcoins SOL, BNB, and AVAX attract capital inflows amid Bitcoin’s recent stalling and offer the potential for high returns. BNB provides a lucrative prospect with its Launchpool allowing BNB stakers to amplify their returns, while SOL and AVAX trail. ANKR, RAY, and MASK are March’s rising stars for gains, but the recent rise in WIF and BNB’s MVRV Z-Score warrant alt caution. As lucrative opportunities emerge, investors divert their capital from Bitcoin (BTC) to altcoins. With Bitcoin’s price stalling near recent highs and perpetual futures funding rates dropping to new lows, market sentiment hints at a cautious approach toward the flagship cryptocurrency. SOL, BNB, AVAX Attract Investors Investors’ recent moves signify a redistribution of capital towards altcoins, showing promising growth. They have isolated three altcoins — Solana (SOL),…