Trump wants to make NFT great again, cryptocurrency may become an important issue in the campaign

Original author: Rhythm Worker, Joyce

This morning, a video of Trump attending a meeting went viral in the crypto community. In the video, Trump expressed his acceptance of the development of cryptocurrencies, and said that Biden and the Democratic Party have always adopted attitudes and policies against cryptocurrencies. If you support cryptocurrency, youd better vote for Trump. Recently, the Biden administration has just objected to a pro-crypto resolution voted through the House of Representatives.

From South Korea and Argentina in the past to the United States this year, cryptocurrency seems to be gradually becoming an important issue in national elections. On this issue, Trump and Biden once again stood on opposite sides.

Trump: Buying $BODEN coin is not a good investment

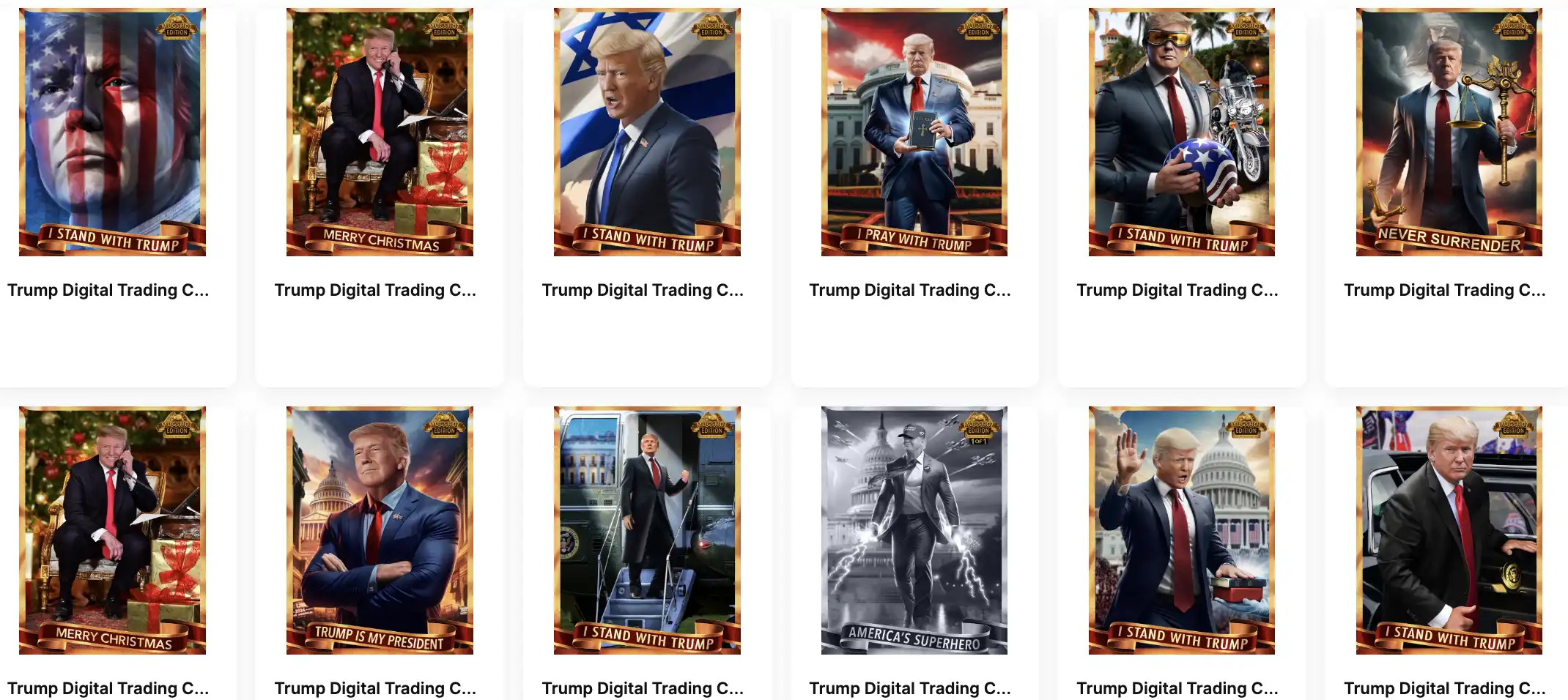

Yesterday, Trump flew back to Florida after his court appearance and held a private dinner with the main buyers of his Mugshot Edition NFT trading cards. The Mugshot Edition NFT series is also very impressive. Its content is a photo of him being arrested in Georgia last year for plotting to overturn the states 2020 election results and various derivative illustrations, including photos of the arrest scene, illustrations of Trump wearing a cowboy hat, and a cartoon image of Trump holding a lightning bolt with American Superhero written below.

Each of these NFTs costs $99, and those who attend the dinner must purchase more than 47 NFTs. Buyers who hold 100 NFTs are also eligible to attend the VIP cocktail party before the dinner, and will receive a card printed with Trumps suit when he was arrested in 2020. The lucky buyer will also get Trumps autograph.

Frank, the founder of DeGods and a well-known founder and KOL in the American NFT community, also participated in the dinner. In addition to the above video, Frank also posted another live video of the event on his X account. In the video, Trump said that he wanted to make NFT hot again.

In addition to talking about his attitude towards cryptocurrencies and NFTs, Trump even mentioned the previously popular election meme coin $BODEN. According to db, Coindesk reporter Danny Nelson, Trump said during the event that he did not like the $BODEN token, saying that there is a bit too much money in this coin. In the previous meme craze, $BODEN, as a Biden election meme, had created hundreds of times of growth in a short period of time. As of now, the market value of $BODEN is about 260 million US dollars, and it has retreated 60% from its high point.

During the event, Malcolm, a member of de Labs (DeGods parent company), asked Trump about crypto companies leaving the United States due to regulatory issues. Trump responded randomly that he would work hard to keep these teams in the United States. I will stop the hostility. If we want to embrace encryption, we need them to stay here.

After Trumps pro-crypto remarks went viral on the X platform, its related meme coin $TRUMP also surged and broke through $5.9, with a 24-hour increase of 31.73%.

Biden opposes House pro-crypto resolution

Early this morning, the U.S. House of Representatives passed the SAB 121 repeal bill, which was regarded as a huge victory by the crypto community. In a circulated recording, former SEC enforcement official John Reed Stark said, As long as the Democrats are in charge of the SEC, the SECs attack on cryptocurrencies will continue. Supervision will not be relaxed and enforcement actions will not slow down.

Yesterday, the U.S. House of Representatives voted to pass a resolution involving the crypto industry, HJ Res 109, which will allow strictly regulated financial companies to act as custodians of Bitcoin and other cryptocurrencies.

But the resolution was opposed by the office of U.S. President Biden, “The administration strongly opposes the passage of HJ Res. 109, which will disrupt the work of the U.S. Securities and Exchange Commission (SEC) to protect investors in the crypto asset market and the broader financial system… If the president receives HJ Res. 109, he will veto it.”

The SECs work to protect the financial system mentioned by the Biden office refers to the SECs previously launched Staff Accounting Bulletin (SAB) No. 121. SAB 121 imposes restrictions on financial institutions in the custody of digital assets, but has been controversial.

Republican Congressman McHenry believes that SAB 121 requires financial institutions and companies that protect customer digital assets to keep these assets on their balance sheets. This means that banks will be required to bear a lot of capital, liquidity and other costs under the existing regulatory framework. This essentially makes it too expensive for financial institutions to keep customer digital assets, which is very different from the traditional strict supervision of assets held by banks on behalf of customers.

Biden said in a statement on Wednesday that he would strongly oppose interference with the SECs work. SAB 121 was issued in response to demonstrated technical, legal, and regulatory risks that have caused significant losses to consumers.

Coinbase Chief Legal Officer paulgrewal.eth tweeted that despite the unforgivable threat of a presidential veto, the repeal of SAB 121 was passed with 21 D votes in favor, Thanks to these independent thinkers. The political tide is increasingly in favor of reasonable rules for cryptocurrencies. History will not be kind to those who persevere.

The Biden administration has been opposed to the cryptocurrency industry in the past. In June last year, Biden said that he would eliminate tax loopholes for cryptocurrencies and hedge funds, and that the rich and large companies must pay taxes fairly. In March of this year, VanEck CEO Matthew Sigel said in an interview that the Biden administration does not want banks and brokers to touch digital assets. If the presidency changes, we will see more support for the industry.

Coinbase has been very clear about the Biden administrations attitude towards cryptocurrencies. Last September, Coinbase CEO Brian Armstrong said in an exclusive interview with Yahoo Finance that if Republicans defeat President Joe Biden in 2024, Gary Gensler will most likely no longer serve as SEC chairman, which will definitely help the industry. In the 2024 campaign, Armstrong believes that cryptocurrency may become a hot topic in the White House campaign, and American voters will force candidates to state their positions on the issue.

Cryptocurrency may become an important issue in the election

Last November, Bitcoin maniac Javier Milei successfully became the president of Argentina. In the previous campaign, he has always been a pro-crypto politician. Javier has repeatedly imagined in public that after the closure of the countrys central bank, Bitcoin will become the main force as a remedy for Argentinas inflation. Before the presidential election, Javier Milei had shuttled between multiple talk shows, often promoting the benefits of Bitcoin and cryptocurrency, saying that Bitcoin can eliminate the central bank.

This Bitcoin Madman Really Became the President of Argentina

In recent years, some savvy politicians have discovered that young votes in the crypto world are a must-fight in national vote battles, especially in South Korea, where internal circulation is serious and young people are fanatically speculating in cryptocurrencies and eager to get rich quickly. According to statistics from the Financial Services Commission (FSC) of South Korea, there are 3.08 million young people aged 20-39 who speculate in cryptocurrencies in South Korea, accounting for 23% of the population in this age group (13.431 million people), accounting for nearly one-fifth.

During the South Korean presidential election in March 2022, the current South Korean President Yoon Seok-yeol promised to relax regulations in the cryptocurrency industry, and also promised to take legal measures against those who illegally obtained cryptocurrency profits, by confiscating assets and returning them to the victims. At that time, Yoon Seok-yeols biggest competitor, Democratic Party candidate Lee Jae-myung, who was regarded as the successor to former President Moon Jae-in, not only announced earlier that he would accept cryptocurrencies as political donations for the campaign, but also stated that he would mint NFTs for campaign donors as proof of donations and souvenirs. The issued NFTs will also include photos and political views of Lee Jae-myung.

This year, the Peoples Power Party led by South Korean President Yoon Seok-yeol promised to postpone the collection of digital asset taxes. Since the Financial Services Commission (FSC) of South Korea previously banned domestic brokerages from acting as agents for Bitcoin spot ETFs listed overseas, the Peoples Power Party now intends to allow cryptocurrency products approved by developed countries such as the United States to enter the local market, including Bitcoin spot ETFs. Other virtual asset industry-friendly plans to be added to the election promises include the establishment of a digital asset promotion committee, the completion of legislation related to token securities within the year, and the permission of financial institutions and enterprises and other entities for the purpose of asset management to invest in virtual assets.

Early this morning, the U.S. House of Representatives passed the SAB 121 repeal bill, which was regarded as a huge victory by the crypto community. In a circulated recording, former SEC enforcement official John Reed Stark said, As long as the Democrats are in charge of the SEC, the SECs attack on cryptocurrencies will continue. Supervision will not be relaxed and enforcement actions will not slow down. It is foreseeable that the encryption industry will continue to be tied to partisan struggles.

This article is sourced from the internet: Trump wants to make NFT great again, cryptocurrency may become an important issue in the campaign

Related: The new wave of interest-paying stablecoins: mechanisms, features, and applications

Original author: 0x Edwardyw The new interest-paying stablecoin generates yield from three different sources: real-world assets, Layer 1 token staking, and perpetual contract funding rates. Ethena offers the highest yield but also the greatest volatility, while Ondo and Mountain protocols restrict access to U.S. users to reduce regulatory risk in order to distribute interest income. Lybras model redistributes $ETH staking income to stablecoin holders and is the most decentralized model, but faces incentive problems. Based on the number of holders and DeFi usage scenarios, Ethenas USDe and Mountains USDM are leading in stablecoin adoption. Part I: Diverse Sources of Income Unlike the last crypto bull cycle, when algorithmic stablecoins relied on subsidies or native token inflation to provide very high but unsustainable returns, ultimately leading to the collapse of projects…