Bankless: The dilemma of the points program and the high FDV airdrop model

Original author: David Hoffman

Original translation: TechFlow

The EIGEN airdrop sparked a discussion about the divide between private and public markets. The large-scale private placement and high FDV airdrop model based on points is causing structural problems in the crypto industry.

Converting a points program into billions of dollars in low-volume tokens is not a stable equilibrium, yet we remain stuck in this model due to a confluence of factors: an excess of venture capital, a lack of new players, and excessive regulation.

The meta regarding token issuance is always changing, and we have witnessed the following major eras:

-

2013: Proof of Work (PoW) Fork and Fair Launch Meta

-

2017: The ICO meta

-

2020: The Era of Liquidity Mining (DeFi Summer)

-

2021: NFT Minting

-

2024: Points and Airdrop Metaverse

Every new token distribution mechanism has its pros and cons. Unfortunately, this particular meta starts with a structural retail disadvantage, which is an inevitable consequence of the industry being ruthlessly regulated.

A large number of venture capital and retail investors

There is currently an oversupply of venture capital in the crypto industry. While 2023 was a bad year for venture capital fundraising, there was still a lot of funding in 2021, and overall, venture capital fundraising in the crypto space is a persistent, ongoing activity.

Currently, many well-funded venture capital firms are still willing to continue to lead rounds at multi-billion dollar valuations, which means that cryptocurrency startups have room to stay private for longer and longer. Of course, this makes sense, because if the current issuance price of the token is a multiple of the last financing, then even late-comer venture capitalists can still find a good deal.

The problem is that when a startup publicly issues a token for $1 billion to $10 billion, most of the upside potential has already been discovered by early adopters — that is, no one is going to get rich by buying a $10 billion token.

The structural bias is unfavorable to public market capital, which worsens the overall atmosphere of the crypto industry. People want to get rich with their internet friends and form strong online communities and friendships around such activities. This is the promise of crypto, and this promise is not being fulfilled at present.

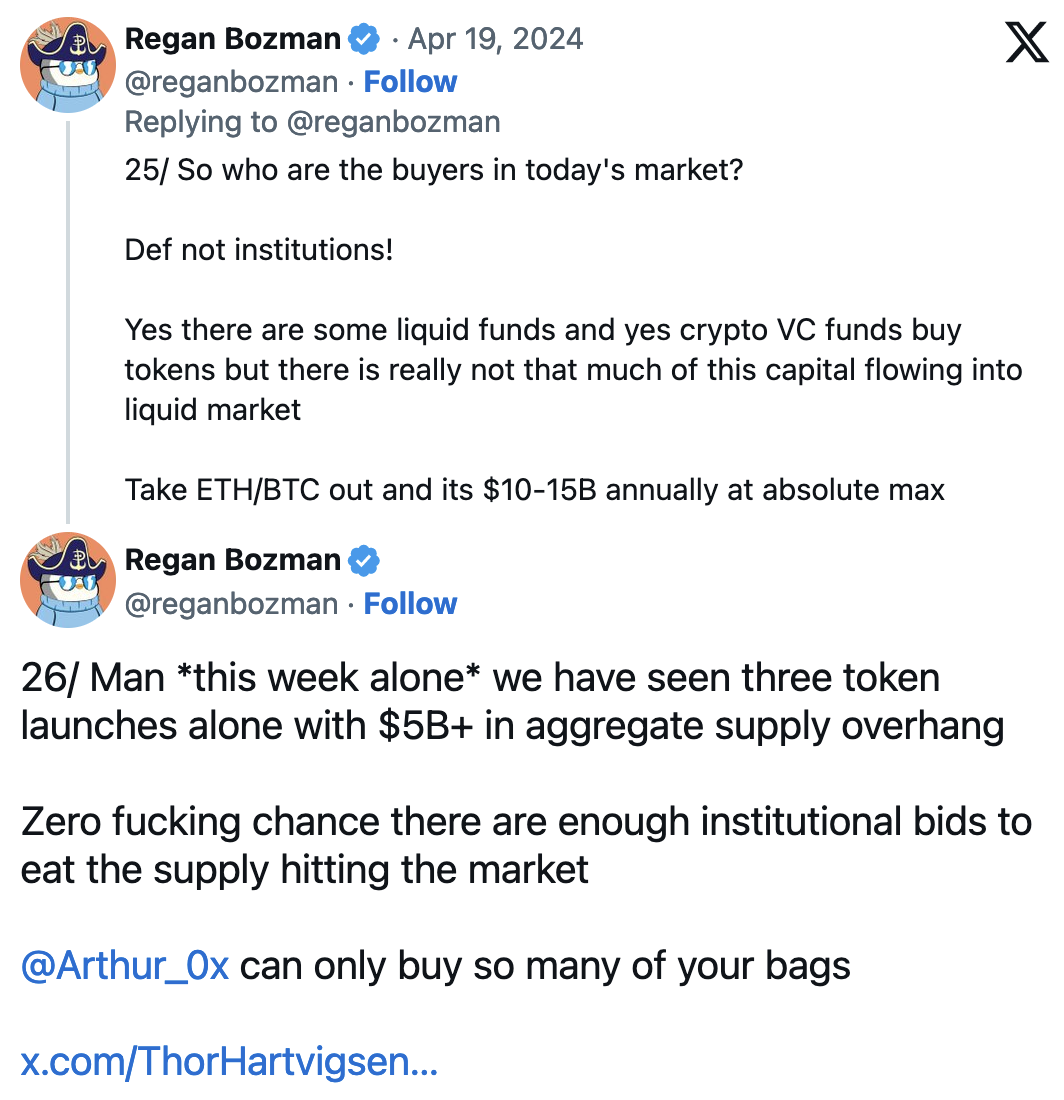

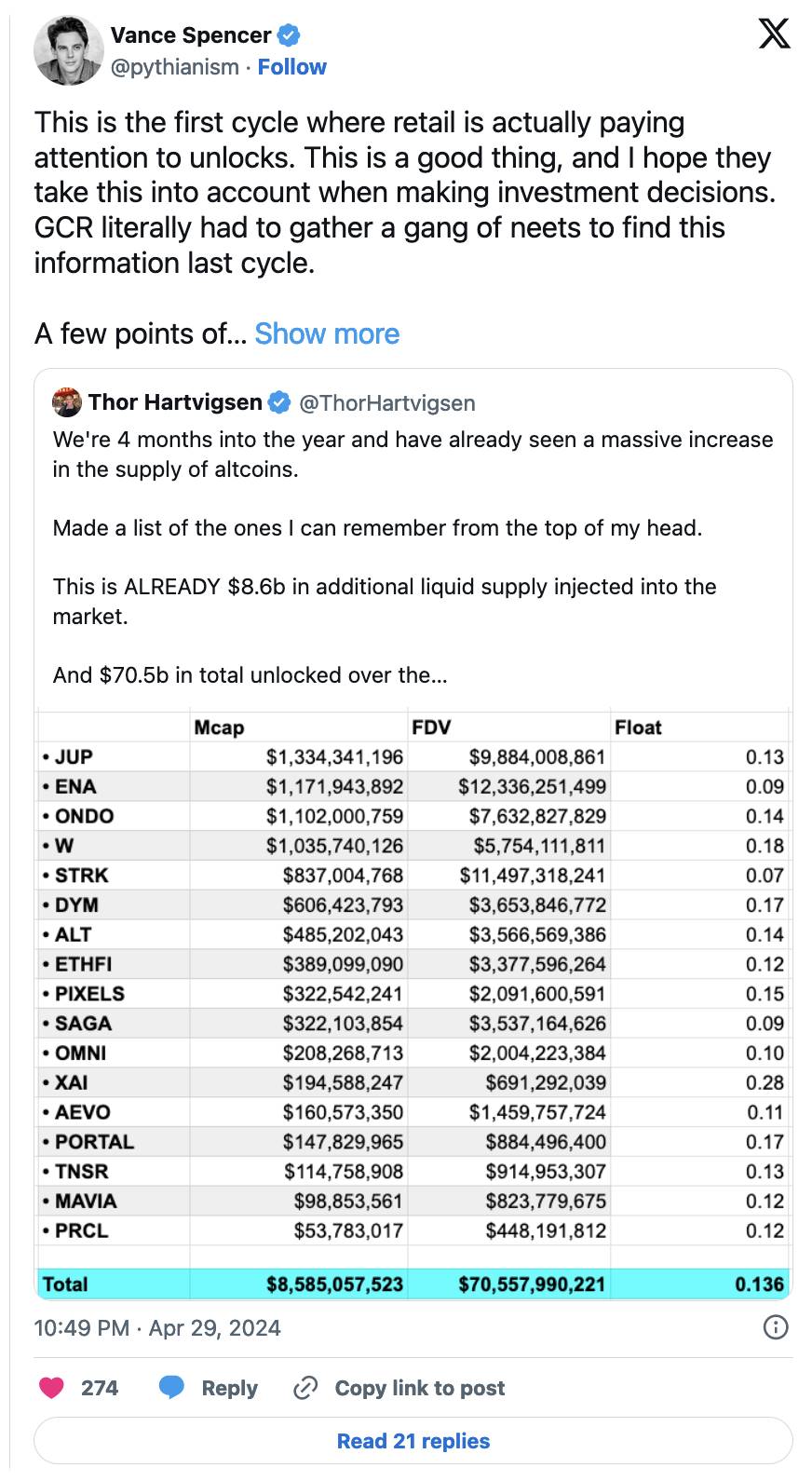

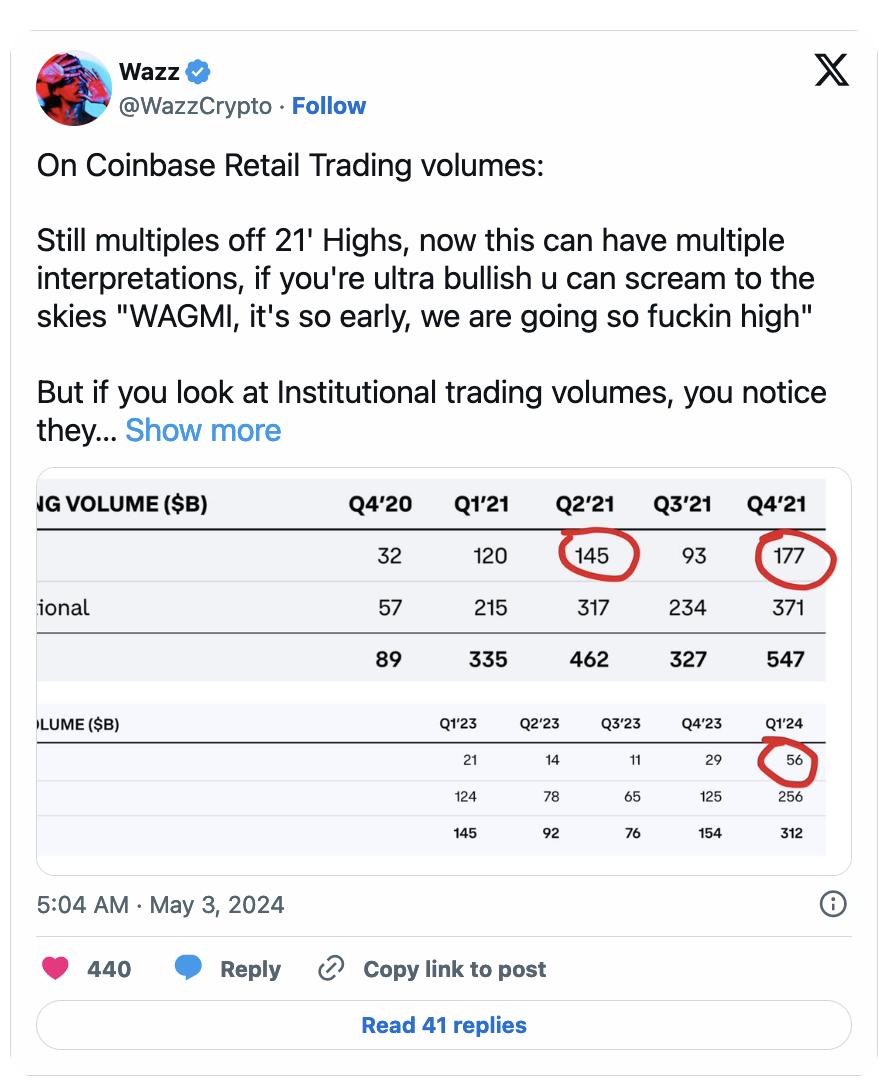

Facing billions to be unlocked without new participants

A few data points should get you thinking:

Since retail investors mainly hold the long tail of crypto assets, institutional liquidity coming in via Bitcoin ETFs will not impact these markets. Capital recovery from crypto native players dumping their $14k BTC purchases to Larry Fink can temporarily support these assets, but this is all internal capital of PVP capable players who understand how unlocking works and how to avoid it.

The impact of the U.S. Securities and Exchange Commission (SEC)

By limiting the ability of startups to more freely raise capital and distribute tokens, the SEC is encouraging capital to flow to private markets where there are fewer regulatory constraints.

The SEC’s corrupt and overzealous attitude toward the nature of tokens is undermining the value of public market capital, and startups cannot exchange tokens for public market capital without triggering massive hemorrhaging of legal teams.

Encryption compliance process

Crypto has slowly become more compliant over time. When I entered the crypto space during the ICO craze in 2017, ICOs were touted as a way to democratize investment and access to capital. Of course, the ICO ultimately devolved into an exploited scam, but regardless, the story forced me and many others to recognize the potential that cryptocurrencies could bring to the world. But the ICO meta ended when regulators deemed these transactions as clear unregistered securities sales.

The industry then moved to liquidity mining and went through a similar process.

With each cycle, cryptocurrencies seek to obfuscate their methods of distributing tokens to the public, and with each cycle, it becomes more difficult to hide this process — a process that is essential to the decentralization of the project and the nature of our industry.

This cycle has been subject to the most relentless regulatory attention we’ve ever seen, and as a result, lawyers for venture-funded startups are facing the greatest compliance challenge the industry has ever seen: distributing tokens to the public without getting sued by regulators.

break the balance

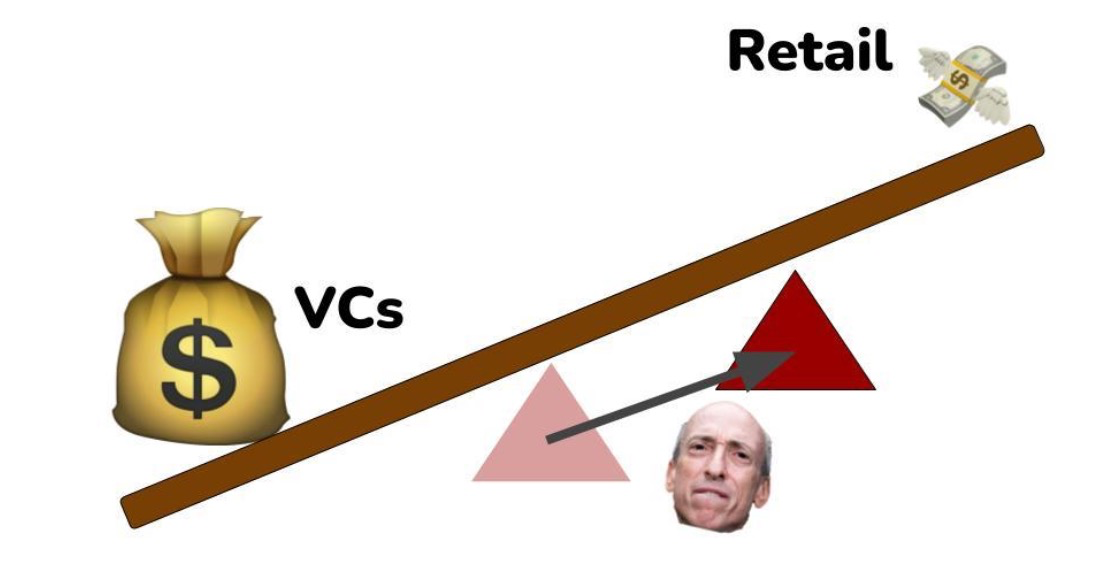

Regulatory compliance has tilted the public-private market pivot heavily toward private markets, as startups can choose to accept venture capital directly rather than violate securities laws.

The location of the fulcrum that supports the balance between private and public capital is determined by the control that regulators have over the crypto market.

-

If there were no investor certification law, the fulcrum would be more balanced.

-

If there were a clear regulatory path for issuing tokens in compliance, the differences between public and private markets would be smaller.

-

If the SEC stayed out of the war on crypto, we would have fairer, more orderly markets.

Because the SEC doesn’t provide clear rules, we end up with a complex and confusing “points” meta that satisfies no one.

Unfair points and chaotic market order

“Points” keep retail investors in the dark about what they are actually receiving, because if there was ever a clear statement about what the points actually are (a bond on a token), the team would expose themselves to possible securities law violations (from the perspective of a corrupt and overzealous SEC regulator).

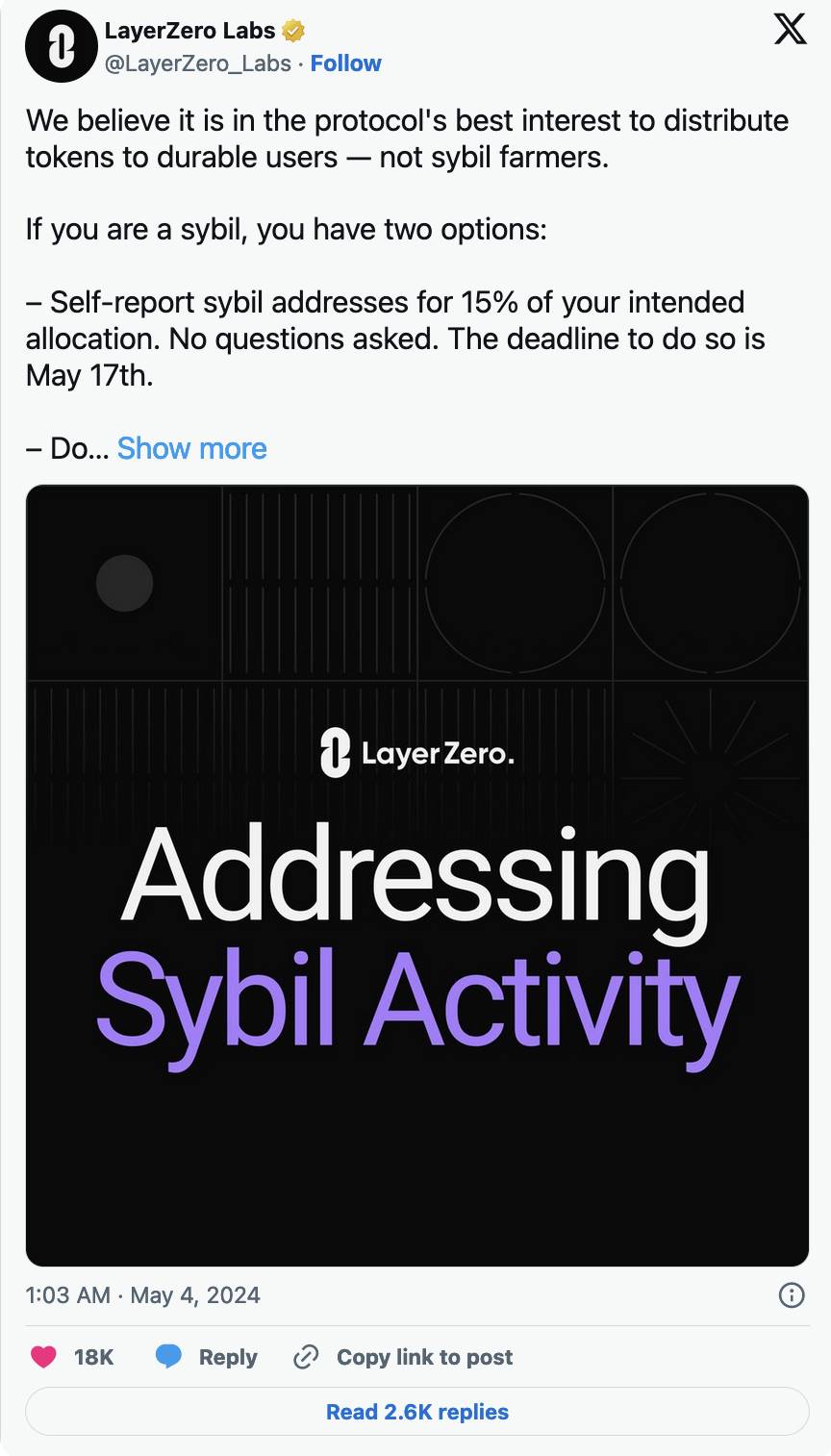

Points do not provide investor protection, because in order to provide investor protection, the process needs to be given regulatory legitimacy in the first place. As we find ourselves in this extremely bad conclusion, we discover the Sybil vs. Community debate, where LayerZero is stuck between a rock and a hard place.

LayerZero recently announced a program to allow users to self-report Sybil activity in the LayerZero airdrop, prompting Kain Warwick to write this post in defense of Sybils, who in some ways strongly support LayerZero and enhance its position in the market.

In reality, there is no boundary between community members and Sybils. Since regular crypto participants cannot participate in private markets, the only way they can get exposure is through commitment and meaningful activity on the platform whose tokens they want.

Since small investors can’t simply write small checks to early rounds of cryptocurrency projects, the current token issuance mechanism forces users to perform witch hunts on projects they favor. As a result, no “community” will band together to get rich in this cycle, like LINK in 2020 or SOL in 2023. Current token issuance does not allow communities to gain early exposure at low valuations.

Hence, attacks on airdrop startups on Twitter are becoming more common — the inevitable result of the community not being able to voice its wishes as a valid stakeholder in the project. A lot like “no representation, no taxation!”

Not to mention another potential problem: mercenary capital exploitatively acquires tokens and dumps them. Without the ability for small investors to invest in early stages of startups, these highly aligned investors must compete for airdrops with toxic hired farmers, with no discernible distinction between the two parties.

Improper balance

The “points” meta became too obvious to continue. The SEC and scammers were working on it, and both sides tried to use it to their advantage.

We will have to turn to a different strategy that hopefully enriches many of the early community stakeholders without angering the SEC. Unfortunately, without regulation around token issuance, this will be a pipe dream.

This article is sourced from the internet: Bankless: The dilemma of the points program and the high FDV airdrop model

Related: Mantle (MNT) Rebounds? Analyzing the Impact of a $36 Million Sale

In Brief Mantle price marked a new all-time high this week, reaching $1.31 before correcting slightly. Whales have sold about 30 million MNT in the span of three days, which was an expected outcome. Active addresses by profitability show that less than 12% of the participants are in profit, suggesting further selling is unlikely. Mantle (MNT) price continues to impress investors with its increases and rallies, which has resulted in the altcoin marking a new all-time high. The question now is whether MNT holders can sustain this rally or move to sell tokens. Mantle Investors Move Quick Mantle price reached a high of $1.31 this past week before correcting to trade at $1.22 at the time of writing. The altcoin still supports the 50-day Exponential Moving Average (EMA). However, as…